North America IVD Regulatory Affairs Outsourcing Market, By Service (Regulatory Writing & Submissions, Regulatory Registration & Clinical Trial Applications, Regulatory Consulting, Legal Representation, Data Management Services, Chemistry Manufacturing and Controls (CMC) Services, and Others), Indication (Oncology, Neurology, Cardiology, Clinical Chemistry and Immunoassays, Precision Medicine, Infectious Diseases, Diabetes, Genetic Testing, HIV/AIDS, Haematology, Drug Testing/Pharmacogenomics, Blood Transfusion, Point of Care, and Others), Deployment Mode (Cloud and On-Premises), Organization Size (Small and Medium Enterprises (SMES) and Large Enterprises), Stage (Clinical, Preclinical, and PMA (Post-Market Authorization)), Class (Class I, Class II, and Class III), End User (Pharmaceutical Companies, Medical Device Companies, Biotechnology Companies, and Others), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2029.

Market Analysis and Insights : North America IVD Regulatory Affairs Outsourcing Market

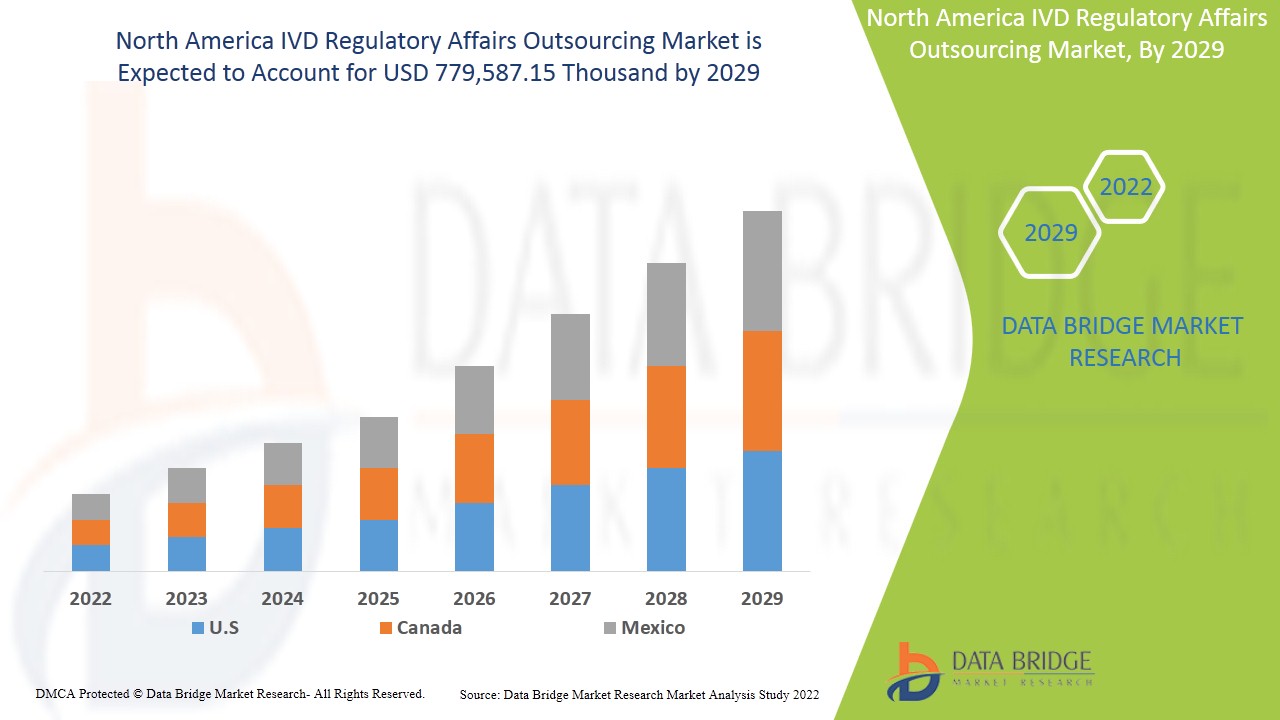

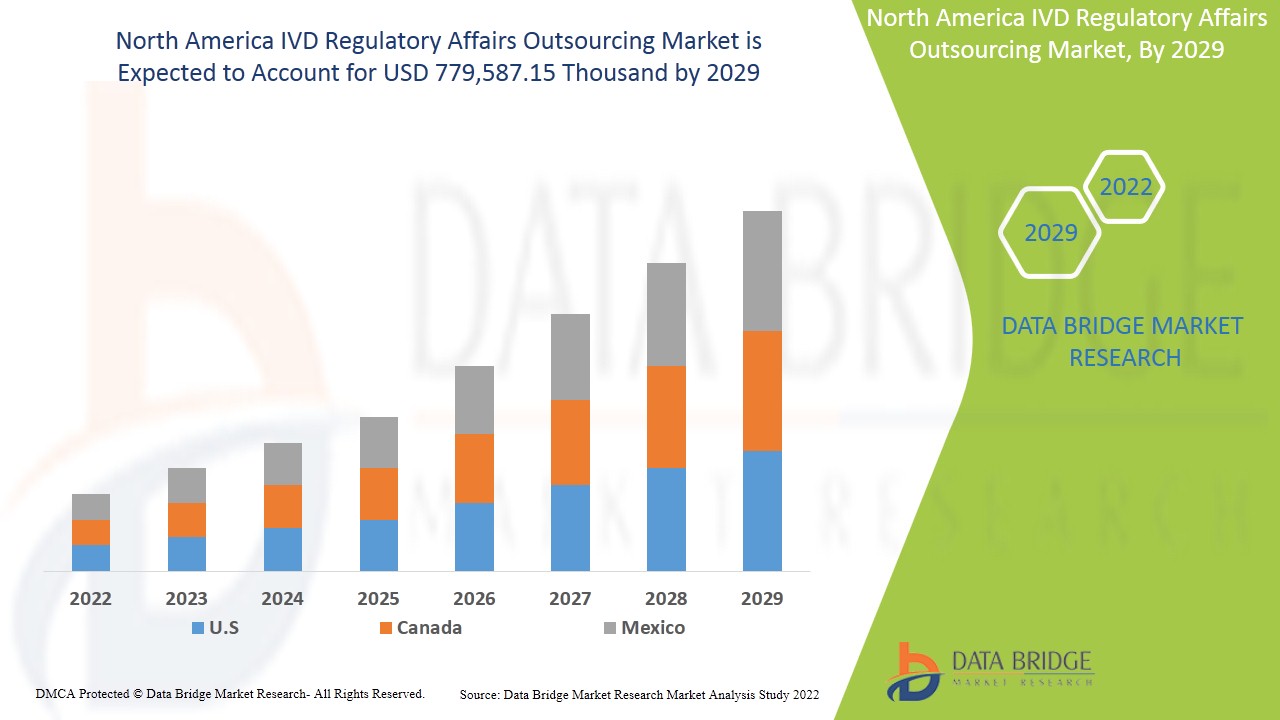

North America IVD regulatory affairs outsourcing market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 13.4% in the forecast period of 2022 to 2029 and expected to reach USD 779,587.15 thousand by 2029.

- In vitro diagnostic products are reagents, devices, and systems used to diagnose disease or other conditions, including determining one's state of health to cure, mitigate, treat, or prevent disease. These products are intended for use in the collecting, preparation, and examination of human body specimens. Regulatory affairs play a crucial part in the in vitro diagnostic device (IVD) and medical device industry. The regulatory affairs outsourcing services entails medical writing and publication of regulatory documentation by professionals who contribute to the production of high-quality documents for clinical research projects. The demand for regulatory services outsourcing is substantially increasing in clinical studies conducted in emerging economies, providing a healthy platform for this industry's growth.

The major factors driving the growth of the IVD regulatory affairs outsourcing market are development of project based support leads to long term outsourcing agreement among organization and technological advancement in various in vitro diagnostic devices. Increase in R&D activities by companies across the region is creating opportunities for the growth of the market. Higher cost related to maintenance and outsourcing of IVD is acting as the major restraint for IVD regulatory affairs outsourcing market. Shortage of skilled personnel for handling in vitro diagnostic devices is acting as a major challenge for the growth of the market.

This IVD regulatory affairs outsourcing market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America IVD Regulatory Affairs Outsourcing Market Scope and Market Size

North America IVD regulatory affairs outsourcing market is segmented into seven notable segments which are based on the services, indication, deployment mode, organization size, stage, class and end user.

- On the basis of services, the North America IVD regulatory affairs outsourcing market is segmented into regulatory writing & submissions, regulatory registration & clinical trial applications, regulatory consulting, legal representation, data management services, chemistry manufacturing and controls (CMC) services, and others. In 2022, regulatory writing & submissions is expected to dominate the market as the industry is responding to several widespread developments, which have triggered innovations and expansion in IVD technologies. These large-scale trends include an aging population, an increase in the occurrence of infectious diseases, the influence of big tech innovators and acceptance of personalized care, and desire for ease of use.

- On the basis of indication, the North America IVD regulatory affairs outsourcing market is segmented into oncology, neurology, cardiology, clinical chemistry and immunoassays, precision medicine, infectious diseases, diabetes, genetic testing, HIV/AIDS, haematology, drug testing/pharmacogenomics, blood transfusion, point of care, and others. In 2022, the oncology segment is expected to dominate as it improves the predictability of the oncology drug development process and becomes a useful tool for oncologists when deciding on a treatment plan for a patient

- On the basis of deployment mode, the North America IVD regulatory affairs outsourcing market is segmented into cloud and on-premises. In 2022, the cloud segment is expected to dominate as it Cloud computing technology in IVD regulatory gives a stable infrastructure with maximum output to IVD systems dealing firms due to its cost-effective and solution-flexible properties.

- On the basis of organization size, the North America IVD regulatory affairs outsourcing market is segmented into small and medium enterprises (SMES) and large enterprises. In 2022, the large enterprises segment is expected to dominate as it involvement of the peer high quality technology and service portfolio related to the IVD regulatory.

- On the basis of stage, the North America IVD regulatory affairs outsourcing market is segmented into clinical, preclinical, and PMA (post-market authorization). In 2022, clinical segment is expected to dominate the market because clinical trials require clearance from authorities, every result must be filed and thoroughly recorded before submissions, regulatory affairs services are in high demand in this area.

- On the basis of class, the North America IVD regulatory affairs outsourcing market is segmented into class I, class II, and class III. In 2022, class I segment is expected to dominate the market as it involves no public health risk or low personal risk with lowest regulations. These are high in demand and 47% of medical devices fall under this category.

- On the basis of end user, the North America IVD regulatory affairs outsourcing market is segmented into pharmaceutical companies, medical device companies, biotechnology companies, and others. In 2022, medical device companies are expected to dominate the market by emerging in various efficient technological services and standards.

North America IVD Regulatory Affairs Outsourcing Market Country Level Analysis

North America IVD regulatory affairs outsourcing market is analysed and market size information is provided by the country, services, indication, deployment mode, organization size, stage, class and end user.

The countries covered in North America IVD regulatory affairs outsourcing market report are U.S., Mexico and Canada.

The U.S. is dominating the market in North America region due to increasing developments in new technologies in healthcare sector and strategic acquisition & partnership among organization.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of IVD Regulatory Affairs Outsourcing

North America IVD regulatory affairs outsourcing market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in IVD regulatory affairs outsourcing and changes in regulatory scenarios with their support for the IVD regulatory affairs outsourcing market. The data is available for historic period 2012 to 2020.

Competitive Landscape and North America IVD Regulatory Affairs Outsourcing Market Share Analysis

North America IVD regulatory affairs outsourcing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to North America IVD regulatory affairs outsourcing market.

Some of the major players operating in the report are IVD regulatory affairs outsourcing market are Freyr Solutions, AXSource, LORENZ Life Sciences Group, PPD Inc. (A Subsidiary of Thremofisher Scientific Inc.), Promedica International, a California Corporation, Assent Compliance Inc., MakroCare, EMERGO, ICON, Parexel International Corporation, CRITERIUM, INC., Groupe ProductLife S.A., Propharma Group, VCLS, Labcorp Drug Development, WuXi AppTec, Charles River Laboratories, Genpact, Medpace, Regulatory Compliance Associates Inc., RQM+, Saraca Solutions Private Limited, PBC BioMed, Dor Pharmaceutical Services, Qserve, mdiConsultants, Inc. among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of North America IVD regulatory affairs outsourcing market.

For instance,

- In September 2021, Tánaiste announces multi-million Euro R&D support of ICON plc accelerate decentralised clinical trial technology.The Tánaiste and Minister for Enterprise, Trade and Employment, Leo Varadkar TD announced that ICON plc (NASDAQ: ICLR), a Dublin-based global provider of drug development and commercialisation services to pharmaceutical, biotechnology and medical device industries, has been awarded USD 4 million in R&D support administered by Enterprise Ireland to further enhance its data solutions and decentralised clinical trial technology. This has helped company to improve its position in market.

- In October 2021, Propharma group acquired Pharmica Consulting. ProPharma Group, a portfolio company of Odyssey Investment Partners, has acquired Pharmica Consulting, a life science consulting company that provides Project Management (PM) consulting solutions and proprietary operations software to pharmaceutical and biotech companies for the execution of clinical trials. This has helped the company to expand their business globally in market.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for IVD regulatory affairs outsourcing through expanded range of size.

SKU-