Market Analysis and Insights: North America Instrument Cluster Market

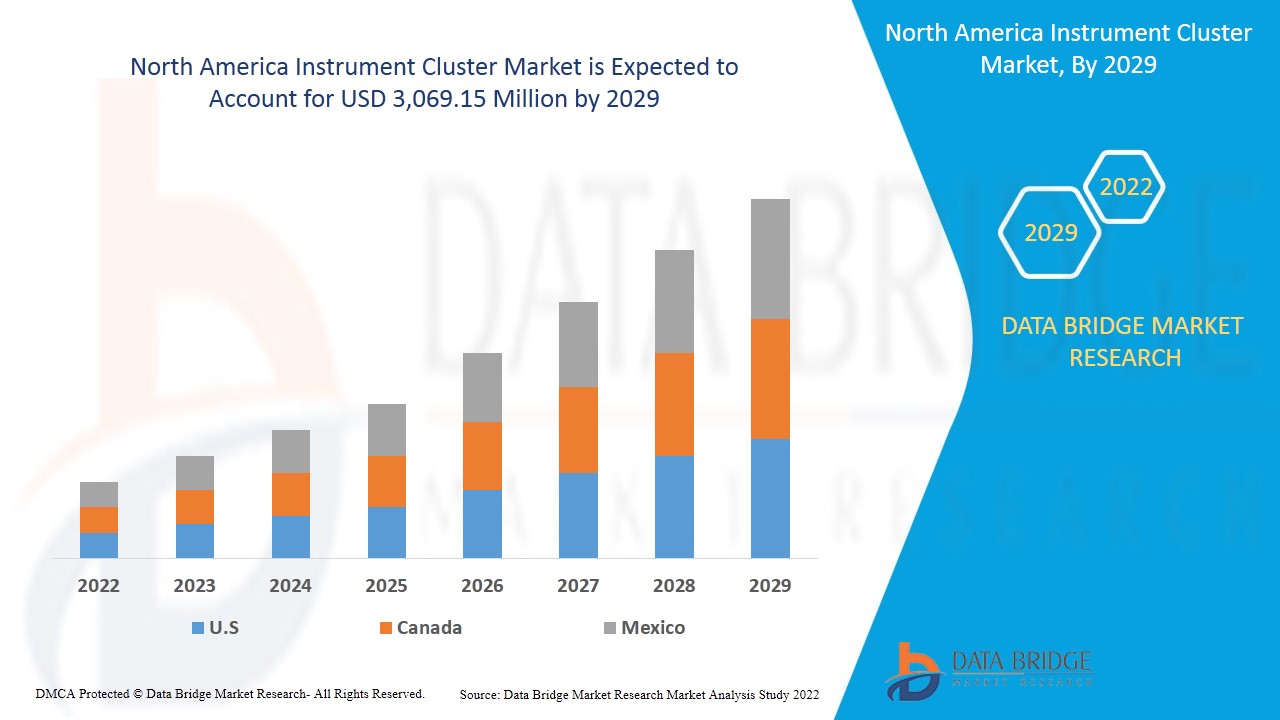

North America instrument cluster market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 5.1% in the forecast period of 2022 to 2029 and expected to reach USD 3,069.15 million by 2029. The growth of the automotive industry in developing countries, and the rise in demand for high-end passenger cars are driving the automotive instrument cluster market. In addition, the rise in production & sales of vehicles and increase in infotainment systems are boosting the market growth. However, fluctuation in raw material costs, such as chips, ICs, and displays, and higher costs associated with digital instrument clusters are expected to hinder the demand in the market.

The instrument cluster is placed directly in front of the steering wheel in most modern automobiles and trucks, placing all of the instruments within the driver's natural line of sight. Some vehicles have turned signal indicators mounted at the front, top end of each fender, many early automobiles had coolant temperature gauges built right into the radiator caps, and some vehicles have also had tachometers that were hood-mounted. No doubt, the first vehicles didn't have instrument clusters when they rolled out of the barns and sheds where they were made (or even when the first mass-produced cars went on sale). They didn't have any instruments at all, for that matter. These early automobiles resembled carriages of the time rather than modern automobiles, and they lacked the passenger compartment or "cockpit" that we are familiar with today.

Rising demand for development of complete digital cockpit solution is expected to drive the growth of the market however, stringent government regulations for vehicle safety is expected to hinder the market’s growth. The increasing adoption of luxury vehicle is expected to create an opportunity for the market’s growth but complicated design structure of digital instrument cluster is expected to challenge the market’s growth

The instrument cluster market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the instrument cluster market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Instrument Cluster Market Scope and Market Size

North America instrument cluster market is segmented into five notable segments which are based on the utility, vehicle type, technology, enterprise size and end-use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of utility, the North America instrument cluster market is segmented into speedometer, tachometer, odometer, oil pressure gauge, coolant temperature gauge, and others. In 2022, the speedometer is expected to dominate the market as they are the primary component of any instrument cluster which provides all the information to the driver related to the vehicle.

- On the basis of vehicle type, the North America instrument cluster market is segmented into ICE vehicle, battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), hybrid electric vehicle (HEV), and fuel cell electric vehicle (FCEV). In 2022, ICE vehicle is expected to dominate the market due the increasing demand for vehicles with advanced features, and the rising need for filtering the information according to the driving scenario.

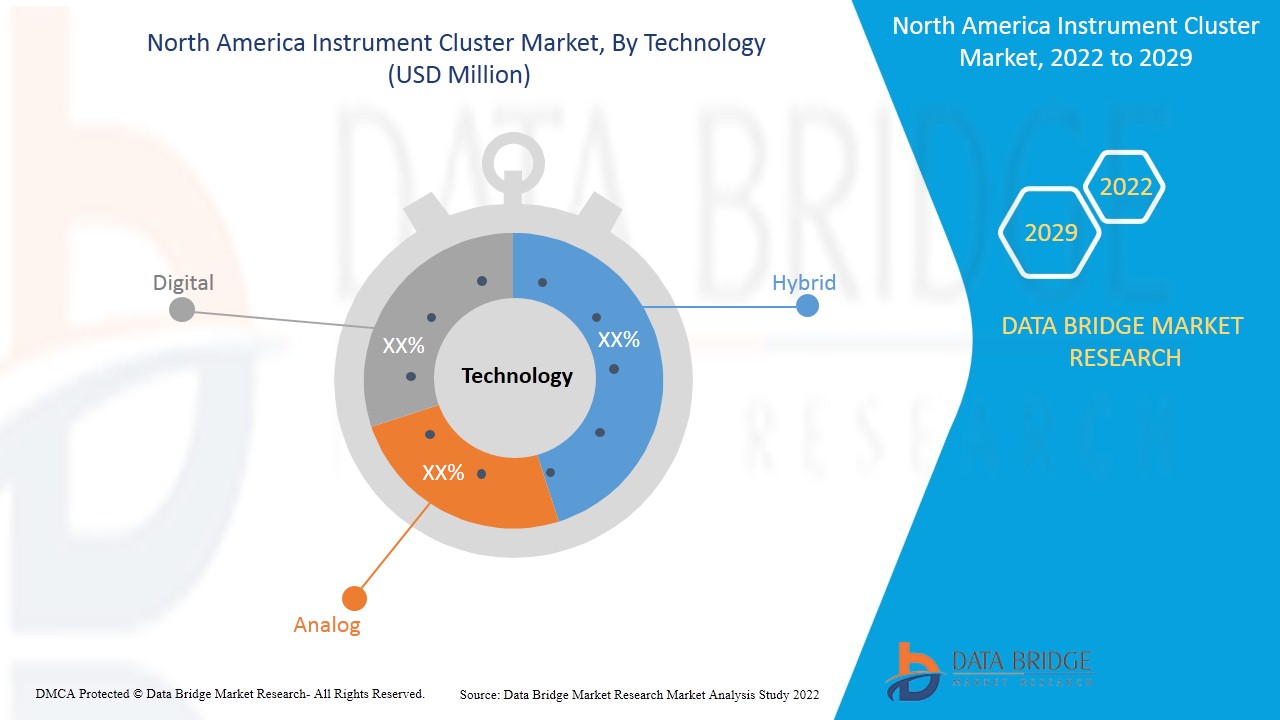

- On the basis of technology, the North America instrument cluster market is segmented into hybrid, analog, digital and others. In 2022, hybrid technology is expected to dominate the market as it offers advancements in digital technology and electronics, dashboard in vehicles now display real time information regarding vehicle in the analog or digital form by using actuators.

- On the basis of enterprise size, the North America instrument cluster market is segmented into large scale organizations, semi-urban mid-scale organizations, and small-scale organizations. In 2022, large-scale organizations are expected to dominate the market as they have a higher capacity of production volume and deal with a wide range of product portfolios in the market.

- On the basis of end-user, the North America instrument cluster market is segmented into passenger cars, commercial vehicles, two-wheelers, agriculture vehicles, off-highway vehicles and others. In 2022, passenger car is expected to dominate the market as the demand for passenger car has surged in recent times due to the increasing leisure and tour activities globally. Small cars are also growing at a fast pace as they find less traffic on the road as compared to large passenger car and the implementation of digital display and instrument cluster are higher in the passenger cars

Instrument Cluster Market Country Level Analysis

The instrument cluster market is analyzed and market size information is provided by the country, utility, vehicle type, technology, enterprise size and end-user as referenced above.

The countries covered in the instrument cluster market report are the U.S., Canada, and Mexico. U.S. dominates the North America region due to the rapid adoption of advanced technologies and development in the automotive industry in the country is expected to drive market growth. Moreover, the presence of key players in U.S. is expected to provide significant opportunities for the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand for Development of Complete Digital Cockpit Solution is Expected to Drive the Growth of the Market

The instrument cluster market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period from 2011 to 2020.

Competitive Landscape and Instrument Cluster Market Share Analysis

Instrument cluster market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to instrument cluster market.

Some of the major players operating in the instrument cluster market are Visteon Corporation., Continental AG, PARKER HANNIFIN CORP, Robert Bosch GmbH, Infenion Technologies AG, Delphi Technologies, HARMAN International, Aptiv, YAZAKI Corporation, Nippon Seiki Co., Ltd., DENSO CORPORATION, Renesas Electronics Corporation, IAC Group, LUXOFT, A DXC TECHNOLOGY COMPANY, Spark Minda, ALPS ALPINE CO., LTD, Panasonic Corporation, Simco Ltd, Texas Instruments Incorporated, Mini Meters Manufacturing Co. Pvt. Ltd., and Embitel among others.

Many contracts and agreements are also initiated by the companies’ which are also accelerating the instrument cluster market.

For instances,

- In March 2019, Visteon Corporation had launched the first 3D cluster for all-new PEUGEOT 208 in all parts of PEUGEOT’s unique 3D i-Cockpit, where the instrument cluster mostly represents the first real 3D cluster in automotive production. It had helped in displaying advanced reflections for creating the impressions of 3D graphics

- In September 2021, HARMAN International announced a collaboration with Renault Mégane E-TECH electric. The collaboration between companies took place for redesigning the interior of the vehicle. The company product launch is in all-new in-car experiences for drivers and customers. The market is expected to have new products with best features and new designs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INSTRUMENT CLUSTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

4.2 CASE STUDY

4.3 TECHNOLOGICAL TRENDS

4.3.1 PREDICTIVE MAINTENANCE

4.3.2 DRIVER MONITORING SYSTEM

4.3.3 DIGITAL COCKPIT SOLUTIONS

4.4 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR DEVELOPMENT OF COMPLETE DIGITAL COCKPIT SOLUTION

5.1.2 TRANSITION OF MECHANICAL SYSTEM TO ELECTRONIC SYSTEM IN AUTOMOBILE SECTOR

5.1.3 INCREASING NUMBER OF ELECTRIC VEHICLE SALES

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT REGULATIONS FOR VEHICLE SAFETY

5.2.2 MOST OF SPEEDOMETERS ACCURACY LOWERS AS TIRES WEAR OFF

5.3 OPPORTUNITIES

5.3.1 ADOPTION OF LUXURY VEHICLES IS IMPOSING A POSITIVE OUTLOOK ON MARKET

5.3.2 INTEGRATION OF HMI SOLUTION IN INSTRUMENT CLUSTER

5.3.3 INCREASE IN ACQUISITION AND MERGER AMONG VARIOUS MARKET PLAYERS

5.4 CHALLENGES

5.4.1 COMPLICATED DESIGN STRUCTURE OF DIGITAL INSTRUMENT CLUSTER

5.4.2 ERRORS ASSOCIATED WITH ANY VEHICLE SENSORS IMPACTS WORKING OF INSTRUMENT CLUSTER

6 IMPACT OF COVID-19 ON NORTH AMERICA INSTRUMENT CLUSTER MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE AND DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY UTILITY

7.1 OVERVIEW

7.2 SPEEDOMETER

7.2.1 ANALOG

7.2.2 DIGITAL

7.3 TACHOMETER

7.4 ODOMETER

7.4.1 MECHANICAL

7.4.2 ELECTRONIC

7.5 OIL PRESSURE GAUGE

7.6 COOLANT TEMPERATURE GAUGE

7.7 OTHERS

8 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY VEHICLE TYPE

8.1 OVERVIEW

8.2 ICE VEHICLE

8.3 BATTERY ELECTRIC VEHICLE (BEV)

8.4 HYBRID ELECTRIC VEHICLE (HEV)

8.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

8.6 FUEL CELL ELECTRIC VEHICLE (FCEV)

9 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 HYBRID

9.3 DIGITAL

9.3.1 LIQUID CRYSTAL DISPLAY (LCD)

9.3.2 ORGANIC LIGHT EMITTING DIODE (OLED)

9.3.3 THIN FILM TRANSISTOR-LIQUID CRYSTAL DISPLAY (TFT-LCD)

9.3.4 5-8 INCH

9.3.5 9-11 INCH

9.3.6 MORE THAN 12 INCH

9.3.7 AI-BASED: DIGITAL INSTRUMENT CLUSTER

9.3.8 NON AI-BASED: DIGITAL INSTRUMENT CLUSTER

9.4 ANALOG

10 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 LARGE SCALE ORGANIZATIONS

10.3 SEMI-URBAN MID SCALE ORGANIZATIONS

10.4 SMALL SCALE ORGANIZATIONS

11 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY END-USER

11.1 OVERVIEW

11.2 PASSENGER CARS

11.3 COMMERCIAL VEHICLES

11.4 TWO-WHEELERS

11.5 AGRICULTURE VEHICLES

11.6 OFF-HIGHWAY VEHICLES

11.7 OTHERS

12 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY REGION

12.1 NORTH AMERICA

13 NORTH AMERICA INSTRUMENT CLUSTER MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VISTEON CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 INFINEON TECHNOLOGIES AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CONTINENTAL AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ROBERT BOSCH GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 RENESAS ELECTRONICS CORPORATION.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 RECENT DEVELOPMENT

15.6 APTIV

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ALPS ALPINE CO., LTD

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 DENSO CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DELPHI TECHNOLOGIES (BORGWARNER INC)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 DONGFENG MOTOR PARTS (GROUP) CO., LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EMBITEL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HARMAN INTERNATIONAL.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 IAC GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 LUXOFT, A DXC TECHNOLOGY COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MINI METERS MANUFACTURING CO. PVT. LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 MARELLI HOLDINGS CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 NIPPON SEIKI CO., LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 PARKER HANNIFIN CORP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 PANASONIC CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 PRICOL LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 SIMCO LTD

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SPARK MINDA

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 TEXAS INSTRUMENTS INCORPORATED

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 YAZAKI CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SPEEDOMETER IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SPEEDOMETER IN INSTRUMENT CLUSTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA TACHOMETER IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ODOMETER IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ODOMETER IN INSTRUMENT CLUSTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OIL PRESSURE GAUGE IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA COOLANT TEMPERATURE GAUGE IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA OTHERS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2022-2029 (USD MILLION)

TABLE 10 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ICE VEHICLE IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BATTERY ELECTRIC VEHICLE (BEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA HYBRID ELECTRIC VEHICLE (HEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLUG-IN ELECTRIC VEHICLE (PHEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HYBRID IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY DISPLAY SIZE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY EMBEDDED TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ANALOG IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA LARGE SCALE ORGANIZATIONS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA SEMI-URBAN MID SCALE ORGANIZATIONS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SMALL SCALE ORGANIZATIONS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA PASSENGER CARS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA COMMERCIAL VEHICLES IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TWO-WHEELERS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA AGRICULTURE VEHICLES IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OFF-HIGHWAY VEHICLES IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INSTRUMENT CLUSTER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA INSTRUMENT CLUSTER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INSTRUMENT CLUSTER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INSTRUMENT CLUSTER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INSTRUMENT CLUSTER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INSTRUMENT CLUSTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INSTRUMENT CLUSTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INSTRUMENT CLUSTER MARKET : DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INSTRUMENT CLUSTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INSTRUMENT CLUSTER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA INSTRUMENT CLUSTER MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR COMPLETE DIGITAL COCKPIT IS EXPECTED TO DRIVE THE NORTH AMERICA INSTRUMENT CLUSTER MARKET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 12 SPEEDOMETER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INSTRUMENT CLUSTER MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE NORTH AMERICA INSTRUMENT CLUSTER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 BELOW IS THE ESTIMATED PRICE OF THE VARIOUS COMPONENT OF THE INSTRUMENT CLUSTER (USD)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA INSTRUMENT CLUSTER MARKET

FIGURE 16 CONSUMER AND GOVERNMENT SPENDING ON ELECTRIC CARS, 2016-2020 (USD BILLION)

FIGURE 17 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY UTILITY, 2021

FIGURE 18 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY VEHICLE TYPE, 2021

FIGURE 19 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY TECHNOLOGY, 2021

FIGURE 20 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 21 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY END USER, 2021

FIGURE 22 NORTH AMERICA INSTRUMENT CLUSTER MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA INSTRUMENT CLUSTER MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 27 NORTH AMERICA INSTRUMENT CLUSTER MARKET: COMPANY SHARE 2021 (%)

North America Instrument Cluster Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Instrument Cluster Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Instrument Cluster Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.