North America Hollow Core Insulator Market, By Voltage Rating (Below 300 KV, 300-600 KV, Above 600 KV), Shed Material Type(High Temperature Vulcanizing (HTV) Silicon Rubber, Liquid Silicon Rubber), Shed Design (Plain Shed, Alternating Shed, Single Rib Shed, Double Rib Shed, Super Deep Rib Shed), Product Type (Ceramic, Composite), Application (Instrument Transformers, Circuit Breakers, Surge Arresters, Bushing, Switching Gear, Station Post, Cable Termination), Country (The U.S., Canada, and Mexico). Industry Trends and Forecast to 2028.

Market Analysis and Insights: North America Hollow Core Insulator Market

An insulator is a material used to keep sound or heat contained or something that does not conduct electricity. Hollow-core insulators are insulating substances for various high voltage applications and electrical power transmission lines. Hollow-core insulators, alternatives for glass and porcelain insulators, provide high quality, reliable and strong performance in high voltages up to 1100 kV AC and 1100 kV DC. Compared to glass and porcelain insulators, hollow core insulators offer other significant benefits due to their lighter weight, better contamination performance, seismic resistance, and increased protection while in a catastrophic failure. Hollow-core insulators offer dimensional consistency, which permits for enhancements in dielectric optimization and higher overall performance of diverse seal systems. The demand for hollow core insulators has increased in the wake of protecting transformers and power transmission lines due to the hydrophobicity of its sheds which therefore provide improved performance under challenging environmental and polluted conditions.

An increase in growth in transmission and distribution networks across the region is expected to act as the major driving factor in the market. The higher cost associated with the purchase of hollow-core insulation is acting as a restraint to the market growth. Also, the challenges faced due to the impact of COVID-19 on the supply chain of raw materials are few other restraining factors.

However, up-gradation and expansion of the electricity and power generation sector are opportunities for the market's growth. Lack of infrastructure for database management systems in the power sector could prove to be a challenge

North America hollow core insulator market provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the hollow core insulator market scenario, contact Data Bridge Market Research for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Hollow Core Insulator Market Scope and Market Size

North America hollow core insulator market is segmented into five notable segments, which are based on the voltage rating, shed material type, shed design, product type, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of voltage rating, the hollow core insulator market is segmented into below 300 kV, 300-600kV, and above 600kV. In 2021, below 300 kV is expected to hold the highest segment owing to the increasing usage in multi-circuit transmission technology and the rise in the application of triple and quadruple circuit lines.

- On the basis of shed material type, the hollow core insulator market is segmented into high temperature vulcanizing (HTV) silicone rubber and liquid silicon rubber. In 2021, high temperature vulcanizing (HTV) silicone rubber is expected to hold the highest segment owing to its better antipollution flashover capacity.

- On the basis of shed design, the hollow core insulator market is segmented into single rib shed, double rib shed, plain shed, alternating shed, and super deep rib shed. In 2021, plain shed safe is expected to hold the largest market share due to the stable distribution of electricity generated at power plants. Moreover, the inorganic bonding used in large plain shed hollow insulators ensures remarkable long-term reliability.

- On the basis of product type, the hollow core insulator market is segmented into ceramic and composite. In 2021, the ceramic insulator is expected to hold the largest market share as they are generally used owing to their high dielectric strength, low electrical loss, and high dielectric constant.

- On the basis of application, the hollow core insulator market is segmented into a circuit breaker, instrument transformer, bushing, cable termination, surge arrester, station post, and switching gear. In 2021, the instrument transformer is expected to hold the highest segment as it provides electrical isolation between high voltage power circuits and measuring instruments. This reduces the electrical insulation requirement for measuring instruments and protective circuits and assures operators' safety.

Hollow Core Insulator Market Country Level Analysis

North America hollow core insulator market is analyzed, and market size information is provided by the country, component, deployment model, device type, technology, application, and end user, as referenced above.

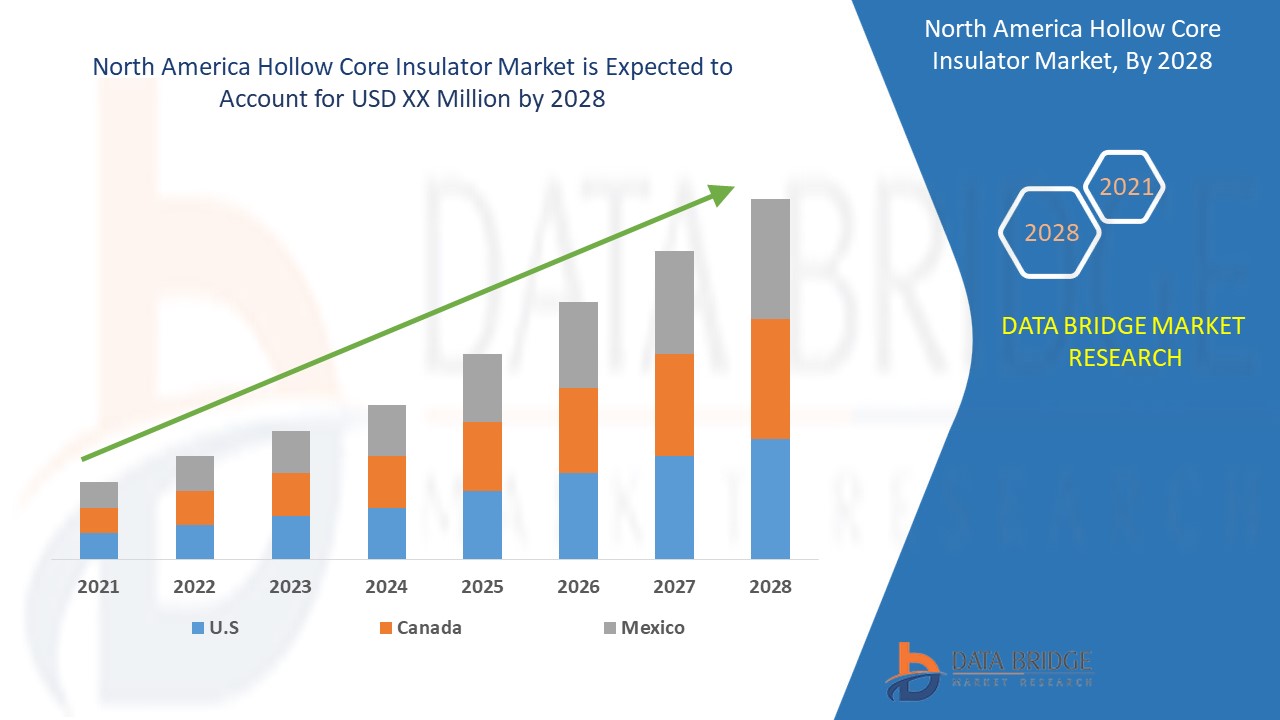

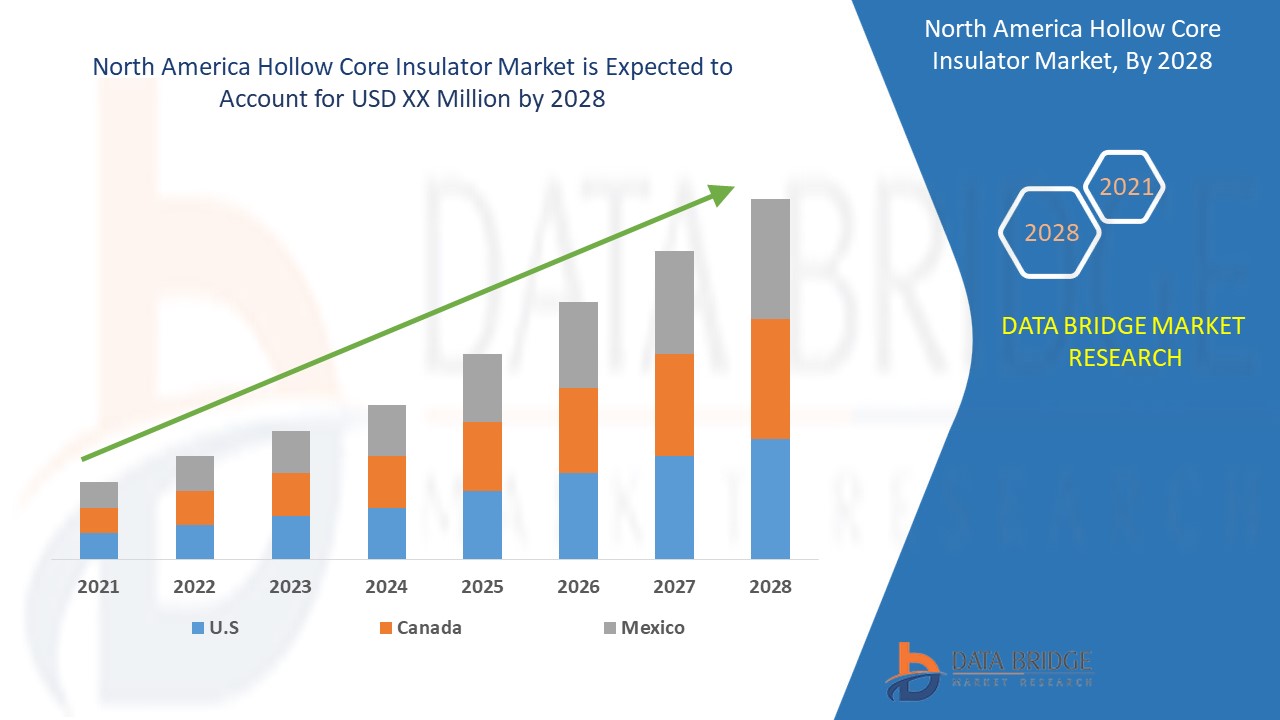

The countries covered in the North America hollow core insulator market report are the U.S., Canada, and Mexico. The U.S. is expected to dominate the North America region because of rapid development in technology and demand for high capacity supply.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Shift in Consumer Preferences Towards Safe and Reliable Power Equipment Is Boosting the Market Growth of Hollow Core Insulator Market.

The hollow core insulator market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players' strategy and their geographical presence. The data is available for the historical period 2010 to 2019.

Competitive Landscape and Hollow Core Insulator Market Share Analysis

North America hollow core insulator market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to the hollow core insulator market.

Some of the major players operating in the North America hollow core insulator market are PPC Austria Holding GmbH, CTC INSULATOR, Modern Insulators Ltd., PFISTERER Holding AG, Jiangsu Shenma Electric Power Co., Ltd, Maschinenfabrik Reinhausen GmbH, SAVER S.p.A, Nanjing Electric(Group)Co., Ltd., NGK INSULATORS, LTD, ZPE ZAPEL S.A, Zhengzhou Orient Power Co., Ltd, SANDIAN ELECTRIC, Aditya Birla Insulators., MacLean-Fogg, Global Insulator Group LLC, Royalinsulator, Hitachi ABB Power Grids, Fujian Ruisen New Materials Co., Ltd., Dalian Hivolt Power System Co., Ltd., Newell & Hindustan Urban Infrastructure Ltd among others.

Many contracts and agreements are also initiated by companies worldwide, which are also accelerating the hollow core insulator market.

For instance,

- In August 2021, Hitachi ABB Power Grids had announced a step for a sustainable energy future and entering the transmission voltage level with its Econi eco-efficient high-voltage portfolio. EconiQ is the company's eco-efficient portfolio for sustainability, where products, services, and solutions are proven to deliver exceptional environmental performance. With that, the company had manufactured the first commercially available alternative to SF6 for gas-insulated switchgear with circuit breakers for power transmission networks, thereby reducing environmental effects significantly

- In July 2019, MacLean-Fogg &Richard Bergner Verbindungstechnik GmbH & Co. KG had announced a joint venture for the high-strength aluminum bolt, screw, and stud fasteners for lightweight, corrosion-sensitive insulators & other components for automotive applications. With this, the company had strengthened its product line to the North American marketplace, with application engineering, customer support, and manufacturing across the U.S.

SKU-