North America Health Insurance Market Analysis and Size

Health insurance policy consists of several types of features and benefits. It provides financial coverage to policyholder against certain treatment. Health insurance policy offers advantages including cashless hospitalization, coverage of pre and post-hospitalization, reimbursement, and various add-ons.

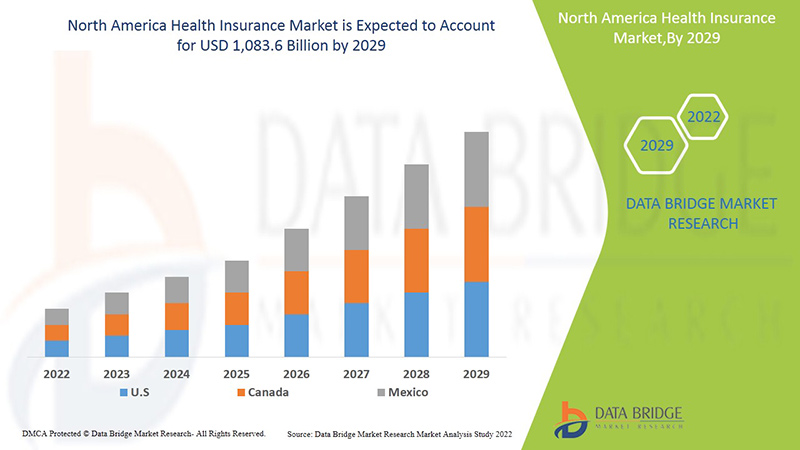

Increasing costs for medical services and the growing number of day care procedures are some of the drivers boosting health insurance demand in the market. Data Bridge Market Research analyses that the health insurance market is expected to reach the value of USD 1,083.6 billion by the year 2029, at a CAGR of 5.4% during the forecast period. "Corporates" accounts for the most prominent end-user segment in the respective market owing to rise in the demand for group health insurance by corporates. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Product, Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assistance, Others), Level of Coverage (Bronze, Silver, Gold, Platinum), Service Providers (Public Health Insurance Providers, Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), Others), Demographics (Adults, Minors, Senior Citizens), Coverage Type (Lifetime Coverage, Term Coverage), End User (Corporates, Individuals, Others) Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics & Others) Industry Trends and Forecast to 2029 |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Some of the major players operating in the market are Bupa (London, U.K.), Now Health International (Hong Kong, China), Cigna (Connecticut, U.S.), Aetna Inc. (a subsidiary of CVS Health) (Connecticut, U.S.), AXA (Paris, France), HBF Health Limited (Perth, Australia), Vitality (a subsidiary of Discovery Limited) (London, U.K.), Centene Corporation (Missouri, U.S.), International Medical Group, Inc. (a subsidiary of Sirius International Insurance Group Ltd.) (Indiana, U.S.), Anthem Insurance Companies, Inc. (a subsidiary of Anthem, Inc.) (Indiana, U.S.), Broadstone Corporate Benefits Limited (London, U.K.), Allianz Care (a subsidiary of Allianz SE) (Paris, France), HealthCare International North America Network Ltd (London, U.K.), Assicurazioni Generali S.P.A. (Trieste, Italy), Aviva (London, U.K.), Vhi Group (Dublin, Ireland), UnitedHealth Group (Minnesota, U.S.), MAPFRE (Majadahonda, Spain), AIA Group Limited (Hong Kong), Oracle (California, U.S.) among others. |

Market Definition

Health insurance is a type of insurance that provide the coverage of all type of surgical expenses as well as medical treatment incurred from the illness or injury. It applies to a comprehensive or limited range of medical services providing the coverage of full or partial costs of specific services. It provides financial support to the policy holder as it covers all the medical expenses when the policyholder is hospitalized for the treatment. It also covers pre as well as post hospitalization expenses.

In the health insurance plan several types of coverage are available which is cashless or reimbursement claim. Cashless benefit is available when the policyholder takes treatment from the network hospitals of the insurance company. If the policyholder takes treatment from the hospitals which are not in the list network, in that case, policyholder meets all the medial expenses and then claims for the reimbursement in the insurance company by submitting all the medical bills.

Regulatory Framework

- The Health Insurance Portability and Accountability Act (HIPAA) protects America workers by allowing them to carry health insurance policies from job to job. [5] The program also permits workers to apply to a select group of health insurance plans to replace lost coverage and adjust for family changes such as marriages, births and adoptions. HIPAA bars insurers from discriminating against policy applicants due to health problems. In some instances, if an insurance company denies a worker’s application, the individual may apply for coverage outside of the normal enrollment period. Additionally, the act preserves state laws that protect workers’ insurance rights.

COVID-19 had a Minimal Impact on Health Insurance Market

COVID-19 impacted various manufacturing and service providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Though, the imbalance between demand and supply and its impact on pricing is considered short-term and is expected to recover as this pandemic comes to an end. Due to outbreak of covid19 throughout the globe, the demand for health insurance has increased tremendously. Also, the fear of pandemic and the increased cost for medical services helped the health insurance market grow during pandemic. In addition, health insurance companies introduced packages and solutions for covering the medical costs for treating covid19 infected insurers. Thus, even though the other industries suffered a lot during covid19 outbreak, the health insurance industry was growing significantly.

The Market Dynamics of the Health Insurance Market Include:

Drivers/Opportunities in the Health Insurance Market

- Increasing Cost of Medical Services

Health insurance provides financial support in cases of serious sickness or accident. Increasing medical services’ costs for surgeries and hospital stays has created a new financial epidemic around the world. The cost of medical services is comprised of the cost of surgery, doctor fee, hospital stay cost, cost of the emergency room, diagnostic testing cost, among others. Therefore, this increase in the cost of medical services propels the growth of the market.

- Growing Number of Daycare Procedures

Daycare procedures are those types of medical procedure or surgery that primarily requires less stay time in the hospitals. In the daycare procedure patients are required to stay in the hospital for a short period. Most of the health insurance companies are now covering the procedures of daycare in their insurance plans, and for the claim of such types of surgery, there is no compulsion on spending 24 hours in the hospital, which is the minimum stay in the hospital to claim insurance. While most of the health insurance plans cover hospital stays and major surgeries, the policyholders can also claim daycare procedures under their health insurance policy, which propels the demand of the market.

- Mandatory Provision of Healthcare Insurance in Public and Private Sectors

Buying a healthcare insurance policy is a mandatory provision for the employees in the public as well as the private sector. Health insurance offers key medical benefits which the employee can avail of while working in a corporate. In case of any emergency or medical issues, the health insurance cover is highly useful to meet treatment expenses. The employee’s health insurance is an extended benefit, given by the individual employer to their employees. The health insurance provided not only covers the employee but also covers their family members under the same policy plan. Also, in certain cases, the employer may pay a part of a premium or insurance coverage of the health insurance policy.

- Advantages of Health Insurance Policies

In the health insurance plans, the policyholder gets the reimbursement insured for their medical expenses such as hospitalization, surgeries, treatments that arise from the injuries. A health insurance policy is a type of agreement between the policyholder and insurance company, where the insurance company agrees to guarantee payment for the treatment costs in case of future medical issues, and the policyholder agrees to pay the amount of premium according to the insurance plan. Thus, the advantages of health insurance policies increases the growth opportunities for North America health insurance market.

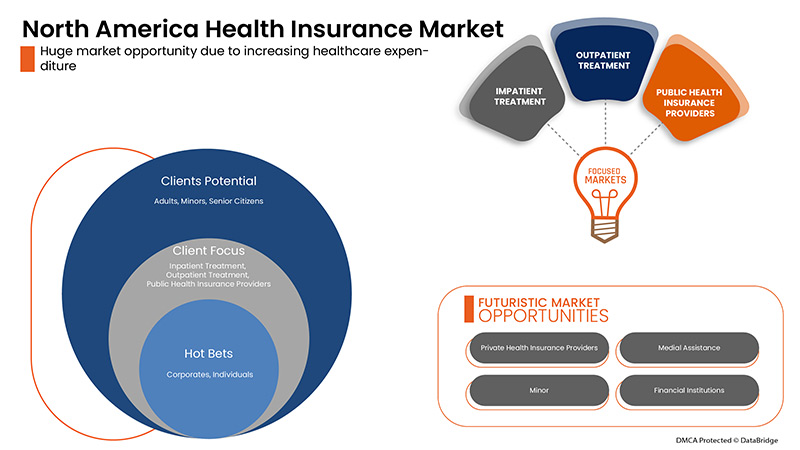

- Increasing Healthcare Expenditure

Spending on health is growing faster around the world. According to the World Health Organization (WHO) report, global health spending has an upward trajectory growth. Global spending on health more than doubled over the past two decades, reaching USD 8.5 trillion in 2019, or 9.8% of global GDP. However, it was unequally distributed, with high-income countries accounting for approximately 80% of the world’s health spending. Health spending in low-income countries was financed primarily by out-of-pocket spending (OOPS; 44%) and external aid (29%), while government spending dominated in high-income countries (70%). Thus, the increasing healthcare expenditure is expected to act as opportunity in the North America health insurance market.

Restraints/Challenges Faced by the Health Insurance Market

- High cost of Insurance Premiums

Health insurance covers all types of medical treatment costs. It provides financial support to the policyholder since it covers all the medical expenses when the policyholder is hospitalized for the treatment. Health insurance also covers pre as well as post-hospitalization expenses. To purchase health insurance, the policyholder has to pay insurance premiums regularly to keep the health insurance policy active. The cost of insurance premium is high in the majority of cases based on the insurance plan, which is hampering the growth of the market.

- Lack of Awareness Regarding the Benefits of Health Insurance

In the field of healthcare, a large portion of the world population is still not aware of the benefits of health insurance policies. The expenses of medical care are increasing across the world with advancements made in the field. Through the advancement in technology, the healthcare sector is one of the growing segments, however, the penetration rate of health insurance policies remains low due to a lack of awareness regarding the benefits offered by them.

This health insurance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the health insurance market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In August 2020, International Medical Group, Inc. (IMG) had enhanced their product offerings to support organizations with the necessary planning and research for safe international travel. Company’s unique, new assistance services were designed to support clients as they make plans for 2020 and beyond. This development helped company to sustain and thrive in pandemic.

- In June 2021, Vitality has announced it has partnered with Samsung UK to integrate Samsung Health into the Vitality Programme, providing members with more ways to track their activity and improve their health. The new partnership with Samsung will unlock the full benefits of the Vitality Programme to Android users as members will be able to link their Samsung Health profile to their Vitality Member Zone account to automatically capture daily steps and heart rate activity to earn Vitality activity points.

North America Health Insurance Market Scope

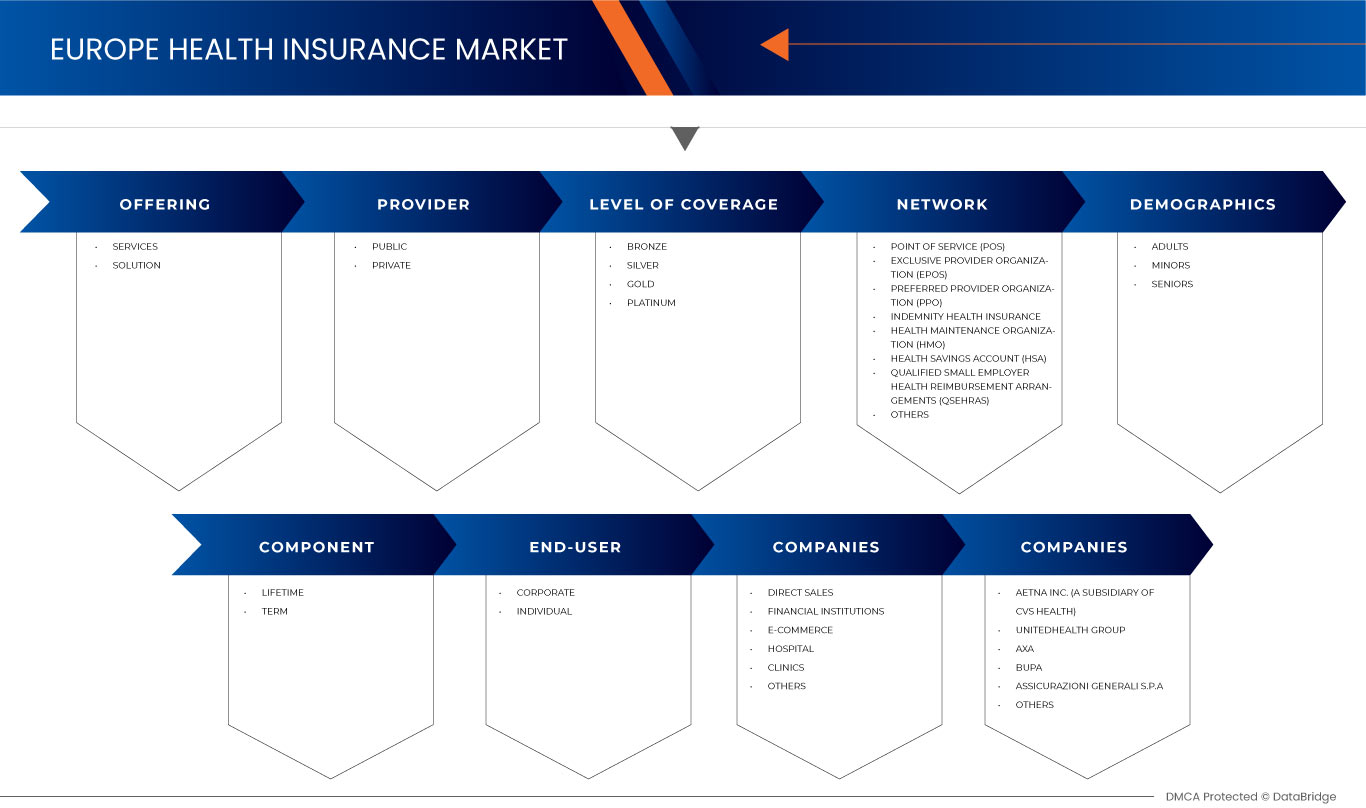

The health insurance market is segmented on the basis of type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Product

- Solutions

On the basis of type, the health insurance market is segmented into product and solutions. The product segment is expected to dominate the North America health insurance market due to the high number of premiums sold across the globe.

Services

- Inpatient Treatment

- Outpatient Treatment

- Medical Assistance

- Others

On the basis of services, the health insurance market is segmented into inpatient treatment, outpatient treatment, medical assistance and others. The inpatient treatment segment is expected to dominate the North America health insurance market because most of the premium plans are used only in inpatient treatment.

Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

On the basis of level of coverage, the health insurance market is segmented into bronze, silver, gold, and platinum. The bronze segment is expected to dominate the North America health insurance market due to the growing adoption of this term plan in mid-class all over the world.

Service Providers

- Private Health Insurance Providers

- Public Health Insurance Providers

On the basis of service providers, the health insurance market is segmented into private health insurance providers and public health insurance providers. The public health insurance providers segment is expected to dominate the North America health insurance market because of the high penetration of public funded health insurance in developed economies.

Health Insurance Plans

- Point Of Service (POS)

- Exclusive Provider Organization (EPOS)

- Indemnity Health Insurance

- Health Savings Account (HSA)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS)

- Preferred Provider Organization (PPO)

- Health Maintenance Organization (HMO)

- Others

On the basis of health insurance plans, the health insurance market is segmented into point of service (POS), exclusive provider organization (EPOS), indemnity health insurance, health savings account (HSA), qualified small employer health reimbursement arrangements (QSEHRAS), preferred provider organization (PPO), health maintenance organization (HMO), and others. Point of service (POS) segment is expected to dominate the North America health insurance market due to high benefits offered by the plan compared to traditional term plan. In addition, growing awareness is also boosting the demand during the forecast period.

Demographics

- Adults

- Minors

- Senior Citizens

On the basis of demographics, the market is segmented into adults, minors, and senior citizens. The adults segment is expected to dominate the North America health insurance market because of the large adult pool of customers in the market.

Coverage Type

- Lifetime Coverage

- Term Coverage

On the basis of coverage type, the market is segmented into lifetime coverage and term coverage. Lifetime coverage segment is expected to dominate the North America health insurance market on account of high demand amongst adult population in developed and developing countries.

End User

- Corporates

- Individuals

- Others

On the basis of end user, the market is segmented into corporates, individuals, and others. The corporates segment is expected to dominate the North America health insurance market due to strict regulation and high spending on health insurance.

Distribution Channel

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

On the basis of distribution channel, the market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics and others. Direct sales segment is expected to dominate the North America health insurance market due to the availability of various third party vendors and their wide acceptance in the domestic market.

Health Insurance Market Regional Analysis/Insights

The health insurance market is analyzed and market size insights and trends are provided by country, type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel as referenced above.

The countries covered in the health insurance market report are the U.S., Canada and Mexico in North America.

U.S. in North America dominates the health insurance market because of the high disposable income of consumers. U.S. is followed by Canada and is expected to witness significant growth during the forecast period of 2022 to 2029 due to growing demand for health insurance from corporates sector in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Health Insurance Market Share Analysis

The health insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to health insurance market.

Some of the major players operating in the health insurance market are Bupa, Now Health International, Cigna, Aetna Inc. (a subsidiary of CVS Health), AXA, HBF Health Limited, Vitality (a subsidiary of Discovery Limited), Centene Corporation, International Medical Group, Inc. (a subsidiary of Sirius International Insurance Group Ltd.), Anthem Insurance Companies, Inc. (a subsidiary of Anthem, Inc.), Broadstone Corporate Benefits Limited, Allianz Care (a subsidiary of Allianz SE), HealthCare International North America Network Ltd, Assicurazioni Generali S.P.A., Aviva, Vhi Group, UnitedHealth Group, MAPFRE, AIA Group Limited, Oracle among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 NORTH AMERICA HEALTH INSURANCE MARKET, BY TYPE

6.1 OVERVIEW

6.2 PRODUCT

6.2.1 MEDICLAIM INSURANCE

6.2.2 INDIVIDUAL COVERAGE INSURANCE

6.2.3 FAMILY FLOATER COVERAGE INSURANCE

6.2.4 HOSPITALIZATION COVERAGE INSURANCE

6.2.5 SENIOR CITIZEN COVERAGE INSURANCE

6.2.6 CRITICAL ILLNESS INSURANCE

6.2.7 UNIT LINKED HEALTH PLANS

6.2.8 PERMANENT HEALTH INSURANCE

6.3 SOLUTIONS

6.3.1 LEAD GENERATIONS SOLUTIONS

6.3.2 REVENUE MANAGEMENT & BILLING SOLUTIONS

6.3.3 ROBOTIC PROCESS AUTOMATION

6.3.4 INSURANCE CLOUD SOLUTIONS

6.3.5 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

6.3.6 VALUE-BASED PAYMENTS SOLUTIONS

6.3.7 ARTIFICIAL INTELLIGENCE & BLOCK CHAIN SOLUTIONS

6.3.8 INTELLIGENT CASE MANAGEMENT SOLUTIONS

6.3.9 OTHERS

7 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICES

7.1 OVERVIEW

7.2 INPATIENT TREATMENT

7.3 OUTPATIENT TREATMENT

7.4 MEDICAL ASSURANCE

7.5 OTHERS

8 NORTH AMERICA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

8.1 OVERVIEW

8.2 BRONZE

8.3 SILVER

8.4 GOLD

8.5 PLATINUM

9 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS

9.1 OVERVIEW

9.2 PUBLIC HEALTH INSURANCE PROVIDERS

9.3 PRIVATE HEALTH INSURANCE PROVIDERS

10 NORTH AMERICA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS

10.1 OVERVIEW

10.2 POINT OF SERVICE (POS)

10.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

10.4 PREFERRED PROVIDER ORGANIZATION (PPO)

10.5 INDEMNITY HEALTH INSURANCE

10.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

10.7 HEALTH SAVINGS ACCOUNT (HSA)

10.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

10.9 OTHERS

11 NORTH AMERICA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULTS

11.3 MINORS

11.4 SENIOR CITIZENS

12 NORTH AMERICA HEALTH INSURANCE MARKET, BY COVERAGE TYPE

12.1 OVERVIEW

12.2 LIFETIME COVERAGE

12.3 TERM COVERAGE

13 NORTH AMERICA HEALTH INSURANCE MARKET, BY END-USER

13.1 OVERVIEW

13.2 CORPORATES

13.3 INDIVIDUALS

13.4 OTHERS

14 NORTH AMERICA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 FINANCIAL INSTITUTIONS

14.4 E-COMMERCE

14.5 HOSPITALS

14.6 CLINICS

14.7 OTHERS

15 NORTH AMERICA HEALTH INSURANCE MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA HEALTH INSURANCE MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.1.1 MERGERS & ACQUISITIONS

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 CIGNA

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATE

18.2 CENTENE CORPORATION

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATE

18.3 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATE

18.4 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATE

18.5 ANTHEM INSURANCE COMPANIES, INC. (A SUBSIDIARY OF ANTHEM, INC.)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATE

18.6 AIA GROUP LIMITED

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 ASSICURANZIONI GENERALI S.P.A.

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT UPDATES

18.8 AVIVA

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT UPDATES

18.9 AXA

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATES

18.1 BROADSTINE CORPORATE BENEFITS LIMITED

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT UPDATES

18.11 BUPA

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT UPDATES

18.12 HEALTHCARE INTERNATIONAL NORTH AMERICA NETWORK LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT UPDATE

18.13 HBF HEALTH LIMITED

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT UPDATES

18.14 INTERNATIONAL MEDICAL GROUP, INC. (A SUBSIDIARY OF SIRIUS POINT LTD.)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT UPDATES

18.15 MAPFRE

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT UPDATES

18.16 NOW HEALTH INTERNATIONAL

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT UPDATE

18.17 ORACLE

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT UPDATES

18.18 UNITEDHEALTH GROUP

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT UPDATES

18.19 VHI GROUP

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAY CARE PROCEDURES

TABLE 3 AVERAGE EMPLOYEE PREMIUMS IN U.S. (2020)

TABLE 4 NORTH AMERICA HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRODUCT IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA PRODUCT IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SOLUTIONS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SOLUTIONS IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA INPATIENT TREATMENT IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OUTPATIENT TREATMENT IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA MEDICAL ASSURANCE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BRONZE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SILVER IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GOLD IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PLATINUM IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PUBLIC HEALTH INSURANCE PROVIDERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA PRIVATE HEALTH INSURANCE PROVIDERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA POINT OF SERVICE (POS) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA EXCLUSIVE PROVIDER ORGANIZATION (EPOS) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PREFERRED PROVIDER ORGANIZATION (PPO) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA INDEMNITY HEALTH INSURANCE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTH MAINTENANCE ORGANIZATION (HMO) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HEALTH SAVINGS ACCOUNT (HSA) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ADULTS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MINORS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SENIOR CITIZENS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA LIFETIME COVERAGE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TERM COVERAGE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTH INSURANCE MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CORPORATES IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA INDIVIDUALS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA DIRECT SALES IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA FINANCIAL INSTITUTIONS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA E-COMMERCE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HOSPITALS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CLINICS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA HEALTH INSURANCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 U.S. HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 U.S. HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 64 U.S. HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 65 U.S. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 66 U.S. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 67 U.S. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 68 U.S. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 69 U.S. HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 U.S. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 CANADA HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 CANADA HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 75 CANADA HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 76 CANADA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 77 CANADA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 78 CANADA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 79 CANADA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 80 CANADA HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 CANADA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 MEXICO HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 MEXICO HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 MEXICO HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 86 MEXICO HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 87 MEXICO HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 89 MEXICO HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 90 MEXICO HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 91 MEXICO HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEALTH INSURANCE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEALTH INSURANCE MARKET: TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA HEALTH INSURANCE MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA HEALTH INSURANCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SECONDARY SOURCES

FIGURE 14 NORTH AMERICA HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 INCREASING COST FOR MEDICAL SERVICES IS EXPECTED TO DRIVE THE NORTH AMERICA HEALTH INSURANCE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 17 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA HEALTH INSURANCE MARKET

FIGURE 19 PERCENTAGE OF OUT-OF-POCKET EXPENDITURE ON HEALTH (2019)

FIGURE 20 HEALTH INSURANCE COVERAGE

FIGURE 21 NORTH AMERICA HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA HEALTH INSURANCE MARKET: BY SERVICES, 2021

FIGURE 23 NORTH AMERICA HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2021

FIGURE 24 NORTH AMERICA HEALTH INSURANCE MARKET: BY SERVICE PROVIDERS, 2021

FIGURE 25 NORTH AMERICA HEALTH INSURANCE MARKET: BY HEALTH INSURANCE PLANS, 2021

FIGURE 26 NORTH AMERICA HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2021

FIGURE 27 NORTH AMERICA HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2021

FIGURE 28 NORTH AMERICA HEALTH INSURANCE MARKET: BY END-USER, 2021

FIGURE 29 NORTH AMERICA HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 30 RELATIVE CONTRIBUTIONS TO U.S. HEALTH EXPENDITURES, 2020

FIGURE 31 NORTH AMERICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 32 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 33 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 NORTH AMERICA SULFURIC ACID MARKET: BY TYPE (2022-2029)

FIGURE 36 NORTH AMERICA HEALTH INSURANCE MARKET: COMPANY SHARE 2021(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.