North America Freezing Fishing Vessels Market

Market Size in USD Million

CAGR :

%

USD

4,048.57 Million

USD

6,073.34 Million

2022

2030

USD

4,048.57 Million

USD

6,073.34 Million

2022

2030

| 2023 –2030 | |

| USD 4,048.57 Million | |

| USD 6,073.34 Million | |

|

|

|

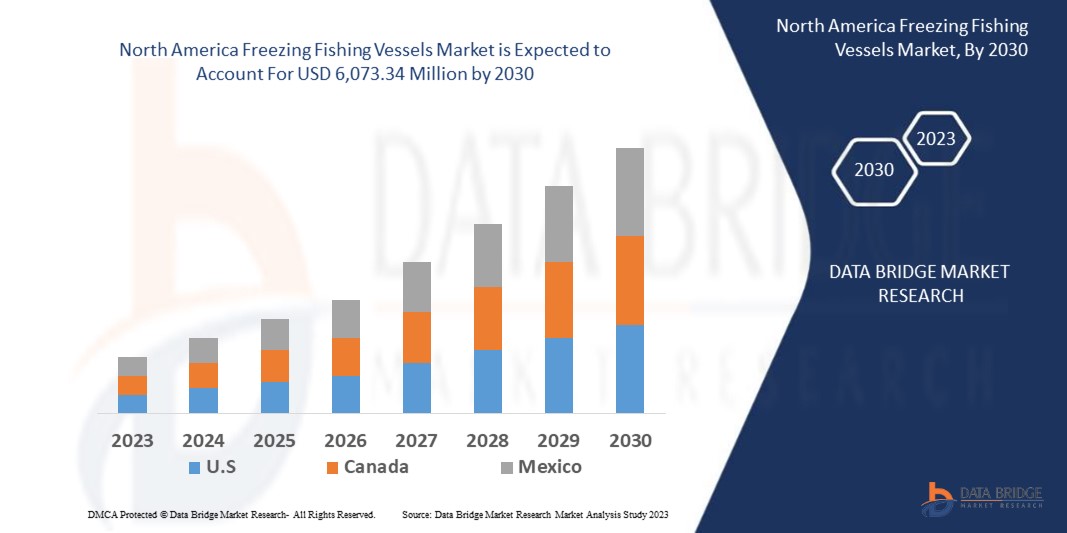

North America Freezing Fishing Vessels Market Analysis and Size

A fishing vessel is a pontoon that is used to fish in a lake, ocean, or stream. Commercial, recreational, and artisanal fishing all make use of various types of fishing vessels. The market is experiencing an increase in demand for freezing fishing vessel solutions as a result of the rising demand for seafood products. The market for frozen fishing vessels in North America is expanding quickly due to the benefits of seafood and the rising demand for fresher produce. Even new products are being introduced by businesses to increase their market share.

Data Bridge Market Research analyses that the freezing fishing vessels market, valued at USD 4,048.57 million in 2022, will reach USD 6,073.34 million by 2030, growing at a CAGR of 5.2% during the forecast period of 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

North America Freezing Fishing Vessels Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

System (Air Blast Freezing, Plate Freezing, Brine, IQF (Individual Quick Frozen)), Type (Commercial Fishing Vessels, Artisanal Fishing Vessels, and Recreational Fishing Vessels), Vessel Length (Less Than 20 M, 21 M-30 M, above 40 M and 31 M-40 M), Freezing Capacity (50 Tons to 150 Tons, 150 Tons to 300 Tons, Less Than 50 Tons, and More Than 300 Tons) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Nordic Wildfish (Norway), Lerøy Havfisk (Norway), Nichols Bros Boat Builders (U.S.), Master Boat Builders, Inc. (U.S.), Chantier de constructions navales Martinez (France), Astilleros Armon (Spain), Karstensens Skibsværft A/S (Denmark), Green Yard Kleven (Norway), Ulstein Group ASA (Norway), Heinen & Hopman Engineering BV (Netherlands), Marefsol B.V. (Netherlands), Integrated Marine Systems, Inc (U.S.), MMC FIRST PROCESS AS (Norway), TEKNO THERM INDUSTRIES. (India), Damen Shipyards Group (Netherlands), Wärtsilä, Kongsberg Gruppen ASA (Finland), Thoma-Sea Ship Builders, LLC (U.S.), Rolls-Royce plc (U.K.), ELLIOTT BAY DESIGN GROUP (U.S.), Aresa Shipyard (Turkey) |

|

Market Opportunities |

|

Market Definition

Aquaculture harvests and produces aquatic resources in either controlled or natural settings. They both make use of a wide range of innovations, from unusual to highly industrial, including both fishing gear and ships. The current trend in the fishing vessel market for aquaculture and fisheries is the use of cutting-edge technologies, such as fishing vessels and the use of engineered filaments, hydraulic equipment, and fish handling. Fishing vessel operations also involve the increased use of detachable motors, installed preservation, satellite-based navigation, and communication technology, and equipment for fish finding. The increasing demand for fishing equipment in fishery technology is predicted to benefit the global market for fishing vessels.

North America Freezing Fishing Vessels Market Dynamics

Drivers

- Growing demand for frozen seafood drives the market growth

The market for freezing fishing vessels is primarily driven by the rising demand for frozen seafood. There is a demand for specialized vessels that can maintain the catch's freshness and quality due to the rising global consumption of frozen seafood products such as fish, shrimp, and other marine products. In order to satisfy consumer preferences for accessibility and convenience, frozen seafood offers a prolonged shelf life, convenient storage, and year-round availability. The market needs such vessels as freezing fishing vessels are outfitted with cutting-edge freezing and storage capabilities to meet this demand, ensuring that seafood products maintain their quality during transportation and storage.

- Increasing focus on food safety and quality drive market growth

The market for freezing fishing vessels is significantly influenced by the growing emphasis on food safety and quality. Concerns about the reliability and caliber of seafood products among consumers and regulatory bodies have increased. By utilizing cutting-edge freezing and storage systems that guarantee the preservation of seafood freshness, and nutritional value, and minimize the risk of contamination, freezing fishing vessels play a crucial role in addressing these concerns. These vessels have the latest in temperature control, bacterial growth prevention, and seafood product shelf-life extension technologies. Freezing fishing vessels increase their demand in the market by assuring consumers and regulatory bodies that they meet strict standards and requirements for food safety and quality.

Opportunities

- Growing investment in fishing infrastructure creates lucrative opportunity to grow

Investment in fishing infrastructure, including vessels for freezing fish is creating growth opportunities in the market. Governments and private investors are aware of the fishing industry's economic potential, which includes rising seafood production and export possibilities. Modern freezing vessels can be added to existing and new fishing fleets to increase the efficiency of transportation and preservation of seafood while also ensuring higher product quality and longer shelf life. These investments also boost local economies by generating employment opportunities in the fishing and maritime industries.

- Improvements in vessel design and efficiency create a lucrative opportunity to grow

The market for freezing fishing vessels has experienced significant growth as a result of advancements in vessel efficiency and design. Environmentally friendly and more effective vessels have been created In view to improvements in design, construction materials, and propulsion systems. These ships have features such as advanced propulsion systems, streamlined hulls, and optimized energy management systems, which improve fuel efficiency and lower emissions. The performance of the vessel is further enhanced by the use of strong, lightweight materials. With these improvements, freezing fishing vessels not only align with environmental sustainability goals by reducing their ecological footprint but also provide economic benefits by lowering fuel consumption and operating costs.

Restraints/Challenges

- Operational costs impede the market growth

Operating expenses are a major impediment to the market for freezing fishing vessels. Systems for freezing and storing food can use a lot of energy, and they can also be expensive to maintain and repair. These ongoing expenses raise the operational overhead and may have an adverse effect on the profitability of vessel operations, particularly when the economy is uncertain or when the price of seafood is fluctuating. Through the complexity of the freezing and storage equipment, high energy consumption translates to higher fuel costs, while maintenance and repair costs can be substantial..

- Trade barriers and geopolitical factors limit the market growth

Trade barriers and geopolitical factors can have a significant impact on the freezing fishing vessels market. International trade policies, tariffs, and disputes can disrupt the smooth flow of seafood products across borders, affecting both import and export activities. Trade barriers can limit market access and increase costs, thereby impacting demand and profitability. Geopolitical tensions and uncertainties can create a challenging business environment, making it difficult for market participants to make informed investment decisions and plan for the long term. Changes in trade policies or geopolitical situations can introduce unpredictability and risk, affecting market dynamics and the growth potential of the freezing fishing vessels market.

This freezing fishing vessels market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the freezing fishing vessels market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2021, Wärtsilä provided Karstensens Shipyard with fishing vessel propulsion options. The NOx Reducer emissions reduction system, the reduction gear, the controllable pitch propeller, and the ProTouch propulsion remote control system were the main components of this propulsion system. The company's market was expanded to this solution launch.

- In 2019, The contract to build a 70-meter-long stern trawler for Engenes fiskeriselskap AS was awarded to Rolls-Royce plc. The company provided ship design services as well as a wide range of tools, including electrical and automation systems, deck machinery, and power and propulsion systems. This business increased its market and global reach.

North America Freezing Fishing Vessels Market Scope

The freezing fishing vessels market is segmented on the basis of system, type, vessel length, and freezing capacity. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

System

- Air Blast Freezing

- Plate Freezing

- Brine

- IQF (Individual Quick Frozen)

Type

- Commercial Fishing Vessels

- Artisanal Fishing Vessels

- Recreational Fishing Vessels

Vessel Length

- Less Than 20 M

- 21 M-30 M

- Above 40 M

- 31 M-40 M

Freezing Capacity

- 50 Tons to 150 Tons

- 150 Tons to 300 Tons

- Less Than 50 Tons

- More Than 300 Tons

North America Freezing Fishing Vessels Market Regional Analysis/Insights

The freezing fishing vessels market is analysed and market size insights and trends are provided by country, system, type, vessel length, and freezing capacity as referenced above.

The countries covered in the freezing fishing vessels market report are U.S., Canada and Mexico in North America

The U.S. dominates the North America freezing fishing vessels market. U.S. is expected to be the fastest-growing North America freezing fishing vessels market. The rising infrastructure, commercial, and industrial developments are credited with the market's dominance. The U.S. dominates the North America region due to the high manufacturing of major companies leading to exports from the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Freezing Fishing Vessels Market Share Analysis

The freezing fishing vessels market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to freezing fishing vessels market.

Some of the major players operating in the freezing fishing vessels market are:

- Nordic Wildfish (Norway)

- Lerøy Havfisk (Norway)

- Nichols Bros Boat Builders (U.S.)

- Master Boat Builders, Inc. (U.S.)

- Chantier de constructions navales Martinez (France)

- Astilleros Armon (Spain)

- Karstensens Skibsværft A/S (Denmark)

- Green Yard Kleven (Norway)

- Ulstein Group ASA (Norway)

- Heinen & Hopman Engineering BV (Netherlands)

- Marefsol B.V. (Netherlands)

- Integrated Marine Systems, Inc (U.S.)

- MMC FIRST PROCESS AS (Norway)

- TEKNO THERM INDUSTRIES. (India)

- Damen Shipyards Group (Netherlands)

- Wärtsilä (Finland)

- Thoma-Sea Ship Builders, LLC (U.S.)

- Rolls-Royce plc (U.K.)

- ELLIOTT BAY DESIGN GROUP (U.S.)

- Aresa Shipyard (Turkey )

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.