North America Food Diagnostics Market Analysis and Insights

Food safety and quality are major concerns for food manufacturing and the retail and hospitality industry. Food quality and hygiene have an impact on productivity. In recent years both intentional and unintentional adulteration has become high-tech, and testing laboratories can help to detect these adulterants. The most important function of the food diagnostics laboratories is to test foods for adulterants, pathogens, pesticide residues, chemical contaminants such as heavy metals, microbial contaminants, non-permitted additives, colors, and antibiotics in food. Without food testing, the food producers and the food manufacturers of the food products cannot ensure that pesticides, antibiotics, heavy metals, naturally occurring toxins, among others. Thus, it is important to ensure food safety.

The demand for food testing is increasing, for which manufacturers are now more focused, and they are involved in the new product launch, promotion, awards, certification, and event participation in the market. These decisions are ultimately enhancing the growth of the market.

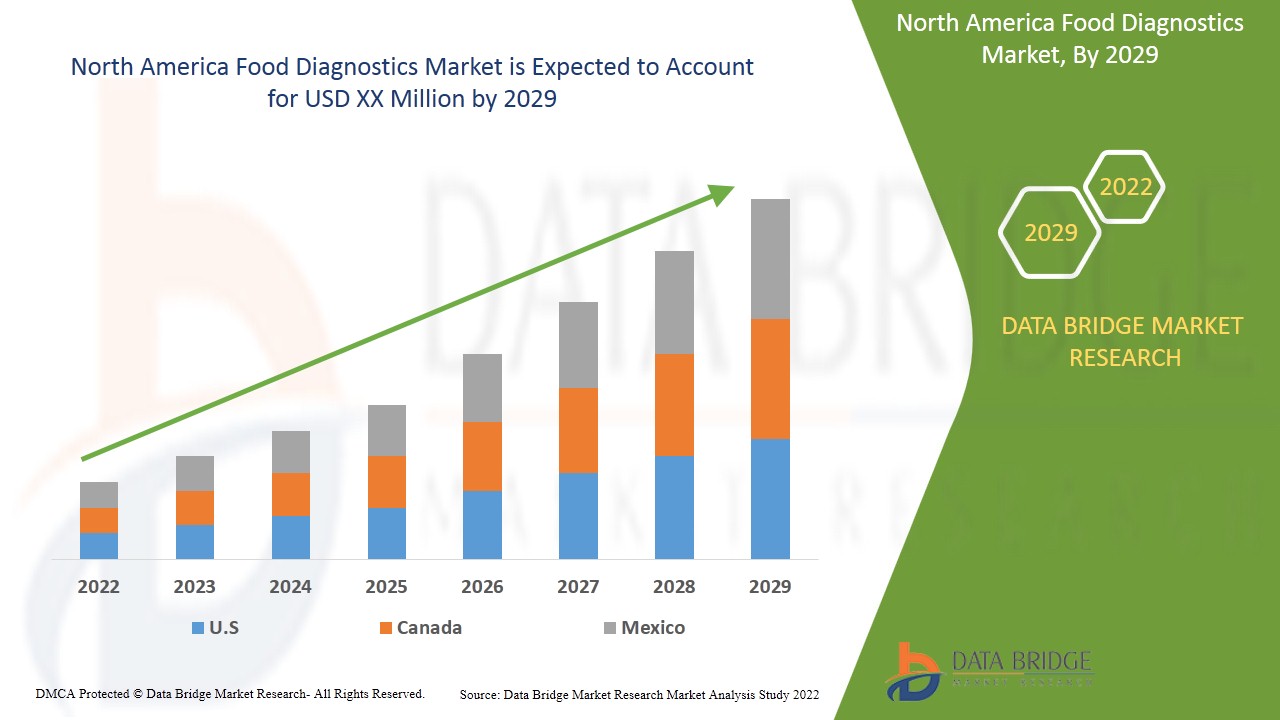

Data Bridge Market Research analyses that the North America food diagnostics market will grow at a CAGR of 7.9% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Testing Type (System, Test Kits, and Consumables), Type of Tests (Food Safety Testing, Food Authenticity Testing, and Food Shelf Life Testing Market), Site (Inhouse, and Outsourcing Facility), Application (Food, Cereals & Grains, Oilseeds & Pulses, Nuts and Beverages) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

SGS SA, Randox Food Diagnostics, 3M, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies, Inc., NEOGEN Corporation, FOSS India Pvt. Ltd., ROKA BIO SCIENCE, Invisible Sentinel, Clear Labs, Inc., ALS Limited, Ring Biotechnology Co Ltd., BIOMÉRIEUX SA, Intertek Group plc, Eurofins Scientific, among others |

North America Food Diagnostics Market Dynamics

Drivers

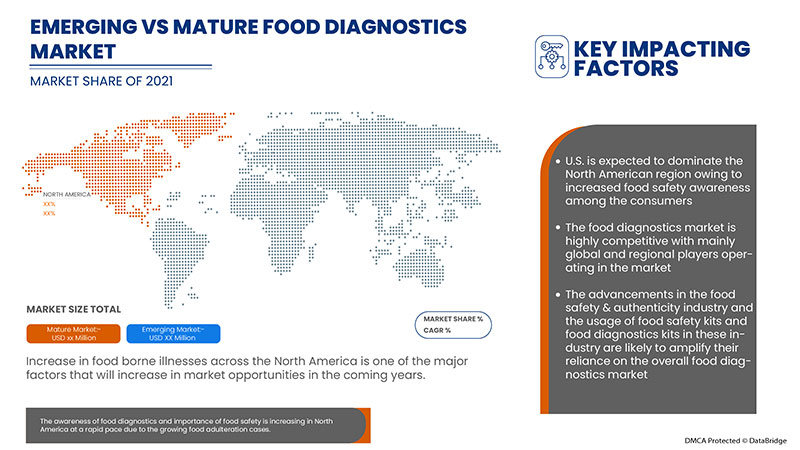

- Increasing Cases of Foodborne Illnesses

The factors such as increasing food adulteration cases, financial scarcity, food control issues, lack of information about foodborne diseases and their adverse effects, lack of hygiene are increasing the number of foodborne diseases are expected to drive the North America food diagnostics market growth.

- Stringent Safety Regulations for Food

The stringent safety regulations for food are expected to drive the growth of the North America food diagnostics market because the regulator has to ensure that the available food in the market is safe for consumption. According to WHO, approximately 600 million, almost one in 10 people in the world, fall ill after eating contaminated food, and 420 000 die every year, resulting in the loss of 33 million healthy life years (DALYs) and the children under the age of 5 years carry 40% of the foodborne disease burden with 125,000 deaths every year.

Opportunities

- Increasing Government Initiatives to Ensure Food Safety and Quality

Many governments are taking initiatives for food safety, quality, and fair trades that may drive the growth of the North America food diagnostics market. The increase in the prevalence of foodborne diseases among consumers increases concerns for food safety and quality, creating immense opportunities for food diagnostics manufacturers so that consumers can trust in the safety and quality of the products they purchase when food manufacturers meet the standards.

Restraints/Challenges

- Increasing Number Of False Labeling

Food manufacturers use images, statements, and other food labels to convey information about a food product and its nutritional characteristics. False labeling is when a company sells or distributes any product that falsely characterizes or mislabels the product's content, character, origin, or utility.

The increase in adulteration of food and ingredients has led to a rise in food fraud cases and false labeling. Which is acting as a restrain for the growth of the market.

Post-COVID-19 Impact on North America Food Diagnostics Market

The impact of the COVID-19 pandemic had resulted in lockdown in most countries to restrict the spread of the virus, which has highly affected each type of industry. The Food Diagnostics market growth across the world has created extreme uncertainty due to the outbreak of COVID-19. Maintaining the food movement along the food chain is an essential function for the food and beverages industry. Most food product companies started Food Safety Management Systems (FSMS) based on the Hazard Analysis and Critical Control Point (HACCP) principles to manage food safety risks and prevent food contamination, which positively impacts the growth of North America food diagnostics market in years to come.

Recent Development

- In 2021, BIOMÉRIEUX SA launched a product called VITEK MS PRIME, the next generation of the VITEK MS MALDI-TOF1 mass spectrometry system for routine microbial identification in minutes. This launch will increase the customer base of the company

North America Food Diagnostics Market Scope

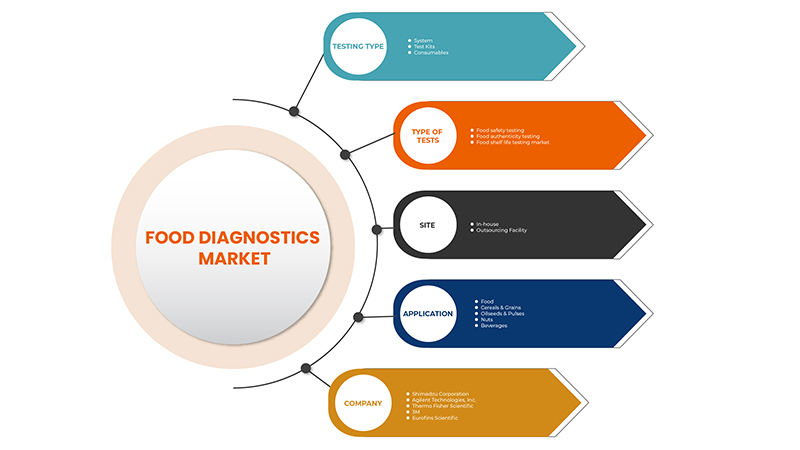

The North America food diagnostics market is segmented into testing type, type of tests, site, and application. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Testing Type

- System

- Test Kits

- Consumables

On the basis of testing type, the North America food diagnostics market is segmented into system, test kits, and consumables.

Type of Tests

- Food Safety Testing

- Food Authenticity Testing

- Food Shelf Life Testing Market

On the basis of type of tests, the North America food diagnostics market is segmented into, food safety testing, food authenticity testing, and food shelf life testing market.

Site

- Inhouse

- Outsourcing Facility

On the basis of site, the North America food diagnostics market is segmented into inhouse, and outsourcing facility.

Application

On the basis of application, the North America food diagnostics market is segmented into food, cereals & grains, oilseeds & pulses, nuts, and beverages.

North America Food Diagnostics Market Regional Analysis/Insights

North America food diagnostics market is analyzed, and market size insights and trends are provided based on country, testing type, type of tests, site, and application as referenced above.

The regions covered in the North America food diagnostics market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America food diagnostics market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of flourishing food and beverages product demand, especially processed food, because of changing lifestyles and time constraints.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Food Diagnostics Market Share Analysis

North America food diagnostics market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points are only related to the companies' focus on the North America food diagnostics market.

Some of the major players operating in the North America food diagnostics market are Randox Food Diagnostics, Thermo Fisher Scientific Inc., Life Technologies, PerkinElmer Inc., Shimadzu Corporation, Invisible Sentinel, 3M, Intertek Group plc, Eurofins Scientific, SGS SA, ALS Limited, Omega Diagnostics Group PLC, Agilent Technologies, Inc., Ring Biotechnology Co Ltd., NEOGEN Corporation, FOSS India Pvt. Ltd., BIOMÉRIEUX SA among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF FOOD SAFETY TESTING TECHNOLOGIES

4.2 GROWING FOOD ADULTERATION CASES

4.2.1 RISKS RELATED TO FOOD ADULTERATION

4.2.2 DETECTION AND PREVENTION OF FOOD ADULTERATION

4.2.3 CONCLUSION:

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 CONCLUSION:

4.5 OVERVIEW OF TECHNOLOGICAL ADVANCEMENTS

4.6 TECHNOLOGICAL TRENDS

5 REGULATORY FRAMEWORK AND GOVERNMENT INITIATIVES:

5.1 EUROPEAN FOOD SAFETY AUTHORITY (EFSA) — ENSURING SAFE FOOD AND ANIMAL FEED IN THE EU

5.2 FDA

5.3 CANADIAN FOOD INSPECTION AGENCY (CFIA)

5.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING CASES OF FOOD-BORNE ILLNESSES

6.1.2 STRINGENT SAFETY REGULATIONS FOR FOOD

6.1.3 AUTOMATION IN FOOD TESTING LABS

6.1.4 INCREASING CONSUMER AWARENESS ON FOOD SAFETY

6.2 RESTRAINTS

6.2.1 LIMITED FUNDING AND RESOURCES IN FOOD PROCESSING

6.2.2 INCREASING NUMBER OF FALSE LABELING

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR CLEAN LABEL FOOD

6.3.2 INCREASING GOVERNMENT INITIATIVES TO ENSURE FOOD SAFETY AND QUALITY

6.3.3 TECHNOLOGICAL ADVANCEMENTS IN TESTING MARKET

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS REGARDING HAZARDOUS EFFECTS OF AVOIDING FOOD TESTINGS

6.4.2 HIGH COSTS ASSOCIATED WITH PURCHASING FOOD TESTING ITEMS

7 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY TESTING TYPE

7.1 OVERVIEW

7.2 SYSTEM

7.3 TEST KITS

7.4 CONSUMABLES

8 NORTH AMERICA FOOD DIAGNOSTICS MARKET, TYPE OF TESTS

8.1 OVERVIEW

8.2 FOOD SAFETY TESTING

8.3 FOOD AUTHENTICITY TESTING

8.4 FOOD SHELF LIFE TESTING MARKET

9 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY SITE

9.1 OVERVIEW

9.2 IN-HOUSE

9.3 OUTSOURCING FACILITY

10 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD

10.3 CEREALS & GRAINS

10.4 OILSEEDS & PULSES

10.5 NUTS

10.6 BEVERAGES

11 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 COMPANY LANDSCAPE: NORTH AMERICA FOOD DIAGNOSTICS MARKET

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 SHIMADZU CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 AGILENT TECHNOLOGIES, INC. (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 THERMO FISHER SCIENTIFIC INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 3M

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 EUROFINS SCIENTIFIC

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ALS LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 BIOMÉRIEUX SA

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CLEAR LABS, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FOSS INDIA PVT. LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 INTERTEK GROUP PLC

14.10.1 COMPANY SNAPSHOT

14.10.2 RECENT FINANCIAL

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 INVISIBLE SENTINEL

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 LIFE TECHNOLOGIES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NEOGEN CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 NOACK GROUP

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 OMEGA DIAGNOSTICS GROUP PLC (2021)

14.15.1 COMPANY SNAPSHOT

14.15.2 RECENT FINANCIAL

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 PERKINELMER INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RANDOX FOOD DIAGNOSTICS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 RING BIOTECHNOLOGY CO LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 ROKA BIO SCIENCE

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 SGS SA

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Figure

FIGURE 1 NORTH AMERICA FOOD DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD DIAGNOSTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FOOD DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA FOOD DIAGNOSTICS MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING CASES OF FOODBORNE ILLNESSES ARE EXPECTED TO DRIVE THE NORTH AMERICA FOOD DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 13 SYSTEM IN TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD DIAGNOSTICS MARKET IN 2022 & 2029

FIGURE 14 THE REQUIREMENTS AND PRINCIPLES OF THE REGULATION-

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FOOD DIAGNOSTICS MARKET

FIGURE 16 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY TESTING TYPE

FIGURE 17 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY TYPE OF TESTS

FIGURE 18 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY SITE

FIGURE 19 NORTH AMERICA FOOD DIAGNOSTICS MARKET, BY APPLICATION

FIGURE 20 NORTH AMERICA FOOD DIAGNOSTICS MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA FOOD DIAGNOSTICS MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA FOOD DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA FOOD DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA FOOD DIAGNOSTICS MARKET: BY TESTING TYPE (2022 & 2029)

FIGURE 25 NORTH AMERICA FOOD DIAGNOSTICS MARKET: COMPANY SHARE 2021 (%)

North America Food Diagnostics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Food Diagnostics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Food Diagnostics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.