North America Exterior Insulated Finishing System (EIFS) Market Segmentation, By Type (Polymer Based (PB), Polymer Modified (PM)), System (Alpha System, Polar System, Perma System), Component (Adhesive, Insulation Boards, Mechanical Fasteners, System Profiles and Accessories, Basecoats, Glass Fiber Mesh, Primers, Decorative Finish Coats, Others), Building Type (Residential New, Residential Renovation, Commercial New, Commercial Renovation), Application (Wall, Pitched Roof, Flat Roof, Floor) - Industry Trends and Forecast to 2031.

North America Exterior Insulated Finishing System (EIFS) Market Size

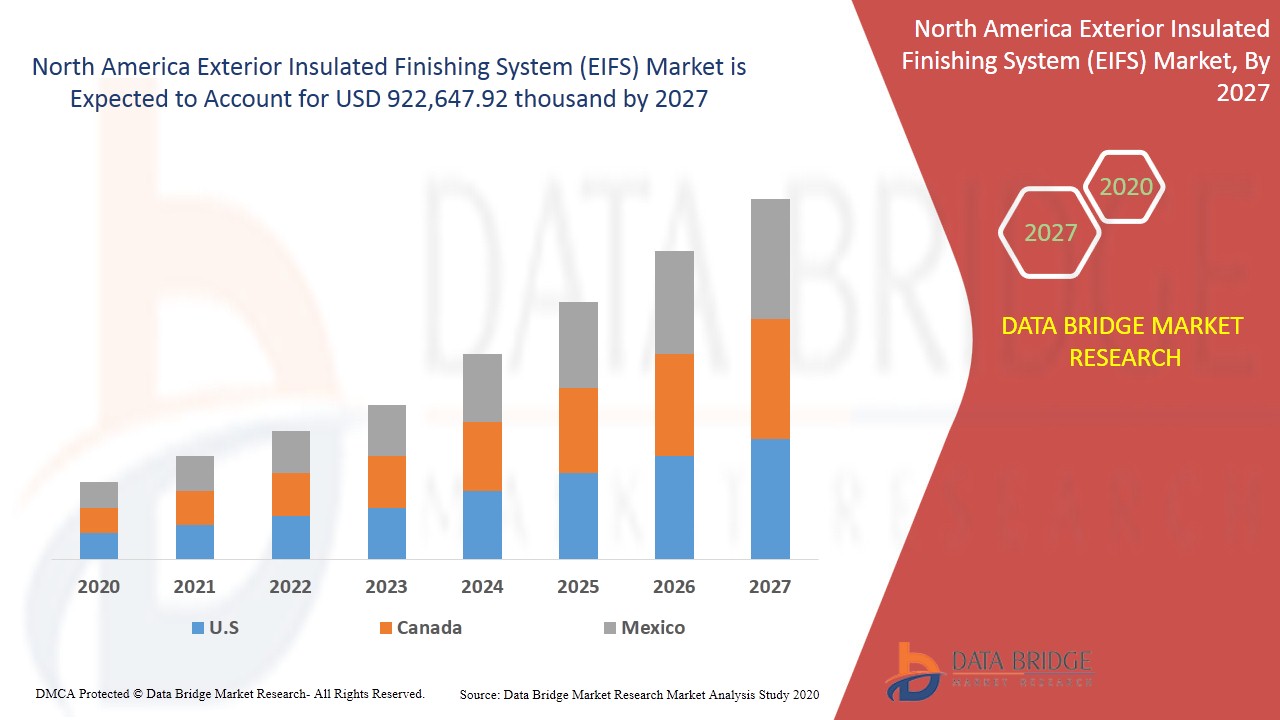

North America exterior insulated finishing system (EIFS) market size was valued at USD 849.04 million in 2023 and is projected to reach USD 1,002.62 million by 2031, with a CAGR of 2.1% during the forecast period of 2024 to 2031.

Report Scope and Market Segmentation

|

Attributes

|

Exterior Insulated Finishing System (EIFS) Key Market Insights

|

|

Segmentation

|

By Type: Polymer Based (PB), and Polymer Modified (PM)

By System: Alpha System, Polar System, and Perma System

By Component: Adhesive, Insulation Boards, Mechanical Fasteners, System Profiles and Accessories, Basecoats, Glass Fiber Mesh, Primers, Decorative Finish Coats, and Others

By Building Type: Residential New, Residential Renovation, Commercial New, and Commercial Renovation

By Application: Wall, Pitched Roof, Flat Roof, and Floor

|

|

Countries Covered

|

U.S., Canada, Mexico

|

|

Key Market Players

|

DUROCK ALFACING INTERNATIONAL LIMITED, BASF SE, Sika AG, Masterwall, Owens Corning, 3M, Saint-Gobain, Durabond Products Limited, Omega Products International., Wacker Chemie AG, Parex USA, Inc., Dryvit Systems, Inc., Sto Corp., Terraco Holdings Limited and DuPONT

|

North America Exterior Insulated Finishing System (EIFS) Market Dynamics

Increasing rule and regulations regarding the non-biodegradable is a factor responsible for the market growth. U.S. is dominating in the region due to increase emission of greenhouse gases by commercial and residential buildings. Increasing stringent rules regarding the building code in the region will boost the North America - exterior insulated finishing system (EIFS) market.

This market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Exterior Insulated Finishing system (EIFS) Market Scope

North America exterior insulated finishing system (EIFS) market is segmented of the basis of type, system, component, building type and application. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Type

- Polymer Modified (PM)

- Polymer Based (PB)

System

- Alpha System

- Polar System

- Perma System

Component

- Adhesive

- Insulation Boards

- Mechanical Fasteners

- System Profiles

- Accessories

- Basecoats

- Glass Fiber Mesh

- Primers

- Decorative Finish Coats

- Others

Processing Building

- Residential New

- Residential Renovation

- Commercial New

- Commercial Renovation

Application

- Wall

- Pitched roof

- Flat roof

- Floor

Exterior Insulated Finishing System (EIFS) Market Regional Analysis

North America exterior insulated finishing system (EIFS) market is analyzed and market size information is provided by country, type, system, component, building type and application as referenced above.

The countries covered in the exterior insulated finishing system (EIFS) market report are U.S., Canada and Mexico in North America.

Exterior Insulated Finishing system (EIFS) market is dominant in the U.S. due to increasing demand for commercial building and residential in area. The market is showing prevalence in Canada due to increasing construction of residential homes from wood. The market has shown growth in Mexico due to increasing rules regarding the control of greenhouses gages in the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Exterior Insulated Finishing System (EIFS) Market Share Analysis

North America exterior insulated finishing system (EIFS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to North America- Exterior Insulated Finishing system (EIFS) market.

Exterior Insulated Finishing System (EIFS) Market Leaders Operating in the Market Are:

- DUROCK ALFACING INTERNATIONAL LIMITED

- BASF SE

- Sika AG

- Masterwall

- Owens Corning

- 3M

- Saint-Gobain

- Durabond Products Limited

- Omega Products International.

- Wacker Chemie AG

- Parex USA, Inc.

- Dryvit Systems, Inc.

- Sto Corp.

- Terraco Holdings Limited

- DuPONT

Latest Developments in Exterior Insulated Finishing System (EIFS) Market

- In October 2019, Sika AG have decided to launched new product named EPD NOW TECHNOLOGY which control the carbon emissions from the commercial building. The development helps the company to increase its product portfolio which will increase the revenue in near future.

- In October 2019, BASF SE have launched the new product which named new masonry veneer systems for exterior building cladding. This development will help to meet the increasing demand in market and generate revenue in future.

SKU-