North America Digital Out Of Home Ooh Advertising Market

Market Size in USD Billion

CAGR :

%

USD

4.94 Billion

USD

11.22 Billion

2025

2033

USD

4.94 Billion

USD

11.22 Billion

2025

2033

| 2026 –2033 | |

| USD 4.94 Billion | |

| USD 11.22 Billion | |

|

|

|

|

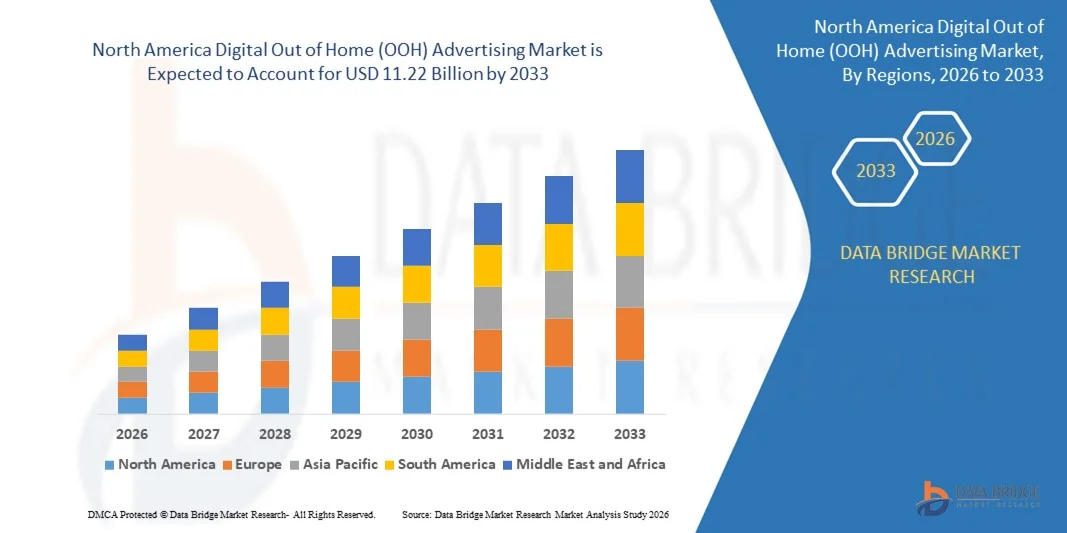

What is the North America Digital Out of Home (OOH) Advertising Market Size and Growth Rate?

- The North America digital out of home (OOH) advertising market size was valued at USD 4.94 billion in 2025 and is expected to reach USD 11.22 billion by 2033, at a CAGR of 10.8% during the forecast period

- Increasing adoption of smart city initiatives, digital signage networks, and interactive display technologies is fueling the growth of the digital out of home (OOH) advertising market. However, high installation and maintenance costs are hampering market expansion

- Rising footfall in urban commercial hubs and growing investments in retail and transit advertising networks is acting as a significant opportunity for the growth of the Digital Out of Home (OOH) Advertising market. At the same time, regulatory constraints and inconsistent digital infrastructure in certain regions are challenging market penetration

What are the Major Takeaways of Digital Out of Home (OOH) Advertising Market?

- Growing consumer engagement through location-based targeting, mobile integration, and dynamic content is positively impacting the Digital Out of Home (OOH) Advertising market. In addition, continuous advancements in AI-driven analytics and real-time content management present lucrative opportunities for market participants

- High upfront costs of digital installations, coupled with competition from traditional advertising mediums and ad fraud, may hinder growth. Limited digital literacy and awareness among small and medium advertisers in emerging regions are projected to challenge widespread adoption

- Despite these challenges, ongoing technological innovation, programmatic advertising integration, and strategic partnerships are expected to sustain long-term growth in the Digital Out of Home (OOH) Advertising market

- The U.S. dominated the North America Digital Out of Home (OOH) Advertising market with a 43.2% revenue share in 2025, driven by extensive deployment of digital billboards, transit displays, and street furniture across major cities

- Mexico is projected to register the fastest CAGR of 7.5% from 2026 to 2033, fueled by urbanization, increasing retail and transit development, and growing awareness of digital advertising solutions

- The Outdoor segment dominated the market with a revenue share of 59.3% in 2025, driven by widespread use in urban streets, highways, public squares, transit hubs, and commercial districts

Report Scope and Digital Out of Home (OOH) Advertising Market Segmentation

|

Attributes |

Digital Out of Home (OOH) Advertising Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Out of Home (OOH) Advertising Market?

Growing Shift Toward Data-Driven, Interactive, and Programmatic Digital OOH Campaigns

- The digital out of home (OOH) advertising market is witnessing strong momentum toward interactive screens, programmatic buying, and location-targeted content, driven by rising advertiser demand for measurable impact and consumer engagement

- Platforms are integrating AI analytics, real-time audience measurement, and dynamic content display to deliver more personalized, engaging, and performance-focused advertising experiences

- Consumers increasingly respond to interactive, context-aware, and visually appealing messaging, accelerating adoption across retail, transit, entertainment, and urban commercial spaces

- For instance, companies such as OUTFRONT Media, Clear Channel Outdoor, Daktronics, Posterscope, and Broadsign are expanding their digital networks with programmatic capabilities and smart displays

- Growing awareness of analytics-driven marketing, brand engagement, and urban mobility is fueling market penetration across the U.S., Europe, and Asia-Pacific

- As advertisers demand higher ROI, real-time insights, and immersive experiences, Digital OOH Advertising is expected to remain central to next-generation outdoor advertising innovation globally

What are the Key Drivers of Digital Out of Home (OOH) Advertising Market?

- Rising demand for real-time, interactive, and measurable advertising is driving strong adoption of Digital OOH globally

- For instance, in 2025, leading players such as OUTFRONT Media, Clear Channel Outdoor, Posterscope, Broadsign, and Daktronics expanded their programmatic and interactive OOH networks to meet growing advertiser demand

- Growing focus on consumer engagement, mobile integration, and urban mobility analytics is boosting adoption across the U.S., Europe, and Asia

- Advancements in AI-driven analytics, content personalization, and high-definition displays have improved campaign effectiveness, targeting precision, and visual impact

- Rising preference for data-backed advertising and measurable outcomes supports market expansion, fueled by marketers’ need for higher ROI

- With continuous R&D, platform upgrades, strategic partnerships, and network expansions, the Digital OOH market is expected to maintain robust growth during the forecast period

Which Factor is Challenging the Growth of the Digital Out of Home (OOH) Advertising Market?

- High installation, maintenance, and technology costs for digital screens and interactive networks continue to limit adoption in price-sensitive regions

- For instance, during 2024–2025, fluctuations in display panel costs, software investments, and urban permitting processes impacted deployment volumes for several network operators

- Regulatory requirements related to urban signage, privacy, and content standards add operational complexity

- Limited awareness among small businesses and emerging-market advertisers about programmatic and data-driven OOH benefits restricts widespread adoption

- Competition from traditional OOH, static displays, and low-cost regional operators exerts pricing pressure and affects differentiation

- Companies are addressing these challenges through cost-efficient deployments, regulatory compliance, network optimization, and market education to expand global adoption of high-quality Digital OOH Advertising

How is the Digital Out of Home (OOH) Advertising Market Segmented?

The market is segmented on the basis of material, type of print, gender, and distribution channel.

- By Location

The Digital Out of Home (OOH) Advertising market is segmented into Indoor and Outdoor locations. The Outdoor segment dominated the market with a revenue share of 59.3% in 2025, driven by widespread use in urban streets, highways, public squares, transit hubs, and commercial districts. Outdoor installations such as billboards, large-scale LED screens, and interactive kiosks provide high visibility, extended reach, and continuous engagement for advertisers. Their capability to deliver dynamic content, support programmatic advertising, and attract large audiences across retail, transit, and public areas enhances adoption.

The Indoor segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for retail mall displays, airports, gyms, corporate offices, and entertainment venues. Increasing focus on personalized advertising, shopper engagement, and interactive installations in confined environments is accelerating indoor adoption globally.

- By Product

The market is segmented into Digital Billboard, Digital Signage, Digital Screens, and Others. The Digital Billboard segment dominated the market with a revenue share of 52.6% in 2025, owing to high-impact visibility, extended reach in urban and highway locations, and support for real-time programmatic content. Digital billboards allow brands to deliver large-format, high-resolution campaigns with dynamic messaging and precise targeting, making them preferred for national and global advertising campaigns.

The Digital Screens segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for indoor and transit displays, interactive touchscreens, and retail-specific installations. Integration with mobile apps, IoT connectivity, and data analytics further enhances their adoption in airports, shopping centers, and transit stations.

- By Application

The market is segmented into Street Furniture, Public Location Based, Transit, and Others. The Transit segment dominated the market with a revenue share of 44.8% in 2025, supported by growing adoption in buses, subways, metro stations, and railway hubs. Transit-based Digital OOH installations provide high-frequency exposure, captive audience engagement, and programmatic content capabilities, making them ideal for commuter-centric campaigns.

The Street Furniture segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing deployment of digital bus shelters, kiosks, benches, and urban signage in smart cities. Rising urbanization, integrated city planning, and interest in interactive public displays are accelerating adoption in North America, Europe, and Asia-Pacific.

- By End-User

The market is segmented into Retail, Automotive, Banking & Financial Services (BFSI), Insurance, Food & Beverages, Healthcare, Education, Government, Public Sector, and Others. The Retail segment dominated the market with a revenue share of 38.7% in 2025, attributed to high adoption of digital screens in malls, brand outlets, supermarkets, and pop-up retail campaigns. Retailers leverage Digital OOH to drive promotions, increase footfall, and deliver personalized, interactive experiences to consumers.

The Healthcare segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for patient awareness campaigns, hospital wayfinding systems, health advisories, and pharmaceutical promotions. Integration of targeted messaging, data analytics, and real-time updates supports rapid adoption in hospitals, clinics, and wellness centers globally.

Which Region Holds the Largest Share of the Digital Out of Home (OOH) Advertising Market?

- The U.S. dominated the North America Digital Out of Home (OOH) Advertising market with a 43.2% revenue share in 2025, driven by extensive deployment of digital billboards, transit displays, and street furniture across major cities

- High consumer exposure in urban centers, retail zones, highways, and airports supports widespread adoption of dynamic, programmatic, and interactive advertising campaigns. Companies are investing in real-time content management, targeted messaging, and analytics-driven strategies to enhance engagement and ROI

- Expansion of smart city initiatives, digital infrastructure, and regulatory support for urban advertising further strengthens the market. Growing collaboration between advertisers, media owners, and technology providers is fueling the development of innovative digital campaigns across both public and commercial spaces

Canada Digital Out of Home (OOH) Advertising Market Insight

Canada exhibits steady growth, with increasing deployment of digital signage, interactive displays, and programmatic billboards in retail locations, transit hubs, airports, and commercial districts. Expansion of smart city projects and urban infrastructure investments facilitates adoption of OOH advertising. Brands are leveraging location-based targeting, real-time updates, and dynamic content to maximize campaign efficiency and consumer engagement. Rising urbanization, higher digital literacy, and demand for sustainable, visually impactful displays support continuous market expansion across Toronto, Vancouver, Montreal, and other metropolitan regions.

Mexico Digital Out of Home (OOH) Advertising Market Insight

Mexico is projected to register the fastest CAGR of 7.5% from 2026 to 2033, fueled by urbanization, increasing retail and transit development, and growing awareness of digital advertising solutions. High adoption of digital billboards, screens, and interactive signage in key cities enhances brand visibility and engagement. Expansion of programmatic advertising, mobile integration, and real-time content strategies is accelerating penetration across urban centers. Rising investment in infrastructure, coupled with government support for smart urban initiatives, strengthens Mexico’s position as a rapidly growing market for digital out of home advertising.

Which are the Top Companies in Digital Out of Home (OOH) Advertising Market?

The digital out of home (OOH) advertising industry is primarily led by well-established companies, including:

- CDecaux SA (France)

- OUTFRONT Media, Inc. (U.S.)

- Clear Channel Outdoor, LLC (U.S.)

- Lamar Advertising Company (U.S.)

- Posterscope (U.K.)

- Talon (Canada)

- Broadsign International, Inc. (Canada)

- ADAMS Outdoor Advertising (U.S.)

- Prismview, A Samsung Electronics Company (South Korea)

- Sharp NEC Display Solutions (Japan)

- Mvix (USA), Inc. (U.S.)

What are the Recent Developments in North America Digital Out of Home (OOH) Advertising Market?

- In May 2025, Lamar Advertising acquired Premier Outdoor Media, strengthening Lamar’s presence in the greater Philadelphia and New York markets, and expanding its reach and influence in key U.S. regions

- In April 2025, JCDecaux, in collaboration with Viooh, launched a programmatic Digital Out of Home (DOOH) offering, enabling advertisers to leverage automated, data-driven campaigns, enhancing efficiency and targeting capabilities

- In February 2025, Daktronics introduced energy-efficient digital billboard technology with eco-conscious display options, including an optional Green Mode, promoting sustainability and reducing operational energy consumption

- In June 2024, Stripe, the digital payment provider, initiated a transatlantic brand campaign to showcase its diverse range of products and services in key cities including London, New York City, and Los Angeles, in collaboration with Wake the Bear, driving global visibility and brand engagement

- In May 2024, CRAFTSMAN+, a leading creative advertising solutions provider, expanded its offerings to include Connected TV (CTV) and Digital Out of Home (DOOH) platforms, supporting integrated campaigns and innovative media strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.