Market Analysis and Insights: North America Diet and Nutrition Apps Market

Market Analysis and Insights: North America Diet and Nutrition Apps Market

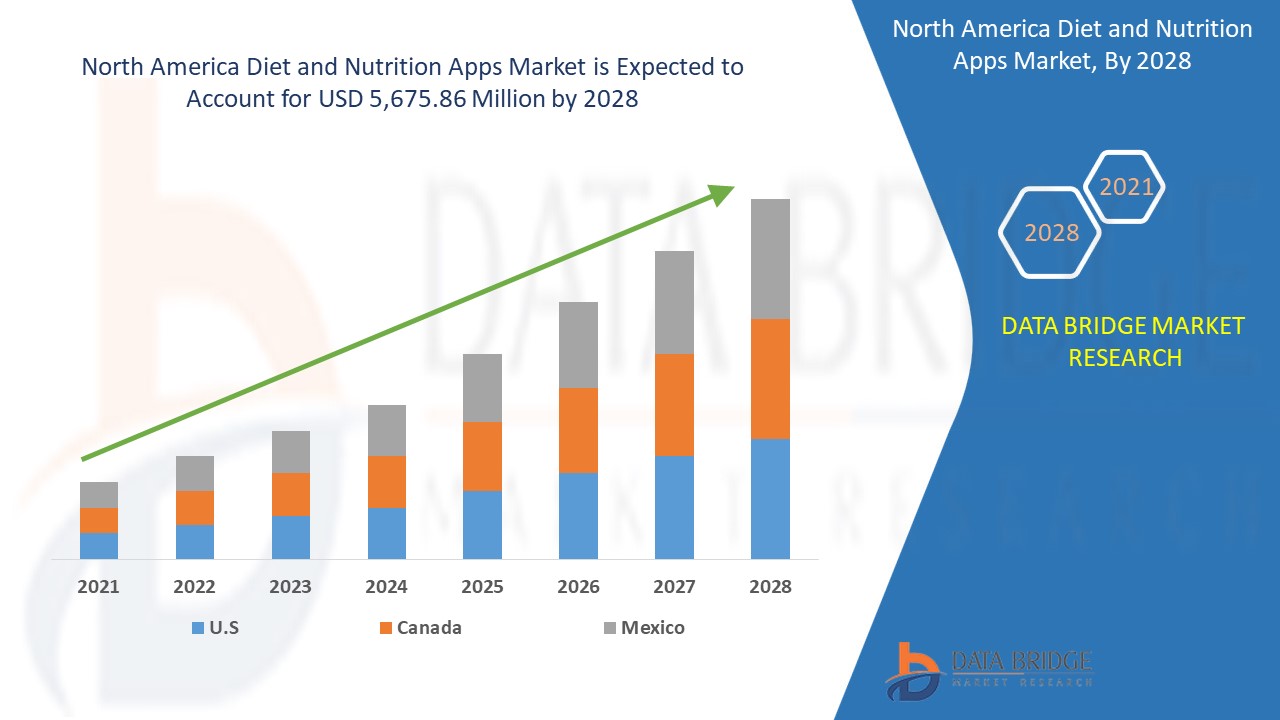

North America diet and nutrition apps market is expected to grow in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 30.6% in the forecast period of 2021 to 2028 and is expected to reach USD 5,675.86 million by 2028.

The diet and nutrition apps are software applications used for tracking nutritional intakes and managing diets for healthy eating, weight loss, weight maintenance, weight gain, and fitness. Diet apps are also in demand for healthcare to track food sensitivities, allergies, and medical conditions, such as diabetes, high blood pressure, and heart disease. These app tools are offered in devices such as smartphones, tablets, and PCs. In recent years, the increased internet penetration and other digital services such as cloud computing have boosted the digital platform offering market. Mobile phone applications are used as tools by many users to get help in their daily tasks. Increasing awareness about health disorders due to unhealthy lifestyles has led to increased diet and nutrition apps.

The major factors driving the growth of the diet and nutrition apps market are the increasing focus of the population towards their eating habits, the rising number of diet coaches that are building their apps, and advancement in digital technologies such as bar code scanners. Increasing penetration of internet services creates opportunities for the market's growth. The non-availability of nutrient information is acting as the major restraint for the diet and nutrition apps market. The availability of fitness centers as an alternative is a major challenge for the market's growth.

This diet and nutrition apps market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

North America Diet and Nutrition Apps Market Scope and Market Size

North America Diet and Nutrition Apps Market Scope and Market Size

The North America diet and nutrition apps market is segmented based on type, products, gender, age, platform, and end-user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the North America diet and nutrition apps market is segmented into nutrition tracking app, activity tracking app, social platform apps, wager apps, and others. In 2021, the nutrition tracking app segment is expected to dominate the market as a nutrition tracking system helps determine the person's calories. The individual can easily track the food intake and balance their diet.

- On the basis of products, the North America diet and nutrition apps market is segmented into smartphones, tablets, and wearable devices. In 2021, the smartphone segment is expected to dominate the market as the North America region has high adoption of smartphones, which are used to download diet and nutrition apps.

- On the basis of gender, the North America diet and nutrition apps market is segmented into men and women. In 2021, the women segment is expected to dominate the market as women are more focused on having healthy diet food. Women have been seen to be more disciplined towards their diet and follow the apps regularly.

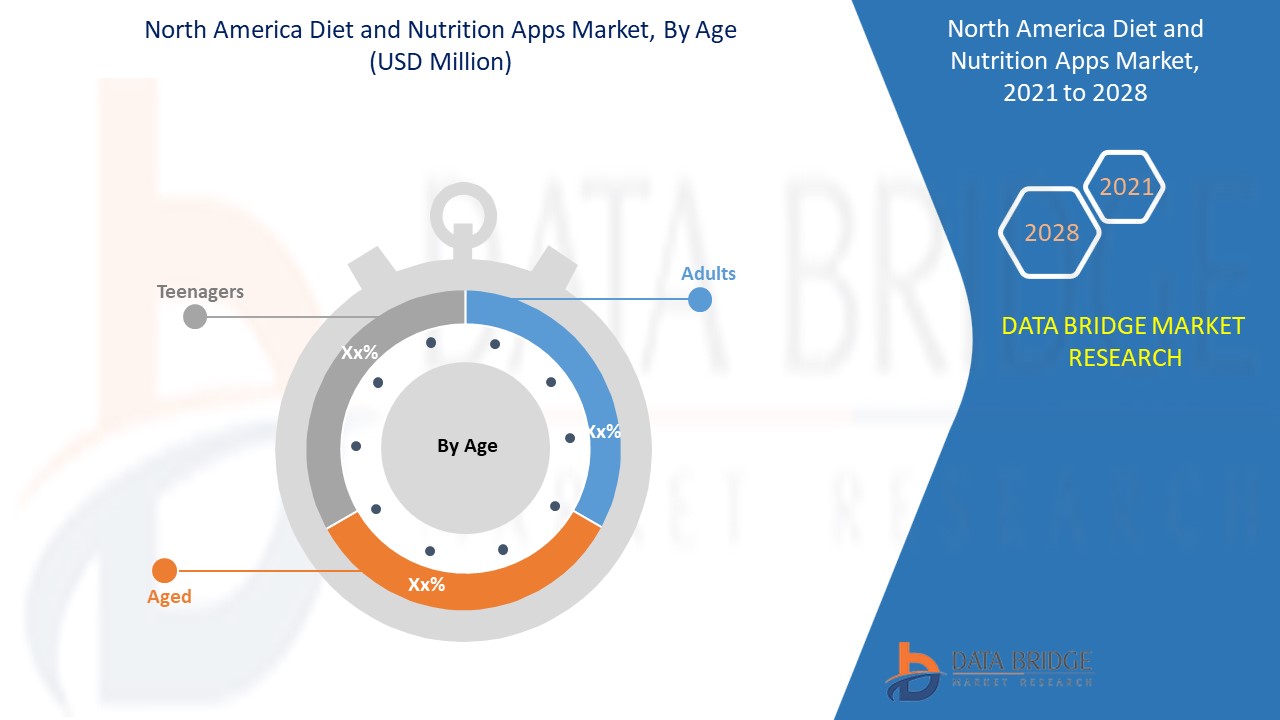

- On the basis of age, the North America diet and nutrition apps market is segmented into teenagers, adults, and the aged. In 2021, the adult segment is expected to dominate the market adult population is more aware of diet and nutrition apps. Moreover, they are more inclined towards digital technologies and therefore have a high number of apps.

- On the basis of platform, the North America diet and nutrition apps market is segmented into Android, iOS, Windows, and others. In 2021, the iOS segment is expected to dominate the market as the iOS app offers better quality apps, and the region has a larger number of iOS smartphones.

- On the basis of end-user, the North America diet and nutrition apps market is segmented into fitness centres, home care settings, healthcare industries, and others. In 2021, the fitness centres segment is expected to dominate the market as fitness centres act as the key source for recommending the apps to individuals.

North America Diet and Nutrition Apps Market Country Level Analysis

North America diet and nutrition apps market is analysed, and market size information is provided by the country, type, products, gender, age, platform, and end-user.

The countries covered in the North America diet and nutrition apps market report are the U.S., Canada, and Mexico.

The U.S. accounted for the maximum share in the North America diet and nutrition apps market due to factors such as the presence of many companies providing diet and nutrition apps.

The country section of the North America diet and nutrition apps market report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Increasing Adoption of Diet and Nutrition Apps

North America diet and nutrition apps market also provides you with detailed market analysis for every country growth in an installed base of different kinds of products for the market, the impact of technology using lifeline curves and changes in requirement of abrasives products, regulatory scenarios, and their impact on the diet and nutrition apps market. The data is available for the historical period 2010 to 2019.

Competitive Landscape and North America Diet and Nutrition Apps Market Share Analysis

The North America diet and nutrition apps market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies’ focus on the North America diet and nutrition apps market.

Some of the major players operating in the North America diet and nutrition apps report are Azumio Inc., MyFitnessPal, Inc., Noom, Inc., Lifesum Ab, FitNow, Inc., MyNetDiary Inc., Innit International SCA, The Kroger Co., mySugr GmbH, FatSecret, HappyCow, Inc., HealthifyMe Wellness Private Limited, Fitocracy, Inc., Wombat Apps LLC, Cronometer Software Inc., CareClinic, Syndigo LLC, foodvisor.io, Eat This Much Inc., Asken Inc., Leaf Group Ltd., Avatar Nutrition LLC among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In October 2020, CareClinic launched Advanced Care Planning Feature to its health management platform. The launch of the new feature aims to raise awareness and educate Canadians about the importance of planning. With this, the company offered users all necessary functions crucial to managing their health and preparing for their future. This enhanced the company’s offerings in the market

- In September 2017, Asken Inc. launched its app in the U.S. with a database containing hundreds of thousands of foods and hundreds of national restaurants and food brands. This move came after the growing demand for nutrient tracking apps in the American market. The app showcased a barcode scanner that captures nutritional information from a large database of nationwide foods after a quick scan. After the expansion, the app collaborated with Sony Network Communications to build the AI-driven meal photo analysis technology. This enabled the company’s expansion in the North American market

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. The expanded product range also benefits the organization to improve its offering for the diet and nutrition apps market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DIET AND NUTRITION APPS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 APPS FEATURE BASED ON THE SPECIFIC REQUIREMENTS

4.2 INFORMATION ON SCORING/RATING

4.3 NUTRIENT INFORMATION GUIDE:

4.4 REASON WHY SOME OF THE FOOD ITEMS ARE NOT RATED:

4.5 REASON WHY SAME TYPE OF FOOD CAN GET DIFFERENT RATINGS:

4.6 REASONS FOR RATING THE FOOD:

4.7 NUTRIENT PROFILING SCHEMES

4.8 APPS PROVIDING PRODUCT NUTRITION RATING/SCORING

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING PENETRATION OF DIGITAL DEVICES AND THE INTERNET

5.1.2 GROWING AWARENESS REGARDING HEALTH AND WELLNESS

5.1.3 SCIENTIFIC ADVANCES IN NUTRITION

5.1.4 INCREASING NUMBER OF LIFESTYLE-RELATED DISEASES

5.1.5 GOVERNMENT ENCOURAGEMENT FOR HEALTHY LIFESTYLES THROUGH REGULATORY LAWS

5.2 RESTRAINTS

5.2.1 NUTRIENT CODING INCONSISTENCY AS COMPARED TO THE STANDARD REFERENCE DATABASES

5.2.2 DATA COMPLIANCES BY REGIONAL GOVERNMENT ORGANIZATION RESTRICTS AND MAKES CROSS BORDER DATA TRANSFER COSTLY

5.3 OPPORTUNITIES

5.3.1 APPLICATION OF AI AND ML TECHNOLOGIES TO PROVIDE PERSONALISED DIET PLANS

5.3.2 INCREASING USE OF SMARTPHONE APPS DUE TO SURGE IN INDIVIDUALS WITH HIGHER PERSONAL INNOVATIVENESS

5.3.3 INCREASING FOCUS OF WORKING CLASS ON PROACTIVE HEALTH MONITORING

5.3.4 INTEGRATION OF APPS WITH FITNESS DEVICES FOR CONTINUOUS TRACKING OF HEALTH

5.4 CHALLENGES

5.4.1 DATA SECURITY ISSUES IN HEALTH AND FITNESS APPS

5.4.2 LACK OF AWARENESS REGARDING SPECIFIC FUNCTIONALITIES AND CAPABILITIES OF NUTRITION APPS

5.4.3 LACK OF KNOWLEDGE REGARDING THE TECHNICAL FEATURES AND PERSONALIZATION IN AN APP LEADING TO SUBSEQUENT DISENGAGEMENT

6 COVID-19 IMPACT ON NORTH AMERICA DIET AND NUTRITION APPS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 PRICE IMPACT

6.7 CONCLUSION

7 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NUTRITION TRACKING APP

7.2.1 CALORIE COUNTING AND DETOX

7.2.2 MEAL DATA AND HEALTHY RECIPES

7.2.3 DIET TIPS

7.2.4 WEIGHT LOSS AND GAIN DIARIES

7.3 ACTIVITY TRACKING APP

7.3.1 FOOD TRACKER

7.3.2 WATER TRACKER

7.3.3 OTHERS

7.4 SOCIAL PLATFORM APPS

7.5 WAGER APPS

7.6 OTHERS

8 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 SMARTPHONES

8.3 WEARABLE DEVICES

8.3.1 WRIST BANDS

8.3.2 SMARTWATCH

8.4 TABLETS

9 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY GENDER

9.1 OVERVIEW

9.2 WOMEN

9.3 MEN

10 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY AGE

10.1 OVERVIEW

10.2 ADULTS

10.3 TEENAGERS

10.4 AGED

11 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PLATFORM

11.1 OVERVIEW

11.2 ANDROID

11.3 IOS

11.4 WINDOWS

11.5 OTHERS

12 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY END USER

12.1 OVERVIEW

12.2 FITNESS CENTERS

12.2.1 GYM

12.2.2 FITNESS STUDIOS

12.2.3 HEALTH CLUBS

12.2.4 OTHERS

12.3 HEALTHCARE INDUSTRIES

12.3.1 HOSPITALS

12.3.1.1 General Hospital

12.3.1.2 Physician Referral

12.3.1.3 Wayfinding

12.3.1.4 Others

12.3.2 CLINICS

12.3.3 OTHERS

12.4 HOMECARE SETTINGS

12.5 OTHERS

13 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA DIET AND NUTRITION APPS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 NOOM, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 THE KROGER CO.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MYFITNESSPAL, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LEAF GROUP LTD.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 LIFESUM AB

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ASKEN INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AVATAR NUTRITION LLC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AZUMIO INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CARECLINIC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CRONOMETER SOFTWARE INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 EAT THIS MUCH INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FATSECRET

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 FITNOW, INC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 FITOCRACY, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 FOODVISOR.IO

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 HAPPYCOW, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 HEALTHIFYME WELLNESS PRIVATE LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 INNIT INTERNATIONAL SCA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MYNETDIARY INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MYSUGR GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 NUTRITIONIX (A SYNDIGO LLC COMPANY)

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 WOMBAT APPS LLC

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 5 NORTH AMERICA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA SOCIAL PLATFORM APPS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA WAGER APPS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 9 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA SMARTPHONES IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 12 NORTH AMERICA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA TABLETS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA WOMEN IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA MEN IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA ADULTS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 19 NORTH AMERICA TEENAGERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA AGED IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA ANDROID IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA IOS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA WINDOWS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA HOMECARE SETTINGS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 47 U.S. DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 U.S. NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 49 U.S. ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 U.S. DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 51 U.S. WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 52 U.S. DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 53 U.S. DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 54 U.S. DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 55 U.S. DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 56 U.S. FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 57 U.S. HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 58 U.S. HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 CANADA DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 CANADA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 61 CANADA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 CANADA DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 63 CANADA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 64 CANADA DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 65 CANADA DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 66 CANADA DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 67 CANADA DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 68 CANADA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 CANADA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 CANADA HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 MEXICO DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 72 MEXICO NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 73 MEXICO ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 MEXICO DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 75 MEXICO WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 MEXICO DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 77 MEXICO DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 78 MEXICO DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 79 MEXICO DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 80 MEXICO FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 MEXICO HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 82 MEXICO HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA DIET AND NUTRITION APPS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DIET AND NUTRITION APPS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIET AND NUTRITION APPS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIET AND NUTRITION APPS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIET AND NUTRITION APPS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIET AND NUTRITION APPS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DIET AND NUTRITION APPS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DIET AND NUTRITION APPS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DIET AND NUTRITION APPS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA DIET AND NUTRITION APPS MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS REGARDING HEALTH AND WELLNESS IS EXPECTED TO DRIVE THE NORTH AMERICA DIET AND NUTRITION APPS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 NUTRITION TRACKING APP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DIET AND NUTRITION APPS MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA DIET AND NUTRITION APPS MARKET

FIGURE 14 INCREASE IN THE INTERNET USERS WORLDWIDE, FROM 2010 TO 2021

FIGURE 15 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY TYPE, 2020

FIGURE 16 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY PRODUCTS, 2020

FIGURE 17 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY GENDER, 2020

FIGURE 18 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY AGE, 2020

FIGURE 19 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY PLATFORM, 2020

FIGURE 20 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY END USER, 2020

FIGURE 21 NORTH AMERICA DIET AND NUTRITION APPS MARKET: SNAPSHOT (2020)

FIGURE 22 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY COUNTRY (2020)

FIGURE 23 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 24 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 25 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY TYPE (2021-2028)

FIGURE 26 NORTH AMERICA DIET AND NUTRITION APPS MARKET: COMPANY SHARE 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.