North America Commercial Jar Blenders Market, By Product Type (Plastic Jar, Metal Jar, Glass Jar and Others), Type (Heavy Duty Blenders, Medium Duty Blenders, and Light Duty Blenders), Application (Food and Beverages), Control Type (Electronic Control, Toggle Control and Others), Mode of Operation (Automatic and Manual), End User (Food Processing Establishments, Food Service Establishments and Others), Distribution Channel (Store Based and Non-store Based), Country (U.S., Canada and Mexico) Industry Trends and Forecast to 2028.

Market Analysis and Insights: North America Commercial Jar Blenders Market

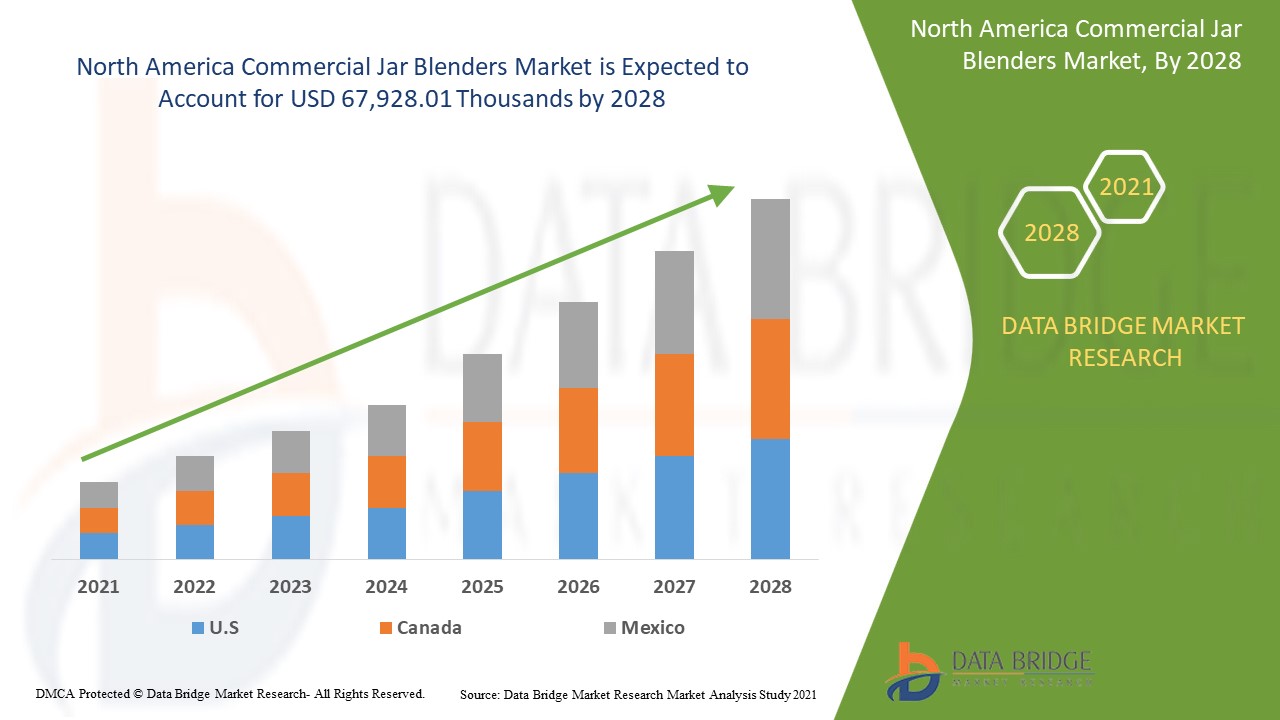

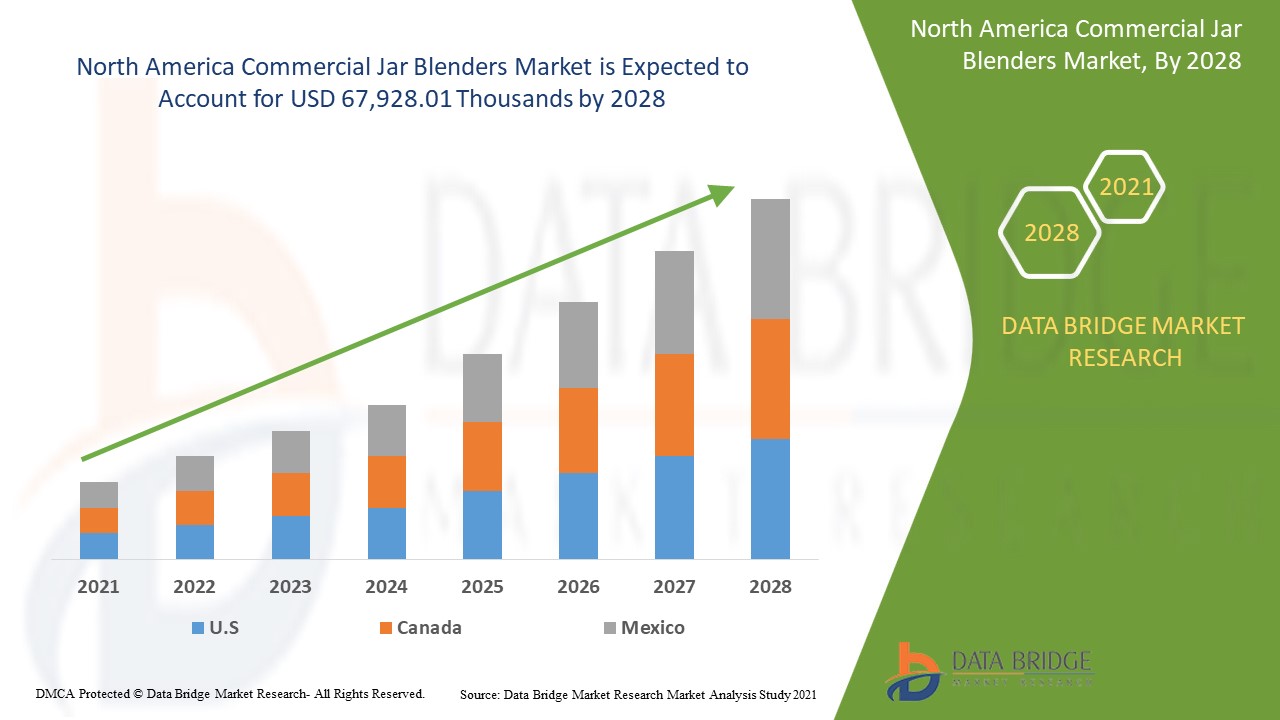

The commercial jar blenders market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% in the forecast period of 2021 to 2028 and is expected to reach USD 67,928.01 thousands by 2028. The high demand of the commercial blenders is accelerating the growth of the market.

Commercial jar blenders are a commercial or cloud kitchen and appliance which are used to mix purée or emulsify food and other substances. A commercial jar blender consists of a blender jar with a rotating metal blade at the bottom, powered by an electric motor in the base. There are different types of commercial jar blenders such as heavy-duty jar blenders, medium duty jar blenders and light duty jar blenders and these are operated by automatic and manual mode of operation.

The factors driving the growth of the market are increasing demand for commercial jar blenders with sound enclosures, rising preference towards the consumption of fruit based drinks, increasing adoption to latest technologies in jar blenders, rising number of dealers and electronic stores. The factors which are restraining the growth of the market are easy availability of products substitutes, high cost associated with commercial jar blenders and high energy consumption of commercial jar blenders. Additionally, growing applications of commercial blenders across industries and changing lifestyle of consumers are driving the growth of North America commercial jar blenders market.

This commercial jar blenders market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Commercial Jar Blenders Market Scope and Market Size

Global commercial jar blenders market is segmented into seven segments which are based on the product type, type, application, control type, mode of operation, end user and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product type, the commercial jar blenders market is segmented into plastic jar, metal jar, glass jar and others. In 2021, plastic jar segment has been dominating the commercial jar market due to its wide application in various industries.

- On the basis of type, the commercial jar blenders market is segmented into heavy-duty blenders, medium medium-duty blenders and light light-duty blenders In 2021, heavy-duty blenders segment is expected to dominate the commercial jar blenders market owing to its and demand in various end use industries.

- On the basis of application, the commercial jar blenders market is segmented into food and beverages. In 2021, beverages segment is expected to dominate the commercial jar blenders market owing to its wide application in food & beverage industry.

- On the basis of control type, the commercial jar blenders market is segmented into electronic control, toggle control and others. In 2021, electronic control segment is expected to dominate the commercial jar blenders market owing to rise in demand for blenders across the globe.

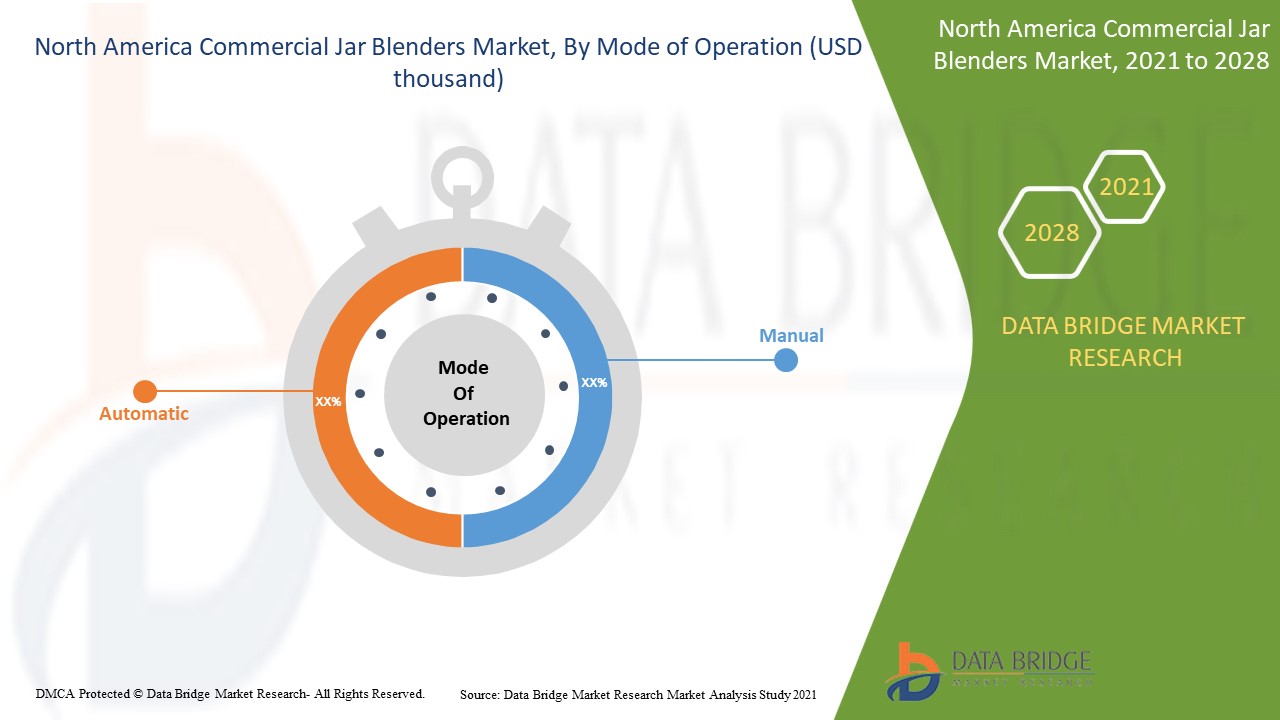

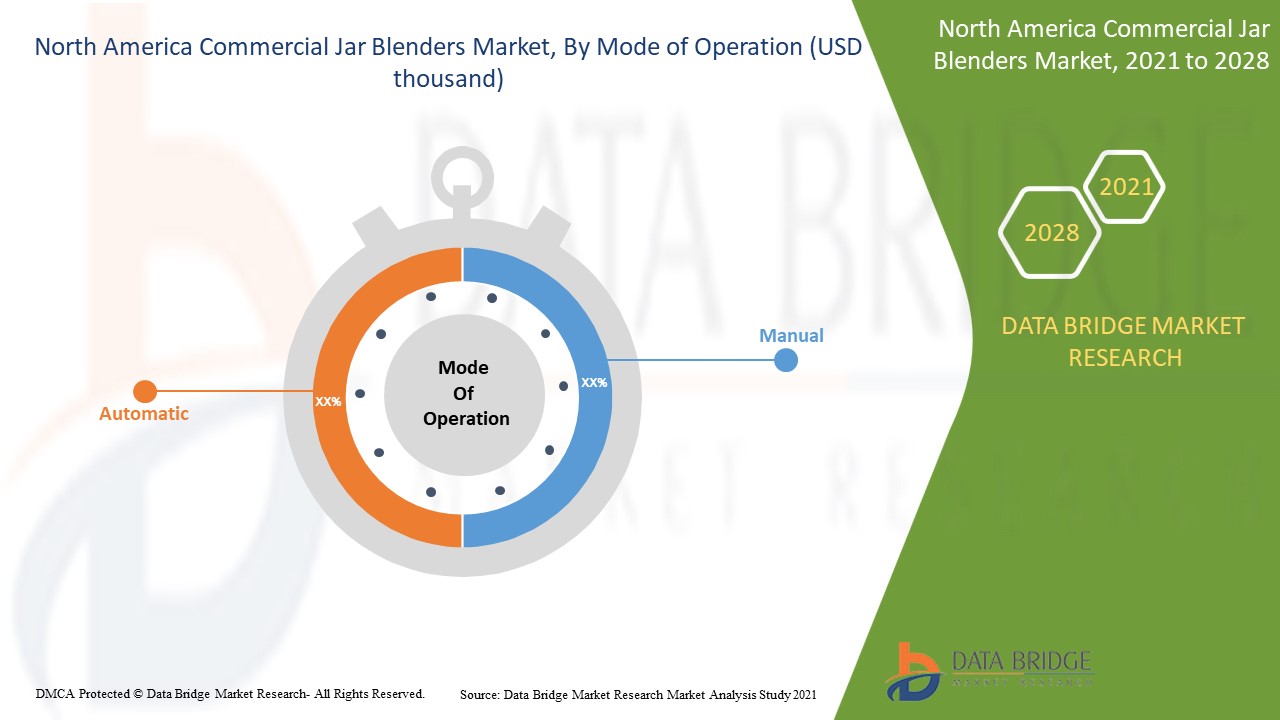

- On the basis of mode of operation, the commercial jar blenders market is segmented into automatic and manual. In 2021, automatic segment is expected to dominate the commercial jar blenders market due to its quality and demand.

- On the basis of end user, the commercial jar blenders market is segmented into food processing establishments, and food service establishments and others. In 2021, food processing establishments segment is expected to dominate the commercial jar blenders market owing to high demand for commercial jar blenders in food service industry.

- On the basis of distribution channel, the commercial jar blenders market is segmented into store store-based and non-non-store based. In 2021, store store-based segment is expected to dominate the commercial jar blenders market owing to customer preference to buy the products from supermarkets/hypermarkets.

Commercial Jar Blenders Market Country Level Analysis

Commercial jar blenders market is analysed and market size information is provided by product type, type, application, control type, mode of operation, end user and distribution channel as referenced above.

The countries covered in North America commercial jar blenders market report are U.S., Canada, and Mexico.

In North America, U.S. is dominating due the increase in demand of commercial jar blenders owing to the factors such as changing life style and eating patterns.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Business expansion for future growth is an opportunity for North America Commercial Jar Blenders Market is Creating New Opportunities for Players

Commercial jar blenders market also provides you with detailed market analysis for every country growth in particular industry with commercial blenders sales, impact of business expansion in the commercial jar blenders and changes in regulatory scenarios with their support for the commercial blenders market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Commercial Blenders Market Share Analysis

Commercial jar blenders market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and source lifeline curve. The above data points provided are only related to the company’s focus related to commercial jar blenders market.

Some of the key player in North Amercia Comemercial Jar Blenders Market are Newell Brands Inc., Whirlpool Corp., Vita-Mix Corp, Spectrum Brands, Inc., Blendtec Inc., Hamilton Beach Brands, Zhongshan CRANDDI Electrical Appliance Co., Ltd, Sammic S.L., NutriBullet, LLC, SANTOS, Cleanblend and WARING COMMERCIAL among other players.

For instance,

- In July 2019, Hamilton Beach Brands, Inc launched Hamilton Beach Professional Juicer Mixer Grinder (JMG) which is designed with Indian technology and culinary expertise, the cutting-edge product promises superior performance, durability and safety.

Exhibition, partnership, joint ventures and other strategies by the market player is enhancing the company market in the commercial jar blenders market which also provides the benefit for organisation to improve their offering for jar blenders.

SKU-