North America Cardiac Monitoring and Cardiac Rhythm Management Devices Market, By Product (ECG Devices, Implantable Loop Recorders, Cardiac Output Monitoring (COM) Devices, Event Monitors, Mobile Cardiac Telemetry Monitoring (MCT/MCOT), Smart Wearable ECG Monitors, Defibrillators, Pacemakers, Cardiac resynchronization therapy (CRT) devices), End-User (Hospitals, Home and Ambulatory Care Settings, Others) – Industry Trends and Forecast to 2030.

North America Cardiac Monitoring and Cardiac Rhythm Management Devices Market Analysis and Size

The North America cardiac monitoring & cardiac rhythm management devices market is experiencing significant growth due to various factors. The rising prevalence of cardiovascular diseases, the increasing aging population, and advancements in medical technology are driving the demand for cardiac monitoring and rhythm management devices in the region. Additionally, the growing awareness about early detection and management of heart conditions, coupled with favorable reimbursement policies, is fuelling market expansion.

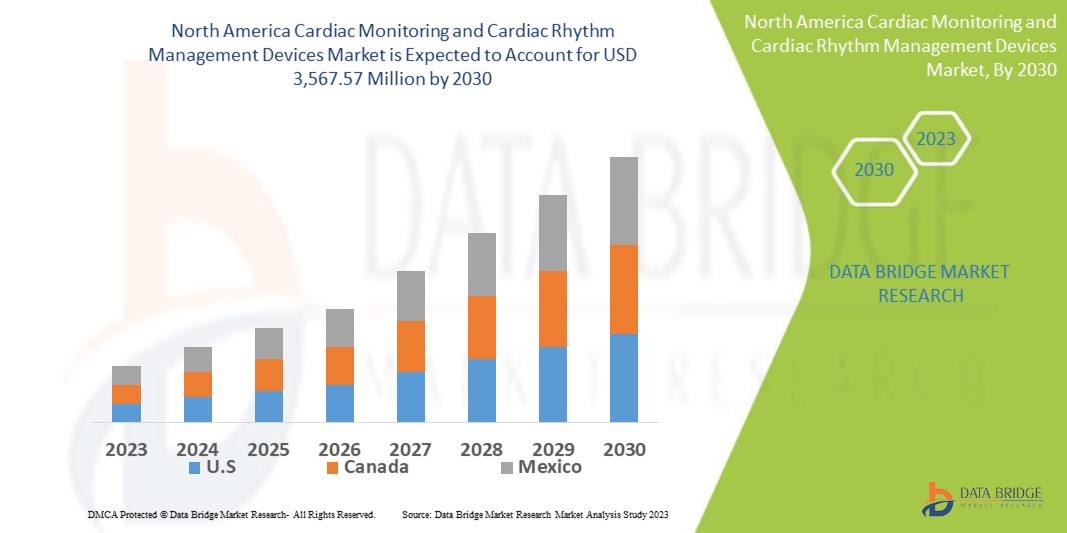

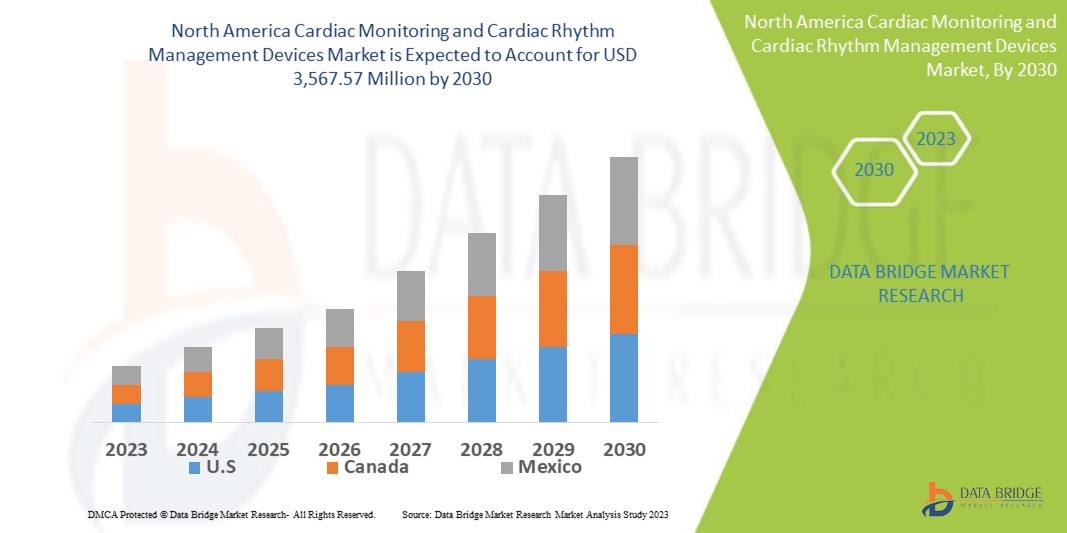

Data Bridge Market Research analyses that the cardiac monitoring and cardiac rhythm management devices market which was USD 2,245.87 million in 2022, would rocket up to USD 3,567.57 million by 2030, and is expected to undergo a CAGR of 3.90% during the forecast period. This indicates that the market value. “ECG devices” dominates the product segment of the cardiac monitoring and cardiac rhythm management devices market owing to the growing demand for ECG devices for cardiac rhythm monitoring. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Cardiac Monitoring and Cardiac Rhythm Management Devices Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (ECG Devices, Implantable Loop Recorders, Cardiac Output Monitoring (COM) Devices, Event Monitors, Mobile Cardiac Telemetry Monitoring (MCT/MCOT), Smart Wearable ECG Monitors, Defibrillators, Pacemakers, Cardiac resynchronization therapy (CRT) devices), End-User (Hospitals, Home and Ambulatory Care Settings, Others)

|

|

Countries Covered

|

U.S., Mexico, Canada

|

|

Market Players Covered

|

GENERAL ELECTRIC (U.S.), Abbott (U.S.), Boston Scientific Corporation (U.S.), SCHILLER (Switzerland), Koninklijke Philips N.V. (Netherlands), Biotronik SE & Co., KG (Germany), Hill-Rom Services, Inc. (U.S.), ABIOMED (U.S.), NIHON KOHDEN CORPORATION (Japan), ReliantHeart Inc. (U.S.), 3M (U.S.), Berlin Heart (Germany), Jarvik Heart, Inc. (U.S.), Stryker (U.S.), Asahi Kasei Corporation (Japan), LivaNova PLC (U.K.), A BioTelemetry, Inc. (U.S.), OSI Systems, Inc. (U.S.), Midmark Corp. (U.S.), ZOLL Medical Corporation (U.S.), Edwards Lifesciences Corporation (U.S.) and Getimge AB (Sweden)

|

|

Market Opportunities

|

|

Market Definition

Cardia monitors are defined as the hardware which reflects the electrical exercise of the heart that are in the shape of stress waveforms. Through electrocardiography, they track the steady and transitory exercise of the core. For the soft and adequate functioning of the core, they are placed inside the core chambers. These devices are used for the treatment of major cardiac disorders such as atrial murmur, latest heart strike signs, atrial fibrillation, heart failure, coronary ischemia, absence of oxygen availability to the heart tissue, drug impacts, and certain genetic mistakes among others.

North America Cardiac Monitoring and Cardiac Rhythm Management Devices Market Dynamics

Drivers

- Increasing prevalence of cardiovascular diseases

The rising incidence of cardiovascular diseases, including heart failure, arrhythmias, and coronary artery disease, is a major driver for the cardiac monitoring and cardiac rhythm management devices market. The growing aging population, sedentary lifestyles, and unhealthy dietary habits contribute to the increasing burden of cardiovascular conditions, leading to a higher demand for monitoring and management devices.

- Increasing awareness and proactive approach to cardiac health

Individuals are growing aware of the importance of early detection and proactive management of cardiac conditions. People are becoming more conscious of maintaining heart health and are seeking preventive measures and regular monitoring. This shift in consumer behavior drives the demand for cardiac monitoring devices and rhythm management solutions.

Opportunities

- Rising demand for home-based and remote monitoring solutions

There is a growing trend towards home-based and remote monitoring solutions in the cardiac monitoring and cardiac rhythm management devices market. Patients and healthcare providers are increasingly recognizing the benefits of monitoring cardiac health from the comfort of one's home. This presents an opportunity for companies to develop and market devices that are user-friendly, portable, and capable of transmitting real-time data to healthcare professionals, enabling proactive management of cardiac conditions.

- Integration of artificial intelligence (AI) and machine learning (ML)

The integration of AI and ML algorithms in cardiac monitoring and rhythm management devices offers significant opportunities for the market. These technologies can analyze large volumes of patient data, identify patterns, and provide predictive analytics for early detection of cardiac abnormalities. AI-driven algorithms can also assist in personalized treatment recommendations and decision-making, improving patient outcomes. Companies that leverage AI and ML capabilities to enhance the accuracy and efficiency of cardiac monitoring and rhythm management devices have a competitive advantage in the market.

Restraints

- High cost of devices and limited healthcare budgets

The cost of cardiac monitoring and cardiac rhythm management devices can be significant, especially for advanced and innovative technologies. This high cost may pose a restraint to market growth, particularly in regions with limited healthcare budgets. Healthcare providers and patients may face challenges in accessing and affording these devices, impacting their adoption rates and overall market expansion.

- Stringent regulatory requirements

The cardiac monitoring and cardiac rhythm management devices market is subject to stringent regulatory requirements, including product approvals and certifications. Obtaining regulatory approvals can be time-consuming and costly, which can hinder the introduction of new devices into the market. Compliance with regulatory standards, such as those set by the FDA in the United States, requires rigorous testing and documentation, which can pose challenges for smaller manufacturers or companies with limited resources.

Challenges

- Intense competition and market saturation

The cardiac monitoring and cardiac rhythm management devices market is highly competitive, with numerous companies vying for market share. This intense competition can make it challenging for new entrants to establish a foothold and for existing players to maintain their market position. The market may also become saturated with similar products, leading to price pressures and reduced profit margins for companies.

- Data privacy and security concerns

Cardiac monitoring and rhythm management devices generate a vast amount of sensitive patient data. Ensuring the privacy and security of this data is a significant challenge for the market. Healthcare organizations and device manufacturers need to implement robust data protection measures to prevent unauthorized access, breaches, and potential misuse of patient information. Compliance with data privacy regulations, such as HIPAA in the United States, adds an additional layer of complexity and responsibility.

This cardiac monitoring and cardiac rhythm management devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the cardiac monitoring and cardiac rhythm management devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In November 2022, Boston Scientific the LUX-Dx Insertable Cardiac Monitor (ICM) System, a long-term diagnostic device inserted under the skin of patients to detect arrhythmias associated with conditions such as atrial fibrillation (AF), cryptogenic stroke, and syncope in Europe.

- In October 2022, Medtronic PLC received the United States FDA approval for extended labeling of a cardiac lead that uses the heart's natural electrical system to deliver therapy to patients while avoiding complications.

North America Cardiac Monitoring and Cardiac Rhythm Management Devices Market Scope

The cardiac monitoring and cardiac rhythm management devices market is segmented on the basis of product and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- ECG devices

Type

- Resting ECG systems

- Stress ECG systems

- Holter monitors

Lead type

- Single-lead ECG leadwires

- ECG leadwires

- Others

- Implantable loop recorders

- Cardiac output monitoring (COM) devices

- Minimally invasive COM devices

- Noninvasive COM devices

- Event monitors

Type

- Pre-symptom (Memory Loop)

- Post-symptom event monitor

Technology

- Auto detect monitors

- Manual event monitor

- Mobile cardiac telemetry monitoring (MCT/MCOT)

- Smart wearable ECG monitors

- Defibrillators

Implantable cardioverter defibrillators

- Transvenous implantable cardioverter defibrillators

- Biventricular ICDS/cardiac resynchronization therapy defibrillators

- Dual-chamber ICDS

- Single-chamber ICDS

- Subcutaneous implantable cardioverter defibrillators

External defibrillators

- Automated external defibrillators

- Fully automated external defibrillators

- Semi-automated external defibrillators

- Pacemakers

Type

- Dual-chamber pacemakers

- Single-chamber pacemakers

- Implantability

- Implantable pacemakers

- External pacemakers

- Cardiac resynchronization therapy (CRT) devices

- CRT-P (CRT with pacemaker function)

- CRT-D (CRT with pacemaker and ICD function)

End-User

- Hospitals

- Home and ambulatory care settings

- Others

North America Cardiac Monitoring and Cardiac Rhythm Management Devices Market Regional Analysis/Insights

The cardiac monitoring and cardiac rhythm management devices market is analysed, and market size insights and trends are provided by country, product and end-user, as referenced above.

The countries covered in the cardiac monitoring and cardiac rhythm management devices market report are U.S., Canada and Mexico in North America.

The U.S. is expected to dominate North America cardiac monitoring and cardiac rhythm management devices market due to Technical advancement in the field of cardiac.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed bAse and New Technology Penetration

The cardiac monitoring and cardiac rhythm management devices market also provides you with a detailed market analysis for every country's growth in healthcare expenditure for capital equipment, installed base of different kind of products for cardiac monitoring and cardiac rhythm management devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the cardiac monitoring and cardiac rhythm management devices market. The data is available for the historic period 2015-2020.

Competitive Landscape and North America Cardiac Monitoring and Cardiac Rhythm Management Devices Market Share Analysis

The cardiac monitoring and cardiac rhythm management devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to cardiac monitoring and cardiac rhythm management devices market.

Some of the major players operating in the cardiac monitoring and cardiac rhythm management devices market are:

- GENERAL ELECTRIC (U.S.)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- SCHILLER (Switzerland)

- Koninklijke Philips N.V. (Netherlands)

- Biotronik SE & Co., KG (Germany)

- Hill-Rom Services, Inc. (U.S.)

- ABIOMED (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- ReliantHeart Inc. (U.S.)

- 3M (U.S.)

- Berlin Heart (Germany)

- Jarvik Heart, Inc. (U.S.)

- Stryker (U.S.)

- Asahi Kasei Corporation (Japan)

- LivaNova PLC (U.K.)

- A BioTelemetry, Inc. (U.S.)

- OSI Systems, Inc. (U.S.)

- Midmark Corp. (U.S.)

- ZOLL Medical Corporation (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- Getimge AB (Sweden)

SKU-