North America Brain Cancer Diagnostic Market Analysis and Size

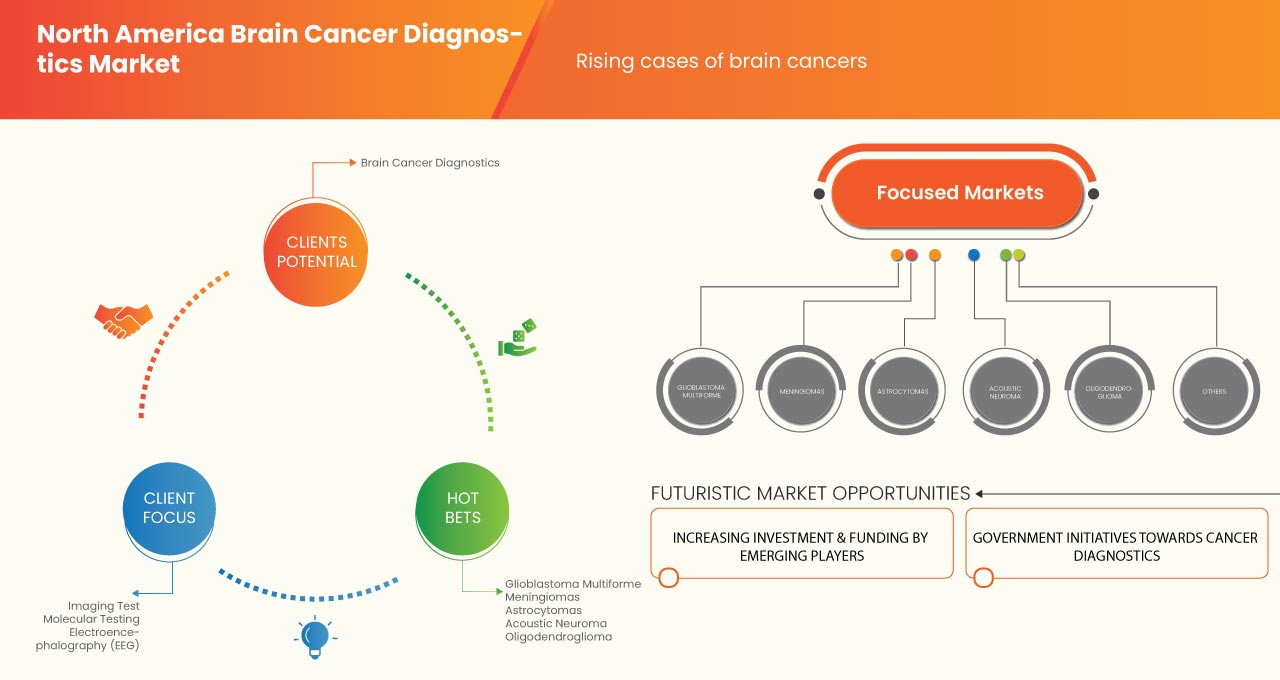

One of the primary factors driving the growth of the brain cancer diagnostic market is the rising cases of brain cancer worldwide. The continuing clinical trial research being conducted by several companies for better treatment leads to market expansion. The market is also influenced by rising awareness of the early diagnosis of brain cancer and innovations in drug delivery to brain cancer cells. However, the high cost associated with diagnosis & treatment for brain cancer, late diagnosis of brain cancer resulting in poor prognosis, and side-effects of treatment drugs & therapies acts as a restraining factor for the North America brain cancer diagnostic market in the forecast period.

On the other hand, increasing investments and funding by emerging players, government initiatives towards cancer diagnostics and rising healthcare expenditure act as an opportunity for the growth of the market. However, stringent regulatory requirements for diagnostics products and operational barriers faced in conducting diagnostics tests create challenges for the North America brain cancer diagnostic market.

The demand for brain cancer diagnostics products will increase North America, owing to improved imaging techniques. Various companies are taking initiatives that gradually lead to the growth of the market.

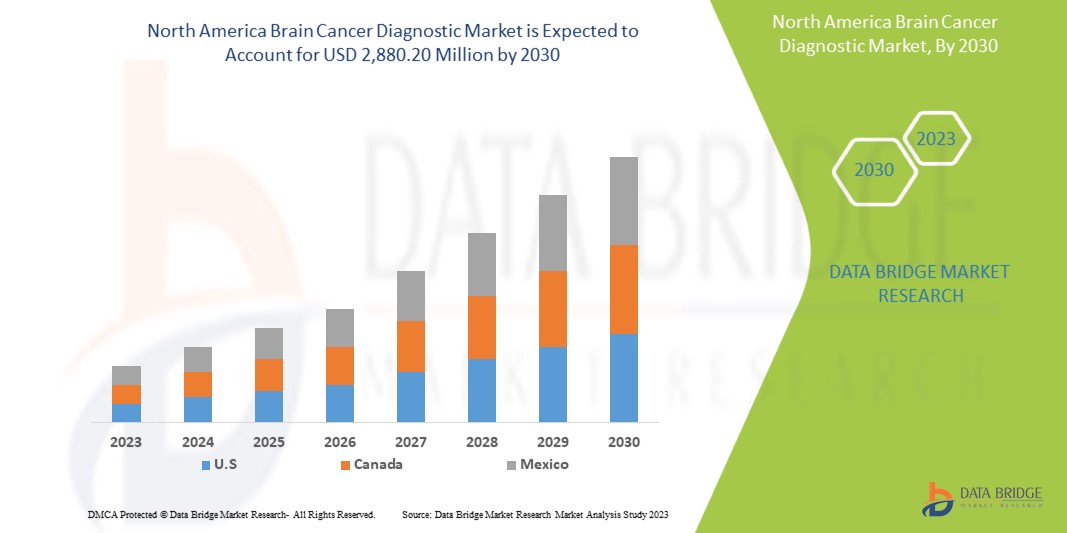

The North America Brain cancer diagnostic market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 19.3% in the forecast period of 2023 to 2030 and is expected to reach USD 2,880.20 million by 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

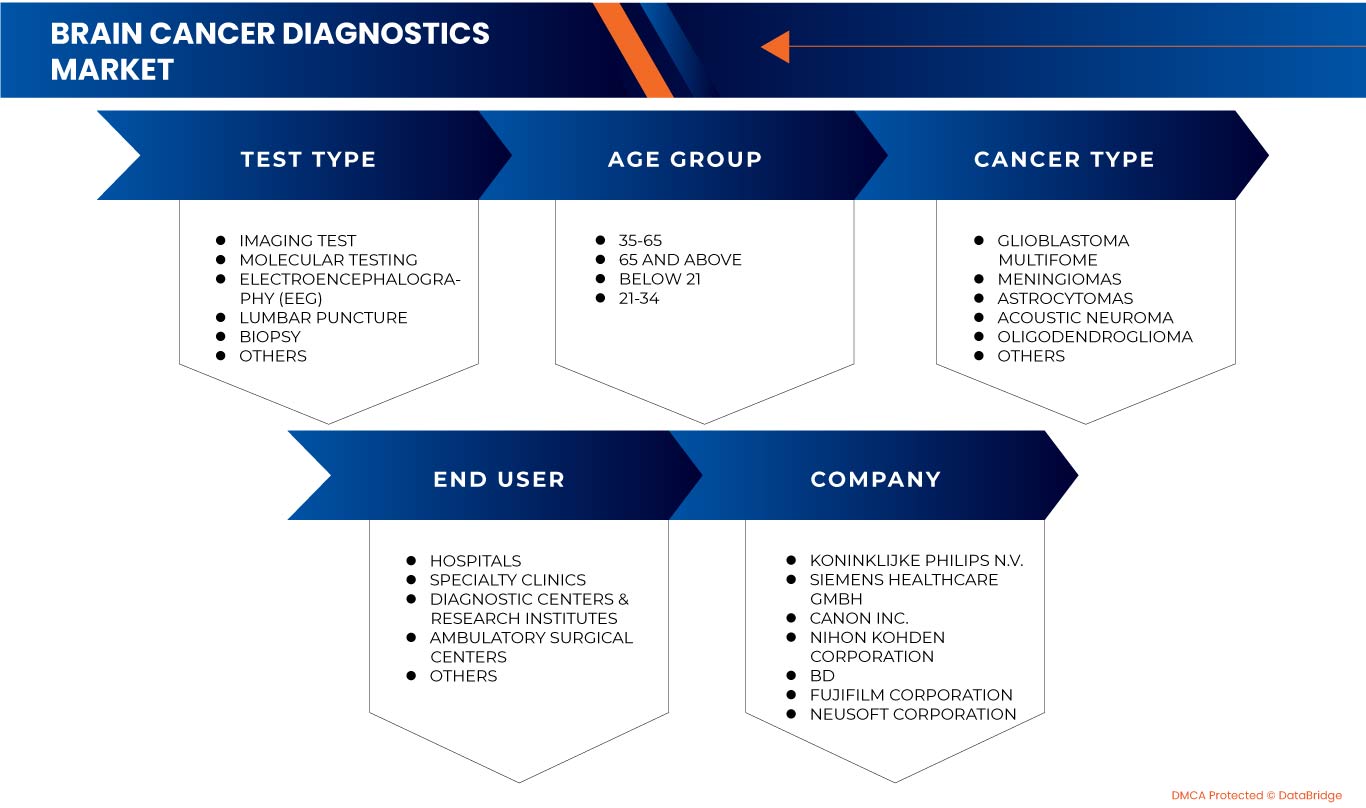

Test Type (Imaging Test, Biopsy, Lumber Puncture, Molecular Testing, Electroencephalography, and Others), Cancer Type (Acoustic Neuroma, Astrocytomas, Glioblastoma Multiforme, Meningiomas, Oligodendroglioma, and Others), Age Group (Below 21, 21-34, 35-65 and 65 and Above), End User (Hospitals, Specialty Clinics, Diagnostic Centers & Research Institutes, Ambulatory Surgical Centers, and Others). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

NIHON KOHDEN CORPORATION., Canon Inc., FUJIFILM Holdings Corporation, Neusoft Corporation, GE HealthCare, Koninklijke Philips N.V., BD, and FONAR Corp., among others |

Market Definition

Brain cancer is an overgrowth of cells in the brain that forms masses called tumors. It is a brain disorder in which cancer cells (malignant cells) arise in the brain tissue. Cancer cells multiply to produce a mass of cancer tissue (tumor) that interferes with brain functions such as muscle control, sensation, memory, and other body functions. Cancer cells that arise from brain tissue are called primary brain tumors, while tumors that spread from other body parts to the brain are called metastatic or secondary brain tumors.

Primary brain tumors can develop from various brain tissues (for example, glial cells, astrocytes, and other brain cell types). Metastatic brain cancer is caused by the spread of cancer cells from a body organ to the brain.

North America Brain Cancer Diagnostic Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising Cases of Brain Cancer Worldwide

Cancer that develops elsewhere in the body & then spreads into the brain is called a secondary brain tumor or brain metastasis. There are various cancers that can metastasize into the brain, such as breast cancer, lung cancer, colon cancer and kidney cancer. Brain cancer cells generally do not spread beyond the brain. Rather, they have the capacity to travel short distances within the brain. Genetic links inherited through family ancestors, chemical exposure to certain industrial chemicals or solvents, compromised immune system, and previous radiation treatments can be some of the major causes of brain cancer.

Brain cancer cases are rising worldwide. In 2019, as per the National Cancer Institute report, there were an estimated 176,566 people found living with brain & other nervous system cancer in the United States. In addition, based on 2017-2019 data, it has been predicted that approximately 0.6 percent of men & women will be diagnosed with brain and other nervous system cancer at some point during their lifetime.

- Rising awareness of the early diagnosis of brain cancer

Brain cancer awareness month is nationally recognized in the United States during the month of May. This awareness month focuses on bringing together the brain tumor community to increase awareness among the patient population.

Brain cancer is not a common type of cancer like other types. However, the need for new & innovative ways to treat brain cancer is more important. As per research studies, 1.4 million patients worldwide are suffering from malignant brain tumors & another 2, 56,000 people will be diagnosed with a malignant brain tumor by the end of the year.

The importance of patient care, education & cancer research is becoming more apparent due to the impact of COVID-19 worldwide. Considering the future perspectives, there is still more groundwork to be done to discover new drugs & effective approaches for brain cancer patients. Brain cancer awareness month is a movement that is fully dedicated to these efforts and even in the midst of a pandemic.

Opportunities

- Increasing investment and funding by emerging players

The market for brain cancer is huge, and the rising number of the population affected by this disease is attracting other players to work in the diagnostic field for this disease. Diagnosis of brain cancer in the early stage is a tedious task but can be possible with the new product line for the diagnosis of disease.

The industry offers numerous growth opportunities. Thus, a number of start-ups providing innovative products and technologies have been entering the market. Many new companies and start-ups are looking forward to the field of brain cancer. They are trying to make business expansion and increase the distribution of their newly marketed product. Some of the company are listed below and is expected to act as an opportunity for a brain cancer diagnosis.

- Government initiatives toward cancer diagnostics

The government plays a major role while taking the initiative for cancer diseases because cancer is a leading disease across the globe. Cancer has increased very briskly in people in past decades. There were 9,555,027 cases of deaths attributable to North America cancers in 2018, of which 241,037 (2.71%) belonged to brain cancers.

The government all around the globe is actively engaged in taking several initiatives towards cancer, specifically brain cancer diagnostics, in order to increase awareness among the people regarding the cancerous disease. Government and Nongovernment organizations funded 57% of therapy-oriented biology and drug development, with 7% to prevention and 13% to early detection, diagnosis and prognosis of cancer disease. These government initiatives towards cancer diagnostics are boosting the demand of the market.

Restraints/Challenges

- High cost associated with diagnosis & treatment for brain cancer

The brain is the most important part of our body, the organ which generates our memories and emotions, as well as containing our skills and expertise. Therefore, cancer of the brain is uniquely destructive. The changes a brain tumor can cause in cognition, behavior and personality result in high economic costs, which are borne by individuals, health systems (direct medical costs) and the wider public purse (direct non-medical costs and indirect costs).

The average cost of brain tumor surgery in western countries is very high. The costs associated with each type of treatment will vary depending on the specific procedure, location, and tumor severity. A study published in the journal Cancer found that brain cancer patients and their families bore a significantly higher economic burden than those affected by other types of cancer. Brain cancer patients had the highest indirect costs, at an average of USD 64,790 per year. Hence, the high cost associated with the diagnosis & treatment of brain cancer may restrain the market growth.

- Operational Barriers Faced in Conducting Diagnostics Tests

Recent advances in the field of brain cancer diagnostics may be related to the kits, instruments, reagents, control or any other. It is not easy to change the adaptability of healthcare professionals with advancement. In order to make the structural decisions and précised results in diagnostics, organizations need to conduct a training session for the healthcare professionals to overcome and avoid errors in diagnosis.

Rural, developing, and low-income countries in the different regions do not have enough infrastructure to maintain the new kits and for the sample storage as well. This is because of the limited supply of electricity and lack and education and awareness among healthcare professionals in the handling of new kits and reagents. This leads to errors in the diagnosis results and can lead to certain deaths, and can become a threat to the carrier of the individual performing the test.

These barriers related to conducting the cancer diagnostics test may affect the life of the populations. This is one of the most difficult parts to overcome with respect to low-income countries. Thus, this is affecting the diagnostics community and acting as a challenge for the North America brain cancer diagnostic market.

Post-COVID-19 Impact on the North America Brain Cancer Diagnostic Market

The COVID-19 pandemic had a great impact on the brain cancer diagnostics and surgical industries. Trade groups in the cancer diagnostic products sector claim that the North America supply chain for diagnostic products has been significantly damaged, impacting end-user consumption of the brain cancer diagnostic market. Sales of diagnostics products in the first quarter of 2020 were significantly delayed due to logistical and transportation issues. On the demand side, the market is increasing as people have to get diagnosed after the lockdown scenario. The situation needs to be taken into consideration, and emergency diagnostics need to be done. Furthermore, on the supply side, the growth of the market is on a negative scale. This is due to the lockdown situations in many countries manufacturing diagnostic, operating and cancer care instruments.

The supply of diagnostic products has suffered a massive hit due to the North America pandemic of COVID-19. This reduction in supply is mainly due to various quarantine policies adopted by countries worldwide. This, along with the restrictions of movement and labor reduction, are the major reasons for a decreasing trend in the supply market of diagnostic instrument tracking systems. This has affected the quality and efficacy of medical devices a great deal. The existing product exportation policies of many countries have misbalanced the supply to demand ratio. Reduction in the headcount of the labor force due to COVID-19 affliction is another factor contributing to the reduced supply of brain cancer diagnostics products.

Recent Developments

- In November 2022, Siemens Healthcare GmbH has presented its two latest magnetic resonance tomographs designed for clinical and scientific use. Due to their high field strengths and strong gradient performance, both scanners will be optimal for detecting the finest structures in the body more clearly.

- In November 2022, BD has announced to grant USD 652,000 to Valley-Mount Sinai Comprehensive Cancer Care to increase diversity, equity and inclusion in cancer clinical trials.

North America Brain Cancer Diagnostic Market Scope

The North America brain cancer diagnostic market is segmented into test type, cancer type, age group and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Test Type

- Imaging Tests

- Biopsy

- Lumbar Puncture

- Molecular Testing

- Electroencephalography (EEG)

- Others

On the basis of test type, the North America brain cancer diagnostic market is segmented into imaging tests, biopsy, lumber puncture, molecular testing, electroencephalography (EEG), and others.

Cancer Type

- Acoustic Neuroma

- Astrocytomas

- Glioblastoma Multiforme

- Meningiomas

- Oligodendroglioma

- Others

On the basis of cancer type, the North America brain cancer diagnostic market is segmented into acoustic neuroma, astrocytomas, glioblastoma multiforme, meningiomas, oligodendroglioma, and others.

Age Group

- Below 21

- 21-35

- 35-65

- 65 and above

On the basis of age group, the North America brain cancer diagnostic market is segmented into below 21, 21-34, 35-65 and 65 and above.

End User

- Hospitals

- Specialty clinics

- Diagnostic centers and research institutes

- Ambulatory surgical centers

- Others

On the basis of end user, the North America brain cancer diagnostic market is segmented into hospitals, specialty clinics, diagnostic centers, research institutes, ambulatory surgical centers, and others.

North America Brain Cancer Diagnostic Market Regional Analysis/Insights

The North America brain cancer diagnostic market is analyzed, and market size insights and trends are provided by country, test type, cancer type, age group, and end user.

The global brain cancer diagnostic market comprises of U.S., Canada, and Mexico.

- In 2023, the U.S. is expected to dominate the North America brain cancer diagnostic market due to increasing awareness among consumers about the benefits of a brain cancer diagnosis. An increase in demand for Brain cancer diagnostics products and an increase in research and development activities in the industry are also expected to drive the market in the forecasted period.

Competitive Landscape and North America Brain Cancer Diagnostic Market Share Analysis

The brain cancer diagnostic market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the North America Brain cancer diagnostic market.

Some of the major players operating in this market are NIHON KOHDEN CORPORATION., Canon Inc., FUJIFILM Holdings Corporation, Neusoft Corporation, GE HealthCare, Koninklijke Philips N.V., BD, and FONAR Corp., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 EPIDEMIOLOGY

6 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, INDUSTRY INSIGHT

7 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, REGULATIONS

7.1 REGULATORY SCENARIO IN THE U.S

7.2 REGULATORY SCENARIO IN AUSTRALIA

7.3 REGULATORY SCENARIO IN JAPAN

7.4 REGULATORY SCENARIO IN CHINA

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING CASES OF BRAIN CANCER WORLDWIDE

8.1.2 RISING AWARENESS OF THE EARLY DIAGNOSIS OF BRAIN CANCER

8.1.3 IMPROVED IMAGING TECHNIQUES

8.1.4 INNOVATIONS IN DRUG DELIVERY TO BRAIN CANCER CELLS

8.2 RESTRAINTS

8.2.1 HIGH COST ASSOCIATED WITH DIAGNOSIS & TREATMENT FOR BRAIN CANCER

8.2.2 SIDE EFFECTS OF BRAIN CANCER TREATMENT DRUGS & THERAPIES

8.2.3 LATE DIAGNOSIS OF BRAIN CANCER RESULTING IN POOR PROGNOSIS

8.3 OPPORTUNITIES

8.3.1 INCREASING INVESTMENT AND FUNDING BY EMERGING PLAYERS

8.3.2 GOVERNMENT INITIATIVES TOWARD CANCER DIAGNOSTIC

8.3.3 RISING HEALTHCARE EXPENDITURE

8.4 CHALLENGES

8.4.1 STRINGENT REGULATORY REQUIREMENTS FOR DIAGNOSTIC PRODUCTS

8.4.2 OPERATIONAL BARRIERS FACED IN CONDUCTING DIAGNOSTIC TESTS

9 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 IMAGING TEST

9.2.1 CT SCAN

9.2.2 MRI

9.2.3 PET

9.2.4 OTHERS

9.3 MOLECULAR TESTING

9.4 ELECTROENCEPHALOGRAPHY (EEG)

9.5 LUMBAR PUNCTURE

9.6 BIOPSY

9.6.1 OPEN BIOPSY

9.6.2 STEREOTACTIC BIOPSY

9.6.3 NEEDLE BIOPSY

9.6.4 NEUROENDOSCOPY

9.7 OTHERS

10 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 GLIOBLASTOMA MULTIFORME

10.3 MENINGIOMAS

10.4 ASTROCYTOMAS

10.5 ACOUSTIC NEUROMA

10.6 OLIGODENDROGLIOMA

10.7 OLIGODENDROGLIOMA

10.8 OTHERS

11 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 35-65

11.3 65 AND ABOVE

11.4 BELOW 21

11.5 21-34

12 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 SPECIALTY CLINICS

12.4 DIAGNOSTIC CENTERS & RESEARCH INSTITUTES

12.5 AMBULATORY SURGICAL CENTERS

12.6 OTHERS

13 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, COMPANY PROFILE

16.1 KONINKLIJKE PHILIPS N.V.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CANON INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 SIEMENS HEALTHCARE GMBH

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 NIHON KOHDEN CORPORATION.

16.5.1 COMPANY SNAPSHOT

16.5.2 RECENT FINANCIALS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 BIOCEPT, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 BIOMIND

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CEREBRAL DIAGNOSTIC

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DXCOVER LIMITED

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 FONAR CORP.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 FUJIFILM CORPORATION

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 GE HEALTHCARE.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 HITACHI, LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 MINFOUND MEDICAL SYSTEMS CO.,

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 NANTOMICS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 NEUSOFT CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 SEQUOIA HEALTHCARE.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 STERNMED GMBH

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 THERMO FISHER SCIENTIFIC INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 TIME MEDICAL HOLDING.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA MOLECULAR TESTING IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ELECTROENCEPHALOGRAPHY (EEG) IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA LUMBAR PUNCTURE IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA OTHERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA GLIOBLASTOMA MULTIFORME IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MENINGIOMAS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA ASTROCYTOMAS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA ACOUSTIC NEUROMA IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OLIGODENDROGLIOMA IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA 35-65 IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA 65 AND ABOVE IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BELOW 21 IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA 21-34 IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA DIAGNOSTIC CENTERS & RESEARCH INSTITUTES IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 35 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 36 U.S. IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 40 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 41 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 42 CANADA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 43 CANADA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 44 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 46 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 48 MEXICO IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 49 MEXICO BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 50 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 51 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 52 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 11 RISING CASES OF BRAIN CANCER WORLDWIDE & IMPROVED IMAGING TECHNIQUES ARE EXPECTED TO DRIVE THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET FROM 2023 TO 2030

FIGURE 12 THE IMAGING TEST SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET FROM 2023 TO 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET

FIGURE 14 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE, 2022

FIGURE 15 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE, 2022

FIGURE 19 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, 2022

FIGURE 23 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 26 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE (2023-2030)

FIGURE 35 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.