North America Active Pharmaceutical Ingredients (API) Market, By Molecule (Small Molecule and Large Molecule), Type (Innovative Active Pharmaceutical Ingredients and Generic Innovative Active Pharmaceutical Ingredients), Type of Manufacturer (Captive API Manufacturer and Merchant API Manufacturer), Synthesis (Synthetic Active Pharmaceutical Ingredients and Biotech Active Pharmaceutical Ingredients), Chemical Synthesis (Acetaminophen, Artemisinin, Saxagliptin, Sodium Chloride, Ibuprofen, Losartan Potassium, Enoxaparin Sodium, Rufinamide, Naproxen, Tamoxifen, and Others), Type of Drug (Prescription Drugs and Over-the-Counter), Usage (Clinical and Research), Potency (Low-to-Moderate Potency Active Pharmaceutical Ingredients, and Potent-to-Highly Potent Active Pharmaceutical Ingredient), Therapeutic Application (Cardiology, CNS and Neurology, Oncology, Orthopedic, Endocrinology, Pulmonology, Gastroenterology, Nephrology, Ophthalmology, and Other Therapeutic Application) – Industry Trends and Forecast to 2031.

North America Active Pharmaceutical Ingredients (API) Market Analysis and Size

The active pharmaceutical ingredients (API) market plays a vital role in drug formulation. High-quality APIs ensure efficacy, safety, and consistency in medications. Pharmaceutical companies benefit from a diverse API market by accessing cost-effective options, enabling rapid drug development, and meeting regulatory standards. Ultimately, patients receive reliable and affordable medications, improving global healthcare outcomes.

The World Health Organization (WHO) reports that cardiovascular diseases claim 17.9 million lives annually, making them the leading cause of global mortality. Active pharmaceutical ingredient (API) is the core substance driving medication efficacy, while formulation involves optimizing component mixtures for pharmaceutical use.

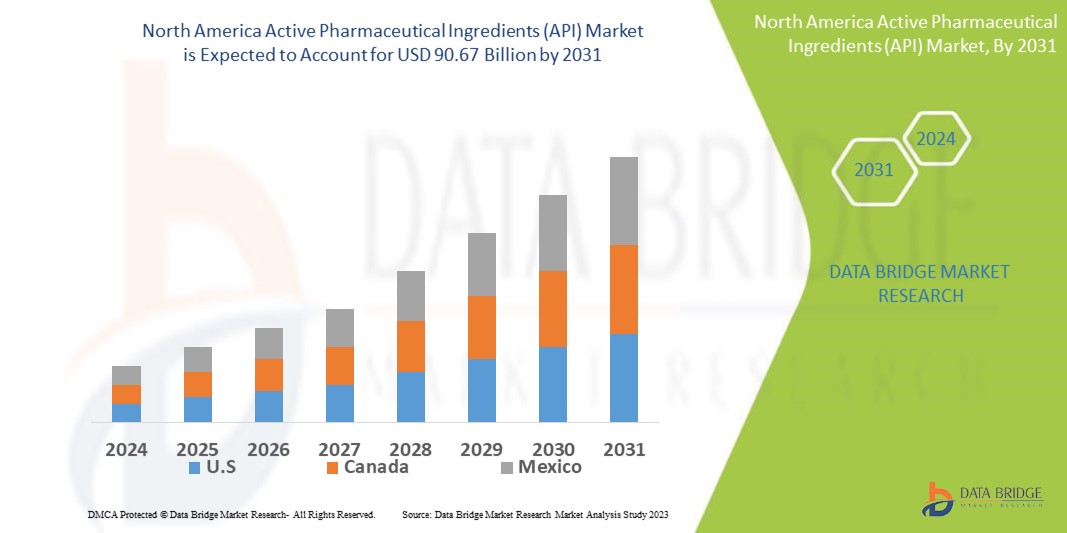

Data Bridge Market Research analyses that the North America active pharmaceutical ingredients (API) market size was valued at USD 68.32 billion in 2023, is projected to reach USD 90.67 billion by 2031, with a CAGR of 3.6% during the forecast period 2024 to 2031. This indicates that the market value. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Active Pharmaceutical Ingredients (API) Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Molecule (Small Molecule and Large Molecule), Type (Innovative Active Pharmaceutical Ingredients and Generic Innovative Active Pharmaceutical Ingredients), Type of Manufacturer (Captive API Manufacturer and Merchant API Manufacturer), Synthesis (Synthetic Active Pharmaceutical Ingredients and Biotech Active Pharmaceutical Ingredients), Chemical Synthesis (Acetaminophen, Artemisinin, Saxagliptin, Sodium Chloride, Ibuprofen, Losartan Potassium, Enoxaparin Sodium, Rufinamide, Naproxen, Tamoxifen, and Others), Type of Drug (Prescription Drugs and Over-the-Counter), Usage (Clinical and Research), Potency (Low-to-Moderate Potency Active Pharmaceutical Ingredients, and Potent-to-Highly Potent Active Pharmaceutical Ingredient), Therapeutic Application (Cardiology, CNS and Neurology, Oncology, Orthopedic, Endocrinology, Pulmonology, Gastroenterology, Nephrology, Ophthalmology, and Other Therapeutic Application)

|

|

Countries Covered

|

U.S., Canada, and Mexico

|

|

Market Players Covered

|

Dr. Reddy's Laboratories Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), GlaxoSmithKline plc (U.K.), Pfizer Inc. (U.S.), Aurobindo Pharma (India), Sanofi (France), Lupin (India), Cipla Inc. (U.S.), BASF SE (Germany), Merck KGaA (Germany), Novo Nordisk A/S (Denmark), AbbVie Inc. (U.S.), Alembic Pharmaceuticals Limited (India), AstraZeneca (U.K.), Teva Pharmaceutical Industries Ltd. (Ireland), Alkem Labs (India), Saneca Pharmaceuticals (Slovakia), Jubilant Pharmova Limited (India), and Neuland Laboratories Ltd (India)

|

|

Market Opportunities

|

|

Market Definition

Active pharmaceutical ingredients (API) are the biologically active ingredients in medications responsible for their therapeutic effects. They are the essence of pharmaceutical formulations, providing the desired medicinal properties. APIs undergo stringent testing and regulation to ensure safety and efficacy. These substances are crucial in drug manufacturing, pivotal in developing various pharmaceutical products.

North America Active Pharmaceutical Ingredients (API) Market Dynamics

Drivers

- Growing Generic Drug Market

Generic drugs, reliant on APIs as active constituents, offer cost-effective alternatives to branded medications, fueling API production growth. This trend reflects the increasing preference for affordable pharmaceutical options, particularly in regions with limited healthcare resources and rising healthcare costs. The growing generic drug market, especially in developing nations, drives API demand.

- Increasing Prevalence of Chronic Diseases

The surge in chronic diseases such as cancer, cardiovascular ailments, and diabetes fuels the demand for active pharmaceutical ingredients (APIs). APIs are indispensable in crafting medications to combat these conditions. Consequently, the escalating prevalence of chronic illnesses propels the need for APIs, essential components in the formulation of drugs targeting these ailments.

For instance, according to the 2022 statistics from the International Diabetes Federation (IDF), diabetic cases are forecasted to increase to 643 million by 2030 and to 784 million by 2045, highlighting a concerning trend in global diabetes prevalence.

Opportunities

- Increasing Outsourcing of API Production

Outsourcing API production to specialized manufacturers, driven by cost advantages and regulatory benefits, drives the growth of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs), shaping the pharmaceutical manufacturing landscape. This trend reflects a strategic shift in API in pharmaceutical industry dynamics, optimizing production capabilities and enhancing global supply chains.

For instance, in October 2022, Mendus AB partnered with Minaris Regenerative Medicine GmbH to facilitate technology transfer for manufacturing DCP-001, its lead development program. DCP-001 is undergoing evaluation in the ADVANCE II Phase 2 trial for preventing tumor recurrence in Acute Myeloid Leukemia (AML) and the ALISON Phase 1 trial in ovarian cancer.

- Technological Advancements in API Manufacturing

Technological advancements in API manufacturing have revolutionized synthesis and production techniques, boosting efficiency, cutting production costs, and elevating product quality. These innovations are pivotal drivers propelling the growth of the API market, ensuring the provision of high-quality pharmaceuticals while enhancing accessibility and affordability for patients worldwide.

Restraints/Challenges

- Rising Research and Development Costs

Research and development costs for new API discovery and development are soaring. The unpredictability of research and development outcomes and lengthy timelines add to the challenge. API manufacturers face substantial investment risks and must navigate through uncertain paths to bring new products to market, necessitating careful resource allocation and strategic decision-making to mitigate financial and operational hurdles.

- Shift in Disease Patterns and Therapeutic Trends

Manufacturers must swiftly adapt to changing healthcare policies, emerging diseases, and shifting therapeutic preferences. Failure to anticipate and respond to these changes can result in reduced market share, diminished revenue streams, and potential obsolescence within the competitive pharmaceutical landscape. Shifts in disease patterns and therapeutic trends challenge the API market by altering demand dynamics.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In April 2023, Aurobindo Pharma approved the transfer of two API units (Unit V and XVII) to its wholly-owned subsidiary Apitoria Pharma Private Limited, streamlining operations

- In January 2023, the U.S. FDA accepted the supplemental new drug application for Jardiance, expanding its indication to include adults with chronic kidney disease, addressing a critical medical need

- In June 2022, Pfizer's submission of a new drug application to the U.S. FDA for paxlovid advances the organization's product portfolio, promising innovation in treatment options

- In October 2021, Boehringer Ingelheim International Gmbh inaugurated its state-of-the-art biopharmaceutical production facility, Large Scale Cell Culture (LSCC), in Vienna, Austria, representing the company's commitment to cutting-edge technology and substantial investment in advancement

- In April 2020, Dr. Reddy’s Laboratories Ltd. received the EIR from the U.S. healthcare regulator for its active pharmaceutical ingredients manufacturers in Nalgonda, boosting manufacturing capabilities and ensuring compliance with rigorous quality standards, enhancing production efficiency and product quality

North America Active Pharmaceutical Ingredients (API) Market Scope

The market is segmented on the basis of molecule, type, type of manufacturer, synthesis, chemical synthesis, type of drug, usage, potency, and therapeutic application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Molecule

- Small Molecule

- Large Molecule

Type

- Innovative Active Pharmaceutical Ingredients

- Generic Innovative Active Pharmaceutical Ingredients

Type of Manufacturer

- Captive API Manufacturer

- Merchant API Manufacturer

Synthesis

- Synthetic Active Pharmaceutical Ingredients

- Biotech Active Pharmaceutical Ingredients

Chemical Synthesis

- Acetaminophen

- Artemisinin

- Saxagliptin

- Sodium Chloride

- Ibuprofen

- Losartan Potassium

- Enoxaparin Sodium

- Rufinamide

- Naproxen

- Tamoxifen

- Others

Type of Drug

- Prescription Drugs

- Over-the-Counter

Usage

- Clinical

- Research

Potency

- Low-to-Moderate Potency Active Pharmaceutical Ingredients

- Potent-to-Highly Potent Active Pharmaceutical Ingredient

Therapeutic Application

- Cardiology

- CNS and Neurology

- Oncology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Other Therapeutic Application

North America Active Pharmaceutical Ingredients (API) Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, molecule, type, type of manufacturer, synthesis, chemical synthesis, type of drug, usage, potency, and therapeutic application as referenced above.

The countries covered in the market report are U.S., Canada, and Mexico.

The U.S. is the fastest growing country in market as the fastest-growing country, propelled by a proliferation of manufacturers, increasing product approvals for treatment, and government and pharmaceutical organizations' initiatives to raise disease awareness. These factors collectively drive market expansion and innovation in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for global autoimmune disease diagnosis market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the market. The data is available for historic period 2016-2021.

Competitive Landscape and North America Active Pharmaceutical Ingredients (API) Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to active pharmaceutical ingredients (API) market.

Some of the major players operating in the market are:

- Dr. Reddy's Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- GlaxoSmithKline plc (U.K.)

- Pfizer Inc. (U.S.)

- Aurobindo Pharma (India)

- Sanofi (France)

- Lupin (India)

- Cipla Inc. (U.S.)

- BASF SE (Germany)

- Merck KGaA (Germany)

- Novo Nordisk A/S (Denmark)

- AbbVie Inc. (U.S.)

- Alembic Pharmaceuticals Limited (India)

- AstraZeneca (U.K.)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Alkem Labs (India)

- Saneca Pharmaceuticals (Slovakia)

- Jubilant Pharmova Limited (India)

- Neuland Laboratories Ltd (India)

SKU-