North America Active Medical Implantable Devices Market

Market Size in USD Billion

CAGR :

%

USD

10.08 Billion

USD

18.51 Billion

2025

2033

USD

10.08 Billion

USD

18.51 Billion

2025

2033

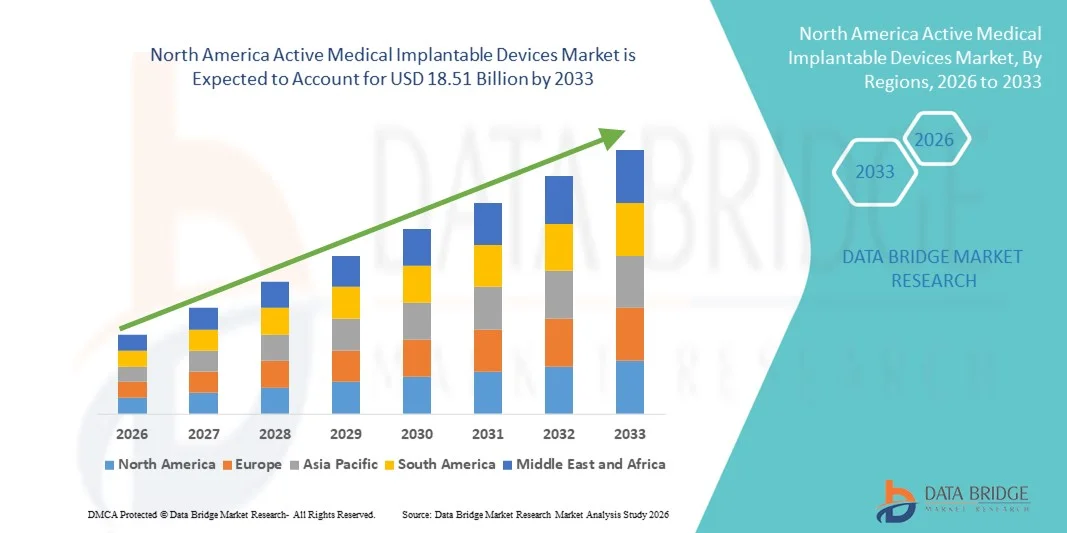

| 2026 –2033 | |

| USD 10.08 Billion | |

| USD 18.51 Billion | |

|

|

|

|

North America Active Medical Implantable Devices Market Size

- The North America active medical implantable devices market size was valued at USD 10.08 billion in 2025 and is expected to reach USD 18.51 billion by 2033, at a CAGR of 7.9% during the forecast period

- The market growth is largely fueled by advanced healthcare infrastructure, rising prevalence of chronic diseases and ongoing technological innovations in implantable solutions that improve patient outcomes in both hospitals and specialized care settings

- Furthermore, increasing demand for high‑precision, minimally invasive and remotely monitored therapeutic devices, coupled with favorable reimbursement policies and early adoption of cutting‑edge medical technologies, is strengthening North America’s position as a leading regional market for active implantable devices. These converging factors are accelerating the uptake of advanced implantable solutions, thereby significantly boosting the industry’s growth

North America Active Medical Implantable Devices Market Analysis

- Active medical implantable devices, including cardiac resynchronization therapy devices (CRT-D), implantable defibrillators, pacemakers, neurostimulators, eye implants, and active hearing devices, are increasingly vital components of modern healthcare in the U.S., offering continuous monitoring, precise therapeutic intervention, and improved patient outcomes across cardiovascular, neurological, and sensory applications

- The escalating demand for active implantable devices is primarily fueled by the rising prevalence of chronic diseases, aging populations, and growing adoption of advanced medical technologies that enable minimally invasive procedures, remote monitoring, and enhanced patient care

- The United States dominated the North America active medical implantable devices market with the largest revenue share of 74.9% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players, with hospitals and specialty clinics experiencing substantial growth in the adoption of cardiac and neurological implants, driven by innovations from both established medical device companies and startups focusing on AI-enabled and digitally connected devices

- Canada is expected to be the fastest growing country in the North America active medical implantable devices market during the forecast period due to increasing healthcare investments, growing awareness of implantable therapies, and improving access to advanced medical technologies

- The Implantable Cardioverter Defibrillators segment dominated the market with a share of 45.3% in 2025, driven by the high prevalence of cardiovascular diseases, technological advancements in defibrillators, and growing patient preference for devices with remote monitoring capabilities

Report Scope and North America Active Medical Implantable Devices Market Segmentation

|

Attributes |

North America Active Medical Implantable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Active Medical Implantable Devices Market Trends

Integration of Advanced Monitoring and AI-Enabled Therapies

- A significant and accelerating trend in the U.S. active medical implantable devices market is the incorporation of AI-enabled monitoring, remote connectivity, and predictive analytics, which enhance patient care and provide clinicians with real-time insights into device performance and patient health

- For instance, Medtronic’s AI-enabled pacemakers can automatically adjust pacing based on patient activity and health data, enabling more personalized therapy and reducing hospital visits. Similarly, Abbott’s implantable cardiac monitors transmit real-time arrhythmia alerts to physicians via secure cloud platforms

- AI integration in these devices enables features such as learning patient-specific cardiac or neurological patterns to suggest therapy adjustments and generating predictive alerts for potential complications. For instance, Boston Scientific’s neurostimulators analyze patient movement patterns to optimize stimulation parameters and alert physicians in case of anomalies

- Remote connectivity allows patients and healthcare providers to monitor device performance and physiological metrics from home, improving compliance and early detection of adverse events. Through a single platform, clinicians can manage multiple implantable devices alongside patient health data, creating an integrated and automated care experience

- This trend towards more intelligent, interconnected, and patient-centric implantable devices is reshaping expectations for medical device functionality. Consequently, companies such as Biotronik are developing AI-enabled defibrillators and pacemakers with adaptive therapy algorithms and cloud-based monitoring

- The demand for implantable devices with AI-enabled monitoring and remote management is growing rapidly across both hospitals and specialty clinics, as patients and providers increasingly prioritize convenience, precision, and improved clinical outcomes

- Additionally, integration with wearable devices and mobile health apps is allowing patients to actively track their health metrics alongside implantable device data, creating a more holistic approach to disease management

North America Active Medical Implantable Devices Market Dynamics

Driver

Rising Chronic Disease Prevalence and Technology Adoption

- The increasing prevalence of cardiovascular, neurological, and sensory disorders, coupled with the adoption of advanced implantable technologies, is a significant driver of demand in the U.S. market

- For instance, in March 2025, Abbott announced the expansion of its implantable cardiac monitoring system with AI-based arrhythmia detection, improving early intervention and patient management

- As healthcare providers focus on reducing hospital readmissions and improving patient outcomes, implantable devices offer advanced features such as continuous monitoring, automated therapy adjustment, and secure data transmission, providing a compelling alternative to traditional interventions

- Furthermore, the growing preference for minimally invasive procedures and remote monitoring is making implantable devices an integral component of modern therapy, allowing clinicians to provide more precise, patient-specific care

- Ease of integration with hospital health IT systems, remote monitoring platforms, and AI-assisted diagnostics is a key factor driving adoption in hospitals and specialty clinics. The trend toward patient-centered care and digital health solutions further contributes to market growth

- For instance, neurostimulators with closed-loop systems are increasingly adopted to optimize therapy delivery for chronic pain and Parkinson’s disease, driving market expansion in specialty clinics

- Additionally, the growing use of implantable hearing devices for pediatric and geriatric populations is boosting demand, as more patients seek improved auditory health with minimally invasive interventions

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- Concerns surrounding high device costs, complex surgical procedures, and stringent regulatory requirements pose significant challenges to broader market penetration. As these devices involve advanced technology and clinical monitoring, they are often expensive and require specialized implantation expertise

- For instance, high-profile recalls of certain implantable cardiac devices due to battery or software issues have made some providers cautious about adopting new technologies

- Addressing these challenges through robust clinical validation, physician training, and adherence to FDA and ISO regulatory standards is crucial for market expansion. Companies such as Medtronic and Boston Scientific emphasize rigorous testing and compliance protocols to reassure clinicians and patients. Additionally, the relatively high cost of some advanced implantable devices compared to traditional therapy can be a barrier for hospitals with budget constraints

- While prices are gradually decreasing and insurance coverage is improving, the premium associated with advanced implantable devices can still hinder widespread adoption, particularly in smaller clinics or less-funded healthcare settings

- Overcoming these challenges through cost optimization, reimbursement support, and enhanced regulatory compliance will be vital for sustained growth of the U.S. active medical implantable devices market

- For instance, compliance with updated cybersecurity and data privacy regulations for connected implantable devices is increasingly complex, requiring additional investments from manufacturers and healthcare providers

- Furthermore, training requirements for minimally invasive implantation procedures and post-operative device monitoring add operational challenges that can limit adoption, particularly in rural or under-resourced healthcare facilities

North America Active Medical Implantable Devices Market Scope

The market is segmented on the basis of product, surgery type, procedure, and end user.

- By Product

On the basis of product, the North America active medical implantable devices market is segmented into Cardiac Resynchronization Therapy Devices (CRT-D), implantable cardioverter defibrillators (icds), implantable cardiac pacemakers, eye implants, neurostimulators, active implantable hearing devices, ventricular assist devices, implantable heart monitors/insertable loop recorders, brachytherapy, implantable glucose monitors, dropped foot implants, shoulder implants, implantable infusion pumps, and implantable accessories. Implantable Cardioverter Defibrillators (ICDs) segment dominated the market with the largest revenue share of 45.3% in 2025, driven by the high prevalence of cardiovascular diseases such as arrhythmias and sudden cardiac arrest in the U.S. Hospitals and specialty clinics often prioritize ICDs for high-risk patients due to their proven efficacy in restoring normal heart rhythms. The demand is further supported by technological advancements, including remote monitoring and AI-enabled predictive alerts, which enhance patient safety. ICDs are compatible with digital health platforms, allowing clinicians to track patient data in real-time. The segment benefits from established reimbursement policies and widespread clinician familiarity, reinforcing its dominant position. Moreover, continuous innovation in battery life, miniaturization, and wireless communication strengthens market adoption and revenue generation.

Implantable Heart Monitors/Insertable Loop Recorders segment is expected to witness the fastest growth during 2026–2033, fueled by increasing adoption in both hospitals and outpatient specialty clinics for early detection of arrhythmias and stroke risk. These devices provide continuous, long-term monitoring, reducing the need for frequent hospital visits. Patients increasingly prefer minimally invasive monitoring solutions, which enhance convenience and comfort. Integration with mobile apps and cloud-based platforms allows remote data sharing and predictive analytics, making these devices more attractive to clinicians and patients alike. Growing awareness of early cardiovascular disease detection and supportive reimbursement policies further contribute to the rapid market uptake. The segment is also seeing technological innovations such as smaller device sizes and improved battery longevity, expanding its appeal among geriatric and high-risk populations.

- By Surgery Type

On the basis of surgery type, the market is segmented into traditional surgical methods and minimally invasive surgery. Minimally Invasive Surgery segment dominated the market in 2025 due to its lower risk of complications, faster recovery times, and shorter hospital stays. Hospitals and specialty clinics increasingly prefer minimally invasive implantation for cardiac, neurovascular, and orthopedic devices, improving patient satisfaction and clinical outcomes. Surgeons are adopting advanced imaging and robotic-assisted techniques to improve procedural accuracy. The rising preference among patients for less intrusive procedures also drives adoption. Minimally invasive surgeries are compatible with most modern implantable devices, supporting continuous growth. Additionally, healthcare reimbursement schemes and clinical guidelines often favor minimally invasive methods, further reinforcing market dominance.

Traditional Surgical Methods segment is expected to witness the fastest growth during 2026–2033, particularly in regions with established surgical expertise and for devices requiring complex implantation such as ventricular assist devices or advanced neurostimulators. Hospitals continue to use traditional techniques for high-risk or multi-device procedures due to familiarity and proven outcomes. The segment benefits from ongoing training programs, procedural standardization, and clinical protocol updates. Traditional methods also allow for simultaneous implantation of multiple devices when needed. Furthermore, increasing clinical research supporting device efficacy via traditional surgical approaches encourages adoption. Rising patient awareness and physician confidence in complex implantations contribute to the projected growth of this segment.

- By Procedure

On the basis of procedure, the market is segmented into neurovascular, cardiovascular, hearing, and others. Cardiovascular procedure segment dominated the market with the largest share in 2025, driven by high incidences of heart failure, arrhythmia, and sudden cardiac arrest in the U.S. Hospitals prioritize devices such as ICDs, pacemakers, and CRT-Ds for life-saving interventions. Cardiovascular implants benefit from strong reimbursement coverage and clinician familiarity. Continuous monitoring and remote connectivity of these devices enhance patient compliance and clinical outcomes. Technological advancements in device miniaturization, AI-enabled monitoring, and wireless data transfer further support adoption. The segment also receives significant attention from manufacturers for innovation, improving reliability, safety, and patient experience, reinforcing its market dominance.

Hearing procedure segment is expected to witness the fastest growth from 2026–2033, due to rising prevalence of hearing impairment across pediatric and geriatric populations. Active implantable hearing devices, including cochlear implants and bone-anchored systems, are increasingly adopted in hospitals and specialty clinics. Integration with digital platforms and mobile apps enables remote tuning and monitoring, improving patient convenience. Awareness campaigns and improved access to hearing healthcare are driving adoption. Technological advancements, such as smaller implant sizes and enhanced sound processing algorithms, boost the segment’s attractiveness. Additionally, reimbursement coverage expansion in both public and private healthcare systems supports the projected rapid growth.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and clinics. Hospitals segment dominated the market in 2025 due to their advanced surgical infrastructure, skilled clinical staff, and high patient volume for implantable device procedures. Hospitals handle complex cardiac, neurovascular, and orthopedic implantations, making them the primary point of care for high-value devices such as ICDs and CRT-Ds. Integration with hospital IT systems allows real-time monitoring and data management. Strong reimbursement support and long-term patient follow-up services further reinforce dominance. Hospitals also act as innovation hubs for device trials, training, and adoption of new technology, maintaining a leadership position.

Specialty Clinics segment is expected to witness the fastest growth from 2026–2033, driven by increasing demand for minimally invasive implant procedures and outpatient monitoring solutions. Specialty clinics offer focused care in cardiology, neurology, and hearing disorders, providing convenience and personalized treatment. Patients prefer clinics for follow-up care, device adjustments, and remote monitoring integration. The segment benefits from advanced diagnostic tools, mobile health platforms, and partnerships with device manufacturers. Rising patient awareness, affordability, and improved access to specialized care are supporting rapid expansion of this end-user segment.

North America Active Medical Implantable Devices Market Regional Analysis

- The United States dominated the North America active medical implantable devices market with the largest revenue share of 74.9% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players

- Patients and healthcare providers in the region highly value the precision, continuous monitoring, and improved clinical outcomes offered by implantable devices such as ICDs, pacemakers, and neurostimulators

- This widespread adoption is further supported by advanced hospitals and specialty clinics, skilled healthcare professionals, and growing awareness of minimally invasive procedures, establishing active medical implantable devices as essential therapeutic solutions across both hospital and outpatient settings

U.S. Active Medical Implantable Devices Market Insight

The U.S. active medical implantable devices market captured the largest revenue share of 74.9% in 2025 within North America, fueled by the widespread adoption of advanced cardiac, neurostimulator, and orthopedic devices. Hospitals and specialty clinics increasingly prioritize ICDs, pacemakers, and CRT-Ds due to their life-saving potential and precision therapy capabilities. Patients and providers are adopting minimally invasive procedures and AI-enabled monitoring systems, enhancing treatment outcomes. The growing awareness of chronic diseases, coupled with supportive reimbursement frameworks, is driving market expansion. Additionally, integration with remote monitoring and cloud-based healthcare platforms is contributing significantly to adoption. The market’s growth is further supported by a strong presence of established device manufacturers and continuous technological innovations.

Canada Active Medical Implantable Devices Market Insight

The Canada active medical implantable devices market is expected to witness the fastest growth in North America during the forecast period, driven by increasing healthcare investments, rising prevalence of cardiovascular and neurological disorders, and expanding awareness of implantable therapies. Hospitals and specialty clinics are adopting minimally invasive implantation procedures and remote monitoring solutions to improve patient care. Government initiatives to enhance access to advanced healthcare technologies and growing patient preference for outpatient and specialty clinic services are supporting rapid adoption. The market is also benefiting from improvements in medical infrastructure and training programs for clinicians. Technological advancements such as AI-enabled defibrillators, neurostimulators, and remote patient monitoring devices are contributing to accelerated growth.

Mexico Active Medical Implantable Devices Market Insight

The Mexico active medical implantable devices market is witnessing steady growth, driven by rising awareness of chronic cardiovascular and neurological diseases and increasing access to advanced medical care. Hospitals and specialty clinics in urban centers are adopting implantable cardiac devices, neurostimulators, and hearing implants to improve patient outcomes. Government initiatives to improve healthcare infrastructure and public health programs are supporting market expansion. Patients increasingly prefer minimally invasive procedures and remote monitoring solutions, enhancing adoption. Local distribution networks and collaborations with international medical device manufacturers are improving device availability. Moreover, ongoing investments in training healthcare professionals and expanding reimbursement coverage are contributing to the country’s growing share of the North American market.

North America Active Medical Implantable Devices Market Share

The North America Active Medical Implantable Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Cochlear Ltd (Australia)

- Biotronik (Germany)

- LivaNova PLC (U.K.)

- MED EL Medical Electronics (Austria)

- Sonova (Switzerland)

- Axonics, Inc. (U.S.)

- NeuroPace, Inc. (U.S.)

- NEVRO CORP (U.S.)

- Zhejiang Nurotron Biotechnology Co., Ltd (China)

- Demant A/S (Denmark)

- Oticon Medical (Denmark)

- Sonova Holding AG (Switzerland)

- Microson (Australia)

- Nano Retina (Israel)

- GluSense (U.S.)

- Second Sight (U.S.)

What are the Recent Developments in North America Active Medical Implantable Devices Market?

- In November 2025, Boston Scientific announced it would acquire the remaining equity in Nalu Medical for approximately USD 533 million, expanding its chronic pain neurostimulation portfolio by incorporating Nalu’s peripheral nerve stimulation technology designed to provide targeted pain relief through wireless, battery‑free implants controlled via smartphone apps.

- In July 2025, Cochlear Limited announced FDA approval of the Cochlear™ Nucleus® Nexa™ System, the world’s first smart cochlear implant system with upgradeable internal firmware that enables future feature updates without replacing hardware. This innovation allows recipients to access new enhancements over time, reduces the need for external hardware replacements, and improves overall hearing performance with smaller, lighter processors

- In February 2025, the U.S. Food and Drug Administration approved the first adaptive brain pacemaker for Parkinson’s treatment, developed by Medtronic, marking a significant milestone in brain‑computer interface technology. The adaptive device can respond in real time to patient needs, reducing involuntary movements and enhancing symptom management for Parkinson’s patients, underscoring FDA support for advanced neurological implants

- In January 2024, Elon Musk’s Neuralink successfully implanted its brain‑computer interface chip in the first human patient, initiating early clinical trials aimed at enabling patients with paralysis or neurological conditions to interact with computers and digital tools using thought alone. This represented a major step forward for implantable BCIs in real‑world clinical use

- In September 2023, Neuralink opened recruitment for its first human clinical trial of its implantable brain‑computer interface, following FDA clearance earlier that year. The trial aimed to evaluate safety and functionality, marking a key regulatory and clinical milestone in bringing implantable neurotechnology to medical applications in the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.