North America Abrasives Market, By Raw Materials (Natural and Synthetic), Type (Coated Abrasive, Bonded Abrasive, Super Abrasive and Others), Product (Disc, Cups, Cylinder and Others), Form (Block Form and Powdered Form), Application (Grinding, Cutting, Polishing, Drilling, Finishing and Others), End-User (Automotive, Machinery, Aerospace and Defence, Metal Fabrication, Building and Construction, Medical Devices, Oil and Gas, Electrical and Electronics and Others), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Abrasives Market

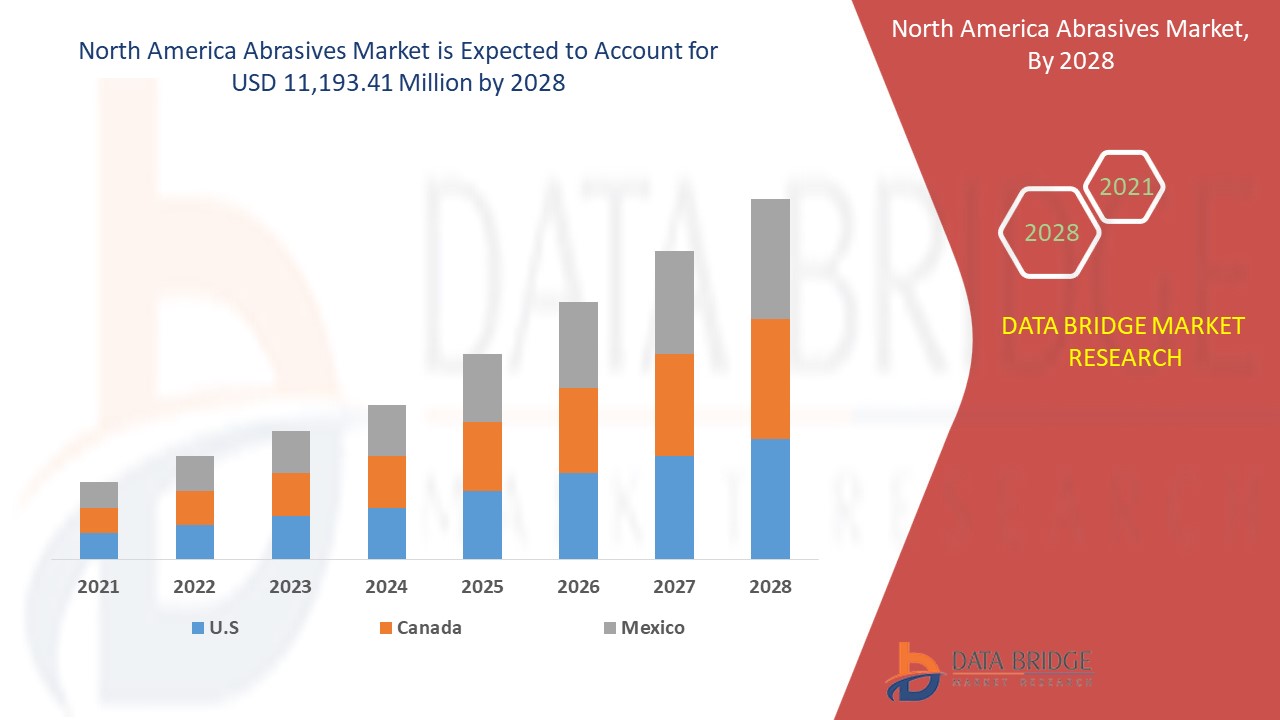

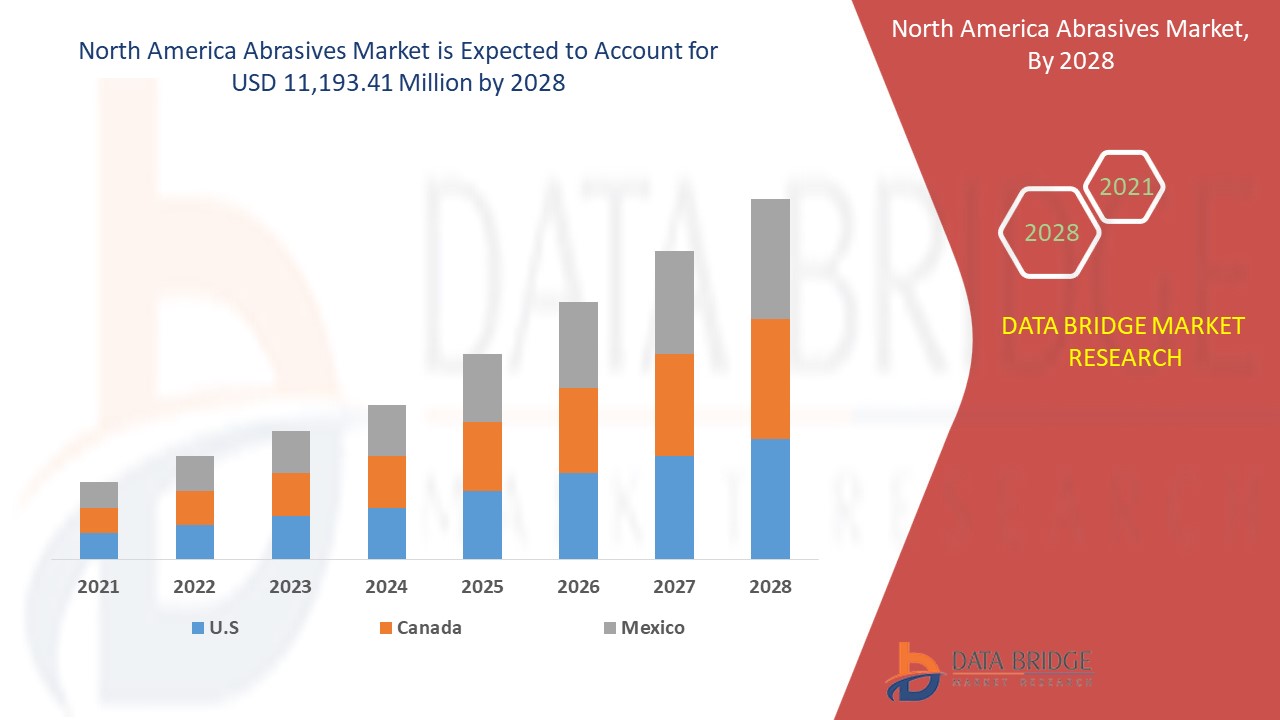

The abrasives market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing at a CAGR of 5.1% in the forecast period of 2021 to 2028 and expected to reach USD 11,193.41 million by 2028.

Abrasives are substance used for grinding, cutting, polishing and drilling of solid surface that can further be used by different end- users such as oil and gas, metal fabrication, aerospace among others. They are basically considered in automotive industry giving smooth surface finish to various parts of automobiles along with automotive bodies.

The good property of abrasives is increasing the effectiveness and efficiency of the electronics goods, so, the usage of abrasives is increasing in electronics goods industry driving the global abrasives market growth in the forecast period. The rising cost of raw materials required in the manufacturing of coated abrasives is restraining the abrasives market. The huge benefits associated with the use of abrasives in medical industry are creating an opportunity for the growth of the abrasives market. The disruption in the use of abrasives in aerospace industry is creating a challenging situation for the growth of the abrasives market.

This abrasives market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Abrasives Market Scope and Market Size

The abrasives market is segmented on the basis of are raw materials, type, product, form, application and end- user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of raw materials, the abrasives market is segmented into natural and synthetic. In 2021, synthetic segment is dominating as the manufacturing of synthetic abrasives is easy that have same properties as of natural abrasives.

- On the basis of type, the abrasives market is segmented into coated abrasive, bonded abrasive, super abrasive and others. In 2021, coated abrasive segment is dominating as coated abrasive are high in purity and quality.

- On the basis of product, the abrasives market is segmented into disc, cups, cylinder and others. In 2021, disc segment is dominating as disc shape gives large area to products.

- On the basis of form, the abrasives market is segmented into block form and powdered form. In 2021, block form segment is dominating as block form are easy to be converted into any desired shape and size.

- On the basis of application, the abrasives market is segmented into grinding, cutting, polishing, drilling, finishing and others. In 2021, polishing segment is dominating due to rise in demand of polished products especially from aerospace and defence industry, metal fabrication among others.

- On the basis of end-user, the abrasives market is segmented into automotive, machinery, aerospace and defence, metal fabrication, building and construction, medical devices, oil and gas, electrical and electronics and others. In 2021, automotive segment is dominating due to the rise in income level and change in living standards of the individuals.

Abrasives Market Country Level Analysis

The abrasives market is analysed and market size information is provided by the country, raw materials, type, product, form, application and end- user as referenced above.

The countries covered in North America abrasives market report are the U.S., Canada and Mexico.

- In North America, countries such as the US and Canada is dominating the abrasives market because of the increased demand of drilling and cutting application with increased efficiency of synthetic raw materials and life creating opportunity of growth for the region.

North America Abrasives Market, By Product

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increase in Use of Abrasives in Pharmaceuticals Industry

The abrasives market also provides you with detailed market analysis for every country growth in installed base of different kind of products for abrasives market, impact of technology using life line curves and changes in requirement of abrasives products, regulatory scenarios and their impact on the abrasives market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Abrasives Market Share Analysis

The abrasives market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to North America abrasives market.

The major players covered in the abrasives market report are Saint-Gobain, DuPont , 3M, VSM AG , Robert Bosch GmbH, Asahi Diamond Industrial Co.,Ltd, Fujimi Incorporated, WASHINGTON MILLS, GMA Garnet Pty Ltd, WINOA GROUP , Mirka Ltd, Henkel AG & Co. KGaA , SAIT ABRASIVI S.p.A, Radiac Abrasive and other players domestic and global. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product launches and agreements are also initiated by the companies’ worldwide which are also accelerating the abrasives market.

For instance,

- In January 2020, Washington Mills attended 44th International Conference and Expo which was an event based on the Advanced Ceramics & Composites materials. This will increase the sales and revenue of Washington Mills.

Collaboration, joint ventures and other strategies by the market players is enhancing the company market in the abrasives market which also provides the benefit for organisation to improve their offering for abrasives.

SKU-