Middle East Class B Bench Top Dental Autoclaves Market

Market Size in USD Billion

CAGR :

%

USD

1.64 Billion

USD

2.18 Billion

2021

2029

USD

1.64 Billion

USD

2.18 Billion

2021

2029

| 2022 –2029 | |

| USD 1.64 Billion | |

| USD 2.18 Billion | |

|

|

|

Middle East Class B Bench-Top Dental Autoclaves Market Analysis and Insights

The drivers responsible for the growth of the market are the increase in the prevalence of dental disorders, the rise in several dental practitioners and dental clinics, and rise in demand for cosmetic dental procedures, and the prevalence of hospital-acquired infection. However, stringent regulations and improper reimbursement scenarios are expected to restrain the market growth.

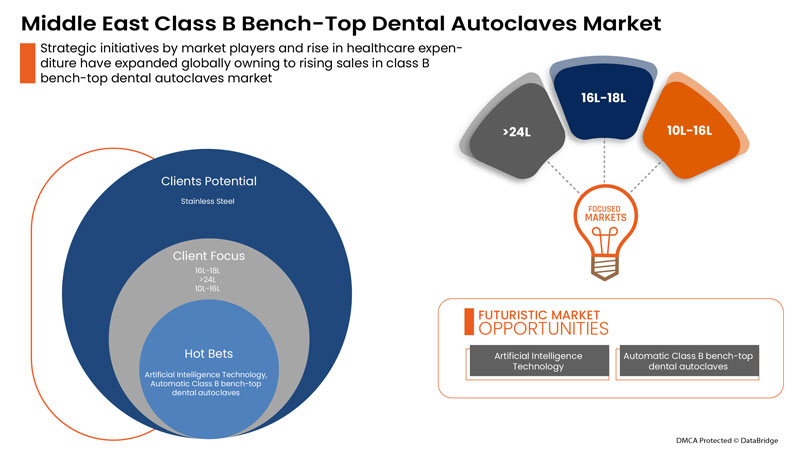

On the other hand, strategic initiatives by market players, rising prevalence of dental health issues, increased awareness across all age groups, and a rise in healthcare expenditure may act as an opportunity for market growth. However, the need for skilled expertise, challenges in implementing the class B bench-top dental autoclaves in dental laboratories, and regulatory approval may create challenges for the market.

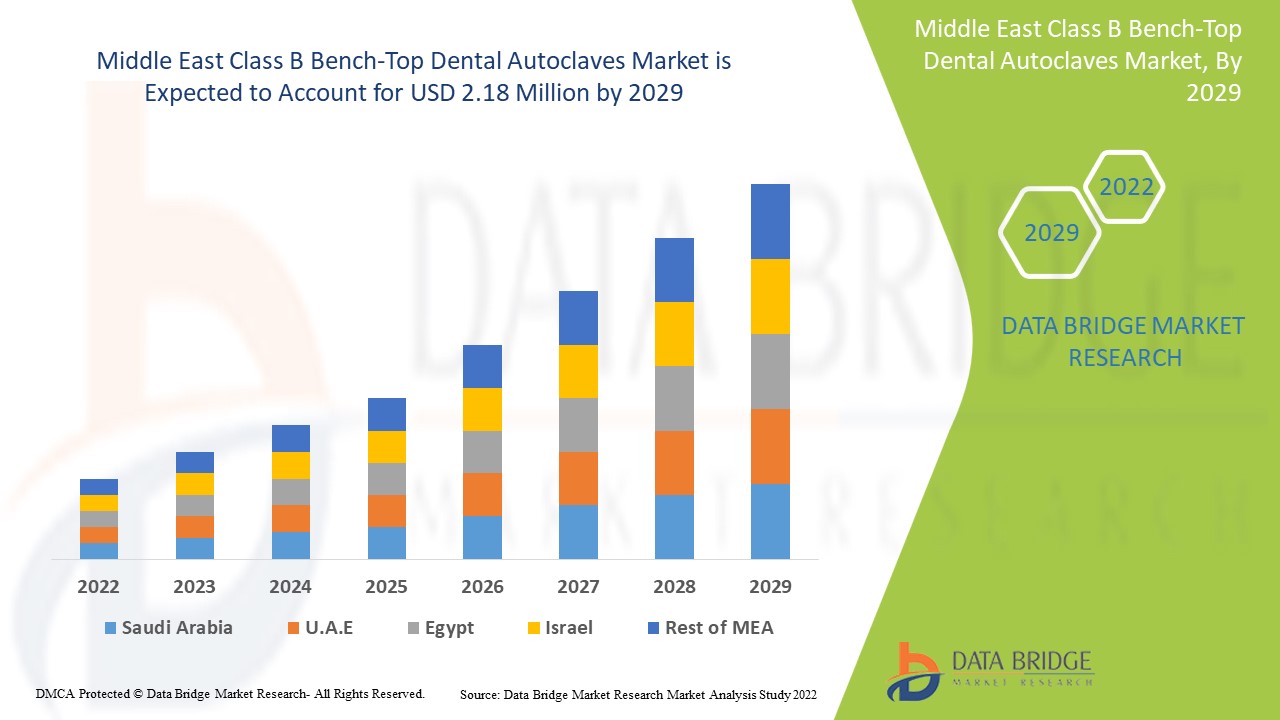

Middle East class B bench-top dental autoclaves market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.6% in the forecast period of 2022 to 2029 and is expected to reach USD 2.18 million by 2029 from USD 1.64 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units |

|

Segments Covered |

Product (Systems, Accessories), Material (Stainless Steel, Copper), Load Type (Porous Materials, Solid Materials, Others), Capacity (<10L, 10L-16L, 16L-18L, 18L-24L, >24L), End User (Hospitals and Dental Clinics, Dental Laboratories, Academic and Research Institutes, Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E, Egypt, Israel and the Rest of the Middle East |

|

Market Players Covered |

Tecno-Gaz S.p.A., Celitron Medical Technologies Kft, MELAG Medizintechnik GmbH & Co. KG, LTE Scientific Ltd, 2022, NSK / Nakanishi Inc., NEWMED, among others |

Market Definition

The class B bench-top dental autoclaves are defined by a pre-sterilization vacuum cycle. Class B is considered the highest autoclave class and can be used to sterilize all loads, including solids, type A hollow instruments, type B hollow instruments, porous loads, and wrapped instruments. The class B bench-top autoclaves should clear the Helix test as per standard EN 13060 outlined by EN 867-5:2001. This can only be achieved by the use of a pre-sterilization fractionated vacuum. Post sterilization vacuum drying ensures complete drying of all loads after the entire sterilization process. A class B Sterilizer is a must have autoclave in every dental clinic. It provides highly effective and safe sterilization for instruments. STERICOX class b autoclaves meet EN13060 standard and come in 23 liters' capacity, which is the most preferred brand at an economical price. Class B dental sterilizers are extensively used in medical and dentistry to safeguard the security of doctors, staff, and patients. Various types of loads such as porous materials, textiles, products in pouches, turbines, wands, and tips can be effectively sterilized in a Class B dental autoclave.

Middle East Class B Bench-Top Dental Autoclaves Market Dynamics

Drivers

-

INCREASED PREVALENCE OF DENTAL DISORDERS

Oral health refers to the healthy gums, teeth, and oral facial system that enables speaking, chewing, and smiling. The most common dental disorders include tooth decay, periodontal diseases, and oral cancer, among others. According to World Health Organization's report, around 2.3 billion people in the world are suffering from caries of a permanent tooth, among which around 530 million children suffer from caries of the primary tooth.

Tooth decay results from a complex interplay of variables, including bacteria, host susceptibility, time, food, and others. Unhygienic practices, such as poor oral health, can cause tooth decay that will have an impact on the growth and maturity of permanent teeth, and widespread consumption of sugary foods causes teeth cavitation. Sterilization is an essential step in reusable dental instruments that have become contaminated due to all the biological fluids.

As the number of dental disorders increases, the chance of infection or cross-contamination through dental equipment also increases. Thus, the availability and use of class B bench-top dental autoclaves are projected to drive market expansion due to the rise in dental disorders.

Thus, increasing cases of dental disorders such as dental caries, tooth decay, and oral cancers are expected to boost the growth of the Middle East class B bench-top dental autoclaves market.

-

INCREASED DEMAND FOR COSMETIC DENTAL PROCEDURES

Cosmetic dentistry enhances the idea of oral health by producing a complete sense of well-being that includes both feeling and looking excellent. New dental materials yield superior results, as cosmetic dentistry has advanced over time. The development of cosmetic dentistry has paved the door for greater, more long-lasting changes to the face that go far beyond simply correcting teeth. Thus, the demand for cosmetic dental procedures has increased the market growth of class B bench top autoclaves as they include a powerful vacuum pump to remove all the air from their chamber, which allows them to sterilize every part of the instruments needed for dental procedures effectively. Its speed and user-friendly interface have raised its demand among health practitioners.

-

INCREASED NUMBER OF DENTAL PRACTITIONERS AND DENTAL CLINICS

As the number of dental problems is increasing globally, the need for dental professionals and dental clinics is also increasing. As the usage of advanced instruments demands trained dental professionals, there is a surge in the number of dental practitioners in developing and developed countries.

Thus, the increased dentist population and dental labs number is expected to drive the market growth of in the forecasted period.

Opportunities

-

RISING PREVALENCE OF DENTAL HEALTH ISSUES AND AWARENESS ACROSS ALL AGE GROUPS

Dental issues are sometimes overlooked, which leads to major dental problems. Increasing cases of oral or dental infections are prevalent according to various age groups. Hence, government bodies have imposed various dental health-related guidelines. Moreover, government bodies and healthcare organizations are spreading awareness to control infections through various health resolutions and programs.

Growing dental health programs significantly affect the development of better and advanced dental products in the market. Thereby surge in dental issues and awareness across all age groups is a greater opportunity for the Middle East class B bench-top dental autoclaves market.

-

STRATEGIC INITIATIVES OF KEY PLAYERS

The dramatic rise in research quality and increasing research opportunities is because of various strategic initiatives key market players take. They are taking initiatives such as product launches, collaborations, mergers, acquisitions, and many more over the years. Hence, they are expected to lead and create more opportunities in the market.

Healthcare product suppliers have a huge opportunity to successfully work with new technology firms to ensure the industry's continued growth, creativity, and viability. Health enterprises implementing technology-enabled technologies will explore new modes of goods for patient care, streamline processes and engage patients more.

Companies are launching new initiatives and collaborating with other key players to deliver more reliable results and services.

The strategic product launches, approvals, acquisitions, and mergers done by major companies in the Middle East class B bench-top dental autoclaves market have opened up an opportunity for companies in various regions. This strategy allows the companies to strengthen their footprints in the market. Therefore, it is projected that strategic initiative is the golden opportunity for the market players to accelerate their revenue growth.

Restraints/Challenges

-

LACK OF AWARENESS ABOUT DENTAL HYGIENE

The development of the worldwide dental autoclave market is anticipated to be hampered by developing nations' lack of dental hygiene awareness.

For instance, oral disorders are commonplace worldwide and negatively impact people's health and the global economy.

The majority of countries continue to see an increase in the prevalence of oral diseases, which is mostly a result of people's poor access to oral health care facilities and lack of knowledge about dental hygiene (which leads to people being unaware of the importance of dental hygiene).

-

INSUFFICIENT ATTENTION TO PROCESS

Insufficient attention to sterilization processes in dental offices and other ambulatory care settings can expose patients to contaminated instruments, implants, or other critical items. Failure to consistently and effectively clean, disinfect, or sterilize contaminated items before use can expose patients to virulent pathogens. Patients may contact contaminated items, especially those intended to enter sterile tissue or the vascular system.

These are some of the factors that will restrain its market growth in the forecast period.

Recent Development

- In December 2021, LTE Scientific Ltd, 2022, 2022 upgraded the product website. The upgradation and development of a new product website created awareness among the customers about upcoming dental sterilizers and loading systems. It also resulted in partnerships among market players and the distribution of dental sterilizers among dental laboratories

Middle East Class B Bench-Top Dental Autoclaves Market Scope

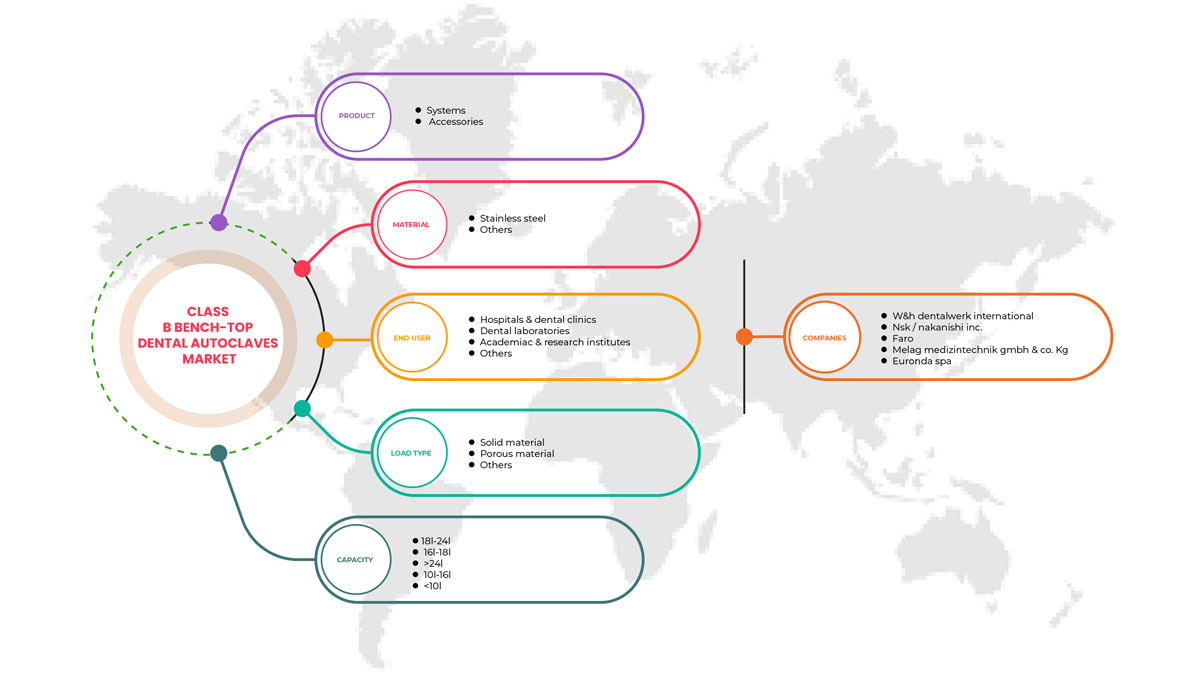

Middle East class B bench-top dental autoclaves market is segmented into product, material, load type, capacity, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Systems

- Accessories

On the basis of products, the Middle East class B bench-top dental autoclaves market is segmented into systems and accessories.

Material

- Stainless Steel

- Copper

On the basis of material, the Middle East class B bench-top dental autoclaves market is segmented into stainless steel and copper.

Load Type

- Solid Materials

- Porous Materials

- Others

On the basis of load type, the Middle East class B bench-top dental autoclaves market is segmented into solid materials, porous materials, and others.

Capacity

- <10L

- 10L-16L

- 16L-18L

- 18L-24L

- >24L

On the basis of capacity, the Middle East class B bench-top dental autoclaves market is segmented into <10L, 10L-16L, 16L-18L, 18L-24L, and >24L.

End User

- Hospitals and Dental Clinics

- Dental Laboratories

- Academic and Research Institutes

- Others

On the basis of end user, the Middle East class B bench-top dental autoclaves market is segmented into hospitals and dental clinics, dental laboratories, academic and research institutes, and others.

Middle East Class B Bench-Top Dental Autoclaves Market Regional Analysis/Insights

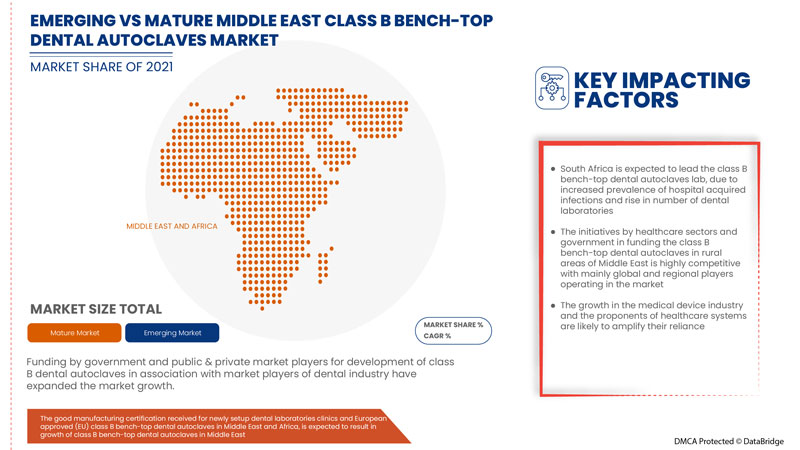

Middle East class B bench-top dental autoclaves market is analyzed, and market size insights and trends are provided by country, product, material, load type, capacity, and end user.

Middle East class B bench-top dental autoclaves market is divided into South Africa, Saudi Arabia, U.A.E, Egypt, Israel and the Rest of the Middle East.

South Africa is expected to lead the class B bench-top dental autoclave lab due to the increased prevalence of hospital-acquired infections and the rise in dental laboratories.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle Eastern brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East Class B Bench-Top Dental Autoclaves Market Share Analysis

The Middle East class B bench-top dental autoclaves market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the Middle East class B bench-top dental autoclaves market.

Some of the major players operating in the Middle East class b bench-top dental autoclaves market are Tecno-Gaz S.p.A., Celitron Medical Technologies Kft, MELAG Medizintechnik GmbH & Co. KG, LTE Scientific Ltd, 2022, NSK / Nakanishi Inc., NEWMED, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, and Middle East vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 RESEARCH METHODOLOGY

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 THE CATEGORY VS TIME GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF DENTAL DISORDERS

6.1.2 INCREASED NUMBER OF DENTAL PRACTITIONERS AND DENTAL CLINICS

6.1.3 INCREASED DEMAND FOR COSMETIC DENTAL PROCEDURES

6.1.4 INCREASED PREVALENCE OF HOSPITAL-ACQUIRED INFECTION

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 INAPPROPRIATE REIMBURSEMENT SCENARIO

6.2.3 INSUFFICIENT ATTENTION TO PROCESS

6.3 OPPORTUNITIES

6.3.1 RISING PREVALENCE OF DENTAL HEALTH ISSUES AND AWARENESS ACROSS ALL AGE GROUPS

6.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 HIGH COST OF BENCH-TOP DENTAL AUTOCLAVES

6.4.2 LACK OF AWARENESS ABOUT DENTAL HYGIENE

7 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SYSTEMS

7.2.1 AUTOMATIC

7.2.2 SEMI-AUTOMATIC

7.2.3 MANUAL

7.3 ACCESSORIES

8 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STAINLESS STEEL

8.3 OTHERS

9 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE

9.1 OVERVIEW

9.2 SOLID MATERIAL

9.2.1 TYPE A SOLID LOADS WITH HOLLOW SECTIONS

9.2.2 TYPE B SOLID LOADS WITH HOLLOW SECTIONS

9.3 POROUS MATERIAL

9.4 OTHERS

10 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 18L-24L

10.3 16L-18L

10.4 >24L

10.5 >10L-16L

10.6 <10L

11 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DENTAL CLINICS

11.3 DENTAL LABORATORIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 OTHERS

12 MIDDLE EAST CLASS B BENCH TOP DENTAL AUTOCLAVE MARKET BY COUNTRY

12.1 MIDDLE EAST & AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 W&H DENTALWERK INTERNATIONAL

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 NSK/NAKANISHI INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MELAG MEDIZINTECHNIK GMBH & CO. KG

15.3.1 COMPANY SNAPSHOT

15.3.2 1.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 FARO

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 EURONDA SPA

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 CELITRON MEDICAL TECHNOLOGIES KFT

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DENTSPLY SIRONA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 FLIGHT DENTAL SYSTEM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 FONA

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 LTE SCIENTIFIC LTD, 2022

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 LABOMIZ SCIENTIFIC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MEDICAL TRADING S.R.L.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MATACHANA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 NEU-TEC GROUP INC.

15.15 COMPANY SNAPSHOT

15.15.1 PRODUCT PORTFOLIO

15.15.2 RECENT DEVELOPMENT

15.16 NEWMED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PRIORCAVE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STURDY INDUSTRIAL CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 TUTTNAUER

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TECNO-GAZ S.P.A.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 ZEALWAY INSTRUMENT INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, BY VOLUME 2020-2029 (UNITS)

TABLE 10 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 SOUTH AFRICA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 14 SOUTH AFRICA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 15 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 16 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 18 SAUDI ARABIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 20 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 21 SAUDI ARABIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 22 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 23 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 U.A.E. SYSTEM IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.A.E. SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 EGYPT SYSTEM IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 35 EGYPT SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 36 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 37 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 ISRAEL SYSTEM IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 41 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 42 ISRAEL SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 43 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 44 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 REST OF MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DATA TRIANGULATION

FIGURE 4 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SNAPSHOT

FIGURE 5 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 6 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: INTERVIEWS: BY REGION AND DESIGNATION

FIGURE 8 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST, CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: THE CATEGORY VS TIME GRID

FIGURE 11 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET SEGMENTATION

FIGURE 12 GROWING APPLICATIONS OF CLASS B BENCH-TOP DENTAL AUTOCLAVES, RISE IN PREVALENCE OF DENTAL DISORDERS AND RISE IN DENTAL PRACTITIONERS, AND INCREASED SAFETY OF HYGIENE AND MAINTENANCE ARE EXPECTED TO DRIVE THE MARKET FOR MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN 2019 AND 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CLASS B BENCH-TOP DENTAL AUTOCLAVE MARKET

FIGURE 15 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2021

FIGURE 16 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2021

FIGURE 20 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 23 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2021

FIGURE 24 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2021

FIGURE 28 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 31 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2021

FIGURE 32 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT (2022-2029)

FIGURE 40 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.