Middle East And Africa Surgical Power Tools Market

Market Size in USD Billion

CAGR :

%

| 2021 –2028 | |

| USD 62.59 Million | |

| USD 80.21 Million | |

|

|

|

Middle East and Africa Surgical Power Tools Market, By Product (Handpiece, Disposables and Accessories), Technology (Electric-Operated Power Tools, Battery -Driven Power Tools, Pneumatic Power Tools and Others), Device Type (Large Bone Power Tools, Small Bone Power Tools, Medium Bone Power Tools and Others), Application (Orthopedic Surgery, ENT Surgery, Neurology Surgery, Dental Surgery, Cardiothoracic Surgery, Others), End User (Hospitals, Ambulatory Surgical Centers (ASC), Clinics and Others), Distribution Channel (Direct Tenders and Third Party Distribution), Country (Saudi Arabia, South Africa, UAE, Israel, Egypt, and Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

Market Analysis and Insights: Middle East and Africa Surgical Power tools Market

Market Analysis and Insights: Middle East and Africa Surgical Power tools Market

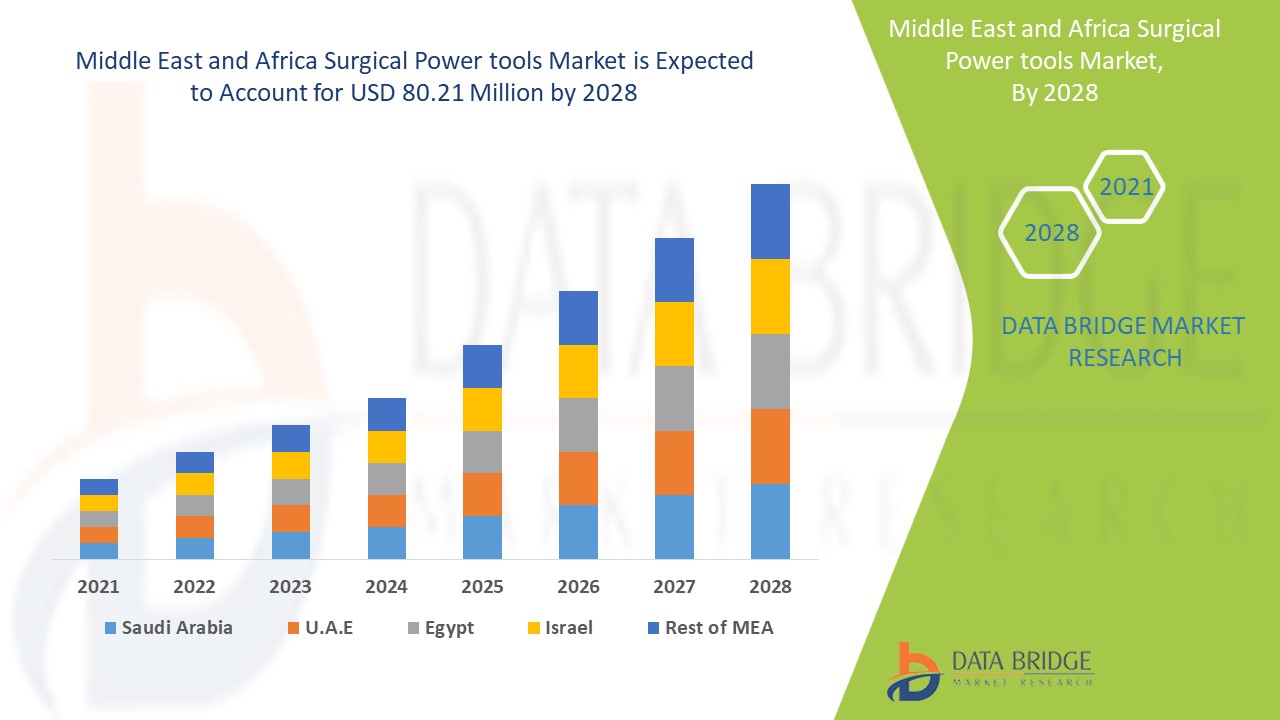

Middle East and Africa surgical power tools market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.4% in the forecast period of 2021 to 2028 and is expected to reach USD 80.21 million by 2028 from USD 62.59 million in 2020. Increasing demand for surgical power tools and increasing orthopedic surgeries are the major drivers which propelled the demand of the market in the forecast period.

Rise in neurological and orthopedic disorders are the major drivers which propelled the demand of surgical power tools are used for performing surgeries on bone or bone fragments, among other types. These power tools help in reaming, sawing, drilling, screwing, and other procedures. It includes a handpiece, disposables, and accessories. Handpieces used for surgeries are generally of two types of electric handpieces and air-driven handpieces; however, with rapid research and development, high torque electric handpieces have also been discovered. Major surgical procedures where these tools can be employed involve orthopedic surgery, ENT surgery, neurology surgery, dental surgery, and cardiothoracic surgery. The discovery of such power tools has revolutionized surgical procedures by making the overall procedure efficient and flawless.

Surgical power tools play a major role during the surgeries. Surgical power tools are the equipment’s and instruments which are used during the several surgeries and give several advantages including power optimization, smooth delivery and compatibility with wide range of attachments which enhances its usage among surgeons. Moreover introduction of electrically powered surgical power tools has attracted surgeons and they usually prefers these electric instruments for their high speed which enhances the flexibility rate of surgeries.

The surgical power tools market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Surgical Power Tools Market Scope and Market Size

Surgical Power Tools Market Scope and Market Size

Surgical power tools market is categorized into six notable segments which are based on basis of product, technology, device type, application, end user and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the surgical power tools market is segmented into handpiece, disposables and accessories. In 2021, the handpiece segment is expected to dominate the market due to its automatic power optimization feature, smooth surgical delivery, and high compatibility rate with a wide range of accessories and disposables. Handpieces are used for various surgical procedures ranging from drilling to reaming, boosting the market growth.

- On the basis of technology, the surgical power tools market is segmented into electric-operated power tools, battery-driven power tools, pneumatic power tools, others. In 2021, the electric-operated power tools segment is expected to dominate the market as this instrument offers constant torque even with high resistance and higher load. Moreover, enhanced safety precautions associated with accidental injuries have been lowered by introducing electrically operated power tools, accelerating market growth. Electric-powered power tools do not produce any vibratory sensation, enhancing their demand in the market.

- On the basis of device type, the surgical power tools market is segmented into large bone power tools, small bone power tools, medium bone power tools, others. In 2021, the large bone power tools segment is expected to dominate the market due to the rise in the prevalence of osteoarthritis, osteoporosis, and hip fractures, among other large bone injuries. Moreover, the growing number of knee arthroplasty, among others, is providing the market with lucrative growth.

- On the basis of application, the surgical power tools market is segmented into orthopedic surgery, ENT surgery, neurology surgery, dental surgery, cardiothoracic surgery, others. In 2021, the orthopedic surgery segment is expected to dominate the market due to the rise in a number of sorts and road accidents and the high adoption of minimally-invasive surgical procedures.

- On the basis of end user, the surgical power tools market is segmented into hospitals, ambulatory surgical centers (ASC), clinics, others. In 2021, the hospitals segment is expected to dominate the market due to the rise in number of surgeries and demand for devices that can cut off the overall surgery time and high-cost pressure.

- On the basis of distribution channel, the surgical power tools market is segmented into direct tenders and third party distribution. In 2021, direct tenders segment is expected to the market due to low cost device procurement and large dependence of hospitals among other end users on direct tenders.

Surgical power tools Market Country Level Analysis

The surgical power tools market is analysed and market size information is provided on basis of six notable segments which are by product, technology, device type, application, end user and distribution channel as referenced above.

The countries covered in the surgical power tools market report are the Saudi Arabia, South Africa, UAE, Israel, Egypt, and Rest of Middle East and Africa.

Middle East and Africa is expected to grow with the CAGR of 3.4% in the forecast period due to innovations in healthcare and rising focus on surgical power tools, and Technological advancements in multifunctional surgical power tools.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Strategic Initiatives by Market players Is Creating New Opportunities in the Surgical Power Tools Market

Surgical power tools market also provides you with detailed market analysis for every country growth in surgical power tools, impact of advancement in surgical power tools and changes in regulatory scenarios with their support for the surgical power tools market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Surgical Power Tools Market Share Analysis

Surgical power tools market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to surgical power tools market.

The major companies providing surgical power tools are Medtronic, Stryker, Zimmer Biomet, DePuy Synthes (The Orthopaedic Company of Johnson & Johnson Services, Inc.), 3M, CONMED Corporation among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product launch and agreement are also initiated by the companies’ worldwide which are also accelerating the surgical power tools market.

For instance,

- In December 2020, Zimmer Biomet announced that they have completed the Acquisition of A&E Medical Corporation. This deal have provided an immaterial impact on the net earnings in 2020 of the company

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: REGULATIONS

5.1 REGULATION IN THE U.S.

5.2 REGULATION IN EUROPE

5.3 REGULATIONS IN JAPAN

6 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: REIMBURSEMENTS

6.1 REIMBURSEMENT IN GERMANY FOR SURGICAL POWER TOOLS

6.2 REIMBURSEMENT IN U.S. FOR SURGICAL POWER TOOLS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN APPLICATION OF SURGICAL POWER TOOLS IN ORTHOPEDIC SURGERIES

7.1.2 ADVANTAGES OF SURGICAL POWER TOOLS

7.1.3 RISE IN PREFERENCE FOR ELECTRIC-OPERATED POWER TOOLS

7.1.4 RISE IN PREVALENCE OF NEUROLOGICAL DISORDERS

7.2 RESTRAINTS

7.2.1 HIGH COST OF SURGICAL POWER TOOLS

7.2.2 HIGHER RISK OF INJURIES

7.2.3 LIMITATION IN USING SURGICAL HAND POWER DRILL

7.2.4 RISK OF INFECTIONS

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVE BY MAJOR MARKET PLAYERS

7.3.2 INCREASE IN ADVANCEMENT & TECHNOLOGY

7.3.3 GROWING DEMAND FOR MINIMALLY INVASIVE PROCEDURES

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS

7.4.2 STRINGENT REGULATORY

8 IMPACT OF COVID-19 ON MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISIONS BY MANUFACTURERS

8.5 CONCLUSION

9 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 HAND PIECE

9.2.1 ELECTRIC HAND PIECE

9.2.2 AIR HAND PIECE

9.2.3 HIGH TORQUE ELECTRIC HAND PIECE

9.3 DISPOSABLES

9.3.1 SAW

9.3.1.1 SAGITTAL SAW

9.3.1.2 RECIPROCATING SAW

9.3.1.3 STERNUM SAW

9.3.1.4 OTHERS

9.3.2 DRILLS (PERFORATORS)

9.3.3 REAMERS

9.3.4 STAPLERS

9.3.5 SHAVER

9.3.6 BURR

9.3.7 SCREWDRIVER

9.3.8 BLADES

9.3.9 OTHERS

9.4 ACCESSORIES

9.4.1 MOTOR ENGINE

9.4.2 BATTERY

9.4.3 ASPETIC TRANSFER KIT

9.4.4 CHARGER

9.4.5 LID

9.4.6 DRILL BIT

9.4.7 SAW BLADES

9.4.8 JOINT DRILLS

9.4.9 OTHERS

10 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 ELECTRIC-OPERATED POWER TOOLS

10.3 BATTERY-DRIVEN POWER TOOLS

10.4 PNEUMATIC POWER TOOLS

10.5 OTHERS

11 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE

11.1 OVERVIEW

11.2 LARGE BONE POWER TOOLS

11.3 MALL BONE POWER TOOLS

11.4 MEDIUM BONE POWER TOOLS

11.5 OTHERS

12 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 ORTHOPEDIC SURGERY

12.2.1 JOINT

12.2.1.1 Total joint replacement (TJR)

12.2.1.2 Joint replacement

12.2.1.3 Others

12.2.2 SPINE

12.2.2.1 Spinal Fusion

12.2.2.2 Laminectomy

12.2.2.3 Disectomy

12.2.2.4 Others

12.2.3 TRAUMA

12.2.4 CRANIOMAXILLOFACIAL

12.2.5 OTHERS

12.3 ENT SURGERY

12.3.1 TYMPANOSTOMY

12.3.2 MYRINGOPLASTY

12.3.3 TYMPANOPLASTY WITH OSSICULAR RECONSTRUCTION

12.3.4 TYMPANOMASTOIDECTOMY

12.3.5 OTHERS

12.4 NEUROLOGY SURGERY

12.5 DENTAL SURGERY

12.5.1 ENDODONTIC

12.5.2 PROSTHODONTICS

12.5.3 OTHERS

12.6 CARDIOTHORACIC SURGERY

12.6.1 HEART VALVE REPAIR

12.6.2 HEART REPLACEMENT

12.6.3 OTHERS

13 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.2.1 HOSPITAL, BY END USER

13.2.1.1 Large Hospitals

13.2.1.2 Medium Hospitals

13.2.1.3 Small Hospitals

13.2.2 HOSPITAL, BY TYPE

13.2.2.1 Public

13.2.2.2 Private

13.3 AMBULATORY SURGICAL CENTER

13.4 CLINICS

13.5 OTHERS

14 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT TENDER

14.3 THIRD PARTY DISTRIBUTORS

15 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY REGION

15.1 MIDDLE EAST & AFRICA

15.1.1 SOUTH AFRICA

15.1.2 SAUDI ARABIA

15.1.3 U.A.E.

15.1.4 EGYPT

15.1.5 ISRAEL

15.1.6 REST OF MIDDLE EAST & AFRICA

16 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

17 SWOT

18 COMPANY PROFILES

18.1 DEPUY SYNTHES (THE ORTHOPEDIC COMPANY OF JOHNSON & JOHNSON SERVICES, INC.)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 STRYKER

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 ZIMMER BIOMET

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 MEDTRONIC

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 3M

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 CONMED CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 ADEOR MEDICAL AG

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ALLOTECH CO., LTD

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 AYGUN CO.,INC

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 ARTHREX, INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 B. BRAUN MELSUNGEN AG

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 CHONGQING XISHAN SCIENCE & TECHNOLOGY CO., LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 DE SOUTTER MEDICAL

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 EXACTECH, INC

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 GPCMEDICAL

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 IMEDICOM

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 KOMET MEDICAL

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 MAXON

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 MATORTHO LIMITED

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 MEDICAL BEES GMBH

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 NOUVAG AG

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 NSK LTD.

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 ORTHOPROMED

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 PUSM MEDICAL

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENTS

18.25 SHANGHAI BOJIN MEDICAL INSTRUMENTS CO., LTD

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 SHARMA ORTHOPEDIC INDIA PVT LTD

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 SHARPLINEGROUP

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 WUHU RUIJIN MEDICAL INSTRUMENT & DEVICE CO., LTD.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

TABLE 3 MIDDLE EAST AND AFRICA HAND PIECE IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA HAND PIECE IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SAWS IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA ELECTRIC-OPERATED POWER TOOLS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA BATTERY-DRIVEN POWER TOOLS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA PNEUMATIC POWER TOOLS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA OTHERS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA LARGE BONE POWER TOOLS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA SMALL BONE POWER TOOLS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA MEDIUM BONE POWER TOOLS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA OTHERS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA JOINT IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA SPINE IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA ENT SURGEY IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA ENT SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA NEUROLOGY SURGERY IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA OTHERS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA AMBULATORY SURGICAL CENTER IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA CLINICS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA OTHERS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA DIRECT TENDER IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA THIRD PARTY DISTRIBUTORS IN SURGICAL POWER TOOLS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

TABLE 46 MIDDLE EAST AND AFRICA HANDPIECE IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SAWS IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE, 2019-2028 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA JOINT IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA SPINE IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA ENT SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 63 SOUTH AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 64 SOUTH AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

TABLE 65 SOUTH AFRICA HANDPIECE IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 66 SOUTH AFRICA DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 67 SOUTH AFRICA SAWS IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 68 SOUTH AFRICA ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 69 SOUTH AFRICA SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 70 SOUTH AFRICA SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE, 2019-2028 (USD MILLION)

TABLE 71 SOUTH AFRICA SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 72 SOUTH AFRICA ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 73 SOUTH AFRICA JOINT IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 74 SOUTH AFRICA SPINE IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 SOUTH AFRICA ENT SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 76 SOUTH AFRICA DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 77 SOUTH AFRICA CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 78 SOUTH AFRICA SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 79 SOUTH AFRICA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 80 SOUTH AFRICA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 SOUTH AFRICA SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 82 SAUDI ARABIA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 83 SAUDI ARABIA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

TABLE 84 SAUDI ARABIA HANDPIECE IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 85 SAUDI ARABIA DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 86 SAUDI ARABIA SAWS IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 87 SAUDI ARABIA ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 88 SAUDI ARABIA SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 SAUDI ARABIA SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE, 2019-2028 (USD MILLION)

TABLE 90 SAUDI ARABIA SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 91 SAUDI ARABIA ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 92 SAUDI ARABIA JOINT IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 93 SAUDI ARABIA SPINE IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 94 SAUDI ARABIA ENT SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 95 SAUDI ARABIA DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 96 SAUDI ARABIA CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 97 SAUDI ARABIA SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 98 SAUDI ARABIA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 99 SAUDI ARABIA HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 100 SAUDI ARABIA SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 101 U.A.E. SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 102 U.A.E. SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

TABLE 103 U.A.E. HANDPIECE IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 104 U.A.E. DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 105 U.A.E. SAWS IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 106 U.A.E. ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 107 U.A.E. SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 108 U.A.E. SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE, 2019-2028 (USD MILLION)

TABLE 109 U.A.E. SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 110 U.A.E. ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 111 U.A.E. JOINT IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 112 U.A.E. SPINE IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 113 U.A.E. ENT SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 114 U.A.E. DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 U.A.E. CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 116 U.A.E. SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 117 U.A.E. HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 118 U.A.E. HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 119 U.A.E. SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 120 EGYPT SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 121 EGYPT SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

TABLE 122 EGYPT HANDPIECE IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 123 EGYPT DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 124 EGYPT SAWS IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 125 EGYPT ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 126 EGYPT SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 127 EGYPT SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE, 2019-2028 (USD MILLION)

TABLE 128 EGYPT SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 129 EGYPT ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 130 EGYPT JOINT IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 131 EGYPT SPINE IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 132 EGYPT ENT SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 133 EGYPT DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 134 EGYPT CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 135 EGYPT SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 136 EGYPT HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 137 EGYPT HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 138 EGYPT SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 139 ISRAEL SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 140 ISRAEL SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

TABLE 141 ISRAEL HANDPIECE IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 142 ISRAEL DISPOSABLES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 143 ISRAEL SAWS IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 144 ISRAEL ACCESSORIES IN SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 145 ISRAEL SURGICAL POWER TOOLS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 146 ISRAEL SURGICAL POWER TOOLS MARKET, BY DEVICE TYPE, 2019-2028 (USD MILLION)

TABLE 147 ISRAEL SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 148 ISRAEL ORTHOPEDIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 149 ISRAEL JOINT IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 150 ISRAEL SPINE IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 151 ISRAEL ENT SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 152 ISRAEL DENTAL SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 153 ISRAEL CARDIOTHORACIC SURGERY IN SURGICAL POWER TOOLS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 154 ISRAEL SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 155 ISRAEL HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 156 ISRAEL HOSPITALS IN SURGICAL POWER TOOLS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 157 ISRAEL SURGICAL POWER TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET, BY PRODUCT, 2019-2028 (UNITS)

List of Figure

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: SEGMENTATION

FIGURE 12 INCREASE IN APPLICATION OF SURGICAL POWER TOOLS IN ORTHOPEDIC SURGERIES AND RISE IN PREVALENCE OF NEUROLOGICAL DISORDERS IS DRIVING THE MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 13 HANDPIECE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET IN 2021 & 2028

FIGURE 14 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY PRODUCT, 2020

FIGURE 15 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY PRODUCT, 2019-2028 (USD MILLION)

FIGURE 16 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY PRODUCT, CAGR (2021-2028)

FIGURE 17 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY TECHNOLOGY, 2020

FIGURE 19 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY TECHNOLOGY, 2019-2028 (USD MILLION)

FIGURE 20 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY TECHNOLOGY, CAGR (2021-2028)

FIGURE 21 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DEVICE TYPE, 2020

FIGURE 23 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DEVICE TYPE, 2019-2028 (USD MILLION)

FIGURE 24 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DEVICE TYPE, CAGR (2021-2028)

FIGURE 25 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DEVICE TYPE, LIFELINE CURVE

FIGURE 26 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY APPLICATION, 2020

FIGURE 27 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY APPLICATION, 2019-2028 (USD MILLION)

FIGURE 28 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY APPLICATION, CAGR (2021-2028)

FIGURE 29 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY END USER, 2020

FIGURE 31 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY END USER, 2019-2028 (USD MILLION)

FIGURE 32 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY END USER, CAGR (2021-2028)

FIGURE 33 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 35 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

FIGURE 36 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 37 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET: SNAPSHOT (2020)

FIGURE 39 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET: BY COUNTRY (2020)

FIGURE 40 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 41 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 42 MIDDLE EAST & AFRICA SURGICAL POWER TOOLS MARKET: BY PRODUCT (2021-2028)

FIGURE 43 MIDDLE EAST AND AFRICA SURGICAL POWER TOOLS MARKET: COMPANY SHARE 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.