Middle East And Africa Sports Betting Market

Market Size in USD Billion

CAGR :

%

USD

6.86 Billion

USD

12.08 Billion

2024

2032

USD

6.86 Billion

USD

12.08 Billion

2024

2032

| 2025 –2032 | |

| USD 6.86 Billion | |

| USD 12.08 Billion | |

|

|

|

|

Middle East and Africa Sports Betting Market Size

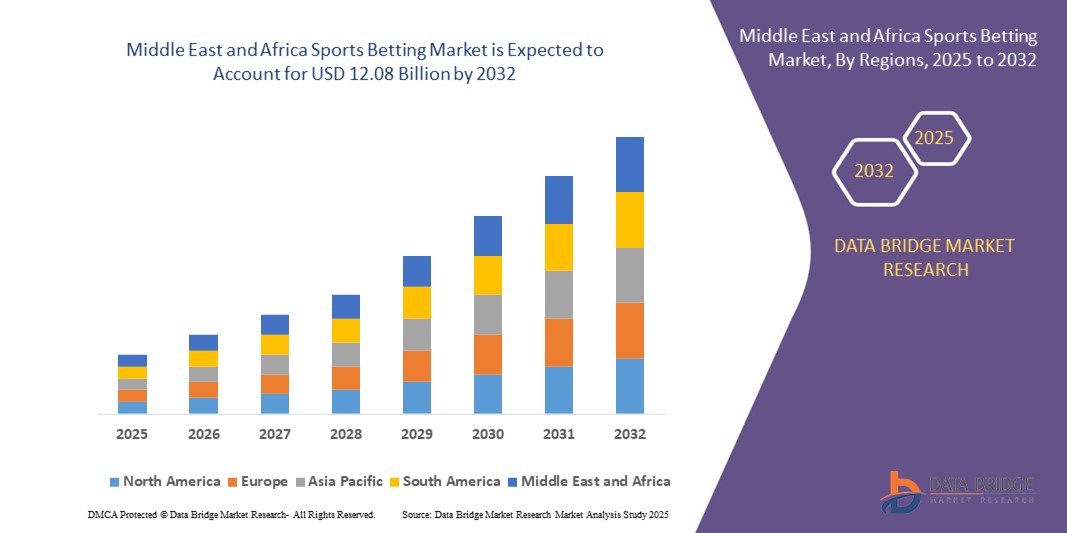

- The Middle East and Africa sports betting market size was valued at USD 6.86 billion in 2024 and is expected to reach USD 12.08 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market is witnessing strong growth, driven by increasing digital penetration, smartphone usage, and the legalization of online betting in select jurisdictions. Countries such as South Africa, Kenya, and Nigeria are emerging as key markets due to high youth engagement in sports and the rapid expansion of mobile-based platforms offering real-time betting experiences

- Government reforms and regulatory advancements are playing a pivotal role in structuring the legal landscape for sports betting across the region. While some countries are liberalizing the market to boost economic contributions through taxation, others are enforcing stricter compliance to minimize illicit betting practices. This regulatory evolution is creating new opportunities for licensed operators and tech innovators in the region

Middle East and Africa Sports Betting Market Analysis

- The Middle East and Africa sports betting market is witnessing significant growth due to the widespread legalization of betting activities, technological advancements in mobile platforms, and increasing internet penetration across the region

- Market growth is further fueled by the growing popularity of sports such as football, cricket, basketball, and horse racing, as well as the rise of fantasy sports platforms and live betting features that enhance user engagement and revenue generation

- Saudi Arabia dominated the Middle East and Africa sports betting market with a 36.2% revenue share in 2024, driven by evolving regulatory reforms, rising youth interest in international sports events, and increasing partnerships between local operators and global betting companies

- U.A.E. is projected to be the fastest-growing country in the Middle East and Africa Sports Betting market, expected to register a CAGR of 10.9% during 2025–2032, supported by high smartphone adoption rates, growing digital payment infrastructure, and increased tourism linked to large-scale sporting events like the FIFA Club World Cup and international tennis tournaments

- The non-racing sports segment dominated the Middle East and Africa sports betting market with a revenue share of 62.4% in 2024, driven by the widespread popularity of football, basketball, and cricket in the region

Report Scope and Middle East and Africa Sports Betting Market Segmentation

|

Attributes |

Middle East and Africa Sports Betting Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Sports Betting Market Trends

Rising Integration of Smart Betting Platforms and Data Analytics in the Middle East and Africa Sports Betting Market

- A significant trend shaping the Middle East and Africa sports betting market is the increasing adoption of smart betting platforms and real-time analytics tools across online and mobile channels. These technologies enable automated odds calculation, personalized betting recommendations, and dynamic user engagement based on behavioral data

- AI-powered betting algorithms and machine learning systems are gaining traction in urban areas across the region, helping sportsbooks predict game outcomes, adjust betting lines in real time, and detect fraudulent activities, thereby improving operational efficiency and fairness

- Major operators in countries such as Saudi Arabia, the U.A.E., and South Africa are introducing AI-integrated betting platforms that allow real-time user profiling, responsible gambling features, and seamless multi-device experiences—driving user retention and lifetime value

- Government-led digital transformation initiatives in cities like Riyadh, Dubai, and Nairobi are encouraging the growth of regulated digital sports betting ecosystems through investments in cybersecurity infrastructure, mobile payment gateways, and blockchain-based transparency tools

- The rise in mobile-first engagement strategies and growing 5G penetration in the region has prompted sportsbooks to invest in lightweight, high-speed mobile applications with live-streaming support, instant cash-out features, and real-time odds visualization for enhanced betting convenience

- Growing consumer demand for gamified and immersive betting experiences, especially among the youth demographic, is boosting the development of virtual sports betting, fantasy leagues, and augmented reality interfaces for football, cricket, and racing events

- This shift toward intelligent, real-time, and personalized sports betting systems is expected to reshape the industry landscape across the Middle East and Africa, positioning the market for robust growth and technological transformation through 2032

Middle East and Africa Sports Betting Market Dynamics

Driver

Growing Demand Driven by Regulatory Evolution, Digital Penetration, and Youth Engagement

- The Middle East and Africa sports betting market is experiencing substantial growth due to evolving regulatory landscapes, increasing digital penetration, and rising youth engagement in international and regional sports events. Governments in countries like Kenya, South Africa, and Nigeria are gradually formalizing betting frameworks, encouraging licensed operations and responsible gambling practices

- For instance, in March 2025, the U.A.E. General Commercial Gaming Regulatory Authority (GCGRA) initiated exploratory talks with international betting companies to establish a legal framework for online sports betting, indicating a major shift toward regulation rather than prohibition in select GCC countries

- With the growing popularity of global events such as the FIFA Club World Cup, AFCON, Formula One, and UFC fights, regional bettors—particularly Gen Z and Millennials—are increasingly using mobile apps and digital wallets to participate in sports betting. This has boosted the uptake of online platforms across urban centers

- Rising smartphone penetration and expanding internet access, especially in sub-Saharan Africa, are enabling more users to access betting platforms and fantasy sports leagues, increasing overall market participation

- In addition, strategic partnerships between local betting operators and global tech companies are enabling the deployment of AI-driven odds management, secure payment gateways, and live streaming features that enhance user engagement and transparency

- Youth-focused marketing, fantasy sports leagues, and esports betting are emerging as high-growth segments, particularly in countries like Egypt, Ghana, and Morocco, where sports fandom is intensifying and disposable income levels are rising

- As regulatory clarity improves and fintech innovations proliferate, the Middle East and Africa Sports Betting market is poised for accelerated growth—driven by legal reforms, tech-savvy bettors, and a sports-centric entertainment culture

Restraint/Challenge

High Cost and Infrastructure Gaps in Low-Income Regions

- Despite strong demand, the Middle East and Africa sports betting market faces challenges such as high product costs, low public awareness in rural areas, and lack of infrastructure to support widespread adoption in low- and middle-income countries

- For instance, while the U.A.E. and Saudi Arabia have high penetration of Sports Betting technologies, countries in Sub-Saharan Africa face slower adoption due to limited access to advanced purification products, unreliable power supply, and lack of government standards for indoor air quality

- The high cost of importing certified air purification systems, along with the need for frequent maintenance, filter replacement, and skilled installation, poses affordability issues for smaller healthcare facilities, schools, and households in economically challenged regions

- In addition, the absence of unified regional indoor air quality regulations limits large-scale institutional investment, as many building operators and public bodies do not consider air purification a critical infrastructure component

- To overcome these barriers, increased government subsidies, local manufacturing initiatives, and public awareness campaigns are essential to drive equitable access and expand the use of air purification technologies across all income segments in the region

Middle East and Africa Sports Betting Market Scope

The market is segmented on the basis of type, platform, sports, operator, and age group.

- By Type

On the basis of type, the Middle East and Africa sports betting market is segmented into Line-In-Play, Fixed Odds Betting, Exchange Betting, Daily Fantasy, Spread Betting, E-Sports, and Pari Mutuel. The Fixed Odds Betting segment dominated the market with the largest revenue share of 34.6% in 2024, driven by its popularity in traditional betting formats and ease of understanding for bettors.

The E-Sports segment is expected to witness the fastest CAGR of 13.2% from 2025 to 2032, owing to increasing youth engagement, growing online gaming culture, and rising tournament viewership across the region.

- By Platform

On the basis of platform, the Middle East and Africa sports betting market is segmented into Online and Offline. The Online segment held the dominant market share of 57.9% in 2024, attributed to rising smartphone penetration, improved internet infrastructure, and the shift toward digital entertainment experiences.

The Offline segment is projected to grow at a CAGR of 8.1% from 2025 to 2032, supported by the enduring popularity of physical betting shops and regulatory support for land-based operators in specific countries.

- By Sports

On the basis of sports, the Middle East and Africa sports betting market is segmented into Racing and Non-Racing Sports. The Non-Racing Sports segment led the market with a revenue share of 62.4% in 2024, driven by the widespread popularity of football, basketball, and cricket in the region.

The Racing segment is expected to grow at a CAGR of 7.6% from 2025 to 2032, supported by cultural preferences in horse and camel racing in countries like the U.A.E. and Saudi Arabia.

- By Operator

On the basis of operator, the Middle East and Africa sports betting market is segmented into Casinos, Bingo Halls, Card Rooms, Bookmakers, Coin-Operated Gambling Devices, Concession Operators, Video Gaming Terminals, Lotteries Operators, Off-Track Sports Betting, and Others. The Bookmakers segment dominated with the largest share of 28.1% in 2024, due to their widespread network, customer familiarity, and evolving digital presence.

The Lotteries Operators segment is projected to witness the fastest CAGR of 9.8% from 2025 to 2032, fueled by strong government backing, public trust, and integration with mobile platforms.

- By Age Group

On the basis of age group, the Middle East and Africa sports betting market is segmented into GEN Z, GEN Y/Millennials, GEN X, and Baby Boomers. The GEN Y/Millennials segment captured the highest market share of 41.7% in 2024, driven by tech-savviness, mobile engagement, and higher disposable income among young adults.

The GEN Z segment is expected to register the fastest CAGR of 11.4% from 2025 to 2032, as younger users increasingly participate in fantasy leagues, e-sports betting, and social betting platforms.

Middle East and Africa Sports Betting Market Regional Analysis

- The Middle East and Africa sports betting market accounted for 8.4% of the global market share in 2024, and is projected to grow at a CAGR of 10.7% from 2025 to 2032, driven by increased legalization of sports betting, the rising popularity of international and regional sporting events, and expanding access to mobile and online betting platforms

- The market is fueled by a young, tech-savvy population, growing internet and smartphone penetration, and government support for regulated betting to boost fiscal revenues. Increasing interest in fantasy sports, esports, and real-time betting formats are further driving growth, particularly in urban centers across the region

- Technological innovations such as blockchain-based platforms, AI-powered odds engines, real-time data analytics, and secure mobile payment solutions are gaining traction across the region, as operators seek to provide safer, faster, and more engaging user experiences

Saudi Arabia Sports Betting Market Insight

The Saudi Arabia dominated the Middle East and Africa Sports Betting market with a 36.2% revenue share in 2024, driven by evolving regulatory reforms, rising youth interest in international sports events, and increasing partnerships between local operators and global betting companies. The growing popularity of football, especially the Saudi Pro League, and government openness to tourism and entertainment investments under Vision 2030, are fostering growth in digital and retail betting segments.

U.A.E. Sports Betting Market Insight

The U.A.E. Sports Betting market captured 22.1% of the regional market share in 2024 and is projected to be the fastest-growing country, registering a CAGR of 10.9% during 2025–2032. Growth is supported by high smartphone adoption rates, growing digital payment infrastructure, and increased tourism linked to large-scale sporting events like the FIFA Club World Cup, Formula 1 Grand Prix, and international tennis tournaments. Additionally, Dubai’s and Abu Dhabi’s smart city initiatives are fostering favorable conditions for secure, tech-integrated betting platforms.

Middle East and Africa Sports Betting Market Share

The sports betting market industry is primarily led by well-established companies, including:

- BETSSON AB (Sweden)

- Flutter Entertainment plc (Ireland)

- 888 Holdings Plc (U.K.)

- Entain (U.K.)

- Kindred Group plc (Malta)

- MGM Resorts International (U.S.)

- Wynn Resorts Holdings, LLC. (U.S.)

- NOVIBET (U.K.)

- Galaxy Entertainment Group Limited (Hong Kong)

- Resorts World at Sentosa Pte. Ltd. (Singapore)

- Sun International (South Africa)

- SKYEXCHANGE (India)

- Peermont Global Proprietary Limited (South Africa)

- SJM Holdings Limited (Hong Kong)

- Sportradar AG (Switzerland)

- FanUp, Inc. (U.S.)

- Rivalry Limited (Canada)

- EveryMatrix (Malta)

- Kairos Group (Malta)

- BETAMERICA (U.S.)

- Scientific Game (U.S.)

- ComeOn Group (Malta)

Latest Developments in Middle East and Africa Sports Betting Market

- In July 2025, the United Arab Emirates established the General Commercial Gaming Regulatory Authority (GCGRA) to oversee licensing and regulate commercial gaming, including sports wagering. This milestone regulatory change is paving the way for companies to enter the UAE sports betting space legally, particularly in Ras Al Khaimah’s upcoming $3.9 billion Wynn Resorts project

- In March 2025, UFC and TKO Group Holdings announced a strategic partnership with Saudi Arabia’s Public Investment Fund (PIF) and General Entertainment Authority to launch a new boxing promotion. The initiative is expected to elevate sports betting interest tied to major combat events

- In June 2025, Golden Matrix Group’s subsidiary Meridianbet Group received a sports betting license in South Africa, expanding regulated betting infrastructure in one of MEA’s largest markets

- In September 2023, Betsson secured a license to conduct online sports betting in France's regulated market, partnering with a local entity. Launching in Q4 2023, the venture under the Betsson banner aimed to tap into the French market's potential

- In March 2023, OpenBet expanded its U.S. presence with a day-one launch in Massachusetts, bolstering its sports betting offerings. This strategic move further solidified OpenBet's foothold in the competitive American sports betting landscape

- In September 2022, Entain Plc collaborated with industry giants such as Bally’s Corporation, BetMGM, DraftKings, FanDuel, and MGM Resorts International to introduce Responsible Gaming Principles, fostering a culture of responsible gambling and bolstering brand reputation globally

- In September 2021, Nuvei Corporation partnered with 888 Holdings Plc to deliver its Instant Bank Transfer payment solution to SI Sportsbook, enriching the payment options available on the newly launched online sports betting platform

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.