Middle East and Africa Specialty Crop Market, By Crop Type (Fruits, Vegetables, Tree Nuts, Herbs, Spices, and Others), Nature (Organic and Conventional), Application (Dairy Products, Bakery, Juices, Nectars & Fruit-Based Drinks, Confectionery, Soups, Sauces & Dressings and Others) Industry Trends and Forecast to 2029.

Middle East and Africa Specialty Crop Market Analysis and Size

Fruits and vegetables, tree nuts, dried fruits, horticulture, and nursery crops are examples of specialty crops (including floriculture). They also contain exotic plants grown in a particular area due to topographical and climatic characteristics. A paradigm shift in consumer eating behaviors has been documented due to population growth and an increase in per capita disposable income, directly affecting the demand for wholesome food. Other factors boosting the market for specialized crops include increased urbanization, ethnic diversity, health concerns, and changes in demographic characteristics. The primary drivers of the specialty crops industry include the expanding application range of specialty crops, encouraging government initiatives, and free trade policies. However, expansion is constrained by trade and environmental constraints.

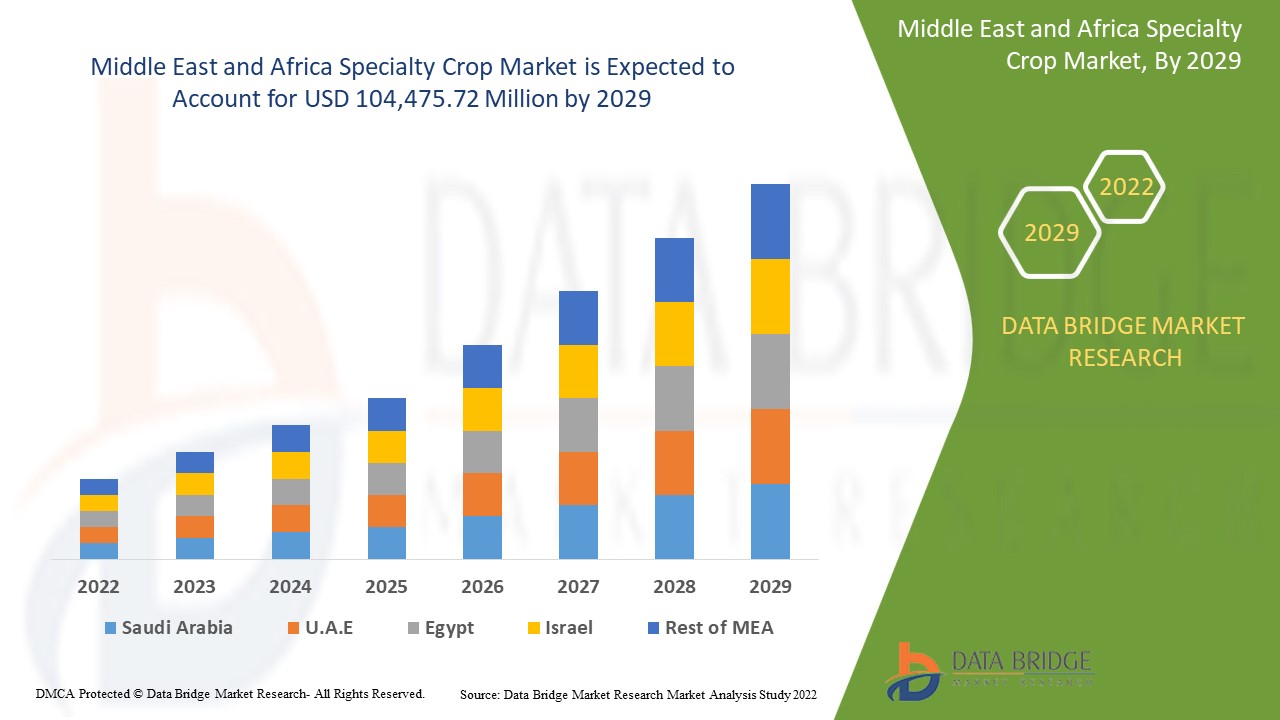

Data Bridge Market Research analyses that the Middle East & Africa specialty crop market is expected to reach the value of USD 104,475.72 million by 2029, at a CAGR of 4.8% during the forecast period.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Year

|

2020 (Customizable to 2019-2014)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Million Units, Pricing in USD

|

|

Segments Covered

|

By Crop Type (Fruits, Vegetables, Tree Nuts, Herbs, Spices, and Others), Nature (Organic and Conventional), Application (Dairy Products, Bakery, Juices, Nectars & Fruit-Based Drinks, Confectionery, Soups, Sauces & Dressings and Others)

|

|

Countries Covered

|

Saudi Arabia, South Africa, Egypt, U.A.E, Israel, Rest of Middle East & Africa

|

|

Market Players Covered

|

Olam Group, Lamex Food Group Limited, AGT Food and Ingredients, NUTSCO, Herbs N Spices International, Banabay, Fisher Nut Company, Simped Foods Pty Ltd., SVZ Industrial Fruit & Vegetable Ingredients, Golden Peanut and Tree Nuts, Barnes Williams, Natural Specialty Crops, ULC

|

Market Definition

Fruits and vegetables, tree nuts, dried fruits, horticulture, and nursery crops are examples of specialty crops (including floriculture). They also contain exotic plants grown in a particular area due to topographical and climatic characteristics. A paradigm shift in consumer eating behaviors has been documented due to population growth and an increase in per capita disposable income, directly affecting the demand for wholesome food. Other factors boosting the market for specialized crops include increased urbanization, ethnic diversity, health concerns, and changes in demographic characteristics.

Middle East and Africa Specialty Crop Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers:

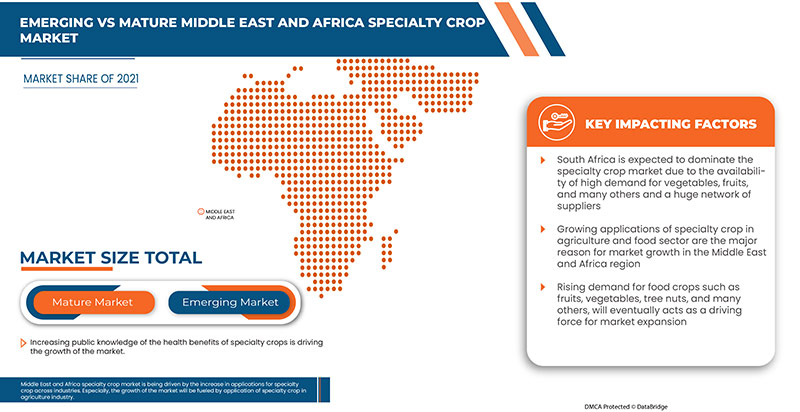

- Increasing public knowledge of the health benefits of specialty crops

Fruits and vegetables, tree nuts, dried fruits, horticulture, and nursery crops, including floriculture, are all considered specialty crops under the law. Specialty crops add significantly to the state's and the region's worth in terms of producing nutritious food, preserving aesthetic and cultural values, and fostering local economic growth, among many other advantages. They also contribute unique agricultural landscapes. Due to their numerous health benefits, these specialty crops are becoming increasingly important nowadays. Following COVID-19, people have expressed a desire to understand the advantages of various foods, particularly specialty crops, which have higher health benefits than conventional crops.

Thus, the rise in awareness about the health, aesthetic and cultural benefits of specialty crops among people directly affects economic growth and is expected to drive market growth.

Restraint

- Limited crop growing facilities for specialty crops

Producers of specialty crops rely largely on seasonal labor inputs. A country's food supply, especially its fresh fruit and vegetable supply, may be in jeopardy if there is insufficient labor to meet agricultural and animal demands. Farmers are forced to sell their produce at low prices to local money lenders due to inadequate transportation. Farmers are unable to keep their food when prices are low since there aren't enough warehouses available. Therefore, these account greatly for the low production of specialty crops. This many lacks of facilities from production to marketing become a major barrier to market growth.

Thus, the lack of various crop cultivation facilities such as irrigation, seeds, fertilizers, transport, and others function may act as a restraint to the market's growth.

Opportunity

- Advancements in agricultural technology

Innovative agricultural technological developments are reshaping farming practices and opening up new prospects. This has altered the way crops are raised and produced more effective ways to manage resources. Technology has an unquestionable impact on agriculture today. Researchers and engineers are always putting in a lot of effort to create new technologies that address issues with farming and crop production. There is a need for increased automation in specialty crop production, particularly in response to rising labor costs and the possibility of labor shortages. To solve these issues, technological advancements are being made, along with methods for collecting and sharing data in innovative formats. Technologies such as hi-tech farming, AI technology in agriculture, robotics, drones, sensors, and various other technologies will boost production and make farming more efficient, which will help in the growth of the MEA specialty crop market to expand.

For instance,

- In February 2022, Verdant Robotics expanded its robot-as-a-service (RaaS) model to ensure access for more specialty crop farmers. The first multi-action autonomous farm robot for specialty crops that will enable superhuman farming

- In February 2022, Abundant Robots Inc. developed an automated picking system to solve the problem of apple bruising by using a high-flow suction mechanism that allows apples to be plucked quickly and without harm. The technique also takes into account any difficulties that may arise while plucking several apples grouped together on a branch

Thus, increasing demand for more automated and hi-tech machinery is an important tool for modern agriculture. Making agriculture more advanced in innovation and technology is expected to provide lucrative opportunities and ultimately promote the growth of the MEA specialty crop market.

Challenges

- Adverse climatic condition

Climate change is affecting food system sustainability by influencing farmer livelihoods, consumer choices, and food security through changes in the natural and human components of agroecosystems. Annual precipitation and heavy rainfall events are becoming more common, especially in the spring. An excessive amount of spring rain slows crop establishment, interrupts planting, increases the prevalence of several fungal and bacterial crop diseases, and might cause labor problems due to the delay of field operations. Variations in temperature and precipitation directly impact the quantity and quality of specialty crop production and indirectly impact the scheduling of important farm operations and the economic effects of pests, weeds, and diseases. Adverse weather conditions also hamper the supply chain and transportation of fruits and vegetables.

Furthermore, temperature increases because faster crop growth, resulting in shorter cropping seasons and lower yields. An increase in tropospheric (or ground-level) ozone leads to an increase in oxidative stress in plants, which inhibits photosynthesis and slows plant growth. Extreme events, especially floods and droughts, can harm crops and reduce yields which will ultimately affect the specialty crop market.

Thus, changing climatic conditions have an adverse impact on agriculture. Reducing yield and more pest infestation will challenge farmers and businesses, which may ultimately challenge market growth.

Post-COVID-19 Impact on the Middle East and Africa Specialty Crop Market

Post the pandemic, the demand for specialty crops has increased as there won't be any restrictions on movement; hence, the supply of products would be easy. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply food products to consumers, initially increasing the demand for products. However, post-COVID, the demand for specialty crops has increased significantly owing to good protein content and other nutrients available.

Recent Developments

- In June 2022, Olam launched Terrascope, a climate technology company, to help businesses realize their net zero goals

- In September 2020, the Fisher Nut Company introduced a new case packaging line due to increased demand for products during COVID-19

Middle East and Africa Specialty Crop Market Scope

Middle East and Africa specialty crop market is segmented on the basis of crop type, nature, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Crop Type

- Vegetables

- Fruits

- Tree Nuts

- Herbs

- Spices

- Others

On the basis of crop type, the Middle East and Africa specialty crop market is segmented into fruits, vegetables, tree nuts, herbs, spices, and others.

Nature

- Conventional

- Organic

On the basis of product type, the Middle East and Africa specialty crop market is segmented into organic and conventional.

Application

- Dairy Products

- Bakery

- Juices

- Nectars & Fruit-Based Drinks

- Confectionery

- Soups

- Sauces & Dressings

- Others

On the basis of end user, the Middle East and Africa specialty crop market is segmented into bakery, confectionery, soups, sauces & dressings, dairy products, juices, nectars & fruit-based drinks, and others.

Middle East and Africa Specialty Crop Market Regional Analysis/Insights

The Middle East and Africa specialty crop market is analyzed, and market size insights and trends are provided by country, crop type, nature, and application.

The countries covered in the Middle East and Africa specialty crop market report are Saudi Arabia, South Africa, Egypt, U.A.E, Israel, and Rest of Middle East & Africa.

In 2022, South Africa is expected to dominate the Middle East and Africa specialty crop market in the Middle East and Africa. South Africa is the largest market for specialty crops. Growing demand for agriculture and food consumption is the major reason for the growth specialty crop market in the Middle East and Africa. Moreover, the food market is growing progressively in the Middle East and Africa region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and the Middle East and Africa Specialty Crop Market Share Analysis

The Middle East and Africa specialty crop market competitive landscape provide details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Middle East and Africa specialty crop market.

Some of the major players operating in the specialty crop market are Olam Group, Lamex Food Group Limited, AGT Food and Ingredients, NUTSCO, Herbs N Spices International, Banabay, Fisher Nut Company, Simped Foods Pty Ltd., SVZ Industrial Fruit & Vegetable Ingredients, Golden Peanut and Tree Nuts, Barnes Williams, and Natural Specialty Crops, ULC among others.

SKU-