Middle East and Africa Ship Bridge Simulators Market Analysis and Size

Simulators are used in many areas of the maritime industry, including towing and anchor handling, engine control, cargo handling, crane operations, and offshore operation training on ships and oil rigs. In addition to the applications above, marine simulators are also utilized for ship-to-shore training, vessel traffic services, and training for crane operations (VTS). Over the forecast period, the market of the Middle East and Africa ship bridge simulators is expected to be driven by the increasing need for trained operators or watch officers on a ship for map-plotting, navigation, fire control, weather monitoring, surveillance, search, and mission rehearsal. However, the market expansion of the Middle East and Africa ship bridge simulators market is anticipated to be hampered by the high installation costs involved with creating ship bridge simulators.

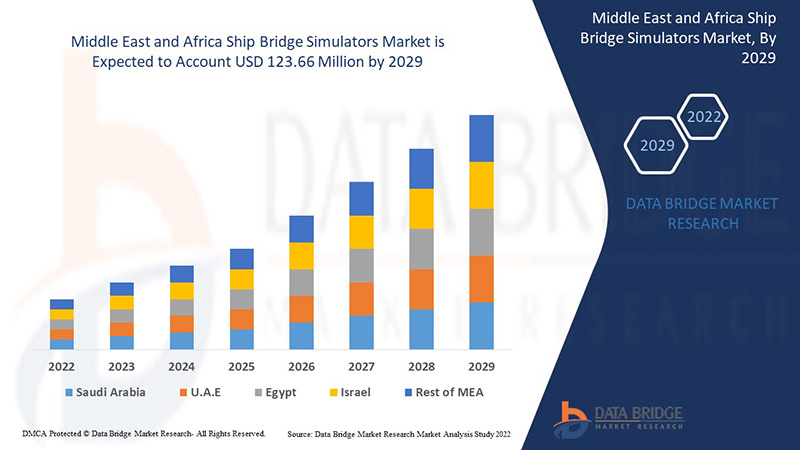

Data Bridge Market Research analyses that the Middle East and Africa ship bridge simulators market is expected to reach the value of USD 123.66 million by 2029, at a CAGR of 4.6% during the forecast period. The Middle East and Africa ship bridge simulators market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

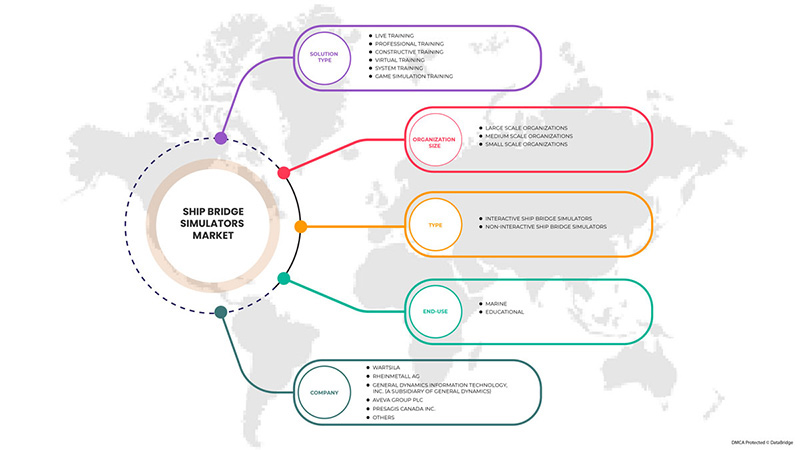

By Solution Type (Live Training, Professional Training, Constructive Training, Virtual Training, System Training, and Game Simulation Training), Type (Interactive Ship Bridge Simulators and Non-Interactive Ship Bridge Simulators), Organization Size (Large Scale Organizations, Medium Scale Organizations, and Small Scale Organizations), End-Use (Marine and Educational) |

|

Countries Covered |

U.A.E, Saudi Arabia, South Africa, Egypt, Israel, Rest of the Middle East and Africa |

|

Market Players Covered |

FORCE TECHNOLOGY, PC Maritime, General Dynamics Information Technology, Inc. (a subsidiary of General Dynamics), AVEVA Group plc, BMT Group Ltd, ST Engineering, Presagis Canada Inc., Synergy Group, Simwave B.V., Wärtsilä, among others |

Market Definition

Ship bridge simulators are extremely advanced manoeuvring tools designed specifically for professional training and testing marine systems in complicated, realistic simulation environments that offer a realistic experience. They are interactive ship simulators, which are different from non-interactive ship simulators in that they both provide concept training, skill training, and understanding of the marine systems. These simulators are offered as software-only options or as a software and hardware combo. These software solutions can be installed on any PC with the bare minimum requirements. They offer the user a fake environment for system testing or expert training. Ship bridge simulators are specifically made for system testing and use in live, constructive, virtual, and game simulation training and professional development.

Middle East and Africa Ship Bridge Simulators Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increase in the Usage of Warfare Technologies

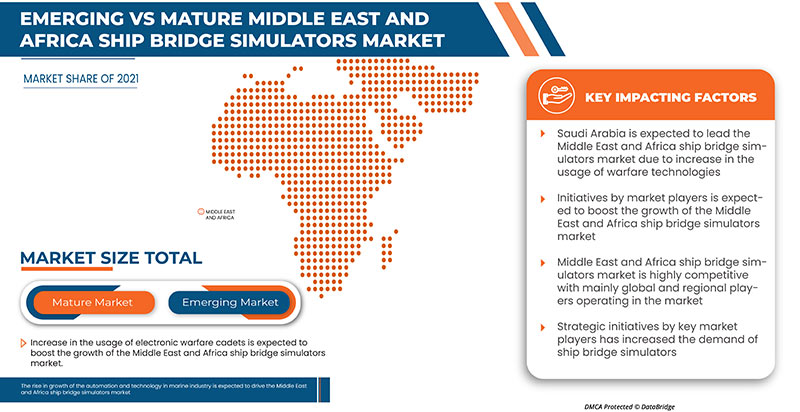

Electronic warfare refers to using electromagnetic spectrum signals such as radio, infrared, or radar to sense, protect and communicate to protect military assets from potential threats. Moreover, electronic warfare cadets help to protect an aircraft, helicopter, or ship from radar or infrared-guided missiles. Thus, these cadets were invented over 50 years ago and increased over the years with the development of technology.

The rise in the innovation and adoption of modern technology such as augmented reality, artificial intelligence, and many others in various marine sectors has driven the adoption of electronic components and modern solutions such as smart ships and autonomous work processes in war to defend and attack the enemies to lower the lifetime risk of cadets.

- Rise in Growth of the Automation and Technology in the Marine Industry

The marine industry is undergoing a huge technological advancement with the implementation of an autonomous work process. The involvement of advanced electronic devices helps to develop automation and adopt advanced techniques such as AI, AR, robotics, and many others in the marine industry. Moreover, automation and technological adoption in various industries is gaining more importance year on year.

Moreover, technology is a game-changing aspect for all types of developments. Adopting modern solutions such as autonomous work processes, business analytical solutions and many others is important in evolving the maritime industry. Thus, technology dives into the automation and adoption of sensors, propulsion, and many aspects related to the ship's working process management. Although navigation management in the marine industry is gaining more importance due to understanding the accurate position and speed to ensure the ship reaches its destination safely and most economically.

Opportunity

- Rise in the Adoption of Simulation Techniques in Educational Institutes

The changing dynamic environment and economic conditions create a demand for re-orientation and modification of educational programs. Technological advancement has increased the integration practices in education and the adoption of computer simulations to understand various concepts across the globe.

However, the conceptual learning method has been very convenient for the past few decades and is not supportive nowadays because of unpredicted market dynamics and complex organizational conditions. This has led to the requirement of altering the teaching and educational methods with the integration of new technology.

Restraints/Challenges

- Stringent Regulations by Maritime Legislative for Effective Training

Many industries are suffering from implementing huge government regulations because of the irrational impediments to profits, economic efficiency, and job creation. The stringent rules and regulations on any type of industries lead to the development of loopholes and violate the laws, which often leads to the adoption of low quality and overcoming the standard procedure which has to be followed, which can further lead to ineffective solutions.

Moreover, most businesses across the globe generally oppose laws, regulations, or tax levies that will restrict business operations and profitability, which directly decreases investments, especially among entrepreneurs who take the risks of starting and managing businesses, limiting the pool of savings for the business.

- Lack of Skilled Training Instructors

Nowadays, technological advancement is booming the market dynamics. The introduction of various techniques and automation processes in the market is very frequent; thus, learning such techniques and new work processes requires time and proper equipment.

Moreover, automation helps networks to run by themselves. Companies still need people with skills, such as trainers and instructors, to train the end user and help adopt techniques to run the networks better. There is a need for training instructors to train and make the end user understand the working procedures.

Post COVID-19 Impact on Middle East and Africa Ship Bridge Simulators Market

COVID-19 negatively impacted the Middle East and Africa ship bridge simulators market due to lockdown regulations and the shutdown of training facilities.

The COVID-19 pandemic has impacted the Middle East and Africa ship bridge simulators market to an extent in a negative manner. However, the increasing adoption of virtual training worldwide has helped the market grow after the pandemic. Also, the growth has been high since the market opened after COVID-19, and it is expected that there will be considerable growth in the sector owing to higher demand for a skilled workforce in the marine industry.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the ship bridge simulators. With this, the companies will bring advanced technologies to the market. In addition, government initiatives to use automation technology have led to the market's growth.

Recent Development

- In September 2021, Wärtsilä announced the launch of Simulation and Training Solutions, Wartsila Voyage's Cloud Simulation Solution on Ocean Technologies Group's (OTG) Ocean Learning Platform. This will help the company to expand the business and product reach to a wide range of customers and enhance the usage of solutions to improve the offerings in the market

Middle East and Africa Ship Bridge Simulators Market Scope

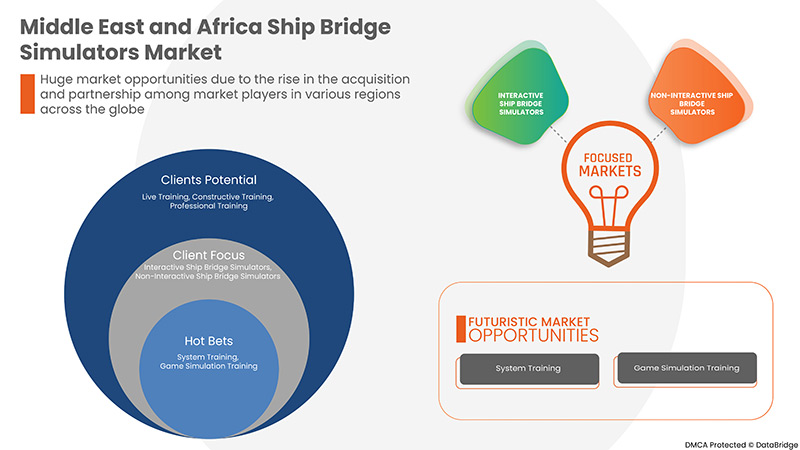

Middle East and Africa ship bridge simulators market is segmented based on solution type, type, organization size, and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Solution Type

- Live Training

- Professional Training

- Constructive Training

- Virtual Training

- System Training

- Game Simulation Training

On the basis of solution type, the Middle East and Africa ship bridge simulators market is segmented into live training, professional training, constructive training, virtual training, system training, game simulation training.

Type

- Interactive Ship Bridge Simulators

- Non-Interactive Ship Bridge Simulators

On the basis of type, the Middle East and Africa ship bridge simulators market is segmented into interactive ship bridge simulators, non-interactive ship bridge simulators.

Organization Size

- Large Scale Organizations

- Medium Scale Organizations

- Small Scale Organizations

On the basis of organization size, the Middle East and Africa ship bridge simulators market is segmented into large scale organizations, medium scale organizations, small scale organizations.

End-Use

- Marine

- Educational

On the basis of end-use, the Middle East and Africa ship bridge simulators market is segmented into marine, and educational.

Middle East and Africa Ship Bridge Simulators Market Regional Analysis/Insights

Middle East and Africa ship bridge simulators market is analyzed, and market size insights and trends are provided by country, solution type, type, organization size, and end-use, as referenced above.

Some countries covered in the Middle East and Africa ship bridge simulators market report are U.A.E, Saudi Arabia, South Africa, Egypt, Israel, Rest of the Middle East and Africa. Saudi Arabia is expected to dominate the Middle East and Africa ship bridge simulators market owing to expanding development investment and funding for the ship bridge simulators and services.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Ship Bridge Simulators Market Share Analysis

Middle East and Africa ship bridge simulators market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Middle East and Africa ship bridge simulators market.

Some of the major players operating in the Middle East and Africa ship bridge simulators market are FORCE TECHNOLOGY, PC Maritime, General Dynamics Information Technology, Inc. (a subsidiary of General Dynamics), AVEVA Group plc, BMT Group Ltd, ST Engineering, Presagis Canada Inc., Synergy Group, Simwave B.V., Wärtsilä, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDIES

4.1.1 FORCE TECHNOLOGY HAS OFFERED SERVICES TO MODERNIZE BRAZILIAN PORT

4.1.2 SINGAPORE MARITIME AND PORT AUTHORITY’S (SMPA), IN ALLIANCE WITH KONGSBERG SHIP’S BRIDGE SIMULATION CENTRE, TO PROVIDE EFFICIENT TRAINING

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGY TRENDS

4.4 INVESTMENT VS ADOPTION MODEL

4.5 TOP WINNING STRATEGIES

4.6 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE USAGE OF WARFARE TECHNOLOGIES

5.1.2 RISE IN GROWTH OF THE AUTOMATION AND TECHNOLOGY IN MARINE INDUSTRY

5.1.3 RISE IN THE NEED FOR EFFECTIVE TRAINING FOR MARITIME OPERATIONS

5.2 RESTRAINTS

5.2.1 REQUIREMENT OF HUGE CAPITAL INVESTMENT

5.2.2 STRINGENT REGULATIONS BY MARITIME LEGISLATIVE FOR EFFECTIVE TRAINING

5.3 OPPORTUNITIES

5.3.1 INCREASE IN THE SAFETY STANDARDS DEMANDS TRAINING

5.3.2 RISE IN THE ACQUISITION AND PARTNERSHIP AMONG MARKET PLAYERS

5.3.3 RISE IN THE ADOPTION OF SIMULATION TECHNIQUES IN EDUCATIONAL INSTITUTES

5.3.4 RISE IN DIGITALIZATION TRENDS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED TRAINING INSTRUCTORS

6 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE

6.1 OVERVIEW

6.2 LIVE TRAINING

6.3 PROFESSIONAL TRAINING

6.4 CONSTRUCTIVE TRAINING

6.5 VIRTUAL TRAINING

6.6 SYSTEM TRAINING

6.7 GAME SIMULATION TRAINING

7 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY TYPE

7.1 OVERVIEW

7.2 INTERACTIVE SHIP BRIDGE SIMULATORS

7.3 NON-INTERACTIVE SHIP BRIDGE SIMULATORS

8 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE SCALE ORGANIZATIONS

8.3 MEDIUM SCALE ORGANIZATIONS

8.4 SMALL SCALE ORGANIZATIONS

9 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY END-USE

9.1 OVERVIEW

9.2 MARINE

9.2.1 LIVE TRAINING

9.2.2 PROFESSIONAL TRAINING

9.2.3 CONSTRUCTIVE TRAINING

9.2.4 VIRTUAL TRAINING

9.2.5 SYSTEM TRAINING

9.2.6 GAME SIMULATION TRAINING

9.3 EDUCATIONAL

9.3.1 LIVE TRAINING

9.3.2 PROFESSIONAL TRAINING

9.3.3 CONSTRUCTIVE TRAINING

9.3.4 VIRTUAL TRAINING

9.3.5 SYSTEM TRAINING

9.3.6 GAME SIMULATION TRAINING

10 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SAUDI ARABIA

10.1.2 U.A.E.

10.1.3 EGYPT

10.1.4 SOUTH AFRICA

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 WARTSILA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SOLUTION PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 RHEINMETALL AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL DYNAMICS INFORMATION TECHNOLOGY, INC. (A SUBSIDIARY OF GENERAL DYNAMICS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 SOLUTION PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 AVEVA GROUP PLC

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 SOLUTION PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 PRESAGIS CANADA INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 ABOA MARE

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMC SEARCH LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 SERVICE PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AMERICAN NAUTICAL SERVICES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ARI SIMULATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BMT GROUP LTD

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 SOLUTION PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 FORCE TECHNOLOGY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 SOLUTION PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 IMAGE SOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JAPAN MARINE SCIENCE INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 KONGSBERG DIGITAL (A SUBSIDIARY OF KONGSBERG GRUPPEN)

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCTS PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 PC MARITIME

13.15.1 COMPANY SNAPSHOT

13.15.2 SOLUTION PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PIVOT MARITIME INTERNATIONAL

13.16.1 COMPANY SNAPSHOT

13.16.2 SOLUTION PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SIMWAVE B.V.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SSPA

13.18.1 COMPANY SNAPSHOT

13.18.2 SOLUTION PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 ST ENGINEERING

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SOLUTION PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SYNERGY GROUP

13.20.1 COMPANY SNAPSHOT

13.20.2 SERVICE PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 VIRTUAL MARINE, INC.

13.21.1 COMPANY SNAPSHOT

13.21.2 SOLUTION PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 VSTEP BV

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA LIVE TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA PROFESSIONAL TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CONSTRUCTIVE TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA VIRTUAL TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SYSTEM TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA GAME SIMULATION TRAINING IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA INTERACTIVE SHIP BRIDGE SIMULATORS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA NON-INTERACTIVE SHIP BRIDGE SIMULATORS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA LARGE SCALE ORGANIZATIONS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MEDIUM SCALE ORGANIZATIONS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SMALL SCALE ORGANIZATIONS IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 27 SAUDI ARABIA SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 28 SAUDI ARABIA SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 SAUDI ARABIA SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 30 SAUDI ARABIA SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 31 SAUDI ARABIA MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 32 SAUDI ARABIA EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.A.E. SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.A.E. SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.A.E. SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 36 U.A.E. SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 37 U.A.E. MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.A.E. EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 39 EGYPT SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 40 EGYPT SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EGYPT SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 42 EGYPT SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 43 EGYPT MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 44 EGYPT EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL SHIP BRIDGE SIMULATORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL SHIP BRIDGE SIMULATORS MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL SHIP BRIDGE SIMULATORS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL MARINE IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL EDUCATIONAL IN SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

TABLE 57 REST OF MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET, BY SOLUTION TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: SEGMENTATION

FIGURE 10 RISE IN THE NEED FOR EFFECTIVE TRAINING FOR MARINE OPERATIONS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 LIVE TRAINING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET IN 2022 & 2029

FIGURE 12 VALUE CHAIN ANALYSIS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET

FIGURE 14 (2020-2025) – MIDDLE EAST & AFRICA ADOPTION RATE OF AUTOMATION IN INDUSTRIES

FIGURE 15 BENEFITS OF SIMULATION TECHNIQUE IN EDUCATION INDUSTRY

FIGURE 16 UNEMPLOYMENT RATE IN THE MIDDLE EAST & NORTH AFRICA REGION

FIGURE 17 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: BY SOLUTION TYPE (2021)

FIGURE 18 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: BY TYPE (2021)

FIGURE 19 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: BY ORGANIZATION SIZE (2021)

FIGURE 20 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: BY END-USE (2021)

FIGURE 21 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET: SNAPSHOT (2021)

FIGURE 22 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA SHIP BRIDGE SIMULATORS MARKET: BY SOLUTION TYPE (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA SHIP BRIDGE SIMULATORS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.