Middle East and Africa Satellite Transponder Market Analysis and Size

With the expansion of space technology and satellite communication, the importance of satellite transponders is increasing rapidly. The presence of a market player that provides rental satellite transponder services or transponder products as per different requirements globally shows the importance of satellite applications in various industries.

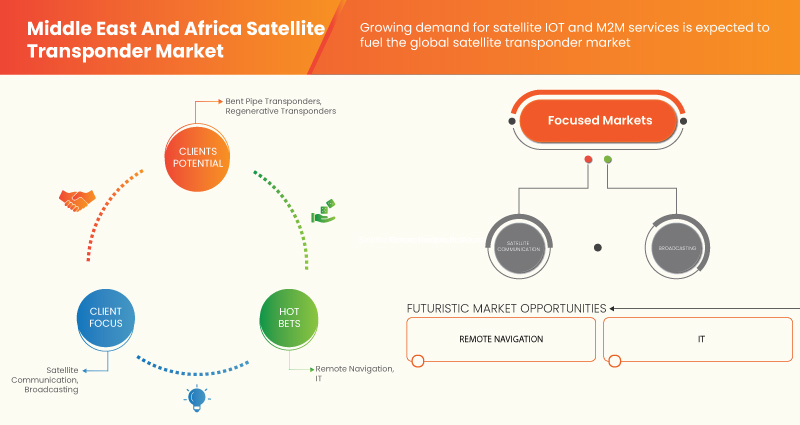

The Middle East and Africa satellite transponder market is expected to grow owing to factors such as an increase in the number of small satellites in earth's orbits. The rise in demand for satellite communication and earth observation and the growing demand for satellite IoT and M2M services are the major driving factor for the market. Additionally, increasing demand for broadband over satellite is expected to boost the market further.

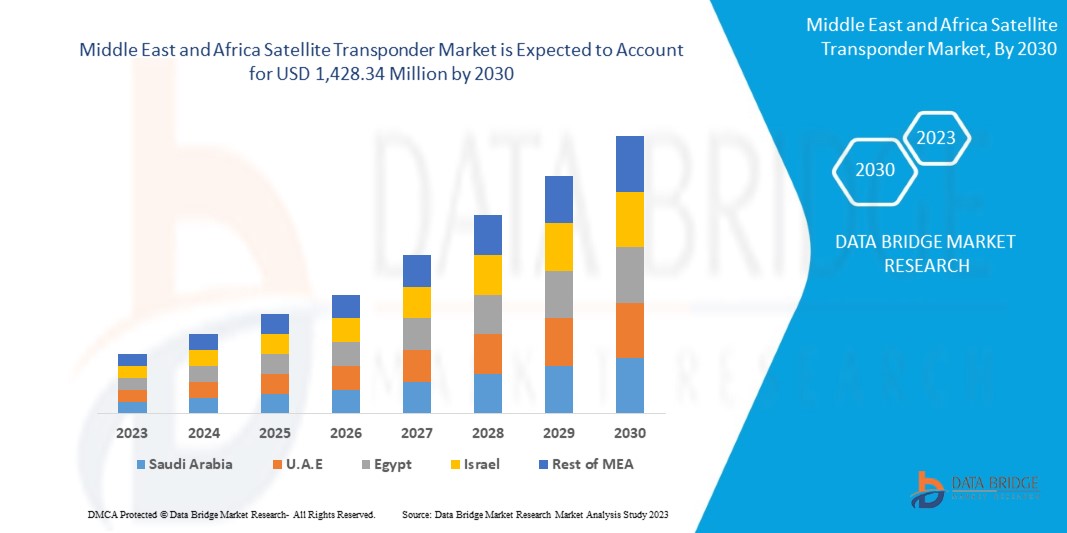

Data Bridge Market Research analyses that the Middle East and Africa satellite transponder market is expected to reach a value of USD 1,428.34 million by 2030, at a CAGR of 3.2% during the forecast period. The Middle East and Africa satellite transponder market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Service (Leasing, Maintenance and Support, Others), Type (Bent Pipe Transponders, Regenerative Transponders), Amplifier Type (Solid-State Power Amplifiers (SSPA), Traveling Wave Tube Amplifiers (TWTA)), Bandwidth (C-Band, KA-Band, KU-Band, K-Band, Others), Application (Commercial Communication, Government Communication, Navigation, Remote Sensing, Reach and Development (R&D), Others), End User (Media and Broadcasting, Data and Telecoms) |

|

Countries Covered |

South Africa, Egypt, Saudi Arabia, U.A.E, Israel, Rest Of Middle East And Africa |

|

Market Players Covered |

EUTELSAT COMMUNICATIONS SA, L3Harris Technologies, Inc., AMOS Spacecom, Thaicom Public Company Limited, General Dynamics Mission Systems, Inc., Intelsat, Hispasat, MEASAT, IMT srl, ABS, Syrlinks, Singtel, ISRO, APT Satellite Co. Ltd / APSTAR, satsearch B.V., Lockheed Martin Corporation, Thales, Boeing, ROMANTIS, kt sat, and others |

Market Definition

A satellite transponder is an electronic device operating in the microwave range and transmitting or receiving signals. A transmitter takes input data and generates a direct-current signal to drive an antenna system. It is a device that sends and receives data from the satellite. When you send or receive data, it goes through a satellite transponder, which takes signals from earth stations sent by users and re-transmits them back to the user on downlink channel(s). The use of frequencies to communicate through satellites, and each frequency band corresponds with one type of service: voice, data, or video communications. It is a device that creates and amplifies radio signals to allow communication between two terrestrial stations. It can be used to connect multiple receiving stations with only one transmitting station.

Middle East and Africa Satellite Transponder Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- The rise in demand for satellite communication and earth observation

Satellite communication is a type of modern telecommunications where artificial satellites provide communication links between various points on earth. It plays an important role in multiple business continuity and emergency management industries in various business sectors such as oil and gas, IoT, healthcare, government, maritime, mining, and others. Moreover, satellite communications have various commercial, governmental, and military applications. The Earth Observation (EO) satellites are specifically designed for monitoring the earth. It helps to monitor and protect & manage the environment and resources and warn about major natural calamities & disasters.

Moreover, satellite communication provides essential information on a vast uncharted area, including oceans and landmasses. This increasing application of artificial satellites in various industries requires satellite transponders to receive various frequency signals and transmit information back to the earth station. Therefore, the rise in demand for satellite communication is expected to act as a driver for the market's growth.

- Increase in the number of small satellites in earth's orbits

The market for small satellites is growing immensely based on consumer demands for imaging, navigation, and communications across the globe. This boom in demand for placing small satellites into orbit for various applications has boosted interest for start-ups in small rockets to enter the market. According to United Launch Alliance, around 120 start-ups for micro launchers; are small rockets that would carry single or multiple small satellites into orbit. This dramatic growth in the segment is due to the technological advancement in the satellite components such as transponders, antennae, and telescopes, which have made it possible to reduce the size of many devices and equipment; miniaturization has affected the satellite industry and space industry. These miniaturized satellites are replacing big and heavy satellites because of their small size, low price while developing, and high offered quality that has allowed the increased adoption of small satellites in orbit. This increase in small satellites has positively affected the market as these satellites carry small and powerful transponder systems.

Opportunity

- Advancement in the satellite transponder technology

With the constant demand for connectivity and advanced channel broadcasting, communication satellites are becoming more sophisticated and complex. A major part of the development of satellites has been related to the advancements in satellite transponder technology. A communications satellite transponder is a series of small, chip-sized, interconnected circuits forming a communication channel between the receiving and transmitting antennas. These circuits are integrated into satellites to provide bandwidth and power over designated radio frequencies. The transponder bandwidth and power determine the capacity of information transmitted through the transponder and how big the ground equipment must be to receive the signal. The advancement in satellite transponder technology has allowed data compression and multiplexing. Several video and audio channels may travel through a single transponder on a single wideband carrier. Such advancement has allowed the satellite manufacturer to innovate further and increase the properties of satellite transponders, which is an opportunity for the market.

Restraint/Challenge

- High cost associated with the satellite launch and transponder leasing services

As technology improves and with the entrance of various new competitors and rivals in the satellite launch service sector, the prices of launch services must go down. However, that is not the case, as launching a satellite is not an easy task/endeavor. According to Middle East and Africa COM, a traditional single satellite launch cost is estimated to be around USD 50 million to a high of about USD 400 million, depending on the nature and type of the satellite. Launching a space shuttle mission can cost USD 500 million, although one mission can carry multiple satellites and send them into orbit. Advanced technology and the introduction of reusable rocket launch vehicles can reduce the cost by up to USD 30 million. Therefore, instead of costing USD 100 million per flight, if the rocket is reused, it is only USD 30 million per flight for the rocket. This is still a higher cost tag associated with satellite launch services. This high cost associated with the satellite launch services directly affects the launch of the satellite and regional demand for satellite components. To avail of satellite launch services, many regional players must get capital support from the government or big market players in the satellite sector. This may restrict the satellite component's demand, negatively affecting the market.

Post COVID-19 Impact on Middle East and Africa Satellite Transponder Market

The COVID-19 pandemic has impacted the Middle East and Africa satellite transponder market to an extent in a negative manner. Increasing government funding in satellite development and in the space sector and advancement in satellite transponder technology are expected to provide lucrative opportunities for the growth of the Middle East and Africa satellite transponder market. Moreover, increasing partnerships, acquisitions and collaboration among market players and rising demand for Ku-band services are expected to fuel the market growth further. Also, the growth has been high since the market opened after COVID-19, and it is expected that there will be considerable growth in the sector. The market players are conducting multiple research and development activities to improve the technology involved in the product. With this, the companies will bring advancement and innovation to the market.

Recent Development

- In August 2021, L3Harris Technologies Inc. announced that the company multi-faceted Mars Sample Return (MSR) campaign is going to gather Martian samples. The mars mission incorporates two L3Harris transponders and is flexible in design to finish the mission as per planning. This step has allowed the company to gain fame in the Middle East and Africa satellite transponder market

- In October 2020, EUTELSAT COMMUNICATIONS SA announced that the 1Sat Telecomunicaçoes had launched the DTH service in Brazil using EUTELSAT 65 West A satellite. This has increased the company's dominance in the satellite transponder sector as the satellite is embedded with high capacity transponder boosting it in the Middle East and Africa satellite transponder market

Middle East and Africa Satellite Transponder Market Scope

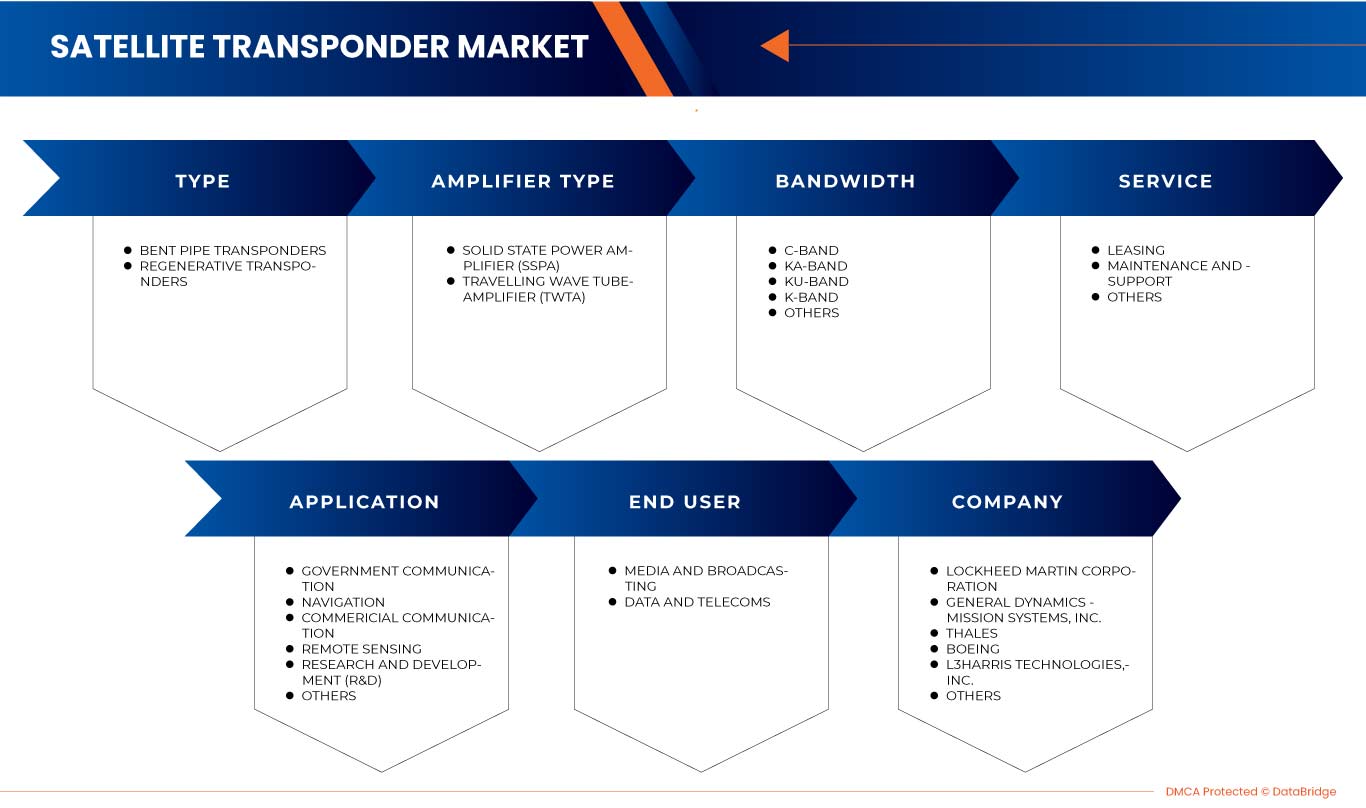

Middle East and Africa satellite transponder market is segmented on the basis of service, type, amplifier type, bandwidth, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY SERVICE

- Leasing

- Maintenance and Support

- Others

On the basis of service, the Middle East and Africa satellite transponder market has been segmented into leasing, maintenance and support, and others

MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY TYPE

- Bent Pipe Transponders

- Regenerative Transponders

On the basis of type, the Middle East and Africa satellite transponder market has been segmented into bent pipe transponders and regenerative transponders

MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE

- Solid State Power Amplifier (SSPA)

- Travelling Wave Tube Amplifier (TWTA)

On the basis of amplifier type, the Middle East and Africa satellite transponder market has been segmented into solid-state power amplifiers (SSPA) and traveling wave tube amplifiers (TWTA)

MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY BANDWIDTH

- C-band

- KA-band

- KU-band

- K-band

- others

On the basis of bandwidth, the Middle East and Africa satellite transponder market has been segmented into C-band, KA-band, KU-band, K-band and others

MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY APPLICATION

- Commercial Communication

- Government Communication

- Navigation

- Remote Sensing

- Research And Development (R&D)

- Others

On the basis of application, the Middle East and Africa satellite transponder market has been segmented into commercial communication, government communication, navigation, remote sensing, reach and development (R&D) and others

MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY END USER

- Media and Broadcasting

- Data and Telecoms

On the basis of end user, the Middle East and Africa satellite transponder market has been segmented into media and broadcasting, data and telecoms

Middle East and Africa Satellite Transponder Market Regional Analysis/Insights

Middle East and Africa satellite transponder market is analysed, and market size insights and trends are provided by country, service, type, amplifier type, bandwidth, application and end user.

The countries covered in the Middle East and Africa satellite transponder market report are South Africa, Egypt, Saudi Arabia, U.A.E, Israel, and the Rest of the Middle East and Africa.

Saudi Arabia is dominating the Middle East and Africa satellite transponder market with a market largest share. This share is attributable to the presence of key markets and rising demand for telecom services such as DTH, broadband, and over-the-top (OTT) platforms such as Netflix and Amazon Prime, as well as rapid technological advancements and the development of innovative technologies.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Satellite Transponder Market Share Analysis

Middle East and Africa Satellite transponder market competitive landscape provide details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Middle East and Africa satellite transponder market.

Some of the major players operating in the Middle East and Africa satellite transponder market are EUTELSAT COMMUNICATIONS SA, L3Harris Technologies, Inc., AMOS Spacecom, Thaicom Public Company Limited, General Dynamics Mission Systems, Inc., Intelsat, Hispasat, MEASAT, IMT srl, ABS, Syrlinks, Singtel, ISRO, APT Satellite Co. Ltd / APSTAR, satsearch B.V., Lockheed Martin Corporation, Thales, Boeing, ROMANTIS, kt sat, and others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 SERVICE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS ANALYSIS

4.3 REGULATORY LANDSCAPE

4.3.1 LICENSING REGIME OF DOT FOR SATELLITE-BASED COMMUNICATION SERVICES

4.3.2 SPECTRUM ALLOTMENT AND USE

4.4 TECHNOLOGICAL ADVANCEMENT

4.5 PATENT ANALYSIS

4.5.1 COMMUNICATION SATELLITE TRANSPONDER INTERCONNECTION UTILIZING VARIABLE BANDPASS FILTER

4.5.2 VARIABLE BANDWIDTH FILTERING AND FREQUENCY CONVERTING SYSTEM

4.5.3 FREQUENCY AGILE SATELLITE RECEIVER

4.5.4 AGILE BANDPASS FILTER

4.5.5 METHOD AND APPARATUS FOR FILTERING RADIO FREQUENCY SIGNALS

4.6 VALUE CHAIN ANALYSIS

4.7 CASE STUDY

4.7.1 EUTELSAT COMMUNICATIONS SA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR SATELLITE COMMUNICATION AND EARTH OBSERVATION

5.1.2 INCREASE IN THE NUMBER OF SMALL SATELLITES IN EARTH ORBITS

5.1.3 GROW IN DEMAND FOR SATELLITE IOT AND M2M SERVICES

5.1.4 INCREASING DEMAND FOR BROADBAND OVER SATELLITE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH THE SATELLITE LAUNCH AND TRANSPONDER LEASING SERVICES

5.2.2 HAZARDOUS ENVIRONMENTAL IMPACT OF SATELLITE LAUNCH

5.3 OPPORTUNITIES

5.3.1 INCREASING GOVERNMENT FUNDING IN SATELLITE DEVELOPMENT AND THE SPACE SECTOR

5.3.2 INCREASING PARTNERSHIP, ACQUISITION AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 RISING DEMAND FOR KU-BAND SERVICES

5.3.4 ADVANCEMENT IN THE SATELLITE TRANSPONDER TECHNOLOGY

5.4 CHALLENGES

5.4.1 LIMITATIONS DUE TO REGULATORY FRAMEWORK

5.4.2 CYBERSECURITY THREATS IN COMMERCIAL COMMUNICATION NETWORKS

6 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY SERVICE

6.1 OVERVIEW

6.2 LEASING

6.3 MAINTENANCE AND SUPPORT

6.4 OTHERS

7 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY TYPE

7.1 OVERVIEW

7.2 BENT PIPE TRANSPONDERS

7.3 REGENERATIVE TRANSPONDERS

8 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE

8.1 OVERVIEW

8.2 TRAVELLING WAVE TUBE AMPLIFIER (TWTA)

8.3 SOLID STATE POWER AMPLIFIER (SSPA)

9 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY BANDWIDTH

9.1 OVERVIEW

9.2 C-BAND

9.3 KU-BAND

9.4 KA-BAND

9.5 K-BAND

9.6 OTHERS

10 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COMMERCIAL COMMUNICATION

10.2.1 VIDEO DISTRIBUTION

10.2.2 DTH

10.2.3 BROADBAND SATELLITE ACCESS SERVICES

10.2.4 LEGACY TELEPHONE AND CARRIER SERVICES

10.2.5 COMMERCIAL MOBILITY SERVICES

10.2.6 ENTERPRISE DATA SERVICE

10.2.7 OAKLAND UNIVERSITY TV (OUTV)

10.2.8 OTHERS

10.3 NAVIGATION

10.4 GOVERNMENT COMMUNICATION

10.5 REMOTE SENSING

10.6 RESEARCH AND DEVELOPMENT (R&D)

10.7 OTHERS

11 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY END USER

11.1 OVERVIEW

11.2 MEDIA AND BROADCASTING

11.3 DATA AND TELECOMS

12 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 SOUTH AFRICA

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 BAHRAIN

12.1.7 KUWAIT

12.1.8 QATAR

12.1.9 OMAN

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 LOCKHEED MARTIN CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GENERAL DYNAMICS MISSION SYSTEMS, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 THALES

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BOEING

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 L3HARRIS TECHNOLOGIES, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABS

15.6.1 COMPANY SNAPSHOT

15.6.2 SOLUTION PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 AMOS SPACECOM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 APT SATELLITE CO. LTD / APSTAR

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EUTELSAT COMMUNICATIONS SA

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 SOLUTION PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HISPASAT

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 IMT SRL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 INTELSAT

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ISRO

15.13.1 COMPANY SNAPSHOT

15.13.2 SERVICE PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 KT SAT

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MEASAT

15.15.1 COMPANY SNAPSHOT

15.15.2 SOLUTION PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 ROMANTIS

15.16.1 COMPANY SNAPSHOT

15.16.2 SERVICE PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SATSEARCH B.V.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SINGTEL

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 SYRLINKS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 THAICOM PUBLIC COMPANY LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 SOLUTION PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 COMMERCIAL TRANSPONDER RENTAL RATES

TABLE 2 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA LEASING IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA MAINTENANCE AND SUPPORT IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA OTHERS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA BENT PIPE TRANSPONDERS IN SATELLITE TRANSPONDER MARKET , BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA REGENERATIVE TRANSPONDERS IN SATELLITE TRANSPONDER MARKET , BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA TRAVELLING WAVE TUBE AMPLIFIER (TWTA) IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOLID STATE POWER AMPLIFIER (SSPA) IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA C-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA KU-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA KA-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA K-BAND IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA NAVIGATION IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA GOVERNMENT COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA REMOTE SENSING IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA RESEARCH AND DEVELOPMENT (R&D) IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA MEDIA AND BROADCASTING IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA DATA AND TELECOMS IN SATELLITE TRANSPONDER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 44 SOUTH AFRICA SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 45 SOUTH AFRICA SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SOUTH AFRICA SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 47 SOUTH AFRICA SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 48 SOUTH AFRICA SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 SOUTH AFRICA COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 SOUTH AFRICA SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 U.A.E. SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 52 U.A.E. SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.A.E. SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.A.E. SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 55 U.A.E. SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 U.A.E. COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 U.A.E. SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 58 EGYPT SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 59 EGYPT SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 EGYPT SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 61 EGYPT SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 62 EGYPT SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 EGYPT COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 EGYPT SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 65 ISRAEL SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 66 ISRAEL SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 68 ISRAEL SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 69 ISRAEL SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 ISRAEL COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 ISRAEL SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 BAHRAIN SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 73 BAHRAIN SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 BAHRAIN SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 75 BAHRAIN SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 76 BAHRAIN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 BAHRAIN COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 BAHRAIN SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 KUWAIT SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 80 KUWAIT SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 KUWAIT SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 82 KUWAIT SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 83 KUWAIT SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 KUWAIT COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 KUWAIT SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 86 QATAR SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 87 QATAR SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 QATAR SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 89 QATAR SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 90 QATAR SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 91 QATAR COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 QATAR SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 93 OMAN SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 94 OMAN SATELLITE TRANSPONDER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 OMAN SATELLITE TRANSPONDER MARKET, BY AMPLIFIER TYPE, 2021-2030 (USD MILLION)

TABLE 96 OMAN SATELLITE TRANSPONDER MARKET, BY BANDWIDTH, 2021-2030 (USD MILLION)

TABLE 97 OMAN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 OMAN COMMERCIAL COMMUNICATION IN SATELLITE TRANSPONDER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 99 OMAN SATELLITE TRANSPONDER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 100 REST OF MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET, BY SERVICE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: SEGMENTATION

FIGURE 11 THE RISE IN DEMAND FOR SATELLITE COMMUNICATION AND EARTH OBSERVATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 THE LEASING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET

FIGURE 14 TOTAL NUMBER OF ACTIVE COMMERCIAL SATELLITES IN EARTH'S ORBIT

FIGURE 15 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET : BY SERVICE, 2022

FIGURE 16 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET : BY TYPE, 2022

FIGURE 17 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET : BY AMPLIFIER TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET : BY BANDWIDTH, 2022

FIGURE 19 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET : BY APPLICATION, 2022

FIGURE 20 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET : BY END USER, 2022

FIGURE 21 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET: SNAPSHOT (2022)

FIGURE 22 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET: BY COUNTRY (2022)

FIGURE 23 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 MIDDLE EAST AND AFRICA SATELLITE TRANSPONDER MARKET: BY SERVICE (2023-2030)

FIGURE 26 MIDDLE EAST & AFRICA SATELLITE TRANSPONDER MARKET: COMPANY SHARE 2022(%)

Middle East And Africa Satellite Transponder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Satellite Transponder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Satellite Transponder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.