Middle East and Africa Release Liner Market, By Substrate (Paper-Based, Film-Based), Labeling Technology (Pressure Sensitive, Glue Applied, Shrink Sleeve, Stretch Sleeve, In-Mold, Others), Material Type (Silicone, Non-Silicone), Printing Process (Flexography, Offset, Gravure, Screen and Digital Printing, Others), Application (Food and Beverages, Medical and Pharmaceuticals, Cosmetics and Personal Care, Automotive, Electronics, Construction, Labels and Tapes, Aviation, Marine, Others) – Industry Trends and Forecast to 2030.

Middle East and Africa Release Liner Market Analysis and Size

The growth of the Middle East and Africa release liner market is being driven by the rising investment in the printing industry with pressure sensitive labels. Additionally, the market is benefiting from the growing demand for packaging in the region. The expanding industrial and manufacturing sectors in the region is also contributing to the market growth, resulting in increased sales and profitability for the market players.

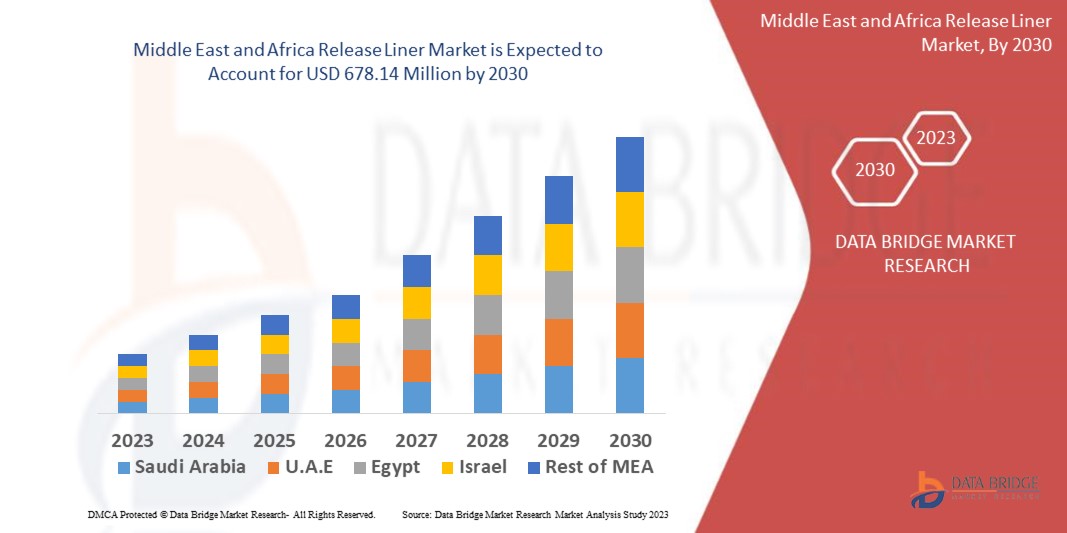

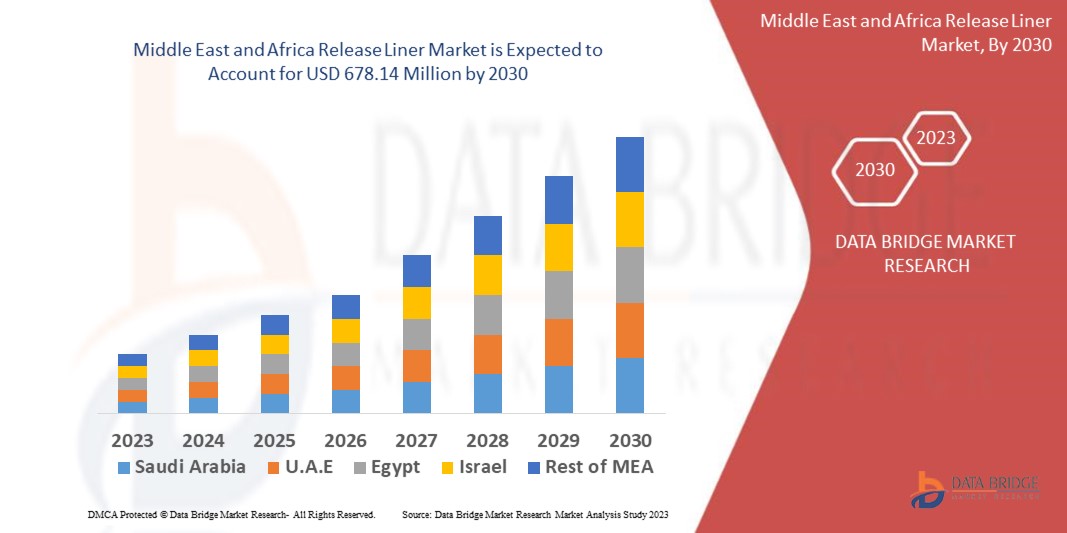

Data Bridge Market Research analyses that the release liner market which was USD 435.23 million in 2022, would rocket up to USD 678.14 million by 2030, and is expected to undergo a CAGR of 5.0% during the forecast period of 2023 to 2030. The “Paper-based” segment in the substrate segment dominates the release liner market as the raw materials required such as wood pulp or paper are easily available in the region which boosts the production of paper based release liner.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Middle East and Africa Release Liner Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Million Square Meters, Pricing in USD

|

|

Segments Covered

|

Substrate (Paper-Based, Film-Based), Labeling Technology (Pressure Sensitive, Glue Applied, Shrink Sleeve, Stretch Sleeve, In-Mold, Others), Material Type (Silicone, Non-Silicone), Printing Process (Flexography, Offset, Gravure, Screen and Digital Printing, Others), Application (Food and Beverages, Medical and Pharmaceuticals, Cosmetics and Personal Care, Automotive, Electronics, Construction, Labels and Tapes, Aviation, Marine, Others)

|

|

Countries Covered

|

United Arab Emirates, Saudi Arabia, Egypt, South Africa, Israel, and Africa and the rest of Middle East & Africa

|

|

Market Players Covered

|

3M (U.S.), Saint-Gobain (France), Loparex (U.S.), Ahlstrom-Munksjö (Finland), LINTEC Corporation (Japan), EMI Specialty Papers (U.S.), AVERY DENNISON CORPORATION (U.S.), UPM (Finland), American coated products (U.S.), Mylan N.V. (U.S.), Polyplex (India), Mondi (U.K.), Sappi Limited (South Africa), Infiana (Germany), GASCOGNE FLEXIBLE (France), Schoeller Technocell GmbH & Co. KG (Germany), Itasa (Spain), Tee Group Films (U.S.), Cheever Specialty Paper & Film (U.S.), and Eastman Chemical Company (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Release liners are plastic or paper coatings that prevent a sticky surface, such as a label, from adhering prematurely. PVC, polyester, PET, polyethylene, and other polymers can be used to coat the liners' substrate surface. Self-adhesive plastic sheets, pressure sensitive tapes, and labels all require release liners. The use of these types of liners makes it easy to handle the object. Silicone is used as the base of the release layer on both sides, ensuring proper release against the appropriate adhesive.

Middle East and Africa Release Liner Market Dynamics

Drivers

- Rising technological advancements and innovation in the industry

The label industry is experiencing advancements and innovations, such as intelligent labels, smart packaging, and RFID technology. These advancements require high-quality release liners to ensure optimal label performance, easy application, and reliable adhesion. There is a growing focus on sustainability and environmental responsibility in the region. The demand for eco-friendly release liners made from recyclable materials or with reduced environmental impact is increasing, driven by regulatory initiatives and consumer preferences.

- Increasing demand for packaging solutions in the region

The rise in e-commerce activities, retail sector growth, and changing consumer preferences are fuelling the demand for packaging materials. Release liners play a crucial role in packaging applications, such as pressure-sensitive labels, tapes, and films, ensuring easy application and protection of adhesive surfaces.

- Growing industrial and manufacturing activities in the region

The region's expanding industrial and manufacturing sectors, including industries such as automotive, electronics, healthcare, and construction, are driving the demand for release liners. These sectors require release liners for various applications such as adhesive tapes, labels, medical products, and construction materials.

Opportunities

- Expansion of E-commerce and online retail channels

The Middle East and Africa region are witnessing a significant expansion of e-commerce and online retail platforms. These platforms require efficient packaging solutions to ensure product protection, secure transportation, and optimal branding. Release liners are integral to packaging solutions in e-commerce and online retail, providing opportunities for market growth.

- Increasing awareness regarding sustainable and eco-friendly solutions

There is an increasing prominence on sustainability and environmental consciousness across the globe. The Middle East and Africa region are also adopting sustainable practices, including the use of eco-friendly packaging materials. Release liners that offer recyclability, composability, and reduced environmental impact are gaining traction. Manufacturers focusing on sustainable release liner solutions have a competitive advantage and growth opportunities in the market.

Restraints/Challenges

- Limitations in terms of availability of skilled labor and technical expertise

The availability of skilled labor and technical expertise related to release liner manufacturing processes, product development, and quality control can be limited in certain areas. This can affect the ability to maintain consistent product quality and meet customer specifications. The awareness and adoption of release liners, especially in smaller and less-developed markets within the region, may be limited. The lack of knowledge about the benefits and applications of release liners can hinder market growth.

- Easy availability and competition from affordable alternatives and substitutes

Release liners face competition from alternative packaging and labeling solutions, such as direct printing, in-mold labels, and digital printing technologies. These substitutes may offer cost advantages, customization options, or environmental benefits, impacting the demand for release liners.

This release liner market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Release Liner market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In March 2021, Loparex obtained ISCC PLUS certification for its German manufacturing site, enabling Middle East and Africa customers to order bio-based polyethylene and polypropylene film solutions with a reduced carbon footprint. This expands Loparex's eco-friendly liner options, supporting sustainability goals and promoting responsible sourcing in the region.

- In February 2021, Mondi, a leading global packaging and paper group, launched a range of sustainable paper-based release liners called EverLiner. These liners are made from recycled and light-weight materials, providing a more environmentally friendly solution for various applications. The EverLiner labelite offers a lighter option with reduced raw material usage and optimized transportation, while the EverLiner M R is the first release liner in the market to use recycled base paper.

Middle East and Africa Release Liner Market Scope

The release liner market are segmented on the basis of the substrate, labeling technology, material type, printing process, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Substrate

- Paper-Based

- Film-Based

Labelling Technology

- Pressure Sensitive

- Glue Applied

- Shrink Sleeve

- Stretch Sleeve

- In-Mold

- Others

Material Type

- Silicone

- Non-Silicone

Printing Process

- Flexography

- Offset

- Gravure

- Screen and Digital Printing

- Others

Application

- Food and Beverages

- Medical and Pharmaceuticals

- Cosmetics and Personal Care

- Automotive

- Electronics

- Construction

- Labels & Tapes

- Aviation

- Marine

- Others

Middle East and Africa Release Liner Market Regional Analysis/Insights

The release liner market is analysed and market size insights and trends are provided by country, product, material, features, distribution channel, and end user as referenced above.

The countries covered in the release liner market report are United Arab Emirates, Saudi Arabia, Egypt, South Africa, Israel, and Africa, and the rest of the Middle East & Africa.

The United Arab Emirates is expected to dominate the release liner market due to the growth in the printing industry. Additionally, increasing R&D investments in terms of commercialized advanced products and technologies drives market growth in the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Release Liner Market Share Analysis

The release liner market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the release liner market.

Some of the major players operating in the release liner market are:

- 3M (U.S.)

- Saint-Gobain (France)

- Loparex (U.S.)

- Ahlstrom-Munksjö (Finland)

- LINTEC Corporation (Japan)

- EMI Specialty Papers (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- UPM (Finland)

- American coated products (U.S.)

- Mylan N.V. (U.S.)

- Polyplex (India)

- Mondi (U.K.)

- Sappi Limited (South Africa)

- Infiana (Germany)

- GASCOGNE FLEXIBLE (France)

- Schoeller Technocell GmbH & Co. KG (Germany)

- Itasa (Spain)

- Tee Group Films (U.S.)

- Cheever Specialty Paper & Film (U.S.)

- Eastman Chemical Company (U.S.)

SKU-