Middle East and Africa Phosphoric Acid Market, By Process Type (Wet Process and Thermal Process), Form (Solid and Liquid), Grade (Technical Grade, Food Grade and Feed Grade), Application (Food and Beverages, Animal Feed, Personal Care, Chemical Manufacturing, Leather and Textile, Cleaning Agents, Ceramics and Refractories, Agricultural Fertilizers, Metallurgy, Water Treatment, Construction, Mining, Semiconductors, Oral and Dental Care, Pharmaceuticals and Others), Country (South Africa, Saudi Arabia, UAE, Egypt, Israel, and Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Market Analysis and Insights: Middle East and Africa Phosphoric Acid Market

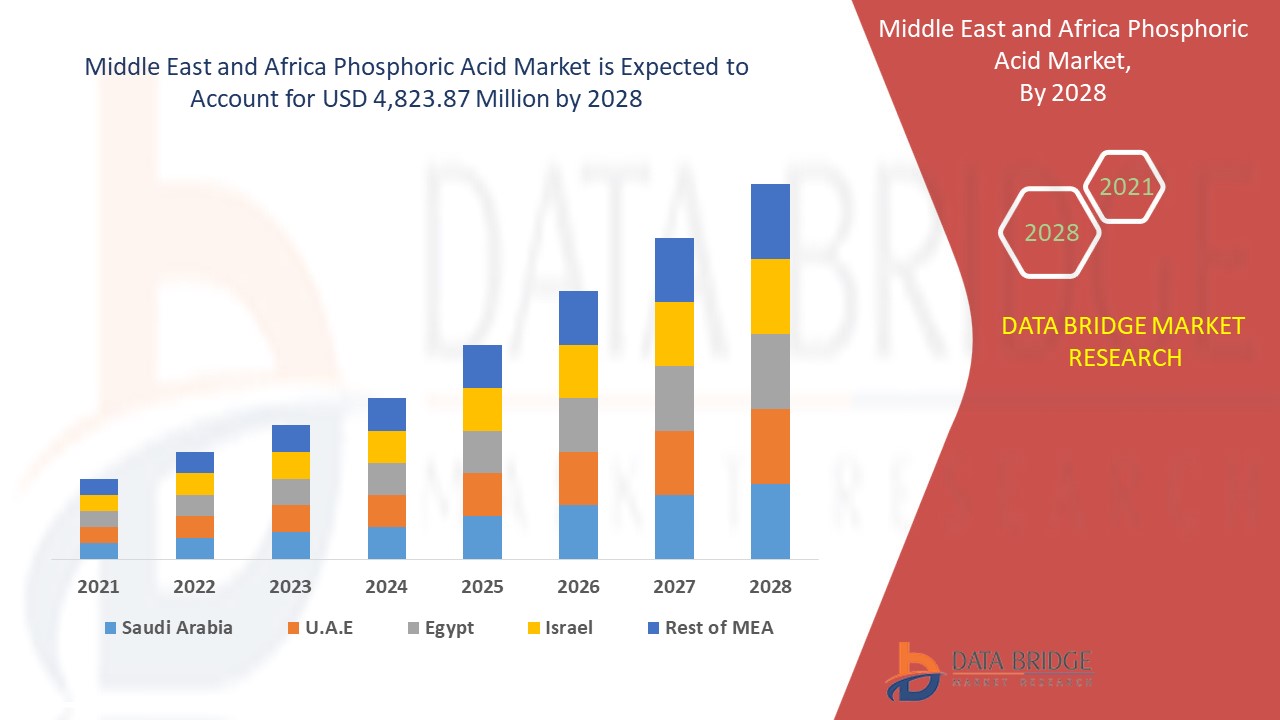

The Middle East and Africa market is expected to grow in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.4% in the forecast period of 2021 to 2028 and is expected to reach USD 4,823.87 million by 2028. Increased demand for phosphoric acid in food and beverage and pharmaceutical industries, thus driving the Middle East and Africa phosphoric acid market growth.

Phosphoric acid refers to a crystalline acid that is generally weak, colorless, and odourless. These inorganic materials are corrosive to the ferrous metal & alloys and possess good solubility in water. These tend to get decomposed in high temperature. These may form toxic fumes when combined with alcohol. Thermal process, dry kiln process and Wet process used for the production of the phosphoric acid. It gives soft drinks a tangy flavor and prevents the growth of mold and bacteria, which can multiply easily in a sugary solution. Most of soda’s acidity also comes from phosphoric acid.

Phosphoric acid is made from the mineral phosphorus, which is found naturally in the body. It works with calcium to form strong bones and teeth. It also helps support kidney function and the way your body uses and stores energy. Phosphorus helps your muscles recover after a hard workout. The mineral plays a major role in the body’s growth and is even needed to produce DNA and RNA, the genetic codes of living things.

Phosphorus is first turned to phosphorus pentoxide through a chemical manufacturing process. It’s then treated again to become phosphoric acid.

Major factors that are expected to boost the growth of the Middle East and Africa phosphoric acid market in the forecast period are the considerable use of phosphoric acid for the production of phosphate fertilizers. Furthermore, stringent government regulations for phosphoric acid are further propelling the Middle East and Africa phosphoric acid market. On the other hand, significant innovation and new product launches are anticipated to derail the Middle East and Africa phosphoric acid market growth. In addition, the availability of substitute product might further create obstructions in the Middle East and Africa phosphoric acid market in the near future.

The Middle East and Africa phosphoric acid market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Middle East and Africa phosphoric acid market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Phosphoric Acid Market Scope and Market Size

The Middle East and Africa phosphoric acid market is segmented into four notable segments which are based on process type, form, grade, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of process type, the phosphoric acid market is segmented into wet process and thermal process. In 2021, the wet process segment is expected to have the largest market share owing due to less cost of wet process as it does not include heating and insulation in storage or during shipment.

- On the basis of form, the phosphoric acid market is segmented into liquid and solid. In 2021, the market is dominated by liquid form due to its application in various industries such as fertilizers, food & beverages, animal feed, pharmaceutical, and others.

- On the basis of the grade, the phosphoric acid market is segmented into food grade, feed grade and technical grade. In 2021, the market is dominated by technical grade segment due its use in the production of STTP (Sodium Tripolyphosphate) which is a preservative.

- On the basis of application, the phosphoric acid market is segmented into food and beverages, animal feed, personal care, chemical manufacturing, leather and textile, cleaning agents, ceramics and refractories, agricultural fertilizers, metallurgy, water treatment, construction, mining, semiconductors, oral and dental care, pharmaceuticals and others. In 2021, the market is dominated by agricultural fertilizers segment because higher demand from phosphate fertilizers such as Mono-Ammonium Phosphate (MAP) and Diammonium Phosphate (DAP).

Middle East and Africa Phosphoric Acid Market Country Level Analysis

The Middle East and Africa phosphoric acid market is analyzed, and market size information is provided by country, process type, form, grade and application as referenced above.

The countries covered in the Middle East and Africa phosphoric acid market report are South Africa, Saudi Arabia, U.A.E., Israel, Egypt and rest of Middle East and Africa. In 2021, the market is dominated by South Africa because growing usage of phosphoric acid in different industries.

The process type segment in the Middle East and Africa region is expected to grow with the highest growth rate in the forecast period of 2021 to 2028 because of increasing use of phosphoric acid in food and beverage segment. The product segment in South Africa dominates the Asia-Pacific market owing to growing usage of phosphoric acid in the health care sector.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing strategic activities by major market players to enhance the awareness for phosphoric acid is boosting the market growth of Middle East and Africa phosphoric acid market

The Middle East and Africa phosphoric acid market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2011 to 2019.

Competitive Landscape and Middle East and Africa Phosphoric Acid Market Share Analysis

The Middle East and Africa phosphoric acid market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points are only related to the company’s focus on the Middle East and Africa phosphoric acid market.

Some of the major players operating in the Middle East and Africa phosphoric acid market are Nutrien Ltd, OCP, J.R. Simplot Company., Brenntag North America, Inc., Arkema, ICL, Innophos, Spectrum Chemical, Solvay, Merck KGaA, Prayon S.A., YPH, Clariant AG, Jordan Phosphate Mines Company (PLC), and Quadra Chemicals. amongst others.

DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product launches are also initiated by companies worldwide, which also accelerates the Middle East and Africa phosphoric acid market.

For instance,

- In September 2020, Clariant AG has launched a new and innovative phosphate ester offering outstanding performance and superior sustainability in metal working fluid formulations. This product launch has helped the company to widen its product portfolio

- In August 2020, OCP has launched the building of a new plant for the production of purified phosphoric acid, through their subsidiary Euro Maroc Phosphore (EMAPHOS). This launch has helped the company to increase the production capacity of the company

Collaboration, product launch, business expansion, award and recognition, joint ventures, and other strategies by the market player enhance the company's footprints in the Middle East and Africa phosphoric acid market, which also benefits the organization’s profit growth.

SKU-