Middle East And Africa Needle Biopsy Market

Market Size in USD Million

CAGR :

%

USD

29.33 Million

USD

39.22 Million

2025

2033

USD

29.33 Million

USD

39.22 Million

2025

2033

| 2026 –2033 | |

| USD 29.33 Million | |

| USD 39.22 Million | |

|

|

|

|

Middle East and Africa Needle Biopsy Market Size

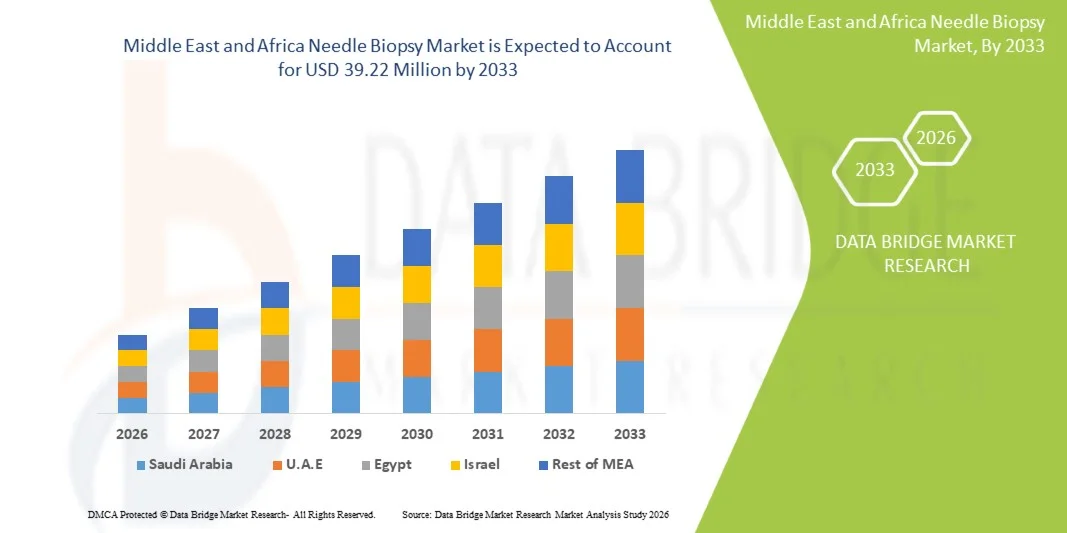

- The Middle East and Africa needle biopsy market size was valued at USD 29.33 million in 2025 and is expected to reach USD 39.22 million by 2033, at a CAGR of 3.70% during the forecast period

- The market growth is largely fueled by the increasing adoption of minimally invasive diagnostic procedures, rising cancer incidence, and growing investment in diagnostic infrastructure across the region

- Furthermore, rising demand for disposable biopsy needles and image-guided procedures that offer precision and patient comfort is establishing needle biopsy as the preferred diagnostic method in hospitals and diagnostic centers. These converging factors are accelerating the uptake of needle biopsy solutions, thereby significantly boosting the industry's growth

Middle East and Africa Needle Biopsy Market Analysis

- Needle biopsy, offering minimally invasive tissue sampling for diagnostic purposes, is increasingly vital in modern healthcare settings across hospitals and diagnostic centers due to its precision, reduced patient discomfort, and compatibility with image-guided technologies

- The escalating demand for needle biopsy procedures is primarily fueled by the rising incidence of cancer and other chronic diseases, growing awareness about early diagnosis, and increasing adoption of minimally invasive diagnostic techniques

- Saudi Arabia dominated the MEA needle biopsy market in 2025 with a 28.5% share, characterized by increasing healthcare infrastructure investment, higher patient awareness, and a strong presence of key diagnostic equipment suppliers

- Kenya is expected to be the fastest growing country in the MEA needle biopsy market during the forecast period due to improving healthcare access, government initiatives to enhance diagnostic capabilities, and rising demand for cancer screening programs

- Core needle biopsy segment dominated the MEA needle biopsy market with a market share of 52.6% in 2025, driven by its established accuracy, efficiency, and suitability for various tissue types in both oncology and non-oncology diagnostics

Report Scope and Middle East and Africa Needle Biopsy Market Segmentation

|

Attributes |

Middle East and Africa Needle Biopsy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Needle Biopsy Market Trends

“Advancements in Image-Guided and Robotic Biopsy Systems”

- A significant and accelerating trend in the MEA needle biopsy market is the increasing adoption of image-guided and robotic-assisted biopsy systems, which enhance procedural precision, reduce patient discomfort, and optimize diagnostic outcomes

- For instance, the UltraCore Robotic Biopsy system integrates real-time imaging with automated needle guidance, enabling clinicians in hospitals and diagnostic centers to obtain accurate tissue samples with minimal invasiveness

- Integration with advanced imaging modalities, such as ultrasound, CT, and MRI, allows needle biopsy systems to target small or difficult-to-reach lesions, improving diagnostic accuracy and reducing repeat procedures

- The seamless use of robotic and image-guided technologies facilitates shorter procedure times and better patient throughput, allowing healthcare providers to improve operational efficiency in both public and private hospitals

- This trend towards more precise, minimally invasive, and automated biopsy procedures is fundamentally reshaping clinical expectations for cancer and chronic disease diagnostics. Consequently, companies such as Merit Medical and Argon Medical Devices are developing robotic-assisted biopsy solutions with real-time imaging feedback

- The demand for needle biopsy systems that offer enhanced precision, integration with imaging modalities, and automated guidance is growing rapidly across both urban hospitals and specialized diagnostic centers, as healthcare providers prioritize patient safety and diagnostic accuracy

Middle East and Africa Needle Biopsy Market Dynamics

Driver

“Increasing Demand Due to Rising Cancer Incidence and Diagnostic Awareness”

- The rising prevalence of cancer and other chronic diseases across MEA, coupled with growing awareness about early diagnosis, is a significant driver of needle biopsy adoption

- For instance, in March 2025, GE Healthcare introduced a high-precision biopsy system for breast and prostate cancer diagnostics in Saudi Arabia, aiming to improve early detection and tissue sampling accuracy

- As hospitals and diagnostic centers expand their oncology and chronic disease screening programs, needle biopsy provides a minimally invasive alternative to surgical biopsies, offering reduced patient risk and faster recovery

- Furthermore, government initiatives promoting cancer screening programs and healthcare infrastructure investments are supporting higher adoption rates of advanced biopsy procedures

- The convenience of image-guided, core, and fine-needle biopsy systems, alongside growing availability of user-friendly and automated devices, is propelling adoption in both public and private healthcare facilities

- Increasing collaborations between global biopsy equipment manufacturers and local distributors are facilitating better market accessibility and faster adoption of innovative biopsy solutions

- Rising patient preference for minimally invasive procedures over surgical biopsies is driving demand for advanced needle biopsy technologies across MEA hospitals and diagnostic centers

Restraint/Challenge

“High Equipment Costs and Limited Skilled Workforce”

- Concerns relatively high cost of advanced needle biopsy systems, including robotic and image-guided devices, poses a significant challenge to widespread adoption, particularly in low- and middle-income MEA countries

- For instance, hospitals in Kenya and Nigeria may face budget constraints when procuring high-end biopsy equipment, limiting access to minimally invasive diagnostic procedures

- In addition, the limited availability of trained radiologists and clinicians skilled in operating advanced biopsy systems restricts their deployment in many regions, affecting market penetration

- Addressing these challenges through cost-effective system offerings, leasing models, and clinical training programs is crucial for expanding the market footprint

- While some disposable and manual biopsy needles provide affordable alternatives, advanced systems remain a premium option, potentially slowing adoption among smaller healthcare facilities

- Overcoming these barriers through technology transfer, training initiatives, and government support for diagnostic programs will be vital for sustained growth in the MEA needle biopsy market

- Regulatory challenges and lengthy approval processes for new biopsy devices in certain MEA countries can delay product launch and slow market growth

- Inconsistent healthcare infrastructure and limited access to advanced imaging equipment in rural areas restrict the widespread deployment of sophisticated needle biopsy systems

Middle East and Africa Needle Biopsy Market Scope

The market is segmented on the basis of needle type, ergonomics, procedure, sample site, utility, application, end user, and distribution channel.

- By Needle Type

On the basis of needle type, the MEA needle biopsy market is segmented into trephine biopsy needles, klima sternal needle, salah needle aspiration needle, jamshidi needle, and others. The Trephine Biopsy Needles segment dominated the market in 2025, owing to their widespread use in bone marrow sampling and high accuracy for hematological and oncological diagnoses. Hospitals and diagnostic centers prefer trephine needles due to their reliability in obtaining core tissue samples, minimal complications, and compatibility with automated biopsy devices. In addition, their standardized design allows ease of use by clinicians across different hospital departments. The segment’s dominance is supported by growing hematology and oncology patient volumes in countries such as Saudi Arabia, UAE, and Egypt. Trephine needles are also favored for their durability and consistent sample quality, making them a trusted choice for repeat procedures.

The Jamshidi Needle segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption in chronic disease diagnostics and hematological procedures. Jamshidi needles offer improved patient comfort and efficient tissue sampling, which is boosting their usage in private hospitals and specialized diagnostic centers. Growing awareness among clinicians about minimally invasive procedures and patient safety is further contributing to this segment’s rapid growth. The rising use of Jamshidi needles in advanced image-guided procedures is expected to accelerate their adoption across MEA.

- By Ergonomics

On the basis of ergonomics, the market is segmented into sharp, blunt, quincke, chiba, franseen, and others. The Sharp segment dominated the market owing to its precision and efficiency in obtaining clean tissue samples across multiple sample sites. Sharp needles are widely preferred in hospitals and diagnostic centers due to their ability to reduce procedural time, lower patient discomfort, and improve diagnostic accuracy. The segment benefits from strong clinician preference, especially for image-guided biopsies, and continued innovation in needle coatings and tip design. Sharp needles are particularly dominant in bone and muscle biopsies where accuracy is critical. Hospitals in GCC countries continue to adopt sharp needles as standard practice in oncology departments.

The Franseen segment is expected to witness the fastest growth during the forecast period, owing to its unique multi-faceted tip design, which provides larger tissue samples with minimal trauma. The growing use of Franseen needles in tumor diagnostics, particularly in oncology centers in Saudi Arabia and UAE, is driving adoption. Their compatibility with core and image-guided biopsy procedures further supports market expansion. Rising clinician awareness of better tissue yield and improved histopathology outcomes is fueling rapid growth for Franseen needles.

- By Procedure

On the basis of procedure, the market is segmented into Fine-Needle Aspiration Biopsy (FNAB), Core Needle Biopsy (CNB), Vacuum-Assisted Biopsy (VAB), and Image-Guided Biopsy. The Core Needle Biopsy segment dominated the market in 2025 with a market share of 52.6% due to its higher diagnostic accuracy compared to FNAB, making it the preferred choice for tumor and organ biopsy procedures. Hospitals and oncology centers in Saudi Arabia, UAE, and Egypt extensively utilize CNB for breast, liver, and prostate cancer diagnostics. Clinicians value CNB for the ability to obtain sufficient tissue for histopathology and molecular testing. Core needle biopsy provides reliable results with fewer repeat procedures, contributing to efficiency in healthcare facilities. It is also widely compatible with image-guided modalities, supporting its dominance across MEA hospitals.

The Image-Guided Biopsy segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption of ultrasound, CT, and MRI-guided procedures across MEA hospitals. Growing cancer incidence and the need for precise sampling in small or deep-seated lesions are key factors contributing to the segment’s rapid growth. Technological innovations in real-time imaging guidance and robotic assistance further accelerate adoption. Urban hospitals and private diagnostic centers are increasingly investing in image-guided systems to reduce procedure time and enhance accuracy.

- By Sample Site

On the basis of sample site, the market is segmented into muscles, bones, and other organs. The Bones segment dominated the market in 2025, primarily due to the high demand for bone marrow biopsies in oncology and hematology diagnostics. Bone biopsies are standard procedures for leukemia, lymphoma, and multiple myeloma, which are increasingly diagnosed in MEA countries. Hospitals favor this segment for its well-established procedural protocols and clinician familiarity. Bones segment dominance is also reinforced by the availability of specialized needles designed for bone tissue sampling. Saudi Arabia, UAE, and Egypt lead the adoption of bone biopsy procedures due to advanced healthcare infrastructure. The high clinical accuracy and low complication rates of bone biopsies contribute to their widespread use.

The Other Organs segment is expected to witness the fastest growth, during the forecast period, driven by the rising prevalence of liver, breast, kidney, and prostate cancers in MEA. The demand for minimally invasive organ-specific biopsies in hospitals and diagnostic centers is increasing, fueled by the need for accurate histopathological diagnosis and targeted treatment planning. Improved imaging guidance and robotic assistance are making biopsies of other organs safer and more precise. Rising patient preference for outpatient procedures also contributes to the segment’s growth. Adoption is strongest in urban hospitals with advanced oncology departments.

- By Utility

On the basis of utility, the market is segmented into disposable and reusable. The Disposable segment dominated the market in 2025, supported by increasing infection control awareness and stringent hospital hygiene standards. Disposable needles minimize cross-contamination, reduce sterilization requirements, and provide convenience for high-volume diagnostic centers. Adoption is particularly strong in Saudi Arabia, UAE, and Egypt where hospitals follow strict infection prevention protocols. The ease of disposal and single-use convenience also reduces procedural preparation time. Disposable needles are preferred in oncology and high-risk infectious disease diagnostics. Growing regulatory encouragement for single-use devices reinforces dominance.

The Reusable segment is expected to witness the fastest growth during the forecast period, driven by cost-conscious hospitals and clinics in countries such as Kenya and Nigeria. Reusable needles are preferred in certain procedures to optimize procurement budgets, and innovations in sterilization and coating technologies enhance their safety and usability. Hospitals seeking long-term cost efficiency are increasingly investing in reusable needle systems. Training programs on safe reuse procedures are supporting adoption. The growth is further aided by improvements in needle durability and precision.

- By Application

On the basis of application, the market is segmented into tumor, infection, inflammation, and others. The Tumor segment dominated the market in 2025, due to the rising cancer prevalence across MEA and the need for accurate histopathological diagnosis. Hospitals and oncology centers rely on needle biopsy for breast, liver, prostate, and other tumor assessments, contributing to the segment’s dominance. Growing cancer screening programs in Saudi Arabia, UAE, and Egypt are boosting tumor biopsy volumes. Tumor diagnostics often require high accuracy and core tissue sampling, favoring needle biopsies. Clinician familiarity and patient preference for minimally invasive procedures reinforce dominance.

The Infection segment is expected to witness the fastest growth during the forecast period, owing to increasing diagnostic testing for abscesses, bone infections, and chronic inflammatory diseases. Growing awareness of minimally invasive procedures in infectious disease diagnosis and improved adoption in diagnostic centers are key growth drivers. Hospitals are increasingly performing needle biopsies for infection localization rather than open surgical procedures. The segment benefits from rising investment in rural healthcare facilities. Adoption of image-guided procedures for infection diagnosis also fuels growth.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centers, biopsy labs, ambulatory surgical centers, academic and research organizations, and others. The Hospitals segment dominated the market in 2025, due to their high patient throughput, advanced infrastructure, and frequent use of needle biopsy for oncology, chronic disease, and routine diagnostics. Hospitals in Saudi Arabia, UAE, and Egypt are leading adopters due to increasing investments in healthcare and cancer screening programs. Hospital dominance is reinforced by their capability to offer image-guided and robotic-assisted biopsy procedures. Hospitals often purchase high-value biopsy systems via direct tender, supporting consistent demand. Skilled clinicians and established pathology labs in hospitals also support the segment’s lead.

The Diagnostic Centers segment is expected to witness the fastest growth during the forecast period, driven by the rising number of specialized diagnostic centers offering minimally invasive biopsy services in urban MEA areas. Adoption is supported by increased patient preference for convenient, outpatient procedures and rapid test results. Diagnostic centers are expanding service portfolios to include image-guided and core needle biopsies. Rising private investment in healthcare is driving center proliferation. Technological upgrades and partnerships with global suppliers accelerate adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The Direct Tender segment dominated the market in 2025, due to government and large hospital procurement contracts for high-value biopsy systems, including image-guided and robotic-assisted devices. Direct tenders ensure timely delivery, training, and after-sales support. Hospitals in Saudi Arabia, UAE, and Egypt rely on tender-based procurement for large-scale deployments. Long-term service contracts and equipment maintenance agreements reinforce the dominance of direct tenders. Regulatory approvals and government partnerships also favor direct procurement.

The Retail Sales segment is expected to witness the fastest growth during the forecast period, driven by growing demand from private hospitals, clinics, and smaller diagnostic centers seeking smaller-scale procurement of disposable needles and core biopsy kits. The increasing presence of local distributors and e-commerce channels in MEA countries supports this growth. Retail sales allow flexible and faster purchasing options for small facilities. Private diagnostic chains and emerging outpatient centers are fueling retail demand. Convenience, quick availability, and variety of products enhance retail adoption.

Middle East and Africa Needle Biopsy Market Regional Analysis

- Saudi Arabia dominated the MEA needle biopsy market in 2025 with a 28.5% share, characterized by increasing healthcare infrastructure investment, higher patient awareness, and a strong presence of key diagnostic equipment suppliers

- Hospitals and diagnostic centers in the country highly value the accuracy, efficiency, and safety offered by needle biopsy procedures for tumor, infection, and chronic disease diagnostics

- This widespread adoption is further supported by advanced healthcare facilities, trained medical professionals, and strong government initiatives for cancer screening and early diagnosis, establishing needle biopsy as a preferred diagnostic solution for both public and private healthcare institutions

The Saudi Arabia Needle Biopsy Market Insight

The Saudi Arabia needle biopsy market captured the largest revenue share of 28.5% in 2025, fueled by rising cancer prevalence, growing investments in healthcare infrastructure, and increased adoption of minimally invasive diagnostic procedures. Hospitals and diagnostic centers are prioritizing accurate and efficient tissue sampling for oncology, infection, and chronic disease diagnostics. The expanding number of specialized oncology centers, combined with government initiatives for early detection and cancer screening, is significantly propelling market growth. Moreover, increasing integration of image-guided and robotic-assisted biopsy systems is enhancing procedural precision and safety. Strong clinician preference and patient awareness are driving wider adoption across both public and private healthcare facilities. The market is also supported by collaborations between global suppliers and local hospitals for advanced biopsy technologies.

UAE Needle Biopsy Market Insight

The UAE needle biopsy market is expected to grow at a substantial CAGR during the forecast period, primarily driven by high healthcare spending, increasing cancer incidence, and the modernization of hospitals with advanced diagnostic technologies. Diagnostic centers and hospitals are investing in core, fine-needle, and image-guided biopsy systems to improve accuracy and patient outcomes. Rising awareness among patients about minimally invasive procedures and faster recovery is fueling demand. Furthermore, the UAE government’s focus on healthcare innovation and medical tourism is supporting the market expansion. Urban hospitals and private diagnostic chains are adopting robotic-assisted and disposable biopsy needles to improve efficiency. The region also benefits from strong availability of skilled clinicians trained in advanced biopsy procedures.

Egypt Needle Biopsy Market Insight

The Egypt needle biopsy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing cancer prevalence, rising investments in hospital infrastructure, and growing demand for minimally invasive diagnostics. Hospitals and specialized diagnostic centers are increasingly using core and image-guided biopsy procedures for tumors and organ-specific sampling. Patient preference for less invasive procedures with faster recovery supports adoption. Expansion of oncology and diagnostic centers in major cities such as Cairo and Alexandria is further stimulating market growth. Collaboration between local distributors and global biopsy equipment manufacturers is enhancing market accessibility. Rising awareness programs for early detection of cancer and hematological disorders also contribute to growth.

Kenya Needle Biopsy Market Insight

The Kenya needle biopsy market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing access to modern diagnostic technologies and the growing burden of cancer and chronic diseases. Hospitals and diagnostic centers in urban areas are adopting disposable and core needle biopsy systems to improve diagnostic efficiency. Government initiatives promoting cancer screening and early diagnosis are supporting market growth. Limited infrastructure in rural areas is gradually being addressed through mobile diagnostic units and telemedicine-supported biopsy procedures. Training programs for clinicians on image-guided procedures are increasing adoption. The market is benefiting from collaborations between international biopsy device manufacturers and local healthcare providers.

Middle East and Africa Needle Biopsy Market Share

The Middle East and Africa Needle Biopsy industry is primarily led by well-established companies, including:

- BD (U.S.)

- Argon Medical Devices (U.S.)

- Cook (U.S.)

- Boston Scientific Corporation (U.S.)

- Hologic, Inc. (U.S.)

- Medtronic (Ireland.)

- B. Braun SE (Germany)

- Siemens Healthineers AG (Germany)

- Olympus Corporation (Japan)

- Merit Medical Systems, Inc. (U.S.)

- Stryker (U.S.)

- Leica Biosystems Nussloch GmbH (Germany)

- PAJUNK (Germany)

- INRAD, Inc. (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Scion Medical Technologies, LLC (U.S.)

- TSK Laboratory (Japan)

- Devicor Medical Products, Inc. (U.S.)

What are the Recent Developments in Middle East and Africa Needle Biopsy Market?

- In October 2025, Olympus announced the launch of SecureFlex, a single‑use fine‑needle‑biopsy device in the EMEA region. This device is designed for use in conjunction with ultrasound endoscopes and is described in the company’s MEA press‑release channel, indicating its availability in Middle East & Africa markets

- In September 2025, Olympus also launched the BF‑UCP190F endobronchial ultrasound (EBUS) bronchoscope, a tool used in endobronchial ultrasound‑guided transbronchial needle aspiration (TBNA), across EMEA including the Middle East and Africa. It is directly tied to needle‑biopsy procedures (bronchoscopic sampling) increasing the capacity of biopsy diagnostics in MEA

- In June 2024, a healthcare industry magazine covering Middle East & Africa published that in Egypt the Alameda Healthcare Group entered into a seven‑year strategic partnership with Siemens Healthineers to revolutionize diagnostic imaging and interventional services across the region. This collaboration supports expanding minimally‑invasive diagnostics capacity in MEA

- In April 2024, The Swedish Institute for Health Economics (IHE) published a report in April 2024 highlighting critical gaps in diagnostic capacity for breast cancer in nine MEA countries, including limited access to core needle biopsy and diagnostic delays

- In April 2021, the American Hospital Dubai performed its first CT‑fluoroscopy‑guided lung biopsy using a newly acquired low‑radiation‑dose CT scanner, employing a co‑axial needle technique to improve safety and reduce invasiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.