Middle East and Africa Hoses Market, By Media (Hydraulic, Steam Hoses, Air and Gas Hoses, Material Handling Hoses, Food Hoses, and Others), Material (Plastic/Polymers Hoses, Rubber Hoses, Metal Hoses, Composite Hoses, Silicon Hoses, and Others), End User (Industrial, Automotive, Commercial, and Residential), Sales Channel (Direct and Indirect) - Industry Trends and Forecast to 2030.

Middle East and Africa Hoses Market Analysis and Size

The Middle East and Africa hoses market is fragmented in nature, as it consists of many Middle East and Africa players, such as Gates Corporation and PARKER HANNIFIN CORP among others. The presence of these companies produces competitive prices, various types of hoses, and other innovative hoses products with services across the globe. Due to the presence of the players at regional and international levels, suppliers and manufacturers offer products and services with different specifications and characteristics for all budgets. The increasing adoption of polymer hoses and the increasing need for durable hoses in critical applications is expected to boost the market's growth. Furthermore, growing infrastructure-related developments and rapid product development related to hoses are also expected to drive the market. However, environmental concern regarding hoses, standards and regulations related to the hoses, and limitations of hoses in various applications is expected to restrain the market growth. Moreover, technical issues related to the hoses and growing concerns about workplace safety are expected to challenge the market growth. But, the growing adoption of hoses in the automobile sector and rising demand for durable hoses are expected to provide lucrative opportunities for market growth in the future.

For this, various market players are introducing new products and forming a partnership to expand their business in the Middle East and Africa hoses market.

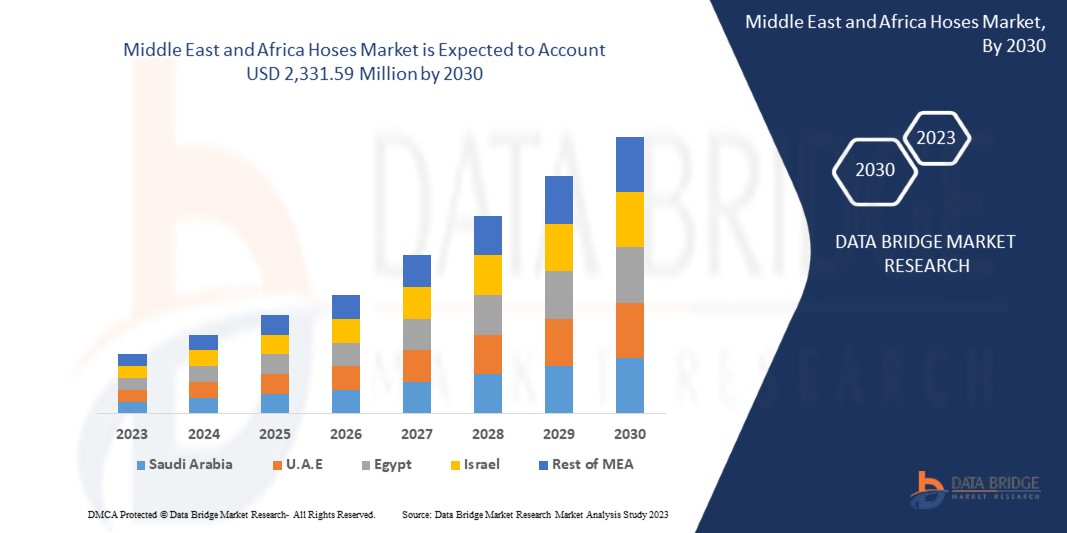

Data Bridge Market Research analyses that the Middle East and Africa hoses market is expected to reach a value of USD 2,331.59 million by 2030, at a CAGR of 4.7% during the forecast period. The Middle East and Africa hoses market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2016-2020)

|

|

Quantitative Units

|

Revenue in Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Media (Hydraulic, Steam Hoses, Air and Gas Hoses, Material Handling Hoses, Food Hoses, and Others), Material (Plastic/Polymers Hoses, Rubber Hoses, Metal Hoses, Composite Hoses, Silicon Hoses, and Others), End User (Industrial, Automotive, Commercial, and Residential), Sales Channel (Direct and Indirect)

|

|

Countries Covered

|

U.A.E., Saudi Arabia, Egypt, Israel, South Africa, Oman, Bahrain, Kuwait, Qatar, and the Rest of the Middle East and Africa

|

|

Market Players Covered

|

Gates Corporation, PARKER HANNIFIN CORP, ContiTech AG (Subsidiary of Continental AG), Colex International Limited, UK, Danfoss, Kanaflex Corporation (Part of Kaizen Capital), NORRES (Part of Triton), Kurt, Robert Bosch Tool Corporation, ALFA GOMMA Spa, Polyhose, Dunlop Hiflex AB, Terraflex, PIRTEK, and KURIYAMA OF AMERICA, INC. (Subsidiary of Kuriyama Holdings Corp.) among others

|

Market Definition

The hoses are flexible tubes that are used for conveying liquids, gases, and other materials in a wide range of applications across various industries such as agriculture, construction, automotive, and oil & gas. Hoses can be made of various materials such as rubber, plastic, or metal and can be designed for various purposes, such as conveying high-pressure fluids, corrosive chemicals, or steam. The market includes both industrial and consumer-grade hoses and is driven by factors such as the growing demand for high-quality hoses that are durable, reliable, and can withstand extreme temperatures and pressure, as well as the increasing need for hoses that are easy to use, maintain, and transport. The Middle East and Africa hoses market is highly competitive, with a large number of players operating in the market, and is expected to grow in the coming years due to the rising demand for hoses from various end-use industries.

Middle East and Africa Hoses Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increasing adoption of polymer hoses

In recent days, industrial hoses of polymer material is becoming prominent in automotive, pharmaceuticals, infrastructure, oil and gas, food and beverages, mining, water, agriculture & other industries for manufacturing and using tubes and pipes for the transportation of air, water, chemicals, fluids from one end to another.

The demand is getting increased day by day owing to their wide range of applications, such as air, abrasive products, mineral oils, water, technical and domestic gases, steam, fuels, and others. Technological development is helping industrial hoses product supplement the growth of the market.

- Increasing need for durable hoses in critical applications

The application of industrial hoses includes moving fluids, chemicals, air, water, oil, and other materials from one place to another. There is a significant demand for robust industrial hoses in the market in crucial applications such as high temperature, high pressure, chemical reaction, and vacuum.

Before choosing the hoses, the customers must consider a number of important criteria, including catastrophic failure, permeability, chemical compatibility, temperature, external environment, vacuum, and others. The major players in the Middle East and Africa hoses market are releasing cutting-edge products for mission-critical uses, which is fuelling the demand for durable hoses in the industry.

Opportunity

- Growing adoption of hoses in automobiles sectors

Automobiles consist of complex internal structures and systems with various components intact. The integration of these systems and components allows the automobile to operate as an efficient machine. In automobiles, hoses play an important role as it is used as an engine cooling system, in a brake oil carrier, as a fuel carrier, in air conditioning, and in other parts of the vehicle. In the design of an engine cooling system, hoses of various types are used for coolant circulation. These hoses are of different material properties as some are designed to withstand the heat of coolant, whereas others can take just cold coolant. This increases the importance of hoses in automobiles, and the growth of the Middle East and Africa hoses market is directly affected by the growth of the automobile industry. As the automobile sector in the EV industry is showing enormous growth over the years owing to rising demand for vehicles and electric vehicles, this is expected to provide lucrative opportunities for the market.

Restraint/Challenge

- Limitations of hoses in various applications

An industrial hose is extensively used across various industries for optimum operating efficiency and transfer of fuel, chemicals, bulk materials, and air, among others. Although the industrial applications of industrial hoses continue to expand, the end users are increasingly focusing on the efficiency levels of industrial hoses. However, industrial hoses pose various challenges in various system environments, such as temperature range, and this results in hampering the overall performance and efficiency of the system. The characteristic limitation of industrial hoses is expected to hamper the growth of the Middle East and Africa hoses market. Many end users and businesses tend towards alternatives to hoses due to their limitations.

Post-COVID-19 Impact on Middle East and Africa Hoses Market

The hoses industry noted a gradual decrease in demand due to the lockdown and COVID-19 governmental laws, as manufacturing facilities and services were closed. Even private and public development was called off. Moreover, the industry was also affected by the halt of the supply chain, especially of raw materials used in the manufacturing process of industrial hoses. Stringent government regulations for different industries and restrictions on trade & transportation were some of the top factors that caused a dent in the growth of the market for industrial hoses around the world in 2020 and in the first two quarters of 2021. As industrial hose production slowed down owing to the restrictions by governments across the globe, the production was not meeting the demand in the first three quarters of 2020. Moreover, high demand/requirement for industrial hose products in the chemical and pharmaceutical industry, in the agriculture sector, and in hydraulics applications has been witnessed. The resuming production of the oil and gas industry and automotive; further fuelled the rising demand for industrial hoses across the globe. Thus, this not only led to a hike in demand but also increased the cost of the product.

Recent Development

- In July 2021, NORRES Schlauchtechnik GmbH, a manufacturer, developer, and distributor of flexible hose system solutions, acquired Baggerman Group ("Baggerman"), a manufacturer and distributor of industrial hoses, couplings, and accessories. This acquisition has helped the company to increase its presence.

- In September 2020, KURIYAMA OF AMERICA company developed a new product called Tigerflex Tiger Aquaâ" ¢ Suction and Discharge Hose. This new addition of a product has not only improved the product portfolio of the company but also helped to boost the overall sales.

Middle East and Africa Hoses Market Scope

The Middle East and Africa hoses market is segmented into four notable segments which are based on the media, material, end user, and sales channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Media

- Hydraulic

- Steam Hoses

- Air and Gas Hoses

- Material Handling Hoses

- Food Hoses

- Others

On the basis of media, the Middle East and Africa hoses market is segmented into hydraulic, steam hoses, air and gas hoses, material handling hoses, food hoses, and others.

Material

- Plastic/polymers Hoses

- Rubber Hoses

- Metal Hoses

- Composite Hoses

- Silicon Hoses

- Others

On the basis of material, the Middle East and Africa hoses market is segmented into plastic/polymers hoses, rubber hoses, metal hoses, composite hoses, silicon hoses, and others.

End User

- Industrial

- Commercial

- Residential

- Automotive

On the basis of end user, the Middle East and Africa hoses market is segmented into industrial, automotive, commercial, and residential.

Sales Channel

- Direct

- Indirect

On the basis of sales channel, the Middle East and Africa hoses market is segmented into direct and indirect.

Middle East and Africa Hoses Market Regional Analysis/Insights

Middle East and Africa hoses market is analyzed, and market size insights and trends are provided by country, media, material, end user, and sales channel, as referenced above.

The countries covered in the Middle East and Africa hoses market report are U.A.E., Saudi Arabia, Egypt, Israel, South Africa, Oman, Bahrain, Kuwait, Qatar, and the rest of Middle East and Africa.

U.A.E is expected to dominate the Middle East and Africa hoses market due to the high demand for PVC hose materials, which is expected to act as a driving factor for the market's growth.

The region section of the report also provides individual market-impacting factors and changes in market regulation that affect the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Middle East and Africa Hoses Market Share Analysis

Middle East and Africa hoses market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Middle East and Africa hoses market.

Some of the major players operating in the Middle East and Africa hoses market are Gates Corporation, PARKER HANNIFIN CORP, ContiTech AG (Subsidiary of Continental AG), Colex International Limited, UK, Danfoss, Kanaflex Corporation (Part of Kaizen Capital), NORRES (Part of Triton), Kurt, Robert Bosch Tool Corporation, ALFA GOMMA Spa, Polyhose, Dunlop Hiflex AB, Terraflex, PIRTEK, and KURIYAMA OF AMERICA, INC. (Subsidiary of Kuriyama Holdings Corp.) among others.

SKU-