Market Analysis and Size

Logistics is utilized in the healthcare industry to control the manner resources are kept, obtained, and transferred. The effective use of logistics in this business aids in the continual transport of pharmaceuticals, devices, and systems from vendors and providers positioned throughout the country. Hospitals and clinics, in addition to wholesalers of clinical objects and big pharmacy retail chains, make up the healthcare industry.

The increased preference for biological pharmaceuticals as well as the growing tendency of businesses to outsource are the main drivers anticipated to drive market growth. Significant numbers of healthcare items need to be shipped over considerable distances through firms these days. These materials are valuable and delicate. The developing market for temperature-sensitive drugs and biological clinical objects, in addition to growing awareness amongst pharmaceutical and logistics companies, is boosting the scope for temperature-controlled healthcare logistics, benefiting the whole healthcare logistics market.

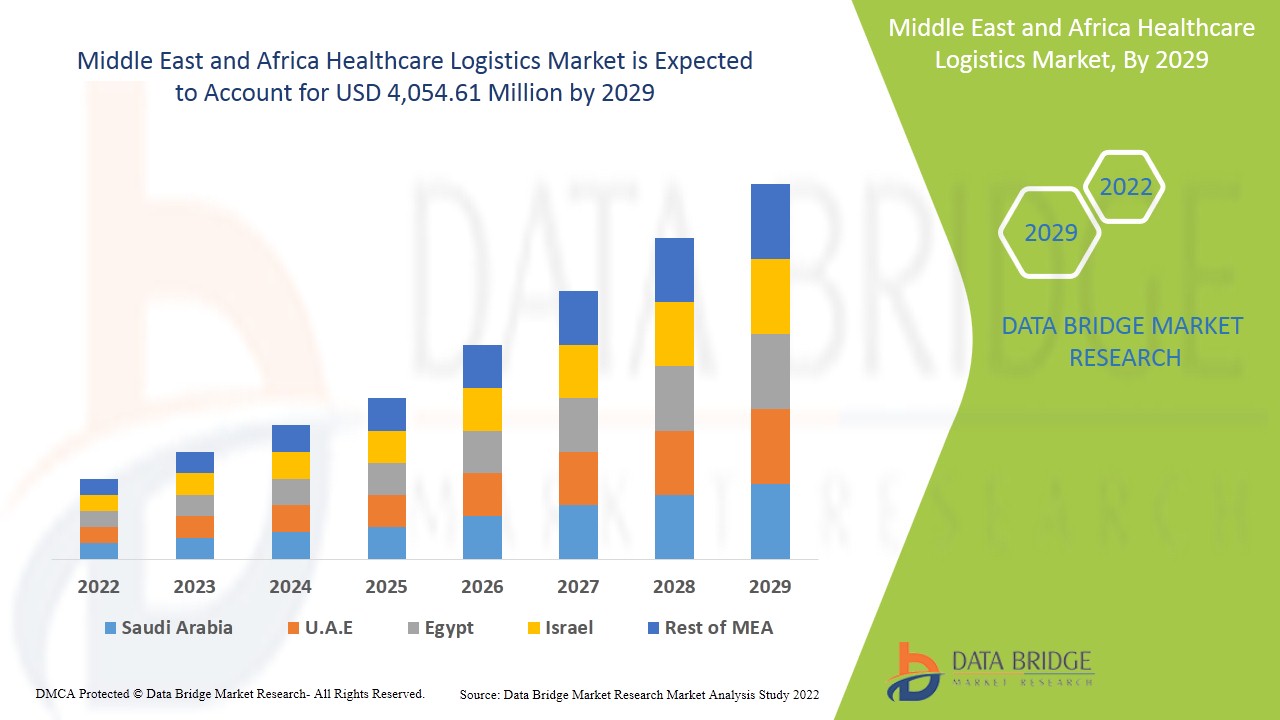

Data Bridge Market Research analyses that the healthcare logistics market is expected to reach the value of USD 4,054.61 million by 2029, at a CAGR of 5.9% during the forecast period. “Non-Cold Chain" accounts for the largest technology segment in the healthcare logistics market non-cold chain as the initial capital cost is low. The healthcare logistics market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Cold Chain and Non-Cold Chain), By Component (Hardware, Software and Services), By Temperature Type (Ambient, Chilled/Refrigerated, Frozen and Cryogenic), By Logistics (Transportation, Packaging, Storage and Others), By Logistic Type (Sea Freight Logistics, Air Freight Logistics, Overland Logistics and Contract Logistics), By Application (Medicine, Bulk Drug Handlers, Vaccine, Chemical & Other Raw Material, Biological Material And Organs, Hazardous Cargo and Others), By End User (Biopharmaceutical Companies, Hospitals & Clinics, Research Institutes and Others) |

|

Countries Covered |

Saudi Arabia, South Africa, U.A.E, Israel, Egypt and Rest of Middle East and Africa in Middle East and Africa |

|

Market Players Covered |

Agility, C.H. Robinson, AmerisourceBergen Corporation, Air Canada, CEVA logistics, DB Schenker, Deutsche Post DHL Group, FedEx, Burris Logistics, United Parcel Service of America, Inc., VersaCold Logistics Services, Abbott among others. |

Market Definition

Healthcare comprises maintenance or improvement of wellness through the conclusion, anticipation, therapy, recuperation, or fix of infection, disease, injury, and different physical and mental impedances in individuals. Healthcare help is addressed with the aid of using fitness experts in allied health fields. Dentistry, pharmacy, nursing, audiology, medicine, optometry, midwifery, psychology, occupational and bodily therapy, and different health professions are all additives to healthcare.

Logistics refers to the general procedure of managing how resources are acquired, stored, and transported to their final destination. It contains figuring out potential distributors and providers and dealing with their effectiveness and accessibility. Hence, healthcare logistics is the logistics of medical and surgical supplies, pharmaceuticals, clinical gadgets and equipment, and different products demanded to assist doctors, nurses, and different healthcare specialists.

Healthcare logistic management is used for various modes of transportation such as roadways, railways, marine, and airways. The freight movement done through the path of roads is termed under the segment. It is the most common type of transportation mode as it requires single customs document process. The Railway mode of transportation is highly fuel-efficient and can be termed as a ‘green’ mode of transportation. Marine shipments are used for the movement of bulk commodities. Airways are the fastest mode of transportation and are highly used to achieve ‘just-in-time’ (JIT) inventory replenishment in healthcare logistics.

Healthcare Logistics Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Rapid Growth In The E-Commerce Sector

E-commerce or electronic commerce is the process of buying and selling goods and services over an electronic network or online platform, primarily the Internet. In recent times, the widespread use of e-commerce platforms such as Amazon, Flipkart, and eBay has contributed to substantial growth in online buying and selling of goods. This has provided a platform for consumers to freely purchase healthcare products and use them according to their requirements.

- High Benefits Offered By Third Party Logistics

Third-party logistics is outsourced with operational logistics from warehousing to delivery, this includes providing a number of services in the supply chain such as freight forwarding, packaging, order fulfillment, inventory forecasting, picking and packing, warehousing, and transportation. Third-party logistics offer a wide range of benefits as it helps the business owners to focus more on the other aspects of business such as product development, marketing, and sales. The high benefits offered by third-party logistics are therefore acting as the major factor for boosting the growth of the global healthcare logistics market.

- Rising Growth In Cross Border Trades

Globalization is the interdependence of the world's economies, populations, and cultures brought together by cross-border trade in technology, goods, and others. Today, most of the country's economy is highly dependent on buying and selling goods among various countries. Asia-Pacific region has been the major players in the Middle East and Africa trade and has a high volume of trade flow that has increased the requirement of logistics service providers to make the flow of trade more convenient and faster. Thus, it is boosting the growth in the healthcare logistics market in Middle East and Africa.

- Congestion Associated With Trade Routes

As traffic volumes and congestion grows on roadways and waterways, freight and transport service operators grow to be increasingly challenged to keep reliable schedules. This affects supply chains and truck-dependent businesses, each of which is of growing significance for both public coverage and private region operators. Moreover, several accidents on roads or oil spills at sea can result in unexpected healthcare logistics restraints. Recent COVID-19 has also halted several logistics operations causing severe damage to entire supply chain operations. These factors act as a significant restraint for the growth of the Middle East and Africa healthcare logistics market.

- High Cost Associated With Reverse Logistics

The cost associated with reverse logistics services offered by various manufacturers and service providers is high. Reverse logistics services are quite popular in the healthcare sector due to the high demand for various healthcare-related products. According to Thomas Publishing Company, Industrial equipment return rates are approximately 4% to 8%, while healthcare equipment has 8% to 20%. Total U.S. revenue impacted by returns is estimated between USD 52 Million and USD 106 Million.

The reason for reverse logistics services being so expensive are a combination of various factors which determine the pricing of these services.

- Concerns Related To Inventory Management in Healthcare Logistics

Inventory management is the process of ordering, storing, and selling a company's products and maintaining its logs. This includes the management of raw materials, components, and finished products and warehousing and processing of returned items.

Inventory is a company's most valuable asset. Adopting inventory management can increase productivity, reduce costs, mitigate risks, improve customer satisfaction, cut costs, and maximize return on assets. However, inventory management has become quite difficult tricky for healthcare logistics services providers.

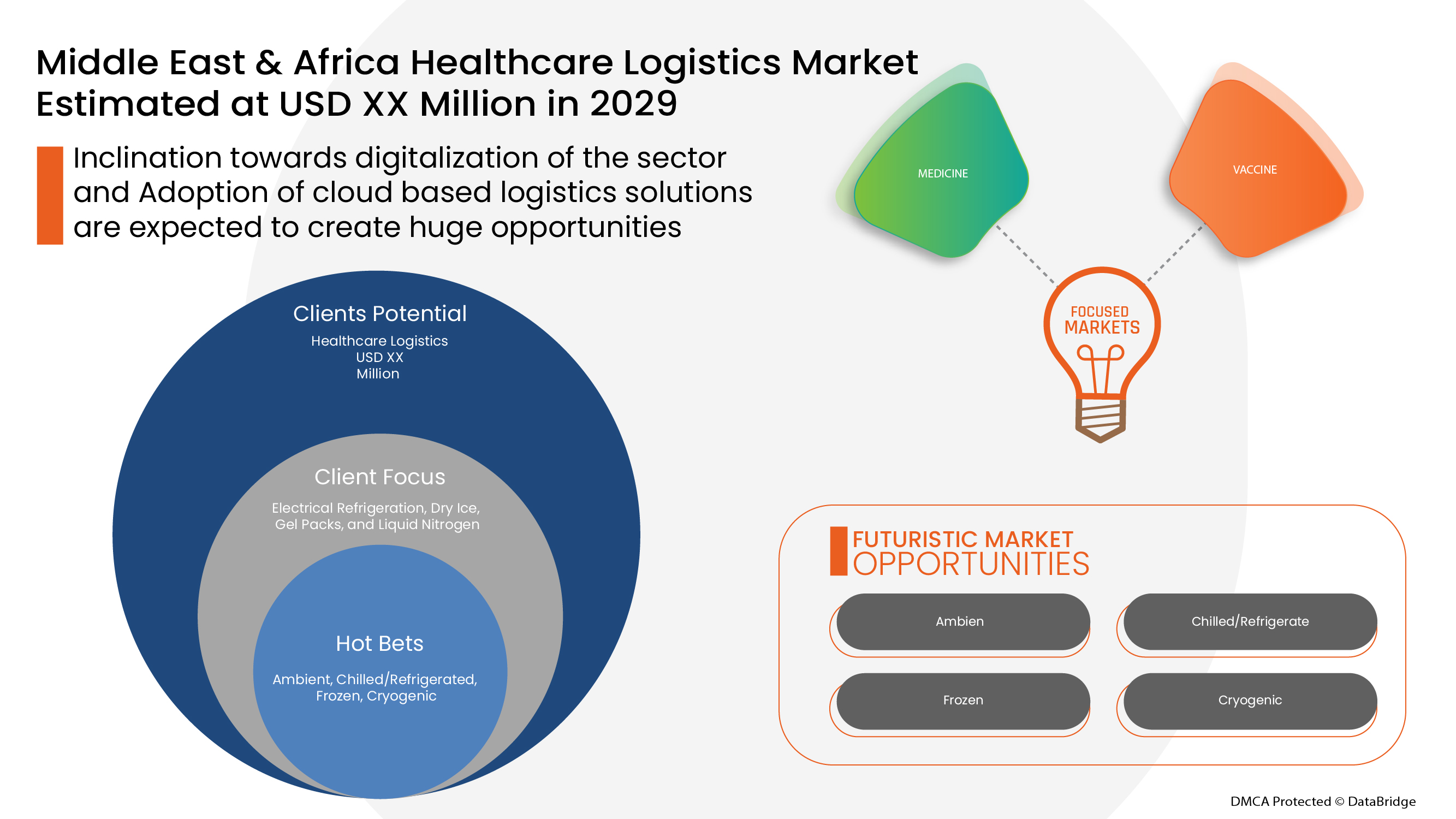

- Inclination Towards Digitalization Of The Sector

Digital transformation is referred to the changes that a business undergoes by adopting digital technology. It has become a necessity for transportation and logistics to give extreme importance to optimization, efficiency, speed, and timing. The changing scenario in the market and upcoming new trends have made it highly important for the transportation industry to go under digital transformation. Healthcare logistics companies use mobile devices to improve agility. Moreover, the mobile apps help the customers to order, process, and track return shipments at any time. This growing digital transformation of the logistics industry is thus boosting the growth of the healthcare logistics market.

- Inadequate Labour Resources To Handle Return

The overall supply chain management process involves analyzing a large amount of data and a large number of returns. Due to rapid growth in the E-commerce sector, the workforce needs to take the necessary steps at the right time. The information provided needs to be well-executed in order to provide optimum results and quality of services.

However, lack of skilled workers and training to the employees can lead to several errors causing inefficiency in the services offered, acting as a major challenge for the growth in the healthcare logistics sector. This can be a major setback as customer satisfaction is everything in the healthcare logistic sector. The workforce working in healthcare logistics must be trained in identifying specific serial or part numbers. Moreover, the workforce must know the authoritative inventory, warranty policy, and accounting information housed in their central enterprise resource planning (ERP) system, but it's difficult to find a skilled workforce to handle healthcare product returns.

Post COVID-19 Impact on Healthcare Logistics Market

COVID-19 created a major impact on the healthcare logistics market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the healthcare logistics market is increase in growth of logistics through airways and water ways and rapid growth in the e-commerce sector across the world. However, factors such as concerns related to inventory management in healthcare logistics are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the healthcare logistics. With this, the companies will bring advanced and accurate controllers to the market. In addition, the use of healthcare logistics by government authorities in sea freight logistics, air freight logistics, overland logistics and contract logistics has led to the market's growth.

Recent Developments

- In November 2021, National Aviation Services (NAS), a subsidiary of Agility signed a partnership agreement with Global Jet Technic (GJT), one of the leading independent providers of maintenance solutions in the Gulf region. NAS (National Achievement Survey) will offer comprehensive line maintenance services approved under the European Union Aviation Safety Agency (EASA) certification. This partnership helps in enhancing the recognition of the company.

- In January 2022, BDP INTERNATIONAL announced three key office locations have achieved Center of Excellence for Independent Validators (CEIV) in pharmaceutical logistics certifications from the International Air Transport Association (IATA). BDP’s Brussels, Belgium, Milan, Italy, and JFK, New York, locations have successfully completed all applicable and necessary training that ensures the highest level of international compliance standards to safeguard pharmaceutical product integrity during the transportation process. This development helped in enhancing the global presence of the company.

Middle East and Africa Healthcare Logistics Market Scope

The healthcare logistics market is segmented on the basis of type, application, components, temperature type, logistics, logistics type and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Non-Cold Chain

- Cold Chain

On the basis of technology, the Middle East and Africa healthcare logistics market is segmented into non-cold chain and cold chain.

Components

- Hardware

- Services

- Software

On the basis of component, the Middle East and Africa healthcare logistics market has been segmented into hardware, software and services.

Temperature Type

- Ambient

- Chilled/Refrigerated

- Frozen

- Cryogenic

On the basis of temperature type, the Middle East and Africa healthcare logistics market has been segmented into ambient, chilled/refrigerated, frozen and cryogenic.

Logistics

- Transportation

- Packaging

- Storage

- Others

On the basis of logistics, the Middle East and Africa healthcare logistics market has been segmented into transportation, packaging, storage and others.

Logistics Type

- Overland Logistics

- Sea Freight Logistics

- Air Freight Logistics

- Contract Logistics

On the basis of logistic type, the Middle East and Africa healthcare logistics market has been segmented into sea freight logistics, air freight logistics, overland logistics and contract logistics.

Application

- Medicine

- Bulk Drug Handlers

- Vaccine

- Chemical & Other Raw Material

- Biological Material and Organs

- Hazardous Cargo

- Others

On the basis of application, the Middle East and Africa healthcare logistics market has been segmented into medicine, bulk drug handlers, vaccine, chemical & other raw material, biological material and organs, hazardous cargo and others.

End User

- Biopharmaceutical Companies

- Hospital & Clinics

- Research Institutes

- Others

On the basis of end user, the Middle East and Africa healthcare logistics market has been segmented into biopharmaceutical companies, hospitals & clinics, research institutes and others.

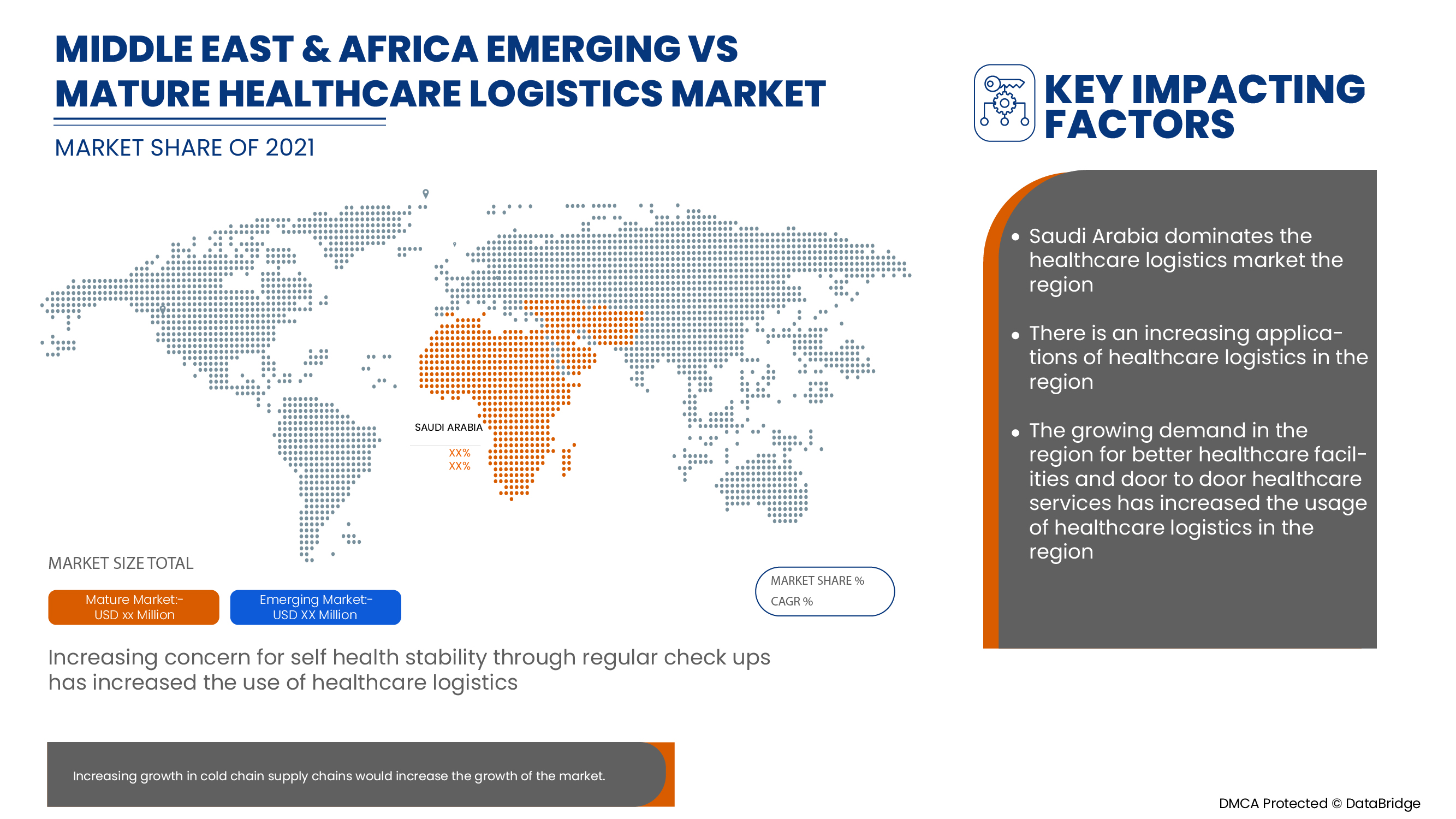

Healthcare logistics Market Regional Analysis/Insights

The healthcare logistics market is analysed and market size insights and trends are provided by country, type, application, components, temperature type, logistics, logistics type and end user as referenced above.

The countries covered in the healthcare logistics market report are Saudi Arabia, South Africa, U.A.E, Israel, Egypt and Rest of Middle East and Africa in Middle East and Africa.

Saudi Arabia dominates the Middle East and Africa healthcare logistics market, this is attributable to the platform for consumers to freely purchase healthcare products and use them according to their requirements. In addition, high benefits offered by third party logistics for consumers to freely purchase healthcare products and use them according to their requirements in the region. The demand in this region is projected to be driven by the increased demand for forward logistics and reverse logistics.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Healthcare logistics Market Share Analysis

The healthcare logistics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to healthcare logistics market.

Some of the major players operating in the healthcare logistics market are - Agility, C.H. Robinson, AmerisourceBergen Corporation, Air Canada, CEVA logistics, DB Schenker, Deutsche Post DHL Group, FedEx, Burris Logistics, United Parcel Service of America, Inc., VersaCold Logistics Services, Abbott among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID GROWTH IN E-COMMERCE SECTOR

6.1.2 HIGH BENEFITS OFFERED BY THIRD PARTY LOGISTICS

6.1.3 RISING GROWTH IN CROSS BORDER TRADES AND MIDDLE EAST & AFRICAIZATION

6.1.4 INCREASE IN GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATER WAYS

6.2 RESTRAINTS

6.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

6.2.2 HIGH COST ASSOCIATED WITH REVERSE LOGISTICS

6.2.3 CONCERNS RELATED TO INVENTORY MANAGEMENT IN HEALTHCARE LOGISTICS

6.3 OPPORTUNITIES

6.3.1 INCLINATION TOWARDS DIGITALIZATION OF THE SECTOR

6.3.2 ADOPTION OF CLOUD BASED LOGISTICS SOLUTIONS

6.3.3 INCREASING GROWTH INVESTMENTS AND EXPANSIONS MADE BY THE MARKET PLAYERS

6.3.4 EMERGENCE OF NEW ADVANCED TECHNOLOGIES

6.4 CHALLENGES

6.4.1 INADEQUATE LABOUR RESOURCES TO HANDLE RETURN

6.4.2 FREQUENT DELAYS IN DELIVERY 0F PRODUCTS DUE TO VARIOUS TECHNICAL FACTORS

7 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-COLD CHAIN

7.3 COLD CHAIN

7.3.1 ELECTRICAL REFRIGERATION

7.3.2 DRY ICE

7.3.3 GEL PACKS

7.3.4 LIQUID NITROGEN

7.3.5 OTHERS

8 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 SENSORS & DATA LOGGERS

8.2.2 NETWORKING DEVICES

8.2.3 BARCODE SCANNERS

8.2.4 RFID DEVICES

8.2.5 TELEMATICS & TELEMETRY DEVICES

8.2.6 OTHERS

8.3 SERVICES

8.3.1 DIRECT DISTRIBUTION FOR RETAILERS

8.3.2 AFTER SALES LOGISTICS

8.3.3 REVERSE LOGISTICS

8.3.4 OTHERS

8.4 SOFTWARE

8.4.1 CLOUD BASED

8.4.2 ON-PREMISE

9 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE

9.1 OVERVIEW

9.2 AMBIENT

9.3 CHILLED/REFRIGERATED

9.4 FROZEN

9.5 CRYOGENIC

10 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS

10.1 OVERVIEW

10.2 TRANSPORTATION

10.3 PACKAGING

10.4 STORAGE

10.5 OTHERS

11 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE

11.1 OVERVIEW

11.2 OVERLAND LOGISTICS

11.3 SEA FREIGHT LOGISTICS

11.4 AIR FREIGHT LOGISTICS

11.5 CONTRACT LOGISTICS

12 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 BRANDED DRUGS

12.3 GENERIC DRUGS

13 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 MEDICINE

13.2.1 CHEMICAL MEDICINES

13.2.2 SPECIALITY MEDICINES

13.2.2.1 RECOMBINANT THERAPEUTIC PROTEINS

13.2.2.2 REGENERATIVE MEDICINE

13.2.2.2.1 STEM CELL THERAPY

13.2.2.2.2 GENE THERAPY

13.2.2.3 OTHERS

13.2.3 BIO MEDICINES

13.2.4 OTHERS

13.3 BULK DRUG HANDLERS

13.4 VACCINE

13.5 CHEMICAL & OTHER RAW MATERIAL

13.6 BIOLOGICAL MATERIAL AND ORGANS

13.7 HAZARDOUS CARGO

13.8 OTHERS

14 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY END USER

14.1 OVERVIEW

14.2 BIOPHARMACEUTICAL COMPANIES

14.3 HOSPITALS & CLINICS

14.4 RESEARCH INSTITUTES

14.5 OTHERS

15 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET BY GEOGRAPHY

15.1 MIDDLE EAST & AFRICA

16 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SF EXPRESS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 FEDEX

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 SERVICE PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 DB SCHENKER

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 C.H. ROBINSON WORLDWIDE, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 SERVICE PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NIPPON EXPRESS CO., LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ABBOTT.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ADALLEN PHARMA

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AGILITY

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 AGRO MERCHANTS GROUP

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 AIR CANADA

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 SERVICE PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 ALLOGA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 AMERISOURCEBERGEN CORPORATION

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 BDP INTERNATIONAL

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 BURRIS LOGISTICS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 CAVALIER LOGISTICS MANAGEMENT II, INC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 CEVA LOGISTICS

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 CRYOPDP

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 DEUTSCHE POST AG

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 EMERALD FREIGHT

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 ENTERO HEALTHCARE

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 INGRAM MICRO SERVICES

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 KERRY LOGISTICS NETWORK LIMITED

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 SERVICE PORTFOLIO

18.23.4 RECENT DEVELOPMENTS

18.24 NICHIREI CORPORATION

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 OIA MIDDLE EAST & AFRICA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 PCI PHARMA SERVICES

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 PENSKE

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENTS

18.28 TOTAL QUALITY LOGISTICS, LLC

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

18.29 TRANSPLACE

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENTS

18.3 UNITED PARCEL SERVICE OF AMERICA, INC.

18.30.1 COMPANY SNAPSHOT

18.30.2 REVENUE ANALYSIS

18.30.3 SERVICES PORTFOLIO

18.30.4 RECENT DEVELOPMENTS

18.31 VERSACOLD LOGISTICS SERVICES

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENTS

18.32 X2 GROUP

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENTS

18.33 YUSEN LOGISTICS CO., LTD.

18.33.1 COMPANY SNAPSHOT

18.33.2 PRODUCT PORTFOLIO

18.33.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA NON-COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY STORAGE TECHNIQUES, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA HARDWARE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HARDWARE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SERVICES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 9 MIDDLE EAST & AFRICA SERVICES IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SOFTWARE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOFTWARE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA AMBIENT IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CHILLED/REFRIGERATED IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 15 MIDDLE EAST & AFRICA FROZEN IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 16 MIDDLE EAST & AFRICA CRYOGENIC IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 17 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TRANSPORTATION IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PACKAGING IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 20 MIDDLE EAST & AFRICA STORAGE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 22 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OVERLAND LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SEA FREIGHT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 25 MIDDLE EAST & AFRICA AIR FREIGHT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA CONTRACT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA BRANDED DRUGS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA GENERIC DRUGS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 30 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD

TABLE 31 MIDDLE EAST & AFRICA MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA SPECIALITY MEDICINES IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA REGENERATIVE MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA BULK DRUG HANDLERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 36 MIDDLE EAST & AFRICA VACCINE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CHEMICAL & OTHER RAW MATERIAL IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 38 MIDDLE EAST & AFRICA BIOLOGICAL MATERIAL AND ORGANS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA HAZARDOUS CARGO IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 41 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA BIOPHARMACEUTICAL COMPANIES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA HOSPITAL & CLINICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 44 MIDDLE EAST & AFRICA RESEARCH INSTITUTES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: MIDDLE EAST & AFRICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 11 INCREASING GROWTH IN MIDDLE EAST & AFRICAIZATION LEADING TO HIGH FREIGHT TRANSPORTATION IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NON-COLD CTYPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET

FIGURE 15 ECONOMIES BY SIZE OF MERCHANDISE TRADE, 2020

FIGURE 16 TONNAGE LOADED AND UNLOADED, 2019 (BILLIONS OF TONS)

FIGURE 17 CONTAINER PORT TRAFFIC BY REGIONS

FIGURE 18 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY COMPONENTS, 2021

FIGURE 20 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS, 2021

FIGURE 22 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY PRODUCT, 2021

FIGURE 24 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2021

FIGURE 25 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY END USER, 2021

FIGURE 26 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY TYPE (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.