Middle East and Africa Health Insurance Market By Type (Products, Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assistance, Others), Level of Coverage (Bronze, Silver, Gold, Platinum), Service Providers (Public Health Insurance Providers, Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), Others), Demographics (Adults, Minors, Senior citizens), Coverage Type (Lifetime Coverage, Term Coverage), End User (Corporates, Individuals, Others), Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics, Others), Country (Saudi Arabia, U.A.E, Egypt, Israel South Africa, Rest of Middle East and Africa and South America), Market Trends and Forecast to 2027

Middle East and Africa Health Insurance Market Analysis and Size

Health insurance policy consists of several types of features and benefits. It provides financial coverage to policyholder against certain treatment. Health insurance policy offers advantages including cashless hospitalization, coverage of pre and post-hospitalization, reimbursement, and various add-ons.

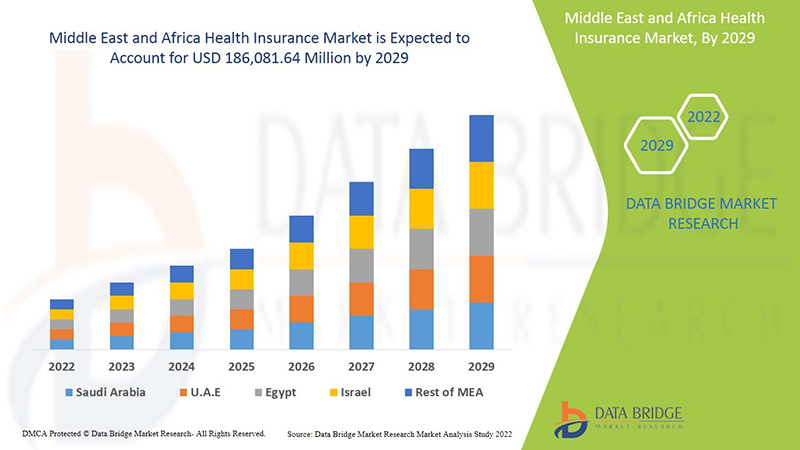

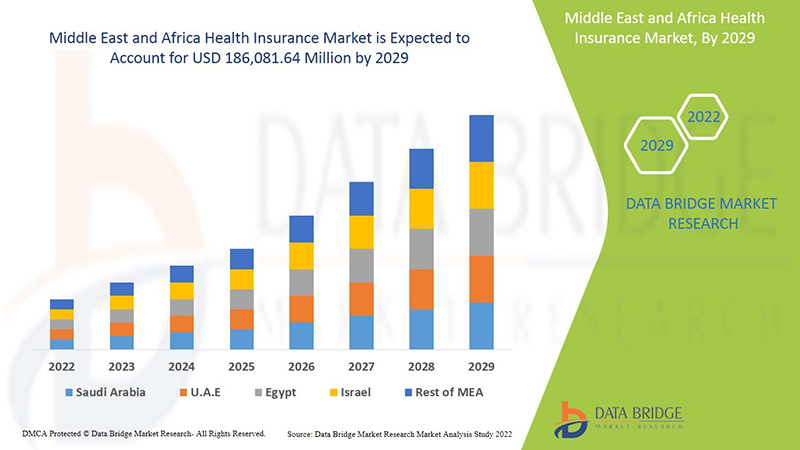

Increasing costs for medical services and the growing number of day care procedures are some of the drivers boosting health insurance demand in the market. Data Bridge Market Research analyses that the health insurance market is expected to reach the value of USD 186,081.64 million by the year 2029, at a CAGR of 3.7% during the forecast period. "Corporates" accounts for the most prominent end-user segment in the respective market owing to rise in the demand for group health insurance by corporates. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Pricing in USD

|

|

Segments Covered

|

Type (Product, Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assistance, Others), Level of Coverage (Bronze, Silver, Gold, Platinum), Service Providers (Public Health Insurance Providers, Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), Others), Demographics (Adults, Minors, Senior Citizens), Coverage Type (Lifetime Coverage, Term Coverage), End User (Corporates, Individuals, Others) Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics Others)

|

|

Countries Covered

|

Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, Rest of Middle East and Africa.

|

|

Market Players Covered

|

Some of the major players operating in the market are Bupa (London, U.K.), Now Health International (Hong Kong, China), Cigna (Connecticut, U.S.), Aetna Inc. (a subsidiary of CVS Health) (Connecticut, U.S.), AXA (Paris, France), HBF Health Limited (Perth, Australia), Vitality (a subsidiary of Discovery Limited) (London, U.K.), Centene Corporation (Missouri, U.S.), International Medical Group, Inc. (a subsidiary of Sirius International Insurance Group Ltd.) (Indiana, U.S.), Anthem Insurance Companies, Inc. (a subsidiary of Anthem, Inc.) (Indiana, U.S.), Broadstone Corporate Benefits Limited (London, U.K.), Allianz Care (a subsidiary of Allianz SE) (Paris, France), HealthCare International Middle East and Africa Network Ltd (London, U.K.), Assicurazioni Generali S.P.A. (Trieste, Italy), Aviva (London, U.K.), Vhi Group (Dublin, Ireland), UnitedHealth Group (Minnesota, U.S.), MAPFRE (Majadahonda, Spain), AIA Group Limited (Hong Kong), Oracle (California, U.S.) among others.

|

Market Definition

Health insurance is a type of insurance that provide the coverage of all type of surgical expenses as well as medical treatment incurred from the illness or injury. It applies to a comprehensive or limited range of medical services providing the coverage of full or partial costs of specific services. It provides financial support to the policy holder as it covers all the medical expenses when the policyholder is hospitalized for the treatment. It also covers pre as well as post hospitalization expenses.

- In the health insurance plan several types of coverage are available which is cashless or reimbursement claim. Cashless benefit is available when the policyholder takes treatment from the network hospitals of the insurance company. If the policyholder takes treatment from the hospitals which are not in the list network, in that case, policyholder meets all the medial expenses and then claims for the reimbursement in the insurance company by submitting all the medical bills.

Regulatory Framework

- Insurance and reinsurance in the Saudi Arabia is governed by the Law On Supervision of Co-operative Insurance Companies, Royal Decree No M/32 of 2 Jumada Thani 1424 Hejra (31 July 2003) (Insurance Law). The Insurance Law applies to all registered companies undertaking insurance business in Saudi Arabia including insurance brokers and insurance service providers. The Insurance Law is supplemented by the Implementing Regulations 2003 published by the Saudi Arabian Monetary Agency (SAMA) on 23 April 2004 (Implementing Regulations) and other regulations issued by SAMA.

COVID-19 had a Minimal Impact on Health Insurance Market

COVID-19 impacted various manufacturing and service providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Though, the imbalance between demand and supply and its impact on pricing is considered short-term and is expected to recover as this pandemic comes to an end. Due to outbreak of covid19 throughout the globe, the demand for health insurance has increased tremendously. Also, the fear of pandemic and the increased cost for medical services helped the health insurance market grow during pandemic. In addition, health insurance companies introduced packages and solutions for covering the medical costs for treating covid19 infected insurers. Thus, even though the other industries suffered a lot during covid19 outbreak, the health insurance industry was growing significantly.

The Market Dynamics of the Health Insurance Market Include:

Drivers/Opportunities in the Health Insurance Market

- Increasing Cost of Medical Services

Health insurance provides financial support in cases of serious sickness or accident. Increasing medical services’ costs for surgeries and hospital stays has created a new financial epidemic around the world. The cost of medical services is comprised of the cost of surgery, doctor fee, hospital stay cost, cost of the emergency room, diagnostic testing cost, among others. Therefore, this increase in the cost of medical services propels the growth of the market.

- Growing Number of Daycare Procedures

Daycare procedures are those types of medical procedure or surgery that primarily requires less stay time in the hospitals. In the daycare procedure patients are required to stay in the hospital for a short period. Most of the health insurance companies are now covering the procedures of daycare in their insurance plans, and for the claim of such types of surgery, there is no compulsion on spending 24 hours in the hospital, which is the minimum stay in the hospital to claim insurance. While most of the health insurance plans cover hospital stays and major surgeries, the policyholders can also claim daycare procedures under their health insurance policy, which propels the demand of the market.

- Mandatory Provision of Healthcare Insurance in Public and Private Sectors

Buying a healthcare insurance policy is a mandatory provision for the employees in the public as well as the private sector. Health insurance offers key medical benefits which the employee can avail of while working in a corporate. In case of any emergency or medical issues, the health insurance cover is highly useful to meet treatment expenses. The employee’s health insurance is an extended benefit, given by the individual employer to their employees. The health insurance provided not only covers the employee but also covers their family members under the same policy plan. Also, in certain cases, the employer may pay a part of a premium or insurance coverage of the health insurance policy.

- Advantages of Health Insurance Policies

In the health insurance plans, the policyholder gets the reimbursement insured for their medical expenses such as hospitalization, surgeries, treatments that arise from the injuries. A health insurance policy is a type of agreement between the policyholder and insurance company, where the insurance company agrees to guarantee payment for the treatment costs in case of future medical issues, and the policyholder agrees to pay the amount of premium according to the insurance plan. Thus, the advantages of health insurance policies increases the growth opportunities for Middle East and Africa health insurance market.

- Increasing Healthcare Expenditure

Spending on health is growing faster around the world. According to the World Health Organization (WHO) report, global health spending has an upward trajectory growth. Global spending on health more than doubled over the past two decades, reaching USD 8.5 trillion in 2019, or 9.8% of global GDP. However, it was unequally distributed, with high-income countries accounting for approximately 80% of the world’s health spending. Health spending in low-income countries was financed primarily by out-of-pocket spending (OOPS; 44%) and external aid (29%), while government spending dominated in high-income countries (70%). Thus, the increasing healthcare expenditure is expected to act as opportunity in the Middle East and Africa health insurance market.

Restraints/Challenges Faced by the Health Insurance Market

- High cost of Insurance Premiums

Health insurance covers all types of medical treatment costs. It provides financial support to the policyholder since it covers all the medical expenses when the policyholder is hospitalized for the treatment. Health insurance also covers pre as well as post-hospitalization expenses. To purchase health insurance, the policyholder has to pay insurance premiums regularly to keep the health insurance policy active. The cost of insurance premium is high in the majority of cases based on the insurance plan, which is hampering the growth of the market.

- Lack of Awareness Regarding the Benefits of Health Insurance

In the field of healthcare, a large portion of the world population is still not aware of the benefits of health insurance policies. The expenses of medical care are increasing across the world with advancements made in the field. Through the advancement in technology, the healthcare sector is one of the growing segments, however, the penetration rate of health insurance policies remains low due to a lack of awareness regarding the benefits offered by them.

This health insurance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the health insurance market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In August 2020, International Medical Group, Inc. (IMG) had enhanced their product offerings to support organizations with the necessary planning and research for safe international travel. Company’s unique, new assistance services were designed to support clients as they make plans for 2020 and beyond. This development helped company to sustain and thrive in pandemic.

- In June 2021, Vitality has announced it has partnered with Samsung UK to integrate Samsung Health into the Vitality Programme, providing members with more ways to track their activity and improve their health. The new partnership with Samsung will unlock the full benefits of the Vitality Programme to Android users as members will be able to link their Samsung Health profile to their Vitality Member Zone account to automatically capture daily steps and heart rate activity to earn Vitality activity points.

Middle East and Africa Health Insurance Market Scope

The health insurance market is segmented on the basis of type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Product

- Solutions

On the basis of type, the health insurance market is segmented into product and solutions. The product segment is expected to dominate the Middle East and Africa health insurance market due to the high number of premiums sold across the globe.

Services

- Inpatient Treatment

- Outpatient Treatment

- Medical Assistance

- Others

On the basis of services, the health insurance market is segmented into inpatient treatment, outpatient treatment, medical assistance and others. The inpatient treatment segment is expected to dominate the Middle East and Africa health insurance market because most of the premium plans are used only in inpatient treatment.

Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

On the basis of level of coverage, the health insurance market is segmented into bronze, silver, gold, and platinum. The bronze segment is expected to dominate the Middle East and Africa health insurance market due to the growing adoption of this term plan in mid-class all over the world.

Service Providers

- Private Health Insurance Providers

- Public Health Insurance Providers

On the basis of service providers, the health insurance market is segmented into private health insurance providers and public health insurance providers. The public health insurance providers segment is expected to dominate the Middle East and Africa health insurance market because of the high penetration of public funded health insurance in developed economies.

Health Insurance Plans

- Point Of Service (POS)

- Exclusive Provider Organization (EPOS)

- Indemnity Health Insurance

- Health Savings Account (HSA)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS)

- Preferred Provider Organization (PPO)

- Health Maintenance Organization (HMO)

- Others

On the basis of health insurance plans, the health insurance market is segmented into point of service (POS), exclusive provider organization (EPOS), indemnity health insurance, health savings account (HSA), qualified small employer health reimbursement arrangements (QSEHRAS), preferred provider organization (PPO), health maintenance organization (HMO), and others. Point of service (POS) segment is expected to dominate the Middle East and Africa health insurance market due to high benefits offered by the plan compared to traditional term plan. In addition, growing awareness is also boosting the demand during the forecast period.

Demographics

- Adults

- Minors

- Senior Citizens

On the basis of demographics, the market is segmented into adults, minors, and senior citizens. The adults segment is expected to dominate the Middle East and Africa health insurance market because of the large adult pool of customers in the market.

Coverage Type

- Lifetime Coverage

- Term Coverage

On the basis of coverage type, the market is segmented into lifetime coverage and term coverage. Lifetime coverage segment is expected to dominate the Middle East and Africa health insurance market on account of high demand amongst adult population in developed and developing countries.

End User

- Corporates

- Individuals

- Others

On the basis of end user, the market is segmented into corporates, individuals, and others. The corporates segment is expected to dominate the Middle East and Africa health insurance market due to strict regulation and high spending on health insurance.

Distribution Channel

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

On the basis of distribution channel, the market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics and others. Direct sales segment is expected to dominate the Middle East and Africa health insurance market due to the availability of various third party vendors and their wide acceptance in the domestic market.

Health Insurance Market Regional Analysis/Insights

The health insurance market is analyzed and market size insights and trends are provided by country, type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel as referenced above.

The countries covered in the health insurance market report are the Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, Rest of Middle East and Africa.

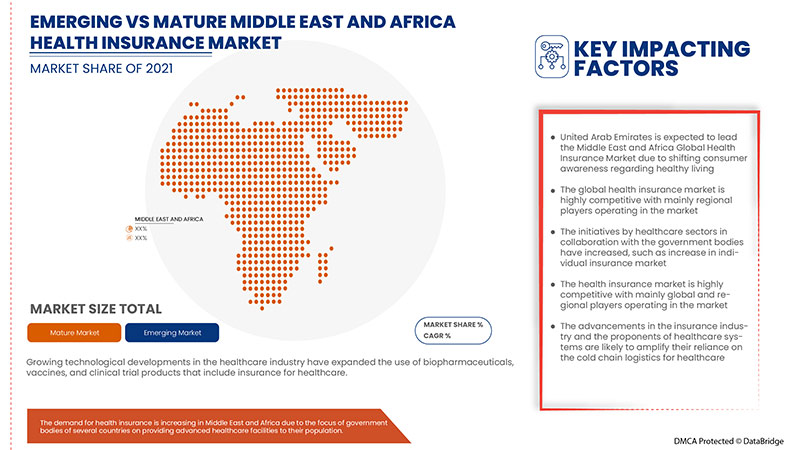

United Arab Emirates in Middle East and Africa dominates the health insurance market because of the high disposable income of consumers. UAE is followed by Saudi Arabia and is expected to witness significant growth during the forecast period of 2022 to 2029 due to growing demand for health insurance from corporates sector in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Health Insurance Market Share Analysis

The health insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to health insurance market.

Some of the major players operating in the health insurance market are Bupa, Now Health International, Cigna, Aetna Inc. (a subsidiary of CVS Health), AXA, HBF Health Limited, Vitality (a subsidiary of Discovery Limited), Centene Corporation, International Medical Group, Inc. (a subsidiary of Sirius International Insurance Group Ltd.), Anthem Insurance Companies, Inc. (a subsidiary of Anthem, Inc.), Broadstone Corporate Benefits Limited, Allianz Care (a subsidiary of Allianz SE), HealthCare International Middle East and Africa Network Ltd, Assicurazioni Generali S.P.A., Aviva, Vhi Group, UnitedHealth Group, MAPFRE, AIA Group Limited, Oracle among others

SKU-