Global Health Insurance Market, By Type (Product and Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assurance, and Others), Level of Coverage (Bronze, Silver, Gold, and Platinum), Service Providers (Public Health Insurance Providers and Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Preferred Provider Organization (PPO), Indemnity Health Insurance, Health Maintenance Organization (HMO), Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), and Others), Demographics (Adults, Minors, and Senior Citizens), Coverage Type (Lifetime Coverage and Term Coverage), End User (Corporates, Individuals, and Others), Distribution Channel (Direct Sales, Financial Institutions, E-Commerce, Hospitals, Clinics, and Others) - Industry Trends and Forecast to 2031.

Health Insurance Market Analysis and Size

Health insurance policy consists of several types of features and benefits. It provides financial coverage to policyholders against certain treatments. It offers advantages including cashless hospitalization, coverage of pre and post-hospitalization, reimbursement, and various add-ons.

Increasing costs for medical services and the growing number of daycare procedures are some of the drivers boosting health insurance demand in the market. With the increasing demand for health insurance globally, major companies are expanding their product portfolios in different countries to strengthen their presence for these products and solutions in the market. However, the major restraint that is impacting the market is the high cost of premiums. Also, the strict documentation process for claim reimbursement is a restraining factor for market growth.

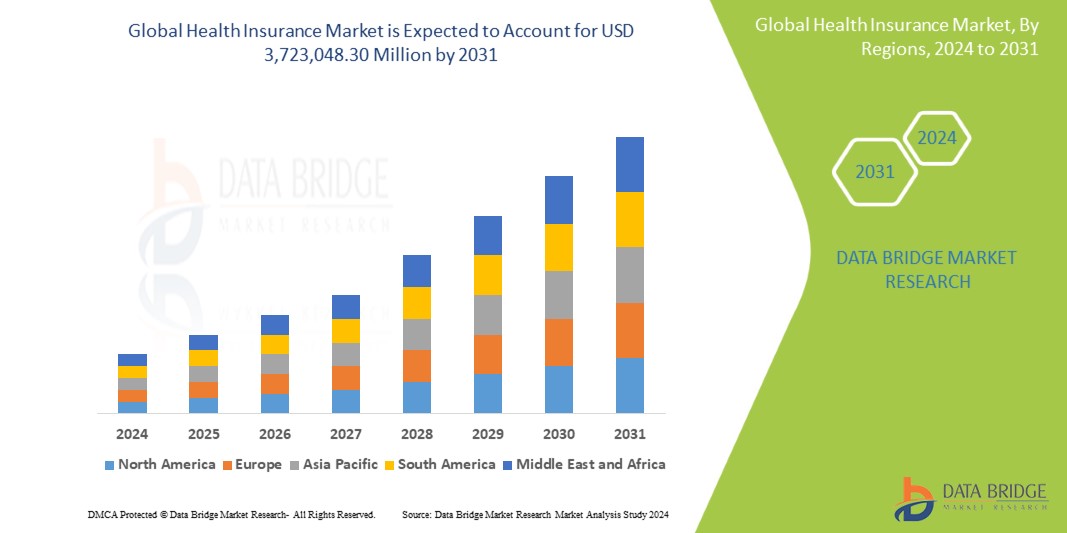

Data Bridge Market Research analyzes that the global health insurance market is expected to reach USD 3,723,048.30 million by 2031 from USD 2,035,166.07 million in 2023, growing with a CAGR of 7.9% in the forecast period of 2024 to 2031.

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Year

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Type (Product and Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assurance, and Others), Level of Coverage (Bronze, Silver, Gold, and Platinum), Service Providers (Public Health Insurance Providers and Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Preferred Provider Organization (PPO), Indemnity Health Insurance, Health Maintenance Organization (HMO), Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), and Others), Demographics (Adults, Minors, and Senior Citizens), Coverage Type (Lifetime Coverage and Term Coverage), End User (Corporates, Individuals, and Others), Distribution Channel (Direct Sales, Financial Institutions, E-Commerce, Hospitals, Clinics, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Italy, Russia, Spain, Turkey, Belgium, Netherlands, Switzerland, Rest of Europe, China, Japan, India, South Korea, Australia and New Zealand, Singapore, Thailand, Indonesia, Philippines, Malaysia, Hong Kong, Taiwan, Rest of Asia-Pacific, Brazil, Argentina Rest of South America, South Africa, Saudi Arabia, United Arab Emirates, Israel, Egypt, and Rest of Middle East and Africa

|

|

Market Players Covered

|

Cigna Healthcare, Centene Corporation, Allianz Care (A Subsidiary of Allianz), Aetna Inc. (A Subsidiary of CVS Health), Anthem Insurance Companies, Inc. (A subsidiary of Elevance Health), AXA, Broadstone Corporate Benefits Limited, Bupa, HealthCare International Global Network Ltd., HBF Health Limited, Now Health International, Oracle, UnitedHealth Group, Vhi Group, Vitality (A Subsidiary of Discovery Ltd), and International Medical Group (A Subsidiary of Sirius Point) among others

|

Market Definition

Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured individual. It is a contract between the policyholder (the person who purchases the insurance) and the insurance company. In exchange for regular premium payments, the insurance company agrees to provide fi nancial protection by covering the costs of certain healthcare services and treatments.

Global Health Insurance Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Cost of Medical Services

Health insurance provides financial support in cases of serious sickness or accident. Increasing medical services’ costs for surgeries and hospital stays has created a new financial epidemic around the world. The cost of medical services is comprised of the cost of surgery, doctor fees, hospital stay cost, cost of the emergency room, and diagnostic testing costs among others.

According to the estimates by NCBI, each person would have to spend INR 1,713 per year for universal healthcare. The use of branded medications and medical supplies can raise this cost by 24%. This indicates that to provide healthcare to everyone in India, the government must spend 3.8% of its GDP for this purpose 60% of all bankruptcies are related to medical expenses due to such high medical service costs, especially for those families who do not have health insurance or have limited budgets. The high cost of medical services has burdened the patients. However, health insurance provides financial support to the patients since it funds all the medical services’ costs according to the terms and conditions of the insurance plan. Therefore, this increase in the cost of medical services propels the market growth.

- Mandatory Provision of Health Insurance in the Private and Public Sectors

Opting for a health insurance policy is a mandatory provision for employees in the public and private sectors. Health insurance offers key medical benefits that the employee can avail of while working in the corporate sector. In case of any emergency or medical issues, health insurance cover is highly useful to meet treatment expenses.

The employee’s health insurance is an extended benefit, given by the individual employer to their employees. The health insurance provided not only covers the employee but also covers their family members under the same policy plan. Also, in certain cases, the employer may pay a part of a premium or insurance coverage of the health insurance policy.

Opportunity

- Advantages of Health Insurance Policies

In health insurance plans, the policyholder gets reimbursement for their medical expenses such as hospitalization, surgeries, and treatments that arise from the injuries. A health insurance policy is a type of agreement between the policyholder and the insurance company, where the insurance company agrees to guarantee payment for the treatment costs in case of future medical issues, and the policyholder agrees to pay the amount of premium according to the insurance plan.

The health insurance policy provides access to the best healthcare. A good insurance policy should offer comprehensive coverage. The benefits and advantages of health insurance policies are framed based on the needs of individuals, families, and senior citizens. Increasing benefits and advantages of health insurance policies are boosting the demand for health insurance among people.

Restraint/Challenge

- Strict Documentation Process for Claim Reimbursement

Health insurance consists of two types of insurance covers such as cashless and claim reimbursement. The insurance company provides a list of hospitals that are a part of the network or tie-ups with the insurance company.

If the policyholder is treated in any of the network hospitals, they will get the benefits of the cashless procedure. In the cashless procedure, hospitals take approval from the insurance company by verifying the details of the patient and the policyholder does not need to pay any amount for their treatment to the hospital.

Recent Developments

- In March 2022, Broadstone Corporate Benefits Limited acquired the clients of Charterhouse Consultancy, which is an independent pensions administration company specializing in smaller trust-based occupational pension schemes. This has strengthened Broadstone’s position in the marketplace and its commitment and offering to the smaller schemes market

- In January 2021, Allianz Care officially began its eight-year worldwide partnership with the Olympic & Paralympic Movements, building on a collaboration with the Paralympic Movement since 2006. This development acted as a strategic branding and helped the company build its brand image

Global Health Insurance Market Scope

The global health insurance market is segmented into nine notable segments based on type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel.

Type

- Product

- Solutions

On the basis of type, the market is segmented into product and solutions.

Services

- Inpatient Treatment

- Outpatient Treatment

- Medical Assurance

- Others

On the basis of services, the market is segmented into inpatient treatment, outpatient treatment, medical assurance, and others.

Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

On the basis of level of coverage, the market is segmented into bronze, silver, gold, and platinum.

Service Providers

- Public Health Insurance Providers

- Private Health Insurance Providers

On the basis of service providers, the market is segmented into public health insurance providers and private health insurance providers.

Health Insurance Plans

- Point of Service (POS)

- Exclusive Provider Organization (EPOS)

- Preferred Provider Organization (PPO)

- Indemnity Health Insurance

- Health Maintenance Organization (HMO)

- Health Savings Account (HSA)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS)

- Others

On the basis of health insurance plans, the market is segmented into Point of Service (POS), Exclusive Provider Organization (EPOS), Preferred Provider Organization (PPO), indemnity health insurance, Health Maintenance Organization (HMO), Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), and others.

Demographics

- Adults

- Minors

- Senior Citizens

On the basis of demographics, the market is segmented into adults, minors, and senior citizens.

Coverage Type

- Lifetime Coverage

- Term Coverage

On the basis of coverage type, the market is segmented into lifetime coverage and term coverage.

End User

- Corporates

- Individuals

- Others

On the basis of end user, the market is segmented into corporates, individuals, and others.

Distribution Channel

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

On the basis of distribution channel, the market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics, and others.

Global Health Insurance Market Regional Analysis/Insights

The global health insurance market is segmented into nine notable segments based on type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel.

The countries covered in the global health insurance market are U.S., Canada, Mexico, Germany, France, U.K., Italy, Russia, Spain, Turkey, Belgium, Netherlands, Switzerland, rest of Europe, China, Japan, India, South Korea, Australia and New Zealand, Singapore, Thailand, Indonesia, Philippines, Malaysia, Hong Kong, Taiwan, rest of Asia-Pacific, Brazil, Argentina rest of South America, South Africa, Saudi Arabia, United Arab Emirates, Israel, Egypt, and rest of Middle East and Africa.

North America is expected to dominate the market due to the increasing cost of treatment. The U.S. is expected to dominate in the North America region due to the rising concerns regarding the health of the population and demographic trends. Germany is expected to dominate in the Europe region due to the government policies and regulations. China is expected to dominate in the Asia-Pacific region due to the rise in middle-class population and income levels.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and global brands, and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Health Insurance Market Share Analysis

The global health insurance market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major market players operating in the global health insurance market are Cigna Healthcare, Centene Corporation, Allianz Care (A Subsidiary of Allianz), Aetna Inc. (A Subsidiary of CVS Health), Anthem Insurance Companies, Inc. (A subsidiary of Elevance Health), AXA, Broadstone Corporate Benefits Limited, Bupa, HealthCare International Global Network Ltd., HBF Health Limited, Now Health International, Oracle, UnitedHealth Group, Vhi Group, Vitality (A Subsidiary of Discovery Ltd), and International Medical Group (A Subsidiary of Sirius Point) among others.

SKU-