Middle East Electric Vehicle Market Analysis and Insights

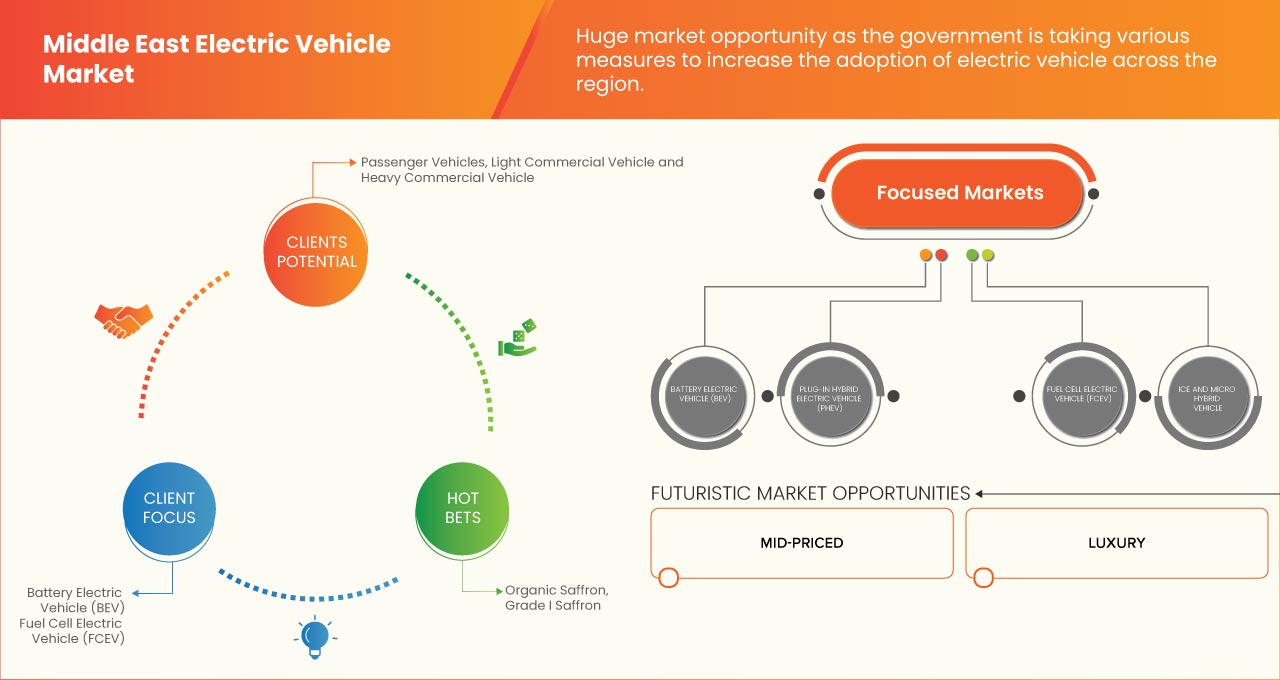

Electric vehicles are the promising renewable substitute to the gasoline power based vehicles for the protection of the environment, and many governments are taking initiatives to promote electric vehicles and are providing tax rebates, and redemption. The rise in the market of the electric vehicles in Middle East is because the technology is upgrading at a fast rate, is making the rise in the demand for electric vehicle in the market. Some of the factors that are driving the market are increasing demand for electric vehicles, incentive & subsidies by government for electric vehicles, increasing environmental concerns. However, high upfront cost is hampering the growth of the market.

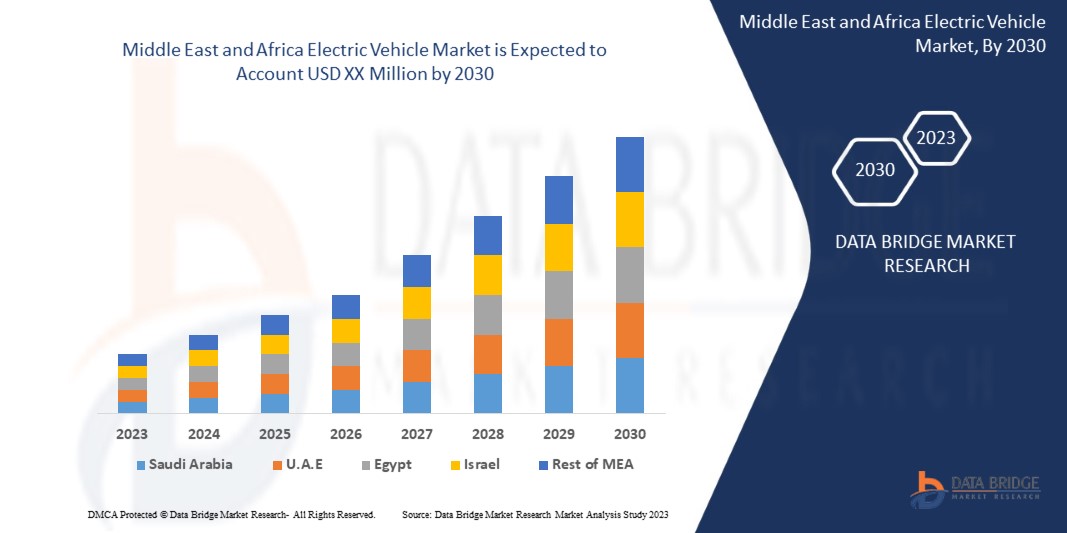

Data Bridge Market Research analyses that the Middle East electric vehicle market will grow at a CAGR of 28.1% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in Million, Volumes in Thousand Units, Pricing in USD |

|

Segments Covered |

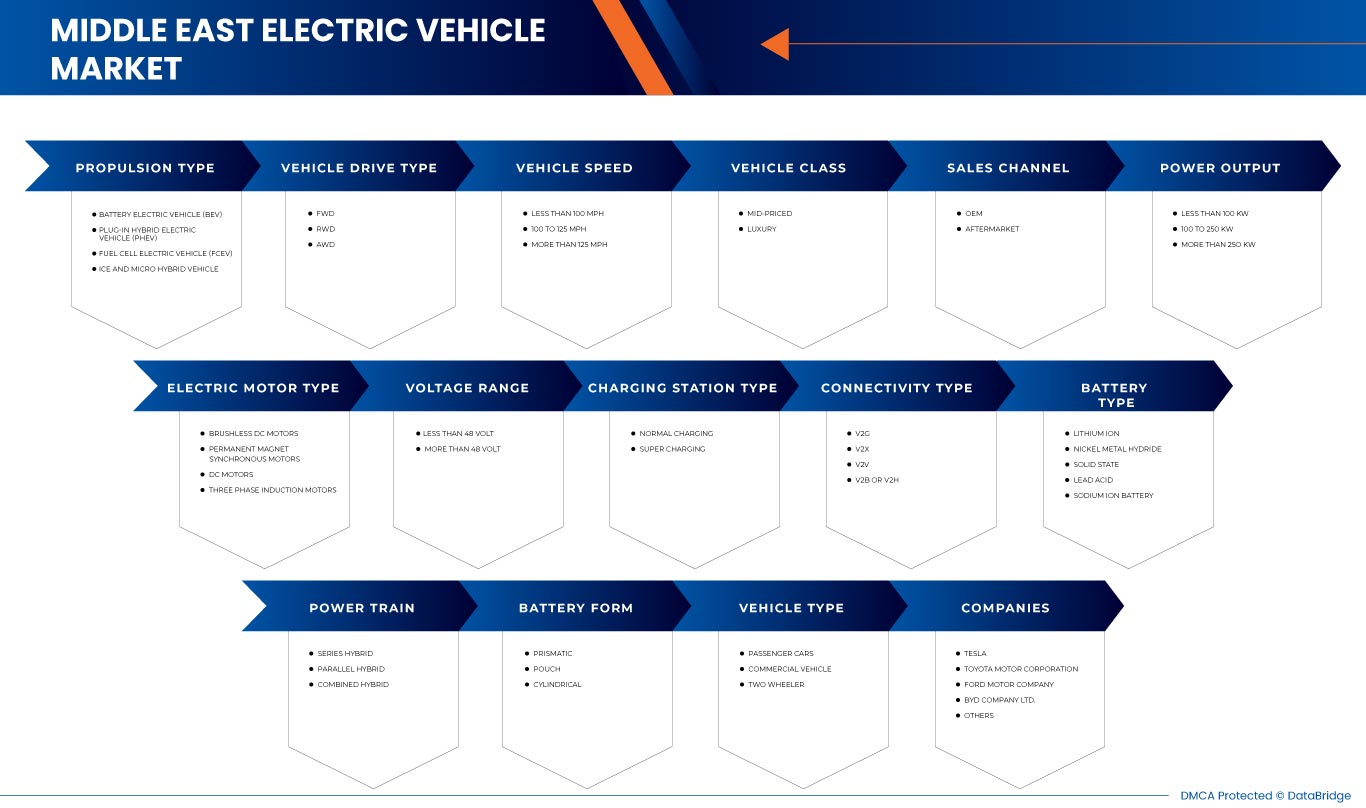

By Propulsion Type (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV) and ICE and Micro Hybrid Vehicle), Vehicle Drive Type (FWD, RWD and AWD), Vehicle Speed (Less than 100 MPH, 100 to 125 MPH and More than 125 MPH), Vehicle Class (Mid-Priced and Luxury), Sales Channel (OEM and Aftermarket), Power Output (Less than 100 KW, 100 to 250 KW and More than 25O KW), Electric Motor Type (Brushless DC Motors, Permanent Magnet Synchronous Motors, DC Motors and Three Phase Induction Motors), Voltage Range (Less than 48 Volt and More than 48 Volt), Charging Station Type (Normal Charging and Super Charging), Connectivity Type (V2G, V2X, V2V and V2B or V2H), Power Train (Series Hybrid, Parallel Hybrid and Combined Hybrid), Vehicle Type (Passenger Cars, Commercial Vehicle and Two Wheeler), Battery Type (Lithium Ion, Nickel Metal Hydride Battery, Solid State, Lead Acid, and Sodium Ion Battery), Battery Form (Prismatic, Pouch, and Cylindrical). |

|

Countries Covered |

Saudi Arabia, U.A.E., Bahrain, Qatar, Kuwait, Oman, and Rest of Middle East. |

|

Market Players Covered |

BMW AG, Nissan Motor Co., Ltd., MITSUBISHI MOTORS CORPORATION, Hyundai Motor Company, Mercedes-Benz Group AG, Tesla, TOYOTA MOTOR CORPORATION, Ford Motor Company, BYD Motors Inc., General Motors Company, Mahindra & Mahindra Ltd., MG MOTOR, JAGUAR LAND ROVER AUTOMOTIVE PLC, Renault Group, Geely Automobile Holdings Limited., Lucid Group, Inc., among others. |

Market Definition

An electric vehicle is a vehicle that runs fully or partially on electricity. Unlike conventional vehicles that just use fossil fuels, e-vehicles use an electric motor powered by a fuel cell or batteries. E-vehicle' or 'EV' are the common terms used for an electric vehicle. In most cases, the term includes both BEVs and PHEVs. The letters BEVs stand for battery electric vehicles, while PHEVs stand for plug-in hybrid electric vehicles. An electric vehicle (EV) operates on an electric motor instead of an internal-combustion engine that generates power by burning a mix of fuel and gases. Therefore, electric vehicles are seen as a possible replacement for current-generation automobiles to address the issue of rising pollution, global warming, and depleting natural resources. The range of an electric vehicle is the distance that it can cover on a single charge.

Middle East Electric Vehicle Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

- Increase in the demand for electric vehicles

The automotive industry is showing an enormous growth over the years owing to rising demand for luxurious electric vehicles. Some of the factors driving the sales of the electric vehicles include stringent government regulations towards vehicles emissions, increasing demand of fuel-efficient, high performance and low emission.

- Incentives & subsidies by government for electric vehicles

It has been observed that governments of many specific states are raising the awareness among the citizens about the electric vehicles and providing more benefits like tax redemption or rebate. People are shifting towards more automated and technologically updated electric vehicle, as more number of electric vehicles has been observed on the roads.

Opportunity

-

Cloud based charging stations (smart electric vehicle charging)

Cloud based charging allows EV charging stations connected to the internet and constantly communicate with a central system. In case of a server failure, the cloud system simply uses one of the multiple back servers and your charging station won't even notice any change. Cloud based charging stations creates a huge opportunity as it has many benefits, like easier to connect to the user and vehicle data, performs calculations a lot faster and being easier to replace and can easily be upgraded.

Restraint/Challenge

- Lack of charging infrastructure for electric vehicles in underdeveloped countries

The major requirement for the electric vehicle to grow is the availability of proper charging stations on adequate distance. However, there is a huge shortage of infrastructural development in underdeveloped countries, which is limiting the growth of electric vehicle market. There is shortage of charging stations, and companies are not taking the initiatives to launch new electric vehicles and electric bikes because of the prevailing shortage of charging stations.

COVID-19 Impact on Electric Vehicle Market

COVID-19 highly impacted the transportation of the public. During the time of social distancing, travellers were asked to avoid travel unless it's completely necessary. Also, the behavior of individuals has certainly changed during the pandemic, which has led to a decrease in the sale of automotive vehicles. The pandemic brought a huge drop in sales for the electric vehicle market as the lockdown prevailed in most of the regions. The lockdown led manufacturers and consumers to completely stop the processes for a few months. The demand for electric vehicles faced a drastic downfall due to shut down of various automobile, transport and electronics industries. Also, global electric car sales experienced an unprecedented drop. However, things are getting normal day by day, and EV growth are now obsolete.

Manufacturers are making various strategic decisions to bounce back post COVID-19. The players are conducting multiple research and development activities to improve the performance and sales electric vehicle. With this, the companies will bring advanced electric vehicle to the market.

For instance,

- In April 2021, As per the Society of Electric Vehicle Manufacturers (SMEV) registration of all electric vehicles during year 2021 declined 20 percent against units sold in FY20. Electric two-wheelers witnessed a decline of 6 percent. Electric three-wheelers (E3W) saw a fall of 37 percent as against units sold in FY20

Thus, the COVID-19 has severely impacted the demand of electric vehicle in the market, limited supply and shortage of semiconductors and gadgets has significantly affected the supply of electric vehicle in the market.

Recent Developments

- In April 2022, TOYOTA MOTOR CORPORATION announced the launch of its all electric SUV bZ4X. It will be available with a choice between front-wheel-drive (FWD) and rear-wheel-drive (RWD), both of which will have a 71.4 kWh battery pack. Thus with this, the company will offer a SUV with longer driving range to their customers.

- In January 2022, Mercedes-Benz Group AG announced that their EQ division will launch the EQA, EQB and EQC SUVs as well as the EQE and EQS luxury sedans in the region. The cars will be sold and serviced through 36 specially appointed dealerships in the country. Thus with this, the company will expand its presence in the region.

Middle East Electric Vehicle Market Scope

The electric vehicle market is segmented based on propulsion type, vehicle drive type, vehicle speed, vehicle class, sales channel, electric motor type, power output, voltage range, charging station type, connectivity type, power train, battery form, battery type, and vehicle type. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Propulsion Type

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

- ICE And Micro Hybrid Vehicle

On the basis of propulsion type, the Middle East electric vehicle market is segmented into battery electric vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), fuel cell electric vehicle (FCEV), and ICE and micro hybrid vehicle.

Vehicle Drive Type

- FWD

- RWD

- AWD

On the basis of vehicle drive type, the Middle East electric vehicle market is segmented into FWD, RWD, and AWD.

Vehicle Speed

- Less Than 100 MPH

- 100 TO 125 MPH

- More Than 125 MPH

On the basis of vehicle speed, the Middle East electric vehicle market is segmented into less than 100 MPH, 100 To 125 MPH, and more than 125 MPH.

Vehicle Class

- Mid-Priced

- Luxury

On the basis of vehicle class, the Middle East electric vehicle market is segmented into mid-priced and luxury.

Sales Channel

- OEM

- Aftermarket

On the basis of sales channel, the Middle East electric vehicle market is segmented into OEM and aftermarket.

Electric Motor Type

- DC Motors

- Brushless DC Motors

- Permanent Magnet Synchronous Motors

- Three Phase Induction Motors

On the basis of electric motor type, the Middle East electric vehicle market is segmented into DC motors, brushless DC motors, permanent magnet synchronous motors, and three phase induction motors.

Power Output

- Less Than 100 KW

- 100 TO 250 KW

- More Than 25O KW

On the basis of power output, the Middle East electric vehicle market is segmented into less than 100 KW, 100 to 250 KW, and more than 100 KW.

Voltage Range

- Less Than 48 Volt

- More Than 48 Volt

On the basis of voltage range, the Middle East electric vehicle market is segmented into less than 48 Volt and more than 48 Volt.

Charging Station Type

- Normal Charging

- Super Charging

On the basis of charging station type, the Middle East electric vehicle market is segmented into normal charging and super charging.

Connectivity Type

- V2B OR V2H

- V2G

- V2V

- V2X

On the basis of connectivity type, the Middle East electric vehicle market is segmented into V2B OR V2H, V2G, V2V, and V2X.

Power Train

- Parallel Hybrid

- Series Hybrid

- Combined Hybrid

On the basis of power train, the Middle East electric vehicle market is segmented into parallel hybrid, series hybrid, and combined hybrid.

Vehicle Type

- Passenger Cars

- Commercial Vehicle

- Two Wheeler

On the basis of vehicle type, the Middle East electric vehicle market is segmented into passenger vehicles, commercial vehicle, and Two Wheeler.

Battery Type

- Lithium Ion

- Nickel Metal Hydride

- Solid State

- Lead Acid

- Sodium Ion Battery

On the basis of battery type, the Middle East electric vehicle market is segmented into lithium ion, nickel metal hydride, solid state, lead acid, and sodium ion battery.

Battery Form

- Prismatic

- Pouch

- Cylindrical

On the basis of battery form, the Middle East electric vehicle market is segmented into prismatic, pouch, and cylindrical.

Middle East Electric Vehicle Market Analysis

The electric vehicle market is analyzed, and market size insights and trends are provided by the propulsion type, vehicle drive type, vehicle speed, vehicle class, sales channel, electric motor type, power output, voltage range, charging station type, connectivity type, power train, vehicle type, battery type, battery form, and countries as referenced above.

Middle East electric vehicle market is covers countries such as Saudi Arabia, U.A.E., Bahrain, Qatar, Kuwait, Oman, and the Rest of the Middle East.

Saudi Arabia is expected to dominate the Middle East electric vehicle market as Saudi Arabia is a regional leader in adopting EVs. The Saudi Arabia government aims to boost its own EV use by 20 percent in the year 2021, which will help to extend EV growth and the growth of the country in the Middle East electric vehicle market. Moreover, Saudi Arabia has the largest number of EV charging stations in the Middle East region. The highest concentration of charging stations is in Dubai. Initiatives such as Dubai Green Mobility which promotes the use of low-carbon transportation, motivate their residents and businesses to use electric and hybrid vehicles is promoting the growth of EVs. Also, the Dubai Supreme Council of Energy mandated that 10 percent of all new cars in the Emirate must be electric or hybrid by 2020, and 10 percent of all cars should be green by 2030. Saudi Arabia has also established an incentive system such as free charging stations, discounted car registrations and renewal, toll exemptions, bonus warranties for EVs, free parking in certain areas and other perks to boost EV adoption in the country. All these factors were contributing to the growth of the country in the Middle East electric vehicle market.

The country section of the electric vehicle market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East Electric Vehicle Market Share Analysis

The electric vehicle market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the electric vehicle market.

Some of the major players operating in the Middle East electric vehicle market are BMW AG, Nissan Motor Co., Ltd., MITSUBISHI MOTORS CORPORATION, Hyundai Motor Company, Mercedes-Benz Group AG, Tesla, TOYOTA MOTOR CORPORATION, Ford Motor Company, BYD Motors Inc., General Motors Company, Mahindra & Mahindra Ltd., MG MOTOR, JAGUAR LAND ROVER AUTOMOTIVE PLC, Renault Group, Geely Automobile Holdings Limited., Lucid Group, Inc., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 EHAIL TECHNOLOGIES TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 EHAIL TECHNOLOGIES MARKET POSITION GRID

2.7 THE MARKET CHALLENGE MATRIX

2.8 MULTIVARIATE MODELING

2.9 VEHICLE CLASS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 XPENG INC. SWOT ANALYSIS

4.2 XPENG INC. BRAND AND COST ANALYSIS AND POSITIONING IN THE GLOBAL MARKET

4.3 OPPORTUNITIES FOR MARKET INTRODUCTION OF THE XPENG BRAND IN THE MIDDLE EAST

4.4 BRAND ANALYSIS OF XPENG INC.

4.5 PORTERS FIVE FORCE MODEL

4.6 TECHNOLOGICAL ADVANCEMENT

4.6.1 CHARGING TECHNOLOGY

4.6.2 AUTONOMOUS DRIVING

4.6.3 BATTERY TECHNOLOGY

4.7 REGULATORY STANDARDS

4.7.1 UAE

4.7.2 SAUDI ARABIA

4.8 SUPPLY CHAIN ANALYSIS

4.9 PESTLE ANALYSIS

4.9.1 POLITICAL FACTORS

4.9.2 ECONOMIC FACTORS

4.9.3 SOCIAL FACTORS

4.9.4 TECHNOLOGICAL FACTORS:

4.9.5 ENVIRONMENTAL FACTORS:

4.9.6 LEGAL FACTORS:

4.1 VENDOR SELECTION CRITERIA

4.11 COMPANY/BRAND COMPARATIVE ANALYSIS

4.11.1 BRAND COMPARATIVE ANALYSIS

4.11.2 TESLA

4.11.3 AUDI

4.11.4 TOYOTA

4.12 RAW MATERIAL PRODUCTION COVERAGE

4.13 SCENARIO-BASED ON PRODUCT ADOPTION

4.14 CONSUMER BEHAVIOUR PATTERN

4.15 FACTORS INFLUENCING THE BUYING DECISION

4.16 GOVERNMENT INCENTIVES TOWARD ELECTRIC VEHICLE

4.16.1 U.A.E.

4.17 TOP SELLING EV MODEL SALES IN 2022

4.18 PRICING ANALYSIS AND PROPOSED MANUFACTURER'S SUGGESTED RETAIL PRICE (MSRP) OF VARIOUS BRANDS OFFERING ELECTRIC VEHICLES

4.19 MARKETING STRATEGY OF MAJOR PLAYERS

4.2 SALES DATA OF ELECTRIC VEHICLES IN THE MIDDLE EAST REGION

4.21 AVAILABILITY OF CHARGING STATION INFRASTRUCTURE IN THE MIDDLE EAST REGION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR ELECTRIC VEHICLES

5.1.2 INCENTIVES & SUBSIDIES BY THE GOVERNMENT FOR ELECTRIC VEHICLES

5.1.3 INCREASE IN ENVIRONMENTAL CONCERNS

5.1.4 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

5.1.5 HIGH FLUCTUATION IN FUEL PRICES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT COST

5.2.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN THE MEA REGION

5.3 OPPORTUNITIES

5.3.1 CLOUD BASED CHARGING STATIONS (SMART ELECTRIC VEHICLE CHARGING)

5.3.2 ADOPTION OF NEW TECHNOLOGIES IN LITHIUM-ION BATTERIES

5.4 CHALLENGE

5.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

5.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

6 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE

6.1 OVERVIEW

6.2 BATTERY ELECTRIC VEHICLE (BEV)

6.2.1 LESS THAN 100 KW

6.2.2 100 TO 250 KW

6.2.3 MORE THAN 250 KW

6.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

6.3.1 LESS THAN 100 KW

6.3.2 100 TO 250 KW

6.3.3 MORE THAN 250 KW

6.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

6.4.1 LESS THAN 100 KW

6.4.2 100 TO 250 KW

6.4.3 MORE THAN 250 KW

6.5 ICE AND MICRO HYBRID VEHICLE

6.5.1 LESS THAN 100 KW

6.5.2 100 TO 250 KW

6.5.3 MORE THAN 250 KW

7 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE

7.1 OVERVIEW

7.2 FWD

7.3 RWD

7.4 AWD

8 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED

8.1 OVERVIEW

8.2 LESS THAN 100 MPH

8.3 100 TO 125 MPH

8.4 MORE THAN 125 MPH

9 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS

9.1 OVERVIEW

9.2 MID-PRICED

9.3 LUXURY

10 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 OEM

10.3 AFTERMARKET

11 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT

11.1 OVERVIEW

11.2 LESS THAN 100 KW

11.3 100 TO 250 KW

11.4 MORE THAN 250 KW

12 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE

12.1 OVERVIEW

12.2 BRUSHLESS DC MOTORS

12.3 PERMANENT MAGNET SYNCHRONOUS MOTORS

12.4 DC MOTORS

12.5 THREE PHASE INDUCTION MOTORS

13 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE

13.1 OVERVIEW

13.2 LESS THAN 48 VOLT

13.3 MORE THAN 48 VOLT

14 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE

14.1 OVERVIEW

14.2 NORMAL CHARGING

14.2.1 LEVEL 2

14.2.2 LEVEL 3

14.2.3 LEVEL 1

14.3 SUPER CHARGING

14.3.1 LEVEL 2

14.3.2 LEVEL 3

14.3.3 LEVEL 1

15 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE

15.1 OVERVIEW

15.2 V2G

15.3 V2X

15.4 V2V

15.5 V2B OR V2H

16 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN

16.1 OVERVIEW

16.2 SERIES HYBRID

16.3 PARALLEL HYBRID

16.4 COMBINED HYBRID

17 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

17.1 OVERVIEW

17.2 PASSENGER CARS

17.2.1 HATCHBACK

17.2.2 SEDAN

17.2.3 SUV

17.2.4 COUPE

17.2.5 MUV

17.2.6 SPORTS CAR

17.2.7 CONVERTIBLE

17.2.8 OTHERS

17.3 COMMERCIAL VEHICLE

17.3.1 LIGHT COMMERCIAL VEHICLE (LCV)

17.3.1.1 VANS

17.3.1.2 MINI BUS

17.3.1.3 PICK UP TRUCKS

17.3.1.4 OTHERS

17.3.2 HEAVY COMMERCIAL VEHICLE (HCV)

17.3.2.1 BUS

17.3.2.2 TRUCKS

17.4 TWO WHEELER

18 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM

18.1 OVERVIEW

18.2 PRISMATIC

18.3 POUCH

18.4 CYLINDRICAL

19 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY TYPE

19.1 OVERVIEW

19.2 LITHIUM ION

19.3 NICKEL METAL HYDRIDE

19.4 SOLID STATE

19.5 LEAD ACID

19.6 SODIUM ION BATTERY

20 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY

20.1 SAUDI ARABIA

20.2 U.A.E.

20.3 BAHRAIN

20.4 QATAR

20.5 KUWAIT

20.6 OMAN

20.7 REST OF MIDDLE EAST

21 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 XPENG INC.

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 TESLA

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENT

23.3 TOYOTA MOTOR CORPORATION

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENT

23.4 FORD MOTOR COMPANY

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 BYD COMPANY LTD

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENT

23.6 BMW AG

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENT

23.7 GEELY AUTOMOBILE HOLDINGS LIMITED

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 GENERAL MOTORS

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENT

23.9 HYUNDAI MOTOR COMPANY

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENT

23.1 JAGUAR LAND ROVER AUTOMOTIVE PLC

23.10.1 COMPANY SNAPSHOT

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 LUCID GROUP, INC.

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENTS

23.12 MERCEDES-BENZ GROUP AG

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 MAHINDRA ELECTRIC MOBILITY LIMITED

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENTS

23.14 MG MOTOR

23.14.1 COMPANY SNAPSHOT

23.14.2 PRODUCT PORTFOLIO

23.14.3 RECENT DEVELOPMENTS

23.15 MITSUBISHI MOTORS CORPORATION

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENTS

23.16 NISSAN MOTOR CO., LTD.

23.16.1 COMPANY SNAPSHOT

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT DEVELOPMENT

23.17 RENAULT GROUP

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENT

24 QUESTIONNAIRE

List of Table

TABLE 1 XPENG EV MODELS IN THE MARKET

TABLE 2 MSRP RANGE FOR XPENG EV MODELS

TABLE 3 MSRP COMPARISON AS MAKE

TABLE 4 BRAND ANALYSIS

TABLE 5 FOLLOWING ARE THE UAE STANDARDS FOR ELECTRICAL MOTOR VEHICLES:

TABLE 6 ADDITIONAL STANDARDS:

TABLE 7 COMPETITIVE EV BRANDS IN THE GLOBAL MARKET

TABLE 8 BEV PRICE TABLE

TABLE 9 PHEV PRICE TABLE

TABLE 10 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 12 MIDDLE EAST BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 14 MIDDLE EAST PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 16 MIDDLE EAST FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 18 MIDDLE EAST ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 20 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 22 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 24 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 26 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 28 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 30 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 32 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 34 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 36 MIDDLE EAST NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 38 MIDDLE EAST SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 40 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 42 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 44 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 46 MIDDLE EAST PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 48 MIDDLE EAST COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 50 MIDDLE EAST LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 52 MIDDLE EAST HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 54 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 56 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 57 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 58 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 60 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 62 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 64 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 66 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 68 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 70 SAUDI ARABIA NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 72 SAUDI ARABIA SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 74 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 75 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 76 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 77 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 78 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 79 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 80 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 81 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 82 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 83 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 84 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 85 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 86 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 87 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 88 SAUDI ARABIA BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 89 SAUDI ARABIA BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 90 SAUDI ARABIA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 91 SAUDI ARABIA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 92 SAUDI ARABIA FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 93 SAUDI ARABIA FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 94 SAUDI ARABIA ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 95 SAUDI ARABIA ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 96 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 97 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 98 SAUDI ARABIA PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SAUDI ARABIA PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 100 SAUDI ARABIA COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 SAUDI ARABIA COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 102 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 104 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 106 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 107 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 108 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 109 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 110 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 111 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 112 U.A.E. ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.A.E. ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 114 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 115 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 116 U.A.E. ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 117 U.A.E. ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 118 U.A.E. NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.A.E. NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 120 U.A.E. SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 121 U.A.E. SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 122 U.A.E. ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 123 U.A.E. ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 124 U.A.E. ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 125 U.A.E. ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 126 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 127 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 128 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 129 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 130 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 131 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 132 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 133 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 134 U.A.E. ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 135 U.A.E. ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 136 U.A.E. BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 137 U.A.E. BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 138 U.A.E. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 139 U.A.E. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 140 U.A.E. FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 141 U.A.E. FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 142 U.A.E. ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 143 U.A.E. ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 144 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 146 U.A.E. PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.A.E. PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 148 U.A.E. COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 U.A.E. COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 150 U.A.E. LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 U.A.E. LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 152 U.A.E. HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 U.A.E. HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 154 U.A.E. ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 155 U.A.E. ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 156 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 157 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 158 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 159 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 160 BAHRAIN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 161 BAHRAIN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 162 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 163 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 164 BAHRAIN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 165 BAHRAIN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 166 BAHRAIN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 167 BAHRAIN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 168 BAHRAIN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 169 BAHRAIN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 170 BAHRAIN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 171 BAHRAIN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 172 BAHRAIN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 173 BAHRAIN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 174 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 175 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 176 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 177 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 178 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 179 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 180 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 181 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 182 BAHRAIN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 183 BAHRAIN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 184 BAHRAIN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 185 BAHRAIN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 186 BAHRAIN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 187 BAHRAIN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 188 BAHRAIN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 189 BAHRAIN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 190 BAHRAIN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 191 BAHRAIN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 192 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 193 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 194 BAHRAIN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 BAHRAIN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 196 BAHRAIN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 BAHRAIN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 198 BAHRAIN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 BAHRAIN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 200 BAHRAIN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 BAHRAIN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 202 BAHRAIN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 203 BAHRAIN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 204 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 205 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 206 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 207 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 208 QATAR ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 209 QATAR ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 210 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 211 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 212 QATAR ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 213 QATAR ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 214 QATAR NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 215 QATAR NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 216 QATAR SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 217 QATAR SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 218 QATAR ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 219 QATAR ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 220 QATAR ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 221 QATAR ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 222 QATAR ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 223 QATAR ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 224 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 225 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 226 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 227 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 228 QATAR ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 229 QATAR ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 230 QATAR ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 231 QATAR ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 232 QATAR BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 233 QATAR BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 234 QATAR PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 235 QATAR PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 236 QATAR FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 237 QATAR FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 238 QATAR ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 239 QATAR ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 240 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 241 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 242 QATAR PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 QATAR PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 244 QATAR COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 QATAR COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 246 QATAR LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 QATAR LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 248 QATAR HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 QATAR HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 250 QATAR ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 251 QATAR ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 252 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 253 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 254 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 255 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 256 KUWAIT ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 257 KUWAIT ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 258 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 259 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 260 KUWAIT ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 261 KUWAIT ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 262 KUWAIT NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 263 KUWAIT NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 264 KUWAIT SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 265 KUWAIT SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 266 KUWAIT ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 267 KUWAIT ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 268 KUWAIT ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 269 KUWAIT ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 270 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 271 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 272 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 273 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 274 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 275 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 276 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 277 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 278 KUWAIT ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 279 KUWAIT ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 280 KUWAIT BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 281 KUWAIT BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 282 KUWAIT PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 283 KUWAIT PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 284 KUWAIT FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 285 KUWAIT FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 286 KUWAIT ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 287 KUWAIT ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 288 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 289 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 290 KUWAIT PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 291 KUWAIT PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 292 KUWAIT COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 KUWAIT COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 294 KUWAIT LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 KUWAIT LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 296 KUWAIT HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 KUWAIT HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 298 KUWAIT ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 299 KUWAIT ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 300 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 301 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 302 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 303 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 304 OMAN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 305 OMAN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 306 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 307 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 308 OMAN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 309 OMAN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 310 OMAN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 311 OMAN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 312 OMAN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 313 OMAN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 314 OMAN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 315 OMAN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 316 OMAN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 317 OMAN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 318 OMAN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 319 OMAN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 320 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 321 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 322 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 323 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 324 OMAN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 325 OMAN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 326 OMAN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 327 OMAN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 328 OMAN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 329 OMAN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 330 OMAN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 331 OMAN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 332 OMAN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 333 OMAN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 334 OMAN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 335 OMAN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 336 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 337 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 338 OMAN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 OMAN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 340 OMAN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 OMAN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 342 OMAN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 OMAN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 344 OMAN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 OMAN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 346 OMAN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 347 OMAN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 348 REST OF MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 349 REST OF MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

List of Figure

FIGURE 1 MIDDLE EAST ELECTRIC VEHICLE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST ELECTRIC VEHICLE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST ELECTRIC VEHICLE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST ELECTRIC VEHICLE MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST ELECTRIC VEHICLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES MARKET POSITION GRID

FIGURE 8 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES CHALLENGE MATRIX

FIGURE 9 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES VEHICLE CLASS

FIGURE 11 MIDDLE EAST ELECTRIC VEHICLE MARKET: SEGMENTATION

FIGURE 12 GOVERNMENT INITIATIVE TOWARDS LOWER DOWN THE EMISSION CONTRIBUTE TO DEMAND FOR EVS IS EXPECTED TO DRIVE MIDDLE EAST ELECTRIC VEHICLE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 MID-PRICED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET IN 2023 & 2030

FIGURE 14 SWOT ANALYSIS

FIGURE 15 TIME OF DELIVERY AND PLANNED PRICE POSITIONING OF THE COMPANY'S FUTURE SMART EV MODELS

FIGURE 16 EV SALES BY UNITS FOR THE YEAR 2020 & 2021

FIGURE 17 PORTER'S FIVE FORCE ANALYSIS

FIGURE 18 FACTORS INFLUENCING BUYING DECISIONS OF CONSUMERS

FIGURE 19 ELECTRIC CAR REGISTRATIONS AND SALES SHARE IN CHINA IN 2021 (IN THOUSANDS)

FIGURE 20 ELECTRIC CAR (PEVS AND PHEVS) SALES SHARE BY MODELS IN CHINA IN 2021

FIGURE 21 ELECTRIC VEHICLE REGISTRATIONS AND SALES SHARE IN EUROPE IN 2021 (IN THOUSANDS)

FIGURE 22 ELECTRIC CAR (PEVS AND PHEVS) SALES SHARE BY MODELS IN EUROPE IN 2021

FIGURE 23 ELECTRIC CAR REGISTRATIONS AND SALES SHARE IN THE USA IN 2021 (IN THOUSANDS)

FIGURE 24 ELECTRIC VEHICLE (PEVS AND PHEVS) SALES SHARE BY MODELS IN THE US IN 2021

FIGURE 25 TOP-SELLING ELECTRIC CARS IN 2022 (JANUARY-OCTOBER) (UNITS)

FIGURE 26 MERCEDES-BENZ GROUP AG

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET

FIGURE 28 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY PROPULSION TYPE, 2022

FIGURE 29 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE DRIVE TYPE, 2022

FIGURE 30 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE SPEED, 2022

FIGURE 31 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE CLASS, 2022

FIGURE 32 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY SALES CHANNEL, 2022

FIGURE 33 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY POWER OUTPUT, 2022

FIGURE 34 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY ELECTRIC MOTOR TYPE, 2022

FIGURE 35 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VOLTAGE RANGE, 2022

FIGURE 36 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY CHARGING STATION TYPE, 2022

FIGURE 37 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY CONNECTIVITY TYPE, 2022

FIGURE 38 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY POWER TRAIN, 2022

FIGURE 39 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE TYPE, 2022

FIGURE 40 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY BATTERY FORM, 2022

FIGURE 41 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY BATTERY TYPE, 2022

FIGURE 42 MIDDLE EAST ELECTRIC VEHICLE MARKET: SNAPSHOT (2022)

FIGURE 43 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2022)

FIGURE 44 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 45 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 46 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE CLASS (2023-2030)

FIGURE 47 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.