Middle East and Africa Eco-Friendly Packaging Market, By Type (Recycled Content Packaging, Reusable Packaging, and Degradable Packaging), Material Type (Paper & Paper Board, Plastic, Metal, Glass, Starch-Based Materials, and Others), Product Type (Bags, Pouches & Sachets, Boxes, Containers, Films, Trays, Tubes, Bottles & Jars, Cans, and Others), Technique (Active Packaging, Molded Packaging, Alternate Fiber Packaging, and Others), Layer (Primary Packaging, Secondary Packaging, and Tertiary Packaging), Application (Food, Beverages, Pharmaceutical, Personal Care, Home Care, and Others), Country (UAE, Saudi Arabia, Egypt, Israel, and South Africa), Industry Trends and Forecast to 2029

Market Analysis and Insights: Middle East and Africa Eco-Friendly Packaging Market

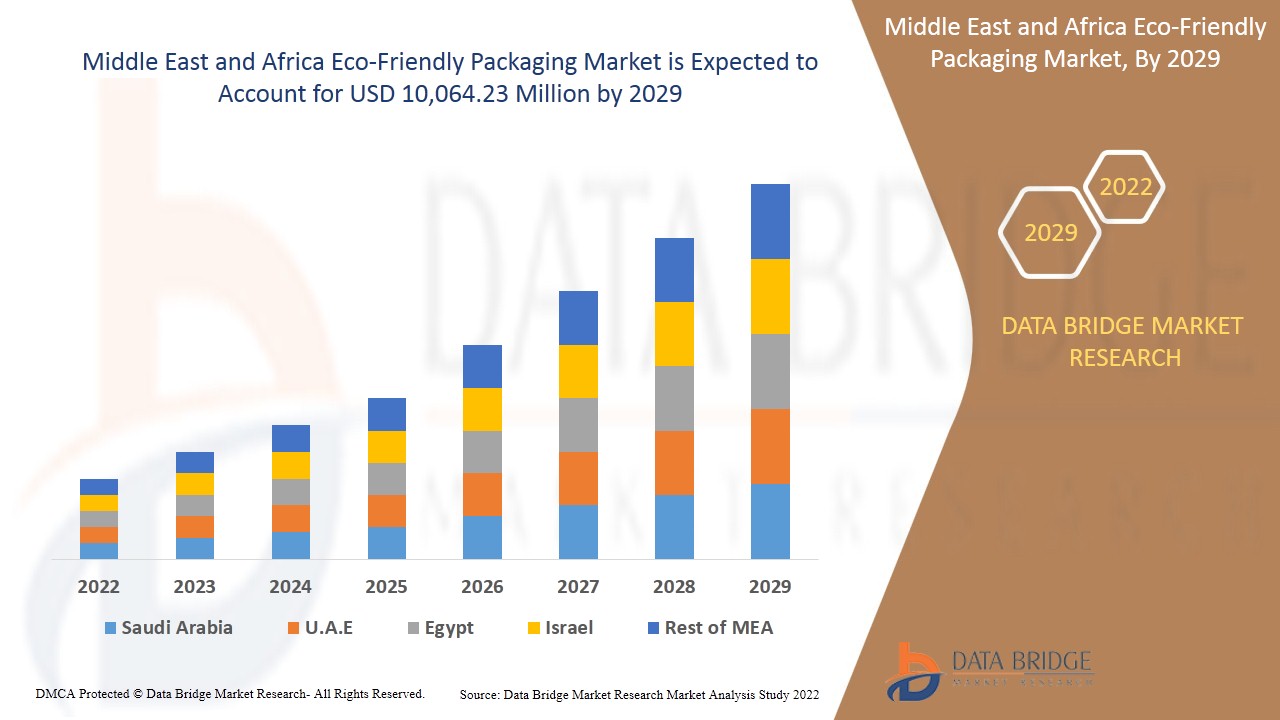

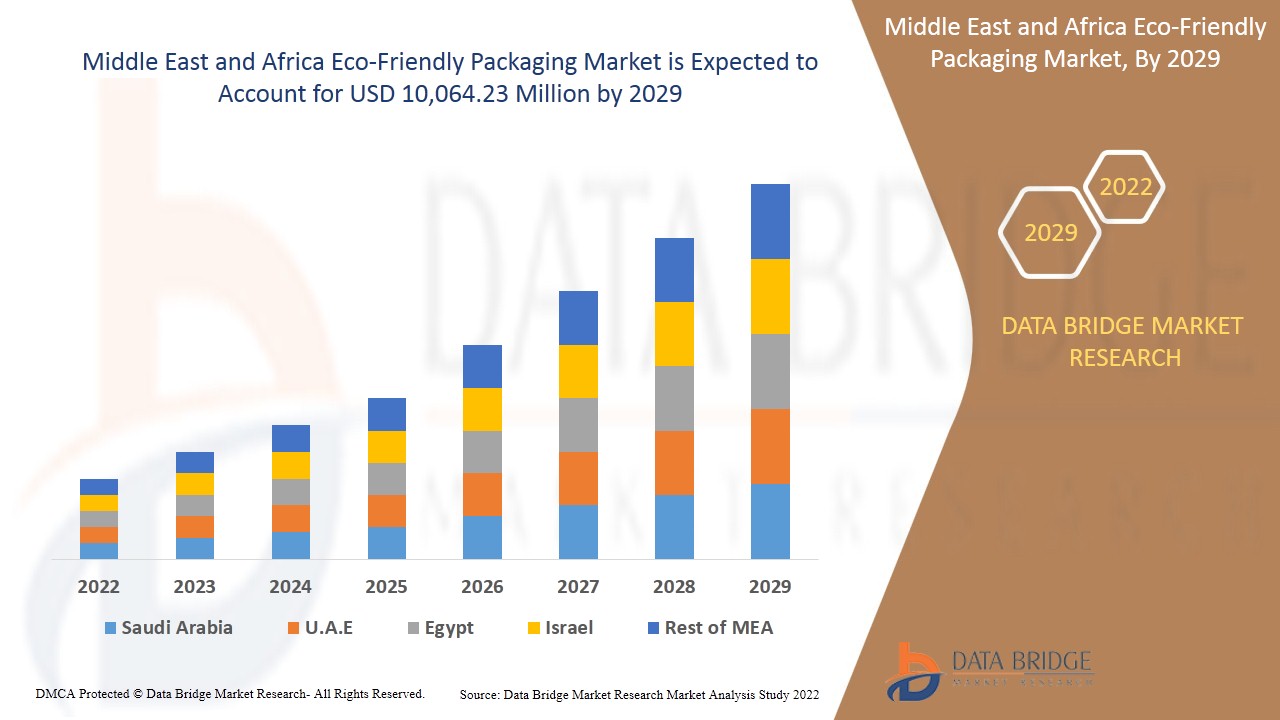

The Middle East and Africa eco-friendly packaging market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing at a CAGR of 3.4% in the forecast period of 2022 to 2029 and is expected to reach USD 10,064.23 million by 2029.

Eco-friendly packaging is any packaging that is easy to recycle, safe for individuals and the environment and is made out of recycled materials. It uses materials and manufacturing practices with minimal impact on energy consumption and natural resources. Consumers are increasingly concerned about the environmental consequences of packaging. Businesses are under pressure from consumers and governments to use eco-friendly packaging for their products.

Eco-friendly packaging solutions aim to: Lessen the amount of product packaging, promote the use of renewable/reusable materials, cut back on packaging-related expenses, eliminate the use of toxic materials in the production of packaging and provide options to recycle packaging easily.

Increasing public awareness about environmental concerns and pollution caused due to conventional packaging such as plastic has resulted in higher demand for eco-friendly packaging, which is largely expected to boost growth in the Middle East and Africa eco-friendly packaging market. The major restraint can be the lack of awareness regarding the benefits of eco-friendly packaging products. Considerable innovations in packaging products are expected to provide opportunities in the market. High cost and poor infrastructure for recycling processes may challenge the Middle East and Africa eco-friendly packaging market.

This Middle East and Africa eco-friendly packaging market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Eco-Friendly Packaging Market Scope and Market Size

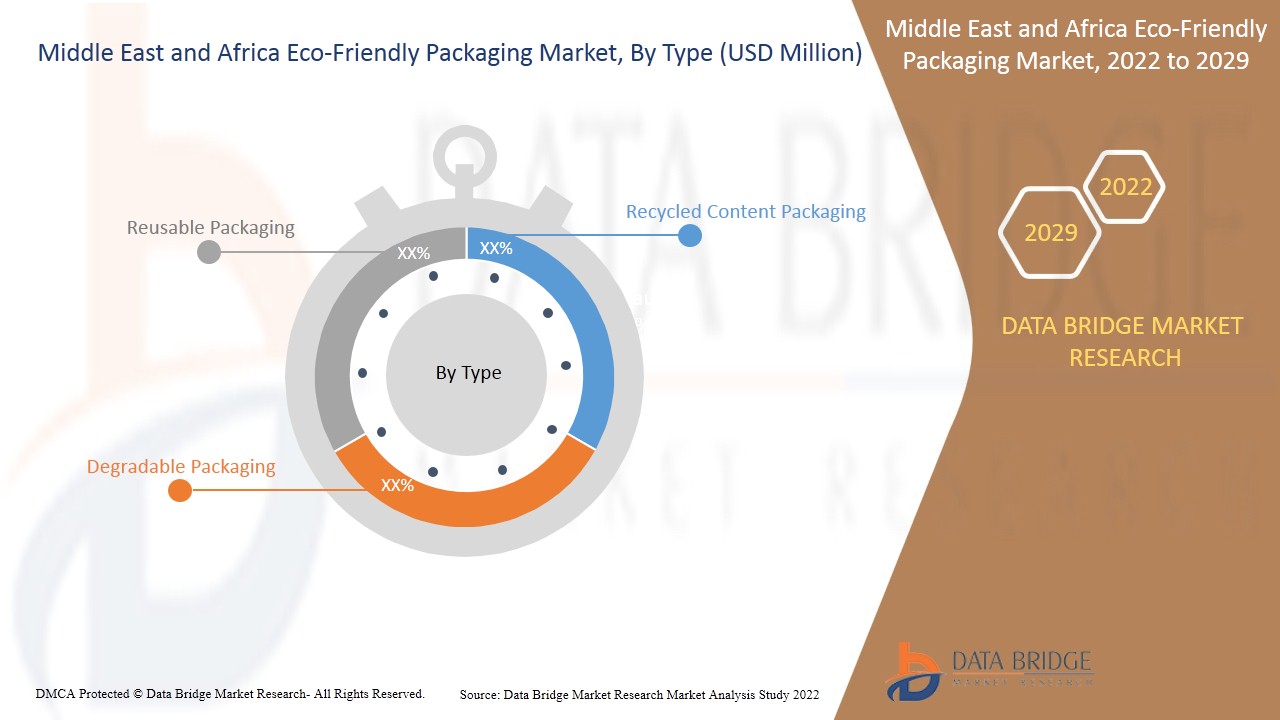

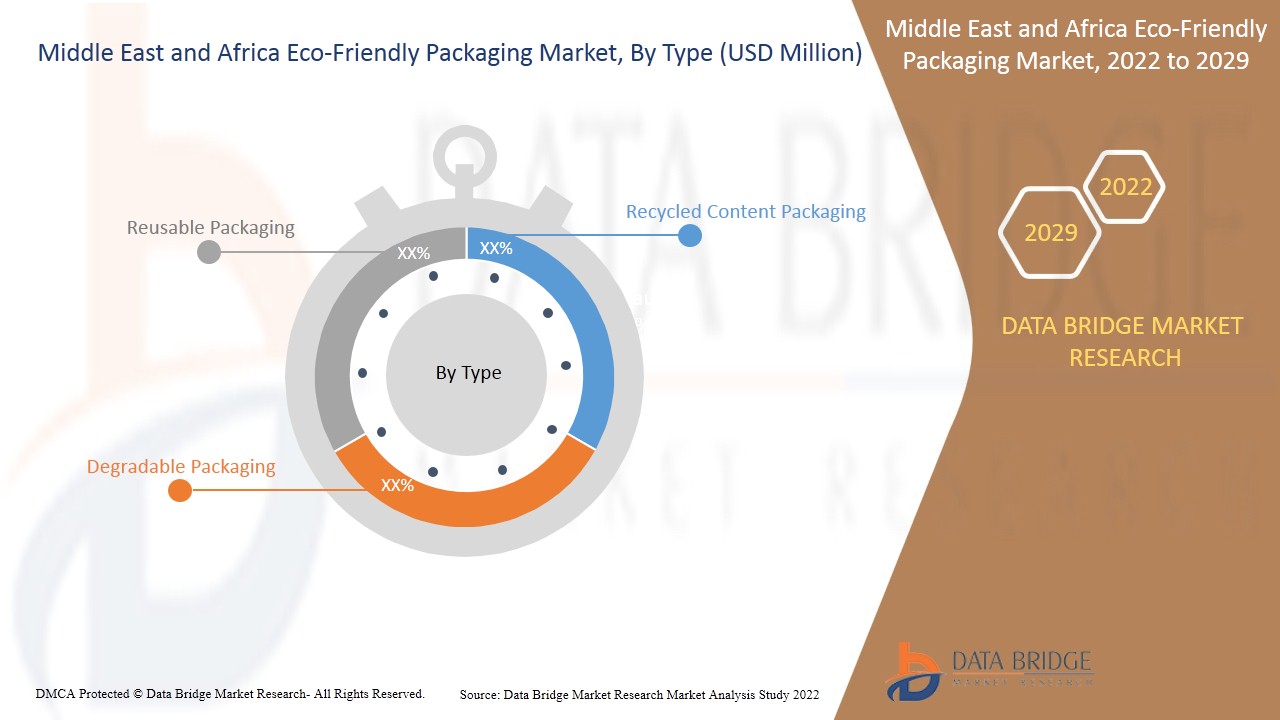

The Middle East and Africa eco-friendly packaging market is segmented into six notable segments, based on type, material type, product type, technique, layer, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the Middle East and Africa eco-friendly packaging market is segmented into recycled content packaging, reusable packaging, and degradable packaging. In 2022, the reusable packaging segment is expected to dominate the market because of their nature of being used again and again without any loss in their properties.

- On the basis of material type, the Middle East and Africa eco-friendly packaging market is segmented into paper & paper board, plastic, metal, glass, starch-based materials, and others. In 2022, the paper & paper board segment is expected to dominate the Middle East and Africa eco-friendly packaging market, as it is 100% naturally degradable property to the packaging solutions with low impact on the environment.

- On the basis of product type, the Middle East and Africa eco-friendly packaging market is segmented into bags, pouches & sachets, boxes, containers, films, trays, tubes, bottles & jars, cans, and others. In 2022, the boxes segment is expected to dominate the Middle East and Africa eco-friendly packaging market as boxes protect their packed materials very efficiently and have a good strength to withstand heavyweights.

- On the basis of technique, the Middle East and Africa eco-friendly packaging market is segmented into active packaging, molded packaging, alternate fiber packaging, and others. In 2022, alternate fiber packaging is expected to dominate the Middle East and Africa eco-friendly packaging market, proving an environmentally-friendly alternative to paper. It also provides a much-needed alternative to polystyrene, detrimental to both the environment and human health.

- On the basis of layer, the Middle East and Africa eco-friendly packaging market is segmented into primary packaging, secondary packaging, and tertiary packaging. In 2022, the primary packaging segment is expected to dominate the Middle East and Africa eco-friendly packaging market, as it allows the product to be preserved in the same manner as it is without being altered by external environment conditions.

- On the basis of application, the Middle East and Africa eco-friendly packaging market is segmented into food, beverages, pharmaceutical, personal care, home care, and others. In 2022, the food segment is expected to dominate the Middle East and Africa eco-friendly packaging market, owing to the fast-growing food industry in the region and the growing use of eco-friendly disposable packaging in the food industry.

Middle East and Africa Eco-Friendly Packaging Market Country Level Analysis

The Middle East and Africa eco-friendly packaging market is analyzed, and market size information is provided by country, type, material type, product type, technique, layer, and application.

The countries covered in the Middle East and Africa eco-friendly packaging market report are South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and the Rest of the Middle East and Africa. In 2022, United Arab Emirates is expected to dominate the Middle-East and Africa eco-friendly packaging market owing to an increase in growth for eco-friendly packaging in the region due to high demand for fast-moving consumer goods and inclining consumers' preference towards green packaging. South Africa is expected to grow owing to rising environmental concerns and growing public awareness about eco-friendly products. Saudi Arabia is expected to grow in the Middle East and Africa eco-friendly packaging market due to stringent regulations implemented by most governments over plastic bags.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle-East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growth in the Middle-East and Africa Eco-Friendly Packaging Market

The Middle East and Africa eco-friendly packaging market also provides you with detailed market analysis for every country's growth in the installed base of different kinds of products for the market, the impact of technology using lifeline curves and changes in infant formula regulatory scenarios, and their impact on the eco-friendly packaging market. The data is available for the historical period 2011 to 2019.

Competitive Landscape and Middle-East and Africa Eco-Friendly Packaging Market Share Analysis

The Middle East and Africa eco-friendly packaging market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle-East and Africa presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the company's focus on the Middle-East and Africa eco-friendly packaging market.

Some of the major players covered in the Middle-East and Africa eco-friendly packaging report are Mondi, Sealed Air, Crown Holdings, Inc., Tetra Pak, Huhtamaki, Berry Global Inc., Amcor plc, Ball Corporation, Pactiv Evergreen Inc., Plastipak Holdings, Inc., Nampak Ltd., Elopak, UFlex Limited, and others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In October 2021, Mondi started supplying a range of recyclable mono-material pet food packaging for Hau-Hau Champion, one of Finland's most recognized brands in the premium dog food segment. This development will help Mondi to acquire more pet food companies for their packaging solutions

SKU-