Middle East And Africa Drive Shaft Market

Market Size in USD Million

CAGR :

%

USD

1,427.53 Million

USD

988.58 Million

2024

2032

USD

1,427.53 Million

USD

988.58 Million

2024

2032

| 2025 –2032 | |

| USD 1,427.53 Million | |

| USD 988.58 Million | |

|

|

|

|

Middle East and Africa Drive Shaft Market Size

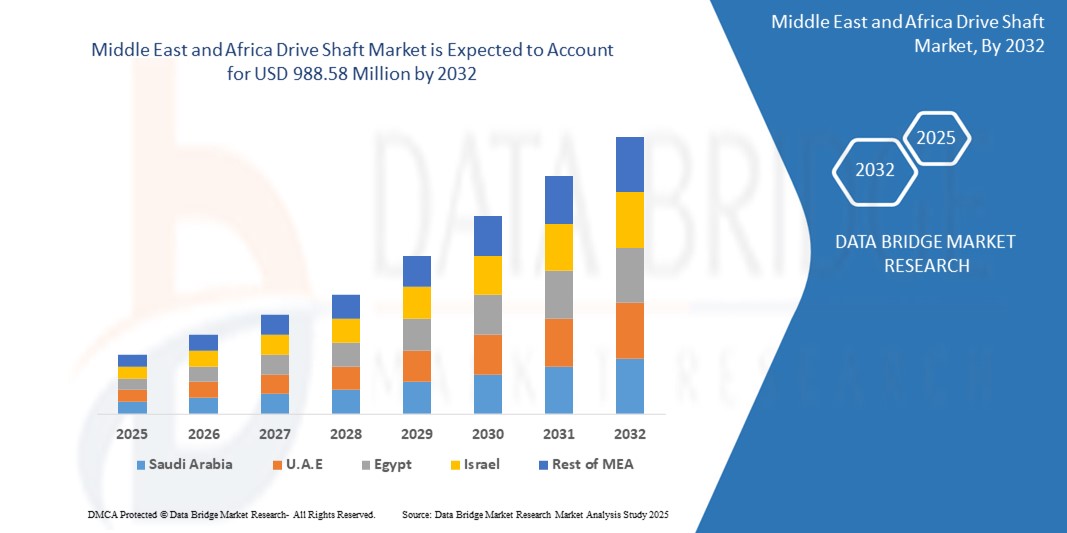

- Middle East and Africa drive shaft market is expected to reach a value of USD 1,427.53 million by 2032 from USD 988.58 million in 2024, growing at a CAGR of 4.70% during the forecast period 2025 to 2032

- This growth is driven by increasing vehicle production across the region, rising demand for lightweight and fuel-efficient automotive components, and the growing adoption of electric and hybrid vehicles, which require advanced drive shaft technologies. The market is further supported by infrastructure development, expansion in the logistics and transportation sectors, and favorable government initiatives promoting industrial growth

Middle East and Africa Drive Shaft Market Analysis

- Drive shafts, critical components in powertrain systems, are used to transmit torque from the engine or motor to the wheels in various vehicles, including passenger cars, commercial vehicles, and off-highway equipment. Their role in maintaining vehicle performance, fuel efficiency, and driveline stability makes them essential across both conventional and electric vehicle architectures.

- The growing demand for fuel-efficient and lightweight automotive components, coupled with the global shift toward electrification, is significantly driving the drive shaft market. Automakers are increasingly adopting advanced materials such as carbon fiber and aluminum in shaft designs to enhance performance and reduce weight.

- Saudi Arabia dominated the Middle East and Africa drive shaft market with the largest revenue share of 24.11% in 2024, driven by the rapid expansion of its automotive industry, increasing vehicle production, and a surge in demand for commercial vehicles

- The U.A.E. is fastest-growing country in the Middle East and Africa drive shaft market with a CAGR of 13.33%, largely due to its status as a major trade and logistics hub

- The slip yokes segment dominated the market with the largest revenue share of 28.4% in 2024, owing to their widespread usage in accommodating drive shaft movement during suspension travel and their critical role in ensuring smooth power transmission

Report Scope and Middle East and Africa Drive Shaft Market Segmentation

|

Attributes |

Middle East and Africa Drive Shaft Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Middle East and Africa Drive Shaft Market Trends

Growing Adoption of Lightweight Materials and Electrification-Compatible Designs

- A key and accelerating trend in the global drive shaft market is the increasing use of lightweight materials and designs tailored specifically for electric and hybrid vehicles. This shift is driven by the automotive industry’s focus on improving fuel efficiency, reducing emissions, and optimizing performance, particularly in EV platforms that demand high torque transmission with minimal energy loss.

- For instance, BorgWarner has launched a new line of composite drive shafts that reduce weight by up to 30% compared to traditional steel versions, enhancing both energy efficiency and handling in electric vehicles. Similarly, GKN Automotive has developed drive shafts specifically designed to meet the torque demands and compact architecture requirements of EVs.

- The use of advanced materials such as carbon fiber-reinforced polymers and aluminum alloys reduces weight and improves torsional stiffness and durability, enabling better performance under high-speed and high-torque conditions. These innovations are essential for EVs, which operate differently than internal combustion engine vehicles and require highly efficient power delivery.

- In addition, manufacturers are focusing on modular and scalable drive shaft systems that can be easily adapted to different vehicle platforms, including electric, hybrid, and commercial applications. This enables automakers to streamline production and reduce costs while meeting diverse drivetrain requirements.

- The integration of smart design elements such as noise, vibration, and harshness (NVH) damping technologies is also gaining traction, especially in premium and electric vehicles where silent operation is a consumer expectation. Companies are embedding lightweight dampers and using precision balancing to reduce vibrations and enhance ride comfort.

- This trend toward material innovation, electrification readiness, and performance optimization is fundamentally reshaping the design philosophy of modern drive shafts. As demand for EVs continues to grow and emission norms become stricter, the drive shaft market is rapidly evolving to support the next generation of mobility solutions with more efficient, lighter, and smarter drivetrain components.

Middle East and Africa Drive Shaft Market Dynamics

Driver

Increasing Demand for Efficient Power Transmission in Automotive and Industrial Applications

- The growing need for reliable and efficient power transmission systems, especially in the automotive and industrial sectors, is a key driver for the drive shaft market. As vehicles and machinery become more advanced, the demand for high-performance, durable drive shafts continues to rise.

- For instance, in May 2023, American Axle & Manufacturing announced its contract to supply e-Beam axles integrated with 3-in-1 e-Drive technology for a future Stellantis electric vehicle program. Such innovations are driving the market by aligning with industry trends toward electrification and efficiency.

- As automakers increase production of electric and hybrid vehicles, the integration of lightweight and energy-efficient components, including advanced drive shafts, becomes essential for enhancing vehicle performance and meeting emission targets.

- In industrial applications, the rise of automation and heavy machinery use has created a strong demand for robust and efficient drive shaft systems capable of handling high torque and operating under demanding conditions.

- In addition, advancements in material technologies—such as carbon fiber and aluminum alloys—have enabled the development of lighter and stronger drive shafts, contributing to improved fuel efficiency, reduced emissions, and better overall vehicle dynamics, especially in EVs and high-performance applications. The growing trend toward sustainable and energy-efficient mobility further reinforces this demand across both automotive and industrial markets.

Restraint/Challenge

Volatility in Raw Material Prices and Complex Manufacturing Processes

- Fluctuating prices of key raw materials such as steel, aluminum, and carbon composites pose a major challenge to the drive shaft market. These materials directly impact the cost of production and can reduce profit margins for manufacturers or increase prices for end users.

- For instance, recent global supply chain disruptions and trade policy uncertainties have led to increased costs and reduced availability of certain materials, creating unpredictability in pricing and production planning for drive shaft manufacturers.

- In addition, manufacturing advanced drive shafts—especially those made from composite materials—requires complex processes and specialized equipment, limiting the number of producers capable of high-volume production. This raises barriers to entry and slows adoption, particularly in price-sensitive markets.

- Companies such as BorgWarner and GKN Automotive continue to invest in process optimization and automation to reduce manufacturing costs, but the complexity remains a significant factor, especially for small or emerging players.

- Furthermore, as vehicle platforms diversify, particularly with the rise of EVs, the need for custom or application-specific drive shaft solutions has increased, adding engineering and design complexity. This customization can raise development time and costs, impacting scalability.

- Overcoming these challenges will require ongoing investment in cost-effective manufacturing technologies, securing stable material supply chains, and designing modular drive shaft systems that can be adapted across various vehicle platforms without compromising performance.

Middle East and Africa Drive Shaft Market Scope

The automotive drive shaft market is segmented into seven notable segments based on component, design type, drive shaft type, position type, material type, vehicle type, and sales channel.

- By Component

On the basis of component, the market is segmented into slip yokes, yoke shafts, end yokes, companion flanges, flange yokes, weld yokes, center yokes, splined slip stubs, midship stubs, and others. The slip yokes segment dominated the market with the largest revenue share of 28.4% in 2024, owing to their widespread usage in accommodating drive shaft movement during suspension travel and their critical role in ensuring smooth power transmission. Slip yokes are highly preferred in both passenger cars and light commercial vehicles for durability and cost efficiency.

The flange yokes segment is projected to record the fastest CAGR of 8.9% from 2025 to 2032, driven by rising demand in heavy-duty trucks, off-highway vehicles, and commercial fleets. Their ability to withstand high torque loads and provide stable joint connections makes them essential in modern driveline systems where performance and reliability are paramount.

- By Design Type

On the basis of design type, the market is segmented into hollow shaft and solid shaft. The hollow shaft segment dominated the market with a 63.5% revenue share in 2024, primarily due to its lightweight structure, reduced inertia, and superior fuel efficiency benefits. Automakers prefer hollow shafts in passenger vehicles and EVs to enhance overall vehicle performance while meeting regulatory emission norms.

The solid shaft segment is anticipated to witness the fastest CAGR of 7.6% during 2025–2032, fueled by its increasing adoption in heavy-duty applications requiring higher strength and torque capacity. Solid shafts are particularly popular in trucks, buses, and industrial vehicles where robustness and load-bearing capacity outweigh weight reduction.

- By Drive Shaft Type

On the basis of drive shaft type, the market is segmented into Hotchkiss drive shaft, torque tube drive shaft, flexible drive shaft, and slip-in-tube drive shaft. The Hotchkiss drive shaft dominated with a 41.7% revenue share in 2024, owing to its extensive use in rear-wheel drive passenger cars and light trucks. Its simple design, cost efficiency, and proven reliability drive its strong market presence.

The flexible drive shaft segment is expected to register the fastest CAGR of 9.3% from 2025 to 2032, supported by rising demand in EVs, hybrid vehicles, and specialized industrial machinery. Flexible shafts enable smoother torque transmission, improved vibration absorption, and compact design integration, making them ideal for lightweight automotive applications.

- By Position Type

On the basis of position type, the market is segmented into front axle and rear axle. The rear axle segment dominated the market with a 58.2% revenue share in 2024, driven by the strong prevalence of rear-wheel-drive configurations in light trucks, SUVs, and commercial vehicles. Rear axles require robust drive shafts for efficient torque transfer over longer distances.

The front axle segment is projected to grow at the fastest CAGR of 8.1% during 2025–2032, largely due to the increasing adoption of all-wheel-drive and front-wheel-drive vehicles across passenger cars. Rising consumer demand for enhanced stability, fuel efficiency, and traction in compact cars and crossovers is boosting demand for front axle drive shafts.

- By Material Type

On the basis of material type, the market is segmented into carbon steel, aluminum, stainless steel, composite materials, carbon fiber, and others. The carbon steel segment accounted for the largest revenue share of 46.9% in 2024, favored for its strength, durability, and cost-effectiveness across passenger and commercial vehicles. Carbon steel drive shafts remain a standard choice in traditional ICE vehicles.

The carbon fiber segment is expected to expand at the fastest CAGR of 10.4% between 2025 and 2032, propelled by growing adoption in high-performance cars, luxury vehicles, and EVs. Its lightweight and superior strength-to-weight ratio make it ideal for improving fuel efficiency and reducing emissions, aligning with global sustainability goals.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger car segment dominated the market with a revenue share of 61.4% in 2024, driven by the rising production of sedans, SUVs, and hatchbacks worldwide. Increasing urbanization, disposable income, and the shift toward connected vehicles further support adoption.

The commercial vehicle segment is forecasted to register the fastest CAGR of 7.8% from 2025 to 2032, as the global logistics and construction industries expand. Heavy-duty trucks and buses demand durable, high-performance drive shafts capable of withstanding high torque loads and long operational hours.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and aftermarket. The OEM segment dominated the market with 68.7% revenue share in 2024, attributed to rising global automobile production and manufacturers’ preference for integrating advanced, lightweight drive shafts during initial assembly. OEM supply ensures consistent quality, regulatory compliance, and warranty assurance for end users.

The aftermarket segment is projected to record the fastest CAGR of 8.6% during 2025–2032, driven by increasing vehicle aging, higher replacement rates, and customization demand. Commercial fleets and individual vehicle owners are turning to aftermarket solutions for cost efficiency and availability of specialized components.

Middle East and Africa Drive Shaft Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa drive shaft market with the largest revenue share of 24.11% in 2024, driven by the rapid expansion of its automotive industry, increasing vehicle production, and a surge in demand for commercial vehicles

- The country’s focus on industrial development, coupled with infrastructure growth and supportive government initiatives under Vision 2030, has significantly boosted the automotive and manufacturing sectors—key consumers of drive shaft components.

- In addition, the presence of local and international vehicle manufacturers, along with rising demand for both passenger and heavy-duty vehicles, has increased the need for advanced power transmission systems. This positions Saudi Arabia as a central hub for drive shaft adoption across the region.

U.A.E. Drive Shaft Market Insight market

The U.A.E. is fastest-growing country in the Middle East and Africa drive shaft market with a CAGR of 13.33%, largely due to its status as a major trade and logistics hub. The country’s well-developed infrastructure and business-friendly policies attract automotive manufacturers and aftermarket service providers, facilitating market growth. Increasing investments in electric and hybrid vehicle adoption, along with government initiatives promoting sustainable transportation, are driving demand for advanced drive shaft technologies. The U.A.E.’s automotive sector benefits from a growing population with rising disposable income, which fuels passenger vehicle sales and replacement part demand. Moreover, the country’s strategic location enables efficient supply chain management for automotive components across the region. However, market growth is moderated by competition from established international players and price sensitivity in the aftermarket segment. Overall, the U.A.E. market is poised for steady growth, supported by technological innovation and expanding vehicle production.

South Africa Drive Shaft Market Insight market

South Africa represents a mature automotive market within the Middle East and Africa region, characterized by a well-established manufacturing base and supportive government policies aimed at boosting local production. The country’s automotive industry benefits from the presence of global vehicle manufacturers and a robust supplier network, driving consistent demand for drive shafts and related components. Industrial automation trends are also fueling growth in non-automotive sectors that use drive shafts extensively. Government incentives focused on increasing exports and improving industrial infrastructure have enhanced the competitiveness of the automotive sector. Despite challenges such as economic volatility and fluctuating raw material prices, South Africa continues to maintain a strong position in the regional market. The ongoing push for innovation, along with increasing adoption of electric and hybrid vehicles, presents new opportunities for advanced drive shaft solutions, making South Africa a vital market for manufacturers targeting the MEA region.

Egypt Drive Shaft Market Insight market

Egypt’s drive shaft market is gradually expanding, driven by rising vehicle ownership and increased industrialization in the country. As one of the largest automotive markets in North Africa, Egypt has seen steady growth in passenger and commercial vehicle sales, which propels demand for reliable drivetrain components. The government’s focus on infrastructure development, such as road expansions and new industrial zones, supports growth in the automotive and machinery sectors where drive shafts are critical. In addition, rising local manufacturing capabilities and improved supply chain logistics contribute to market development. However, economic challenges and fluctuating regulatory environments may impact the pace of growth. Despite these hurdles, Egypt’s expanding middle class and urbanization trends create long-term opportunities for drive shaft manufacturers. Increasing awareness around fuel efficiency and vehicle performance is also encouraging adoption of advanced, lightweight drive shafts in the market.

Israel Drive Shaft Market Insight market

Israel’s drive shaft market is characterized by steady growth driven by technological innovation and a dynamic automotive industry. The country is known for its advancements in automotive engineering and electric vehicle technologies, which create demand for sophisticated, high-performance drive shafts. Israel’s focus on research and development, combined with government incentives for clean and efficient transportation solutions, supports the adoption of lightweight and durable drive shaft components. The country also benefits from a strong manufacturing base for automotive parts and components, fostering a competitive market environment. However, the relatively smaller size of the domestic automotive market and import dependency can limit rapid expansion. Nonetheless, Israel’s emphasis on innovation and quality positions it well for future growth, particularly in specialized segments such as electric and hybrid vehicles. The market outlook remains positive, supported by continuous technological progress and evolving consumer preferences.

Middle East and Africa Drive Shaft Market Share

Market Leaders Operating in the Market are:

- Bailey Morris (U.K.)

- Cummins Inc. (U.S.)

- HYUNDAI WIA CORP (South Korea)

- THE TIMKEN COMPANY (U.S.)

- GSP EUROPE GmbH (Germany)

- TUNGALOY CORPORATION (Japan)

- GKN Automotive Limited (U.K.)

Latest Developments in Middle East and Africa Drive Shaft Market

- In September 2024, Cummins Inc. completed the acquisition of Jacobs Vehicle Systems, including the renowned Jake Brake technology, originally inspired by Clessie Cummins' 1931 innovation. This acquisition strengthens Cummins' portfolio in powertrain technologies and enhances safety and braking efficiency in commercial vehicles, aligning with the company’s strategy to provide advanced, integrated engine solutions for global markets.

- In August 2024, Nexteer Automotive launched a new modular pinion-assist Electric Power Steering (EPS) system. Designed for compatibility across all EPS architectures, this system offers flexible integration, reduced weight, and improved fuel efficiency. It supports Nexteer's broader initiative to enhance driveline and steering systems for electrified and autonomous vehicle platforms.

- In September 2023, JTEKT Corporation showcased significant advancements in steering and driveline systems at the 2023 Tokyo Motor Show. These innovations are aimed at enhancing vehicle performance, ride comfort, and energy efficiency. The company’s display reflected its commitment to supporting the evolution of mobility with smart, high-performance components tailored for both conventional and electric vehicles.

- In May 2023, American Axle & Manufacturing (AAM) announced a major contract to supply e-Beam axles integrated with 3-in-1 e-Drive technology for a future Stellantis electric vehicle program. Production is expected to begin later in the decade, reinforcing AAM’s role in electrification and its ability to meet the high torque and efficiency demands of modern EV platforms.

- In December 2021, AEQUITA SE & Co. KGaA finalized the acquisition of IFA Group, a leading specialist in drive shaft technology. This move increased AEQUITA’s automotive sector sales to over EUR 1 billion. The acquisition leverages IFA's strong OEM relationships and technical expertise, positioning AEQUITA for continued innovation and competitive growth in the global drive shaft market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.