Middle East and Africa Baby Feeding Bottle Market, By Material (Plastic, Glass, Stainless Steel, Silicone and Others), Capacity (4.1 to 6 Oz, 6.1 to 9 Oz, up to 4 Oz and > 9 Oz), and Distribution Channel (Pharmacy & Drug Stores, Specialty Stores, Hypermarkets/Supermarkets, Convenience Stores, Online Retailing and Other Retailing Formats), Country (United Arab Emirates, Saudi Arabia, Egypt, Israel, South Africa & Rest of Middle East and Africa) Industry Trends and Forecast to 2029.

Market Analysis and Insights : Middle East and Africa Baby Feeding Bottle Market

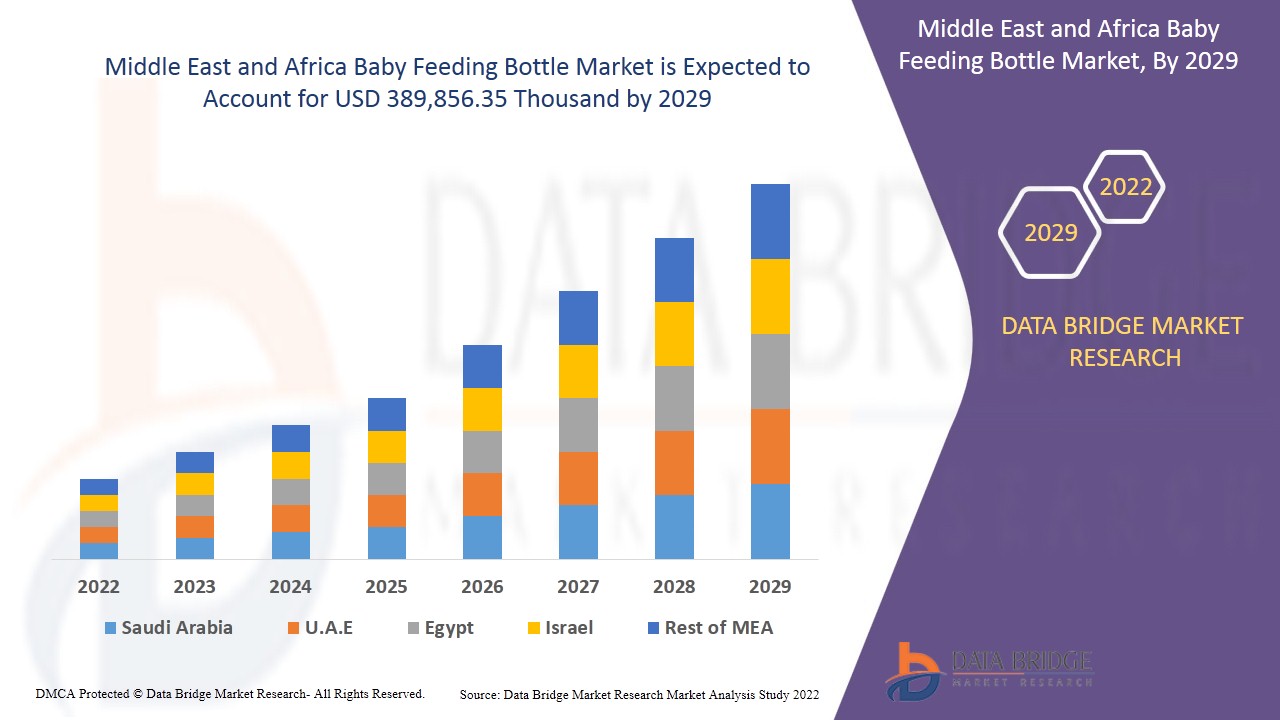

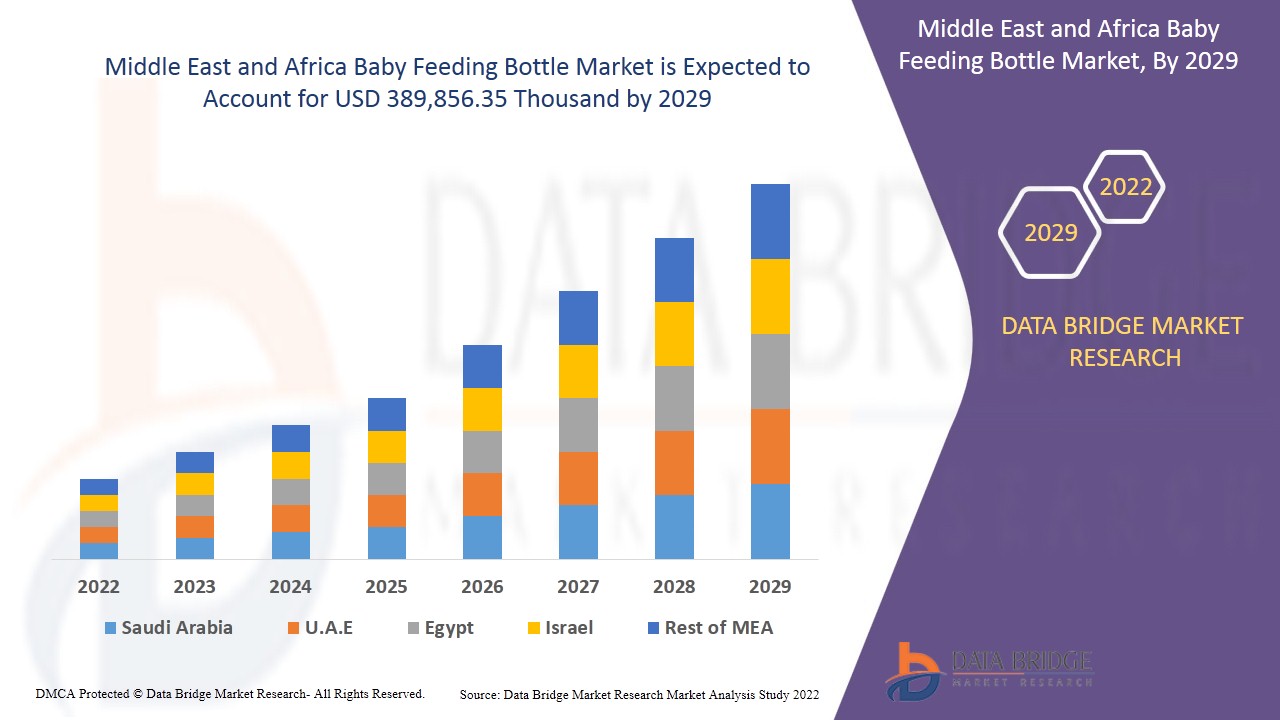

Middle East and Africa baby feeding bottle market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing at a CAGR of 5.2% in the forecast period of 2022 to 2029 and expected to reach USD 389,856.35 thousand by 2029.

Bottle-feeding is an infant feeding modality that has been in existence since ancient times, and currently, a significant number of infants are being fed via a bottle with either breastmilk or formula. Bottle feeding mainly depends on the size of the nipples used in the bottles as it ensures that the formula drips slowly and steadily reaches inside the baby's mouth from the nipple. All babies are different and the size chosen should depend more on the comfort of the baby than the age range specified.

Plastic bottles are generally less costly than glass bottles as the material is cheaper and they are quicker to make.

Stainless steel tends to have insulating properties which keep baby milk warmer for a long time and are easy to clean, less prone to scratches, and highly durable.

Silicone is extremely heat resistant which are microwave, dishwasher and sterilizer safe and can be boiled in water.

Glass bottles are easier to clean and contain no harmful chemicals, which eliminates the risk of chemicals leaching into the baby’s milk.

The increasing number of working women is driving the market growth. Rising acceptance of infant formula and perfectly ventilated feeding bottle is acting as a potential market driver for the market. Also, increase in the number of birth-rates, increasing the sales and profit of the players operating in the market.

The major restraint impacting the baby feeding bottle market is the complexity associated with the distortion of bottles kept in freezers. Further, Difficulty in cleaning and sterilizers of small neck opening bottles will also restraint the market growth. The opportunities for the baby feeding bottle are the rising demand for BPA and harmful chemical free baby bottles. Some of the significant drivers associated with the Middle East and Africa baby feeding bottle market are the availability of different size bottles products on online platforms.

This baby feeding bottle market report provides details of market share, new developments, and product baby feeding bottleline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Baby Feeding Bottle Market Scope and Market Size

Middle East and Africa baby feeding bottle market is segmented on the basis of material, capacity, distribution channel and geography. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of material, Middle East and Africa baby feeding bottle market is segmented into plastic, glass, stainless steel, silicone and others. In 2022, plastic segment is dominating the region as it eliminates the risk of breakage, which helps to boost its demand in the forecast year.

- On the basis of capacity, Middle East and Africa baby feeding bottle market is segmented into 4.1 to 6 Oz, 6.1 to 9 Oz, up to 4 Oz and > 9 Oz. In 2022, 4.1 to 6 Oz segment is dominating the region as they help the babies to intake the exact quantity of feed, which helps to boost its demand in the forecast year.

- On the basis of distribution channel, Middle East and Africa baby feeding bottle market is segmented into pharmacy & drug stores, specialty stores, hypermarkets/supermarkets, convenience stores, online retailing and other retailing formats. In 2022, pharmacy & drug stores segment is dominating the region as these stores provide the right guidance for using the feeding bottles, which helps to boost its demand in the forecast year.

- On the basis of geography, Middle East and Africa baby feeding bottle market is segmented into U.S., Canada, and Mexico. In 2022, U.S. is dominating in the Middle East and Africa region due increasing number of working women and the demand for baby feeding bottles increased.

Middle East and Africa Baby feeding bottle Market Country Level Analysis

Middle East and Africa market is analysed and market size information is provided by country, material, capacity, distribution channel and geography.

The countries covered in the Middle East and Africa baby feeding bottle market report United Arab Emirates, Saudi Arabia, Egypt, Israel, South Africa & Rest of Middle East and Africa.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growth in the Baby Feeding Bottle Industry

Middle East and Africa Baby feeding bottle Market also provides you with detailed market analysis for every country growth in installed base of different kind of products for baby feeding bottle market, impact of technology using life line curves and changes in infant formula regulatory scenarios and their impact on the baby feeding bottle market. The data is available for historic period 2012 to 2020.

Competitive Landscape and Baby Feeding Bottle Market Share Analysis

Middle East and Africa baby feeding bottle market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials baby feeding bottlelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Middle East and Africa baby feeding bottle market.

Some of the major players covered in the report are Pigeon Corporation, Koninklijke Philips N.V., and Artsana S.p.A. are among other players domestic and regional. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In February, 2022, Pigeon Corporation opened its Tsukuba Engineering Center. Tsukuba Engineering Center will act as a hub for actively exploring and prototyping productivity improvements and new environmentally-friendly materials and manufacturing technologies. This will also help in training initiatives, with a focus on products in the nursing bottle category.

SKU-