Mexico Stainless Steel Market Analysis and Insights

The Mexico stainless steel market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.7% in the forecast period of 2023 to 2030 and is expected to reach USD 991,441.52 thousand by 2030. The growing use of stainless steel in various industries has been the major driver for the Mexico stainless steel market.

The market report provides details of market share, new developments, and the impact of domestic and localized market players, and analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand and Volume in Tons |

|

Segments Covered |

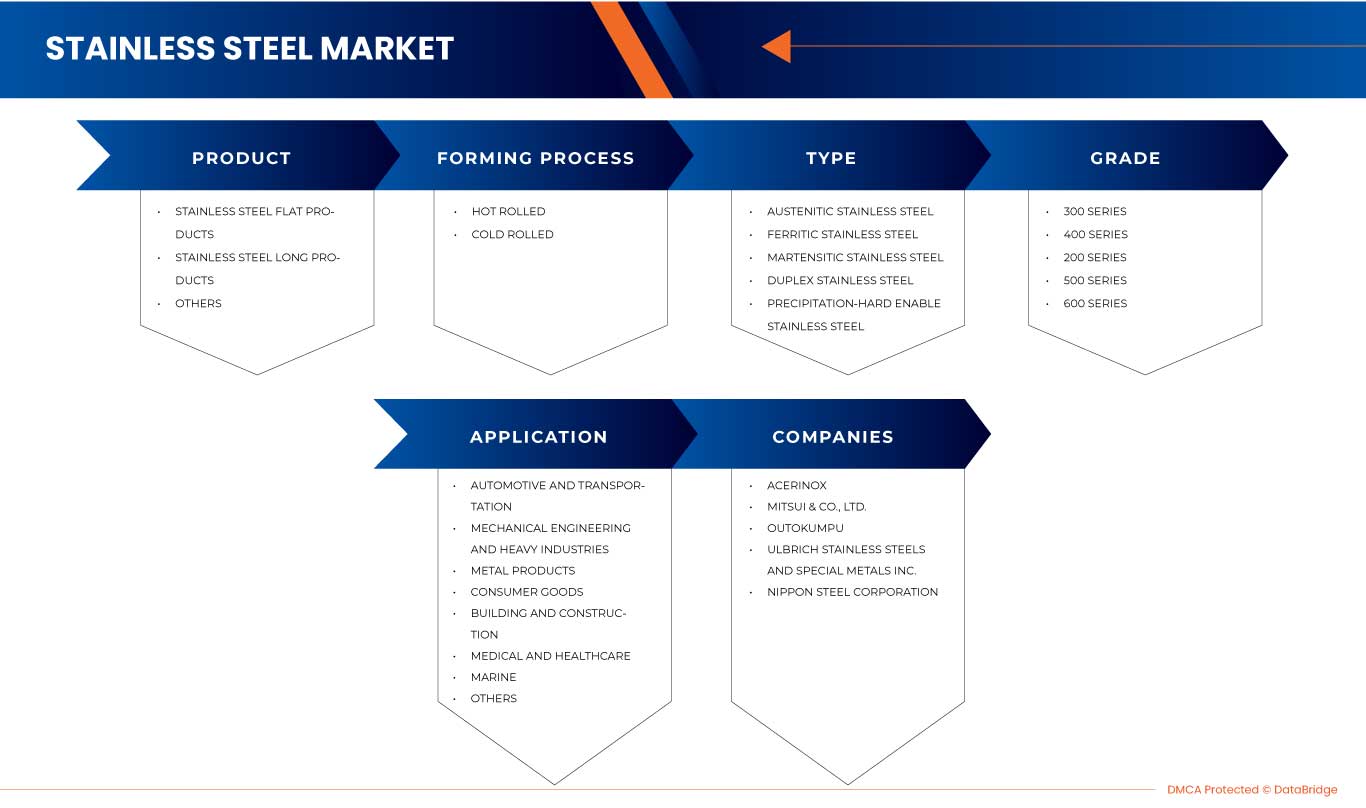

Product (Stainless Steel Flat Products, Stainless Steel Long Products, and Others), Forming Process (Hot Rolled and Cold Rolled), Type (Austenitic Stainless Steel, Ferritic Stainless Steel, Martensitic Stainless Steel, Duplex Stainless Steel, and Precipitation-Hard Enable Stainless Steel), Grade (300 Series, 400 Series, 200 Series, 500 Series, and 600 Series), Application (Automotive and Transportation, Mechanical Engineering and Heavy Industries, Metal Products, Consumer Goods, Medical and Healthcare, Building and Construction, Marine, and Others) |

|

Regions Covered |

Northern Mexico, Central Mexico, Eastern Mexico, Western Mexico, and Southern Mexico |

|

Market Players Covered |

Industeel, Acerinox, Aperam, NIPPON STEEL CORPORATION, Alleima, MITSUI & CO., LTD., Olympic Steel, Outokumpu, Ulbrich Stainless Steels and Special Metals Inc., Swiss Steel Holding AG, Gibbs Wire & Steel Company LLC, TIMEX METALS, Shrikant Steel Centre, Nitech Stainless Inc, and R H Alloys, among others. |

Market Definition

A power alloy is created when different components found in stainless steel are combined. In some circumstances, stainless steel, an alloy of iron, chromium, and nickel, give resistance to the corrosion of iron. This resistant quality of the alloy is due to chromium. The passive layer is a thin oxide film secreted by chromium. In addition to chromium, this alloy also includes nitrogen and molybdenum. It is an environmentally neutral and inert alloy, making it indefinitely recyclable. Stainless steel is strong and long-lasting, making it ideal for usage in many end-user verticals.

Mexico Stainless Steel Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

- Increasing industrial activities in Mexico

Increasing industrial activity is driving stainless steel demand in Mexico. In recent years, there has been a notable increase in industrialization across a wide range of industries, including automotive, construction, manufacturing, and energy. Stainless steel has become the preferred material for a wide range of industrial applications due to its exceptional properties such as corrosion resistance, strength, and aesthetic appeal. The expansion of industrial activities in Mexico has been accompanied by a growing need for durable and reliable materials. Stainless steel's unique characteristics make it an ideal choice for diverse applications within the industrial landscape. Stainless steel's versatility and resilience position it as a key player in Mexico's economic development as industries continue to evolve and strive for efficiency and sustainability.

- Rising urbanization and infrastructure development.

Rising urbanization and infrastructure development in Mexico are significant drivers of rising stainless steel demand. There is a greater demand for the construction of residential and commercial structures, and the development of infrastructure projects as the country's urbanization accelerates. Stainless steel has become a popular material for architectural structures due to its excellent corrosion resistance and durability, which has increased demand for stainless steel in the construction industry.

Opportunity

- Integration into green industries

The integration of stainless steel into green industries, such as the production of electric vehicles and sustainable infrastructure, presents a market opportunity for Mexico. Stainless steel can position itself as a key player in these developing sectors thanks to its inherent toughness and corrosion resistance, offering the industry promising growth prospects.

The use of stainless steel in renewable energy projects is one of the most promising prospects for the material in Mexico. The nation has been making active investments in renewable energy sources like wind, solar, and hydroelectric power to diversify its energy mix and lessen reliance on fossil fuels. The durability and corrosion resistance of stainless steel makes it a highly suitable material for a variety of components used in the infrastructure for renewable energy sources. For instance, the support structures and wind turbines used in wind energy are frequently exposed to harsh weather, such as high winds and saltwater exposure in coastal areas. The durability and dependability of wind turbine towers and components are guaranteed by stainless steel's high mechanical strength and resistance to corrosion.

Restraint

- Fluctuation in raw material prices

The Mexico stainless steel market is hampered by fluctuating raw material costs, particularly for critical components such as nickel, chromium, and iron. These raw materials are critical in the production of stainless steel, and changes in their prices can have a significant impact on the overall production costs incurred by manufacturers. The industry's ability to maintain stable pricing and ensure profitability is becoming increasingly difficult.

The production of corrosion-resistant stainless steel grades requires a significant amount of nickel, a raw material that is used extensively in the stainless steel manufacturing process. While iron serves as the primary constituent of the majority of stainless steel alloys, chromium is crucial for improving the corrosion resistance and strength of stainless steel. Numerous variables, such as shifts in market conditions, geopolitical events, and dynamics of global demand and supply, have an impact on the prices of these raw materials.

Challenge

- Infrastructure and Logistic Challenges

The efficient movement of stainless steel products in certain regions of Mexico is hampered by a lack of adequate transportation infrastructure and logistical constraints. These factors can cause delays and cost increases, affecting the stainless steel industry's growth and competitiveness. Addressing these infrastructure gaps is critical to ensuring the smooth flow of stainless steel products and supporting the industry's growth in these regions.

The efficient transportation of stainless steel products from manufacturing facilities to end users or distribution centers may be hampered in some parts of Mexico due to insufficient transportation infrastructure. Long-distance freight transportation may be challenging due to inadequately developed or poorly maintained roads, bridges, and highways. Delays in delivery times may result as a result, affecting production timelines and possibly resulting in untapped market potential.

Recent Development

- In 2022, According to SteelOrbis Electronic Marketplace Inc., the steel industry in Mexico received $2.14 billion in Foreign Direct Investment (FDI), a 674 percent increase over the previous year's $276 million. This ranked the sector fourth in investor preference, trailing only vehicle and truck manufacturing, which received $2.70 billion in FDI in the same year. Mexico, as a country, received a total of $35.29 billion in FDI in 2022, with an accumulated sum of $674.54 billion from 1999 to 2022.

Mexico Stainless Steel Market Scope

The market is categorized into five notable segments based on product, forming process, type, grade, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Stainless Steel Flat Products

- Stainless Steel Long Products

- Others

On the basis of product, the Mexico stainless steel market is segmented into stainless steel flat products, stainless steel long products, and others.

Forming Process

- Hot Rolled

- Cold Rolled

On the basis of forming process, the Mexico stainless steel market is segmented into hot rolled and cold rolled.

Type

- Austenitic Stainless Steel

- Ferritic Stainless Steel

- Martensitic Stainless Steel

- Duplex Stainless Steel

- Precipitation-Hard Enable Stainless Steel

On the basis of type, the Mexico stainless steel market is segmented into austenitic stainless steel, ferritic stainless steel, martensitic stainless steel, duplex stainless steel, and precipitation-hard enable stainless steel.

Grade

- 300 Series

- 400 Series

- 200 Series

- 500 Series

- 600 Series

On the basis of grade, the Mexico stainless steel market is segmented into 300 series, 400 series, 200 series, 500 series, and 600 series.

Application

- Automotive and Transportation

- Mechanical Engineering and Heavy Industries

- Metal Products

- Consumer Goods

- Medical and Healthcare

- Building and Construction

- Marine

- Others

On the basis of application, the Mexico stainless steel market is segmented into automotive and transportation, mechanical engineering and heavy industries, metal products, consumer goods, medical and healthcare, building and construction, marine, and others.

Mexico Stainless Steel Market Regional Analysis/Insights

The market is categorized into five notable segments on the basis of product, forming process, type, grade, and application.

The regions covered in the Mexico stainless steel market are the Northern Mexico, Central Mexico, Eastern Mexico, Western Mexico, and Southern Mexico.

The northern region is expected to dominate the Mexico stainless steel market due to the increasing demand in the automotive industry. Also, Northern Mexico is the fastest growing region due to increasing demand in end use industries like automotive, building and construction etc.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Mexico brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Stainless Steel Market Share Analysis

The market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the stainless steel market.

Some of the major market players operating in the market are Industeel, Acerinox, Aperam, NIPPON STEEL CORPORATION, Alleima, MITSUI & CO., LTD., Olympic Steel, Outokumpu, Ulbrich Stainless Steels and Special Metals Inc., Swiss Steel Holding AG, Gibbs Wire & Steel Company LLC, TIMEX METALS, Shrikant Steel Centre, Nitech Stainless Inc, and R H Alloys, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 COMPARATIVE OVERVIEW OF NORTH AMERICA

4.6 ADDITIONAL CUSTOMIZATION

4.7 IMPORT-EXPORT SCENARIO

4.8 PRICE INDEX SCENARIO

4.9 RAW MATERIAL COVERAGE

4.9.1 NICKEL

4.9.2 IRON ORE

4.9.3 CHROMIUM

4.9.4 SILICON

4.9.5 MOLYBDENUM

4.9.6 OTHERS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INDUSTRIAL ACTIVITIES IN MEXICO

6.1.2 RISING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.3 GROWING FOREIGN INVESTMENT AND TRADE AGREEMENTS

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL COSTS

6.2.2 COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION INTO GREEN INDUSTRIES

6.3.2 EXPANSION INTO MEDICAL AND HEALTHCARE SECTORS

6.4 CHALLENGES

6.4.1 INFRASTRUCTURE AND LOGISTIC CHALLENGES

6.4.2 ENVIRONMENTAL REGULATIONS COMPLIANCE

7 MEXICO STAINLESS STEEL MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BUILDING AND CONSTRUCTION

7.2.1 BUILDING AND CONSTRUCTION

7.2.1.1 RESIDENTIAL

7.2.1.2 COMMERCIAL

7.2.1.3 INFRASTRUCTURE

7.3 AUTOMOTIVE AND TRANSPORTATION

7.3.1 AUTOMOTIVE AND TRANSPORTATION

7.3.1.1 VEHICLES

7.3.1.1.1 TWO-WHEELER

7.3.1.1.2 FOUR-WHEELER

7.3.1.1.3 OTHERS

7.3.1.2 AEROSPACE

7.3.1.2.1 COMMERCIAL AIRCRAFT

7.3.1.2.2 MILITARY AIRCRAFT

7.3.1.2.3 PRIVATE CHARTER

7.4 MARINE

7.4.1 MARINE

7.4.1.1 CARGOS

7.4.1.2 PASSENGER SHIPS

7.4.1.3 BOATS

7.4.1.4 OTHERS

7.5 CONSUMER GOODS

7.5.1 CONSUMER GOODS

7.5.1.1 KITCHEN SINKS

7.5.1.2 CUTLERY

7.5.1.3 COOKWARE

7.5.1.4 KITCHEN APPLIANCES

7.5.1.5 FURNITURE

7.5.1.6 GARDEN EQUIPMENT

7.5.1.7 OTHERS

7.6 MECHANICAL ENGINEERING AND HEAVY INDUSTRIES

7.6.1 MECHANICAL ENGINEERING AND HEAVY INDUSTRIES

7.6.1.1 AGGREGATE MINING

7.6.1.2 METAL MINING

7.6.1.3 COAL MINING

7.6.1.4 OTHERS

7.7 METAL PRODUCTS

7.8 MEDICAL AND HEALTHCARE

7.8.1 MEDICAL AND HEALTHCARE

7.8.1.1 MEDICAL DEVICES

7.8.1.2 SURGICAL TOOLS

7.9 OTHERS

8 MEXICO STAINLESS STEEL MARKET BY REGION

8.1 NORTHERN MEXICO

8.2 CENTRAL MEXICO

8.3 EASTERN MEXICO

8.4 WESTERN MEXICO

8.5 SOUTHERN MEXICO

9 MEXICO STAINLESS STEEL MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MEXICO

9.2 ACQUISITION

9.3 SUSTAINABILITY

9.4 PARTNERSHIP

9.5 PRODUCT LAUNCH

9.6 AWARD

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 ACERINOX

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENTS

11.2 MITSUI & CO., LTD

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 OUTOKUMPU

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 ULBRICH STAINLESS STEELS AND SPECIAL METALS INC.

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENTS

11.5 NIPPON STEEL CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 ALLEIMA

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 APERAM

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENT

11.8 GIBBS WIRE & STEEL COMPANY LLC

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 INDUSTEEL

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENTS

11.1 NITECH STAINLESS INC

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 OLYMPIC STEEL

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENTS

11.12 R H ALLOYS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 SHRIKANT STEEL CENTRE

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

11.14 SWISS STEEL HOLDING AG

11.14.1 COMPANY SNAPSHOT

11.14.2 REVENUE ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT DEVELOPMENT

11.15 TIMEX METALS

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENT

11.16 POSCO HOLDINGS

11.16.1 COMPANY SNAPSHOT

11.16.2 REVENUE ANALYSIS

11.16.3 PRODUCT PORTFOLIO

11.16.4 RECENT DEVELOPMENT

11.17 AK STEEL INTERNATIONAL B.V. (CLEVELAND-CLIFFS INC)

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 COMPARATIVE DATA OF NORTH AMERICA STAINLESS STEEL MARKET (U.S. AND CANADA)

TABLE 2 ANNUAL APPARENT NATIONAL CONSUMPTION OF STAINLESS STEEL PRODUCTS IN MEXICO

TABLE 3 ANNUAL APPARENT REGIONAL CONSUMPTION OF STAINLESS STEEL PRODUCTS

TABLE 4 ANNUAL WEIGHTED AVERAGE MARGIN

TABLE 5 APPARENT NATIONAL CONSUMPTION ACROSS MAJOR STATES IN MEXICO

TABLE 6 CONSUMPTION DATA FOR HIGH ALLOY STAINLESS STEEL IN MEXICO

TABLE 7 ESTIMATED IMPORT AND PRODUCTION DATA OF STAINLESS STEEL IN MEXICO

TABLE 8 REGULATORY COVERAGE

TABLE 9 MEXICO STAINLESS STEEL MARKET, 2021-2030

TABLE 10 MEXICO STAINLESS STEEL MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MEXICO STAINLESS STEEL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 12 MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 14 MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 15 MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 16 MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 17 MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 18 MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 20 MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 23 MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 24 MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 25 MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 26 MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 NORTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 37 NORTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 38 NORTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 39 NORTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 40 NORTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 41 NORTHERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTHERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 43 NORTHERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTHERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTHERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 46 NORTHERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 47 NORTHERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 48 NORTHERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 49 NORTHERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTHERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTHERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTHERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTHERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTHERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 NORTHERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTHERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 NORTHERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CENTRAL MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 CENTRAL MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 60 CENTRAL MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 61 CENTRAL MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 62 CENTRAL MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 63 CENTRAL MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 64 CENTRAL MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 CENTRAL MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 66 CENTRAL MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 CENTRAL MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 CENTRAL MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 69 CENTRAL MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 70 CENTRAL MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 71 CENTRAL MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 72 CENTRAL MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 73 CENTRAL MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 CENTRAL MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 CENTRAL MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 CENTRAL MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 CENTRAL MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 CENTRAL MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 CENTRAL MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 CENTRAL MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 EASTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 82 EASTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 83 EASTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 84 EASTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 85 EASTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 86 EASTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 87 EASTERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 EASTERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 89 EASTERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 EASTERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 EASTERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 92 EASTERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 93 EASTERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 94 EASTERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 95 EASTERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 EASTERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 EASTERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 EASTERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 EASTERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 EASTERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 EASTERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 EASTERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 EASTERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 WESTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 105 WESTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 106 WESTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 107 WESTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 108 WESTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 109 WESTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 110 WESTERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 WESTERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 112 WESTERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 WESTERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 WESTERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 115 WESTERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 116 WESTERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 117 WESTERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 118 WESTERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 119 WESTERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 WESTERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 WESTERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 WESTERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 WESTERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 WESTERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 WESTERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 WESTERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 128 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 129 SOUTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 130 SOUTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 131 SOUTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 132 SOUTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 133 SOUTHERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 135 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 SOUTHERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 138 SOUTHERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 139 SOUTHERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 140 SOUTHERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 141 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 142 SOUTHERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 SOUTHERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 SOUTHERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 SOUTHERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 146 SOUTHERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 SOUTHERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 SOUTHERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 SOUTHERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 MEXICO STAINLESS STEEL MARKET

FIGURE 2 MEXICO STAINLESS STEEL MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO STAINLESS STEEL MARKET: DROC ANALYSIS

FIGURE 4 MEXICO STAINLESS STEEL MARKET: MEXICO VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO STAINLESS STEEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO STAINLESS STEEL MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MEXICO STAINLESS STEEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO STAINLESS STEEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO STAINLESS STEEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO STAINLESS STEEL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MEXICO STAINLESS STEEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MEXICO STAINLESS STEEL MARKET: SEGMENTATION

FIGURE 13 RISING URBANIZATION AND INRASTRUCTURE DEVELOPMENT ARE EXPECTED TO DRIVE THE MEXICO STAINLESS STEEL MARKET IN THE FORECAST PERIOD

FIGURE 14 THE STAINLESS STEEL FLAT PRODUCTS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO STAINLESS STEEL MARKET IN 2023 AND 2030

FIGURE 15 THE BELOW GRAPH SHOWS THE GREENHOUSE GAS EMISSIONS FOR STAINLESS STEEL.THE TOTAL EMISSIONS ARE 3.3 TONS OF CO2/ TON OF STAINLESS STEEL.

FIGURE 16 THE BELOW DIAGRAM SHOWS THE LIFE CYCLE OF STAINLESS STEEL IN 2010

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 THE HYBRID TECHNIQUE IS ONE OF NUMEROUS DEVELOPMENTS THAT USE HYDROGEN AS A REDUCING AGENT, WITH THE HYDROGEN BEING GENERATED THROUGH ELECTROLYSIS USING SUSTAINABLE POWER. THE MOST MAJOR ADVANTAGE FROM A NATURAL STANDPOINT IS THAT THE FUMES PRODUCED BY THIS TECHNIQUE ARE WATER RATHER THAN CARBON DIOXIDE.

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO STAINLESS STEEL MARKET

FIGURE 21 THE BELOW DATA SHOWS THE INDUSTRIAL PRODUCTION IN MEXICO

FIGURE 22 THE BELOW FIGURE SHOWS 'MEXICO'S URBAN POPULATION BY CITY SIZE CLASS, 1990–2035 (HISTORICAL AND PROJECTED)

FIGURE 23 MEXICO STAINLESS STEEL MARKET: BY APPLICATION, 2022

FIGURE 24 MEXICO STAINLESS STEEL MARKET: COMPANY SHARE 2022 (%)

Mexico Stainless Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Mexico Stainless Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Mexico Stainless Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.