Latin America Rotomolding Market Segmentation, Material (Polyethylene, Polypropylene, Polycarbonate, PVC, Polyurethane, Nylon, Elastomers, and Others), Form (Powder and Liquid), Utility (Heating, Cooling, and Others), Machine Type (Bi-Axial Machine, Carousel Machine, Shuttle Machine, Rock and Roll Machine, Clamshell Machine, Swing Arm Machine, Vertical Wheel Machine, Open Flame Machine, and Others), Machine Type (Non-Tank and Tank) – Industry Trends and Forecast to 2032.

Rotomolding Market Analysis

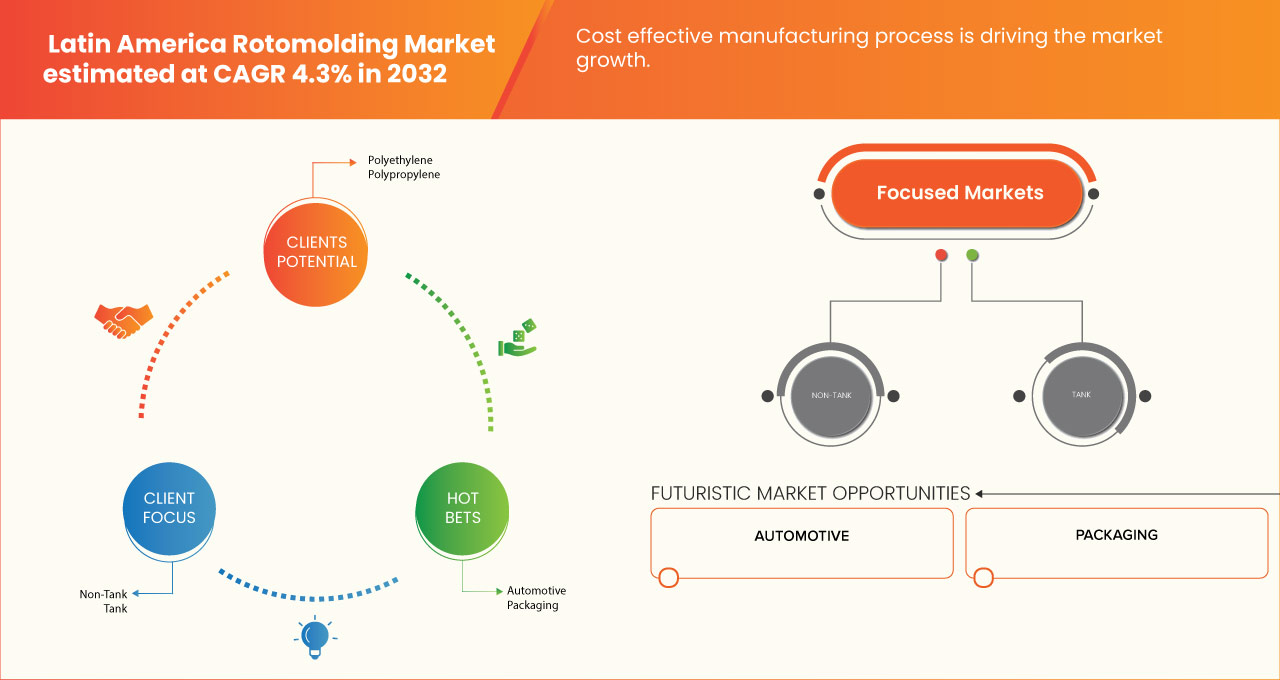

Growing demand for rotomolded products in agriculture and water management and cost-effective manufacturing process are some of the driving factors expected to propel the market growth. Some of the major restraints that may negatively impact the market growth are the fluctuating raw material costs and lack of advanced manufacturing technologies and skilled labor. Growth in infrastructure and construction projects in Latin America and increasing use of recycled materials are expected to create opportunities for the market growth. Stiff competition from imported rotomolded products and logistical and supply chain limitations are projected to challenge the market growth., thereby driving market growth in Latin America.

Rotomolding Market Size

Latin America rotomolding market size was valued at USD 157.06 million in 2024 and is projected to reach USD 219.82 million by 2032, with a CAGR of 4.3% during the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Rotomolding Market Trends

“Growing Demand for Rotomolded Products in Agriculture and Water Management”

Rotational molding, with its ability to create durable, cost-effective, and customizable products, has led to widespread Machine Types in agriculture, particularly in water storage, irrigation systems, and crop protection. Rotomolded products such as tanks, containers, and irrigation components are highly valued for their ability to withstand harsh environmental conditions, including UV exposure, extreme temperatures, and physical wear. These characteristics make rotomolded products ideal for agricultural environments, where reliability and longevity are essential.

In water management, rotomolded tanks are extensively used for rainwater harvesting, water storage, and distribution. The increasing demand for efficient water management solutions, particularly in regions facing water scarcity or irregular rainfall patterns, has further boosted the market. Rotomolded products are especially popular because they are leak-proof, resistant to corrosion, and capable of holding large volumes of water in a compact and space-efficient design. These features are crucial in rural and semi-urban areas, where water infrastructure is often inadequate or inaccessible.

Report Scope and Market Segmentation

|

Attributes

|

Rotomolding Market Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

Brazil, Mexico, Argentina, Colombia, Peru, Venezuela, Chile, Bolivia, Rest of Latin America

|

|

Key Market Players

|

Tecma Group of Companies (U.S.), ROTOMAQ (Mexico), Rotomold Mexico (Mexico), Krompa (Mexico), and Brecher Manufacturing (U.S.)

|

|

Market Opportunities

|

Growth in infrastructure and construction projects in latin america

Increasing use of recycled materials

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Rotomolding Market Definition

Rotomolding or rotational molding, is a manufacturing process used to create hollow, seamless plastic products through a multi-stage process of molding. It involves placing a powdered polymer inside a mold that is then heated and rotated bi-axially in an oven. As the mold rotates, the heat melts the polymer, which evenly coats the interior surfaces of the mold, creating a uniform layer. Once the desired thickness is achieved, the mold is cooled and the solidified product is removed. Rotomolding is highly versatile, allowing for the creation of complex shapes and durable parts without seams or joints. Rotomolding products encompass a wide range of Machine Types, including tanks, containers, toys, automotive components, marine buoys, playground equipment, and custom-designed structures. They are known for their durability, cost-effectiveness, lightweight nature, and corrosion resistance, making them suitable for industries such as agriculture, healthcare, construction, and transportation. The process enables consistent production with minimal material waste.

Rotomolding Market Dynamics

Drivers

- Cost Effective Manufacturing Process

Rotational molding offers a relatively low-cost production method compared to other plastic manufacturing techniques such as injection molding or blow molding. This is particularly beneficial in markets where cost efficiency is a primary concern, such as in emerging economies across Latin America. The process involves heating plastic resin powder in a mold and then rotating the mold along two perpendicular axes to ensure the material evenly coats the interior. Once cooled, the mold is removed, revealing the finished product. This simple yet effective process eliminates the need for high-pressure systems or complicated injection machinery, reducing both capital investment and operational costs.

Another reason for the cost-effectiveness of rotomolding is the material usage. The method produces minimal waste, as it allows for the reuse of excess material, thereby optimizing material costs. Additionally, rotomolding can produce large, complex, hollow structures in a single cycle without the need for seams, joints, or additional assembly steps, further reducing production costs. The ability to create a wide range of shapes, sizes, and thicknesses in one mold reduces tooling costs, which can be a significant expense in traditional molding processes..

For instance,

In January 2021, according to a blog published by Roto Dynamics, rotomolding is a cost-effective manufacturing process due to its low tooling costs, minimal waste, and ability to produce complex shapes without the need for expensive molds. Ideal for small to medium production runs, it offers flexibility and high-quality results, making it a preferred choice for many industries.

- Growing Potential of Rotomolded Parts In New Sectors Such As Automotive, Furniture, Healthcare And Others

The growing potential of rotomolded parts in new sectors, such as automotive, furniture, healthcare, and others, is a promising trend driving the expansion of the rotomolding market in Latin America. Traditionally associated with industries such as agriculture, water management, and consumer goods, rotational molding is increasingly finding applications in more diverse sectors due to its versatility, cost-effectiveness, and ability to produce durable, lightweight, and complex parts.

In the automotive industry, rotomolded components are gaining popularity for use in interior and exterior parts, such as bumpers, fenders, storage bins, and door panels. The ability of rotomolding to create lightweight yet strong parts helps improve fuel efficiency while maintaining high durability and safety standards. Moreover, rotomolded parts are highly resistant to impact, UV exposure, and weathering, making them ideal for automotive applications, especially in vehicles designed for rugged environments or outdoor use.

Opportunities

- Growth In Infrastructure and Construction Projects in Latin America

The infrastructure and construction sectors in Latin America are undergoing a substantial expansion, driven by increased public and private investment, population growth, and the need to modernize aging infrastructure. This rapid development presents a significant growth opportunity for the rotomolding market in the region, as it aligns with the rising demand for high-performance, durable, and cost-effective plastic products and components used in a wide range of construction applications.

Rotomolding, known for its flexibility in producing seamless, hollow, and complex shapes with uniform wall thickness, is well-positioned to cater to the needs of the construction sector. The versatility of rotomolded products, such as tanks, containers, pipes, and fittings, can meet the unique requirements of diverse infrastructure projects, including water management, wastewater treatment, housing developments, and road construction. As governments in Latin America prioritize urbanization and the enhancement of public utilities, the demand for lightweight, corrosion-resistant, and durable products manufactured through rotational molding is expected to surge. Furthermore, the growing emphasis on sustainable construction practices offers an additional avenue for market expansion. Rotomolding enables the use of eco-friendly and recyclable materials, aligning with the region’s sustainability goals and regulatory mandates. This makes rotomolded solutions attractive to developers and contractors seeking to comply with environmental standards while optimizing costs and maintaining high-quality outputs..

For instance,

In October 2020, according to an article published on the World Bank website Brazil has been investing heavily in improving its water infrastructure, including water storage and treatment facilities, to address water scarcity and distribution issues. As rotomolded tanks, known for their durability, leak resistance, and ability to store large volumes of water, can play a critical role in these projects. This creates an opportunity for rotomolding companies to supply products tailored to water conservation and management solutions

- Increasing Use of Recycled Materials

The growing emphasis on environmental sustainability and circular economy practices in Latin America is accelerating the adoption of recycled materials across various industries, including the rotomolding market. This trend presents a substantial opportunity for rotomolders to strengthen their market position by delivering eco-friendly solutions that meet evolving consumer and regulatory demands.

The use of recycled resins in rotomolding processes enables manufacturers to produce high-quality, durable products while reducing their environmental footprint. This aligns with government regulations and corporate sustainability goals, making rotomolded products more attractive to environmentally-conscious customers, including construction firms, utilities, and consumer goods companies. By leveraging recycled materials, rotomolders can address the growing market demand for sustainable, lightweight, and versatile solutions, such as water tanks, containers, and outdoor furniture, without compromising on performance or cost-effectiveness. Moreover, the incorporation of recycled materials into rotomolded products can lead to cost savings in material procurement, as recycled resins are often more economical than virgin materials. These savings can be passed on to customers, enhancing the competitiveness of rotomolded products in price-sensitive markets. This cost advantage, combined with the increased appeal of sustainable solutions, positions rotomolders to capture new business opportunities and expand their customer base.

Restrains/Challenges

- Stiff Competition from Imported Rotomolded Products

The manufacturers benefit from economies of scale, advanced production techniques, and lower labor costs, which allow them to offer competitive pricing for rotomolded products, such as tanks, containers, and outdoor furniture. This price advantage makes it difficult for Latin American manufacturers to compete, particularly in price-sensitive sectors such as construction and consumer goods, where cost is a key consideration for buyers. Local manufacturers may struggle to match these lower prices without compromising on quality or increasing their production costs. Additionally, Asia-Pacific manufacturers often have established supply chains and distribution networks that enable them to deliver products more quickly and efficiently, further enhancing their competitiveness in the Latin American market. The sheer volume of imports from Asia also leads to market saturation, making it challenging for local companies to differentiate their products or maintain customer loyalty

- Logistical and Supply Chain Limitations

Latin America’s vast geography, coupled with underdeveloped transportation infrastructure in certain areas, often results in high logistical costs and extended lead times for the delivery of critical materials, such as resins and additives used in rotomolding. Delays in the supply chain can lead to production bottlenecks, affecting the timeliness and reliability of customer orders. This poses a significant challenge, particularly in industries like construction, agriculture, and consumer goods, where customers demand quick and consistent product availability. Additionally, supply chain inefficiencies may lead to increased reliance on imported materials, exposing manufacturers to global supply chain disruptions, currency fluctuations, and tariffs that can raise material costs. Local rotomolding businesses are also hindered by limited access to modern warehousing facilities and just-in-time inventory systems. This makes it difficult to optimize inventory levels, leading to higher carrying costs and potential stockouts. Furthermore, the fragmented nature of supply chains across the region can increase the complexity of procurement and distribution, ultimately impacting the competitiveness and profitability of rotomolding companies.

- Regulatory Framework Content

The regulatory landscape in the Latin American rotomolding market is diverse and evolving, with significant emphasis on environmental sustainability, product quality, trade policies, and workplace safety. Environmental regulations are pushing manufacturers towards eco-friendly practices, while product standards ensure that rotomolded items meet the necessary quality and safety benchmarks. Trade policies and agreements play a crucial role in shaping access to raw materials and influencing cost structures, while health and safety regulations help ensure safe manufacturing conditions.

Navigating this regulatory environment requires companies to stay updated on both local laws and international standards, especially if they intend to export to markets with strict requirements. By prioritizing regulatory compliance and aligning with global standards, Latin American rotomolding manufacturers can improve competitiveness, foster sustainable growth, and strengthen their position in both regional and international markets.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Latin America Rotomolding Market Scope

The market is segmented on the basis of materials, form, utility, machine type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market Machine Types.

Materials

- Polyethylene

- Polypropylene

- Polycarbonate

- PVC

- Polyurethane

- Nylon

- Elastomers

- Others

Form

- Powder

- Liquid

Utility

- Heating

- Cooling

- Others

Machine Type

- Bi-Axial Machine

- Carousel Machin

- Shuttle Machine

- Rock and Roll Machine

- Clamshell Machine

- Swing Arm Machine

- Vertical Wheel Machine

- Open Flame Machine

- Others

Application

- Non-Tank

- Tank

Latin America Rotomolding Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, materials, form, utility, machine type, and application as referenced above.

The countries covered in the market are Brazil, Mexico, Argentina, Colombia, Peru, Venezuela, Chile, Bolivia, and rest of Latin America.

Brazil is expected to dominate the market due to advanced agricultural practices, strong research and development, and high demand for innovative solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Latin America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Latin America Rotomolding Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Latin America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Machine Type dominance. The above data points provided are only related to the companies' focus related to market.

Rotomolding Market Leaders Operating in the Market Are:

- Tecma Group of Companies (U.S.)

- ROTOMAQ (Mexico)

- Rotomold Mexico (Mexico)

- Krompa (Mexico)

- Brecher Manufacturing (U.S.)

SKU-