Supply Chain Ecosystem Analysis now part of DBMR Reports

LATAM Intermediate Bulk Containers (IBC) Market, By Product Type (Rigid Intermediate Bulk Containers (RIBC) and Flexible Intermediate Bulk Containers (FIBC), Material (Plastic, Metal, Fiberboard, and Others), Filling Technology (Aseptic and Non-Aseptic), Content Type (Solids, Semi-Solids, and Liquids), Container Type (Dry Container, Isolated Container, Open Top Container, Hard Top Container, Tank Container, Platform Container, Ventilated Container, and Others), Application (Chemicals, Oil & Gas, Food & Beverages, Agriculture, Pharmaceuticals, Paints, Inks & Dyes, Cosmetic & Personal Care, Building & Construction, Textiles, and Others) - Industry Trends and Forecast to 2031.

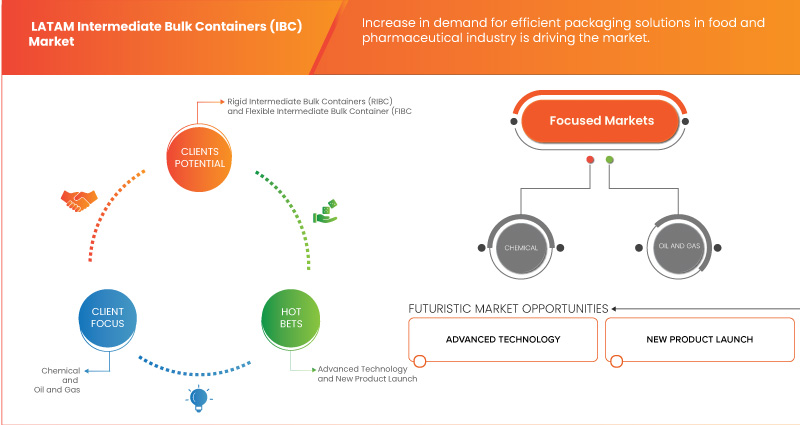

Rising demand in industrial packaging and storage is driving market growth. Advancements in material technology and emerging e-commerce trends are expected to create opportunities for market growth. However, regulatory compliance and certification and high initial investment and maintenance costs are restraining the market.

Data Bridge Market Research analyzes that the LATAM Intermediate Bulk Containers (IBC) market is expected to reach USD 421,772,425.90 by 2031 from USD 327,430,000.00 in 2023, growing with a CAGR of 3.3% in the forecast period of 2024 to 2031.

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD and Volume in Unit

|

|

Segments Covered

|

Product Type (Rigid Intermediate Bulk Containers (RIBC) and Flexible Intermediate Bulk Containers (FIBC), Material (Plastic, Metal, Fiberboard, and Others), Filling Technology (Aseptic and Non-Aseptic), Content Type (Solids, Semi-Solids, and Liquids), Container Type (Dry Container, Isolated Container, Open Top Container, Hard Top Container, Tank Container, Platform Container, Ventilated Container, and Others), Application (Chemicals, Oil & Gas, Food & Beverages, Agriculture, Pharmaceuticals, Paints, Inks & Dyes, Cosmetic & Personal Care, Building & Construction, Textiles, and Others)

|

|

Countries Covered

|

Mexico, Brazil, Argentina, Chile, Colombia, Peru, Ecuador, Costa Rica, Panama, Paraguay, Bolivia, Venezuela, Guatemala, El Salvador, Honduras, Rep Dominicana, Trinidad and Tobago, Jamaica, and Rest of LATAM

|

|

Market Players Covered

|

Greif, BWAY Corporation, Schütz GmbH & Co. KGaA., Bulk-Pack, Inc., THIELMANN - The Container Company, Brambles, FlexiblePackagingSolutions, Snyder Industries, Mondi, International Paper, and Schoeller Allibert, among others

|

Market Definition

Intermediate Bulk Containers (IBCs) are large, reusable industrial containers designed for transporting and storing bulk liquids, powders, or granulated materials. Typically made of durable materials such as plastic or metal, IBCs have standardized dimensions for easy handling and compatibility with various logistics systems. They often feature a pallet base for stability and can hold volumes ranging from 200 to 3,000 liters. IBCs provide a cost-effective and environmentally friendly alternative to traditional packaging methods. Commonly used in industries such as chemicals, food and beverages, and pharmaceuticals, IBCs play a crucial role in facilitating efficient and secure bulk material handling throughout the supply chain.

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

The food and pharmaceutical industries require packaging solutions that can ensure the protection and safety of their products. Intermediate Bulk Containers (IBCs) are designed to provide a secure and durable packaging option, protecting contents from contamination, damage, and external elements.

Intermediate Bulk Containers (IBCs) are known for their ability to transport large quantities of goods efficiently. In industries where bulk transportation is essential, such as the food and pharmaceutical sectors, Intermediate Bulk Containers (IBCs) offer a practical solution as they can streamline logistics, reduce transportation costs, and minimize the environmental impact associated with multiple smaller packaging units. Using Intermediate Bulk Containers (IBCs) can lead to cost savings in terms of transportation, storage, and handling.

The pharmaceutical and food industry demand for efficient, compliant, and cost-effective packaging solutions, combined with the unique features of Intermediate Bulk Containers (IBCs), contributes to the growth of the IBC market in this sector. The ability of Intermediate Bulk Containers (IBCs) to address the specific needs of pharmaceutical and food products makes them a preferred choice for bulk transport and storage in the pharmaceutical and food supply chain, which is driving the market growth.

Intermediate Bulk Containers (IBCs) are designed to safely handle and transport hazardous materials, meeting the stringent regulatory requirements associated with the chemical industry. The robust construction and containment capabilities of Intermediate Bulk Containers (IBCs) make them suitable for transporting and storing a wide range of chemicals. Intermediate Bulk Containers (IBCs) are available in various materials, such as stainless steel, plastic, and composite materials, allowing for compatibility with a broad spectrum of chemicals. This versatility makes Intermediate Bulk Containers (IBCs), a preferred choice for chemical manufacturers and distributors who deal with diverse products, as the containers can be customized to meet specific chemical compatibility requirements.

The rising demand for Intermediate Bulk Containers (IBCs) in the chemical industry is influenced by such factors which include safety compliance, product compatibility, bulk storage, and transportation efficiency, reduced handling risks, durability, international standard compliance, efficiency in handling and storage, and customization options. The adoption of Intermediate Bulk Containers (IBC) is likely to play a pivotal role in meeting the industry packaging and transportation needs, as the chemical industry continues to grow, which is driving the market growth.

Opportunities

Rising urbanization in the region is fueling the growth of infrastructure, building, and commercial development projects. These projects necessitate vast quantities of construction materials, chemicals, and other commodities, which may be easily transported and stored in IBCs. IBC durability and capacity make them ideal for usage on building sites, manufacturing facilities, and urban logistical centers, promoting the growth of these industries.

Industrialization often leads to increased manufacturing activities, resulting in higher demand for efficient and bulk transportation of raw materials and finished products. Intermediate Bulk Containers (IBCs), with their capacity to handle large volumes, become essential for streamlining logistics and supply chains in industrial hubs. Urbanization brings about concentrated population centers and the development of urban areas. This, in turn, intensifies the demand for efficient logistics to meet the needs of these concentrated populations. Intermediate Bulk Containers (IBCs), with their ability to optimize storage and transportation, offer a solution for the effective movement of goods within and between urban centers. Which is expected to create opportunities for market growth

Material technology advances by enabling the development of new, high-performance containers that satisfy the region's changing customer and industry needs. One opportunity is the development of lightweight but durable materials for IBC construction. Advanced polymers, composites, and metals have higher strength-to-weight ratios, allowing manufacturers to create IBCs that are lighter and less expensive to transport while preserving structural integrity and product safety. This is especially advantageous in Latin America, where transportation costs can be high due to long distances and difficult terrain.

The progress in material technology contributes significantly to the growth of the market. Enhanced materials offer the potential for Intermediate Bulk Containers (IBC) to become more durable, lightweight, and environmentally sustainable. This, in turn, can positively impact the design and efficiency of Intermediate Bulk Containers (IBC), making them more attractive to industries involved in the storage and transportation of bulk goods. Advanced materials can lead to the development of Intermediate Bulk Containers (IBC) with improved structural integrity, better resistance to corrosion, and increased lifespan, meeting the evolving demands of diverse sectors. In essence, innovations in material technology drive the evolution and competitiveness of Intermediate Bulk Containers (IBC) in the broader logistics and supply chain landscape is expected to create an opportunity for market growth.

Restraints/Challenges

Intermediate Bulk Containers (IBCs) typically involve a higher upfront cost compared to alternative storage solutions such as drums. The cost structure of Intermediate Bulk Containers (IBCs) includes not only the container itself but also additional features such as specialized linings, fittings, and valves, contributing to the overall initial investment. Small and Medium-Sized Enterprises (SMEs), prevalent in the LATAM region, may face financial constraints that hinder their ability to allocate a substantial amount of capital for Intermediate Bulk Containers (IBCs). The financial implications go beyond the purchase cost and extend to potential modifications in storage infrastructure, training for handling Intermediate Bulk Containers (IBCs) and compliance with safety regulations, intensifying the financial commitment.

Despite their durability, the necessity for periodic maintenance and potential replacement parts creates ongoing financial burdens for businesses. The elevated maintenance costs associated with intermediate bulk containers (Intermediate Bulk Containers (IBCs) are restraining the market growth.

A major obstacle is the wide variety of different packaging options accessible in Latin America, such as drums, flexi tanks, bulk tankers, and typical palletized loads. In comparison to IBCs, these alternatives may provide benefits such as greater flexibility, or better applicability for certain applications or sectors. As a result, IBC manufacturers and suppliers must compete with competitors who provide alternative solutions that may better match client expectations in terms of convenience and performance.

Competition from alternative packaging options is expected to be an important challenge to the Intermediate Bulk Containers (IBCs) market in Latin America, as manufacturers and suppliers are under pressure to distinguish their offerings and suit the region's distinct demands and preferences is expected to challenge the market growth.

Recent Development

The LATAM Intermediate Bulk Containers (IBC) market is segmented into seven notable segments which are based on product type, material, filling technology, content type, container type, application, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

On the basis of product type, the LATAM Intermediate Bulk Containers (IBC) market is segmented into Rigid Intermediate Bulk Containers (RIBC) and Flexible Intermediate Bulk Containers (FIBC).

Material

On the basis of material, the LATAM Intermediate Bulk Containers (IBC) market is segmented into plastic, metal, fiberboard, and others.

Filling Technology

On the basis of filling technology, the LATAM Intermediate Bulk Containers (IBC) market is segmented into aseptic and non-aseptic.

Content Type

On the basis of content type, the LATAM Intermediate Bulk Containers (IBC) market is segmented into solids, semi-solids, and liquids.

Container Type

On the basis of container type, the LATAM Intermediate Bulk Containers (IBC) market is segmented into dry container, isolated container, open top container, hard top container, tank container, platform container, ventilated container, and others.

Application

On the basis of application, the LATAM Intermediate Bulk Containers (IBC) market is segmented into chemicals, oil & gas, food & beverages, agriculture, pharmaceuticals, paints, inks & dyes, cosmetic & personal care, building & construction, textiles, and others.

Distribution Channel

On the basis of distribution channel, the LATAM Intermediate Bulk Containers (IBC) market is segmented into direct and indirect.

The LATAM Intermediate Bulk Containers (IBC) market is segmented into seven notable segments which are based on product type, material, filling technology, content type, container type, application, and distribution channel.

The countries covered in the LATAM Intermediate Bulk Containers (IBC) market are Mexico, Brazil, Argentina, Chile, Colombia, Peru, Ecuador, Costa Rica, Panama, Paraguay, Bolivia, Venezuela, Guatemala, El Salvador, Honduras, Rep Dominicana, Trinidad and Tobago, Jamaica, and rest of LATAM.

Brazil is expected to dominate the LATAM Intermediate Bulk Containers (IBC) market due to the rising demand for industrial packaging and storage in the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

The LATAM Intermediate Bulk Containers (IBC) market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the LATAM Intermediate Bulk Containers (IBC) market.

Some of the major players operating in the market are Greif, BWAY Corporation, Schütz GmbH & Co. KGaA., Bulk-Pack, Inc., THIELMANN - The Container Company, Brambles, FlexiblePackagingSolutions, Snyder Industries, Mondi, International Paper, and Schoeller Allibert among others.

SKU-

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS

4.2.2 THE THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 IMPORT EXPORT SCENARIO

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.7 SUPPLY CHAIN OF LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET

4.7.1 SUPPLIERS

4.7.2 MANUFACTURING

4.7.3 DISTRIBUTION

4.7.4 LOGISTICS

4.7.5 END USERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 RAW MATERIAL COVERAGE

4.9.1 PLASTIC

4.9.2 STEEL

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR EFFICIENT PACKAGING SOLUTIONS IN FOOD AND PHARMACEUTICAL INDUSTRY

6.1.2 RISING DEMAND FOR INTERMEDIATE BULK CONTAINERS (IBCS) IN CHEMICAL INDUSTRY

6.1.3 RISING DEMAND FOR INDUSTRIAL PACKAGING AND STORAGE

6.1.4 COST-EFFECTIVE ALTERNATIVE TO OTHER BULK PACKAGING OPTIONS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT AND MAINTENANCE COSTS

6.2.2 REGULATORY COMPLIANCE AND CERTIFICATION

6.3 OPPORTUNITIES

6.3.1 GROWING INDUSTRIALIZATION AND URBANIZATION IN THE REGION

6.3.2 PROGRESS IN INNOVATIVE MATERIAL SCIENCE AND TECHNOLOGY

6.3.3 GROWTH IN E-COMMERCE TRENDS

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE PACKAGING SOLUTIONS

6.4.2 SUPPLY CHAIN DISRUPTIONS STEMMING FROM NATURAL DISASTERS AND ECONOMIC VOLATILITY

7 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 RIGID INTERMEDIATE BULK CONTAINERS (RIBC)

7.2.1 RIGID INTERMEDIATE BULK CONTAINERS (RIBC), BY CAPACITY

7.2.2 RIGID INTERMEDIATE BULK CONTAINERS (RIBC), BY TYPE

7.2.3 FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC), BY TYPE

7.3 FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC)

7.3.1 FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC), BY CAPACITY

7.3.2 FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC), BY TYPE

8 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 PLASTIC, BY MATERIAL

8.2.2 POLYETHYLENE (PE), BY MATERIAL

8.3 METAL

8.3.1 METAL, BY MATERIAL

8.4 FIBERBOARD

8.5 OTHERS

9 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILLING TECHNOLOGY

9.1 OVERVIEW

9.2 NON-ASEPTIC

9.3 ASEPTIC

10 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE

10.1 OVERVIEW

10.2 LIQUIDS

10.3 SOLIDS

10.4 SEMI-SOLIDS

11 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE

11.1 OVERVIEW

11.2 TANK CONTAINER

11.2.1 TANK CONTAINER, BY CONTAINER TYPE

11.3 DRY CONTAINER

11.4 ISOLATED CONTAINER

11.5 OPEN TOP CONTAINER

11.6 HARD TOP CONTAINER

11.7 VENTILATED CONTAINER

11.8 PLATFORM CONTAINER

11.9 OTHERS

12 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 CHEMICALS

12.2.1 CHEMICALS, BY PRODUCT TYPE

12.3 OIL & GAS

12.3.1 OIL & GAS, BY PRODUCT TYPE

12.4 FOOD & BEVERAGES

12.4.1 FOOD & BEVERAGES, BY PRODUCT TYPE

12.5 AGRICULTURE

12.5.1 AGRICULTURE, BY PRODUCT TYPE

12.6 PHARMACEUTICALS

12.6.1 PHARMACEUTICALS, BY PRODUCT TYPE

12.7 PAINTS, INKS & DYES

12.7.1 PAINTS, INKS & DYES, BY PRODUCT TYPE

12.8 COSMETIC & PERSONAL CARE

12.8.1 COSMETIC & PERSONAL CARE, BY PRODUCT TYPE

12.9 BUILDING & CONSTRUCTION

12.9.1 BUILDING & CONSTRUCTION, BY PRODUCT TYPE

12.1 TEXTILES

12.10.1 TEXTILES, BY PRODUCT TYPE

12.11 OTHERS

12.11.1 OTHERS, BY PRODUCT TYPE

13 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 INDIRECT

13.3 DIRECT

14 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY COUNTRY

14.1 BRAZIL

14.2 MEXICO

14.3 ARGENTINA

14.4 CHILE

14.5 COLOMBIA

14.6 PERU

14.7 EUCADOR

14.8 COSTA RICA

14.9 PANAMA

14.1 VENEZUELA

14.11 GUATEMALA

14.12 BOLIVIA

14.13 REP DOMINICANA

14.14 HONDURAS

14.15 PARAGUAY

14.16 EL SALVADOR

14.17 JAMAICA

14.18 TRINIDAD AND TOBAGO

14.19 REST OF LATAM

15 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: LATAM

15.2 TECHNOLOGY

15.3 PRODUCT LAUNCH

15.4 EXPANSION

15.5 AWARD

15.6 PARTNERSHIP

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 BWAY CORPORATION

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 INTERNATIONAL PAPER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 SCHÜTZ GMBH & CO. KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 GREIF

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 MONDI

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 BRAMBLES

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 BULK-PACK, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 FLEXIBLEPACKAGINGSOLUTIONS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 SCHOELER ALLIBERT

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 SNYDER INDUSTRIES

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 THIELMANN - THE CONTAINER COMPANY

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

TABLE 1 COUNTRIES INCLUDED IN THIS TABLE ACCOUNTED FOR APPROXIMATELY 98% OF TOTAL WORLD CRUDE STEEL PRODUCTION IN 2021:

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 DESIGNATORY CODE SYSTEM FOR INTERMEDIATE BULK CONTAINERS (IBCS)

TABLE 4 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 5 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 6 LATAM RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 7 LATAM RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 8 LATAM FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 9 LATAM FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 10 LATAM FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 11 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 12 LATAM PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 13 LATAM POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 14 LATAM METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 15 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILLING TECHNOLOGY, 2022-2031 (USD)

TABLE 16 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 17 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 18 LATAM TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 19 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 20 LATAM CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 21 LATAM OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 22 LATAM FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 23 LATAM AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 24 LATAM PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 25 LATAM PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 26 LATAM COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 27 LATAM BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 28 LATAM TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 29 LATAM OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 30 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 31 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY COUNTRY, 2022-2031 (USD)

TABLE 32 LATAM INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY COUNTRY, 2022-2031 (UNIT)

TABLE 33 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 34 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 35 BRAZIL RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 36 BRAZIL RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 37 BRAZIL FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 38 BRAZIL FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 39 BRAZIL FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 40 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 41 BRAZIL PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 42 BRAZIL POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 43 BRAZIL METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 44 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 45 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 46 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 47 BRAZIL TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 48 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 49 BRAZIL CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 50 BRAZIL OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 51 BRAZIL FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 52 BRAZIL AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 53 BRAZIL PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 54 BRAZIL PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 55 BRAZIL COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 56 BRAZIL BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 57 BRAZIL TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 58 BRAZIL OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 59 BRAZIL INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 60 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 61 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 62 MEXICO RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 63 MEXICO RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 64 MEXICO FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 65 MEXICO FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 66 MEXICO FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 67 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 68 MEXICO PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 69 MEXICO POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 70 MEXICO METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 71 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 72 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 73 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 74 MEXICO TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 75 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 76 MEXICO CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 77 MEXICO OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 78 MEXICO FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 79 MEXICO AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 80 MEXICO PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 81 MEXICO PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 82 MEXICO COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 83 MEXICO BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 84 MEXICO TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 85 MEXICO OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 86 MEXICO INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 87 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 88 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 89 ARGENTINA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 90 ARGENTINA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 91 ARGENTINA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 92 ARGENTINA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 93 ARGENTINA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 94 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 95 ARGENTINA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 96 ARGENTINA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 97 ARGENTINA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 98 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 99 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 100 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 101 ARGENTINA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 102 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 103 ARGENTINA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 104 ARGENTINA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 105 ARGENTINA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 106 ARGENTINA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 107 ARGENTINA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 108 ARGENTINA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 109 ARGENTINA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 110 ARGENTINA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 111 ARGENTINA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 112 ARGENTINA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 113 ARGENTINA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 114 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 115 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 116 CHILE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 117 CHILE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 118 CHILE FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 119 CHILE FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 120 CHILE FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 121 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 122 CHILE PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 123 CHILE POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 124 CHILE METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 125 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 126 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 127 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 128 CHILE TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 129 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 130 CHILE CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 131 CHILE OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 132 CHILE FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 133 CHILE AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 134 CHILE PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 135 CHILE PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 136 CHILE COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 137 CHILE BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 138 CHILE TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 139 CHILE OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 140 CHILE INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 141 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 142 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 143 COLOMBIA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 144 COLOMBIA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 145 COLOMBIA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 146 COLOMBIA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 147 COLOMBIA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 148 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 149 COLOMBIA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 150 COLOMBIA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 151 COLOMBIA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 152 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 153 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 154 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 155 COLOMBIA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 156 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 157 COLOMBIA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 158 COLOMBIA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 159 COLOMBIA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 160 COLOMBIA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 161 COLOMBIA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 162 COLOMBIA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 163 COLOMBIA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 164 COLOMBIA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 165 COLOMBIA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 166 COLOMBIA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 167 COLOMBIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 168 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 169 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 170 PERU RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 171 PERU RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 172 PERU FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 173 PERU FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 174 PERU FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 175 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 176 PERU PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 177 PERU POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 178 PERU METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 179 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 180 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 181 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 182 PERU TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 183 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 184 PERU CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 185 PERU OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 186 PERU FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 187 PERU AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 188 PERU PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 189 PERU PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 190 PERU COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 191 PERU BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 192 PERU TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 193 PERU OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 194 PERU INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 195 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 196 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 197 ECUADOR RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 198 ECUADOR RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 199 ECUADOR FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 200 ECUADOR FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 201 ECUADOR FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 202 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 203 ECUADOR PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 204 ECUADOR POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 205 ECUADOR METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 206 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 207 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 208 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 209 ECUADOR TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 210 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 211 ECUADOR CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 212 ECUADOR OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 213 ECUADOR FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 214 ECUADOR AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 215 ECUADOR PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 216 ECUADOR PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 217 ECUADOR COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 218 ECUADOR BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 219 ECUADOR TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 220 ECUADOR OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 221 ECUADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 222 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 223 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 224 COSTA RICA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 225 COSTA RICA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 226 COSTA RICA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 227 COSTA RICA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 228 COSTA RICA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 229 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 230 COSTA RICA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 231 COSTA RICA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 232 COSTA RICA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 233 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 234 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 235 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 236 COSTA RICA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 237 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 238 COSTA RICA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 239 COSTA RICA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 240 COSTA RICA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 241 COSTA RICA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 242 COSTA RICA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 243 COSTA RICA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 244 COSTA RICA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 245 COSTA RICA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 246 COSTA RICA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 247 COSTA RICA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 248 COSTA RICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 249 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 250 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 251 PANAMA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 252 PANAMA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 253 PANAMA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 254 PANAMA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 255 PANAMA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 256 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 257 PANAMA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 258 PANAMA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 259 PANAMA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 260 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 261 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 262 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 263 PANAMA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 264 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 265 PANAMA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 266 PANAMA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 267 PANAMA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 268 PANAMA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 269 PANAMA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 270 PANAMA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 271 PANAMA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 272 PANAMA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 273 PANAMA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 274 PANAMA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 275 PANAMA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 276 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 277 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 278 VENEZUELA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 279 VENEZUELA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 280 VENEZUELA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 281 VENEZUELA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 282 VENEZUELA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 283 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 284 VENEZUELA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 285 VENEZUELA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 286 VENEZUELA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 287 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 288 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 289 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 290 VENEZUELA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 291 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 292 VENEZUELA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 293 VENEZUELA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 294 VENEZUELA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 295 VENEZUELA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 296 VENEZUELA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 297 VENEZUELA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 298 VENEZUELA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 299 VENEZUELA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 300 VENEZUELA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 301 VENEZUELA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 302 VENEZUELA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 303 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 304 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 305 GUATEMALA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 306 GUATEMALA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 307 GUATEMALA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 308 GUATEMALA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 309 GUATEMALA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 310 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 311 GUATEMALA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 312 GUATEMALA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 313 GUATEMALA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 314 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 315 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 316 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 317 GUATEMALA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 318 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 319 GUATEMALA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 320 GUATEMALA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 321 GUATEMALA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 322 GUATEMALA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 323 GUATEMALA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 324 GUATEMALA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 325 GUATEMALA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 326 GUATEMALA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 327 GUATEMALA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 328 GUATEMALA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 329 GUATEMALA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 330 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 331 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 332 BOLIVIA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 333 BOLIVIA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 334 BOLIVIA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 335 BOLIVIA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 336 BOLIVIA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 337 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 338 BOLIVIA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 339 BOLIVIA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 340 BOLIVIA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 341 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 342 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 343 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 344 BOLIVIA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 345 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 346 BOLIVIA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 347 BOLIVIA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 348 BOLIVIA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 349 BOLIVIA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 350 BOLIVIA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 351 BOLIVIA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 352 BOLIVIA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 353 BOLIVIA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 354 BOLIVIA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 355 BOLIVIA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 356 BOLIVIA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 357 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 358 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 359 REP DOMINICANA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 360 REP DOMINICANA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 361 REP DOMINICANA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 362 REP DOMINICANA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 363 REP DOMINICANA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 364 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 365 REP DOMINICANA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 366 REP DOMINICANA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 367 REP DOMINICANA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 368 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 369 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 370 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 371 REP DOMINICANA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 372 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 373 REP DOMINICANA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 374 REP DOMINICANA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 375 REP DOMINICANA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 376 REP DOMINICANA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 377 REP DOMINICANA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 378 REP DOMINICANA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 379 REP DOMINICANA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 380 REP DOMINICANA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 381 REP DOMINICANA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 382 REP DOMINICANA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 383 REP DOMINICANA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 384 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 385 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 386 HONDURAS RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 387 HONDURAS RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 388 HONDURAS FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 389 HONDURAS FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 390 HONDURAS FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 391 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 392 HONDURAS PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 393 HONDURAS POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 394 HONDURAS METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 395 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 396 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 397 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 398 HONDURAS TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 399 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 400 HONDURAS CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 401 HONDURAS OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 402 HONDURAS FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 403 HONDURAS AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 404 HONDURAS PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 405 HONDURAS PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 406 HONDURAS COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 407 HONDURAS BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 408 HONDURAS TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 409 HONDURAS OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 410 HONDURAS INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 411 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 412 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 413 PARAGUAY RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 414 PARAGUAY RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 415 PARAGUAY FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 416 PARAGUAY FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 417 PARAGUAY FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 418 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 419 PARAGUAY PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 420 PARAGUAY POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 421 PARAGUAY METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 422 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 423 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 424 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 425 PARAGUAY TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 426 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 427 PARAGUAY CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 428 PARAGUAY OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 429 PARAGUAY FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 430 PARAGUAY AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 431 PARAGUAY PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 432 PARAGUAY PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 433 PARAGUAY COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 434 PARAGUAY BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 435 PARAGUAY TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 436 PARAGUAY OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 437 PARAGUAY INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 438 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 439 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 440 EL SALVADOR RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 441 EL SALVADOR RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 442 EL SALVADOR FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 443 EL SALVADOR FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 444 EL SALVADOR FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 445 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 446 EL SALVADOR PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 447 EL SALVADOR POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 448 EL SALVADOR METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 449 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 450 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 451 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 452 EL SALVADOR TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 453 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 454 EL SALVADOR CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 455 EL SALVADOR OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 456 EL SALVADOR FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 457 EL SALVADOR AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 458 EL SALVADOR PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 459 EL SALVADOR PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 460 EL SALVADOR COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 461 EL SALVADOR BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 462 EL SALVADOR TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 463 EL SALVADOR OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 464 EL SALVADOR INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)

TABLE 465 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 466 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (UNIT)

TABLE 467 JAMAICA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 468 JAMAICA RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 469 JAMAICA FOLDABLE RIGID INTERMEDIATE BULK CONTAINERS (RIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 470 JAMAICA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CAPACITY, 2022-2031 (USD)

TABLE 471 JAMAICA FLEXIBLE INTERMEDIATE BULK CONTAINERS (FIBC) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY TYPE, 2022-2031 (USD)

TABLE 472 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 473 JAMAICA PLASTIC IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 474 JAMAICA POLYETHYLENE (PE) IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 475 JAMAICA METAL IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY MATERIAL, 2022-2031 (USD)

TABLE 476 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY FILING TECHNOLOGY, 2022-2031 (USD)

TABLE 477 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTENT TYPE, 2022-2031 (USD)

TABLE 478 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 479 JAMAICA TANK CONTAINER IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY CONTAINER TYPE, 2022-2031 (USD)

TABLE 480 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY APPLICATION, 2022-2031 (USD)

TABLE 481 JAMAICA CHEMICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 482 JAMAICA OIL & GAS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 483 JAMAICA FOOD & BEVERAGES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 484 JAMAICA AGRICULTURE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 485 JAMAICA PHARMACEUTICALS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 486 JAMAICA PAINTS, INKS & DYES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 487 JAMAICA COSMETIC & PERSONAL CARE IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 488 JAMAICA BUILDING & CONSTRUCTION IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 489 JAMAICA TEXTILES IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 490 JAMAICA OTHERS IN INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY PRODUCT TYPE, 2022-2031 (USD)

TABLE 491 JAMAICA INTERMEDIATE BULK CONTAINERS (IBC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD)