KSA Freight Forwarding Market, By Offering (Services and Software), Mode of Transport (Road Freight Forwarding, Air Freight Forwarding, Sea Freight Forwarding, and Rail Freight Forwarding), Logistics Model (Third Party Logistics, Second Party Logistics, and First Party Logistics), Customer Type (B2B, B2C, and E-Commerce & Last Mile Delivery), Freight Forwarder Type (Consolidators/NVOCC, Multimodal Transport Operators, Custom Brokers, Port Agent, and Others), End-User (Oil & Gas Industry, Industrial & Manufacturing, Food & Beverages, Energy & Utility, FMCG, Healthcare, Automotive, IT & Telecom, Retail, Military, and Others) - Industry Trends and Forecast to 2031.

KSA Freight Forwarding Market Analysis and Insights

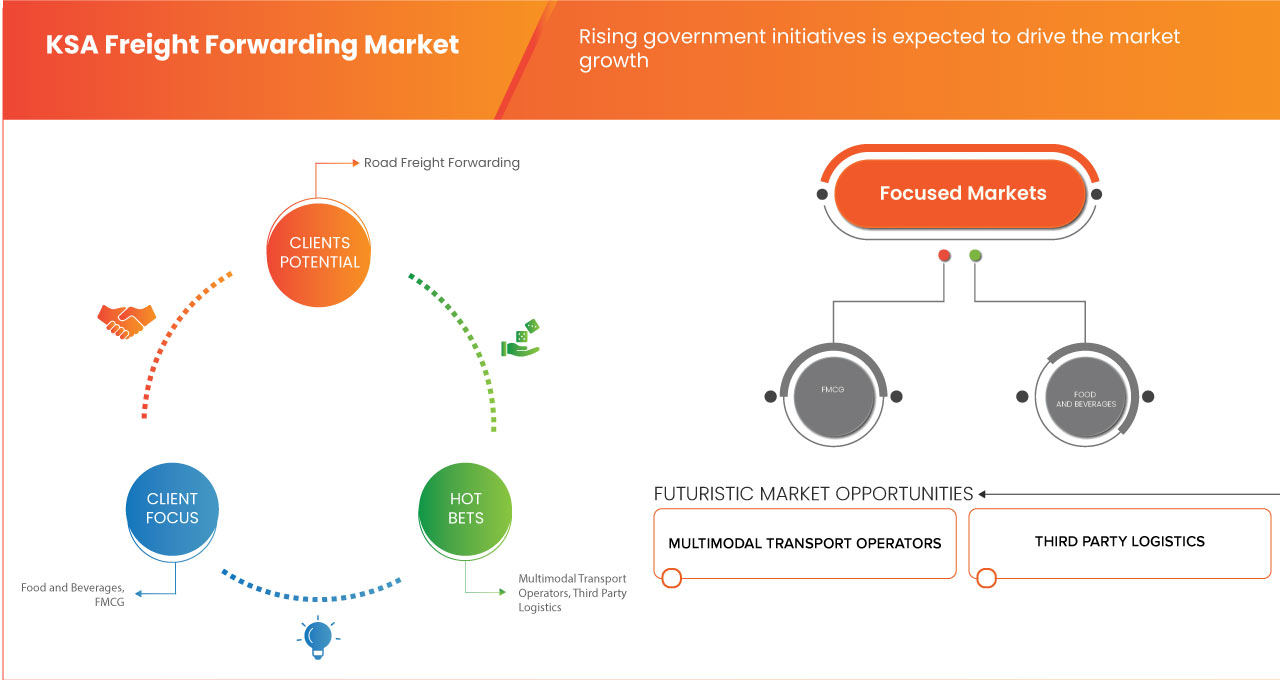

Growing demand for FMCG, retail, food industry, and E-commerce in the KSA and increasing demand for outsourcing logistics services will emerge as the major market growth driving factors. Rising government initiatives will further aggravate the growth of the market. High infrastructure investment leading opportunities for businesses and Collaboration and partnership are some other factors driving the market growth. However, Security and risk management will act as a restraint for the market growth.

Data Bridge Market Research analyzes that the KSA freight forwarding market is expected to reach USD 2,880.73 million by 2031 from USD 1,766.07 million in 2023, growing with a CAGR of 6.4% in the forecast period of 2024 to 2031.

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Offering (Services and Software), Mode of Transport (Road Freight Forwarding, Air Freight Forwarding, Sea Freight Forwarding, and Rail Freight Forwarding), Logistics Model (Third Party Logistics, Second Party Logistics, and First Party Logistics), Customer Type (B2B, B2C, and E-Commerce & Last Mile Delivery), Freight Forwarder Type (Consolidators/NVOCC, Multimodal Transport Operators, Custom Brokers, Port Agent, and Others), End-User (Oil & Gas Industry, Industrial & Manufacturing, Food & Beverages, Energy & Utility, FMCG, Healthcare, Automotive, IT & Telecom, Retail, Military, and Others)

|

|

Country Covered

|

KSA

|

|

Market Players Covered

|

DSV, Kuehne+Nagel, GAC, Almajdouie, CEVA Logistics, Expeditors International of Washington, Inc. , SINOTRANS, DB SCHENKER, SEKO Logistics, JAS, Abdul Latif Jameel IPR Company Limited, United Parcel Service of America, Inc., NAQEL Company, DHL, Crane Worldwide Logistics, fourwinds, ARABCO Logistics, FedEx, BOLLORÉ LOGISTICS, Freights Solutions Co. , PAREKH GROUP, Swift Cargo., and WeFreight among others

|

Market Definition

This market refers to the industry involved in the transportation of goods from one place to another within Saudi Arabia and internationally. It encompasses services such as shipping, customs clearance, and storage. Freight forwarding companies act as intermediaries, coordinating the movement of cargo for businesses. With a focus on efficiency and reliability, these companies play a crucial role in ensuring smooth logistics operations. The market is influenced by factors such as trade policies, infrastructure, and global economic conditions. As a vital component of the supply chain, the KSA freight forwarding market supports businesses of all sizes in transporting goods, facilitating trade, and contributing to the overall economic activity of the region.

Global Facility Management Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Demand for FMCG, Retail, Food Industry, and E-Commerce in the KSA

The Kingdom of Saudi Arabia (KSA) is experiencing a significant transformation in its economic landscape, with the FMCG (Fast-Moving Consumer Goods), retail, food industry, and E-commerce sectors playing pivotal roles. The increasing desire for everyday products such as groceries, household items, and online shopping is causing a surge in demand for Fast-Moving Consumer Goods (FMCG), retail, food, and E-commerce in Saudi Arabia. Businesses need to bring in goods from other places, leading to a rise in imports as people want more variety and convenience.

The flourishing demand for fast-moving consumer goods, the evolving retail landscape, the thriving food industry, and the booming e-commerce sector collectively propel the freight forwarding market in the Kingdom of Saudi Arabia. The crucial role played by freight services in ensuring swift and reliable transportation for a diverse range of products is driving the market growth.

- Increasing Demand for Outsourcing Logistics Services

The freight forwarding market in Saudi Arabia has experienced a significant boost in recent years, driven by the escalating demand for outsourcing logistics services. This surge is particularly evident in the outsourcing of warehouse services and the growing reliance on third-party logistics (3PL) providers. Over the past five years, the third-party logistics market has observed a marginal yet noteworthy increase, reflecting the evolving landscape of logistics management in the Kingdom.

Opportunity

- High Infrastructure Invest Leading Opportunity for Businesses

The Kingdom of Saudi Arabia (KSA) has undergone a remarkable transformation through substantial investments in its infrastructure. This strategic move has not only paved the way for enhanced connectivity within the region but has also emerged as a catalyst for burgeoning economic activities. One of the significant beneficiaries of this transformation is the Freight Forwarding sector, which is experiencing a surge in opportunities owing to the increasing demand for efficient logistics services. This unprecedented growth in business activities has created a unique window of opportunity for Freight Forwarding companies operating in the region. These companies play a pivotal role in facilitating the smooth and efficient movement of goods, ensuring that businesses can meet their supply chain demands seamlessly. Furthermore, as global supply chains become more complex, freight forwarding companies' knowledge becomes increasingly important for companies looking to expand and become competitive.

Restraints/Challenges

- Impact of Environmental Regulations on Constraints in Freight Forwarding

Global regulatory agencies are enforcing strict regulations in response to growing concerns about climate change and sustainability. These regulations have an impact on several industries, including freight forwarding and logistics. Environmental regulations, aimed at reducing carbon footprints and promoting sustainable practices, have become a significant constraint for the freight forwarding market in KSA. These regulations encompass emissions standards, waste management, and other eco-friendly initiatives that directly impact the operational dynamics of freight forwarders.

- Security and Risk Management Difficulty in Trade

Freight forwarding, pivotal in global supply chains, faces intricate challenges in the Kingdom of Saudi Arabia (KSA). Beyond its role in operational and financial risks, the industry deals with the heightened complexity of security concerns. Valuable goods traversing borders encounter threats ranging from theft to cyber-attacks.

The multifaceted challenges faced by the KSA freight forwarding market, ranging from vulnerability to theft and damage, limited control post-possession, to emerging technological risks such as cybersecurity threats, collectively form a complex web of obstacles. Safeguarding valuable shipments in this dynamic landscape is expected to challenge market growth.

Recent Developments

- In November 2023, GAC secured the prestigious Ship Agency of the Year award at The Maritime Standard Awards, marking its fifth win. Acknowledging GAC's commitment to excellence, innovation, and customer-centric services in the Middle East and Indian Subcontinent, the award reflects the company's adaptability to industry demands while upholding the highest standards of service quality. The Ship Agency of the Year award at The Maritime Standard Awards 2023 reaffirms GAC's industry leadership, boosting its reputation for excellence and customer-focused services. This accolade underscored GAC's commitment to setting new standards and enhanced its competitive edge in the dynamic Middle East and Indian Subcontinent maritime industry

- In October 2023, DSV teamed up with NEOM, a flagship development project in Saudi Arabia, to establish a significant USD 10.00 billion joint venture. This collaboration aims to bolster the logistical infrastructure essential for the ongoing ambitious projects in NEOM. The partnership seeks to provide comprehensive logistics services that will play a crucial role in facilitating the development of DSV in Saudi Arabia. This joint venture reflects a strategic move to enhance operational capabilities and contribute to the successful execution of major initiatives in the region

- In October 2023, Kuehne+Nagel and Tamer Logistics forged an exclusive partnership in Saudi Arabia, addressing the rising demand for logistics solutions. This partnership enhances Kuehne+Nagel's contract logistics and freight forwarding with Tamer Logistics' local expertise, expanding their service portfolio. The strategic alliance aims to drive sustainable industry growth, aligning with Saudi Arabia's Vision 2030 and bolstering the country's position as a regional logistical hub

- In August 2023, Kuehne+Nagel has secured a contract from Envision Energy to transport 190 wind turbine generators and 67 tower sets, totaling 1.4 million tons, for Saudi Arabia’s NEOM project. This aligns with Kuehne+Nagel’s Roadmap 2026, emphasizing renewable energy solutions. The NEOM wind farm, set for completion in 2025, will produce 1.67 GW to power NEOM Green Hydrogen Company, the world’s largest hydrogen facility. Kuehne+Nagel's dedicated team, spanning logistics professionals, drivers, and engineers, underscores its commitment to advancing the global energy transition

- In May 2023, CEVA Logistics received the Most Inspiring Automotive Logistics Solution Award for its commitment to customer satisfaction, value, and safety, highlighted by the recent launch of its DCBrain SaaS solution, showcasing a strong emphasis on digitalization, integration, and standardization for efficient global supply chain management in the automotive sector

KSA Freight Forwarding Market Scope

The market is segmented into six notable segments based on offering, mode of transport, logistics model, customer type, freight forwarder type, and end-user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the differences in your target markets.

Offering

- Services

- Software

On the basis of offering, the market is segmented into services and software.

Mode of Transport

- Road Freight Forwarding

- Air Freight Forwarding

- Sea Freight Forwarding

- Rail Freight Forwarding

On the basis of mode of transport, the market is segmented into road freight forwarding, air freight forwarding, sea freight forwarding, and rail freight forwarding.

Logistics Model

- Third Party Logistics

- Second Party Logistics

- First Party Logistics

On the basis of logistics model, the market is segmented into third party logistics, second party logistics, and first party logistics.

Customer Type

- B2B

- B2C

- E-Commerce & Last Mile Delivery

On the basis of customer type, the market is segmented into B2B, B2C, and e-commerce & last mile delivery.

Freight Forwarder Type

- Consolidators/NVOCC

- Multimodal Transport Operators

- Custom Brokers

- Port Agent

- Others

On the basis of freight forwarder type, the market is segmented into consolidators/NVOCC, multimodal transport operators, custom brokers, port agent, and others.

End-User

- Oil & Gas Industry

- Industrial & Manufacturing

- Food & Beverages

- Energy & Utility

- FMCG

- Healthcare

- Automotive

- IT & Telecom

- Retail

- Military

- Others

On the basis of end-user, the market is segmented into oil and gas industry, industrial & manufacturing, food and beverages, energy and utility, FMCG, healthcare, automotive, IT & telecom, retail, military, and others.

Competitive Landscape and KSA Freight Forwarding Market Share Analysis

The KSA freight forwarding market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the KSA freight forwarding market are DSV, Kuehne+Nagel, GAC, Almajdouie, CEVA Logistics, Expeditors International of Washington, Inc., SINOTRANS, DB SCHENKER, SEKO Logistics, JAS, Abdul Latif Jameel IPR Company Limited, United Parcel Service of America, Inc., NAQEL Company, DHL, Crane Worldwide Logistics, fourwinds, ARABCO Logistics, FedEx, BOLLORÉ LOGISTICS, Freights Solutions Co., PAREKH GROUP, Swift Cargo., and WeFreight among others.

SKU-