Kenya Uganda Tanzania And Rwanda Potato Processing Market

Market Size in USD Million

CAGR :

%

USD

553.15 Million

USD

720.84 Million

2023

2034

USD

553.15 Million

USD

720.84 Million

2023

2034

| 2024 –2034 | |

| USD 553.15 Million | |

| USD 720.84 Million | |

|

|

|

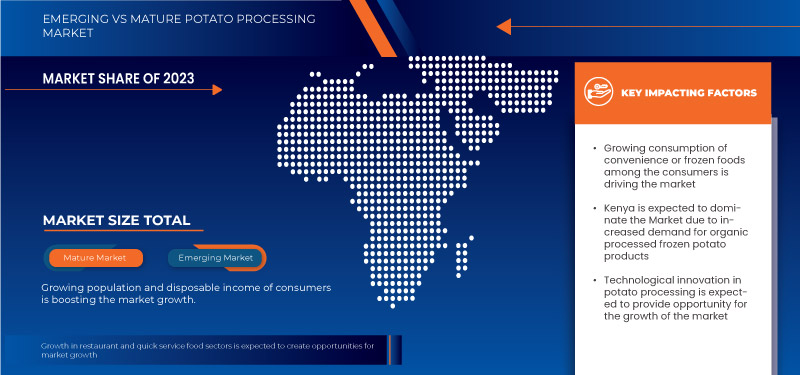

Potato Processing Market Analysis

Growing consumption of conveniene or frozen foods among the consumers and growing popularity of restaurant and quick service food sectors is driving the market growth.Technological innovation in potato processing and increasing demand for organic processed frozen potato products provodes opportunities in the market.Moreover, availability of a diverse range of products driving market growth.

Potato Processing Market Size

The Kenya, Uganda, Tanzania, and Rwanda potato processing market is expected to reach USD 720.84 million by 2034 from USD 553.15 million in 2023, growing with a substantial CAGR of 2.5% in the forecast period of 2024 to 2034.

Potato Processing Market Trends

“Growing Consumption of Convenience or Frozen Foods among the Consumers”

There is an increasing trend in the demand for convenience or frozen foods. Numerous factors have contributed to the rise in demand for frozen or convenient potato products. First of all, as a result of busier lifestyles, people now need quick and simple meal options. The products made from frozen potatoes provide a fast and easy solution. Additionally, frozen potato products have a longer shelf life than fresh potato products, which makes them a sensible choice for customers who want to stock up on essentials.

Moreover, because frozen potato products are adaptable and can be used in a variety of dishes, from sides to main courses, both home cooks and food service providers favor them. Furthermore, the cost of frozen potato products is frequently lower than that of fresh potatoes, which is another important consideration for people trying to cut costs on groceries. Overall, the rising demand for frozen potato products is being driven by a combination of convenience, usefulness, versatility, and affordability.

Report Scope and Potato Processing Market Segmentation

|

Attributes |

Potato Processing Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

Kenya, Uganda, Rwanda, Tanzania |

|

Key Market Players |

Tropical Heat.(Kenya), Norda Industries Limited (Kenya), Leson Company Ltd (Tanzania), Butcher (Kenya), Wedgehut Foods Ltd (Kenya), and Hollanda FairFoods LTD (Rwanda) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Potato Processing Market Definition

Potato processing involves a multitude of techniques to achieve desired end products. This process is typically carried out in specialized potato processing plants that are equipped with various tools and equipment. The typical steps involved in the production of French fries, chips, flakes, and starch include cleaning, peeling, and washing, slicing, and blanching of fresh potatoes. Processed potato products are used by households, fast food chains, and restaurants as they are already partially prepared, which reduces the time required to prepare dishes such as French fries, soups, salads, and potato snacks. Processed potato is used in a variety of applications by many end-user industries, including snack industry, ready to cook foods industry, bakery, and foodservice industry among others.

Potato Processing Market Dynamics

Drivers

- Growing consumption of convenience or frozen foods among the consumers

There is an increasing trend in the demand for convenience or frozen foods. Numerous factors have contributed to the rise in demand for frozen or convenient potato products. First of all, as a result of busier lifestyles, people now need quick and simple meal options. The products made from frozen potatoes provide a fast and easy solution. Additionally, frozen potato products have a longer shelf life than fresh potato products, which makes them a sensible choice for customers who want to stock up on essentials.Moreover, because frozen potato products are adaptable and can be used in a variety of dishes, from sides to main courses, both home cooks and food service providers favor them. Furthermore, the cost of frozen potato products is frequently lower than that of fresh potatoes, which is another important consideration for people trying to cut costs on groceries. Overall, the rising demand for frozen potato products is being driven by a combination of convenience, usefulness, versatility, and affordability.

For instance,

- In 2021, according to an article published on Researchgate, over the past 50 years, African consumers have increasingly purchased processed food. This trend has accelerated in recent decades due to a surge in the supply side of the processing sector, with Small and Medium Enterprises (SMEs) and large private companies making significant investments. Packaged, industrialized, ultra-processed foods and sugar-sweetened beverages (SSBs) now constitute a growing proportion of the processed food consumed

The increasing demand for convenience and frozen potato products is driven by the need for quick, easy, and versatile meal options amidst busier lifestyles. The extended shelf life, affordability, and adaptability of frozen potatoes further contribute to their growing popularity.

- Growth of restaurant and quick service food sectors

The expansion of the Kenya, Uganda, Tanzania, and Rwanda potato processing market has been significantly fuelled by the expansion of the restaurant and quick service food industries. The demand for foods made from potatoes has increased as more people around the world look for quick, tasty, and affordable meal options. Fast food restaurants and other food service providers frequently choose potatoes because they are a versatile and affordable ingredient. In order to meet this expanding demand, potato processing businesses have been expanding their operations, opening up new scope for farmers, processors, and other players in the East African food industry.

The expansion of the quick-service food and restaurant industries has had a significant impact on the potato processing market. The demand for potato-based goods like French fries, hash browns, and mashed potatoes has increased as fast food restaurants and other food service providers continue to broaden their menus and provide more options. Additionally, the growth of fast-casual dining has given the potato processing industry more opportunities because it offers better food at a marginally higher price point than traditional fast food. Due to this trend, upscale fast-casual restaurants are increasingly serving specialty potato products like gourmet fries and other specialty potato products. Overall, it is anticipated that the expansion of the restaurant and quick-service food industries will continue to fuel demand for products used in the processing of potatoes, opening up a new business scope for those involved in the sector in the coming years.

For instance,

- According to a report by Glovo, the food services market in Kenya has seen significant growth, with a 160% rise in local food orders compared to 2021, reflecting an increasing preference for ordering food from kibandas and local street food shops

Hence, the market for potato processing has been significantly impacted by the expansion of the restaurant and quick-service food industries. The industry has grown as a result of the rising demand for quick, tasty, and affordable meal options, opening up new business opportunities for growers, processors, and other participants in the food supply chain. Additionally, new and inventive products can now be created by potato processing companies thanks to advancements in processing technology, which has increased demand. The quick service and restaurant food industries' ongoing expansion, along with ongoing innovations in potato processing, bode well for the future growth of the potato processing market.

Opportunities

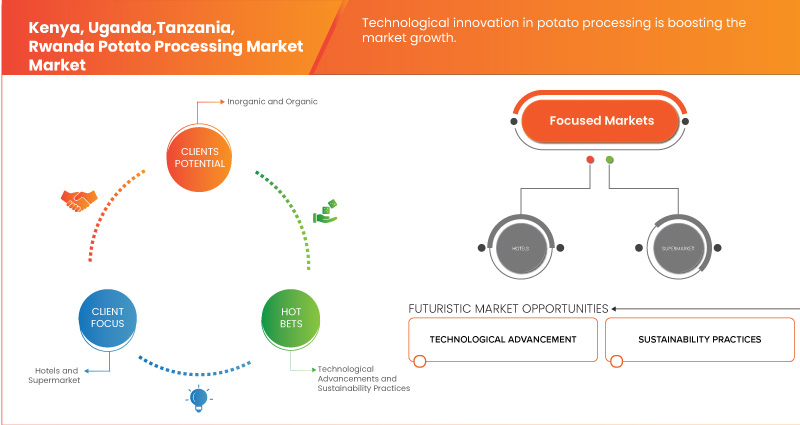

- Technological innovation in potato processing

Technological innovation presents a significant opportunity for the potato processing market in Kenya, Rwanda, and Tanzania, offering transformative potential for productivity, efficiency, and market growth. As the potato industry in these regions evolves, advanced technologies can address existing challenges and unlock new avenues for development. One of the primary benefits of technological innovation is enhanced processing efficiency. Modern processing equipment, such as high-performance peelers, slicers, and fryers, can significantly improve the speed and quality of potato processing. Automation technologies, including robotic systems for sorting and packaging, reduce manual labor and increase production capacity. These advancements enable processors to meet the growing demand for potato products while maintaining consistent quality and reducing operational costs. For instance, automated systems can handle larger volumes of potatoes with precision, ensuring uniformity in processed products like chips and fries and minimizing waste.

Technological advancements also play a crucial role in sustainability. Energy-efficient processing equipment and waste reduction technologies contribute to more environmentally friendly operations. For example, innovations in energy recovery systems and water recycling technologies can significantly reduce the environmental footprint of potato processing. These sustainable practices not only align with the trends towards greener production but also appeal to increasingly eco-conscious consumers. By adopting such technologies, processors in Kenya, Rwanda, and Tanzania can enhance their market competitiveness and appeal to international buyers who prioritize sustainability.

For instance,

- According to a blog published on Potato Business, modern potato processors use data from intelligent machines to improve production yields and ensure consistent product quality. Sensors placed at critical points, such as before packaging or after freezing, continuously collect data to monitor process parameters. This data is shared across the production line, allowing for seamless integration and better control of the entire process

Thus, the potato processing markets are significantly impacted by technological advancements because they enable manufacturers to operate more effectively, save money, and seize new opportunities. The development of automation, robotics, and digital technologies has allowed the processing of potatoes to be more efficient, reduce energy use, and enhance product quality.

- Increasing demand for organic processed frozen potato products

The growing consumer preference for organic and natural foods has significantly increased demand for organic frozen potato products in recent years in African countries like Kenya, Rwanda, and others. Products made from organic frozen potatoes are made from potatoes that were grown without the use of artificial fertilizers, pesticides, or GMOs. Compared to traditional frozen potato products, these products have a number of advantages, such as a lower risk of chemical exposure, improved environmental sustainability, and higher nutritional value. Consumers can feel confident in the quality and safety of the products they are buying because the organic certification process makes sure that the production process abides by strict standards. The demand for organic frozen potato products is likely to increase as consumers continue to look for healthier and more organic food options. This will present producers with opportunities to diversify their product lines and take advantage of this expanding market.

Many producers are now providing a wide variety of organic options to meet this market segment's growing demand for organic frozen potato products. These goods consist of frozen potatoes in various forms, such as organic tater tots, hash browns, and French fries. To meet a broader range of consumer preferences, some manufacturers have even gone a step further by providing non-GMO and gluten-free options. To satisfy the demands of environmentally conscious consumers, many manufacturers are also implementing sustainable production techniques, such as using renewable energy sources and cutting waste.

For instance,

- In Kenya, there is a notable increase in the demand for organic potato products, driven by a growing awareness of healthy eating. This shift is evident in the rise of organic markets and restaurants, such as the Bridges Organic Restaurant in Nairobi. Sales and marketing manager Suzanne Gathitu highlights that the restaurant sources its potatoes exclusively from certified organic farmers, ensuring that the produce is free from pesticides, chemicals, and GMOs. This growing demand for organic options reflects a broader trend toward healthier lifestyles and the need for safe, chemical-free food

Thus, the rising consumer demand for organic and natural foods is significantly boosting the market for organic frozen potato products in African countries like Kenya and Rwanda. These products offer advantages such as reduced chemical exposure, improved environmental sustainability, and higher nutritional value. As consumer preferences increasingly favor healthier, organic options, producers are diversifying their offerings to include various forms of organic frozen potatoes and incorporating sustainable practices. This trend not only meets the growing demand but also presents opportunities for market expansion and innovation in the organic food sector.

Restraints/Challenges

- Increasing health problems associated with the higher consumption of processed potato snacks

Potatoes are an incredibly versatile root vegetable consumed in a variety of dishes all around the world. However, Potatoes in the processed form are typically categorized as high-fat and sodium foods. High acrylamide levels are present in processed potato snacks due to the use of high heat in processing and frying potatoes, which makes them unhealthier for human health. High glycemic index makes them unfit for diabetic patients as they immediately spike their blood sugar levels.

The side effects associated with health due to these processed potato snacks are listed below-

- Excess consumption of processed potato snacks can raise blood pressure

- Potato chips can increase the chances of heart disease

- Potato snacks can increase the risk of stroke

- It can cause intense weight gain

- High GI makes them spike the blood sugar level

- Higher intake of processed potato snacks elevates levels of triglycerides and total cholesterol levels

Thus, the side effects such as weight gain and obesity are increasing day by day owing to increased consumption of potato chips and snacks, which may restrain the growth of the market.

For instance,

- In 2024, according to an article published in The New Times, a recent study by the Rwanda Biomedical Centre (RBC) reveals a rise in obesity among Rwandans. The prevalence of overweight individuals increased from 14 percent in 2013 to 18.6 percent in 2022. The study, which surveyed 5,676 people across all provinces, highlighted that the rate of overweight women rose significantly from 19 percent to 26 percent, while overweight men saw a modest increase from 9 percent to 11.5 percent

Thus, the high intake of processed potato snacks may increase cholesterol levels, which may result in heart risks. Therefore, the increased awareness about the side effects of processed potato snacks among consumers may restrain the growth of the market.

- Unfavorable environmental concerns

Potato cultivation in Kenya, Rwanda, and Tanzania faces significant environmental challenges that constrain the growth of the potato processing market in these regions. These ecological concerns impact not only the agricultural practices but also the broader potato supply chain, affecting the market dynamics for processed potato products.

One major environmental issue is the overuse of chemical fertilizers and pesticides. In an effort to increase yields and combat pests and diseases, many potato farmers rely heavily on these chemicals. However, excessive use leads to soil degradation, reduced soil fertility, and contamination of water sources. This environmental strain can result in lower-quality potatoes and increased production costs, ultimately affecting the consistency and price of raw materials available for processing. As the market for processed potato products grows, the sustainability of potato cultivation becomes increasingly critical. The long-term viability of potato production is threatened by soil degradation, which can reduce crop yields and quality, thereby impacting the supply of raw potatoes for processing.

For instance,

- In 2017, according to an article published on the World Bank Group website in Tanzania, water scarcity was increasingly impacting agricultural practices, including potato cultivation. Despite the country's abundance of freshwater lakes and rivers, the rapid population growth and economic expansion have significantly reduced per capita renewable freshwater from over 3,000m³ to about 1,600m³. This decline has led to severe water stress, particularly evident in the Great Ruaha River, which now runs dry for several months each year. The primary cause is the expansion of informal irrigation upstream, which, while providing economic benefits to individual farmers, has contributed to unsustainable water usage

Thus, the weather fluctuations and specific temperature requirements of the potatoes have been a reason for the decreased production of potatoes across the region, which is ultimately affecting the market, hence creating a significant restraint in the growth of the market, in the African region.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Potato Processing Market Scope

The market is segmented into six notable segments based on category, product type, shape, packaging, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Category

- Inorganic

- Organic

Product Type

- Frozen

- Frozen, By Product Type

- Frozen French Fries

- Frozen, By Product Type

- Low Fat French Fries

- Sweet Potato Fries

- Others

- Frozen French Fries, By Type

- Straight cut fries

- Curly cut fries

- Crinkle Fries

- Others

- Frozen French Fries

- Potato Specialties

- Potato Specialties , By Cut Specialties

- Wedges

- Slices

- Roast Potatoes

- Others

- Potato Specialties, By Mash Specialties

- Plain Mash

- Potato Croquettes

- Noissettes

- Duchesses

- Others

- Potato Specialties, By Shredded Specialties

- Hash Browns

- Potato Rosti

- Tater tots

- Others

- Potato Specialties , By Cut Specialties

- Ambient

- Ambient, By Product Type

- Chips

- Flakes

- Others

- Ambient, By Product Type

- Frozen, By Product Type

- Dehydrated, By Product Type

- Dehydrated, By Product Type

- Potato Granules

- Starch

- Dehydrated, By Product Type

- Others

Shape

- Dices

- Round

- Tater Drums

- Shreds

- Others

Packaging

- Pouches

- Cardboard Boxes

- Cans

- Others

Application

- Ready-to-Cook & Prepared Meals

- Snacks and Bakery Industry

- Baby Food (Bottled)

- Dough Mixtures

- Soups and Jams

- Others

End-User

- Food Service Sector

- Food Service Sector, By End-User

- Restaurant

- Restaurant, By Type

- Chain Restaurant

- Independent Restaurant

- Restaurant, By Service Category

- Quick Service Restaurants

- Full Service Restaurants

- Restaurant, By Type

- Hotel

- Cafe

- Bars and Clubs

- Catering

- Others

- Restaurant

- Food Service Sector, By End-User

Potato Processing Market Regional Analysis

The market is analyzed and market size insights and trends are provided by category, product type, shape, packaging, application and end-user as referenced above.

The countries covered in the market are Kenya,Tanzania, Rwanda and Uganda.

Kenya is expected to dominate the potato processing market due to its well-established infrastructure, advanced processing technology, and higher levels of investment in the sector compared to other East African countries are expected to further fuel the market's growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Potato Processing Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Potato Processing Market Leaders Operating in the Market Are:

- Tropical Heat.(Kenya)

- Norda Industries Limited (Kenya)

- Leson Company Ltd (Tanzania)

- Butcher (Kenya)

- Wedgehut Foods Ltd (Kenya)

- Hollanda FairFoods LTD (Rwanda)

Latest Developments in Potato Processing Market

- In April 2022, Tropical Heat. has launched new product lines, including healthy snacks and breakfast cereals. The upcoming range features innovative items such as rice cakes made with brown rice and flavored chocolate rice cakes, which offer a low-calorie alternative to traditional snacks. These products aimed to bridge the gap between health and taste, catering to consumers seeking nutritious yet flavorful options. Additionally, Tropical Heat is expanding its market presence, now operating in 25 countries, with plans to reach 30 soon

- In August 2022, Butcher. (Sereni Fries) has launched new product: frozen chips. The product includes three cuts—matchstick, medium, and standard—and offers convenience, quality, and reduced preparation time. This expansion has helped the company to increase their production capacity to 40 tons per day and tap into the retail and export markets. This launch has also created 15 new jobs, growing the workforce from 48 to 63 employees

- In 2022,Butcher. (Sereni Fries) has presented their Good Potato Initiative in the event held in between 30 May - 2 June, at the 11th World Potato Congress in Dublin, T. This program trained Kenyan smallholder farmers in Good Agricultural Practices and Climate Smart Agricultural Practices to overcome challenges such as traditional farming methods and inadequate information. This initiative aimed to increase crop productivity, reduce post-harvest losses, and improve farmers' standards of living through contract farming. It also focuses on poverty eradication, job creation, and food security enhancement, significantly benefiting women and youth

- In September2022, Wedgehut Foods Ltd. specializes in adding value to potato varieties such as Markies, Shangi, Arizona, and Destiny. Being a part of the Mavuno Zaidi program with Syngenta and IDH, the company has planned to support 100,000 farmers with financing. They are also collaborating with AgricoPSA to advance Kenya’s potato value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICE INDEX

4.2 PRODUCTION CAPACITY OVERVIEW (KILO TONS)

4.3 SUPPLY CHAIN OF KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

4.3.1 RAW MATERIAL PROCUREMENT

4.3.2 PROCESSING

4.3.3 MARKETING AND DISTRIBUTION

4.3.4 END USERS

4.4 BRAND OUTLOOK

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

4.6.1 OVERVIEW

4.6.2 CONCLUSION

4.7 IMPORT AND EXPORT

4.8 MARKET SHARE OF POTATO PROCESSED PRODUCTS AMONG POTATO BASED SNACKS, 2023, (%)

4.9 TECHNOLOGICAL INNOVATION

4.1 OVERVIEW ON POTATO COLD STORAGE

4.10.1 FOOD-GRADE POTATO STORAGE

4.10.2 PROCESSING-GRADE POTATO STORAGE

4.10.3 STORAGE AND UTILIZATION CAPACITY

4.10.4 UTILIZATION

4.11 FACTORS AFFECTING BUYING DECISION

4.11.1 LARGE PRODUCT RANGE

4.11.2 COMPANY AUTHENTICITY

4.11.3 INCOME

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF KENYA, UGANDA, RWANDA, AND TANZANIA POTATO PROCESSING MARKET

4.12.1 INDUSTRY TRENDS

4.12.2 FUTURE TRENDS

4.13 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS

4.13.1 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS, BY PRODUCT TYPE, 2022-2024, (TONS)

4.13.2 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS, BY APPLICATION, 2022-2024, (TONS)

4.13.3 PRODUCTION CAPACITY ANALYSIS ON POTATO INDUSTRY, BY GRADE, 2022-2024, (TONS)

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMPTION OF CONVENIENCE OR FROZEN FOODS AMONG THE CONSUMERS

6.1.2 GROWTH OF RESTAURANT AND QUICK SERVICE FOOD SECTORS

6.1.3 GROWING POPULATION AND DISPOSABLE INCOME OF CONSUMERS

6.1.4 AVAILABILITY OF A DIVERSE RANGE OF PRODUCTS

6.2 RESTRAINTS

6.2.1 INCREASING HEALTH PROBLEMS ASSOCIATED WITH THE HIGHER CONSUMPTION OF PROCESSED POTATO SNACKS

6.2.2 UNFAVORABLE ENVIRONMENTAL CONCERNS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL INNOVATION IN POTATO PROCESSING

6.3.2 INCREASING DEMAND FOR ORGANIC PROCESSED FROZEN POTATO PRODUCTS

6.4 CHALLENGES

6.4.1 HIGH COST ASSOCIATED WITH POTATO CHIPS MACHINES

6.4.2 FLUCTUATION IN PRICES OF RAW MATERIALS

7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 INORGANIC

7.3 ORGANIC

8 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 FROZEN

8.3 AMBIENT

8.4 DEHYDRATED

9 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY SHAPE

9.1 OVERVIEW

9.2 DICES

9.3 ROUND

9.4 TATER DRUMS

9.5 SHREDS

9.6 OTHERS

10 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 POUCHES

10.3 CARDBOARD BOXES

10.4 CAN

10.5 OTHERS

11 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 READY-TO-COOK & PREPARED MEALS

11.3 SNACKS AND BAKERY INDUSTRY

11.4 BABY FOOD (BOTTLED)

11.5 DOUGH MIXTURES

11.6 SOUPS AND JAMS

11.7 OTHERS

12 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD SERVICE SECTOR

12.3 RETAIL/HOUSEHOLD

13 KENYA, UGANDA, TANZANIA AND, RWANDA POTATO PROCESSING MARKET, BY COUNTRY

13.1 OVERVIEW

13.1.1 KENYA

13.1.2 RWANDA

13.1.3 UGANDA

13.1.4 TANZANIA

14 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KENYA, UGANDA, TANZANIA, AND RWANDA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 TROPICAL HEAT.

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENTS

16.2 NORDA INDUSTRIES LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 LESON COMPANY LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 BUTCHER. (SERENI FRIES)

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 WEDGEHUT FOODS LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 HOLLANDA FAIRFOODS LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 1.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 AVERAGE IMPORT OF POTATO CRISPS AND FROZEN READY-CUT POTATO CHIPS, 2020-21, (HS CODE:- 200410) (TONS)

TABLE 2 REGULATORY COVERAGE

TABLE 3 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 4 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 5 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 6 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 8 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 9 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 10 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 11 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 12 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 13 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 14 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 15 KENYA, UGANDA, TANZANIA, AND RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 16 KENYA, UGANDA, TANZANIA AND RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 17 KENYA, UGANDA, TANZANIA AND RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 18 KENYA, UGANDA, TANZANIA AND RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 19 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 20 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 21 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 22 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 23 KENYA, UGANDA, TANZANIA AND RWANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 24 KENYA, UGANDA, TANZANIA AND RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 25 KENYA, UGANDA, TANZANIA AND RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 26 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, BY COUNTRY, 2022-2034 (USD THOUSAND)

TABLE 27 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, BY COUNTRY, 2022-2034 (TONS)

TABLE 28 KENYA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 29 KENYA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 30 KENYA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 31 KENYA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 32 KENYA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 33 KENYA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 34 KENYA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 35 KENYA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 36 KENYA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 37 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 38 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 39 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 40 KENYA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 41 KENYA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 42 KENYA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 43 KENYA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 44 KENYA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 45 KENYA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 46 KENYA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 47 KENYA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 48 KENYA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 49 KENYA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 50 KENYA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 51 RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 52 RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 53 RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 54 RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 55 RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 56 RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 57 RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 58 RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 59 RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 60 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 61 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 62 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES 2022-2034 (USD THOUSAND)

TABLE 63 RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 64 RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 65 RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 66 RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 67 RWANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 68 RWANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 69 RWANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 70 RWANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 71 RWANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 72 RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 73 RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 74 UGANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 75 UGANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 76 RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 77 UGANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 78 UGANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 79 UGANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 80 UGANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 81 UGANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 82 UGANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 83 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 84 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 85 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 86 UGANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 87 UGANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 88 UGANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 89 UGANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 90 UGANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 91 UGANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 92 UGANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 93 UGANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 94 UGANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 95 UGANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 96 UGANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 97 TANZANIA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 98 TANZANIA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 99 TANZANIA POTATO PROCESSING MARKET,AVERAGE SELLING PRICE, BY CATEGORY, 2022-2034 (USD/TONS)

TABLE 100 TANZANIA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 101 TANZANIA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 102 TANZANIA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 103 TANZANIA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 104 TANZANIA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 105 TANZANIA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 106 TANZANIA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 107 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 108 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 109 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 110 TANZANIA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 111 TANZANIA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 112 TANZANIA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 113 TANZANIA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 114 TANZANIA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 115 TANZANIA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 116 TANZANIA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 117 TANZANIA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 118 TANZANIA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 119 TANZANIA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 120 TANZANIA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

List of Figure

FIGURE 1 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 2 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DATA TRIANGULATION

FIGURE 3 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DROC ANALYSIS

FIGURE 4 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: MULTIVARIATE MODELLING

FIGURE 7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: SEGMENTATION

FIGURE 12 GROWING CONSUMPTION OF CONVENIENCE OR FROZEN FOODS AMONG THE CONSUMERS IS EXPECTED TO DRIVE THE KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET IN THE FORECAST PERIOD

FIGURE 13 THE INORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET IN 2024 AND 2034

FIGURE 14 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, 2024-2034, AVERAGE SELLING PRICE (USD/KG)

FIGURE 15 SUPPLY CHAIN OF KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 17 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: CATEGORY, 2023

FIGURE 18 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: PRODUCT TYPE, 2023

FIGURE 19 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: SHAPE, 2023

FIGURE 20 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: PACKAGING, 2023

FIGURE 21 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: APPLICATION, 2023

FIGURE 22 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: END-USER, 2023

FIGURE 23 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET -COMPANY SHARE 2023 (%)

Kenya Uganda Tanzania And Rwanda Potato Processing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Kenya Uganda Tanzania And Rwanda Potato Processing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Kenya Uganda Tanzania And Rwanda Potato Processing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.