Market Analysis and Size

Packaging has developed a platform allowing companies to take advantage of their e-commerce products. The company also established a means of explicitly printing on big or tiny corrugated plates. This eliminates the need for printing of lithographic labels and saves time and cost. It is eco-friendly, and according to the service, direct printing on board is recyclable. With this order and distribution system, more and more users, templates can be changed easily, and great potential in third party ads on e-commerce packaging. The more lavish the object is shipped, the more surprising the exterior becomes. This is achieved to provide no hint as to the worth of the package to ensure protection and prevent pilfering. For such instances, there are still beautifully written graphics inside the packet. Which will only be disclosed if the package is opened.

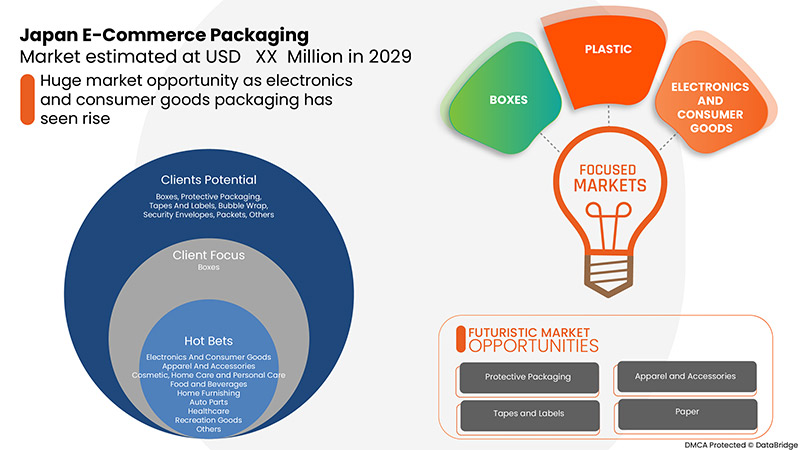

Shifting shopping preference towards online due to convenience and the growing popularity of smart packaging are some of the drivers expected to boost E-commerce packaging demand in the market. Data Bridge Market Research analyses that the E-commerce packaging market is expected to reach the value of USD 13,396.98 million by the year 2029, at a CAGR of 16.0% during the forecast period. "Boxes" accounts for the most prominent product segment in the respective market, owing to the rise in the demand of E-commerce packaging. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Million Units |

|

Segments Covered |

By Product (Boxes, Protective Packaging, Security Envelopes, Tapes and Labels, Packets, Bubble Wraps, Others), Materials (Glass, Paper, Wood, Plastic, Metal, Others), Printing Technology (Flexo Printing, Digital Printing, Litho Laminate Printing, Offset Lithography, Digital Printing, Others), Application (Electronics and Consumer Goods, Apparel and Accessories, Cosmetic, Home Care and Personal Care, Food and Beverages, Home Furnishing, Auto Parts, Healthcare, Recreation Goods, Others), End-User (Traditional E-Commerce Retailers, Third Party and Logistics Companies, Brick and Mortar Retailers, Specialty Retailers, Others) |

|

Country Covered |

Japan |

|

Market Players Covered |

International Paper (Tennessee, U.S.), NIPPON PAPER INDUSTRIES CO., LTD. (Tokyo, Japan), Mondi (Addlestone, U.K.), Amcor Plc (Zürich, Switzerland), Sealed Air (North Carolina, U.S.), Rengo Co., Ltd. (Osaka, Japan), AptarGroup, Inc. (Illinois, U.S.), WestRock Company (Georgia, U.S.), Yamakoh, Co., Ltd. (Kyoto, Japan), CHUOH PACK INDUSTRY CO., LTD. (Honshu, Japan), Holmen Iggesund (Iggesund, Sweden), among others. |

Market Definition

E-commerce packaging is an essential part of branding. The first natural contact customer with a particular brand often handles the package delivered to him when shopping online. This is a rare opportunity for companies to create a good impact and strengthen or ruin their brand image. Due to broken or poor quality packaging, premium packaging can increase customers' loyalty. Even stronger by recent third-party online retailers advertise on their products. Industry professionals anticipate other retail stores and distribution companies to adopt this model. Packaging will boost revenue and incorporate innovative forms of cross-branding and marketing.

Regulatory Framework

Packaging and labelling regulation in Japan - The Customs services are very particular about the quality of packaging and labeling. Correct packing, marking, and labeling are critical to smooth customs clearance in Japan. Generally, labeling for most imported products is not required at the customs clearance stage but at the point of sale. Consequently, it is common for a Japanese importer to affix a label to an imported product after it has cleared customs. Packing in straw is prohibited in Japan.

COVID-19 had a Minimal Impact on the E-Commerce packaging Market

COVID-19 pandemic caused a sudden lockdown in many parts of the world to prevent the spread of the virus, which resulted in rapid closing down of factories, shops, and others. The rapid decline of demand and supply and travel bans led to the downfall of the non-essential product's market globally. The pandemic has made a significant negative impact on the economy due to less demand, a shortage of employees in the factory, and a travelling ban led to a shortage of raw materials, thus stopping the production of E-commerce packaging products. However, with the lockdown being relaxed and vaccination drives happening in Japan, the workflow has started increasing, thus, helping the market players to make a comeback. Government’s regulations and support regarding the growth in the economy and rising start-ups are expected to surge the valuation of Japan's e-commerce packaging market during the forecast period. The demand for E-commerce packaging was rising during the pandemic owing to increased online shopping, but supply chain disruption hampered the growth up to some extent.

The Market Dynamics of the E-Commerce Packaging Market Include:

Drivers/Opportunities in the E-Commerce Packaging Market

- Shifting shopping preference towards online due to convenience

Convenience is the cornerstone of e-commerce and a major reason for the rise of online shopping over the last few years. Online shopping provides a method of money of your choice for purchases and where it is appropriate and even to collect the item using a convenient process.

- Rising demand for secondary packaging and protective packaging for electronic goods

As e-commerce shifts from an existing distribution network to a fragmented customer network, a modern system of initiatives is being created to provide direct fulfillment to satisfy different criteria. As these transformations are better understood, it will improve responsive strategies' development. Making sure that unintended impacts are avoided remains essential. To this, communication and coordination around the supply chain are important. Working together, the industry can take advantage of this opportunity to integrate sustainability into supply chains much earlier in its development.

- Growing popularity of smart packaging

Consumers expect intelligent opening and packages that can be easily opened without using tools. A strip of tear is preferred, and the package should be opened. The goods should be well delivered, preferably with a personal touch, which transmits the impression that someone particularly packs the package for them. Articles shall arrive in perfection without excessive filling material or space, as they are well protected. This is particularly important as consumers are looking to find sustainable solutions when it comes to products and packaging.

- COVID-19 pandemic increased dependency on grocery shopping to e-commerce

Contradictory to anything the world has ever seen in the COVID-19 crisis, the countries, institutions and business leaders face difficult choices with unprecedented uncertainty levels. In the short term, orientation is crucial, that the crisis becomes clearer and the social and economic order will constantly shape as for many recent disasters, the future has become the situation. Society trends are changing rapidly as we work, learn, shop and use technology. While these developments have already formed before the crisis, we see an escalation contributing to a new normal crisis. Although a short-term reaction is important to live, the winners will be taken in the long run.

Restraints/Challenges faced by the E-Commerce Packaging Market

- Increasing packaging cost for e-commerce companies reduced their bottom line

Consumers get a lot better aware of their impact, and they want to buy decisions about just what their companies want to do to offset their operations' impact. However, this is necessary for you to consider when doing so the triggers of the rise in average packaging prices and the different aspects in which they can be offset. It is important to take advantage of the available value-added services, make the packaging function harder, ensure optimal quality, and take advantage of acceptable value-added services.

- Cost-to-benefit ratio is a concern for manufacturers

Companies use Internet electronic services (e-services) to attract customers, share business information, maintain business links and carry out business transactions. In the early stages of the usage of e-services, organizations have no facts and awareness regarding their corporate and social impacts. Companies also acquired similar expertise through many years of e-services experience. It is urgently necessary to evaluate the costs of moving service online against the advantages of adopting e-service and identify the impact on company relations with customers of e-service through innovative utilization of e-services.

Recent Developments

- In March 2022, Rengo Co., Ltd. won three awards in two categories of the 61st Japan Packaging Competition (2022JPC) that the Japan Federation of Printing Industries sponsors. This achievement will help the company to get global recognition.

- In April 2022, Amcor Rigid Packaging (ARP) and Danone launched a 100% recyclable bottle for the Villavicencio water brand. It is made from 100% recycled content and has a reduced carbon footprint of 21% compared to the old bottle. This development will attract new customers who are in search of innovative products.

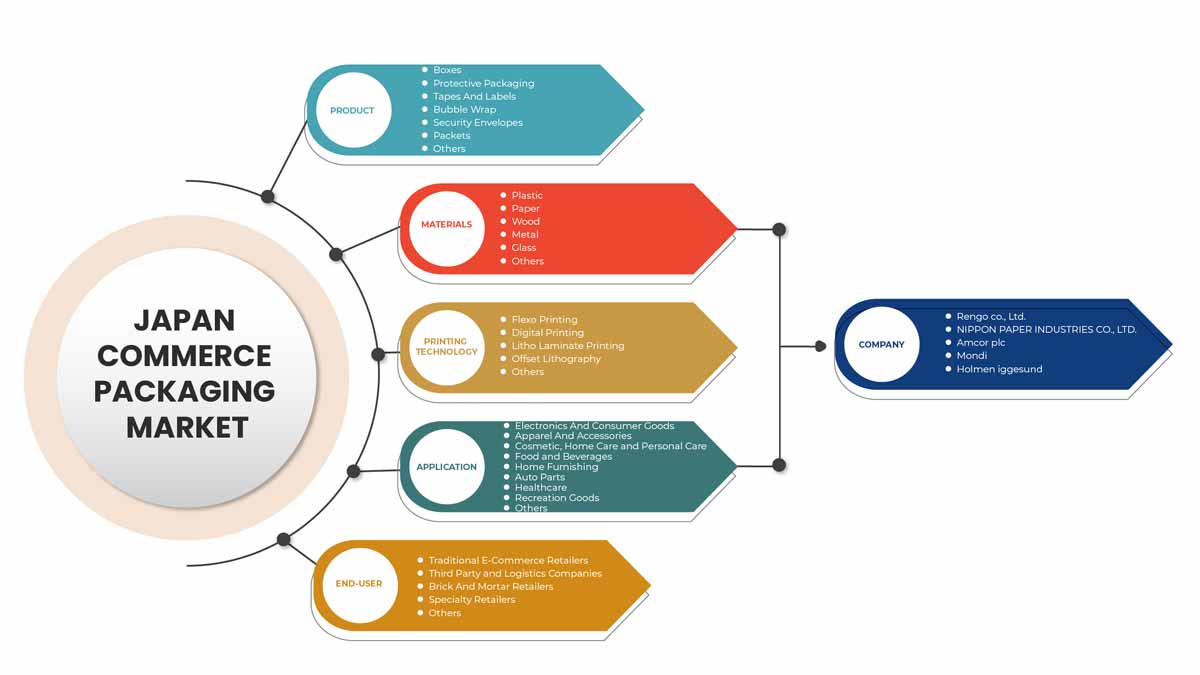

Japan E-Commerce Packaging Market Scope

The e-commerce packaging market is segmented based on product, materials, printing technology, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Boxes

- Protective Packaging

- Tapes And Labels

- Bubble Wrap

- Security Envelopes

- Packets

- Others

Based on product, the Japan e-commerce packaging market is segmented into boxes, protective packaging, security envelopes, tapes and labels, packets, bubblewrap, others.

Materials

- Plastic

- Paper

- Wood

- Metal

- Glass

Based on materials, the Japan E-commerce packaging market is segmented into glass, paper, wood, plastic, metal, and others.

Printing Technology

- Flexo Printing

- Digital Printing

- Litho Laminate Printing

- Offset Lithography

- Others

Based on printing technology, the Japan E-commerce packaging market is segmented into flexo printing, digital printing, litho laminate printing, offset lithography, digital printing, others.

Application

- Electronics and Consumer Goods

- Apparel and Accessories

- Cosmetic, Home Care and Personal Care

- Food and Beverages

- Home Furnishing

- Auto Parts

- Healthcare

- Recreation Goods

- Others

Based on application, the Japan E-commerce packaging market is segmented into electronics and consumer goods, apparel and accessories, cosmetic, home care and personal care, food and beverages, home furnishing, auto parts, healthcare, recreation goods, and others.

End-User

- Traditional E-Commerce Retailers

- Third Party and Logistics Companies

- Brick and Motar Retailers

- Specialty Retailers

- Others

Based on end-user, the Japan e-commerce packaging market is segmented into traditional e-commerce retailers, third party and logistics companies, brick and mortar retailers, specialty retailers, and others.

Competitive Landscape and E-commerce Packaging Market Share Analysis

The e-commerce packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to e-commerce packaging market.

Some of the major market players engaged in the Japan E-commerce packaging market are International Paper, NIPPON PAPER INDUSTRIES CO., LTD., Mondi, Amcor Plc, Sealed Air, Rengo Co., Ltd., AptarGroup, Inc., WestRock Company, Yamakoh, Co., Ltd., CHUOH PACK INDUSTRY CO., LTD., and Holmen Iggesund, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF JAPAN E-COMMERCE PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFTING SHOPPING PREFERENCE TOWARDS ONLINE DUE TO CONVENIENCE

5.1.2 RISING DEMAND FOR SECONDARY PACKAGING AND PROTECTIVE PACKAGING FOR ELECTRONIC GOODS

5.1.3 GROWING POPULARITY OF SMART PACKAGING

5.1.4 COVID-19 PANDEMIC INCREASED DEPENDENCY OF GROCERY SHOPPING TO E-COMMERCE

5.2 RESTRAINTS

5.2.1 GOVERNMENT RULES AND REGULATIONS REGARDING PACKAGING

5.2.2 INCREASING PACKAGING COST FOR E-COMMERCE COMPANIES REDUCED THEIR BOTTOM LINE

5.2.3 COST-TO-BENEFIT RATIO IS A CONCERN FOR MANUFACTURERS

5.3 OPPORTUNITY

5.3.1 GROWING DEMAND FOR SUSTAINABLE PACKAGING SOLUTIONS

5.4 CHALLENGES

5.4.1 GREATER TECHNOLOGICAL UNDERSTANDING THAN REQUIRED FOR OTHER PACKAGING FORMS

5.4.2 FLUCTUATIONS IN THE RAW MATERIAL PRICES

6 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 BOXES

6.2.1 CORRUGATED BOXES

6.2.1.1 REGULAR SLOTTED CONTAINERS

6.2.1.2 ROLL END CORRUGATED BOXES

6.2.1.3 OTHERS CORRUGATED BOXES

6.2.2 SET-UP BOXES

6.3 PROTECTIVE PACKAGING

6.4 TAPES AND LABELS

6.5 BUBBLE WRAP

6.6 SECURITY ENVELOPES

6.7 PACKETS

6.8 OTHERS

7 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY

7.1 OVERVIEW

7.2 FLEXO PRINTING

7.3 DIGITAL PRINTING

7.4 LITHO LAMINATE PRINTING

7.5 OFFSET LITHOGRAPHY

7.6 OTHERS

8 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.1.1 LOW DENSITY POLYETHYLENE (LDPE)

8.2.1.2 HIGH DENSITY POLYETHYLENE (HDPE)

8.2.1.3 LINEAR LOW DENSITY POLYETHYLENE (LLDPE)

8.2.1.4 OTHERS

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 POLYVINYL CHLORIDE (PVC)

8.2.5 POLYCARBONATE (PC)

8.2.6 POLYSTYRENE (PS)

8.2.7 OTHERS

8.3 PAPER

8.3.1 PAPER BAGS

8.3.2 CORRUGATED BOARD

8.3.3 PAPER CARTONS

8.3.4 KRAFT PAPER

8.3.5 GREASEPROOF PAPER

8.3.6 OTHERS

8.4 WOOD

8.5 METAL

8.5.1 ALUMINUM

8.5.2 STEEL

8.5.3 OTHERS

8.6 GLASS

8.7 OTHERS

9 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ELECTRONICS AND CONSUMER GOODS

9.2.1 WEARABLE TECHNOLOGY

9.2.2 COMPUTER AND ACCESSORIES

9.2.3 MEDIA PLAYERS

9.2.4 MOBILE PHONES

9.2.5 CAMERAS AND PHOTOGRAPHY

9.2.6 CAR AND VEHICLE ELECTRONICS

9.2.7 HOME AUDIO

9.2.8 OTHERS

9.3 APPAREL AND ACCESSORIES

9.3.1 APPAREL AND ACCESSORIES, BY APPLICATION

9.3.1.1 CLOTHING

9.3.1.2 SHOES

9.3.1.3 HANDBAG AND CLUTCHES

9.3.1.4 WATCHES

9.3.1.5 JEWELLERY

9.3.1.6 OTHERS

9.3.2 APPAREL AND ACCESSORIES, BY GENDER

9.3.2.1 MEN

9.3.2.2 WOMEN

9.3.2.3 KIDS

9.4 COSMETIC, HOME CARE AND PERSONAL CARE

9.4.1 SKIN CARE

9.4.2 BATH AND SHOWER

9.4.3 HAIR CARE AND STYLING

9.4.4 TOILET CLEANERS

9.4.5 DISHWASHING

9.4.6 FOOT CARE

9.4.7 HAND CARE

9.4.8 OTHERS

9.5 FOOD AND BEVERAGES

9.5.1 EXTRUDED SNACKS

9.5.2 FRUITS AND VEGETABLES

9.5.3 FROZEN FOOD

9.5.4 PROCESSED FOODS

9.5.5 BAKERY PRODUCTS

9.5.6 BABY FOODS

9.5.7 DAIRY PRODUCTS

9.5.8 JUICES

9.5.9 BOTTLED WATER

9.5.10 OTHERS

9.6 HOME FURNISHING

9.6.1 BED SHEETS

9.6.2 BEDDING SETS

9.6.3 KITCHEN APRONS

9.6.4 BLANKETS

9.6.5 FABRIC

9.6.6 CARPETS

9.6.7 OTHERS

9.7 AUTO PARTS

9.7.1 INTERIOR MIRRORS

9.7.2 DOOR PROTECTION

9.7.3 VEHICLE TOOLS

9.7.4 MOTORBIKE FILTERS

9.7.5 CAR STYLING BODY FITTINGS

9.7.6 SIDE MIRROR AND ACCESSORIES

9.7.7 OTHERS

9.8 HEALTHCARE

9.9 RECREATION GOODS

9.1 OTHERS

10 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER

10.1 OVERVIEW

10.2 TRADITIONAL E-COMMERCE RETAILERS

10.2.1 BOXES

10.2.2 PROTECTIVE PACKAGING

10.2.3 TAPES AND LABELS

10.2.4 BUBBLE WRAP

10.2.5 SECURITY ENVELOPES

10.2.6 PACKETS

10.2.7 OTHERS

10.3 THIRD PARTY AND LOGISTICS COMPANIES

10.3.1 BOXES

10.3.2 PROTECTIVE PACKAGING

10.3.3 TAPES AND LABELS

10.3.4 BUBBLE WRAP

10.3.5 SECURITY ENVELOPES

10.3.6 PACKETS

10.3.7 OTHERS

10.4 BRICK AND MORTAR RETAILERS

10.4.1 BOXES

10.4.2 PROTECTIVE PACKAGING

10.4.3 TAPES AND LABELS

10.4.4 BUBBLE WRAP

10.4.5 SECURITY ENVELOPES

10.4.6 PACKETS

10.4.7 OTHERS

10.5 SPECIALTY RETAILERS

10.5.1 BOXES

10.5.2 PROTECTIVE PACKAGING

10.5.3 TAPES AND LABELS

10.5.4 BUBBLE WRAP

10.5.5 SECURITY ENVELOPES

10.5.6 PACKETS

10.5.7 OTHERS

10.6 OTHERS

10.6.1 BOXES

10.6.2 PROTECTIVE PACKAGING

10.6.3 TAPES AND LABELS

10.6.4 BUBBLE WRAP

10.6.5 SECURITY ENVELOPES

10.6.6 PACKETS

10.6.7 OTHERS

11 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY

11.1 JAPAN

12 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: JAPAN

12.1.1 AGREEMENTS

12.1.2 PRODUCT LAUNCHES

12.1.3 PARTNERSHIP

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 RENGO CO., LTD.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 NIPPON PAPER INDUSTRIES CO., LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATE

14.3 AMCOR PLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 MONDI

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 HOLMEN IGGESUND

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 CHUOH PACK INDUSTRY CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 APTARGROUP, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATE

14.8 INTERNATIONAL PAPER

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATE

14.9 SEALED AIR

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATE

14.1 WESTROCK COMPANY

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT UPDATES

14.11 YAMAKOH, CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; HS CODE - 392310 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; HS CODE - 392310 (USD THOUSAND)

TABLE 3 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION UNITS)

TABLE 5 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION METER SQUARE)

TABLE 6 JAPAN BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 JAPAN CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 9 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 10 JAPAN PLASTIC IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 11 JAPAN POLYETHYLENE (PE) IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 12 JAPAN PAPER IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 13 JAPAN METAL IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 14 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 JAPAN ELECTRONICS AND CONSUMER GOODS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 JAPAN APPAREL AND ACCESSORIES COMPANIES IN E-COMMERCE PACKAGING MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 18 JAPAN COSMETIC, HOME CARE AND PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 JAPAN FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 JAPAN HOME FURNISHING IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 JAPAN AUTO PARTS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 JAPAN TRADITIONAL E-COMMERCE RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 24 JAPAN THIRD PARTY AND LOGISTICS COMPANIES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 JAPAN BRICK AND MORTAR RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 JAPAN SPECIALTY RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 JAPAN OTHERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 30 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION METER SQUARE)

TABLE 31 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION UNITS)

TABLE 33 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION METER SQUARE)

TABLE 34 JAPAN BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 JAPAN CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 37 JAPAN PAPER IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 38 JAPAN PLASTIC IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 39 JAPAN POLYETHYLENE (PE) IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 40 JAPAN METAL IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 41 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 JAPAN ELECTRONICS AND CONSUMER GOODS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 46 JAPAN HOME FURNISHING IN IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 JAPAN AUTO PARTS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 JAPAN FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 JAPAN COSMETIC, HOME CARE AND PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 JAPAN TRADITIONAL E-COMMERCE RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 JAPAN THIRD PARTY AND LOGISTICS COMPANIES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 JAPAN BRICK AND MOTOR RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 54 JAPAN SPECIALTY RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 JAPAN OTHERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 JAPAN E-COMMERCE PACKAGING MARKET: SEGMENTATION

FIGURE 2 JAPAN E-COMMERCE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN E-COMMERCE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 JAPAN E-COMMERCE PACKAGING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 JAPAN E-COMMERCE PACKAGING MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 JAPAN E-COMMERCE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 JAPAN E-COMMERCE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 JAPAN E-COMMERCE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 JAPAN E-COMMERCE PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 11 JAPAN E-COMMERCE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 JAPAN E-COMMERCE PACKAGING MARKET: CHALLENGE MATRIX

FIGURE 13 JAPAN E-COMMERCE PACKAGING MARKET: SEGMENTATION

FIGURE 14 SHIFTING SHOPPING PREFERENCE TOWARDS ONLINE DUE TO CONVENIENCE IS EXPECTED TO DRIVE THE JAPAN E-COMMERCE PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 BOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN E-COMMERCE PACKAGING MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITY, AND CHALLENGES OF JAPANE-COMMERCE PACKAGING MARKET

FIGURE 17 JAPAN E-COMMERCE PACKAGING MARKET: BY PRODUCT, 2021

FIGURE 18 JAPAN E-COMMERCE PACKAGING MARKET: BY PRINTING TECHNOLOGY, 2021

FIGURE 19 JAPAN E-COMMERCE PACKAGING MARKET: BY MATERIALS, 2021

FIGURE 20 JAPAN E-COMMERCE PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 21 JAPAN E-COMMERCE PACKAGING MARKET: BY END USER, 2021

FIGURE 22 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY SHARE 2021 (%)

Japan E Commerce Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Japan E Commerce Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Japan E Commerce Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.