Indonesia Corporate Telehealth Market Analysis and Insights

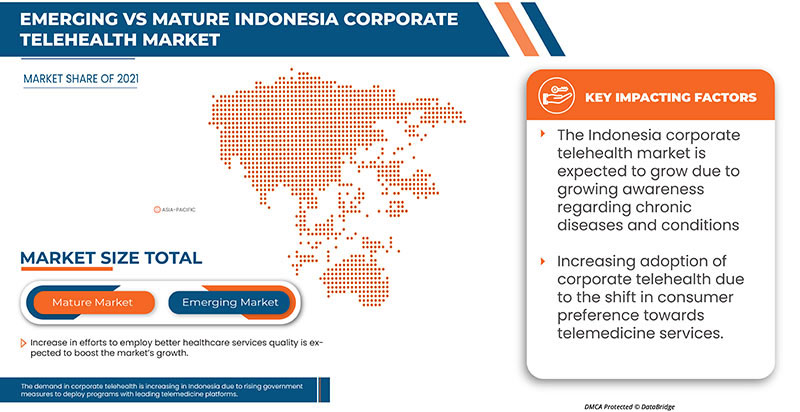

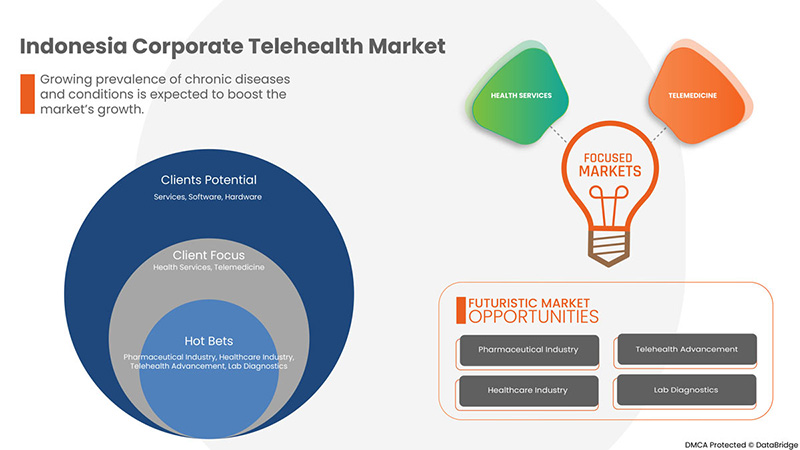

Indonesia corporate telehealth market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.3% in the forecast period of 2022 to 2029 and is expected to reach USD 10,180.06 thousand by 2029. The major factor driving the growth of the corporate telehealth market is the increase in efforts to employ better healthcare services quality, the growing prevalence of chronic diseases and conditions, and the shortage of physicians and medical staff as per the Indonesian population.

Indonesia has introduced several reforms to different aspects of the health system, while the health system has also been affected by multisectoral reforms of government and public administration. Key multisectoral reforms include the delegation of authority for certain government functions from central to local governments, including responsibility for the management and provision of public health services, and the progressive introduction of greater autonomy in the management of public service organizations, including hospitals.

Indonesia corporate telehealth market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Component (Hardware, Services, and Software), Delivery Mode (Cloud, On-Premise), Application (Virtual Primary Care and Continuing Care, Teleradiology, Comprehensive Behavioral Health/Telepsychiatry, Dermatology Care, High-Acuity Care, Pediatric Corporate Telehealth, Others), Connectivity Device (Smartphone, Laptop, and Others), End-User (Healthcare Providers, Patients, and Healthcare Payers) |

|

Countries Covered |

Indonesia |

|

Market Players Covered |

HALODOC, Alodokter, ProSehat, Good Doctor, aido health, PT Medika Komunika Teknologi, Vascular Indonesia, Get Healthy Indonesia, Intel Corporation, Cisco Systems, Inc Healthy Link, and Trustmedis Indonesia |

Market Definition

Telehealth allows caregivers and nurses to maintain a consistent connection while also providing suppliers with real-time patient health information. Telehealth facilities use technology to provide long-distance health education to improve customer outcomes. The surge in demand for telehealth care is due to the growing use of the internet and smartphones along with the shifting consumer preference towards a healthier lifestyle. Telehealth services provide access to healthcare services via telephonic/video consultation, which helps the patient to save time and reduce unnecessary travel costs.

Indonesia Corporate Telehealth Market Dynamics

Drivers

- Increase in efforts to employ better healthcare services quality

The government of Indonesia is expanding its healthcare-related schemes to achieve universal health coverage while also addressing regional disparities in service quality and accessibility, managing resources effectively, reducing costs, and minimizing fraud. Moreover, the government is engaging the private sector and maintaining investment in health promotion and prevention programs. The Government of Indonesia (GoI) has recently moved in this direction. It applied for the Jaminan Kesehatan Nasional (JKN) national health insurance program in 2014 by establishing Law No. 40/ 2004 on The National Social Security System.

- Growing prevalence of chronic diseases and conditions

There has been a constant rise in remote and urban consultations owing to the rising prevalence of chronic diseases, which is anticipated to contribute to the progressive growth of the Indonesian corporate telehealth market. The increase in healthcare costs, a spur in the technological innovations in the healthcare sector, and efforts to find a resolution to address the accessibility issues of the healthcare sector in remote areas have been perennial problems in developing economies across the world, including Indonesia. At the same time, risk factors for non-communicable diseases (NCDs), such as high blood pressure, high cholesterol, overweight, and smoking, are increasing. Responding to this increasingly complex epidemiological pattern amid multiple macro-transitions is one of the major challenges for the 'country's health system, which is being catered to effectively by using corporate telehealth services.

- Shortage of physicians and medical staff as per the Indonesian population

Telehealth is an alternative product that has proven to be very suitable for Indonesia's demographic conditions during the pandemic. After the pandemic, with limited access to health facilities and social and economic centers, patients who need information regularly about health, consultation, and treatment has been hampered, thus requiring information technology of health. Healthcare systems with telehealth sustain the continuity of outpatient patient care during this pandemic—amid "stay-at-home" orders and physical distancing measures while reducing community and nosocomial spread.

Opportunities

- Rising government's measures to deploy programs with leading telehealth platforms

The Indonesian government is working hard and is striving to achieve universal health coverage (UHC) so that the entire population can receive comprehensive and quality health services without cost constraints. Moreover, The National Health Insurance/Healthy Indonesia Card (JKN/KIS) program has existed since January 1, 2014. The Health Social Security Administration (BPJS) is responsible for this program based on Law Number 40 of 2004 concerning the National Social Security System (SJSN). This program aims to provide public access to health services and provide financial protection. In 2020, most of the participants came from the PBI (APBN) segment by 49.10%. However, the most significant growth in participants from year to year occurred in the non-PBI. Until the end of 2020, the total coverage of JKN/KIS reached 222.4 million people.

- Shifting consumer preference toward telehealth services

The recent episodes of the COVID-19 pandemic have altered lives in many sectors and forced people to apply social distancing in daily life. Various directions from the Centers for Disease Control and Prevention (CDC) to people and healthcare providers in areas of the coronavirus (COVID-19) pandemic have been placed. These directions implement social distancing practices and specifically recommend that healthcare facilities and providers should use virtualized on-clinical services. Patients who receive palliative care through telehealth are typically very satisfied because they save more time and money. Telehealth refers to telecommunications and information technology (IT) to access health assessment, diagnosis, intervention, consultation, surveillance, and information across distances.

Restraints/Challenges

- Risks associated with cyber-security threats and securing data protections

Telehealth relies on meeting and sending information electronically using computer networks and the public internet. Information exchanged during these sessions (as well as the connected networks themselves) are more exposed to cyber threats. In today's climate of strictly regulated protection, leaks can cause serious problems for medical institutions in terms of both reputational damage and fines from regulators. Therefore, this rapid expansion of corporate telehealth services by a growing number of private and public providers comes during a time of the enhanced cyber assault on the healthcare sector. These forces create the imperative to address the unique cyber security issues faced by clinicians, patients, and the systems in which they work. Healthcare organizations need to partner with telemedicine and cybersecurity vendors to leverage these technologies to understand how to best implement and use their infrastructure and products.

- Increasing instances of healthcare fraud

As the number of medical patients seeking telehealth visits bloomed, so did the potential for fraud and abuse. In the era of corporate telehealth services, clinicians must ensure their malpractice or liability insurance covers telemedicine and, if needed, that it covers services provided across state lines. During the COVID-19 outbreak, many clinicians were first-time users of telehealth services who must ensure they were protected before providing services. There has been rising telemedicine fraud by companies that often pay kickbacks to doctors, labs, and others to generate orders paid by Medicare and another federal health program, some of which are a part of a telemarketing network that lure thousands of elderly or disabled patients to get unnecessary genetic testing or orders for medical equipment. Apart from this, there have been various frauds regarding billing and payments during the telehealth sessions, and the money has not been credited to the hospital or corporate telehealth service provider.

- Technical problems related to medical procedures

One of the biggest challenges related to telehealth use is the inability to conduct direct physical examinations, issues regarding the compatibility of certain professional activities with telehealth, and issues around inter professional collaboration. The most significant limitation of telehealth is that some hospitals and large physician practices are equipped to deliver care in this way. Still, most hospitals and private practices are not such as some hospitals may not have dedicated technology for programs such as stroke care or emergency first aid on telehealth services. Gaps in technology access and use among some groups of patients are a serious concern.

Recent Development

- In April 2021, HALODOC raised a funding of USD 80 million in funding led by a new investor, PT Astra Digital Internasional, a subsidiary of PT Astra International Tbk (Astra). Some other investors Temasek, Telkomsel’s TMI, Acrew Diversify Capital Fund, Novo Holdings, and Bangkok Bank. UOB Venture Management, Singtel Innov8, Blibli Group, Allianz X, Openspace Ventures, and other existing investors also participated

Impact of COVID-19 on Indonesia Corporate Telehealth Market

The recent episodes of the COVID-19 pandemic have altered lives in many sectors and forced everyone to apply social distancing in daily life. Various directions from the Centers for Disease Control and Prevention (CDC) to people and healthcare providers in areas of the Coronavirus (COVID-19) pandemic have been placed. The implementation of telehealth by integrating it within the national health system was urgently done to fight the COVID-19 pandemic and other health-related complications. The government of Indonesia announced that patients with mild symptoms of COVID-19 should be treated via telehealth. The implementation of telehealth by integrating it within the national health system is urgently done to fight the COVID-19 pandemic and other health-related complications. Thus, COVID-19 has positively affected the Indonesia corporate telehealth market and boosted its growth.

Indonesia Corporate Telehealth Market Scope

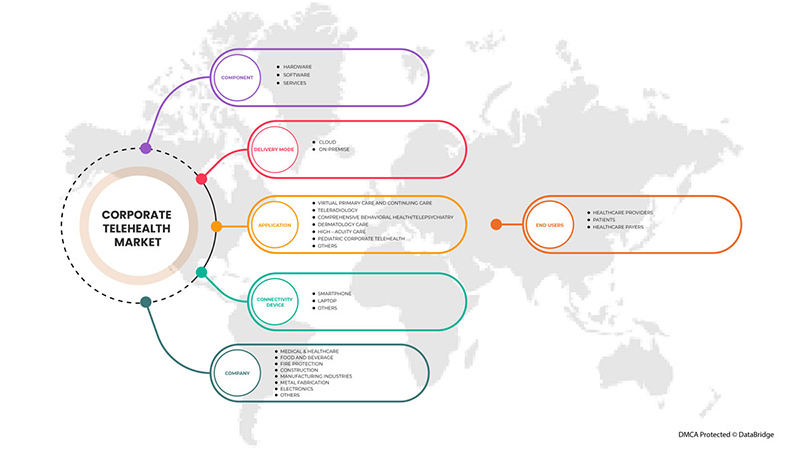

Indonesia corporate telehealth market is categorized based on component, delivery mode, application, connectivity device, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Component

- Services

- Software

- Hardware

Based on components, the Indonesia corporate telehealth market is classified into hardware, software, and services.

Delivery Mode

- Cloud

- On-premise

Based on a delivery mode, the Indonesia corporate telehealth market is classified into cloud and on-premise.

Application

- Virtual primary care and continuing care

- Teleradiology

- Comprehensive behavioral health/telepsychiatry

- Dermatology care

- High-acuity care

- Pediatric corporate telehealth

- Others

Based on the application, the Indonesia corporate telehealth market is classified into virtual primary care and continuing care, teleradiology, comprehensive behavioral health/telepsychiatry, dermatology care, high-acuity care, pediatric telehealth, and others.

Connectivity Device

- Smartphone

- Laptop

- Others

Based on connectivity device, the Indonesia corporate telehealth market is classified into smartphone, laptop, and others.

End-User

- Healthcare providers

- Patients

- Healthcare payers

Based on end-user, the Indonesia corporate telehealth market is classified into healthcare providers, patients, and healthcare payers.

Competitive Landscape and Indonesia Corporate Telehealth Market Share Analysis

Indonesia corporate telehealth market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Indonesia corporate telehealth market.

Some of the prominent participants operating in the Indonesia corporate telehealth market are HALODOC, Alodokter, ProSehat, Good Doctor, aido health, PT Medika Komunika Teknologi, Vascular Indonesia, Get Healthy Indonesia, Intel Corporation, Cisco Systems, Inc Healthy Link, and Trustmedis Indonesia among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Indonesia Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDONESIA CORPORATE TELEHEALTH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 COMPONENT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKET STRATEGIC INITIATIVES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 TECHNOLOGICAL ANALYSIS

4.5 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN EFFORTS TO EMPLOY BETTER HEALTHCARE SERVICES QUALITY

5.1.2 GROWING PREVALENCE OF CHRONIC DISEASES AND CONDITIONS

5.1.3 SHORTAGE OF PHYSICIANS AND MEDICAL STAFF AS PER THE INDONESIAN POPULATION

5.2 RESTRAINTS

5.2.1 RISKS ASSOCIATED WITH CYBER-SECURITY THREATS AND SECURING DATA PROTECTIONS

5.2.2 INCREASING INSTANCES OF HEALTHCARE FRAUDS

5.3 OPPORTUNITIES

5.3.1 RISING ' 'GOVERNMENT'S MEASURES TO DEPLOY PROGRAMS WITH LEADING TELEHEALTH PLATFORMS

5.3.2 SHIFTING CONSUMER PREFERENCE TOWARD TELEHEALTH SERVICES

5.4 CHALLENGE

5.4.1 TECHNICAL PROBLEMS RELATED TO MEDICAL PROCEDURES

6 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT

6.1 OVERVIEW

6.1.1 SERVICES

6.1.1.1 MANAGED SERVICES

6.1.1.2 PROFESSIONAL SERVICES

6.1.1.3 TRAINING AND CONSULTING

6.1.1.4 IMPLEMENTATION AND INTEGRATION

6.1.1.5 SUPPORT AND MAINTENANCE

6.1.2 SOFTWARE

6.1.2.1 REAL-TIME INTERACTIONS

6.1.2.2 REMOTE PATIENT MONITORING

6.1.2.3 STORE-AND-FORWARD CONSULTATIONS

6.1.2.4 OTHERS

6.1.3 HARDWARE

6.1.3.1 MONITORS

6.1.3.2 MEDICAL PERIPHERAL DEVICES

6.1.3.3 BLOOD PRESSURE MONITORS

6.1.3.4 BLOOD GLUCOSE METERS

6.1.3.5 PULSE OXIMETERS

6.1.3.6 WEIGHT SCALES

6.1.3.7 PEAK FLOW METERS

6.1.3.8 ECG MONITORS

6.1.3.9 ACCESSORIES

6.1.3.10 OTHERS

7 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL

7.1 OVERVIEW

7.1.1 CLOUD

7.1.2 ON-PREMISE

8 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION

8.1 OVERVIEW

8.1.1 VIRTUAL PRIMARY CARE AND CONTINUING CARE

8.1.1.1 DIABETIC SOLUTIONS

8.1.1.1.1 DIABETIC

8.1.1.1.2 PRE-DIABETIC

8.1.1.2 WEIGHT MANAGEMENT

8.1.1.3 OUTPATIENT CARE SOLUTIONS

8.1.1.4 HEART DISEASE

8.1.1.5 ASTHMA

8.1.2 TELERADIOLOGY

8.1.3 COMPREHENSIVE BEHAVIORAL HEALTH/TELEPSYCHIATRY

8.1.4 DERMATOLOGY CARE

8.1.4.1 HIGH-ACUITY CARE

8.1.4.1.1 STROKE SOLUTIONS

8.1.4.1.2 ICU

8.1.5 PEDIATRIC CORPORATE TELEHEALTH

8.1.6 OTHERS

9 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE

9.1 OVERVIEW

9.1.1 SMART PHONE

9.1.2 LAPTOP

9.1.3 OTHERS

10 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER

10.1 OVERVIEW

10.2 HEALTHCARE PROVIDERS

10.3 HOSPITALS

10.4 CLINICS

10.5 DIAGNOSTIC CENTERS

10.6 PHARMACIES

10.7 AMBULATORY SURGERY CENTERS (ASCS)

10.8 OTHERS

10.9 PATIENTS

10.1 HEALTHCARE PAYERS

10.11 PRIVATE

10.12 ICU

11 INDONESIA CORPORATE TELEHEALTH MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: INDONESIA

11.1.1 CERTIFICATIONS

11.1.2 FUNDING

11.1.3 ACHIEVEMENT

11.1.4 COLLOBORATION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 HALODOC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 ALODOKTER

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT UPDATES

13.3 PROSEHAT

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATES

13.4 GOOD DOCTOR

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATE

13.5 AIDO HEALTH

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT UPDATE

13.6 PT MEDIKA KOMUNIKA TEKNOLOGI

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 VASCULAR INDONESIA

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 CISCO SYSTEMS, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 GET HEALTHY INDONESIA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 HEALTHY LINK

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 INTEL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATES

13.12 TRUSTMEDIS INDONESIA

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 2 INDONESIA SERVICES IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 INDONESIA SOFTWARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 INDONESIA HARDWARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL, 2020-2029 (USD THOUSAND)

TABLE 6 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 7 INDONESIA VIRTUAL PRIMARY CARE AND CONTINUING CARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 INDONESIA DIABETIC SOLUTIONS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 INDONESIA HIGH-ACUITY CARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE, 2020-2029 (USD THOUSAND)

TABLE 11 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 12 INDONESIA HEALTHCARE PROVIDERS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 INDONESIA HEALTHCARE PAYERS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 INDONESIA CORPORATE TELEHEALTH MARKET: SEGMENTATION

FIGURE 2 INDONESIA CORPORATE TELEHEALTH MARKET: DATA TRIANGULATION

FIGURE 3 INDONESIA CORPORATE TELEHEALTH MARKET: DROC ANALYSIS

FIGURE 4 INDONESIA CORPORATE TELEHEALTH MARKET: INDONESIA MARKET ANALYSIS

FIGURE 5 INDONESIA CORPORATE TELEHEALTH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDONESIA CORPORATE TELEHEALTH MARKET: THE COMPONENT LIFE LINE CURVE

FIGURE 7 INDONESIA CORPORATE TELEHEALTH MARKET: MULTIVARIATE MODELLING

FIGURE 8 INDONESIA CORPORATE TELEHEALTH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 INDONESIA CORPORATE TELEHEALTH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 INDONESIA CORPORATE TELEHEALTH MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDONESIA CORPORATE TELEHEALTH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 INDONESIA CORPORATE TELEHEALTH MARKET: SEGMENTATION

FIGURE 13 INCREASE IN EFFORTS TO EMPLOY BETTER HEALTHCARE SERVICES QUALITY IS EXPECTED TO DRIVE INDONESIA CORPORATE TELEHEALTH MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 14 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDONESIA CORPORATE TELEHEALTH MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA CORPORATE TELEHEALTH MARKET

FIGURE 16 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT, 2021

FIGURE 17 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL, 2021

FIGURE 18 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION, 2021

FIGURE 19 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE, 2021

FIGURE 20 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER, 2021

FIGURE 21 INDONESIA CORPORATE TELEHEALTH MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.