Market Analysis and Insights

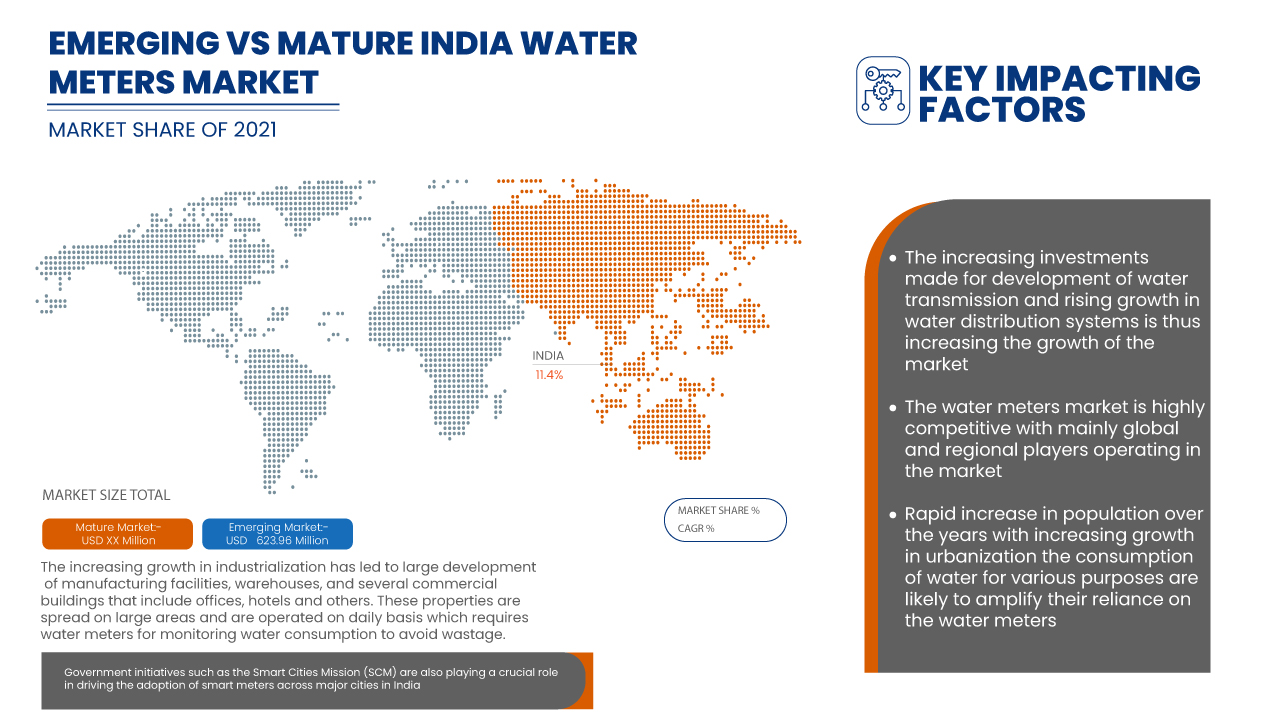

The world has noticed a rapid increase in population over the years. With increasing growth in urbanization, water consumption for various purposes such as drinking, construction purposes, bathing, and other activities has increased. However, with high consumption, the groundwater level has been continuously depleting, and major parts of the world are not equipped with water resources leading to a water crisis. On top of that, if water is leaked due to any fault in pipelines, it will lead to even more water crisis; thus, there is a vast need to stop water leakage through the water meter.

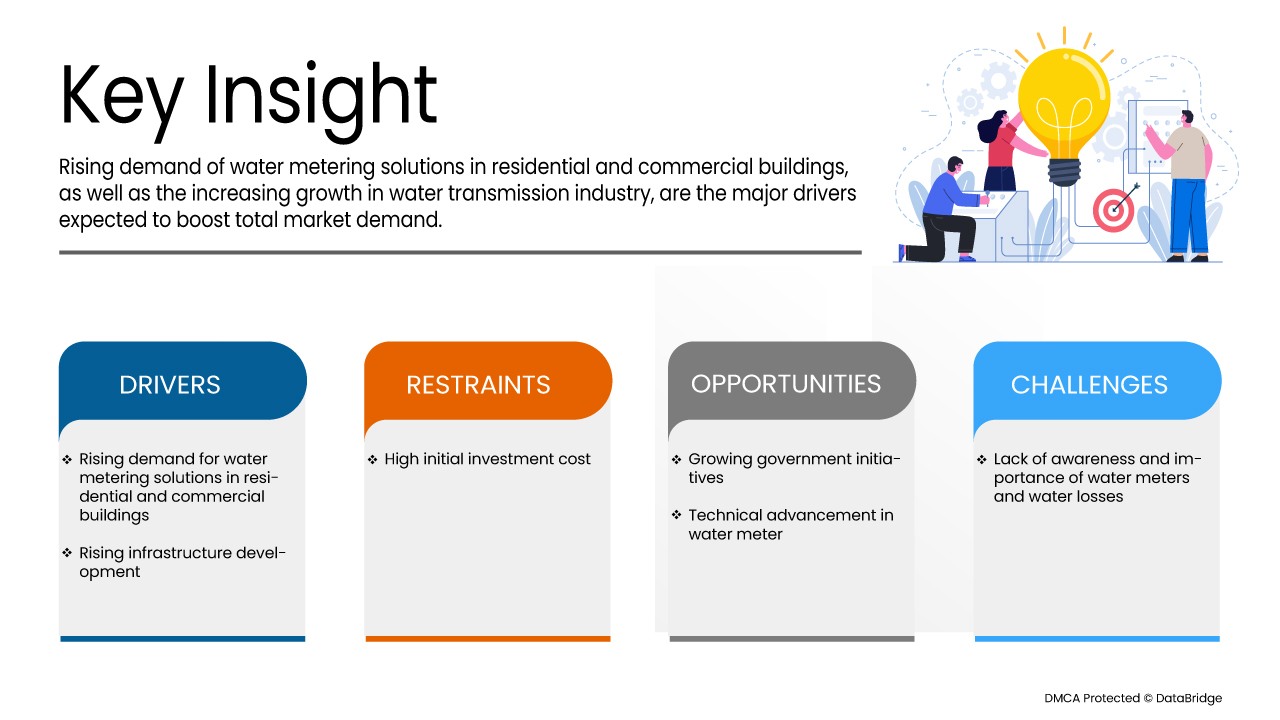

Some of the factors driving the market growth are rising demand for water meters in residential and commercial buildings and rising infrastructure development in the country. However, a lack of awareness regarding water meters and water loss is expected to hamper the market's growth.

Data Bridge Market Research analyses that the water meters market will grow at a CAGR of 11.4% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Component (Hardware, Software And Services), Type (Positive Displacement Meters (PD Meters), Velocity Flow Meters, Electromagnetic Meter, Ultrasonic, Mechanical, Turbine, Compound Water Meters And Woltman), Specification (Smart And Standard), Smart Technology (Advanced Metering Infrastructure (AMI), Automatic Meter Reading (AMR) and Others), Product Type (Cold Water Meter And Hot Water Meter), Application (Water Utility, Residential, Commercial And Industrial), Communication Network (Wireless And Wired), Distribution Channel (Offline And Online), Size (Less Than 100 mm, 100 mm - 250 mm, 250 mm-500 mm and More Than 500 mm), Body Material (Ductile Cast Iron, Bronze, Copper Alloy, Stainless Steel and Others) |

|

Countries Covered |

India |

|

Market Players Covered |

Xylem, WEGoT Utility Solutions Pvt Ltd., Everest Sanitation, Itron, Inc., Azbil Corporation, Flowtech Water Meters and Instruments Pvt. Ltd., Honeywell International Inc., Dasmesh Engineering Works, Siemens, ZENNER Aquamet India Pvt Ltd., Peltek India, Aclara Technologies LLC |

Market Definition

Water meters are mainly used to measure the volume of water flowing through the pipes. It can be used by a residential or commercial building supplied with public water. It is also used in the industrial sector and for irrigation purposes to measure the volume of water used for the respective purpose. Water utilities use a water meter to measure the amount of water their customers use during the month. The results are then added together to help them monitor their water supply. With this, they make sure they have enough water to supply everyone and help them generate bills for each month. Water meters will also help monitoring water wastage through leakages, dripping taps or any other reason and will help in taking action against such problems.

Water Meters Market Dynamics

Drivers

-

Rising demand of water metering solutions in residential and commercial buildings

The increasing growth in industrialization has led to the extensive development of manufacturing facilities, warehouses, and several commercial buildings that include offices, hotels and others. These properties are spread over large areas and are operated daily.

-

Rising infrastructure development

Infrastructure has been the primary focus for most developing economies, and high investments are being made to increase the development. Many residential complexes, schools, offices, sewage systems, government offices, and others are being developed. The recent technological advancement has led to the increasing incorporation of advanced technologies such as smart water meters to detect leaking water in buildings.

-

Increasing growth in water transmission industry

The increasing investments made to develop water transmission and rising growth in water distribution systems are thus increasing the market's growth.

-

Increasing problem of water scarcity

The world has noticed a rapid increase in population over the years. With increasing growth in urbanization, water consumption for various purposes such as drinking, construction purposes, bathing, and other activities has increased. The presence of water scarcity is increasing the need to conserve water and protect the pipelines from any leakages so that no amount of water can be lost, thus increasing the demand for water meters.

Opportunities

-

Growing government initiatives

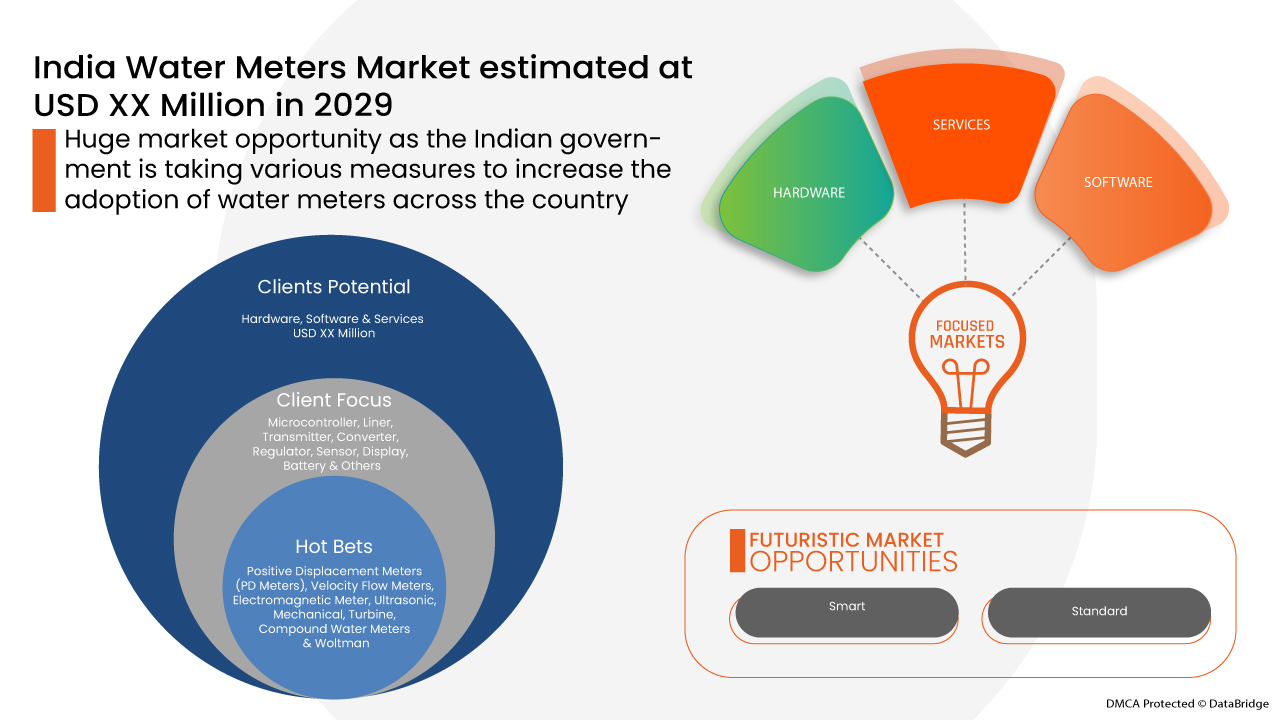

Government initiatives such as the Smart Cities Mission (SCM) are also playing a crucial role in driving the adoption of smart meters across cities. The Government has also introduced a series of initiatives to create awareness about water conservation, including the Jal Jeevan Mission, under the Ministry of Jal Shakti, which aims to promote water conservation in 256 most water-stressed districts of India.

Restraints/Challenges

- High initial investment cost

Water meters provide many benefits, such as tracking wastewater, pay per use fairness, saving money on water tankers, etc. But due to the initial cost on the whole infrastructure, plumbing charges, and inconvenience caused after, people mostly hesitate to install a water meter.

COVID-19 Impact on Water Meters Market

COVID-19 has negatively affected the market. The COVID 19 outbreak has affected the growth of the water meter industry due to the lockdown measure in the countries and delays in the production and manufacturing of water meters utilized in residential, commercial, and industrial spaces. Moreover, the limited supply of semiconductors and gadgets has significantly affected the supply of water meters in the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the water meters. With this, the companies will bring advanced water meters to the market.

For instance,

- In December 2021, The Nation Authority started the installation of smart water meters in Noida. Under this, 5,000 meters were installed in the first phase of the pilot project.

The pandemic threatened to put immense pressure on overstretched water utilities; therefore, the Government of India is looking for the adoption and deployment of smart meters, which aims to combat the looming water crisis that might take severe shape due to the COVID-19 global pandemic to water consumption limits, identify leaks on their side and suggest behaviour options to reduce residential water consumption

Recent Development

- In April 2022, Itron, Inc. announced the launch of its online Partner Solution Marketplace, where the customers can directly access field-proven and pilot-ready solutions from third parties. The catalog showcases innovative and emerging solutions like smart city technologies and Distributed Intelligence (DI) applications. Thus, the company will help its customers modernize their infrastructure with this

- In June 2020, Aclara Technologies LLC announced that Austin Water had selected them to supply and implement a landmark advanced metering infrastructure (AMI) program for the utility. The company will provide and implement a fully integrated end-to-end solution and replace current and manual meter reading systems. With this, the company will help Austin Water achieve its goal of bringing advanced water metering technology to the City

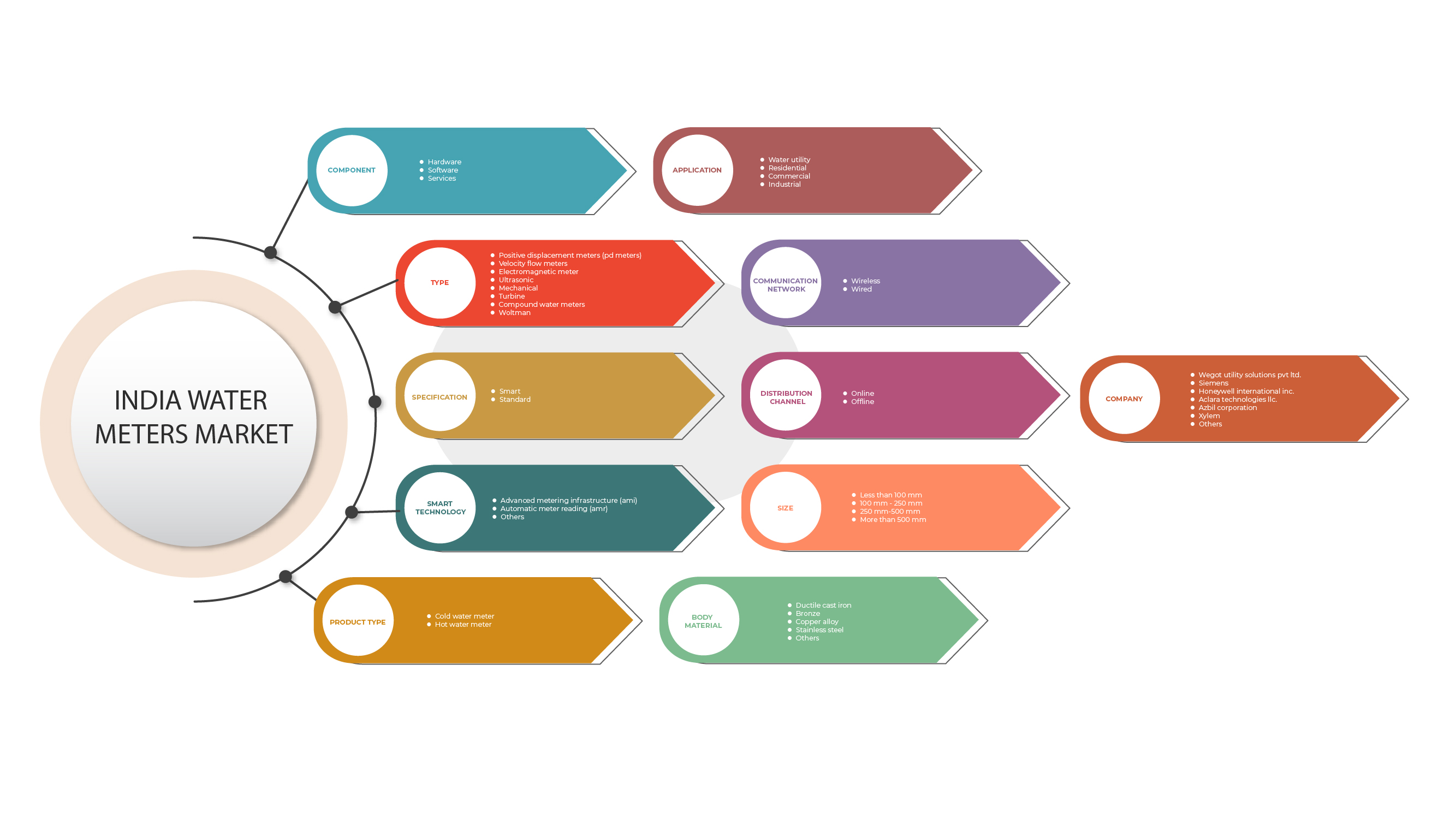

India Water Meters Market Scope

The water meters market is segmented based on component, type, specification, smart technology, product type, application, communication network, size and body material. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

- Services

On the basis of component, the India water meter market has been segmented into hardware, software and services.

Type

- Positive Displacement Meters (Pd Meters)

- Velocity Flow Meters

- Electromagnetic Meter

- Ultrasonic

- Mechanical

- Turbine

- Compound Water Meters

- Woltman

Based on type, the India water meter market has been segmented into positive displacement meters (PD meters), velocity flow meters, electromagnetic meter, ultrasonic, mechanical, turbine, compound water meters and woltman.

Specification

- Smart

- Standard

Based on the specification, the India water meter market has been segmented into smart and standard.

Smart Technology

- Advanced Metering Infrastructure (Ami)

- Automatic Meter Reading (Amr)

- Others

Based on smart technology, the India water meter market has been segmented into advanced metering infrastructure (AMI), automatic meter reading (AMR) and others.

Product Type

- Cold Water Meter

- Hot Water Meter

Based on product type, the India water meter market has been segmented into cold water meter and hot water meter.

Application

- Water Utility

- Residential

- Commercial

- Industrial

Based on application, the India water meter market has been segmented into water utility, residential, commercial and industrial.

Communication Network

- Wireless

- Wired

Based on the communication network, the India water meter market has been segmented into wireless and wired.

Distribution Channel

- Offline

- Online

Based on the distribution channel, the India water meter market has been segmented into offline and online.

Size

- Less Than 100 MM

- 100 MM - 250 MM

- 250 MM-500 MM

- More Than 500 MM

Based on the size, the India water meter market has been segmented into less than 100 mm, 100 mm - 250 mm, 250 mm-500 mm and more than 500 mm.

Body Material

- Ductile Cast Iron

- Bronze

- Copper Alloy

- Stainless Steel

- Others

Based on body material, the India water meter market has been segmented into ductile cast iron, bronze, copper alloy, stainless steel and others.

India Water Meters Market

The water meters market is analyzed, and market size insights and trends are provided by the component, type, specification, smart technology, product type, application, communication network, size and body material as referenced above.

The country section of the water meters market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Water Meters Market Share Analysis

The water meters market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the water meters market.

Some of the major players operating in the water meter market are Xylem, WEGoT Utility Solutions Pvt Ltd., Everest Sanitation, Itron, Inc., Azbil Corporation, Flowtech Water Meters and Instruments Pvt. Ltd., Honeywell International Inc., Dasmesh Engineering Works, Siemens, ZENNER Aquamet India Pvt Ltd., Peltek India, Aclara Technologies LLC among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, India versus Regional and Vendor Share Analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 COMPONENT TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.2 PORTERS MODEL

4.3 VALUE CHAIN

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR WATER METERING SOLUTIONS IN RESIDENTIAL AND COMMERCIAL BUILDINGS

5.1.2 RISING INFRASTRUCTURE DEVELOPMENT

5.1.3 INCREASING GROWTH IN THE WATER TRANSMISSION INDUSTRY

5.1.4 INCREASING PROBLEM OF WATER SCARCITY

5.2 RESTRAINT

5.2.1 HIGH INITIAL INVESTMENT COST

5.3 OPPORTUNITIES

5.3.1 GROWING GOVERNMENT INITIATIVES

5.3.2 TECHNICAL ADVANCEMENT IN WATER METER

5.3.3 RISING NEED FOR SMART METERING

5.3.4 EMERGENCE OF NEW PRODUCT DEVELOPMENTS

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS AND IMPORTANCE OF WATER METERS AND WATER LOSSES

6 INDIA WATER METERS MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 MICROCONTROLLER

6.2.2 LINER

6.2.3 TRANSMITTER

6.2.4 CONVERTER

6.2.5 REGULATOR

6.2.6 SENSOR

6.2.6.1 FLOW

6.2.6.2 MAGNETORESISTIVE

6.2.6.3 OTHERS

6.2.7 DISPLAY

6.2.7.1 LCD

6.2.7.2 MECHANICAL

6.2.8 BATTERY

6.2.9 OTHERS

6.3 SOFTWARE

6.4 SERVICES

6.4.1 INSTALLATION

6.4.2 SUPPORT & MAINTENANCE

6.4.3 TRAINING

7 INDIA WATER METERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 POSITIVE DISPLACEMENT METERS (PD METERS)

7.3 VELOCITY FLOW METERS

7.3.1 MULTI-JET METERS

7.3.2 SINGLE JET METERS

7.4 ELECTROMAGNETIC METER

7.4.1 FLANGE TYPE METER

7.4.2 INSERTION TYPE METER

7.5 ULTRASONIC

7.5.1 TRANSIT TIME TRANSDUCER BASED

7.5.2 DOPPLER TRANSDUCER BASED

7.6 MECHANICAL

7.7 TURBINE

7.8 COMPOUND WATER METERS

7.9 WOLTMAN

8 INDIA WATER METERS MARKET, BY SPECIFICATION

8.1 OVERVIEW

8.2 SMART

8.3 STANDARD

9 INDIA WATER METERS MARKET, BY SMART TECHNOLOGY

9.1 OVERVIEW

9.2 ADVANCED METERING INFRASTRUCTURE (AMI)

9.3 AUTOMATIC METER READING (AMR)

9.4 OTHERS

10 INDIA WATER METERS MARKET, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 COLD WATER METER

10.3 HOT WATER METER

11 INDIA WATER METERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 WATER UTILITY

11.3 RESIDENTIAL

11.4 COMMERCIAL

11.5 INDUSTRIAL

11.5.1 BY TYPE

11.5.1.1 AGRICULTURE

11.5.1.2 PHARMACEUTICAL

11.5.1.3 FOOD AND BEVERAGES

11.5.1.4 OTHERS

11.5.2 BY SIZE

11.5.2.1 LARGE

11.5.2.2 SMALL SCALE INDUSTRY

12 INDIA WATER METERS MARKET, BY COMMUNICATION NETWORK

12.1 OVERVIEW

12.2 WIRELESS

12.2.1 CELLULAR

12.2.2 BLUETOOTH

12.2.3 RF

12.2.4 NB-IOT

12.2.5 LORA

12.2.6 OTHERS

12.3 WIRED

13 INDIA WATER METERS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 OFFLINE

13.3 ONLINE

13.3.1 E-COMMERCE

13.3.2 COMPANY WEBSITE

14 INDIA WATER METERS MARKET, BY SIZE

14.1 OVERVIEW

14.2 LESS THAN 100 MM

14.3 100 MM - 250 MM

14.4 250 MM-500 MM

14.5 MORE THAN 500 MM

15 INDIA WATER METERS MARKET, BY BODY MATERIAL

15.1 OVERVIEW

15.2 DUCTILE CAST IRON

15.3 BRONZE

15.4 COPPER ALLOY

15.5 STAINLESS STEEL

15.6 OTHERS

16 INDIA WATER METERS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: INDIA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 WEGOT UTILITY SOLUTIONS PVT LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 SIEMENS

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 HONEYWELL INTERNATIONAL INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 ACLARA TECHNOLOGIES LLC

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 AZBIL CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 DASMESH ENGINEERING WORKS

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 EVEREST SANITATION

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 FLOWTECH WATER METERS AND INSTRUMENTS PVT. LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 ITRON INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 PELTEK INDIA

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 XYLEM

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 ZENNER AQUAMET INDIA PVT LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 WATER CONNECTIONS RATES, EFFECTIVE FROM 01-04-2015

TABLE 2 WATER CONSUMPTION RATES, EFFECTIVE FROM 01-04-2015

TABLE 3 MINIMUM WATER CHARGES AS PER SIZE OF METER, EFFECTIVE FROM 01-04-2015

TABLE 4 INDIA WATER METERS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 5 INDIA HARDWARE IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 INDIA SENSOR IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 INDIA DISPLAY IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 INDIA SERVICES IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 INDIA WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 INDIA WATER METERS MARKET, BY TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 11 INDIA VELOCITY FLOW METERS IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 INDIA ELECTROMAGNETIC METER IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 INDIA ULTRASONIC IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 INDIA WATER METERS MARKET, BY SPECIFICATION, 2020-2029 (USD MILLION)

TABLE 15 INDIA WATER METERS MARKET, BY SMART TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 INDIA WATER METERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 INDIA WATER METERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 INDIA INDUSTRIAL IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 INDIA INDUSTRIAL IN WATER METERS MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 20 INDIA WATER METERS MARKET, BY COMMUNICATION NETWORK, 2020-2029 (USD MILLION)

TABLE 21 INDIA WIRELESS IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 INDIA WATER METERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 INDIA ONLINE IN WATER METERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 INDIA WATER METERS MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 25 INDIA WATER METERS MARKET, BY BODY MATERIAL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 INDIA WATER METERS MARKET: SEGMENTATION

FIGURE 2 INDIA WATER METERS MARKET: DATA TRIANGULATION

FIGURE 3 INDIA WATER METERS MARKET: DROC ANALYSIS

FIGURE 4 INDIA WATER METERS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA WATER METERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA WATER METERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA WATER METERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA WATER METERS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 INDIA WATER METERS MARKET : CHALLENGE MATRIX

FIGURE 10 INDIA WATER METERS MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR WATER METERING SOLUTIONS IN RESIDENTIAL AND COMMERCIAL BUILDINGS IS EXPECTED TO DRIVE INDIA WATER METERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA WATER METERS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF INDIA WATER METERS MARKET

FIGURE 14 INDIA WATER METERS MARKET: BY COMPONENT, 2021

FIGURE 15 INDIA WATER METERS MARKET: BY TYPE, 2021

FIGURE 16 INDIA WATER METERS MARKET: BY SPECIFICATION, 2021

FIGURE 17 INDIA WATER METERS MARKET: BY SMART TECHNOLOGY, 2021

FIGURE 18 INDIA WATER METERS MARKET: BY PRODUCT TYPE, 2021

FIGURE 19 INDIA WATER METERS MARKET: BY APPLICATION, 2021

FIGURE 20 INDIA WATER METERS MARKET: BY COMMUNICATION NETWORK, 2021

FIGURE 21 INDIA WATER METERS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 INDIA WATER METERS MARKET: BY SIZE, 2021

FIGURE 23 INDIA WATER METERS MARKET: BY BODY MATERIAL, 2021

FIGURE 24 INDIA WATER METERS MARKET: COMPANY SHARE 2021 (%)

India Water Meters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its India Water Meters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as India Water Meters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.