India, Malaysia, and Indonesia Modular Kitchen Market Analysis and Size

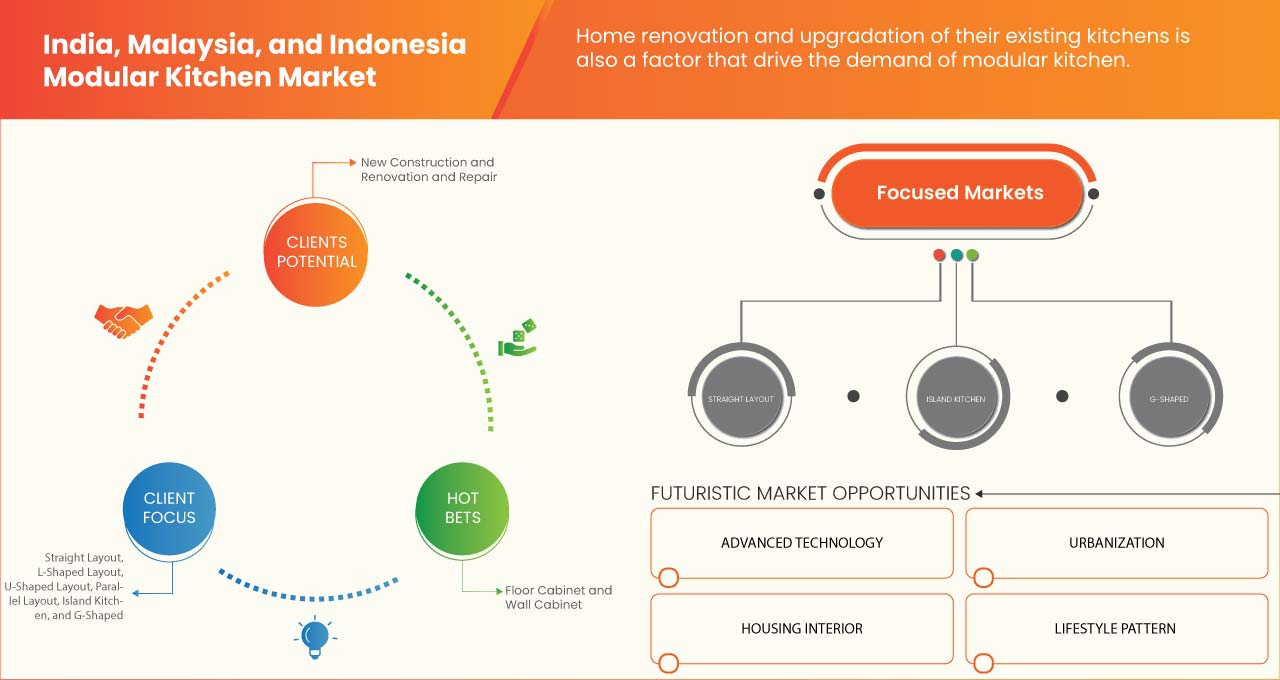

The India, Malaysia, and Indonesia modular kitchen markets are expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 11.1% in the forecast period of 2023 to 2030 and is expected to reach USD 9,180.01 million by 2030. The major factor driving the growth of the modular kitchen market is the growing urbanization, residential construction and renovation activities across the countries, and increasing demand for space-saving and efficient storage in housing design. Raising demand for aesthetics looks in the housing interior, high adoption of the modular kitchen due to changing the lifestyle pattern of consumers increasing investments in the construction industry will drive the market growth.

A modular Kitchen is mostly made up of wood, metal, fibers/plastics and others. Modular kitchen is in high demand in these countries due to the aesthetics and appealing look it offers to the kitchen, along with the space and work efficiency. Modular kitchen manufacturers offer various unique designs and layouts like Straight Layouts, L-Shaped Layouts, U-Shaped Layouts, Parallel Layouts, Island kitchens, and G-Shaped. A modular kitchen is also more flexible for modification. It is cost-effective, along with the ability to install and repair, compared to the traditional kitchen style, where the appliances are permanently attached to the concrete wall and floor. Several companies are involved in providing design and innovation for an efficient and good looking modular kitchen.

The India, Malaysia, and Indonesia modular kitchen market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Millions |

|

Segments Covered |

By Product (Floor Cabinet and Wall Cabinet), Layout (Straight Layout, L-Shaped Layout, U-Shaped Layout, Parallel Layout, Island Kitchen, and G-Shaped), Raw Material (Wood, Metal, Fiber/Plastic, and Others), Application (Residential and Commercial), Construction (New Construction, Renovation, and Repair), Distribution Channel (Offline and Online), Country (India, Malaysia, and Indonesia) |

|

Countries Covered |

India, Malaysia, and Indonesia |

|

Market Players Covered |

Snaidero Rino Spa, Wudley Modulars, Godrej Interio, Oppein, Signature Kitchen SDN BHD, and Alea Modular Kitchen, among others. |

Market Definition

A modular kitchen is defined as a modern kitchen with furniture that has been constructed in modules or units. The name modular kitchen originates from the idea of the module. They consist of small sections or modules, which are accumulated together to form a complete kitchen. They comprise cabinets or storage units of standard sizes customized as per the kitchen sizes and layout. Modular kitchen designs break down large systems into essential parts to meet various customer needs, replicating flexibility and agility. They are usually a combination of wall units and base units.

Modular kitchen advances over the traditional kitchen in terms of hygiene, space management, cost-efficiency, and easy and low maintenance. The biggest advantage of modular kitchens is that they can be assembled and reassembled. They allow an efficient workflow even in very compact spaces. Modular kitchens are popular today because of their sleek and smooth finishes. They are light on the eyes as they are designed with fine and clean edges. The cabinets and other accessories are available in different styles, colors, and patterns.

India, Malaysia, and Indonesia Modular Kitchen Market Dynamics

Drivers

- Growing urbanization, residential construction and renovation activities across the countries

The growing urbanization due to the huge migration of working people to cities that lead to rapid urbanization. The lifestyle of people is shifting towards modern lifestyles and trends. This has changed the whole concept and idea of new infrastructures and construction. With various advancements in technology, trends, and innovation, new models for infrastructure and construction are generated. The growing development of the residential sector leads to the demand for modular kitchen construction. The modular kitchen takes less space, offers proper hygiene, and provides more working efficiency and space. It is also more flexible for modification and is cost-effective, along with the ability to install and repair compared to the traditional kitchen style, where the appliances are permanently attached to the concrete wall and floor. The newly constructed residential and commercial buildings, including the buildings that need renovation over the older ones, prefer modular kitchen solutions, which can contribute to the modular kitchen market. Thus, growing urbanization, residential construction and renovation activities in these countries are expected to drive the India, Malaysia, and Indonesia Modular kitchen market.

- Increasing demand for space-saving and efficient storage in housing design

People today, especially those with limited space, are more concerned with making the most of their kitchen or home. Modern, multipurpose, and space-saving modular kitchen options are the solution. Kitchen storage cabinets cover up the bulk space in a kitchen. They take up more room than the actual cooking area. Therefore, putting drawers underneath the counters instead of racks or cabinets allows for extra storage space. Modular kitchens' technology advancements make it feasible to fit a stove, sink, and other kitchen equipment in a small space extremely effectively. Storage options include wall-mounted storage and drawers beneath the counter.

Moreover, modular kitchen furniture is designed to provide more open space. The micro-compartments, drawers, cabinets, and counters are all customizable for improved space efficiency, keeping up with current trends. As a result, rising consumer demand for space-saving and effective storage can be regarded as one of the key factors propelling the development of the India, Malaysia, and Indonesia modular kitchen market.

Opportunities

- Increasing investments in the construction industry

Investment in the construction industry is increasing with the increasing focus from both the private and public sectors. With the aim to transform the economy, there is a various number of developing large-scale buildings and complex and multi-propose construction projects. The increasing development of the construction industry due to the high demand for modern houses results in the demand for modular kitchens. A new house owner will always aspire to have a well-designed modular kitchen when moving to a new home or apartment. Home renovation and upgradation of their existing kitchens is also a factor that drives the demand for modular kitchens. With more homeowners adapting to the new trend of having fancy housing interiors, improving and upgradation their kitchens is not an excuse. Modular kitchens have merged into the living and dining spaces, creating one big space for family and friends to have a great time. Furthermore, the emergence of nuclear families, an increasing number of housing projects, growth in organized retails, and a shift in changing home aesthetics may provide various growth opportunities for the India, Malaysia, and Indonesia modular kitchen market.

Restraints/Challenges

- High costs associated with the installation of modular kitchen

Modular kitchens are very sophisticated, modern, extremely useful, and adaptable to the needs of consumers. However, the installation expenses for modular kitchens are significantly high and represent a long-term investment that should last for many years. Costs vary according to the shape, kitchen size, material type, cabinet module, and package style buyers select. Modular kitchen prices are higher than traditional kitchen designs with minimalistic designs, and the design and installation of modular kitchens are relatively higher. Designing a good design modular kitchen requires proper decision-making by experts with respect to the kitchen design layout, the materials used and the design and layout that will offer work efficiency and space as per the customer's need, which contributes to the higher cost during installation. Therefore, the high installation costs for modular kitchens and the need for technical assistance while installation and repair may hinder the growth of the India, Malaysia, and Indonesia modular kitchen market.

- Fluctuation in the prices of raw materials

Raw materials are the backbones of any manufacturing unit, and when it comes to modular kitchen manufacturing, companies dependent on raw materials are no exception. Raw material is available in various qualities and at different rates, due to which production of modular kitchen products is very difficult for the manufacturers. Highly fluctuating raw materials costs and ineffective price management can greatly impact a manufacturer in the market due to the fluctuation in the raw material price. The manufacturers cannot fix the products' cost, which further results in a loss for the manufacturers. Fluctuations in the raw materials price will affect the production cost of modular kitchen equipment and cabinet. With the change in production, the cost of raw materials will change the revenue for the manufacturers. Plastic, metal and wood are raw materials used in the production of modular kitchen products, which are used in various applications such as residential and commercial. Thus, more fluctuation in the raw materials price will result in losses to the manufacturers and the inability to invest more in the market. So, the fluctuation in raw material prices is expected to challenge the market

Recent Development

- In June 2022, Snaidero Rino Spa participated in the Furniture Fair 2022. The company presented ELEMENTI, a new model of the ultimate expression of minimalist style, a product of Snaidero Research & Development, oriented to the natural essence of shapes. This participation will help the company to engage with market participants and gain recognition for its abilities.

- In January 2022, Sneidero Rino Spa, the company presented new products that offer the customer customization in the design of the kitchen, An attitude that confirms a strategic and sought-after positioning also in the up-grade product innovations through range extensions capable of guaranteeing maximum customization, flexibility and extreme characterization: from the new kitchen worktops to the sliding tops, passing through new 75 cm modularity, to the corner cabinets for the oven, up to increasingly sophisticated and elegant finishes and lighting.

India, Malaysia, and Indonesia Modular Kitchen Market Scope

The India, Malaysia, and Indonesia modular kitchen market t is categorized based on product, layouts, raw materials, application, construction and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Floor Cabinet

- Wall Cabinet

On the basis of product, India, Malaysia, and Indonesia modular kitchen market is segmented into floor cabinet and wall cabinet.

Layout

- Straight Layout

- L-Shaped Layout

- U-Shaped Layout

- Parallel Layout

- Island Kitchen

- G-Shape

On the basis of layout, India, Malaysia, and Indonesia modular kitchen market is segmented into straight layouts, L-shaped layouts, U-shaped layouts, parallel layouts, island kitchens, and G-shape.

Raw material

- wood

- metal

- fiber/plastic

- others

On the basis of raw material, India, Malaysia, and Indonesia modular kitchen market is segmented into wood, metal, fiber/plastic and others.

Application

- Residential

- Commercial

On the basis of application, India, Malaysia, and Indonesia modular kitchen market is segmented into residential and commercial.

Construction

- New Construction

- Renovation and Repair

On the basis of construction, India, Malaysia, and Indonesia modular kitchen market is segmented into new construction, renovation and repair.

Distribution Channel

- Offline

- Online

On the basis of distribution channels in India, Malaysia, and Indonesia modular kitchen market is segmented into offline and online.

Competitive Landscape and India, Malaysia, and Indonesia Modular Kitchen Market Share Analysis

India, Malaysia, and Indonesia modular kitchen market competitive landscape provide details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the India, Malaysia, and Indonesia modular kitchen markets.

Some of the prominent participants operating in the India, Malaysia, and Indonesia modular Kitchen markets are Snaidero Rino Spa, Wudley Modulars, Godrej Interio, Oppein, Signature Kitchen SDN BHD, and Alea Modular Kitchen, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 POLITICAL FACTORS

4.3 ECONOMIC FACTORS

4.3.1 SOCIAL FACTORS

4.3.2 TECHNOLOGICAL FACTORS

4.3.3 LEGAL FACTORS

4.3.4 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 IMPORT EXPORT SCENARIO

4.6 VENDOR SELECTION CRITERIA

4.7 RAW MATERIAL SOURCING ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING URBANIZATION, RESIDENTIAL CONSTRUCTION AND RENOVATION ACTIVITIES ACROSS THE COUNTRIES

6.1.2 INCREASING DEMAND FOR SPACE-SAVING AND EFFICIENT STORAGE IN HOUSING DESIGN

6.1.3 RAISING DEMAND FOR AESTHETIC LOOK IN THE HOUSING INTERIOR.

6.1.4 HIGH ADOPTION OF MODULAR KITCHENS DUE TO CHANGING THE LIFESTYLE PATTERN OF CONSUMERS

6.2 RESTRAINTS

6.2.1 HIGH COSTS ASSOCIATED WITH THE INSTALLATION OF MODULAR KITCHEN

6.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 INCREASING INVESTMENTS IN THE CONSTRUCTION INDUSTRY

6.3.2 TECHNOLOGICAL ADVANCEMENTS AND LAUNCHING NEW PRODUCTS TO FLOURISH THE MARKET

6.4 CHALLENGES

6.4.1 HIGH MAINTENANCE COSTS ASSOCIATED WITH THE MODULAR KITCHEN

6.4.2 A SUBSTANTIAL NUMBER OF LOCAL PLAYERS ARE BUDDING IN THE MARKET

7 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLOOR CABINET

7.3 WALL CABINET

8 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET, BY LAYOUT

8.1 OVERVIEW

8.2 STRAIGHT LAYOUT

8.3 L-SHAPED LAYOUT

8.4 U-SHAPED LAYOUT

8.5 PARALLEL LAYOUT

8.6 ISLAND LAYOUT

8.7 G-SHAPED LAYOUT

9 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET, BY RAW MATERIAL

9.1 OVERVIEW

9.2 WOOD

9.3 METAL

9.4 FIBER/PLASTIC

9.5 OTHERS

10 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 RESIDENTIAL

10.3 COMMERCIAL

11 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET, BY CONSTRUCTION

11.1 OVERVIEW

11.2 NEW CONSTRUCTION

11.3 RENOVATION AND REPAIR

12 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 COMPANY SHARE ANALYSIS: INDIA, MALAYSIA, AND INDONESIA

13.1 PARTICIPATION AWARD

13.2 LAUNCH

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SNAIDERO RINO SPA

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 WUDLEY MODULARS

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 GODREJ INTERIO

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 OPPEIN

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 SIGNATURE KITCHEN SDN BHD

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ALEA MODULAR KITCHEN

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DECORA-CORPORATE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 LUKWOOD KITCHEN

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 MODULARS WORLD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 NEXUS INTERIO PRIVATE LIMITED

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 SLEEK INTERNATIONAL PVT LTD. (A SUBSIDIARY OF ASIAN PAINTS)

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF WOODEN FURNITURE FOR KITCHENS (EXCLUDING SEATS); HS CODE – 940340(USD THOUSAND)

TABLE 2 EXPORT DATA OF WOODEN FURNITURE FOR KITCHENS (EXCLUDING SEATS); HS CODE – 940340(USD THOUSAND)

TABLE 3 INDIA MODULAR KITCHEN MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 INDONESIA MODULAR KITCHEN MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 MALAYSIA MODULAR KITCHEN MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 INDIA MODULAR KITCHEN MARKET, BY LAYOUT, 2021-2030 (USD MILLION)

TABLE 7 INDONESIA MODULAR KITCHEN MARKET, BY LAYOUT, 2021-2030 (USD MILLION)

TABLE 8 MALAYSIA MODULAR KITCHEN MARKET, BY LAYOUT, 2021-2030 (USD MILLION)

TABLE 9 INDIA MODULAR KITCHEN MARKET: BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 10 INDONESIA MODULAR KITCHEN MARKET: BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 11 MALAYSIA MODULAR KITCHEN MARKET: BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 12 INDIA MODULAR KITCHEN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 13 INDONESIA MODULAR KITCHEN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 MALAYSIA MODULAR KITCHEN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 INDIA MODULAR KITCHEN MARKET, BY CONSTRUCTION, 2021-2030 (USD MILLION)

TABLE 16 INDONESIA MODULAR KITCHEN MARKET, BY CONSTRUCTION, 2021-2030 (USD MILLION)

TABLE 17 MALAYSIA MODULAR KITCHEN MARKET, BY CONSTRUCTION, 2021-2030 (USD MILLION)

TABLE 18 INDIA MODULAR KITCHEN MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 19 INDONESIA MODULAR KITCHEN MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 20 MALAYSIA MODULAR KITCHEN MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET

FIGURE 2 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: DATA TRIANGULATION

FIGURE 3 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: DROC ANALYSIS

FIGURE 4 INDIA MODULAR KITCHEN MARKET: MARKET ANALYSIS

FIGURE 5 MALAYSIA MODULAR KITCHEN MARKET: MARKET ANALYSIS

FIGURE 6 INDONESIA MODULAR KITCHEN MARKET: MARKET ANALYSIS

FIGURE 7 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 9 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: MULTIVARIATE MODELLING

FIGURE 10 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 11 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: DBMR MARKET POSITION GRID

FIGURE 12 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 14 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 15 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: SEGMENTATION

FIGURE 16 GROWING URBANIZATION, RESIDENTIAL CONSTRUCTION AND RENOVATION ACTIVITIES ACROSS THE COUNTRIES ARE EXPECTED TO DRIVE INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET IN THE FORECAST PERIOD

FIGURE 17 THE FLOOR CABINET SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA MODULAR KITCHEN MARKET IN 2022 & 2029

FIGURE 18 THE FLOOR CABINET SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MALAYSIA AND INDONESIA MODULAR KITCHEN MARKET IN 2022 & 2029

FIGURE 19 THE FLOOR CABINET SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDONESIA MODULAR KITCHEN MARKET IN 2022 & 2029

FIGURE 20 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MODULAR KITCHEN MARKET

FIGURE 22 INDIA MODULAR KITCHEN MARKET: BY PRODUCT, 2022

FIGURE 23 INDONESIA MODULAR KITCHEN MARKET: BY PRODUCT, 2022

FIGURE 24 MALAYSIA MODULAR KITCHEN MARKET: BY PRODUCT 2022

FIGURE 25 INDIA MODULAR KITCHEN MARKET: BY LAYOUT, 2022

FIGURE 26 INDONESIA MODULAR KITCHEN MARKET: BY LAYOUT, 2022

FIGURE 27 MALAYSIA MODULAR KITCHEN MARKET: BY LAYOUT, 2022

FIGURE 28 INDIA MODULAR KITCHEN MARKET: BY RAW MATERIAL, 2022

FIGURE 29 INDONESIA MODULAR KITCHEN MARKET: BY RAW MATERIAL, 2022

FIGURE 30 MALAYSIA MODULAR KITCHEN MARKET: BY RAW MATERIAL, 2022

FIGURE 31 INDIA MODULAR KITCHEN MARKET: BY APPLICATION, 2022

FIGURE 32 INDONESIA MODULAR KITCHEN MARKET: BY APPLICATION, 2022

FIGURE 33 MALAYSIA MODULAR KITCHEN MARKET: BY APPLICATION, 2022

FIGURE 34 INDIA MODULAR KITCHEN MARKET: BY CONSTRUCTION, 2022

FIGURE 35 INDONESIA MODULAR KITCHEN MARKET: BY CONSTRUCTION, 2022

FIGURE 36 MALAYSIA MODULAR KITCHEN MARKET: BY CONSTRUCTION, 2022

FIGURE 37 INDIA MODULAR KITCHEN MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 38 INDONESIA MODULAR KITCHEN MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 39 MALAYSIA MODULAR KITCHEN MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 40 INDIA, MALAYSIA, AND INDONESIA MODULAR KITCHEN MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.