India Blood Gas Analyzer Market

Market Size in USD Million

CAGR :

%

USD

51.08 Million

USD

88.51 Million

2022

2030

USD

51.08 Million

USD

88.51 Million

2022

2030

| 2023 –2030 | |

| USD 51.08 Million | |

| USD 88.51 Million | |

|

|

|

India Blood Gas Analyzer Market Analysis and Insights

The adaptation of advanced technologies for blood analysis in the industry has been stimulated by the requirement to improve product quality and reduce manufacturing costs at the same time or, rather, to secure competitiveness. Consequently, the growing demand for blood gas analyzers in healthcare is likely to drive market growth in the projected period.

The rising incidence of chronic disorders such as cardiovascular and neuro are accelerating the market's growth.

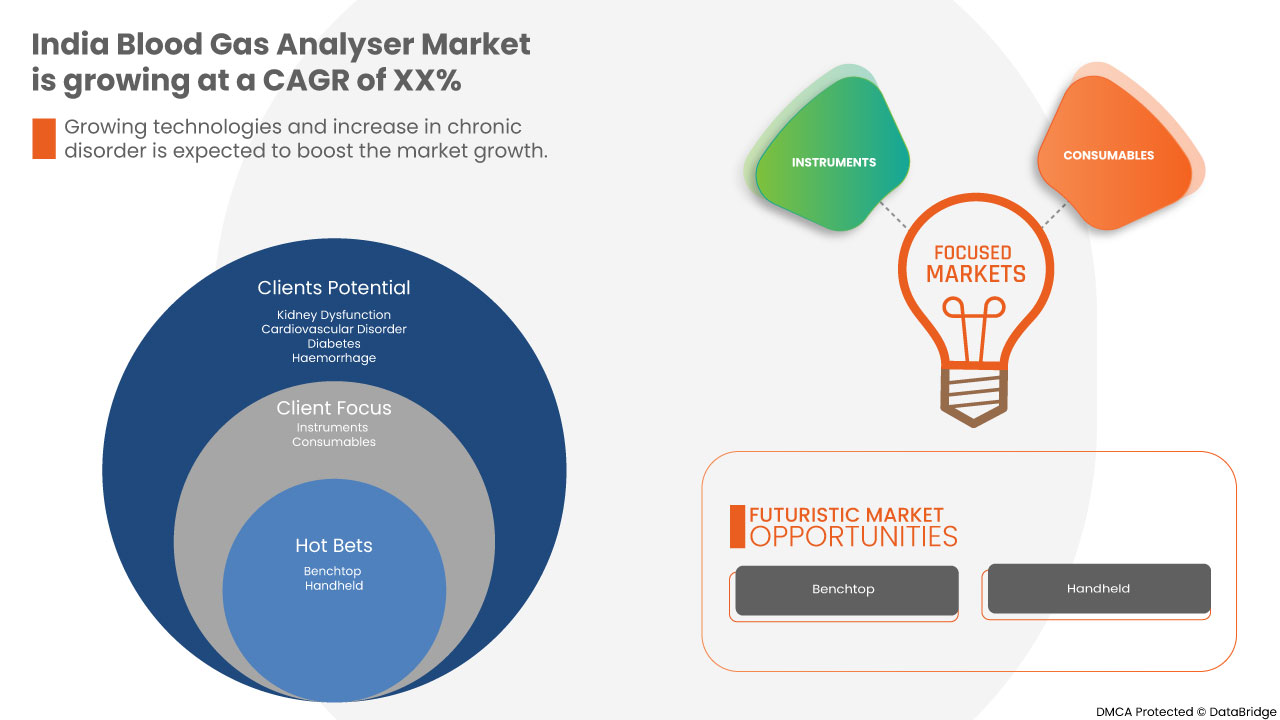

India blood gas analyzer market is expected to reach USD 88.51 million by 2030 from USD 51.08 million in 2022, growing at a CAGR of 7.1% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Instruments and Consumables), Modality (Benchtop, Handheld, and Portable), Medical Condition (Kidney Dysfunction, Cardiovascular Disorder, Diabetes, Haemorrhage, and Others), End Users (Hospitals, Clinical Laboratories, Research/Academic Institutes, Home Settings, and Others) Distribution Channel (Direct Tender, and Retail Sale) |

|

Countries Covered |

India |

|

Market Players Covered |

Abbott, Techno MedicaCo., Ltd., Nova Biomedical, WERFEN, Sensacore, OPTI Medical Systems, HDC India, AFFORD MEDICAL TECHNOLOGIES PVT. LTD., Radiometer India (a Subsidiary of Danaher), Siemens Healthcare Private Limited (a Subsidiary of Siemens), F. Hoffmann-La Roche Ltd., i-SENS, Inc., EDAN Instruments, Inc., ESCHWEILER GmbH & CO.KG, essential medical, Medica Corporation, and Wondfo among others |

Market Definition

The term "blood gas analysis" (BGA) is used for lab tests that connect with a patient's corrosive base equilibrium and oxygen status. Oxygen status is surveyed utilizing the fractional strain of O2 (pO2) and the hemoglobin oxygen saturation (sO2).

The partial pressure of O2 (pO2) is measured by amperometry, while that of SO2 is measured by co-oximetry. Blood gas analyzers that don't have an incorporated co-oximeter report the SO2 assessed from PO and different boundaries.

Current analyzers measure not only blood gas parameters but also electrolytes (PH, sodium, potassium, chloride, ionized calcium, ionized magnesium) and metabolites (glucose, lactate, bilirubin, and creatinine). Emergency and intensive care departments use BGA as an essential part of an assessment of a patient's clinical status.

India Blood Gas Analyzer Market Dynamics

Drivers

-

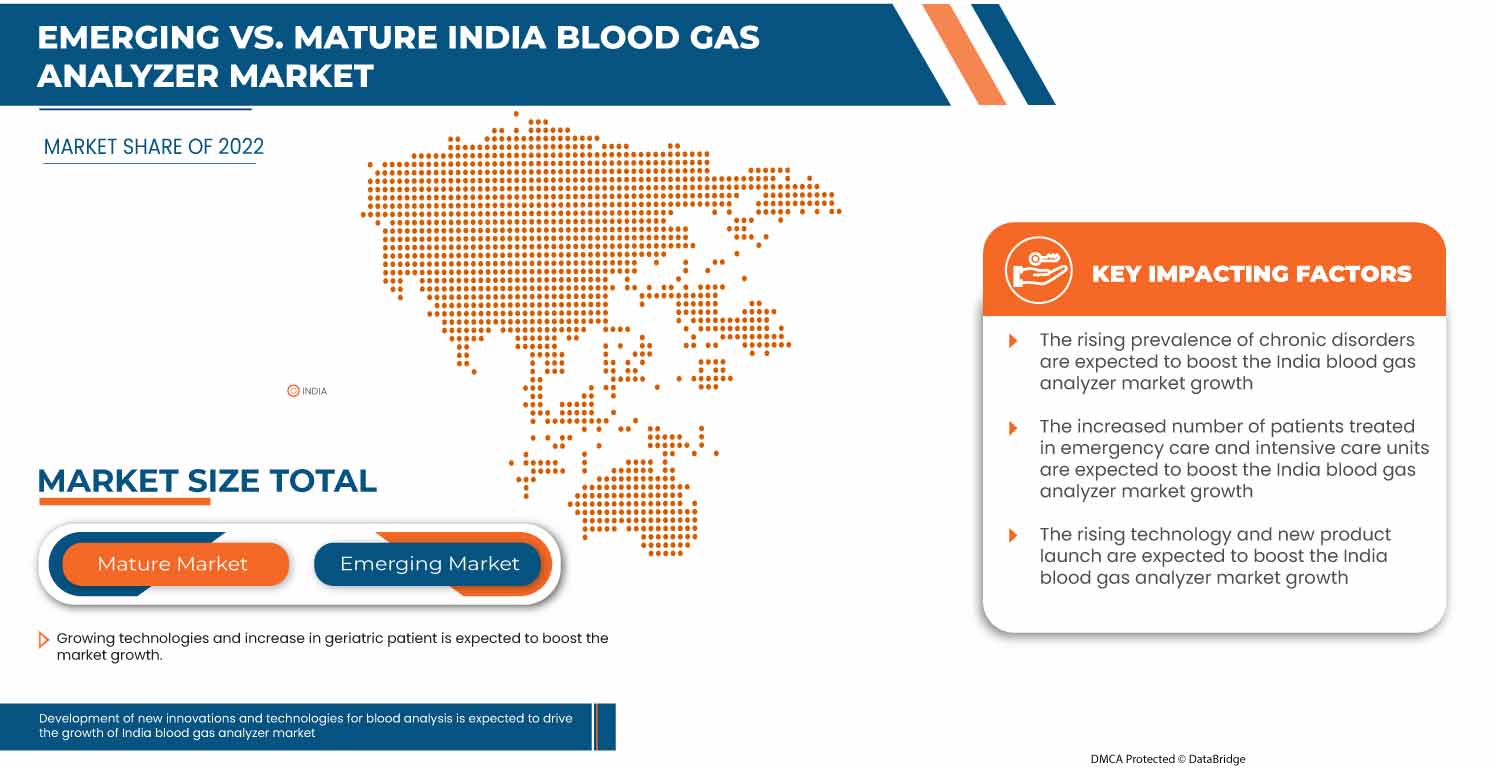

Rising prevalence of chronic disorders

The change in lifestyle habits, such as smoking tobacco, drinking liquor, having a stationary way of life, and numerous others, has raised the instances of patients experiencing constant ailment. The rising prevalence of chronic disorders is expected to boost market growth and positively influence the blood gas analyzer market.

-

Increased number of patients treated in emergency care and intensive care units

The increased number of patients being treated in NICUs, emergency departments, and ICUs is rising with the increase in the number of chronic disorders, which is leading more patients into NICUs, emergency departments, and ICUs. The increased number of patients treated in emergency care and intensive care units will act as one of the major drivers in the growth of the India blood gas analyzer market.

-

Increase in the number of product launches

Growing research activities to miniaturize the blood gas analyzer presents a great opportunity and a large number of product approval by market key players. The products perform multiple tests and provide coverage of wide results that will help in the rise of the blood analyzer market. The product portfolio for the companies working in this market is vast, and due to this, the revenue of the companies has increased continuously from the past recent revenue years. An increased number of product approval will act as a driver to boost the growth of the India blood gas analyzer market in the forecast period.

Opportunities

-

Rising technological advancement in blood gas analyzer

Technological advancement plays an important role in almost all processes of the healthcare industry, such as the possibility of medication errors, which exist due to an increase in disease burden, patient registration for data management, and laboratory testing for self-care equipment. The reach of these technological innovations can be seen in healthcare with the development of technologies. The commercialization of advanced technology-based blood gas analyzers has increased its demand among consumers due to the increasing prevalence of chronic diseases, raising the need for the India blood gas analyzer market.

- Increasing initiatives by governmental bodies for diagnostic tools

Many governmental agencies and key market players in the blood gas analyzer market are involved in spreading the use and importance of devices among society and across the state. These initiatives by the market players and government are helping the users to reach out to take advantage of the policies made for low-income and developing states that make them aware of preventable diseases if diagnosed earlier. The growth of blood gas analyzer in hospitals and emergency rooms are strongly encouraged due to the increased prevalence of chronic diseases in the nation and rising initiatives by government bodies. Various government bodies are taking initiatives to extend healthcare facilities to remote regions, such as Ayushman Bharat Yojana and National Rural Health Mission among others. Increasing initiatives by the government bodies are acting as an opportunity for the growth of the India blood gas analyzer market.

Restraints/Challenges

- Lack of skilled professionals

The lack of capable laboratory professionals is not a new story in diagnosis and healthcare. As with the increase in the burden of chronic diseases, the increase in the aged population and the development of healthcare insurance have increased the demand for healthcare laboratory professionals. Another reason is the lack of training sessions for the professionals. Factors such as the retention rate and workload lack of certification are reasons for the lack of trained laboratory manpower, lack of education, and relevant degrees. These factors are hampering the growth of the India blood gas analyzer market.

- Lack of reimbursement policies for blood gas analyzer

Reimbursement for blood gas analyzer tests and services has been under downward pressure for several years. The blood gas analyzer also faces major roadblocks in its growth due to the lack of reimbursement for these services.

The reimbursement of a device can significantly affect the ability of a provider to access a particular technology, as well as the willingness of a manufacturer to deliver it. If coverage is uncertain, the manufacturer has difficulty predicting whether an investment in new technology will yield enough returns. This lack of predictability is an apparent barrier to obtaining funding for the company. It further compromises innovation and restricts patient access to advanced technology and solutions.

Thus, inadequate reimbursement coverage may act as a restraint to the growth of the market in the forecast period.

- High cost associated with parts of analyzers

The rise in the cost of the blood gas analyzers components is due to robust research and effectiveness. However, the price of the material used and the developments incurred in the therapeutics and services would increase the number of manufacturing units and more workforce and human resources required to diagnose and screen pathogen viability. The rise in the cost of blood gas analyzers is due to technological development and increased demand for non-invasive in hospitals, clinics, nursing facilities, and ambulatory surgical centers. Therefore, the present high cost is expected to show a descending trend in the future.

Post-COVID-19 Impact on India Blood Gas Analyzer Market

COVID-19 has positively affected the India blood gas analyzers market. Lockdowns and isolation during pandemics complicate disease management and medication adherence. The lack of access to healthcare facilities for routine treatment and medication administration will further affect the market.

Recent Development

- In September 2021, Sensacore announced the launch of ST-200 CC Blood Gas Analyzer-Ultra Smart is the highly advanced blood gas model of Sensacore. It is a completely automated, microprocessor-controlled electrolyte system that uses direct current measurement with ION selective electrode (ISE), Impedance (Hct), and Amperometry (pO2) technology to make arterial blood gas analysis and electrolyte measurements

- In September 2020, Agappe diagnostics Ltd. launched a new hematology analyzer- Mispa Count X. Mispa Count X with Smart Impedance Technology is an advanced 3-part differential cell counter which offers quality CBC testing to deliver safe patient care

The India Blood Gas Analyzer Market Scope

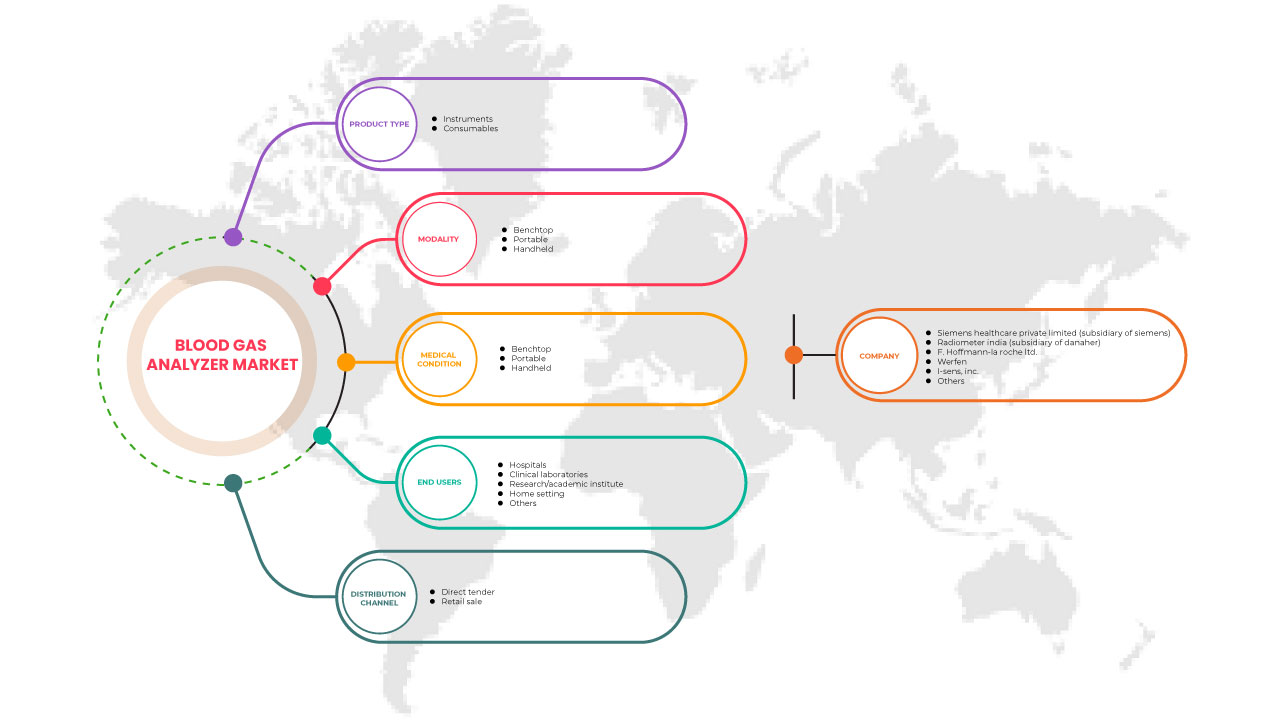

India blood gas analyzer market is categorized into five notable segments such as product type, modality, medical condition, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY PRODUCT TYPE

- Instruments

- Consumables

On the basis of product type, the India blood gas analyzer market is segmented into instruments and consumables.

BY MODALITY

- Benchtop

- Portable

- Handheld

On the basis of modality, the India blood gas analyzers market is segmented into handheld, benchtop, and portable.

BY MEDICAL CONDITION

- Kidney dysfunction

- Cardiovascular disorder

- Diabetes

- Hemorrhage

- Others

On the basis of medical condition, the India blood gas analyzers market is segmented into kidney dysfunction, cardiovascular disorder, diabetes, hemorrhage, and others.

BY DISTRIBUTION CHANNEL

- Direct tender

- Retail sale

On the basis of distribution channel, the India blood gas analyzers market is segmented into direct tender and retail sale distributors.

BY END USERS

- Hospital

- Clinical laboratories

- Research/Academic institute

- Home setting

- Others

On the basis of end-users, the India blood gas analyzers market is segmented into hospitals, clinical laboratories, research/academic institute, home setting, and others.

India Blood Gas Analyzer Market Regional Analysis/Insights

India blood gas analyzer market is analyzed, and product type, modality, medical condition, end user, and distribution channel provide market size insights and trends.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and the challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Blood Gas Analyzer Market Share Analysis

The India blood gas analyzer market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, India presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the India blood gas analyzer market.

Some of the major companies which are dealing in the market are Abbott, Techno MedicaCo., Ltd., Nova Biomedical, WERFEN, Sensacore, OPTI Medical Systems, HDC India, AFFORD MEDICAL TECHNOLOGIES PVT. LTD., Radiometer India (a Subsidiary of Danaher), Siemens Healthcare Private Limited (a Subsidiary of Siemens), F. Hoffmann-La Roche Ltd., i-SENS, Inc., EDAN Instruments, Inc., ESCHWEILER GmbH & CO.KG, essential medical, Medica Corporation, and Wondfo among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE INDIA BLOOD GAS ANALYZERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDIA BLOOD GAS ANALYZER MARKET, INDUSTRY INSIGHT

4.4 PATENT ANALYSIS

4.5 PRICING ANALYSIS

4.6 KEY STRATEGIC INITIATIVES

4.7 DEMOGRAPHIC TRENDS: IMPACT OF ALL INCIDENCE RATE

5 REGULATIONS OF INDIA BLOOD GAS ANALYZERS MARKET

5.1 INDIA

6 COUNTRY WRITE-UP

6.1 OVERVIEW

7 INDIA BLOOD GAS ANALYZER MARKET, MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CHRONIC DISORDERS

7.1.2 INCREASED NUMBER OF PATIENTS TREATED IN EMERGENCY CARE, AND INTENSIVE CARE UNITS

7.1.3 INCREASE IN THE NUMBER OF PRODUCT LAUNCHES

7.1.4 RISING GERIATRIC POPULATION

7.2 RESTRAINTS

7.2.1 LACK OF REIMBURSEMENT POLICIES FOR BLOOD GAS ANALYSER

7.2.2 HIGH COST ASSOCIATED WITH PARTS OF ANALYZERS

7.2.3 COMPLEXITY ASSOCIATED WITH INTERPRETING THE DATA/RESULTS OF BLOOD GAS ANALYZER

7.3 OPPORTUNITIES

7.3.1 RISING TECHNOLOGICAL ADVANCEMENT IN BLOOD GAS ANALYZER

7.3.2 INCREASING INITIATIVES BY GOVERNMENTAL BODIES FOR DIAGNOSTIC TOOLS

7.3.3 RISING HEALTHCARE EXPENDITURE

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS

7.4.2 STRINGENT REGULATION FOR PRODUCT APPROVAL

8 INDIA BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 BY ANALYZER TYPE

8.2.1.1 COMBINED ANALYZER

8.2.1.1.1 FULLY AUTOMATIC

8.2.1.1.2 SEMI-AUTOMATIC

8.2.1.2 ELECTROLYTE ANALYZER

8.2.1.2.1 FULLY AUTOMATIC

8.2.1.2.2 SEMI-AUTOMATIC

8.2.1.3 BLOOD GAS ANALYZER

8.2.1.3.1 FULLY AUTOMATIC

8.2.1.3.2 SEMI-AUTOMATIC

8.2.2 BY SAMPLE VOLUME

8.2.2.1 MORE THAN 100 TO200 µL

8.2.2.2 50 TO 100 µL

8.2.2.3 LESS THAN 50 µL

8.2.2.4 MORE THAN 200 µL

8.3 CONSUMABLES

8.3.1 CARTRIDGES

8.3.1.1 DISPOSABLE

8.3.1.2 NON- DISPOSABLE

8.3.2 REAGENT

8.3.3 TEST STRIPS

8.3.4 BATTERIES

8.3.4.1 RECHARGEABLE

8.3.4.2 DISPOSABLE

8.3.5 OTHERS

9 INDIA BLOOD GAS ANALYZER MARKET, BY MODALITY

9.1 OVERVIEW

9.2 BENCHTOP

9.2.1 15 KG

9.2.2 20 KG

9.2.3 25 KG

9.2.4 OTHERS

9.3 PORTABLE

9.4 HANDHELD

9.4.1 4 KG

9.4.2 5 KG

9.4.3 6 KG

9.4.4 OTHERS

10 INDIA BLOOD GAS ANALYZER MARKET, BY MEDICAL CONDITIONS

10.1 OVERVIEW

10.2 HEMORRHAGE

10.3 DIABETES

10.4 CARDIOVASCULAR

10.5 KIDNEY DYSFUNCTION

10.6 OTHERS

11 INDIA BLOOD GAS ANALYZER MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.2.1 ICU

11.2.2 ER

11.2.3 NICU

11.2.4 OR

11.2.5 CENTRAL LAB

11.2.6 STAT LAB

11.2.7 OTHER DEPARTMENT WITHIN THE HOSPITALS

11.3 CLINICAL LABORATORIES

11.4 RESEARCH/ACADEMIC INSTITUTES

11.5 HOME SETTINGS

11.6 OTHERS

12 INDIA BLOOD GAS ANALYZER MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 INDIA BLOOD GAS ANALYZERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: INDIA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SIEMENS HEALTHCARE PRIVATE LIMITED (SUBSIDIARY OF SIEMENS)

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.1 RECENT DEVELOPMENT

15.2 RADIOMETER INDIA (SUBSIDIARY OF DANAHER)

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 F. HOFFMANN-LA ROCHE LTD

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 WERFEN

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 I-SENS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUS ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ABBOTT.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 AFFORD MEDICAL TECHNOLOGIES PVT. LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 EDAN INSTRUMENTS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ESCHWEILER GMBH & CO.KG

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 ESSENTIAL MEDICAL

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 HDC INDIA

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MEDICA CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 NOVA BIOMEDICAL

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 OPTI MEDICAL SYSTEMS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SENSACORE

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 TECHNO MEDICACO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 WONDFO

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 INDIA BLOOD GAS ANALYZER MARKET, PATENT ANALYSIS

TABLE 2 INDIA BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 3 INDIA INSTRUMENT IN BLOOD GAS ANALYZERS MARKET, BY ANALYZER TYPE, 2021-2030 (USD MILLION)

TABLE 4 INDIA COMBINED ANALYZER IN BLOOD GAS ANALYZERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 INDIA ELECTROLYTE ANALYZER IN BLOOD GAS ANALYZERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 INDIA BLOOD GAS ANALYZER IN BLOOD GAS ANALYZERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 INDIA INSTRUMENT IN BLOOD GAS ANALYZERS MARKET, BY SAMPLE VOLUME, 2021-2030 (USD MILLION)

TABLE 8 INDIA CONSUMABLES IN BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 INDIA CARTRIDGES IN BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 INDIA BATTERIES IN BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 INDIA BLOOD GAS ANALYZER MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 12 INDIA BENCHTOP IN BLOOD GAS ANALYZER MARKET, BY WEIGHT 2021-2030 (USD MILLION)

TABLE 13 INDIA HANDHELD IN BLOOD GAS ANALYZER MARKET, BY WEIGHT 2021-2030 (USD MILLION)

TABLE 14 INDIA BLOOD GAS ANALYZER MARKET, BY MEDICAL CONDITION, 2021-2030 (USD MILLION)

TABLE 15 INDIA BLOOD GAS ANALYZER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 16 INDIA HOSPITAL IN BLOOD GAS ANALYZER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 17 INDIA BLOOD GAS ANALYZER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 INDIA BLOOD GAS ANALYZERS MARKET: SEGMENTATION

FIGURE 2 INDIA BLOOD GAS ANALYZERS MARKET: DATA TRIANGULATION

FIGURE 3 INDIA BLOOD GAS ANALYZERS MARKET: DROC ANALYSIS

FIGURE 4 INDIA BLOOD GAS ANALYZERS MARKET: GLOBAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA BLOOD GAS ANALYZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA BLOOD GAS ANALYZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA BLOOD GAS ANALYZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA BLOOD GAS ANALYZERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 INDIA BLOOD GAS ANALYZERS MARKET: SEGMENTATION

FIGURE 10 THE INCREASE IN DEMAND FOR BLOOD ANALYSIS AND THE RISE IN CHRONIC DISORDERS ARE EXPECTED TO DRIVE THE INDIA BLOOD GAS ANALYZERS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 INSTRUMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA BLOOD GAS ANALYZERS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDIA BLOOD GAS ANALYZERS MARKET

FIGURE 13 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, 2022

FIGURE 14 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 15 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 16 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 17 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, 2022

FIGURE 18 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, 2023-2030 (USD MILLION)

FIGURE 19 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, CAGR (2023-2030)

FIGURE 20 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, LIFELINE CURVE

FIGURE 21 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, 2022

FIGURE 22 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, 2023-2030 (USD MILLION)

FIGURE 23 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, CAGR (2023-2030)

FIGURE 24 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, LIFELINE CURVE

FIGURE 25 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, 2022

FIGURE 26 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 27 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, CAGR (2023-2030)

FIGURE 28 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 30 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 31 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 32 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 INDIA BLOOD GAS ANALYZERS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.