Gulf Collagen Market

Market Size in USD Million

CAGR :

%

USD

598.57 Million

USD

897.04 Million

2021

2029

USD

598.57 Million

USD

897.04 Million

2021

2029

| 2022 –2029 | |

| USD 598.57 Million | |

| USD 897.04 Million | |

|

|

|

Market Analysis and Insights: Gulf Collagen Market

Gulf collagen market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is expected to reach USD 897.04 million by 2029 from USD 598.57 million in 2021, growing with the CAGR of 5.3% in the forecast period of 2022 to 2029. The growing demand for collagen in the cosmetic industry is the major factor that is driving the demand for collagen globally. Collagen has a wider range of usage in food products, dietary supplements, animal feed, laboratory tests, and many other places. Several manufacturers are entering into mergers, launching new products, and making strategic decisions to fulfill the increasing demand for collagen in the market.

Collagen is a kind of fibrous and hard protein that forms abundant protein in the human bones, skin, muscles, and tendons. Collagen is present in various kinds of products that are consumed or used by humans in their daily routines. The collagen is extracted from the connective tissues of animals such as cattle, chickens, marine fishes, and various other sources. It helps in providing tensile strength as well as elasticity to the individual. Collagen is used in cosmetic products, food products, beverages, nutritional diets, which are consumed by athletes and at several other places, which has increased the preferences among consumers and retailers.

Collagen can be used for different functions such as an emulsifier, findings, stabilizer, and various end industries. Thus, manufacturers are promoting the products for other applications by publishing the benefits offered by their brands.

The collagen products are rich in proteins that mainly provide the anti-aging benefit to the skin and the smoothness that offers healthy skin for the individual. The collagen also helps repair the dead skin and keeps the skin hydrated for a longer duration. With that, collagen provides elasticity to the skin. The collagen proteins are connected to create the fibroblasts. Such advantages associated with collagen have propelled the manufacturers to introduce collage-based cosmetics in the market. Increasing usage of collagen as an ingredient in supplements for sports and medical applications has maximized collagen usage, leading to the increase in collagen extraction in the market. However, collagen falls under the third category of the FDA food ingredient rule. This attracts the regulations laid by the FDA. The manufacturers need to get a green chit from the FDA before being used in the products, based on purity and criteria laid down in the act. This is expected to restrain the market.

Collagen has a great application in preparing pharmaceutical products used in wound management, ophthalmic, orthopedic and oral surgeries, which is expected to provide lucrative opportunities for the market's growth. On the other hand, the lack of the proper processing technologies for the raw material of collagen and GMO certification for labeling collagen products may challenge the market's growth.

The Gulf collagen market report provides details of market share, new developments, the impact of domestic and localized market players, opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Gulf Collagen Market Scope and Market Size

The Gulf collagen market is segmented on the basis of product type, type, form, source, product category, function, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product type, the Gulf collagen market is segmented into gelatin, hydrolyzed collagen, native collagen, collagen peptide, and others. In 2022, gelatin is expected to dominate the Gulf collagen market as it has a wide range of usage in several sectors such as pharmaceutical, food, and various other industries.

- On the basis of type, the Gulf collagen market is segmented into type into type I, type II, type III, and type IV. In 2022, type I is expected to dominate the Gulf collagen market as rising demand for nutritional and functional food is expected to drive the growth of this segment.

- On the basis of form, the Gulf collagen market is segmented into powder and liquid. In 2022, the powder is expected to dominate the Gulf collagen market as the growing consumer awareness toward the consumption of nutritious food increases the demand for collagen peptide powder. This is expected to drive the growth of this segment.

- On the basis of source, the Gulf collagen market is segmented into bovine, poultry, porcine, marine, and others. In 2022, bovine is expected to dominate the Gulf collagen market due to its wider application in the medical sector, which is expected to drive the growth of this segment.

- On the basis of product category, the Gulf collagen market is segmented into GMO and Non-GMO. In 2022, GMO is expected to dominate the Gulf collagen market as GMO collagen is extensively used in the dietary supplements that are preferred by dieticians in Keto-diet, which is expected to drive the growth of this segment.

- On the basis of function, the Gulf collagen market is segmented into texture, stabilizer, emulsifier, finding, and others. In 2022, the texture is expected to dominate the Gulf collagen market due to the growing demand as the texture or surface of collagen maximizes the protein content of the skin, which is expected to drive the growth of this segment in the forecast year.

- On the basis of application, the Gulf collagen market is segmented into food products, beverages, nutraceuticals and dietary supplements, cosmetics and personal care, animal feed, laboratory tests, and others. In 2022, the food products segment is expected to dominate the Gulf collagen market as the application of collagen as a food stabilizer owes a maximum share, which is expected to drive the growth of this segment.

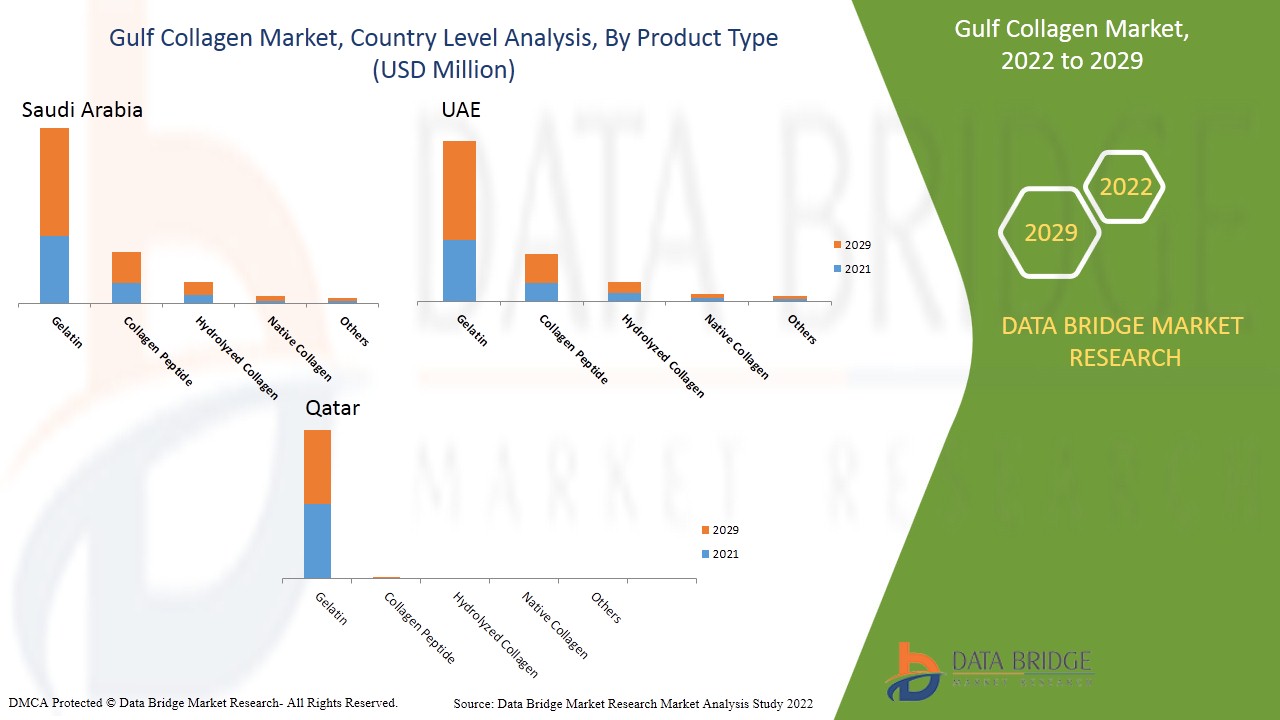

Gulf Collagen Market Country Level Analysis

Gulf collagen market is analyzed, and market size information is provided by collagen product type, type, form, source, product category, function, application.

The countries covered in the Gulf collagen market report are Saudi Arabia, South Africa, UAE, Turkey, Israel, Egypt, Iraq, Qatar, Algeria, Kuwait, Morocco, Nigeria, Oman, Ghana, Jordan, Lebanon, Tunis, Bahrain, Tanzania, Syria, Angola, Libya, Sudan, and rest of the Middle East.

Saudi Arabia is expected to dominate the Gulf collagen market due to the presence of the largest consumer market with high GDP. Saudi Arabia holds the majority of the share in the collagen market. UAE is expected to dominate the Gulf collagen market and witness the highest CAGR during the forecast period due to premium collagen-based products sales in the country. Qatar is expected to dominate the Gulf collagen market due to growth in local and international markets of luxury products, including cosmetics.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Strategic Initiatives by Manufactures in Creating New Opportunities for Players in the Gulf Collagen Market

Gulf collagen market also provides you with a detailed market analysis for every country's growth in aesthetic, nutrition, and processed food industry with collagen product sales, the impact of advancement in the collagen products, and changes in regulatory scenarios with their support for the Gulf collagen market. The data is available for the historical period 2011 to 2020.

Competitive Landscape and Gulf Collagen Market Share Analysis

Gulf collagen market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to the Gulf collagen market.

Some of the major companies in the Gulf collagen market are COBIOSA, PB Leiner (A Part of Tessenderlo Group), ConnOils LLC, Holista Colltech, Ashland, DSM, Collagen Solutions Plc, Rousselot, ADVANCED BIOMATRIX, INC., Proteïn S.A., Queen, GELITA AG, Collagen Solutions Plc, Vital Proteins LLC, Weishardt, SMPNutra.com, Titan Biotech, Elnasr4Gelatin, Sel Sanayi AS, Halavet Food, SelJel Jelatin A.S., among others.

DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product launches and agreements are also initiated by companies worldwide which are also accelerating the collagen market.

For instances,

- In May 2021, Rousselot launched X-Pure GelDAT. This Gelatin Desaminotyrosine will meet the response toward the customer's demand to overcome the barriers encountered in clinic translation

- In June 2020, Nestlé Health Science (NH SC), the market leader in the field of nutritional science globally, acquired a majority stake in Vital Proteins LLC. This will help the company to expand our wellness platform to the world. Collaboration, joint ventures, and other strategies by the market player are enhancing the company market in the collagen market, which also provides the benefit for the organization to improve their offering for the Gulf collagen market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GULF COLLAGEN MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION METHOD COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 GULF COLLAGEN MARKET: LIST OF SUBSTITUTES

6 GULF COLLAGEN MARKET: MARKETING STRATEGIES

6.1 LAUNCHING NEW INNOVATIVE PRODUCTS

6.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

6.3 A VAST NETWORK OF DISTRIBUTION

6.4 LAUNCHING CLEAN, SUSTAINABLE, AND ORGANIC PRODUCTS FOR HEALTH-CONSCIOUS CONSUMERS

6.5 POPULARITY OF PLANT-BASED MEAT ALTERNATIVE

7 PATENT ANALYSIS OF SAUDI ARABIA GULF, MIDDLE EAST AND AFRICA COLLAGEN MARKET

7.1 DBMR ANALYSIS

7.2 YEARWISE ANALYSIS

7.3 PATENT ANALYSIS BY COMPANY

8 GULF COLLAGEN MARKET: PRODUCTION & CONSUMPTION PATTERN

9 GULF COLLAGEN MARKET: RAW MATERIAL PRICING ANALYSIS

10 REGULATORY FRAMEWORKS

11 MARKET OVERVIEW

11.1 DRIVERS

11.1.1 INCREASING USAGE OF COLLAGEN PRODUCTS IN THE COSMETIC INDUSTRY

11.1.2 SUBSTANTIAL DEMAND FOR THE COLLAGEN PRODUCTS AS FOOD STABILIZER

11.1.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

11.1.4 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY

11.1.5 GROWTH OF FISHING INDUSTRY TO USE FISH AS A RAW MATERIAL FOR GELATIN PRODUCTION

11.2 RESTRAINTS

11.2.1 INCREASING STRINGENT REGULATIONS REGARDING THE USE OF FOOD ADDITIVES

11.2.2 RISK OF DISEASE TRANSFER FROM ANIMAL SOURCES

11.2.3 REGULATIONS UPON THE SLAUGHTERING OF FARM AND POULTRY ANIMALS

11.3 OPPORTUNITIES

11.3.1 RISING COLLAGEN APPLICATION AS BIOMATERIALS IN THE LABORATORIES

11.3.2 RECENT TECHNOLOGICAL ADVANCEMENTS, INCLUDING THE FORMATION OF COLLAGEN-BASED PELLET AS GENE DELIVERY CARRIER

11.3.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

11.4 CHALLENGES

11.4.1 LACK OF ADVANCED PROCESSING TECHNOLOGIES FOR COLLAGEN EXTRACTION

11.4.2 HIGH PROCESSING COSTS IN THE COLLAGEN INDUSTRY

11.4.3 COMPLICATED GMO CERTIFICATION PROCESS FOR COLLAGEN PRODUCTS LABELLING

12 IMPACT OF COVID-19 IMPACT ON THE GULF COLLAGEN MARKET

12.1 ANALYSIS ON IMPACT OF COVID-19 ON THE GULF COLLAGEN MARKET

12.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE GULF COLLAGEN MARKET

12.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

12.4 IMPACT ON PRICE

12.5 IMPACT ON DEMAND

12.6 IMPACT ON SUPPLY CHAIN

12.7 CONCLUSION

13 GULF COLLAGEN MARKET, BY PRODUCT TYPE

13.1 OVERVIEW

13.2 GELATIN

13.3 HYDROLYZED COLLAGEN

13.4 NATIVE COLLAGEN

13.5 COLLAGEN PEPTIDE

13.6 OTHERS

14 GULF COLLAGEN MARKET, BY TYPE

14.1 OVERVIEW

14.2 TYPE 1

14.3 TYPE 11

14.4 TYPE III

14.5 TYPE IV

15 GULF COLLAGEN MARKET, BY FORM

15.1 OVERVIEW

15.2 POWDER

15.3 LIQUID

16 GULF COLLAGEN MARKET, BY SOURCE

16.1 OVERVIEW

16.2 BOVINE

16.3 POULTRY

16.4 PORCINE

16.5 MARINE

16.6 OTHERS

17 GULF COLLAGEN MARKET, BY PRODUCT CATEGORY

17.1 OVERVIEW

17.2 GMO

17.3 NON-GMO

18 GULF COLLAGEN MARKET, BY FUNCTION

18.1 OVERVIEW

18.2 TEXTURE

18.3 STABILIZER

18.4 EMULSIFIER

18.5 FINDING

18.6 OTHERS

19 GULF COLLAGEN MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 FOOD PRODUCTS

19.3 BEVERAGES

19.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

19.5 COSMETICS AND PERSONAL CARE

19.6 ANIMAL FEED

19.7 LABORATORY TESTS

19.8 OTHERS

20 GULF COLLAGEN MARKET: BY REGION

20.1 GULF

20.1.1 UAE

20.1.2 KUWAIT

20.1.3 QATAR

20.1.4 BAHRAIN

20.1.5 OMAN

21 GULF COLLAGEN MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GULF

22 COMPANY PROFILE

22.1 DSM

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 ASHLAND

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 GELITA AG

22.3.1 COMPANY SNAPSHOT

22.3.2 PRODUCT PORTFOLIO

22.3.3 RECENT DEVELOPMENTS

22.4 SELJEL JELATIN A.S.

22.4.1 COMPANY SNAPSHOT

22.4.2 PRODUCT PORTFOLIO

22.4.3 RECENT DEVELOPMENT

22.5 ROUSSELOT

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 ADVANCED BIOMATRIX, INC.

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 COBIOSA

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 COLLAGEN SOLUTIONS PLC

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENTS

22.9 CONNOILS LLC

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENT

22.1 ELNASR4GELATIN

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENT

22.11 HALAVET FOOD

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 HOLISTA COLLTECH

22.12.1 COMPANY SNAPSHOT

22.12.2 REVENUE ANALYSIS

22.12.3 PRODUCT PORTFOLIO

22.12.4 RECENT DEVELOPMENTS

22.13 PB LEINER

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENTS

22.14 PROTEÏN S.A.

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENT

22.15 QUEEN

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 SEL SANAYI AS

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 TITAN BIOTECH

22.17.1 COMPANY SNAPSHOT

22.17.2 REVENUE ANALYSIS

22.17.3 PRODUCT PORTFOLIO

22.17.4 RECENT DEVELOPMENT

22.18 VITAL PROTEINS LLC

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 WEISHARDT

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

List of Table

TABLE 1 THE FOLLOWING CAN BE USED AS SUBSTITUTES FOR COLLAGEN AND COLLAGEN BASED PRODUCTS:

TABLE 2 COLLAGEN RAW MATERIAL PRICE ANALYSIS IN 2020 (PER KGS)

TABLE 3 PERCENTAGE OF COLLAGEN YIELD FROM DIFFERENT SOURCES

TABLE 4 FOUR COMMON TYPES OF COLLAGEN AND THEIR RESPECTIVE LOCATION

TABLE 5 REGULATIONS BY SOUTH AFRICAN HEALTH PRODUCT REGULATORY AUTHORITY (SAHPRA)-

TABLE 6 BELOW ARE THE MANUFACTURERS AND THEIR PHARMA PRODUCTS BASED ON COLLAGEN THAT IS USED AS THERAPEUTICS OR AS NUTRACEUTICALS:

List of Figure

FIGURE 1 GULF COLLAGEN MARKET: SEGMENTATION

FIGURE 2 GULF COLLAGEN MARKET: DATA TRIANGULATION

FIGURE 3 GULF COLLAGEN MARKET: DROC ANALYSIS

FIGURE 4 GULF COLLAGEN MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GULF COLLAGEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GULF COLLAGEN MARKET: THE PRODUCT TYPE LIFELINE CURVE

FIGURE 7 GULF COLLAGEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GULF COLLAGEN MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GULF COLLAGEN MARKET: MARKET APPLICATION METHOD COVERAGE GRID

FIGURE 10 GULF COLLAGEN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 GULF COLLAGEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 GULF COLLAGEN MARKET: SEGMENTATION

FIGURE 13 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE GULF COLLAGEN MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 COLLAGEN DEVICES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GULF COLLAGEN MARKET IN 2022 & 2029

FIGURE 15 PATENT REGISTERED YEAR (2018 - 2020)

FIGURE 16 CONCENTRATION OF EACH AMINO ACID IN HYDROLYSED COLLAGEN (IN %)

FIGURE 17 CONSUMPTION OF COLLAGEN OF MIDDLE EAST AND AFRICA (USD MILLION)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GULF COLLAGEN MARKET

FIGURE 19 GULF COLLAGEN MARKET, BY PRODUCT TYPE, 2021

FIGURE 20 GULF COLLAGEN MARKET, BY TYPE, 2021

FIGURE 21 GULF COLLAGEN MARKET, BY FORM, 2021

FIGURE 22 GULF COLLAGEN MARKET, BY SOURCE, 2021

FIGURE 23 GULF COLLAGEN MARKET, BY PRODUCT CATEGORY, 2021

FIGURE 24 GULF COLLAGEN MARKET, BY FUNCTION, 2021

FIGURE 25 GULF COLLAGEN MARKET, BY APPLICATION, 2021

FIGURE 26 GULF COLLAGEN MARKET: SNAPSHOT (2021)

FIGURE 27 GULF COLLAGEN MARKET: BY COUNTRY (2021)

FIGURE 28 GULF COLLAGEN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 GULF COLLAGEN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 GULF COLLAGEN MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 31 GULF COLLAGEN MARKET: COMPANY SHARE 2021 (%)

Gulf Collagen Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Gulf Collagen Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Gulf Collagen Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.