Global Wood Based Panel Market, By Product (Plywood, Fiberboard, Oriented Strand Board, Cement-Bonded Particleboard, Lumber Panels, T-Beam Panels, Stress-Skin Panels, and Others), Thickness (9 MM, 10 MM, 18 MM, 20 MM, 40 MM, 50 MM, and Others), Distribution Channel (B2B, OEMs, Specialty Stores, E-Commerce and Others), Application (Outdoor Door, Window Trim, Ceiling Wall, Mantel, Floor, and Others), End-User (Residential Building, Commercial Building, Hotels, Villa, Hospitals, School, Malls, and Others) - Industry Trends and Forecast to 2030.

Wood Based Panel Market Analysis and Size

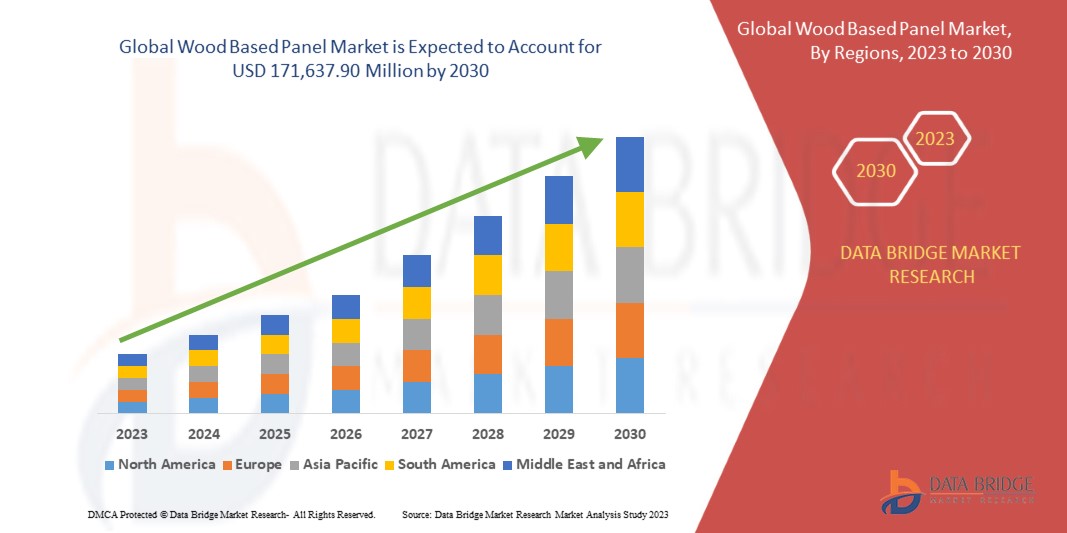

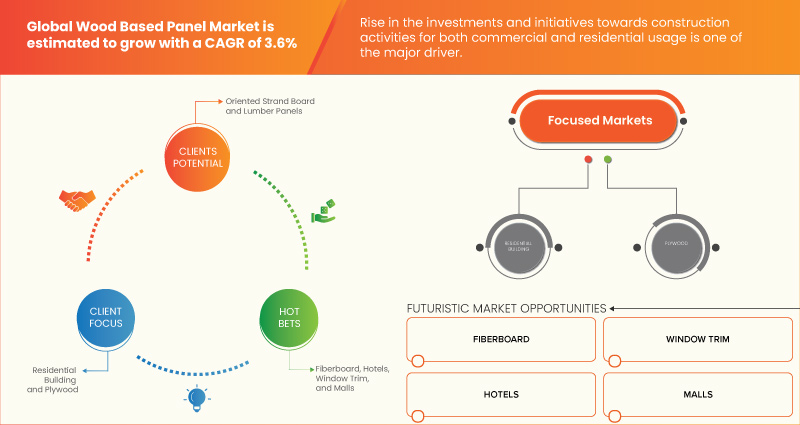

The global wood based panel market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.6% from 2023 to 2030 and is expected to reach USD 171,637.90 million by 2030. The major factor driving the growth of the wood based panel market is the balanced import and export procedures of wood panels among the countries.

Wood-based panels have diverse applications across various end-user industries. In construction, they are used for structural elements, flooring, roofing, and interior paneling. In furniture manufacturing, they are the primary material for cabinets, shelves, and tabletops. The automotive industry utilizes them in vehicle interiors. They are also utilized in packaging, shipbuilding, retail fixtures, and other sectors requiring cost-effective, versatile, and sustainable paneling solutions.

The global wood based panel market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. Contact us for an analyst brief to understand the analysis and the market scenario. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 – 2020)

|

|

Quantitative Units

|

Revenue in USD Million and Volume in Million Cubic Meters

|

|

Segments Covered

|

Product (Plywood, Fiberboard, Oriented Strand Board, Cement-Bonded Particleboard, Lumber Panels, T-Beam Panels, Stress-Skin Panels, and Others), Thickness (9 MM, 10 MM, 18 MM, 20 MM, 40 MM, 50 MM, and Others), Distribution Channel (B2B, OEMs, Specialty Stores, E-Commerce and Others), Application (Outdoor Door, Window Trim, Ceiling Wall, Mantel, Floor, and Others), End-User (Residential Building, Commercial Building, Hotels, Villa, Hospitals, School, Malls, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, and Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Hong Kong, Malaysia, Philippines, Australia & New Zealand, and Rest of Asia-Pacific, Brazil, Argentina, and Rest of South America, South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and Rest of Middle East and Africa

|

|

Market Players Covered

|

EGGER Gr0up, Boise Cascade, West Fraser, Starbank Panel Products Ltd, Dongwha Group, Kronoplus Limited, BinderHolz GmbH, DARE panel group co., ltd., Georgia-Pacific, ARAUCO, Canfor, Sonae Industria, EVERGREEN FIBREBOARD BERHAD, Mieco Chipboard Berhad, Green River Holding Co., Ltd., Kastamonu Entegre, PFEIFER GROUP, Weyerhaeuser Company, Timber Products, among others.

|

Market Definition

Wood-based panels are a common term for various board products with a good range of engineering properties. While some panel types are relatively new on the market, others were developed and successfully introduced more than a hundred years ago. However, panel types with a long history of continuous optimization are still far from being fully developed and may always have a chance for improvement. Technological developments, on the one hand, new market and regulative requirements, and a steadily changing raw material situation drive continuous improvements of wood-based panels and their manufacturing processes.

Global Wood Based Panel Market Dynamics

This section deals with understanding the market drivers, advantages, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in consumer spending on wood-based panels in the renovation of homes and furniture

The wood panel industry includes plywood sheets, engineered wood panels, MDF (Medium Density Fibre Boards), furniture boards, particleboard, and decorative surface products such as laminates. A rise in consumer spending on wood-based panels in the renovation of homes & furniture is expected to boost demand for wood-based panels in commercial & residential buildings.

For instance,

- According to the Joint Center for Housing Centers of Harvard University (JCHS), home improvement projects spending in 2023 is estimated to be $485 billion, which increased from $328 billion in 2019 to $472 billion in 2022.

Improvement and increase in building renovation activities with the adoption of wood-based panels for an increase in the aesthetic is another factor driving the market's growth. Moreover, the increased construction of public buildings, grand hotels, and resorts with decorative wood panels has led to the market's growth.

- Balanced import and export procedures of wood panels among the countries

The global trade in wood products is highly regionalized, with Europe, North America, and Asia. In recent years, the global trade of wood products has changed greatly with the demand for wood panels and the increase in emerging markets in countries such as China, Russia, Eastern Europe, and other regions globally.

In recent years, the increase in production & trade of wood-based panels product such as plywood, particleboard, fibreboard, oriented strand board, and lumber panels is increased due to the rise in demand from the housing market and the global increase in population.

Hence, the balanced import and export procedures of wood panels among the countries will drive the growth of the global wood based panel market shortly.

Opportunities

- Rise in the investments and initiatives toward construction activities for both commercial and residential usage

The construction industry has become a robust and efficient manufacturing sector worldwide. Across the countries, growth in demand for construction and real estate projects is driven by macro-economic and disruptive megatrends, such as increasing urbanization, expanding trade, demographic trends such as rising income levels, and technology and sustainable environments. Various project has been initiated to create socially inclusive sustainable communities, as the economic growth of any country is primarily dependent on the development of its infrastructure.

For instance,

- In April 2021, Egyptian Kuwaiti Holding (EKHO) announced that its 99.99 percent-owned subsidiaries, International Co for Financial Investment, will begin construction for an MDF facility in two stages, with a total investment of LE2 billion in Egypt. The investment cost of the first phase amounts to USD 70.0 million and USD 77.31 million for the second phase with a production capacity of 150,000m3/year, thereby projecting strong growth in the coming years.

All these initiatives are further creating much scope for foreign investors to drive investment viability into the construction sector, bolstering the growth of wood based panel markets.

- Increase in partnerships for the growth of the construction sector in emerging countries

Coordinating and investing in infrastructural projects is essential for sustaining improvements in the construction sector. The government and other private organizations are striving through partnerships and acquisitions, accelerating the growth of the industries. This helps to make awareness and profit of the organization and creates scope for a new invention. Also, the company can invest more in projects to provide the highest standard material, such as softwood and plywood, through partnerships. Furthermore, this helps both companies to get recognized in the competitive market. Hence, the increase in mergers and acquisitions in the construction sector creates many opportunities for the wood based panel market to grow.

For instance,

- In July 2021, Innovation Solutions Bois (Groupe ISB) entered a sales partnership in France with Metsä Group on 1st July to expand the timber range for the construction industry. This helped the companies to maximize their production of planed-goods significantly in the coming timeframe.

All these partnerships create various opportunities for the construction industry, helping the wood based panel market grow remarkably.

Restraints/Challenges

- Shortage of timber and climate change

The woodworking industry is facing major challenges nowadays. A huge emphasis on research and development is required due to the rise in the scarcity of lumber and the effects of climate change. Panels that are both sustainable and durable and those that can be manufactured and consumed with lower emissions must be further researched and optimized.

Climate change is also predicted to have far-reaching effects on forests worldwide. Therefore, agrifibre solutions have been adopted as an alternative for all usual particleboard, OSB, or MDF production processes. With that, the research for substitute raw material and implementation of panel plants with agrifibre has increased significantly.

- Stringent rules and norms by the government regarding deforestation

The demand for wood has increased with the increased use of wood-based panels globally, leading to cutting down the trees to a larger extent for a primary raw material for wood-based panels products. With the increase in demand for wood-based panels, deforestation in several regions has increased, leading to an imbalance in the environment and greenhouse gas emissions in the environment. Therefore, the government of several regions has made stringent rules and regulations which have to be followed strictly by people in the region.

For instance,

- According to Regulation Impact Statement (RIS), a policy by Australian Government on illegally logged timber, the government utilizes a due diligence (co-regulation) approach for identifying illegally logged timber and restricting its importation into Australia. The co-regulation option would include targeted investment in capacity building and maintaining Australia's bilateral and multilateral engagement with other countries in the Asia-Pacific region

Stringent rules and regulations by the government or higher authorities regarding deforestation in the region restrain the wood-based panels market from growing. Importing and exporting raw materials for wood-based panel products is becoming difficult because manufacturers face raw materials.

Hence, from the above statements, it can be concluded that the government's stringent rules and norms regarding deforestation can shortly restrain the growth of the global wood-based panel market.

Recent Developments

- In December 2022, EGGER acquired 60% of the shares in Italian wood-based materials manufacturer SAIB. This acquisition helps broaden market access, increase capacity and expand the portfolio. This opens up further growth and synergies for the company to process.

- In May 2022, Weyerhaeuser Company (NYSE: WY) announced that it acquired 80,800 acres of high-quality timberlands in North and South Carolina. With this acquisition, Weyerhaeuser now owns or manages more than 900,000 acres of timberlands in the Carolinas, and the company also operates four mills, a distribution center, and a tree nursery. This strengthened the company's market presence as it increased its production capacity.

Global Wood Based Panel Market Scope

The global wood based panel market is categorized based on product, thickness, distribution channel, application, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Plywood

- Fiberboard

- Oriented Strand Board

- Cement-Bonded Particleboard

- Lumber Panels

- T-Beam Panels

- Stress-Skin Panels

- Others

On the basis of product, the market is segmented into plywood, fiberboard, oriented strand board, cement-bonded particleboard, lumber panels, t-beam panels, stress-skin panels, and others.

Thickness

- 9 MM

- 10 MM

- 18 MM

- 20 MM

- 40 MM

- 50 MM

- Others

On the basis of thickness, the market is segmented into 9 mm, 10 mm, 18 mm, 20 mm, 40 mm, 50 mm, and others.

Distribution Chanel

- B2B

- OEMs

- Specialty Stores

- E-Commerce

- Others

On the basis of distribution channel, the market is segmented into B2B, OEMs, specialty stores, e-commerce, and others.

Application

- Outdoor Door

- Window Trim

- Ceiling Wall

- Mantel

- Floor

- Others

On the basis of application, the market is segmented into outdoor door, window trim, ceiling wall, mantel, floor, and others.

End-User

- Residential Building

- Commercial Building

- Hotels

- Villa

- Hospitals

- School

- Malls

- Others

On the basis of end-user, the market is segmented into residential building, commercial building, hotels, villa, hospitals, school, malls, and others.

Global Wood Based Panel Market Regional Analysis/Insights

The global wood based panel market is segmented on the basis of product, thickness, end-user, distribution channel, and application.

The countries covered in the global wood based panel market report are U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, and Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Hong Kong, Malaysia, Philippines, Australia & New Zealand, and Rest of Asia-Pacific, Brazil, Argentina, and Rest of South America, South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate the global wood based panel market in terms of market share and market revenue due to the rising spending on wood-based panels in the renovation of homes and furniture. The China is expected to grow due to the rise in technological advancement.

Germany dominates the Europe region due to balanced import and export procedures of wood panels among the countries. U.S. dominates the North America region due to rise in the investments and initiatives towards construction activities for both commercial and residential usage.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Wood Based Panel Market Share Analysis

The global wood based panel market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in the global wood based panel market are EGGER Gr0up, Boise Cascade, West Fraser, Starbank Panel Products Ltd, Dongwha Group, Kronoplus Limited, BinderHolz GmbH, DARE panel group co., ltd., Georgia-Pacific, ARAUCO, Canfor, Sonae Industria, EVERGREEN FIBREBOARD BERHAD, Mieco Chipboard Berhad, Green River Holding Co., Ltd., Kastamonu Entegre, PFEIFER GROUP, Weyerhaeuser Company, Timber Products among others.

SKU-