Global Whiskey Market

Market Size in USD Billion

CAGR :

%

USD

67.43 Billion

USD

103.95 Billion

2024

2032

USD

67.43 Billion

USD

103.95 Billion

2024

2032

| 2025 –2032 | |

| USD 67.43 Billion | |

| USD 103.95 Billion | |

|

|

|

|

Global Whiskey Market Size

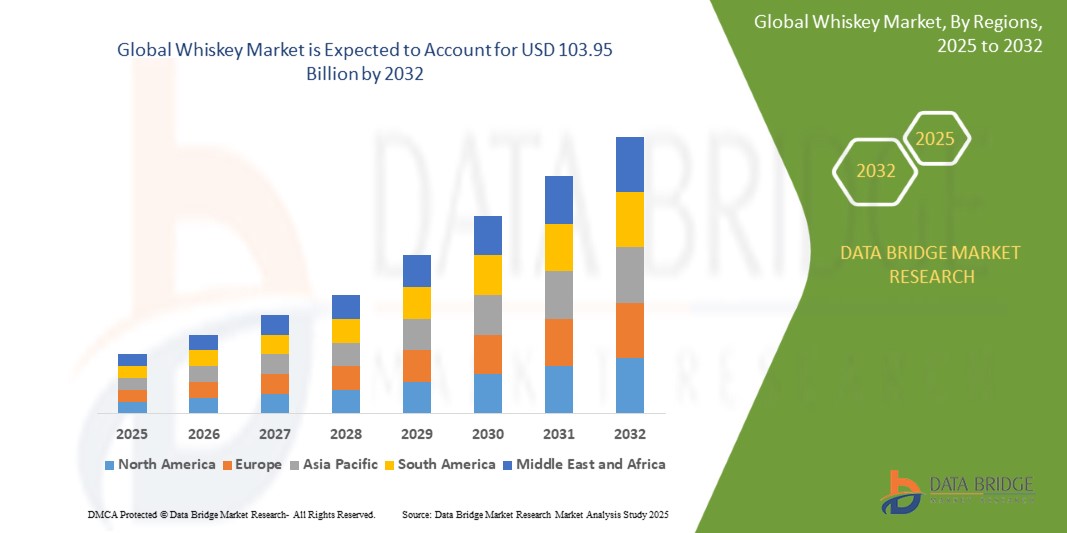

- The global whiskey market was valued at USD 67.43 billion in 2024 and is expected to reach USD 103.95 billion by 2032

- During the forecast period of 2025 to 2032 the market is such as to grow at a CAGR of 5.56%, primarily driven by the increasing global demand and evolving consumer preferences for premium and craft whiskey

- This growth is driven by factors such as the rising disposable income, expansion of distribution channels, and growing popularity of whiskey among younger demographics

Global Whiskey Market Analysis

- Premiumization is driving a shift in consumer preferences toward aged, high-quality, and artisanal whiskey offerings

- Whiskey brands are focusing on exclusive packaging and storytelling to elevate brand value and consumer engagement

- Craft and super-premium whiskey segments are witnessing increased demand among collectors and enthusiasts

- Distilleries are launching innovative, limited-edition releases to cater to evolving tastes and boost market presence

- Online platforms and curated retail experiences are expanding access to premium whiskey selections

- The consistent move toward premium experiences is shaping the future of the whiskey market, making quality and exclusivity key growth pillars

Report Scope and Global Whiskey Market Segmentation

|

Attributes |

Global Whiskey Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Whiskey Market Trends

“Rising Demand for High-End Whiskey Products”

- Consumers are increasingly gravitating toward premium and high-end whiskeys, seeking more than just alcohol by valuing authenticity, craftsmanship, and exclusive taste experiences

- The growing appeal of craft and small-batch whiskeys is reshaping the market, with demand rising for limited releases that highlight local ingredients, unique barrel finishes, and specialized aging processes

- Sustainability is becoming a central innovation area, with leading brands introducing eco-friendly packaging, reducing water usage, and sourcing ingredients ethically to meet the values of environmentally aware consumers

- Digital transformation is playing a vital role, as companies invest in virtual tasting events, influencer collaborations, and immersive storytelling to connect with younger audiences and whiskey newcomers

- While North America and Europe maintain strong demand due to established whiskey culture, Asia-Pacific is emerging as the fastest-growing region, driven by rising income levels, urban lifestyles, and a growing curiosity for premium Western spirits

- This evolving focus on quality, sustainability, and personalization is driving a new era of growth and creativity in the global whiskey market

Global Whiskey Market Dynamics

Driver

“Growing Demand for Premium and Craft Spirits”

- Consumers are increasingly seeking high-quality, small-batch, and artisanal whiskey options.

- Premium whiskey is often associated with status, sophistication, and a refined lifestyle.

- Growth in single malt and aged whiskey segments reflects a shift toward quality over quantity.

- Craft distilleries are gaining traction by offering unique flavor profiles and brand stories.

- Urban consumers, especially millennials, are driving demand through a preference for authenticity and exclusivity.

Opportunity

“Growth Through Digital and E-commerce Platforms”

- E-commerce is creating new space for whiskey brands to connect directly with consumers and offer rare or limited-edition selections not typically found in stores

- Digital platforms such as Flaviar and Caskers enable enthusiasts to subscribe to curated whiskey boxes and access exclusive products globally

- Online shopping allows customers to compare brands, read reviews, and learn about whiskey characteristics before purchasing, enhancing trust and confidence

- Small and emerging distilleries are using digital storefronts and social media to reach international markets without relying on traditional retail networks

- Virtual tastings, live sessions, and AI-driven recommendations are improving engagement while also generating valuable consumer behavior data

- Digital expansion is opening the door for whiskey brands to grow beyond borders

By embracing e-commerce, brands can increase loyalty, visibility, and long-term profitability

Restraint/Challenge

“Regulatory Complexity and Taxation”

- Whiskey producers face different legal definitions and aging standards across markets, making global consistency difficult and costly to maintain

- Import duties and tariffs can significantly increase the retail price of whiskey, which affects accessibility and competitiveness, especially for premium products

- Restrictions on advertising and alcohol marketing limit how brands can promote products and educate consumers in various regions

- Smaller distilleries often struggle with the legal costs and administrative load of meeting varied international compliance standards

- For instance, Japan revised its whiskey labeling laws in 2021, causing several popular brands to rebrand or relabel products due to stricter definitions

- In conclusion, these regulatory inconsistencies slow innovation and create entry barriers

Navigating legal frameworks efficiently is crucial for long-term industry expansion and brand trust

Global Whiskey Market Scope

The market is segmented on the basis of product type, quality type, package type, and distribution type.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Quality Type |

|

|

By Package Type

|

|

|

By Distribution Type

|

|

Global Whiskey Market Regional Analysis

“North America is the Dominant Region in the Global Whiskey Market”

- North America leads the global whiskey market due to strong consumption patterns and a well-established whiskey culture

- The presence of globally recognized brands and a mature distribution network enhances market reach and consumer trust

- Continuous innovation in product offerings, including flavored and craft whiskeys, sustains consumer interest

- High disposable income and a strong preference for premium and ultra-premium spirits contribute to regional dominance

- Whiskey tourism, distillery experiences, and heritage branding add value and drive brand loyalty across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is witnessing the fastest growth in whiskey demand, driven by evolving lifestyles and preferences

- Countries such as China, Japan, and South Korea are adopting premium whiskey consumption at a rising rate

- Global brands are expanding operations and targeting this region with tailored marketing and product lines

- Growth in digital platforms and online alcohol sales is improving product reach and consumer access

- A younger consumer base is exploring whiskey more than ever, fueling ongoing expansion in this region

Global Whiskey Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Accolade Wines (Australia)

- Ace Liquors (U.S.)

- Allagash Brewing Company (U.S.)

- Allied Blenders and Distillers Limited (India)

- Brown Forman (U.S.)

- Diageo (U.K.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Bacardi & Company Limited (Bermuda)

- Pernod Ricard (France)

- Suntory Global Spirits Inc., (U.S.)

- Carlsberg Breweries A/S (Denmark)

- Constellation Brands, Inc. (U.S.)

- HEINEKEN Beverages (South Africa)

- Davide Campari-Milano N.V. (Italy)

- Molson Coors Beverage Company (U.S.)

- AL-KO GmbH (Finland)

- William Grant & Sons (U.K.)

- Anchor Brewing (U.S.)

- Chivas Brothers Limited & Chivas Brothers International Limited (U.K.)

Latest Developments in Global Whiskey Market

- In March 2023, Pernod Ricard announced its acquisition of a majority stake in Skrewball, a prominent craft whiskey distillery located in the United States. This strategic acquisition is designed to bolster Pernod Ricard's position in the rapidly expanding craft whiskey market while diversifying its portfolio with premium products that appeal to discerning consumers. By integrating Skrewball into its offerings, Pernod Ricard aims to enhance its reach and respond to the evolving preferences of whiskey enthusiasts

- In 2023, Diageo plc launched a significant sustainability initiative focused on minimizing its carbon footprint throughout its whiskey production operations. The company announced plans to invest $50 million in renewable energy projects and to adopt energy-efficient technologies at its distilleries globally. Furthermore, Diageo has pledged to source 100% of its electricity from renewable sources by 2030, reinforcing its commitment to combating climate change and promoting environmental responsibility within the whiskey industry

- In April 2023, Royal Salute introduced two luxury blended Scotch whiskies, enhancing its premium portfolio. The company unveiled the Royal Salute Platinum Jubilee Edition and the Royal Salute House of Quinn decanter, both available at the Duty-Free store in Chhatrapati Shivaji Maharaj International Airport, Mumbai. This strategic launch aims to bolster Royal Salute's presence in the growing Indian market, catering to the rising demand for high-end spirits among consumers

- In September 2022, Thirstie, an e-commerce platform for liquor brands, teamed up with Benriach single malt Scotch whisky to launch an online store for U.S. consumers. This partnership marked Benriach as the first brand in Brown-Forman's esteemed spirits portfolio to provide an online shopping experience in the United States. Through this new online store, powered by Thirstie, consumers benefit from a seamless digital purchasing process, enhanced by Thirstie's retail partnerships and collaborations

- In April 2022, Chivas Brothers, the Scotch whisky division of Pernod Ricard, revealed a substantial investment of USD 95.20 million in its strategic single malt distilleries, Aberlour and Miltonduff. This funding aims to enhance sustainable distillation technologies at these Speyside distilleries while significantly increasing production capacity to satisfy the rising global demand for Scotch whisky. The investment reflects Chivas Brothers' commitment to sustainability and innovation in the industry, positioning the brand to better serve its expanding consumer base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Whiskey Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Whiskey Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Whiskey Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.