Global Wheat Gluten Market

Market Size in USD Billion

CAGR :

%

USD

2.22 Billion

USD

3.96 Billion

2024

2032

USD

2.22 Billion

USD

3.96 Billion

2024

2032

| 2025 –2032 | |

| USD 2.22 Billion | |

| USD 3.96 Billion | |

|

|

|

|

Wheat Gluten Market Size

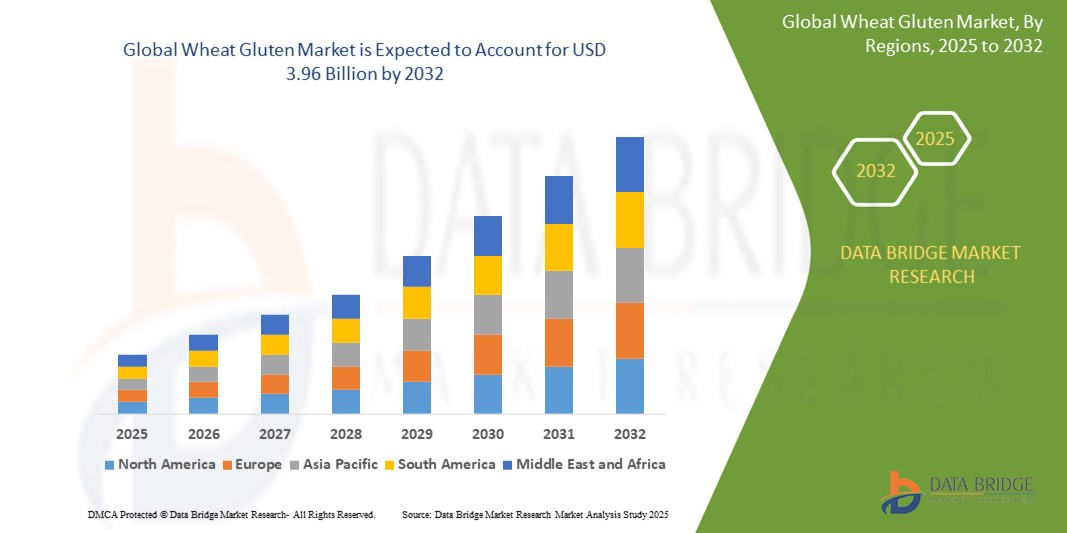

- The global wheat gluten market size was valued at USD 2.22 billion in 2024 and is expected to reach USD 3.96 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fuelled by the rising demand for plant-based proteins and functional food ingredients across the food and beverage industry

- The market is also supported by increasing applications of wheat gluten in bakery, meat alternatives, and nutraceuticals due to its binding and elasticity-enhancing properties

Wheat Gluten Market Analysis

- Wheat gluten is gaining traction across food industries for its functional properties, particularly in enhancing texture and elasticity in baked goods and plant-based alternatives

- The market is witnessing steady growth as manufacturers explore wheat gluten for clean-label formulations and high-protein product innovations

- North America dominated the global wheat gluten market with the largest revenue share of 38.5% in 2024, driven by rising demand for plant-based protein and clean-label food ingredients

- The Asia-Pacific region is expected to witness the highest growth rate in the global wheat gluten market, driven by increasing consumer awareness of plant-based proteins, rising adoption of vegan and vegetarian diets, and expanding food processing industries in countries such as China, India, and Japan

- The organic segment held the largest market revenue share in 2024, as consumers become more conscious about clean-label and naturally sourced ingredients, preferring products free from synthetic additives. This segment appeals especially to health-conscious customers and manufacturers focusing on sustainable and environmentally friendly product lines. Organic wheat gluten is increasingly incorporated into premium bakery and plant-based meat products, enhancing the product’s nutritional profile and market positioning

Report Scope and Wheat Gluten Market Segmentation

|

Attributes |

Wheat Gluten Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wheat Gluten Market Trends

“Rising Use of Wheat Gluten in Plant-Based Meat Alternatives”

- Wheat gluten is increasingly used to replicate meat-such as textures in plant-based food products due to its fibrous structure and high protein content

- Demand continues to grow as vegetarian, vegan, and flexitarian diets gain widespread popularity among health-conscious consumers

- For instance, brands such as Tofurky use wheat gluten to produce seitan-based meat alternatives for a protein-rich, meat-such as experience

- The presence of seitan dishes is expanding in mainstream restaurants and grocery stores, reflecting rising consumer interest

- This trend encourages sustainable eating habits and offers a nutritious solution for reducing dependence on animal-based proteins

Wheat Gluten Market Dynamics

Driver

“Rising Demand for High-Protein, Plant-Based Food Options”

- Wheat gluten is increasingly used in vegetarian and vegan foods due to its high protein content and ability to mimic the texture of meat

- It serves as a key plant-based protein source for health-conscious consumers looking to reduce animal-based intake

- In bakery applications, wheat gluten improves dough elasticity and volume, making it popular among commercial food producers

- For instance, seitan made from wheat gluten is widely available in alternative protein food lines in major supermarket chains

- Rising awareness of sustainability and clean label trends is further encouraging the use of wheat gluten in modern diets

Restraint/Challenge

“Growing Prevalence of Gluten Sensitivity and Celiac Disease Among Consumers”

- Rising cases of gluten sensitivity and celiac disease are limiting the appeal of wheat gluten among health-conscious consumers

- Many food manufacturers are shifting toward gluten-free formulations to meet growing dietary preferences

- For instance, the increasing popularity of gluten-free bakery and snack products is reducing reliance on traditional wheat-based ingredients

- Wheat gluten is unsuitable for individuals on medically prescribed gluten-free diets, shrinking its potential customer base

- Changing consumer perceptions that gluten-free is healthier, even without medical need, is driving product reformulation and market shift

Wheat Gluten Market Scope

The global wheat gluten market is segmented based on category, function, form, application, packaging, distribution channel, and end user.

- By Category

On the basis of category, the wheat gluten market is segmented into organic and inorganic wheat gluten. The organic segment held the largest market revenue share in 2024, as consumers become more conscious about clean-label and naturally sourced ingredients, preferring products free from synthetic additives. This segment appeals especially to health-conscious customers and manufacturers focusing on sustainable and environmentally friendly product lines. Organic wheat gluten is increasingly incorporated into premium bakery and plant-based meat products, enhancing the product’s nutritional profile and market positioning.

The inorganic segment is expected to witness the fastest growth rate from 2025 to 2032, due to its cost-effectiveness and consistent performance in food formulations, including baked goods, snacks, and meat alternatives. Inorganic wheat gluten is widely used in mass-produced food items where affordability and functional reliability are key. This balance between premium organic offerings and bulk inorganic supply shapes the competitive dynamics of the market.

- By Function

On the basis of function, the wheat gluten market is segmented into emulsifier, solidifier, binder, and others. The binder segment held the largest market revenue share in 2024, due to wheat gluten’s excellent adhesive properties, which improve dough elasticity, texture, and structural integrity, especially in bakery products and meat substitutes. Its ability to hold water and fats enhances product mouthfeel and volume, making it indispensable in gluten-rich recipes and vegan meat analogues.

The emulsifier is expected to witness the fastest growth rate from 2025 to 2032, increasingly important in processed foods and beverages where wheat gluten helps stabilize mixtures and extend shelf life by preventing ingredient separation.

- By Form

On the basis of form, the wheat gluten market is segmented into liquid and dry wheat gluten. The dry wheat gluten segment held the largest market revenue share in 2024, favored for its extended shelf life, ease of storage, and transport advantages. It is widely used across food manufacturing industries due to its ability to maintain functionality over time and its flexibility for blending into dry mixes or flours. The dry form also suits global supply chains, allowing large-scale producers to maintain consistent quality.

Liquid wheat gluten is expected to witness the fastest growth rate from 2025 to 2032, particularly in industrial baking processes, where its solubility and easy integration into dough mixers enhance production efficiency. The liquid form also benefits automated food manufacturing systems by ensuring uniform ingredient dispersion. Despite its shorter shelf life, liquid gluten appeals to manufacturers aiming to optimize processing speed and product consistency, especially in fresh bakery and meat analogue production.

- By Application

On the basis of application, the wheat gluten market is segmented into food & beverages, animal feed, and others. The food & beverages segment held the largest market revenue share in 2024, as wheat gluten is a crucial ingredient in meat substitutes, bakery items, snacks, and protein-enriched foods. The growing consumer shift toward plant-based diets and healthier eating habits continues to fuel demand within this segment. Wheat gluten improves texture, protein content, and shelf life, making it highly valuable for alternative protein products that mimic meat’s sensory qualities.

The animal feed segment is expected to witness the fastest growth rate from 2025 to 2032, driven by wheat gluten’s high protein concentration and digestibility, which supports improved animal growth and feed efficiency in livestock and aquaculture. In addition, wheat gluten enhances pellet quality and reduces feed wastage.

- By Packaging

On the basis of packaging, the wheat gluten market is segmented into bottle/jar, pouch & bags, boxes, and others. Pouch and bags segment held the largest market revenue share in 2024, widely used packaging formats due to their cost-effectiveness, lightweight nature, and ease of handling, which benefit both manufacturers and end-users. Flexible packaging also allows for varying product quantities, appealing to different scales of food production and retail needs.

Bottle and jar packaging is expected to witness the fastest growth rate from 2025 to 2032, for premium or specialty wheat gluten products, often targeting niche markets requiring airtight sealing and prolonged freshness. This rigid packaging enhances product shelf appeal and supports branding efforts, particularly in organic and clean-label segments.

- By Distribution Channel

On the basis of distribution channel, the wheat gluten market is segmented into store-based retailers and non-store-based retailers. Store-based retailers segment held the largest market revenue share in 2024, with supermarkets, hypermarkets, and specialty health food stores serving as primary points of purchase for both commercial buyers and consumers. The convenience, product variety, and trusted shopping environment contribute to strong store-based sales.

The non-store-based retail is expected to witness the fastest growth rate from 2025 to 2032, due to the rising adoption of e-commerce and digital food marketplaces. Online channels provide access to a broader customer base, enabling manufacturers and distributors to reach niche markets and remote regions. The convenience of home delivery and the availability of detailed product information also drive online sales. Hybrid strategies combining store presence with digital platforms are becoming common to maximize reach and consumer engagement.

- By End User

On the basis of end user, the distribution channel market is segmented into household/retail and commercial. The commercial segment held the largest market revenue share in 2024, due to large-scale food manufacturing, foodservice, and hospitality industries that use wheat gluten extensively in bakery products, meat alternatives, and snacks. Commercial users benefit from bulk purchasing, consistent supply, and product customization options. The growth of plant-based food production and increasing demand for protein-rich ingredients among food producers sustain this segment’s dominance.

Household/retail is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing popularity of home baking and cooking with plant-based ingredients. Consumers are increasingly experimenting with wheat gluten-based products such as seitan and gluten-enriched baked goods, reflecting the trend toward healthier and sustainable eating habits. The availability of smaller packaging sizes and clean-label products encourages household adoption.

Wheat Gluten Market Regional Analysis

- North America dominated the global wheat gluten market with the largest revenue share of 38.5% in 2024, driven by rising demand for plant-based protein and clean-label food ingredients

- The region's health-conscious consumers and well-established food manufacturing sector encourage widespread adoption of wheat gluten in bakery, meat alternatives, and processed foods

U.S. Wheat Gluten Market Insight

The U.S. wheat gluten market captured the largest revenue share in North America in 2024, propelled by widespread consumer adoption of plant-based proteins and clean-label products. The growing vegan and vegetarian population, alongside increased innovation in meat alternatives and bakery sectors, fuels demand. In addition, strong distribution networks through supermarkets and online platforms enhance accessibility. The U.S. market also benefits from rising awareness regarding the environmental impact of animal protein, encouraging sustainable ingredient use such as wheat gluten.

Europe Wheat Gluten Market Insight

The Europe wheat gluten market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing vegan and vegetarian populations and stringent food safety regulations. Countries such as Germany, France, and the U.K. are driving demand for organic and non-GMO wheat gluten products in bakery and meat substitute applications. Growing consumer preference for clean-label and natural ingredients, along with expansion in health food retail channels, bolsters the regional market

U.K. Wheat Gluten Market Insight

The U.K. wheat gluten market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing demand for vegan and vegetarian food products and clean-label ingredients. Consumers’ growing interest in sustainable and plant-based diets encourages manufacturers to use wheat gluten extensively in bakery, meat substitutes, and processed foods. The region’s well-developed retail and foodservice sectors, along with rising awareness of wheat gluten’s functional benefits, support its adoption. Regulatory emphasis on food safety and labelling further boosts market confidence.

Germany Wheat Gluten Market Insight

The Germany wheat gluten markets accounting for a significant revenue share in 2024, with growth driven by strong demand for meat alternatives and protein-enriched bakery products. The country’s focus on sustainable food production and organic product lines promotes organic wheat gluten uptake. Increasing investments in food technology and consumer preference for high-quality, natural ingredients bolster market expansion. Germany’s robust food manufacturing infrastructure also enables efficient wheat gluten integration into diverse applications.

Asia-Pacific Wheat Gluten Market Insight

The Asia-Pacific wheat gluten market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rapid urbanization, rising disposable incomes, and increasing demand for protein-rich foods in countries such as China, India, and Japan. The expanding food processing industry and adoption of Western dietary habits further stimulate demand. In addition, growing awareness of gluten’s functional benefits in improving food texture and shelf life promotes its use in bakery and meat alternative products.

China Wheat Gluten Market Insight

The China leads the Asia-Pacific wheat gluten market, accounting for a significant revenue share in 2024. Rising consumer interest in plant-based proteins and rapid growth in bakery and processed food sectors are key factors driving the market. Government initiatives promoting sustainable agriculture and food innovation, alongside local manufacturers expanding production capacity, enhance market penetration in both retail and commercial segments.

Japan Wheat Gluten Market Insight

The Japan wheat gluten market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s increasing focus on health and wellness trends, as well as a rising number of consumers adopting plant-based diets. Japanese food manufacturers are incorporating wheat gluten in traditional and innovative products to improve texture and nutritional content. Moreover, the aging population’s demand for high-protein, easily digestible foods support market expansion in both retail and commercial sectors. Integration of wheat gluten in convenience foods and meat alternatives is also on the rise.

Wheat Gluten Market Share

The Wheat Gluten industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Dow (U.S.)

- DuPont (U.S.)

- Cargill, Incorporated (U.S.)

- Kerry Group plc. (Ireland)

- Ingredion Incorporated (U.S.)

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Solvay (Belgium)

- Akzo Nobel N.V. (Netherlands)

- Arkema (France)

- Eastman Chemical Company (U.S.)

- The Lubrizol Corporation (U.S.)

- Clariant (Switzerland)

- LANXESS (Germany)

- Lonza (Switzerland)

- Stepan Company (U.S.)

- DSM (Netherlands)

- Corbion (Netherlands)

- Estelle Chemicals Pvt. Ltd. (India)

Latest Developments in Global Wheat Gluten Market

- In September 2021, Corbion introduced the Pristine 3000, an advanced dough conditioning solution in its clean label product range. This innovation helps bakers address challenges related to wheat protein variability and high-speed processing without using gluten additives or traditional chemicals such as diacetyl tartaric acid ester of monoglycerides. The new product supports cleaner ingredient labels and improves dough performance, meeting the growing demand for natural baking solutions. This development strengthens Corbion’s position in the bakery ingredients market and offers manufacturers a healthier alternative for quality bread production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wheat Gluten Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wheat Gluten Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wheat Gluten Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.