Global Virtual Infrastructure Manager Market

Market Size in USD Billion

CAGR :

%

USD

3.40 Billion

USD

13.42 Billion

2023

2030

USD

3.40 Billion

USD

13.42 Billion

2023

2030

| 2024 –2030 | |

| USD 3.40 Billion | |

| USD 13.42 Billion | |

|

|

|

|

Virtual Infrastructure Manager Market Size

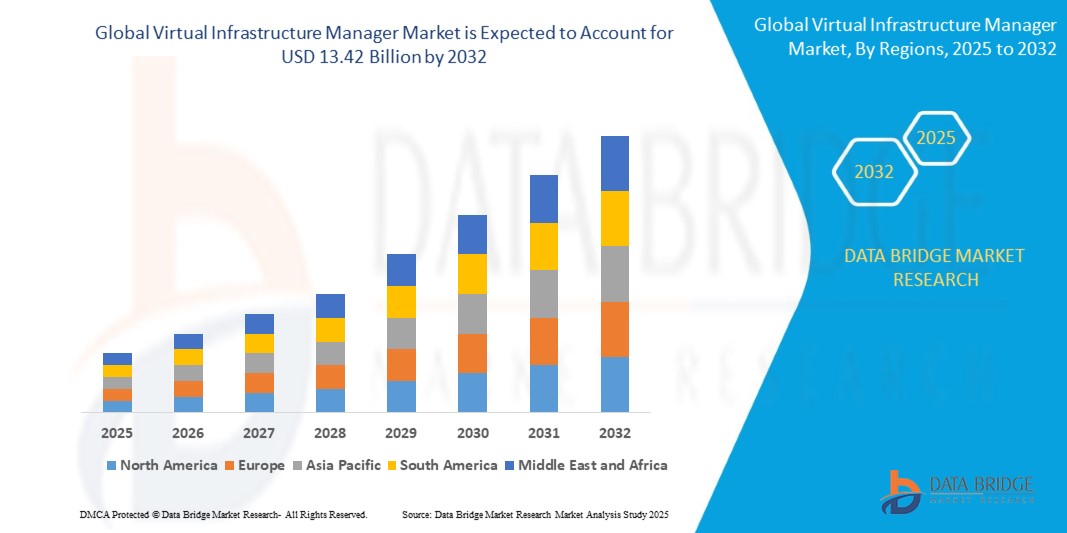

- The global virtual infrastructure manager market size was valued at USD 3.40 billion in 2024 and is expected to reach USD 13.42 billion by 2032, at a CAGR of 18.70% during the forecast period

- The market growth is largely fuelled by the rising adoption of cloud-native infrastructure, increasing demand for centralized and automated virtual environment management, and the growing shift towards network function virtualization (NFV) and software-defined data centers (SDDC) across enterprises

- The expansion of digital transformation initiatives and the growing emphasis on optimizing IT workloads and reducing capital expenditure (CapEx) are further accelerating the adoption of virtual infrastructure managers across various industries

Virtual Infrastructure Manager Market Analysis

- The demand for virtual infrastructure managers is accelerating as organizations prioritize IT agility, scalability, and cost-efficiency in handling complex hybrid and multi-cloud environments

- The increasing deployment of 5G infrastructure and edge computing technologies is boosting the need for dynamic, real-time orchestration of virtual resources, where virtual infrastructure managers play a critical role

- North America dominated the virtual infrastructure manager market with the largest revenue share of 37.82% in 2024, driven by high adoption of cloud services, widespread digital transformation across industries, and the presence of key technology providers

- Asia-Pacific region is expected to witness the highest growth rate in the global virtual infrastructure manager market, driven by increasing internet penetration, rapid growth of e-commerce and telecom sectors, and government initiatives supporting digital transformation and smart city development across countries such as China, India, and Japan

- The solution segment dominated the market with the largest revenue share of 61.4% in 2024, driven by the increasing demand for centralized infrastructure management and automation across cloud and virtual environments. Organizations are investing heavily in scalable and intelligent management platforms to support complex, hybrid IT architectures. The rapid adoption of virtualization in data centers has further boosted demand for robust solutions that offer real-time monitoring, orchestration, and performance optimization

Report Scope and Virtual Infrastructure Manager Market Segmentation

|

Attributes |

Virtual Infrastructure Manager Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Virtual Infrastructure Manager Market Trends

“Increased Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Infrastructure Management”

- AI and ML are being increasingly embedded into virtual infrastructure management platforms to automate routine tasks, manage workloads, and reduce human dependency in high-scale environments. These technologies help streamline complex processes, improve response times, and ensure consistency in performance management across large digital infrastructures

- These technologies enhance system reliability through real-time analytics, automated diagnostics, and anomaly detection. Such capabilities help organizations detect and resolve issues proactively, significantly reducing infrastructure downtime and improving end-user service continuity

- AI-driven workload balancing enables dynamic allocation of compute, storage, and network resources based on changing demand across cloud ecosystems. This ensures cost efficiency, prevents resource underutilization or overload, and improves system responsiveness for critical applications

- Predictive maintenance powered by ML algorithms is helping enterprises identify performance bottlenecks, hardware degradation, and failure trends before they impact operations. This proactive approach improves infrastructure stability, reduces emergency repairs, and enhances long-term business continuity planning

- For instance, IBM’s Turbonomic platform uses AI to analyze application performance in real time and automatically manage infrastructure resources. It helps enterprises ensure that applications always receive the compute and memory they need, without manual intervention or over-provisioning

Virtual Infrastructure Manager Market Dynamics

Driver

“Surging Demand for Network Function Virtualization (NFV) and Cloud-native Applications”

- The rise of NFV is enabling telecom and enterprise networks to shift from hardware-based functions to virtualized solutions for improved flexibility. By virtualizing network services such as routing, switching, and security, organizations are reducing operational costs and enhancing service agility

- Cloud-native applications built on microservices and containers require dynamic orchestration and scaling across cloud platforms. Virtual infrastructure managers play a critical role by automating container placement, managing storage demands, and balancing resource consumption

- NFV allows decoupling of hardware from software, accelerating service rollout and simplifying network updates without physical reconfigurations. This transformation is helping telecom operators respond faster to customer demands while minimizing capital expenditure on legacy hardware

- Virtual infrastructure managers help reduce operational complexity in hybrid and multi-tenant environments by automating resource provisioning and monitoring. They provide centralized control over infrastructure layers, improving visibility and performance management across distributed systems

- For instance, Red Hat’s OpenStack Platform enables NFV infrastructure by using virtual infrastructure managers for high availability and efficient orchestration. This supports telecom operators in delivering scalable, automated services with better uptime and resource optimization

Restraint/Challenge

“Complexity in Integration with Legacy Infrastructure”

- Many legacy systems lack the APIs, software support, or compatibility needed to work with modern virtual infrastructure managers. This leads to prolonged integration timelines, higher costs, and greater risks during the migration from traditional to cloud-based environments

- Transitioning from hardware-centric data centers to software-defined infrastructure requires a major investment in tools and training. The disruption during migration may temporarily impact critical business operations and reduce productivity during the adjustment period

- A key challenge is the shortage of professionals skilled in both legacy technologies and modern virtualization platforms. This talent gap increases the burden on IT departments and slows down successful adoption of virtual infrastructure management tools

- Legacy systems often operate on outdated protocols, file formats, and incompatible security configurations. Integrating them with AI-optimized cloud systems can expose vulnerabilities, increase complexity, and require custom integration efforts

- For instance, hospitals operating legacy EMR systems find it difficult to align with modern infrastructure platforms due to data incompatibility and compliance issues. These limitations delay digital upgrades, hinder cloud adoption, and slow innovation in mission-critical healthcare environments

Virtual Infrastructure Manager Market Scope

The market is segmented on the basis of offering, development, and end-user.

• By Offering

On the basis of offering, the virtual infrastructure manager market is segmented into solution and services. The solution segment dominated the market with the largest revenue share of 61.4% in 2024, driven by the increasing demand for centralized infrastructure management and automation across cloud and virtual environments. Organizations are investing heavily in scalable and intelligent management platforms to support complex, hybrid IT architectures. The rapid adoption of virtualization in data centers has further boosted demand for robust solutions that offer real-time monitoring, orchestration, and performance optimization.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing reliance on managed services and system integration. As businesses navigate digital transformation, the need for consulting, deployment, and support services continues to rise, especially among small and medium enterprises lacking internal IT expertise.

• By Development

On the basis of development, the market is segmented into Infrastructure as a Service (IaaS) and on-premises. The IaaS segment held the largest market revenue share in 2024, driven by the surge in cloud computing and increasing need for scalable infrastructure solutions. IaaS offers flexibility, reduced hardware dependency, and cost-effective deployment models, which are essential for enterprises operating in dynamic digital ecosystems.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, supported by demand from highly regulated industries such as banking and healthcare. These sectors prefer on-premises deployment to maintain control over sensitive data and comply with strict governance standards, especially in regions with stringent data residency laws.

• By End-User

On the basis of end-user, the market is segmented into IT and telecom, banking, financial services and insurance (BFSI), healthcare, manufacturing, retail, and others. The IT and telecom segment dominated the market in 2024, largely due to increased investment in cloud-native technologies and virtualization for network function management. This sector's dependence on continuous availability and high-performance infrastructure has accelerated the uptake of virtual infrastructure managers.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the digitalization of patient records, telemedicine expansion, and the need for secure, agile infrastructure. Virtual infrastructure managers help streamline operations, ensure compliance with data privacy regulations, and support scalable solutions for health data storage and processing.

Virtual Infrastructure Manager Market Regional Analysis

- North America dominated the virtual infrastructure manager market with the largest revenue share of 37.82% in 2024, driven by high adoption of cloud services, widespread digital transformation across industries, and the presence of key technology providers

- Enterprises in the region prioritize infrastructure scalability and seamless IT operations, making virtual infrastructure managers integral to improving efficiency, reducing operational costs, and enhancing data security

- The strong technological ecosystem, combined with early adoption of infrastructure-as-a-service (IaaS) models, supports market growth across sectors such as banking, healthcare, and telecommunications

U.S. Virtual Infrastructure Manager Market Insight

The U.S. virtual infrastructure manager market captured the largest revenue share of 79% in 2024 within North America, primarily due to its rapid expansion of cloud-native applications and virtualization platforms. The growing demand for centralized control, automation, and efficient resource management is fueling deployment across both private and public sectors. In addition, the increasing need for hybrid cloud infrastructure and data center modernization is prompting organizations to integrate advanced virtual infrastructure managers. Major cloud service providers headquartered in the U.S. also contribute to the innovation and availability of solutions in the market.

Europe Virtual Infrastructure Manager Market Insight

The Europe virtual infrastructure manager market is expected to witness the fastest growth rate from 2025 to 2032, driven by the surge in enterprise digitalization and strict data protection laws. The General Data Protection Regulation (GDPR) has heightened the demand for secure, compliant infrastructure management solutions. Countries such as Germany, France, and the Netherlands are investing in advanced virtualization technologies to optimize IT infrastructure. The region also benefits from strong government backing for cloud adoption and sustainable IT strategies.

U.K. Virtual Infrastructure Manager Market Insight

The U.K. virtual infrastructure manager market is expected to witness the fastest growth rate from 2025 to 2032, supported by an expanding digital economy and increased IT investment in banking and finance, retail, and healthcare. The demand for agile, scalable virtual infrastructure platforms is being propelled by the need to streamline operations and support remote work environments. The presence of leading cloud solution providers and a vibrant tech startup ecosystem further enhances market growth in the country.

Germany Virtual Infrastructure Manager Market Insight

The Germany virtual infrastructure manager market is expected to witness the fastest growth rate from 2025 to 2032, owing to its advanced industrial sector and robust IT infrastructure. The country's commitment to Industry 4.0 and digital factory concepts is driving the implementation of virtualized infrastructure in manufacturing and engineering. German enterprises are also investing in on-premise and hybrid cloud models, necessitating efficient infrastructure management tools that support scalability, data integrity, and operational automation.

Asia-Pacific Virtual Infrastructure Manager Market Insight

The Asia-Pacific virtual infrastructure manager market is expected to witness the fastest growth rate from 2025 to 2032, propelled by the digital boom in emerging economies such as India, China, and Southeast Asian countries. Increased adoption of cloud computing, the proliferation of data centers, and government initiatives supporting digital transformation are major growth drivers. As more small and medium enterprises (SMEs) shift toward cloud infrastructure, demand for flexible and cost-effective virtual infrastructure managers is rising.

Japan Virtual Infrastructure Manager Market Insight

The Japan virtual infrastructure manager market is expected to witness the fastest growth rate from 2025 to 2032, supported by widespread digital transformation in the healthcare, financial, and manufacturing sectors. Japan’s strong focus on innovation, automation, and resilience in IT operations is fostering the integration of advanced virtualization tools. Enterprises are leveraging virtual infrastructure managers to increase uptime, optimize performance, and ensure security compliance across diverse workloads. The rising popularity of containerization and edge computing is also influencing market dynamics.

China Virtual Infrastructure Manager Market Insight

The China virtual infrastructure manager market accounted for the largest revenue share in Asia-Pacific in 2024, driven by an explosion in data generation, cloud usage, and smart city development. The government's focus on digital infrastructure, along with the presence of domestic cloud giants such as Alibaba Cloud and Tencent Cloud, is accelerating the deployment of virtual infrastructure managers. These tools are being widely adopted across e-commerce, financial services, and telecommunications to enable real-time scalability, automation, and resource efficiency.

Virtual Infrastructure Manager Market Share

The virtual infrastructure manager industry is primarily led by well-established companies, including:

- SolarWinds Worldwide, LLC (U.S.)

- Ciena Corporation (U.S.)

- Ribbon Communications Operating Company, Inc. (U.S.)

- Corsa Technology Inc. (Canada)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Broadcom (U.S.)

- Fujitsu (Japan)

- IBM Corporation (U.S.)

- Nokia (Finland)

- NetApp (U.S.)

- Enterprise Management Associates, Inc. (U.S.)

- Virtual Open Systems SAS (France)

- HashRoot Ltd. (India)

- Netedge Technology (India)

- Datanetiix Solutions Inc. (U.S.)

- Paessler AG (Germany)

- Micropro (India)

- eG Innovations (U.S.)

- Zuci (U.S.)

Latest Developments in Global Virtual Infrastructure Manager Market

- In September 2023, Corsa Technology Inc. partnered with Eventus Security, India's leading Managed Security Services Provider. Eventus expanded its managed security services portfolio through this collaboration by adopting Corsa Security's hosted and managed virtual firewall service. Utilizing the Corsa Security Orchestrator (CSO) and software firewalls from top vendors, Eventus achieved rapid service delivery, providing customers with flexible firewall capacity and tailored security services to meet their specific needs

- In October 2023, Ciena Corporation showcased groundbreaking Open Broadband Solutions and expertise at Network X 2023 during the Broadband Forum (BBF) and CloudCo Proof of Concept. The demonstration highlighted Ciena's virtual Broadband Network Gateway (vBNG) and Secure Service Edge (SSE) capabilities within a Secure Access Service Edge (SASE) framework, delivering edge security for residential and small businesses. Featured use cases included secure high-speed internet as an overlay service with spam filtering and DDoS protection. This benefits the company to expand its product and solution portfolio and thus increase revenue

- In May 2023, Telefonaktiebolaget LM Ericsson achieved the FutureNet World Network Sustainability Award for its Predictive Cell Energy Management (PCEM) solution. Recognized for reducing energy consumption without compromising service quality, PCEM is a key component of Ericsson's Energy Infrastructure Operations offering. This multi-vendor, multi-technology application optimizes energy usage at the cell level, ensuring network quality and customer experience. This benefits the company by boosting its image in the IT industry

- In January 2023, Micropro emerged victorious at the Digital India Awards, a prestigious accolade presented by the Ministry of Electronics and Information Technology, Government of India. The award recognizes excellence in e-governance initiatives and underscores Micropro's outstanding contributions to India's digital transformation. This benefits the company to boost its image in the region

- In August 2022, SolarWinds Worldwide, LLC was acknowledged in GigaOm Radar Reports as a Leader in Network and Cloud Observability for 2022. The company's hybrid and multi-cloud observability solutions earned praise for enhancing enterprise visibility, intelligence, and productivity in today's distributed network environments. GigaOm's recognition positioned SolarWinds as a Leader and Outperformer in Network Observability and a Leader and Fast Mover in Cloud Observability Solutions for 2022. The evaluations were based on technical capabilities, product roadmap, innovation, and execution prowess. This benefits the company by accelerating its digital transformation efforts and adopting a proactive IT posture

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Virtual Infrastructure Manager Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Virtual Infrastructure Manager Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Virtual Infrastructure Manager Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.