Global Data Center Interconnect Market

Market Size in USD Billion

CAGR :

%

USD

6.79 Billion

USD

8.80 Billion

2024

2032

USD

6.79 Billion

USD

8.80 Billion

2024

2032

| 2025 –2032 | |

| USD 6.79 Billion | |

| USD 8.80 Billion | |

|

|

|

|

Data Center Interconnect Market Size

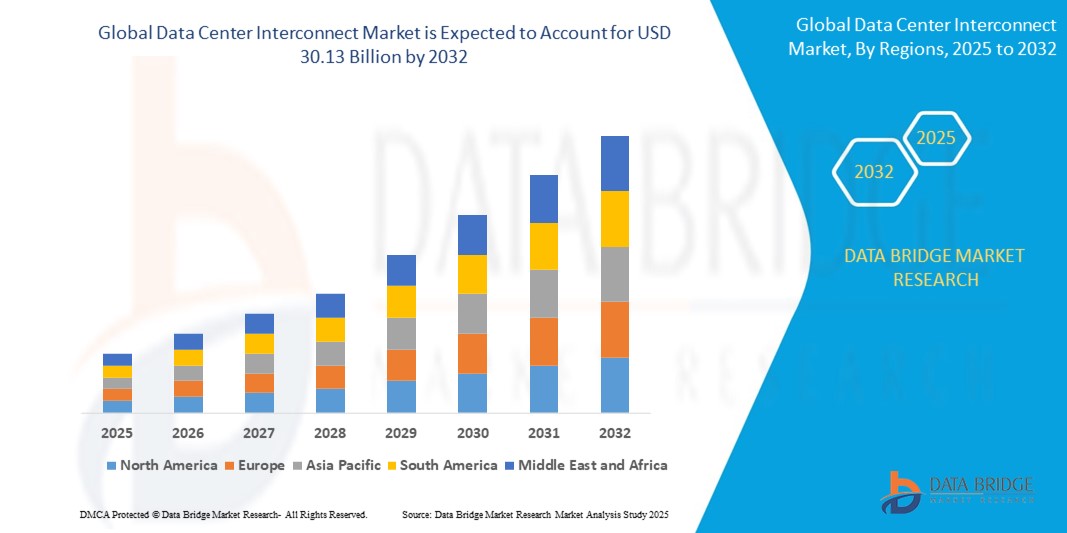

- The global data center interconnect market was valued at USD 10.63 billion in 2024 and is expected to reach USD 30.13 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.90%, primarily driven by the rising demand for high-capacity and low-latency connectivity across data centers

- This growth is driven by factors such as the rapid adoption of cloud services, data traffic surge from AI and IoT, and the need for business continuity and disaster recovery solutions

Data Center Interconnect Market Analysis

- Data center interconnect (DCI) solutions enable seamless connectivity and data transfer between two or more data centers, facilitating high-speed data replication, workload mobility, backup, and disaster recovery across geographically dispersed locations. These solutions are vital for ensuring business continuity, efficient resource utilization, and scalability

- The demand for DCI solutions is significantly driven by the surge in cloud adoption, rapid data traffic growth, and the expanding need for real-time data synchronization across hybrid and multi-cloud environments. The increasing deployment of hyperscale data centers and AI workloads are also contributing heavily to market expansion

- The North America region stands out as one of the dominant markets for data center interconnect solutions, driven by its technological advancements, strong presence of hyperscale cloud providers, and growing investments in infrastructure modernization

- For instance, major cloud service providers like Amazon Web Services, Microsoft Azure, and Google Cloud have consistently expanded their inter-data center connectivity capabilities across the U.S. to support low-latency services and real-time analytics

- Globally, DCI solutions are considered among the most critical components of modern data center architectures, following core routing systems, and play a pivotal role in supporting scalable, resilient, and secure enterprise and cloud operations

Report Scope and Data Center Interconnect Market Segmentation

|

Attributes |

Data Center Interconnect Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Data Center Interconnect Market Trends

“Shift Toward Hyperscale and Edge Data Centers”

- Another major trend in the global DCI market is the increasing shift toward hyperscale and edge data centers, driven by the explosive growth of cloud computing, IoT, AI, and real-time applications

- Hyperscale data centers, built to support massive workloads and high-density computing, require robust interconnect solutions to ensure seamless communication between multiple locations and regions

- For instance, the rollout of 5G networks is accelerating edge computing adoption, compelling operators to establish low-latency, high-bandwidth DCI connections between central and remote data hubs

- This growing need for localized data processing and global data availability is pushing enterprises to adopt flexible, scalable DCI architectures that can support a mix of core, edge, and hyperscale environments

- The trend is fostering innovation in optical transport technologies, modular interconnect solutions, and cloud-centric connectivity platforms, shaping the future of the DCI landscape

Data Center Interconnect Market Dynamics

Driver

“Growing Need Due to Increasing Data Traffic and Cloud Adoption”

- The exponential growth in data traffic, driven by the rapid adoption of cloud services, IoT devices, AI workloads, and 5G networks, is significantly fueling the demand for data center interconnect (DCI) solutions

- As businesses shift toward hybrid and multi-cloud environments, there is a rising need for high-capacity, low-latency, and secure connections between geographically distributed data centers

- Enterprises and cloud service providers are increasingly deploying DCI to ensure data redundancy, disaster recovery, and real-time data replication, all of which are vital for business continuity

- The push for digital transformation across industries and the increasing demand for streaming services, e-commerce, and remote work setups are further intensifying the need for robust DCI infrastructure

- DCI solutions also play a critical role in enabling edge computing, where data processing happens closer to the user, requiring seamless connectivity between edge locations and core data centers

For instance,

- In November 2024, Virgin Media O2 (U.K.) partnered with Ciena Corporation (U.S.) to deploy a Converged Interconnect Network (CIN) that combines fixed and mobile traffic, enabling a scalable and efficient network backbone to meet evolving data demands

- In October 2024, Megaport (Australia) expanded its European presence by adding 14 new data centers and forming partnerships with Portus Data Centers, NorthC Data Centers, and Sipartech, enhancing its Network as a Service (NaaS) capabilities and interconnect offerings across the region

- As data volumes continue to grow and the digital landscape becomes increasingly complex, the global DCI market is witnessing robust demand for scalable, high-speed, and secure interconnection solutions, making DCI a cornerstone of modern digital infrastructure

Opportunity

“Growing Investments in Hyperscale Data Centers Fueling DCI Demand”

- The ongoing boom in hyperscale data center construction presents a major opportunity for the data center interconnect (DCI) market, as these large-scale facilities require ultra-reliable, high-capacity interconnection to support massive data throughput across regions and cloud environments

- As cloud service providers, content delivery networks, and big tech companies expand their global infrastructure, the need for advanced DCI solutions to support real-time data replication, load balancing, and disaster recovery is rising sharply

- DCI is becoming a foundational component of modern hyperscale architecture, enabling seamless connectivity between data center clusters and improving overall operational efficiency

For instance,

- In November 2024, Amazon Web Services (AWS) announced plans to open 12 new hyperscale data centers globally by 2027, which include robust regional interconnect plans to ensure redundancy and low-latency delivery of cloud services

- In October 2024, Microsoft revealed a $3.2 billion investment in expanding its Azure data center footprint across Germany and Southeast Asia, with a significant portion allocated to inter-data center connectivity infrastructure

- These developments signify that hyperscale expansion is directly accelerating the adoption of next-generation DCI solutions, creating new market opportunities for vendors offering high-speed optical transport, intelligent software-defined interconnects, and scalable cloud integration services

Restraint/Challenge

“High Infrastructure and Deployment Costs Hindering Market Penetration”

- The high infrastructure and deployment costs associated with data center interconnect (DCI) solutions pose a significant challenge for the market, particularly affecting the adoption rate among small to mid-sized enterprises and data center operators in emerging regions

- DCI implementations often require significant capital investment in optical transport systems, advanced networking hardware, and software-defined networking (SDN) platforms, as well as skilled personnel to manage integration and ongoing maintenance

- This financial burden can deter smaller enterprises or regional data centers from upgrading their interconnect capabilities or expanding into new geographic markets, leading to reliance on legacy systems with limited performance and scalability

For instance,

- In September 2024, a white paper by Infinera Corporation highlighted that initial setup and operational costs for high-capacity DCI systems remain a major concern, particularly for enterprises in Tier-2 and Tier-3 markets. The paper emphasized that unless pricing structures are optimized, access to next-generation interconnect solutions may remain limited for many organizations

- As a result, this cost barrier can contribute to uneven technological progress, restricting access to real-time data sharing, cloud-based applications, and disaster recovery solutions, ultimately slowing down the broader expansion of the DCI market

Data Center Interconnect Market Scope

The market is segmented on the basis product, technology, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Application |

|

|

By End User |

|

Data Center Interconnect Market Regional Analysis

“North America is the Dominant Region in the Data Center Interconnect Market”

- North America dominates the data center interconnect (DCI) market, driven by a robust digital infrastructure, early adoption of cloud and edge computing technologies, and the presence of leading data center and cloud service providers

- The U.S. holds a significant share due to the growing need for high-speed data transmission, increased adoption of hybrid and multi-cloud strategies, and the continuous expansion of hyperscale data centers

- The region benefits from large-scale investments in AI, IoT, and 5G networks, which require high-capacity interconnects and ultra-low latency performance, further boosting DCI adoption

- In addition, the growing demand for real-time data analytics, disaster recovery solutions, and secure inter-data center communication is fueling the market expansion, with enterprises and cloud operators heavily investing in scalable, software-defined DCI solutions

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the data center interconnect (DCI) market, fueled by rapid digital transformation, increasing cloud adoption, and substantial investments in IT infrastructure and smart technologies

- Countries such as China, India, Japan, and South Korea are emerging as key markets due to the explosive growth of data generation, driven by e-commerce, social media, mobile applications, and IoT-enabled services

- Japan, known for its technological innovation, continues to invest heavily in high-performance computing, AI, and advanced data center architectures, making it a strategic hub for DCI solution deployments across the region

- China and India, with their rapidly expanding digital economies and government-led initiatives for cloud-first and data localization policies, are seeing a surge in hyperscale and colocation data center projects. The increasing presence of global cloud providers, local telecom operators, and infrastructure vendors is significantly boosting DCI market growth and modern interconnect network deployments

Data Center Interconnect Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Equinix, Inc. (U.S.)

- Digital Realty Trust (U.S.)

- Ciena Corporation (U.S.)

- Nokia (Finland)

- Huawei Technologies Co., Ltd. (China)

- Infinera Corporation (U.S.)

- ADVA Optical Networking (Germany)

- Juniper Networks, Inc. (U.S.)

- Colt Technology Services Group Limited (U.K.)

- Extreme Networks, Inc. (U.S.)

- Fiber Mountain, Inc. (U.S.)

- Pluribus Networks (U.S.)

- ZTE Corporation (China)

- RANOVUS Inc. (Canada)

- FUJITSU (Japan)

- Megaport (Australia)

Latest Developments in Global Data Center Interconnect Market

- In November 2024, Nokia Corporation (Finland) partnered with Cloudbear, a Dutch hosting services provider, to deploy an advanced data center networking infrastructure built on a Kubernetes environment. This implementation leverages Nokia’s high-performance data center fabric switching and gateway routers, enhancing Cloudbear’s ability to deliver customized and efficient hosting services across Europe. The collaboration focuses on boosting speed, reliability, and security, ensuring Cloudbear meets customers' specific needs more effectively

- In November 2024, Virgin Media O2 (U.K.) partnered with Ciena Corporation (U.S.) to successfully launch a Converged Interconnect Network (CIN), integrating its fixed and mobile networks to manage both types of traffic seamlessly. This next-generation network is built for scalability, allowing it to adapt to evolving consumer and business demands. By unifying its networks, Virgin Media O2 aims to enhance service efficiency, resilience, and overall customer experience

- In November 2024, Adtran (Germany) announced a strategic partnership with Sonic Fiber Internet (U.S.) to roll out 50Gbit/s passive optical network (50G PON) connectivity in California. This collaboration is set to boost Sonic’s capability to deliver ultra-fast broadband services, addressing the growing demand for higher capacity and faster internet speeds across the U.S. Leveraging Adtran’s advanced technology, Sonic will be well-equipped to meet the evolving needs of both residential and business customers

- In October 2024, Juniper Networks (U.S.) announced that Seoul Semiconductor (South Korea) has deployed its AI-Native Networking Platform to enhance both wired and wireless access services. Powered by Mist AI™, the upgrade is designed to increase employee productivity and reduce operational costs by delivering reliable and measurable network performance. Utilizing advanced AIOps and a microservices cloud architecture, the platform ensures a superior experience for both users and network operators

- In October 2024, Megaport (Australia) expanded its footprint in Europe by adding 14 new data center locations across seven countries and forming strategic partnerships with Portus Data Centers, NorthC Data Centers, and Sipartech. This expansion strengthens Megaport’s ability to deliver its Network as a Service (NaaS) solutions, allowing customers to connect with a wider ecosystem of service providers and data centers across the European region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Data Center Interconnect Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Data Center Interconnect Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Data Center Interconnect Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.