Global Veterinary Infectious Disease Diagnostics Market, By Technology (Immunodiagnostics, Molecular Diagnostics, Other Veterinary Diagnostic Technologies), Animal Type (Companion Animals, Food Producing Animals), End User (Reference Laboratories, Veterinary Laboratories and Clinics, Point of Care / In House Testing, Research Institutes and Universities), Infection Type (Bacterial Infections, Viral Infections, Parasitic Infections, Other Infections) – Industry Trends and Forecast to 2030.

Veterinary Infectious Disease Diagnostics Market Analysis and Size

Increased demand for animal-derived food products, an increase in the number of veterinary practitioners, the adoption of disease control and disease prevention measures, the growth of the companion animal population, and the prevalence of favourable pet insurance policies are some of the most insightful factors that will likely boost the growth of the veterinary infectious disease diagnostics market during the forecast period of 2023-2030. On the other hand, rising applications from emerging economies and rising vegan population trends will create immense opportunities for the veterinary infectious disease diagnostics market during the forecast period.

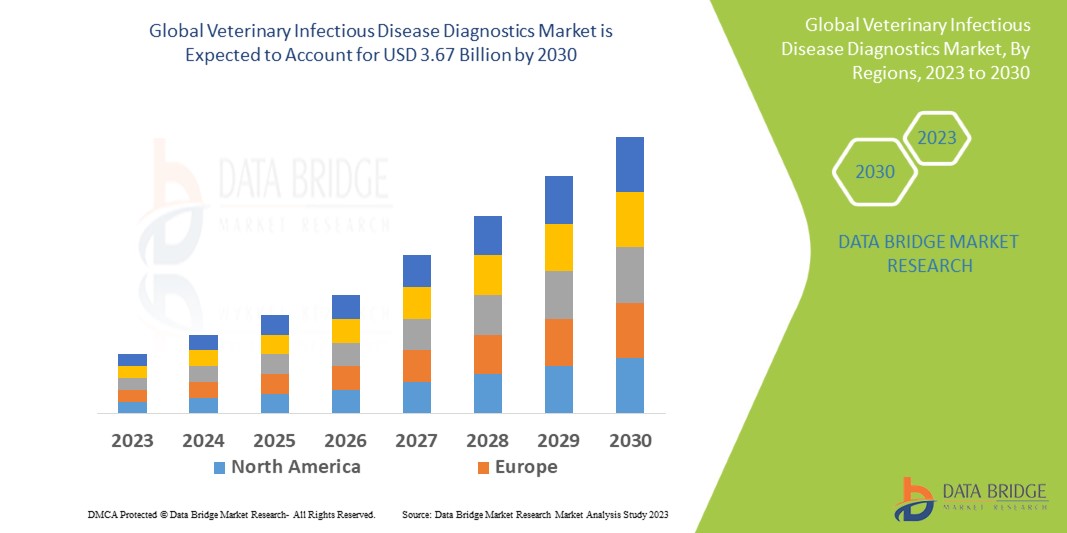

Data Bridge Market Research analyses that the veterinary infectious disease diagnostics market which is USD 1.80 billion in 2022, is expected to reach USD 3.67 billion by 2030, at a CAGR of 9.3% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Veterinary Infectious Disease Diagnostics Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Technology (Immunodiagnostics, Molecular Diagnostics, Other Veterinary Diagnostic Technologies), Animal Type (Companion Animals, Food Producing Animals), End User (Reference Laboratories, Veterinary Laboratories and Clinics, Point of Care / In House Testing, Research Institutes and Universities), Infection Type (Bacterial Infections, Viral Infections, Parasitic Infections, Other Infections)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

BIOMÉRIEUX (France), Heska Corporation (U.S.), IDEXX (U.S.), Neogen Corporation (U.S.), INDICAL BIOSCIENCE GmbH (Germany), Randox Laboratories Ltd. (U.K.), Thermo Fisher Scientific Inc. (U.S.), Virbac (France), Zoetis (U.S.), Creative Diagnostics (U.S.), DRG INSTRUMENTS GMBH (Germany), Chembio Diagnostic Systems, Inc. (U.S.), Eurofins Technologies (Luxembourg), Abaxis (U.S.), Agrolabo S.p.A. (Italy), Abbott (U.S.), Danaher (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Animals with infectious infections who are not treated for an extended period of time can die. As a result, treating animals with these diseases necessitates early diagnosis and treatment. Furthermore, veterinary diagnostics refers to the processes and examinations used to detect the presence of infectious diseases. These tests and methods also make use of veterinary infectious disease diagnostics. These diagnostics can detect infectious diseases caused by viruses, bacteria, and parasites in animals. Additionally, diagnostics can be performed to detect contagious diseases in animals such as cats and dogs. The primary drivers of the global Veterinary Infectious Disease Diagnostics Market are an increase in pet ownership and an increase in animal health expenditure.

Veterinary Infectious Disease Diagnostics Market Dynamics

Drivers

- Increased adoption of companion animals

The demand for pet care goods and services is expected to rise in response to the growing pet population, which will fuel the global expansion of related sectors such as the veterinary infectious disease diagnostics market. According to the American Pet Products Association's (APPA) National Pet Owners Survey, 68% of US homes, or approximately 84.9 million families, owned a pet in North America. In addition, 43 million families had cats, 64 million had dogs, and 1.7 billion had all three. As the demand for pets grows, the demand for veterinary infectious disease diagnostics also grows.

- Increase in R&D activities

The cost increase reflects owners' desire to take their dogs for diagnostic tests. These factors will cause the market to grow significantly in the coming years. Furthermore, an increase in R&D activities and the availability of good healthcare infrastructure are significantly supporting the regional market's overall expansion. For instance, in September 2021, the International Society for Infectious Diseases (a branch of the United Nations) will present various awards in various infectious disease-related subjects. A large number of grants are available for veterinary infectious diagnostics.

Opportunities

- Rising prevalence of transboundary and zoonotic diseases

Rabies in pets and animals is detected using veterinary infectious disease diagnostics. These devices are used to keep animals from killing themselves. For instance, rabies disease was discovered in over 150 nations and territories in 2021, according to the World Health Organization (WHO), a Swiss-based government agency. Dogs are the leading cause of human rabies deaths, accounting for up to 99% of rabies transmissions. 40% of those bitten by suspected rabid animals are under the age of 15. Every year, infection kills tens of thousands of people, primarily in Asia and Africa. As a result, the growing prevalence of transboundary and zoonotic diseases is propelling the veterinary infectious disease diagnostics market forward.

Restraints/Challenges

- Rising cost of pet care

The rising cost of pet care, combined with a lack of awareness about animal healthcare in developing economies, will likely impede the growth of the veterinary infectious disease diagnostics market during the forecast period. The lack of veterinarians in emerging economies will be the most difficult challenge to the market's growth.

This veterinary infectious disease diagnostics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the veterinary infectious disease diagnostics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, Heska Corp., a US-based manufacturer of point-of-care diagnostics equipment and imaging devices, paid $110 million for Scil Animal Care Co. Heska Corp.'s overseas market share increased to 40% in Germany and 30% in Spain and France as a result of this acquisition, which also expanded the company's animal care offering. Social Animal Care is a veterinary diagnostic device manufacturer based in France.

- In 2021, Zomedica Corp., a veterinary health corporation that manufactures point-of-care diagnostics for cats and dogs, recorded the first veterinarian sale of TRUFORMA and officially entered commercialization.

Global Veterinary Infectious Disease Diagnostics Market Scope

The veterinary infectious disease diagnostics market is segmented on the basis of technology, animal type, infection type, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Immunodiagnostics

- Lateral flow assays

- ELISA tests

- Other immunodiagnostic technologies

- Molecular Diagnostics

- Polymerase chain reaction (PCR) tests

- Microarrays

- Other molecular diagnostic tests

- Other Veterinary Diagnostic Technologies

Animal Type

- Companion Animals

- Dogs

- Cats

- Horses

- Other companion animals

- Food Producing Animals

- Cattle

- Swine

- Poultry

- Other food-producing animals

End User

- Reference Laboratories

- Veterinary Laboratories and Clinics

- Point of Care / In House Testing

- Research Institutes and Universities

Infection Type

- Bacterial Infections

- Viral Infections

- Parasitic Infections

- Other Infections

Veterinary Infectious Disease Diagnostics Market Regional Analysis/Insights

The veterinary infectious disease diagnostics market is analyzed and market size insights and trends are provided by country, technology, animal type, infection type, and end user as referenced above.

The countries covered in the veterinary infectious disease diagnostics market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the veterinary infectious disease diagnostics market due to the diagnostic products' availability, increasing pet ownership, and rising healthcare expenditure.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 due to the prevalence of various market players along with rising awareness among the people related to animal health.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The veterinary infectious disease diagnostics market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for veterinary infectious disease diagnostics market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the veterinary infectious disease diagnostics market. The data is available for historic period 2011-2021.

Competitive Landscape and Veterinary Infectious Disease Diagnostics Market Share Analysis

The veterinary infectious disease diagnostics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to veterinary infectious disease diagnostics market.

Some of the major players operating in the veterinary infectious disease diagnostics market are:

- BIOMÉRIEUX (France)

- Heska Corporation (U.S.)

- IDEXX (U.S.)

- Neogen Corporation (U.S.)

- INDICAL BIOSCIENCE GmbH (Germany)

- Randox Laboratories Ltd. (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- Virbac (France)

- Zoetis (U.S.)

- Creative Diagnostics (U.S.)

- DRG INSTRUMENTS GMBH (Germany)

- Chembio Diagnostic Systems, Inc. (U.S.)

- Eurofins Technologies (Luxembourg)

- Abaxis (U.S.)

- Agrolabo S.p.A. (Italy)

- Abbott (U.S.)

- Danaher (U.S.)

SKU-