Global Version Control Systems Market

Market Size in USD Billion

CAGR :

%

USD

21.80 Billion

USD

33.90 Billion

2024

2032

USD

21.80 Billion

USD

33.90 Billion

2024

2032

| 2025 –2032 | |

| USD 21.80 Billion | |

| USD 33.90 Billion | |

|

|

|

|

Version Control Systems Market Size

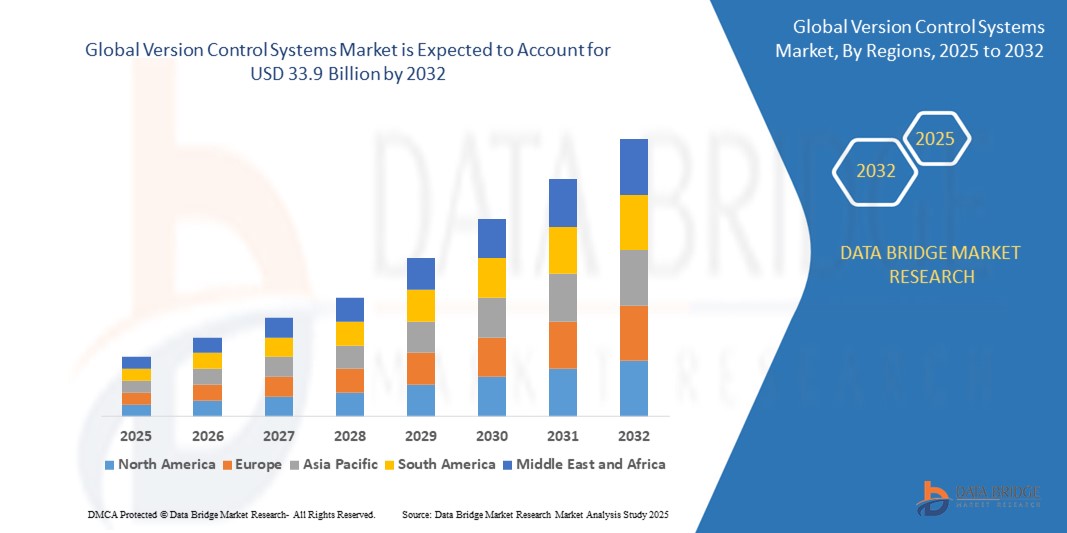

- The Global Version Control Systems Market was valued at USD 21.8 billion in 2025 and is projected to reach USD 33.9 billion by 2032, growing at a CAGR of 6.51% during the forecast period.

- This growth is fueled by the increasing need for collaborative software development, real-time code tracking, and continuous integration (CI) and DevOps practices across all business sizes.

Version Control Systems Market Analysis

- Version control systems (VCS) are essential tools in modern software development, enabling teams to track changes, manage code versions, and collaborate efficiently. These systems have become a critical component in agile development and DevOps pipelines.

- The adoption of cloud-native development environments, the growth of open-source projects, and the rising demand for secure and scalable code management platforms are key factors propelling market growth.

- As remote development teams become more common, enterprises are increasingly relying on distributed version control systems (DVCS) like Git, which support decentralized workflows, high scalability, and offline access.

- Integration of VCS with project management tools, CI/CD platforms, and AI-powered code analytics is enhancing productivity and decision-making in software engineering environments.

Report Scope and Version Control Systems Market Segmentation

|

Attributes |

Version Control Systems Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Version Control Systems Market Trends

“Integrated DevOps, Cloud-First Repositories, and AI in Code Management”

- A key trend is the convergence of version control systems with CI/CD, DevSecOps, and agile project tools, creating unified development environments. Git-based platforms now offer everything from repository hosting and issue tracking to code scanning and deployment pipelines.

- Cloud-first VCS adoption is accelerating, with GitHub, GitLab, Bitbucket, and AWS CodeCommit offering seamless collaboration, unlimited repositories, and global sync capabilities—essential for remote development teams.

- The integration of AI and machine learning in version control systems is transforming how developers manage code quality, identify bugs, and track coding patterns. AI-powered suggestions, auto-documentation, and anomaly detection are becoming standard in enterprise-grade platforms.

- There's increasing demand for graph-based version control and visual diff tools, helping users understand complex branching workflows and code evolution more intuitively.

- Organizations are also deploying private GitOps workflows to automate infrastructure-as-code updates, manage pull requests with defined policies, and enable consistent development-to-deployment cycles.

Version Control Systems Market Dynamics

Driver

“Demand for Scalable, Secure, and Collaborative Software Development Infrastructure”

- As software becomes core to every business, demand is rising for tools that support secure, auditable, and collaborative development. Version control systems are fundamental for managing codebases, tracking changes, and ensuring consistent delivery across distributed teams.

- The rapid expansion of DevOps practices, microservices architectures, and cloud-native app development has positioned VCS platforms as essential for integrating source code with testing, deployment, and monitoring workflows.

- Enterprises are using VCS to enforce code governance, enhance IP protection, and streamline audit compliance, especially in industries like finance, defense, and healthcare where traceability is critical.

- The rise in remote engineering teams and open-source contributors requires VCS platforms to support access control, workflow flexibility, and real-time collaboration—driving widespread adoption across geographies and industries.

Restraint/Challenge

“Complexity of Branch Management and Security Vulnerabilities in Public Repositories”

- As repositories grow in size and complexity, managing multiple branches, merge conflicts, and pull request workflows becomes challenging—especially for new or non-technical users.

- Public and cloud-hosted VCS platforms can pose security risks if misconfigured, exposing sensitive code to unauthorized access, IP theft, or malware injection. Ensuring access governance, secret scanning, and secure key management is essential but resource-intensive.

- Integration complexity between VCS and legacy systems or highly customized DevOps stacks can delay implementation and reduce visibility.

- Smaller organizations or academic teams may struggle with the learning curve associated with advanced features like Git workflows, webhook automation, and pipeline scripting.

Version Control Systems Market Scope

The market is segmented by type, deployment, enterprise size, and industry, highlighting the diverse applications of VCS tools across organizational and operational structures.

• By Type

Divided into Centralized Version Control Systems (CVCS) and Distributed Version Control Systems (DVCS). DVCS dominate in 2025 due to their flexibility, offline capabilities, and popularity in collaborative coding environments (e.g., Git, Mercurial). CVCS, such as Subversion (SVN), still retain relevance in legacy enterprise applications.

• By Deployment

Segmented into On-Premise and Cloud-Based. Cloud-based VCS leads the market with tools like GitHub, GitLab Cloud, and Bitbucket offering scalable and accessible code hosting and collaboration features. On-premise solutions are still preferred in sectors with strict data security and compliance requirements.

• By Enterprise Size

Categorized into Large Enterprises and Small & Medium Enterprises (SMEs). Large enterprises hold the largest share due to complex development teams and higher investments in DevOps infrastructure. SMEs are rapidly adopting freemium and open-source VCS platforms to scale their software development capabilities.

• By Industry

Includes IT & Telecom, BFSI, Healthcare, Education, Retail, Media & Entertainment, and Others. IT & Telecom leads the market due to its software-intensive operations, while healthcare and BFSI are showing strong adoption for secure code versioning in compliance-heavy environments.

Version Control Systems Market Regional Analysis

- North America leads the global version control systems market, driven by mature DevOps ecosystems, high cloud adoption, and the presence of leading vendors such as GitHub, Microsoft, and AWS. U.S.-based enterprises are integrating VCS tools across IT, finance, and media sectors to scale secure and agile development.

- Europe holds a strong position due to widespread enterprise IT modernization across Germany, the U.K., and France. Open-source communities, GDPR-driven audit controls, and the push for hybrid cloud infrastructure are encouraging VCS integration in BFSI and healthcare.

- Asia-Pacific is the fastest-growing region through 2032. Countries like India, China, Japan, and Australia are witnessing rapid adoption among startups, SMEs, and educational institutions. Cloud-first policies and tech-sector growth are expanding the use of Git-based platforms.

- Middle East and Africa (MEA) is gaining momentum with rising investments in digital infrastructure and cybersecurity. Countries like UAE and Saudi Arabia are using VCS tools to support government-led innovation labs, fintech, and defense applications.

- South America, particularly Brazil and Argentina, is adopting VCS in growing developer communities and IT outsourcing hubs. Cloud-based platforms are increasingly being used to support regional software product development and agile delivery models.

United States

The U.S. is the largest contributor to the global version control systems market. Leading tech companies, robust DevOps culture, and remote team infrastructure are driving widespread adoption of GitHub, Bitbucket, and GitLab. The U.S. is also home to large open-source communities and educational institutions using VCS platforms for curriculum and project management.

Germany

Germany represents a key market in Europe, with strong demand from automotive, industrial automation, and enterprise software providers. Git-based tools are used to manage complex embedded software projects and collaborate across multidisciplinary R&D teams.

India

India is emerging as a high-growth market with its large developer base and flourishing startup ecosystem. Educational institutions, IT service firms, and software product companies are integrating cloud-based VCS tools like GitHub and GitLab to support agile and open-source development.

United Kingdom

The U.K. market is driven by rapid digitalization in BFSI, government, and e-commerce sectors. GitOps workflows and private cloud VCS adoption are increasing due to regulatory focus on auditability and code integrity.

Brazil

Brazil is a leading VCS market in Latin America, with adoption across fintech, telecommunications, and academic sectors. Local developers and startups are using version control tools for real-time collaboration, open-source contributions, and DevOps integration.

Version Control Systems Market Share

The Version Control Systems industry is primarily led by well-established companies, including:

- GitHub, Inc. (U.S.)

- GitLab Inc. (U.S.)

- Bitbucket (Atlassian Corporation Plc) (Australia)

- Perforce Software, Inc. (U.S.)

- AWS CodeCommit (Amazon Web Services) (U.S.)

- Microsoft Corporation (U.S.)

- Apache Software Foundation (U.S.)

- SourceGear LLC (U.S.)

- Unity Technologies (U.S.)

- Canonical Ltd. (U.K.)

- IBM Corporation (U.S.)

- Micro Focus International plc (U.K.)

Latest Developments in Global Version Control Systems Market

- In April 2025, GitHub launched an advanced AI-powered coding assistant, Copilot X, offering intelligent pull request summaries, auto-complete suggestions, and code refactoring tools integrated directly within GitHub repositories.

- In March 2025, GitLab introduced its Enterprise DevSecOps 16.0 platform, featuring automated compliance monitoring, vulnerability detection, and full pipeline visibility—geared toward large enterprises and government clients.

- In February 2025, Atlassian upgraded Bitbucket Cloud with deeper integration into Jira and Confluence, enabling real-time linking of commits, sprints, and team discussions for agile software teams.

- In January 2025, Perforce Software acquired Assembla, expanding its version control suite to include Git, SVN, and Perforce Helix across cloud-hosted environments for gaming and defense sectors.

- In December 2024, Microsoft launched Azure DevOps Workflow Analyzer, a tool that leverages version control logs to detect workflow inefficiencies and suggest automation in CI/CD pipelines.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.